Beruflich Dokumente

Kultur Dokumente

Highlights: U.S. Office Space Market Posts Weakest Quarter Since Q3 2001

Hochgeladen von

FooOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Highlights: U.S. Office Space Market Posts Weakest Quarter Since Q3 2001

Hochgeladen von

FooCopyright:

Verfügbare Formate

C O L L I E R S I N T E R N AT I O N A L

N O RT H A M E R I C A

Highlights

OFFICE

F I R S T Q U A RT E R

2009

U.S. Office Space Market Posts Weakest Quarter Since Q3 2001

MARKET INDICATORS

Q1

Q2

2009 2009*

VACANCY

NET ABSORPTION

CONSTRUCTION

RENTAL RATE

* Projected, relative

to prior period

U.S. OFFICE MARKET

SUMMARY STATISTICS

FIRST QUARTER 2009

Vacancy Rate Q1 2009 (Change from

Q4 2008): 14.75% (+0.95)

Absorption Q1 2009

(Million Square Feet): -26.7

For the fifth consecutive quarter tenants returned more space to the market than they leased

helping to push the national vacancy rate up for the sixth consecutive three month period.

A modest supply of office development also came on the market during the first quarter again

helping to put upward pressure on the national vacancy rate. Rents accelerated downward as

landlords had no choice but to lower lease rates to attract new tenants and keep occupancies from

declining any further. This was more apparent in downtown markets but suburban rents also

moved lower. While the economy may bottom sometime in the third quarter the prospects for the

office market are not encouraging until well into 2010 or perhaps 2011. Almost every region of the

country is reporting weak economic growth with heavy job losses expected for the next

few months and little hope of employment gains until early 2010. Weakness that was largely

restricted to the financial services and housing sector has now spread to the economy at large

with very few industries considering expansion or new hiring. With such an uncertain business

environment the office space market will remain extremely weak through to the end of 2009.

U.S. office vacancy rate posts sixth consecutive increase. The US national office vacancy

rate moved substantially higher during the first quarter marking the sixth consecutive increase.

Aided by sublease space increasing by 7.5 million square feet (MSF) to total 81.6 MSF the

overall vacancy rate increased 95 basis points to register 14.75%. Vacancy levels have now

returned to Q2 2005 levels. The Downtown vacancy rate increased 87 basis points to register

12.79% while suburban vacancies increased 98 basis points to total 15.67%. Class A vacancy rates

also moved higher with prime CBD vacancies rising 93 basis points to 12.28% compared with

suburban vacancies which increased 108 basis points to 16.45%.

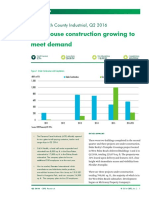

A trickle turns into a flood as tenants seek to reduce their space needs. First quarter

absorption was again negative with occupied space contracting by 26.7 MSF, the fifth consecutive

quarterly contraction and significantly worse than a year ago when absorption was -1.3 MSF and

more than double Q4 when occupied space fell by 11.4 MSF. Companies are now shedding space

at the quickest pace since Q3 2001 when occupied space shrank by 28.0 MSF. Highlighting the

widespread nature of the current downturn, CBD and suburban markets were equally affected as

were prime and non-prime office properties.

(Continued on page 6)

U.S. OFFICE MARKET Q1 2008 Q1 2009

New Construction Completions

Q1 2009 (Million Square Feet): 15.4

Asking Rents Per Square Foot

(Change from Q4 2008)

Downtown Class A: $43.36 (-5.5%)

Suburban Class A: $27.69 (-1.4%)

Tenant Inducements

Per Square Foot/Free Rent (Months)

Downtown Class A: $29.63 (4.3)

14.8

20.3

19.4

20

Million Square Feet

Under Construction Activity

(Million Square Feet): 83.8

25

17.4

15.4

15

-5

14.0%

13.8

10

5

0

15.0%

18.6

13.3

13.5

13.0

13.0%

-1.3

-1.6

-2.2

-10

-11.4

-20

-26.7

-30

Q1 2008

Q2 2008

Absorption

Q3 2008

Q4 2008

Completions

Q1 2009

Vacancy

www.colliers.com

Colliers International 2009 Colliers International is a worldwide affiliation of independently owned and operated companies.

COLLIERS INTERNATIONAL

UNITED STATES

MARKET

EXISTING

INVENTORY (SF)

