Beruflich Dokumente

Kultur Dokumente

Accountings

Hochgeladen von

solo_gauravOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Accountings

Hochgeladen von

solo_gauravCopyright:

Verfügbare Formate

There is an article published in summer of 2011, it is from reputed daily financ

ial review, dated 23rd Nov, 2011.

Article headlines directly highlight the profit strategy of Regional express hol

ding (REX) and how financial year 2011/12 proven for REX.

during year 2011/12 REX has maintained a course of earning profit. but yet due t

o highly unstable & flickle financial and economic environment, fuel rates and e

xchange rates its very difficult for them to offer a definite profit forecasts.

There are several statement also been mentioned in the context, one of them is c

oming from REX deputy chairman John Sharp at company's annual general meeting. H

e addressed the shareholders, where he assured confidence about REX ltd & its su

bsidiaries for earning profit in financial year 2011/12 as he states "The group

expect all subsidiaries to be profitable in FY11/12."

He also assent in parlance of company business strategy and course, that despite

been thru crest & troughs in past financial years, REX is all set to handle cha

llenges in coming future. quoting "we believe that the REX group is well poised

for the challenges ahead."

Furthermore its been mentioned how the course of earning profit in unchanged fro

m previous financial year, describing how they lagged in FY2010/11, where their

profit lowered by 28.5 percent from the prior corresponding period.

Article also highlight the operating region & other businesses of REX, as they a

re regionally operated aviation giant. REX Flights are mainly operated from Syd

ney, Melbourne and Adelaide to regional destinations in SA, NSW and Victoria. al

so It has business operation in charter flights and contract flyings. Plus, REX

also has an pilot training academy.

Rex maintains profit guidance

Rex profit poised to fall on economy, $A

This article highlights decline in profit for REX Ltd. in current financial year

(FY12/13)

Analysis : Starting in FY2010/11 the Price Earning Ratio (P/E) ratio for REX ltd

. 4.56 times it means the capital value of share 4.56 higher than its current l

evel of earnings, wh ich can be considerd as moderate. In 2011/12 there is a sli

ghtly P/E ratio decreased and it reached to 4.33 times, that could be fluctuatio

n/correction in market value of company share as compared to FY2010/11. But in f

inancial year 2012/13, it went quite high upto 8.83 times higher than its cur re

nt level of earnings.

Deduction : PE ratio is the essence , a measure of market confidence in the fut

ure of company. In our case REX ltd. has a moderate P/E ratio i.e 4.56 times. La

ter, in Financial year 2011/12 it got corrected because of market stablization.

then as from above ratio we can conclude (ROA and NPM) that REX is going thru so

me tough times, yet market believe in REX business and show confidence in their

future. as the result despite being performance below average in year 2012/13 th

ey have higher P/E ratio and its believed that the market will eventually correc

t itself .

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Georg v. Holy Trinity College, Inc. (July 20, 2016Dokument4 SeitenGeorg v. Holy Trinity College, Inc. (July 20, 2016Noreen NOmbre100% (1)

- 48 Government of Philippines Islands V El Hogar FilipinoDokument5 Seiten48 Government of Philippines Islands V El Hogar FilipinoAlex DulayNoch keine Bewertungen

- Salary Slip (31221188 June, 2019)Dokument1 SeiteSalary Slip (31221188 June, 2019)ahmed aliNoch keine Bewertungen

- CGTMSEDokument21 SeitenCGTMSEakashNoch keine Bewertungen

- TDS Challan 06-05-18Dokument1 SeiteTDS Challan 06-05-18sandipgargNoch keine Bewertungen

- Kodak's failure to understand changing photo habitsDokument13 SeitenKodak's failure to understand changing photo habitsenna_sys100% (1)

- ProjectPlan WhiteDokument42 SeitenProjectPlan Whitebriand28Noch keine Bewertungen