MARCH 31, 2009

Atlanta, GA

55,688,000

Bakersfield, CA

2,926,000

Baltimore, MD

19,471,000

Boise, ID

3,470,000

Boston, MA

57,591,000

Charleston, SC

2,064,000

Charlotte, NC

19,023,000

Chicago, IL

130,460,000

Cincinnati, OH

12,707,000

Cleveland, OH

30,081,000

Columbia, SC

4,460,000

Columbus, OH

9,673,000

Dallas/Fort Worth,TX

35,365,000

Denver, CO

26,608,000

Detroit, MI

29,744,000

Fresno, CA

3,206,000

Ft. Lauderdale/Broward County, FL

6,122,000

Greenville, SC

3,144,000

Hartford, CT

10,096,000

Honolulu, HI

15,706,000

Houston,TX

37,422,000

Indianapolis, IN

11,559,000

Jacksonville, FL

12,878,000

Kansas City MO-KS

11,285,000

Las Vegas, NV

3,369,000

Little Rock, AR

6,280,000

Los Angeles, CA

31,409,000

Louisville, KY

10,105,000

Memphis,TN

8,451,000

Miami/Dade County, FL

15,165,000

Milwaukee,WI

10,629,000

Minneapolis/St. Paul, MN

24,422,000

Nashville,TN

7,524,000

New York, NY - DT Manhattan

89,744,000

New York, NY - MT Manhattan

257,412,000

New York, NY - MTS Manhattan

98,339,000

Oakland, CA

16,913,000

Orlando, FL

11,611,000

Philadelphia, PA

41,978,000

Phoenix, AZ

19,972,000

Pleasanton/Walnut Creek, CA

22,370,000

Portland, OR

32,824,000

Raleigh/Durham/Chapel Hill, NC

3,712,000

Reno, NV

1,318,000

Sacramento, CA

18,680,000

San Diego County, CA

10,100,000

San Francisco, CA

82,895,000

San Jose/Silicon Valley, CA

7,275,000

Santa Rosa/Sonoma County, CA

1,070,000

Seattle/Puget Sound,WA

57,644,000

St. Louis, MO

11,401,000

Stockton/San Joaquin County, CA

7,272,000

Tampa, FL

8,508,000

Washington, DC

114,200,000

W. Palm Beach/Palm Beach County, FL 8,847,000

Total US

1,592,187,000

COLLIERS INTERNATIONAL

DOWNTOWN OFFICE

NEW

SUPPLY Q1

2009 (SF)

0

0

0

0

0

0

0

1,350,000

0

0

0

0

0

0

0

114,000

0

0

0

0

0

0

0

44,000

0

23,000

0

0

0

0

0

0

75,000

0

2,102,000

0

0

0

0

0

0

124,000

(26,000)

0

0

0

0

0

0

31,000

0

0

0

908,000

0

4,744,000

UNDER

CONSTRUCTION

(SF)

1,260,000

0

803,000

0

1,544,000

0

2,817,000

2,303,000

825,000

0

190,000

195,000

0

496,000

0

0

0

60,000

0

0

1,817,000

0

0

0

0

0

0

0

0

1,982,000

0

0

520,000

4,600,000

1,438,000

315,000

172,000

10,000

0

1,030,000

0

908,000

24,000

0

434,000

40,000

468,000

300,000

0

4,797,000

0

30,000

0

8,446,000

0

37,826,000

ALL INVENTORY

ABSORPTION

Q1 2009

(SF)

63,000

(9,000)

(70,000)

(13,000)

(580,000)

(28,000)

(204,000)

(507,000)

(3,000)

(76,000)

(45,000)

(36,000)

317,000

(266,000)

(57,000)

28,000

(14,000)

0

(205,000)

(849,000)

(171,000)

17,000

(13,000)

17,000

(82,000)

24,000

46,000

(32,000)

(50,000)

(50,000)

(192,000)

(15,000)

(50,000)

(3,000)

(3,596,000)

(1,647,000)

(47,000)

(130,000)

(304,000)

(161,000)

(831,000)

(99,000)

(27,000)

(12,000)

92,000

21,000

554,000

(164,000)

(18,000)

(641,000)

24,000

(33,000)

(64,000)

174,000

(17,000)

(10,034,000)

VACANCY

RATE (%)

DEC. 31, 2008

VACANCY

RATE (%)

MARCH 31, 2009

13.40

6.34

17.38

9.52

10.51

6.60

2.56

12.69

17.32

16.30

12.53

13.06

20.59

14.12

16.12

8.34

14.87

23.79

14.86

5.04

12.44

14.90

10.80

20.38

8.94

11.71

14.90

7.57

11.92

14.76

17.54

15.78

15.80

10.21

10.14

11.38

11.12

13.84

9.25

13.80

17.33

7.32

8.39

21.01

8.46

15.34

12.55

21.09

10.72

9.03

21.59

18.56

14.68

7.84

18.91

11.93

13.28

6.54

17.74

9.90

11.52

7.96

4.06

13.98

17.43

16.42

13.54

14.81

19.70

15.11

16.43

10.72

15.10

23.79

16.25

5.65

12.90

14.77

10.90

20.53

10.29

11.56

14.99

7.88

12.52

15.09

18.62

15.85

17.30

10.22

12.44

13.06

10.99

15.10

9.97

14.62

19.34

8.09

8.80

21.96

7.96

15.13

13.22

20.47

12.42

9.28

21.38

19.02

15.43

8.27

19.11

12.79

UNITED STATES

MARKET

EXISTING

INVENTORY (SF)