- Redp4918 PDFDokument40 SeitenRedp4918 PDFsolo_gauravNoch keine Bewertungen

- Data Strategy 2018 20 Our RoadmapDokument1 SeiteData Strategy 2018 20 Our Roadmapsolo_gauravNoch keine Bewertungen

- Most Effective Santan Gopal Mantra For Removing Hindrances in Birth of Child - Vedic RishiDokument6 SeitenMost Effective Santan Gopal Mantra For Removing Hindrances in Birth of Child - Vedic Rishisolo_gauravNoch keine Bewertungen

- ArcadeCab CabinetPlans2Dokument60 SeitenArcadeCab CabinetPlans2Mark WarrenNoch keine Bewertungen

- InstructionsDokument1 SeiteInstructionssolo_gauravNoch keine Bewertungen

- ProjectPlan WhiteDokument42 SeitenProjectPlan Whitebriand28Noch keine Bewertungen

- ProjectPlan WhiteDokument42 SeitenProjectPlan Whitebriand28Noch keine Bewertungen

- InfoDokument2 SeitenInfosolo_gauravNoch keine Bewertungen

- Windows Pre-Activation MethodsDokument3 SeitenWindows Pre-Activation Methodssolo_gauravNoch keine Bewertungen

- Guide: Powerpoint TemplatesDokument12 SeitenGuide: Powerpoint Templatessolo_gauravNoch keine Bewertungen

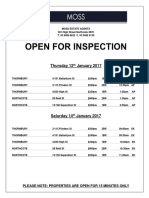

- Thursday 12 January 2017: Please Note: Properties Are Open For 15 Minutes OnlyDokument1 SeiteThursday 12 January 2017: Please Note: Properties Are Open For 15 Minutes Onlysolo_gauravNoch keine Bewertungen

- ProjectPlan WhiteDokument42 SeitenProjectPlan Whitebriand28Noch keine Bewertungen

- Guide: Powerpoint TemplatesDokument12 SeitenGuide: Powerpoint Templatessolo_gauravNoch keine Bewertungen

- Accolade: Power Point TemplateDokument100 SeitenAccolade: Power Point TemplateMehedi Hasan NiloyNoch keine Bewertungen

- 20 060 4C 8T 3600 Intel Xeon CPU E5 1620 0 64 BitDokument1 Seite20 060 4C 8T 3600 Intel Xeon CPU E5 1620 0 64 Bitsolo_gauravNoch keine Bewertungen

- Isys3303 Bit Proj Final Report Assesment Criteria s2 - 2015Dokument1 SeiteIsys3303 Bit Proj Final Report Assesment Criteria s2 - 2015solo_gauravNoch keine Bewertungen

- TESTCDokument4 SeitenTESTCsolo_gauravNoch keine Bewertungen

- LicenseDokument6 SeitenLicensemerrysun22Noch keine Bewertungen

- Ref 1Dokument6 SeitenRef 1solo_gauravNoch keine Bewertungen

- DSH 2019 PriceList PDFDokument1 SeiteDSH 2019 PriceList PDFsolo_gauravNoch keine Bewertungen

- Wesfarmers ReportingDokument2 SeitenWesfarmers Reportingsolo_gauravNoch keine Bewertungen

- Ref Diary InputDokument3 SeitenRef Diary Inputsolo_gauravNoch keine Bewertungen

- Point To IncorporateDokument1 SeitePoint To Incorporatesolo_gauravNoch keine Bewertungen

- RporateDokument7 SeitenRporatesolo_gauravNoch keine Bewertungen

- D IncorporateDokument2 SeitenD Incorporatesolo_gauravNoch keine Bewertungen

- IncorporateDokument2 SeitenIncorporatesolo_gauravNoch keine Bewertungen

- Dahi MurgDokument1 SeiteDahi Murgsolo_gauravNoch keine Bewertungen

- Example of Reflective Diary WritingDokument3 SeitenExample of Reflective Diary Writingsolo_gauravNoch keine Bewertungen