MARCH 31, 2009

Atlanta, GA

30,293,000

Bakersfield, CA

670,000

Baltimore, MD

9,204,000

2,038,000

Boise, ID

Boston, MA

39,352,000

Charleston, SC

1,031,000

13,179,000

Charlotte, NC

Chicago, IL

71,229,000

Cincinnati, OH

5,869,000

Cleveland, OH

8,932,000

Columbia, SC

1,896,000

Columbus, OH

4,308,000

Dallas/Fort Worth,TX

22,524,000

Denver, CO

17,328,000

Detroit, MI

11,619,000

Fresno, CA

1,039,000

Ft. Lauderdale/Broward County, FL 4,549,000

Greenville, SC

1,794,000

Hartford, CT

6,337,000

Honolulu, HI

4,700,000

Houston,TX

27,510,000

Indianapolis, IN

6,504,000

Jacksonville, FL

6,602,000

Kansas City MO-KS

6,115,000

Las Vegas, NV

700,000

Little Rock, AR

2,191,000

Los Angeles, CA

14,715,000

Louisville, KY

2,857,000

Memphis,TN

1,901,000

Miami/Dade County, FL

7,702,000

Milwaukee,WI

5,323,000

Minneapolis/St. Paul, MN

1,661,000

Nashville,TN

3,943,000

New York, NY - DT Manhattan 55,574,000

New York, NY - MT Manhattan 162,663,000

New York, NY - MTS Manhattan 14,176,000

Oakland, CA

9,843,000

Orlando, FL

5,681,000

Philadelphia, PA

30,929,000

Phoenix, AZ

9,547,000

Pleasanton/Walnut Creek, CA 12,991,000

Portland, OR

13,611,000

Raleigh/Durham/Chapel Hill, NC 2,704,000

Reno, NV

548,000

Sacramento, CA

8,220,000

San Diego County, CA

6,977,000

San Francisco, CA

51,965,000

San Jose/Silicon Valley, CA

3,047,000

Santa Rosa/Sonoma County, CA

369,000

Seattle/Puget Sound,WA

28,475,000

St. Louis, MO

6,843,000

Stockton/San Joaquin County, CA 2,557,000

Tampa, FL

4,795,000

Washington, DC

72,917,000

W. Palm Beach/Palm Beach County, FL 3,313,000

Total US

853,359,000

ABSORPTION

Q1 2009

(SF)

27,000

0

(87,000)

2,000

(393,000)

5,000

(157,000)

515,000

(5,000)

(164,000)

(25,000)

(5,000)

313,000

(229,000)

(25,000)

(2,000)

83,000

0

(205,000)

(18,000)

(131,000)

(18,000)

73,000

(24,000)

0

155,000

27,000

(4,000)

(62,000)

(90,000)

30,000

32,000

(31,000)

79,000

(1,855,000)

(281,000)

(35,000)

(55,000)

(314,000)

(60,000)

(495,000)

(3,000)

(5,000)

(11,000)

93,000

1,000

399,000

(105,000)

1,000

(475,000)

24,000

(62,000)

(52,000)

(241,000)

3,000

(3,866,000)

DOWNTOWN OFFICE

VACANCY

RATE (%)

DEC. 31, 2008

17.64

5.03

15.61

4.65

9.96

6.44

1.39

12.18

14.12

11.70

8.15

11.86

22.23

13.28

13.26

4.01

18.34

17.61

13.26

10.93

8.12

17.56

14.40

17.43

15.06

15.87

13.20

8.68

20.42

10.70

12.56

101.94

15.64

7.69

9.85

5.80

6.93

17.14

8.34

12.81

17.18

5.43

7.00

14.59

6.73

16.34

12.06

23.59

12.65

9.34

21.64

24.83

15.95

8.36

21.40

11.35

VACANCY

RATE (%)

MARCH 31, 2009

17.56

5.25

16.56

4.56

10.96

5.90

3.30

13.12

14.30

13.54

9.47

13.19

20.85

14.60

13.47

12.47

16.51

17.61

15.47

11.31

8.59

17.80

13.30

17.83

10.54

8.53

13.53

8.84

23.69

11.87

12.00

100.00

18.04

7.54

12.16

7.78

7.28

18.11

9.36

13.43

18.67

6.40

7.17

16.66

5.60

16.33

12.83

25.08

12.40

11.00

21.29

27.25

17.04

8.95

21.32

12.28

CLASS A

AVERAGE ANNUAL

QUOTED RENT (US$PSF)

MARCH 31, 2009

22.60

17.40

25.20

20.70

52.40

30.00

30.70

37.00

23.50

20.60

20.40

23.00

25.80

32.00

22.50

25.80

32.00

21.90

23.80

37.50

38.90

20.30

21.00

20.20

39.30

16.40

39.10

20.70

16.80

42.70

22.00

27.80

19.50

49.70

74.80

52.30

27.20

27.90

25.70

30.40

27.40

25.30

23.20

22.90

34.30

33.80

39.50

40.30

23.40

34.50

20.60

20.20

23.40

50.20

39.70

43.40 (Weighted)

29.70 (Equal)

QUARTERLY ANNUAL

CHANGE

CHANGE

(%)

(%)

(1.35)

0.00

4.31

3.92

(15.32)

7.14

(4.53)

(5.13)

(0.34)

3.62

0.00

0.66

(0.96)

(5.88)

0.72

(2.27)

(1.81)

0.00

0.00

0.37

1.20

(1.51)

0.00

0.95

0.00

3.81

4.15

(3.50)

(0.18)

(3.20)

0.00

2.54

0.15

(12.17)

(8.88)

(11.87)

(19.79)

(1.55)

0.31

(2.41)

0.00

(0.20)

0.65

0.00

0.35

(1.74)

(8.35)

(1.18)

3.17

7.21

0.00

(2.33)

3.95

0.10

(1.07)

(5.47)

(2.46)

1.75

0.00

4.31

7.76

(13.64)

8.11

6.11

(7.50)

0.13

3.57

2.61

3.09

(0.96)

7.93

(9.89)

(6.52)

(2.56)

21.78

(0.17)

2.91

0.93

4.01

5.00

(1.94)

(0.88)

3.81

(2.10)

5.95

(0.30)

(0.02)

0.00

5.14

(4.94)

(14.40)

(22.51)

(15.32)

(19.50)

(2.14)

(34.27)

0.07

(2.15)

3.35

6.78

0.00

(3.70)

(5.37)

(24.29)

13.83

(3.47)

(4.28)

0.00

7.01

(0.81)

(1.18)

1.15

(13.03)

(4.03)

COLLIERS INTERNATIONAL

UNITED STATES

MARKET

EXISTING

INVENTORY (SF)

MARCH 31, 2009

Atlanta, GA

179,044,000

Bakersfield, CA

5,876,000

Baltimore, MD

48,430,000

Boise, ID

10,337,000

Boston, MA

100,011,000

Charleston, SC

7,910,000

Charlotte, NC

54,501,000

Chicago, IL

105,846,000

Cincinnati, OH

19,336,000

Cleveland, OH

71,557,000

4,816,000

Columbia, SC

16,366,000

Columbus, OH

254,780,000

Dallas/Fort Worth,TX

Denver, CO

129,937,000

Detroit, MI

99,826,000

Fairfield, CA

3,572,000

Fresno, CA

17,591,000

Ft. Lauderdale/Broward County, FL 40,950,000

Greenville, SC

4,328,000

Hartford, CT

14,325,000

Honolulu, HI

7,642,000

Houston,TX

153,891,000

Indianapolis, IN

19,877,000

Jacksonville, FL

26,339,000

Kansas City MO-KS

35,743,000

Las Vegas, NV

37,246,000

Little Rock, AR

6,803,000

Los Angeles - Inland Empire, CA

22,913,000

Los Angeles, CA

195,933,000

Louisville, KY

9,632,000

Memphis,TN

27,366,000

Miami/Dade County, FL

51,166,000

Milwaukee,WI

17,809,000

Minneapolis/St. Paul, MN

44,113,000

Nashville,TN

24,826,000

New Jersey - Central

103,965,000

New Jersey - Northern

158,718,000

New York - Fairfield County, CT

57,371,000

New York - Westchester County, NY 44,229,000

Oakland, CA

15,877,000

Orange County, CA

77,207,000

Orlando, FL

51,536,000

Philadelphia, PA

108,763,000

Phoenix, AZ

106,004,000

Pleasanton/Walnut Creek, CA

17,865,000

Portland, OR

41,990,000

Raleigh/Durham/Chapel Hill, NC

40,726,000

Reno, NV

5,349,000

Sacramento, CA

68,747,000

San Diego County, CA

66,225,000

San Francisco Peninsula, CA

33,347,000

San Jose/Silicon Valley, CA

52,569,000

Santa Rosa/Sonoma County, CA

8,495,000

Seattle/Puget Sound,WA

83,473,000

St. Louis, MO

38,673,000

Tampa, FL

70,722,000

Washington, DC - N.Virginia

150,300,000

Washington, DC - Suburban, MD

73,812,000

W. Palm Beach/Palm Beach County, FL 28,619,000

Total US

3,375,217,000

COLLIERS INTERNATIONAL

SUBURBAN OFFICE

NEW

SUPPLY Q1

2009 (SF)

195,000

104,000

25,000

29,000

244,000

0

132,000

0

50,000

39,000

0

0

851,000

468,000

0

0

38,000

184,000

0

0

0

1,651,000

44,000

0

106,000

632,000

90,000

306,000

501,000

0

0

778,000

0

0

35,000

10,000

0

0

0

0

0

316,000

83,000

795,000

0

20,000

(183,000)

0

431,000

421,000

198,000

777,000

0

237,000

361,000

17,000

424,000

238,000

12,000

10,657,000

UNDER

CONSTRUCTION

(SF)

2,706,000

48,000

1,387,000

278,000

651,000

0

162,000

280,000

884,000

212,000

0

930,000

3,575,000

17,000

217,000

0

46,000

435,000

0

0

0

3,567,000

0

0

824,000

611,000

0

455,000

2,124,000

0

148,000

1,655,000

0

430,000

318,000

577,000

231,000

975,000

0

0

81,000

929,000

1,298,000

1,768,000

0

548,000

824,000

0

1,280,000

913,000

0

1,844,000

107,000

7,659,000

1,033,000

710,000

1,590,000

1,549,000

102,000

45,978,000

ALL INVENTORY

ABSORPTION

Q1 2009

(SF)

(154,000)

63,000

(1,057,000)

(93,000)

(784,000)

98,000

(167,000)

(872,000)

(113,000)

(89,000)

0

19,000

847,000

(558,000)

(407,000)

(29,000)

(63,000)

(265,000)

0

(129,000)

(38,000)

(1,057,000)

(75,000)

(414,000)

(177,000)

(331,000)

128,000

(154,000)

(2,620,000)

19,000

(10,000)

(302,000)

11,000

(517,000)

(293,000)

228,000

253,000

(680,000)

(424,000)

(60,000)

(1,121,000)

(229,000)

386,000

(337,000)

(798,000)

(270,000)

(371,000)

(101,000)

(399,000)

(268,000)

(603,000)

(823,000)

(126,000)

116,000

249,000

(506,000)

(521,000)

(424,000)

(204,000)

(16,616,000)

VACANCY

RATE (%)

DEC. 31, 2008

VACANCY

RATE (%)

MARCH 31, 2009

15.59

9.15

16.55

15.94

14.78

21.20

13.38

20.93

21.73

9.90

17.83

14.28

16.03

14.02

18.12

24.50

13.27

13.72

25.94

18.55

7.31

13.65

20.78

14.43

15.59

21.80

13.78

18.40

10.35

16.37

13.11

12.42

16.44

18.71

10.22

15.50

11.32

16.44

15.99

16.47

18.20

13.62

15.43

20.04

14.04

10.33

16.99

18.56

15.76

17.38

16.12

13.62

27.52

10.31

9.15

13.33

9.41

11.02

18.88

14.69

15.71

10.64

18.77

17.08

17.81

19.96

14.76

21.76

22.50

9.98

17.83

14.55

15.98

14.90

18.60

25.30

13.81

14.30

25.94

19.16

7.81

15.34

21.74

16.00

16.33

23.60

11.54

23.29

14.46

16.18

13.14

13.42

16.37

19.88

11.55

15.29

11.17

17.62

16.95

16.86

19.45

14.37

15.14

20.99

14.41

11.00

18.97

21.12

16.87

18.16

18.42

16.77

29.00

10.41

9.36

14.10

10.00

11.49

20.99

15.67

UNITED STATES

MARKET

EXISTING

INVENTORY (SF)