- What Are Typical Problems in Offshoring Organisations? What Initiatives Can Be Taken To Solve Those Problems? - Write Down With ExamplesDokument12 SeitenWhat Are Typical Problems in Offshoring Organisations? What Initiatives Can Be Taken To Solve Those Problems? - Write Down With ExamplesNaiem AbdullahNoch keine Bewertungen

- Insuring Members of Armed Groups and Incontestability ClauseDokument7 SeitenInsuring Members of Armed Groups and Incontestability ClauseCristine M. LimucoNoch keine Bewertungen

- 7Ps Marketing Mix Big BazaarDokument8 Seiten7Ps Marketing Mix Big BazaarMayank RajNoch keine Bewertungen

- Class 11 Cbse Business Studies Syllabus 2012-13Dokument4 SeitenClass 11 Cbse Business Studies Syllabus 2012-13Sunaina RawatNoch keine Bewertungen

- Company Audit MCQs - Sanidhya SarafDokument8 SeitenCompany Audit MCQs - Sanidhya SarafTarun Bhardwaj100% (1)

- CP Graduates MerseysideDokument10 SeitenCP Graduates Merseysidenelly1996Noch keine Bewertungen

- Summer Internship Nasir FinalDokument10 SeitenSummer Internship Nasir FinalKanishq BawejaNoch keine Bewertungen

- LC NotesDokument2 SeitenLC NotesAnnie KhowajaNoch keine Bewertungen

- Practice Test 1 KeyDokument11 SeitenPractice Test 1 KeyAshley Storey100% (1)

- Analysis of Mutual Funds in IndiaDokument78 SeitenAnalysis of Mutual Funds in Indiadpk1234Noch keine Bewertungen

- Managing Interdependence: Social Responsibility and Ethics ch02Dokument21 SeitenManaging Interdependence: Social Responsibility and Ethics ch02diversified1Noch keine Bewertungen

- Tamilnadu Industrial Investment Corporation Credit Scheme ListDokument27 SeitenTamilnadu Industrial Investment Corporation Credit Scheme ListvishnusrikanthrNoch keine Bewertungen

- Bursa Malaysia RSS Approved Securities List UpdateDokument8 SeitenBursa Malaysia RSS Approved Securities List UpdateFahmi YusoffNoch keine Bewertungen

- Subscription Agreement MSTIDokument2 SeitenSubscription Agreement MSTIZhanika Marie CarbonellNoch keine Bewertungen

- ISIN As On 31 Oct 2018Dokument216 SeitenISIN As On 31 Oct 2018KarthikNoch keine Bewertungen

- Brand PT BBIDokument13 SeitenBrand PT BBIapi-3854746Noch keine Bewertungen

- Chapter I12Dokument39 SeitenChapter I12DrellyNoch keine Bewertungen

- Marcum ComplaintDokument25 SeitenMarcum Complaintkcoleman7239Noch keine Bewertungen

- Shell Emails PP 296-311 54772-13 Faldone 17Dokument16 SeitenShell Emails PP 296-311 54772-13 Faldone 17saharaReporters headlines100% (1)

- CHAPTER 13 Strategic Issues in Entrepreneurial Ventures and Small BusinessesDokument24 SeitenCHAPTER 13 Strategic Issues in Entrepreneurial Ventures and Small BusinessesLaurentiumanolacheNoch keine Bewertungen

- M/S. Lavish Ceramics: The Project Cost 1 Cost of ProjectDokument20 SeitenM/S. Lavish Ceramics: The Project Cost 1 Cost of ProjectSabhaya ChiragNoch keine Bewertungen

- Permits Information For 3/31/2013 To 4/6/2013Dokument520 SeitenPermits Information For 3/31/2013 To 4/6/2013ankitch123Noch keine Bewertungen

- CEO COO VP Senior Living in USA Resume William PickhardtDokument3 SeitenCEO COO VP Senior Living in USA Resume William PickhardtWilliamPickhardtNoch keine Bewertungen

- IDBI PresentationDokument13 SeitenIDBI PresentationDP DileepkumarNoch keine Bewertungen