MARCH 31, 2009

Atlanta, GA

76,666,000

2,661,000

Bakersfield, CA

20,510,000

Baltimore, MD

Boise, ID

4,391,000

Boston, MA

28,580,000

Charleston, SC

3,878,000

Charlotte, NC

19,460,000

Chicago, IL

57,134,000

Cincinnati, OH

12,042,000

Cleveland, OH

12,597,000

Columbia, SC

959,000

Columbus, OH

8,884,000

Dallas/Fort Worth,TX

92,733,000

Denver, CO

38,036,000

Detroit, MI

27,661,000

Fairfield, CA

2,157,000

Fresno, CA

3,764,000

Ft. Lauderdale/Broward County, FL 9,849,000

Greenville, SC

1,812,000

Hartford, CT

8,139,000

Houston,TX

64,929,000

Indianapolis, IN

9,961,000

Jacksonville, FL

9,410,000

Kansas City MO-KS

10,953,000

Las Vegas, NV

4,797,000

Little Rock, AR

1,733,000

Los Angeles - Inland Empire, CA 4,936,000

Los Angeles, CA

97,852,000

Louisville, KY

5,394,000

Memphis,TN

6,964,000

Miami/Dade County, FL

12,480,000

Milwaukee,WI

5,974,000

Minneapolis/St. Paul, MN

16,733,000

Nashville,TN

15,555,000

New Jersey - Central

61,418,000

New Jersey - Northern

89,908,000

New York - Fairfield County, CT 31,271,000

NewYork - Westchester County, NY 25,108,000

Oakland, CA

13,425,000

Orange County, CA

32,256,000

Orlando, FL

14,595,000

Philadelphia, PA

66,537,000

Phoenix, AZ

32,660,000

Pleasanton/Walnut Creek, CA

9,802,000

Portland, OR

11,437,000

Raleigh/Durham/Chapel Hill, NC 24,560,000

Reno, NV

2,881,000

Sacramento, CA

14,606,000

San Diego County, CA

23,352,000

San Francisco Peninsula, CA

21,643,000

San Jose/Silicon Valley, CA

24,003,000

Santa Rosa/Sonoma County, CA 3,170,000

Seattle/Puget Sound,WA

22,564,000

St. Louis, MO

24,000,000

Tampa, FL

23,642,000

Washington, DC - N.Virginia

98,511,000

Washington, DC - Suburban, MD 38,386,000

W. Palm Beach/Palm Beach County, FL 8,403,000

Total US

1,417,716,000

ABSORPTION

Q1 2009

(SF)

110,000

67,000

(518,000)

(34,000)

(337,000)

128,000

(130,000)

(583,000)

(38,000)

49,000

0

3,000

558,000

(38,000)

(171,000)

(20,000)

(6,000)

(72,000)

0

(128,000)

(193,000)

(81,000)

(480,000)

(6,000)

(142,000)

110,000

(61,000)

(1,525,000)

41,000

(70,000)

(146,000)

85,000

(386,000)

(169,000)

418,000

536,000

(462,000)

(260,000)

(24,000)

(413,000)

(275,000)

423,000

131,000

39,000

(110,000)

32,000

(67,000)

(122,000)

(14,000)

(340,000)

(354,000)

(15,000)

42,000

200,000

(209,000)

353,000

(116,000)

274,000

(4,516,000)

SUBURBAN OFFICE

CLASS A

VACANCY

RATE (%)

DEC. 31, 2008

VACANCY

RATE (%)

MARCH 31, 2009

16.14

6.90

18.67

16.99

16.06

19.74

18.01

21.73

19.52

10.73

13.46

9.14

15.83

15.38

15.73

26.49

23.68

18.58

14.20

16.48

12.93

20.34

12.00

14.83

30.06

16.00

27.30

11.76

15.93

6.79

14.71

12.39

13.15

9.74

15.54

14.52

18.49

18.31

9.15

20.88

13.92

14.73

23.99

12.36

8.72

15.10

19.67

20.19

22.04

15.66

13.79

33.29

8.42

7.04

15.20

12.96

13.01

20.92

15.37

16.10

7.20

21.20

18.32

18.23

16.44

19.92

22.75

20.43

10.34

13.46

9.09

15.66

16.10

16.57

27.44

24.09

18.97

14.20

17.54

15.04

22.36

17.10

15.71

34.75

9.51

33.30

13.66

15.17

7.79

17.23

10.97

15.46

10.84

14.86

14.00

19.97

19.34

9.33

21.43

16.10

14.20

25.75

11.96

15.79

16.77

23.95

22.67

23.39

17.84

19.11

33.75

16.07

7.60

16.15

13.31

14.85

21.92

16.45

AVERAGE ANNUAL

QUOTED RENT (US$PSF)

MARCH 31, 2009

22.80

24.00

26.00

18.30

30.20

26.50

20.10

28.00

21.10

21.20

17.70

19.30

25.80

24.50

23.70

21.60

26.40

28.00

18.80

21.10

27.90

19.50

21.00

22.70

36.20

18.30

28.00

37.10

17.60

21.80

28.30

21.00

27.80

22.00

26.20

28.70

33.80

28.10

28.20

32.30

23.70

24.80

27.80

24.00

24.30

22.20

22.80

26.50

37.10

36.00

40.40

24.70

27.00

25.00

24.80

29.80

29.70

31.50

27.70 (Weighted)

25.70 (Equal)

QUARTERLY ANNUAL

CHANGE

CHANGE

(%)

(%)

(1.56)

0.00

(0.31)

(3.43)

(5.86)

26.19

0.10

16.67

2.88

0.33

0.00

(0.46)

(0.96)

(2.00)

(0.46)

(14.98)

(2.22)

(10.90)

1.07

(0.14)

(0.11)

1.40

0.00

0.26

(1.52)

0.00

(2.10)

(2.44)

(9.66)

1.73

(18.41)

(30.81)

(0.64)

(2.10)

(3.46)

(1.24)

7.64

(1.06)

(11.60)

(8.87)

(1.78)

(0.92)

(6.11)

(0.99)

(1.10)

(0.81)

0.00

5.24

(3.13)

(8.26)

(2.60)

0.00

34.93

(3.85)

2.27

7.63

(2.46)

(4.17)

(1.41)

(1.84)

(4.29)

0.00

0.82

(3.99)

(0.20)

3.92

0.45

0.72

2.78

0.48

4.67

(0.26)

(4.63)

4.26

(1.29)

(4.35)

(6.68)

4.61

0.29

1.90

(0.31)

2.44

1.02

(2.66)

0.00

(7.96)

(12.10)

2.01

(15.32)

0.00

4.99

(0.72)

(3.53)

(1.71)

2.58

(6.36)

(7.48)

(13.28)

(12.75)

0.61

(12.74)

(10.71)

1.42

0.36

(5.00)

(2.64)

(4.04)

(17.13)

(2.88)

(0.96)

(2.06)

4.17

1.27

(10.01)

1.16

5.32

(3.81)

(3.04)

COLLIERS INTERNATIONAL

UNITED STATES

OFFICE

INVESTMENT

UNITED STATES OFFICE INVESTMENT

MARKET

CBD

CBD

SUBURBAN SUBURBAN

SALES PRICE CAP RATE SALES PRICE CAP RATE

(US$PSF)

(%)

(US$PSF)

(%)

Atlanta, GA

178.00

Bakersfield, CA

170.00

Baltimore, MD

200.00

Boise, ID

151.00

Boston, MA

245.00

Charleston, SC

275.00

Charlotte, NC

275.00

Chicago, IL

161.00

Cincinnati, OH

65.00

Cleveland, OH

115.00

Dallas/Fort Worth,TX

Denver, CO

225.00

Fresno, CA

185.00

Ft. Lauderdale/Broward County, FL

Greenville, SC

166.00

Houston,TX

140.00

Jacksonville, FL

115.00

Kansas City MO-KS

245.00

Las Vegas, NV

Little Rock, AR

78.50

Los Angeles - Inland Empire, CA

Los Angeles, CA

282.00

Miami/Dade County, FL

345.00

Milwaukee,WI

225.00

Minneapolis/St. Paul, MN

175.00

Nashville,TN

176.50

New Jersey - Central

New Jersey - Northern

New York - Fairfield County, CT

New York - Westchester County, NY

New York, NY - DT Manhattan

300.00

New York, NY - MT Manhattan 390.00

New York, NY - MTS Manhattan 300.00

Oakland, CA

250.00

Orange County, CA

Orlando, FL

185.00

Philadelphia, PA

144.00

Phoenix, AZ

185.00

Pleasanton/Walnut Creek, CA

311.00

Portland, OR

126.56

Raleigh/Durham/Chapel Hill, NC

Reno, NV

150.00

Sacramento, CA

250.00

San Diego County, CA

208.93

San Francisco Peninsula, CA

San Francisco, CA

330.69

San Jose/Silicon Valley, CA

Santa Rosa/Sonoma County, CA

St. Louis, MO

100.00

Stockton/San Joaquin County, CA 160.00

Tampa, FL

150.00

Washington, DC

401.00

Washington, DC - Suburban, MD

W. Palm Beach/Palm Beach County, FL

Total US

208.59

COLLIERS INTERNATIONAL

7.40

8.50

7.60

7.00

8.00

7.00

7.50

10.00

8.50

8.50

8.00

8.00

9.00

9.00

9.00

5.00

6.50

8.00

8.00

8.25

8.00

6.00

8.00

8.00

9.00

8.00

7.80

8.10

7.58

8.00

7.75

9.75

8.75

9.00

7.50

8.00

170.00

175.00

151.00

180.00

170.00

120.00

112.00

50.00

115.00

121.00

125.00

202.50

147.71

138.00

100.00

135.00

150.00

270.00

127.78

187.00

300.00

227.95

180.00

165.00

188.24

175.00

180.00

275.00

200.00

200.00

285.00

175.00

170.00

126.51

285.00

199.68

125.00

205.00

218.00

246.42

390.00

280.00

243.10

100.00

145.00

280.00

183.02

185.00

7.90

9.00

7.60

9.00

7.75

8.20

9.50

9.00

9.25

8.00

8.52

8.50

9.60

9.00

10.00

8.00

9.00

5.90

6.10

7.29

8.00

8.50

7.25

7.50

7.50

8.00

8.00

8.00

6.30

9.50

8.00

7.50

6.10

7.04

9.25

7.75

7.25

7.75

5.50

10.70

6.40

10.50

9.00

6.60

7.66

8.06

U.S. Office Space Market Posts Weakest

Quarter Since Q3 2001 (Continued from page 1)

Wilting demand pushing rents lower. For the second

consecutive quarter, downtown lease rates dropped

substantially during the quarter with Q1 asking rents

dipping by 5.5% to $43.36 per square foot. Markets such as

Manhattan, Boston and San Francisco contributed largely

to the unusually large drop but nonetheless the national

trend is clearly down (see unweighted rent on page 3).

Suburban asking rents also fell during the quarter, declining

by 1.4% to $27.69 per square foot. On an annual basis this

left CBD rents down 13.0% and suburban rents down 3.8%.

Office construction falls to a two year low. First quarter

office completions dropped considerably relative to the prior

quarter with new construction totaling 15.4 MSF compared

with 18.6 MSF in Q4. This was also a modest decline from

the first quarter of 2008 when construction registered 17.4

MSF. Construction activity also registered a substantial

decline with Q1 under construction activity falling by 10.4

MSF to total 83.8 MSF. Construction activity is expected

to drop-off sharply in the coming quarters leaving the

development pipeline below levels witnessed in early 2005

when just 40 MSF of office development was underway.

Ross J. Moore

Executive Vice President, Market and Economic Research

Colliers International USA, ross.moore@colliers.com

GLOSSARY

Inventory Includes all existing multi or single tenant leased and

owner-occupied office properties greater than or equal to 10,000

square feet (net rentable area). In some larger markets this

minimum size threshold may vary up to 50,000 square feet.

Does not include medical or government buildings.

Vacancy Rate Percentage of total inventory physically vacant as

at the survey date including direct vacant and sublease space.

Absorption Net change in physically occupied space over a given

period of time.

New Supply Includes completed speculative and build-tosuit construction. New supply quoted on a net basis after any

demolitions or conversions.

Annual Quoted Rent Includes all costs associated with

occupying a full floor in the mid-rise portion of a Class A building

inclusive of taxes, insurance, maintenance, janitorial and utilities

(electricity surcharges added where applicable). All office rents in

this report are quoted on an annual, gross per square foot basis.

Rent calculations do not include sublease space.

Cap Rate (Or going-in cap rate) Capitalization rates in this

survey are based on multi-tenant institutional grade buildings fully

leased at market rents. Cap rates are calculated by dividing net

operating income (NOI) by purchase price.

Note: SF=Square Feet

PSF=Per Square Foot

CBD=Central Business District

COLLIERS INTERNATIONAL

NORTH AMERICAN HIGHLIGHTS

FIRST QUARTER 2009

Colliers Office Locations

278 OFFICES WORLDWIDE

Colliers International is a corporation of leading real estate firms committed to delivering

consistently superior commercial real estate services, wherever, and whenever needed.

127

Global $2.0 Billion in Revenue

868 Million SF Under Management

11,000 Employees

62 Countries

6 Continents

90

61

Americas

94 United States

17 Canada

16 Latin America

Europe, Middle East & Africa

Asia Pacific

62 COUNTRIES

ON 6 CONTINENTS

HAWAII

SOUTH

AMERICA

NORTH AMERICA

ASIA

PACIFIC

EUROPE AND

MIDDLE EAST

AFRICA

AUSTRALIA

Albania

Argentina

Australia

Austria

Belarus

Belgium

Brazil

Bulgaria

Canada

Chile

China

Colombia

Costa Rica

Croatia

Czech Republic

Denmark

Estonia

Finland

France

Germany

Greece

Hong Kong

Hungary

India

Indonesia

Ireland

Israel

Italy

Japan

Latvia

Lithuania

Macau

Mexico

Montenegro

Netherlands

New Zealand

Norway

Pakistan

Per

Philippines

Poland

Portugal

Qatar

Romania

Russia

Saudi Arabia

Serbia

Singapore

Slovak Republic

South Africa

South Korea

Spain

Sweden

Switzerland

Taiwan

Thailand

Turkey

UAE

Ukraine

United Kingdom

U.S.A.

Vietnam

Office Locations

Colliers International

50 Milk Street, 20th Floor

Boston, MA 02109 USA

Tel: (617) 722-0221

Fax: (617) 722-0224

The information contained herein has been obtained from sources deemed reliable. While every reasonable effort has been

made to ensure its accuracy, we cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are encouraged

to consult their professional advisors prior to acting on any of the material contained in this report.

www.colliers.com

COLLIERS INTERNATIONAL

Das könnte Ihnen auch gefallen

- Cost of Doing Business Study, 2012 EditionVon EverandCost of Doing Business Study, 2012 EditionNoch keine Bewertungen

- Toronto: OntarioDokument8 SeitenToronto: Ontarioapi-26443221Noch keine Bewertungen

- D N - T W, P T D: Espite EAR ERM Eakness Ositive Rends EvelopingDokument4 SeitenD N - T W, P T D: Espite EAR ERM Eakness Ositive Rends EvelopingevansthNoch keine Bewertungen

- Office Market - Panama City: Quick Stats (Class A)Dokument4 SeitenOffice Market - Panama City: Quick Stats (Class A)Fernando Rivas CortesNoch keine Bewertungen

- Cushman & Wakefield's MarketBeat - Industrial U.S. 3Q 2013Dokument0 SeitenCushman & Wakefield's MarketBeat - Industrial U.S. 3Q 2013Angie BrennanNoch keine Bewertungen

- Tenant Report 3Q 2011 DC - FINAL-LetterDokument4 SeitenTenant Report 3Q 2011 DC - FINAL-LetterAnonymous Feglbx5Noch keine Bewertungen

- Marketview: Greensboro/Winston-Salem IndustrialDokument5 SeitenMarketview: Greensboro/Winston-Salem Industrialapi-273306257Noch keine Bewertungen

- Q3 2012 OfficeSnapshotDokument2 SeitenQ3 2012 OfficeSnapshotAnonymous Feglbx5Noch keine Bewertungen

- BaltimoreOfficeSnapshot Q32013Dokument2 SeitenBaltimoreOfficeSnapshot Q32013Anonymous Feglbx5Noch keine Bewertungen

- Slight Softening in Fundamentals During Fourth Quarter: ResearchDokument6 SeitenSlight Softening in Fundamentals During Fourth Quarter: ResearchAnonymous Feglbx5Noch keine Bewertungen

- Q2 2012 OfficeSnapshotDokument2 SeitenQ2 2012 OfficeSnapshotAnonymous Feglbx5Noch keine Bewertungen

- Howard County 3Q11Dokument3 SeitenHoward County 3Q11William HarrisNoch keine Bewertungen

- BaltimoreOfficeSnapshot Q42012Dokument2 SeitenBaltimoreOfficeSnapshot Q42012Anonymous Feglbx5Noch keine Bewertungen

- 1 PDFDokument6 Seiten1 PDFAnonymous Feglbx5Noch keine Bewertungen

- JVB Vol5 No1v 09Dokument2 SeitenJVB Vol5 No1v 09Arnel Rebeta AggabaoNoch keine Bewertungen

- Ims PDFDokument4 SeitenIms PDFAnonymous Feglbx5Noch keine Bewertungen

- Tell Us MoreDokument13 SeitenTell Us MoreFooNoch keine Bewertungen

- CAE Q1 2013 Market ReportsDokument8 SeitenCAE Q1 2013 Market ReportsColliersIntlSCNoch keine Bewertungen

- Cbre PDFDokument99 SeitenCbre PDFAnonymous Feglbx5100% (1)

- The Nest Report: 3rd Quarter, 2009Dokument10 SeitenThe Nest Report: 3rd Quarter, 2009api-26005222Noch keine Bewertungen

- Palm BeachDokument5 SeitenPalm BeachAnonymous Feglbx5Noch keine Bewertungen

- 2014 Office TRENDSDokument20 Seiten2014 Office TRENDSGreater Baton Rouge Association of REALTORS® Commercial Investment DivisionNoch keine Bewertungen

- Real Estate: 4th Quarter 2015Dokument6 SeitenReal Estate: 4th Quarter 2015San SéngNoch keine Bewertungen

- Q3 2009 MoneyTree Report FinalDokument7 SeitenQ3 2009 MoneyTree Report FinaledwardreynoldsNoch keine Bewertungen

- Q3:11 Baltimore: Transwestern OutlookDokument7 SeitenQ3:11 Baltimore: Transwestern OutlookWilliam HarrisNoch keine Bewertungen

- Industrial PDFDokument4 SeitenIndustrial PDFAnonymous Feglbx5Noch keine Bewertungen

- Q4 2011 OfficeSnapshotDokument2 SeitenQ4 2011 OfficeSnapshotAnonymous Feglbx5Noch keine Bewertungen

- 2 Q 13 Office Market ReportDokument4 Seiten2 Q 13 Office Market ReportBea LorinczNoch keine Bewertungen

- CT DC 2Q14 SnapshotDokument2 SeitenCT DC 2Q14 SnapshotWilliam HarrisNoch keine Bewertungen

- Office Market Report: Baltimore Metro Economic Outlook (A Little) BrighterDokument4 SeitenOffice Market Report: Baltimore Metro Economic Outlook (A Little) BrighterAnonymous Feglbx5Noch keine Bewertungen

- US Manufacturing White PaperDokument2 SeitenUS Manufacturing White PaperAnonymous Feglbx5Noch keine Bewertungen

- 2016 TRENDS OfficeDokument21 Seiten2016 TRENDS OfficeGreater Baton Rouge Association of REALTORS® Commercial Investment DivisionNoch keine Bewertungen

- BDS - 2010 - CBRE - Toan Canh Thi Truong HA NOI (En) Q2 2010 - 06 07 2010Dokument28 SeitenBDS - 2010 - CBRE - Toan Canh Thi Truong HA NOI (En) Q2 2010 - 06 07 2010ac2000Noch keine Bewertungen

- Miami Office Insight Q3 2013Dokument4 SeitenMiami Office Insight Q3 2013Bea LorinczNoch keine Bewertungen

- Baltimore Office: Quick StatsDokument4 SeitenBaltimore Office: Quick StatsAnonymous Feglbx5Noch keine Bewertungen

- Inside Focus:: NYC: A Fragile Recovery After Seven Quarters of RecessionDokument9 SeitenInside Focus:: NYC: A Fragile Recovery After Seven Quarters of RecessionCeleste KatzNoch keine Bewertungen

- Marketview: Greensboro/Winston-Salem OfficeDokument4 SeitenMarketview: Greensboro/Winston-Salem Officeapi-273306257Noch keine Bewertungen

- Marketbeat: Office SnapshotDokument1 SeiteMarketbeat: Office Snapshotapi-150283085Noch keine Bewertungen

- Global Construction MaterialDokument86 SeitenGlobal Construction MaterialAmit SarafNoch keine Bewertungen

- Office OverviewDokument22 SeitenOffice OverviewAnonymous Feglbx5Noch keine Bewertungen

- Palm Beach County Office MarketView Q1 2016Dokument4 SeitenPalm Beach County Office MarketView Q1 2016William HarrisNoch keine Bewertungen

- NorthernVA IND 3Q11Dokument2 SeitenNorthernVA IND 3Q11Anonymous Feglbx5Noch keine Bewertungen

- Property Market Overview: IndiaDokument20 SeitenProperty Market Overview: Indiavarun_cbtNoch keine Bewertungen

- SF Off 4Q09Dokument4 SeitenSF Off 4Q09Justin BedecarreNoch keine Bewertungen

- Statewide Trends: Florida Net Absorption (Millions of SF)Dokument2 SeitenStatewide Trends: Florida Net Absorption (Millions of SF)Anonymous Feglbx5Noch keine Bewertungen

- Statewide Trends: Florida Net Absorption (Millions of SF)Dokument2 SeitenStatewide Trends: Florida Net Absorption (Millions of SF)Anonymous Feglbx5Noch keine Bewertungen

- Steady Leasing Pushed Down Vacancy For The Seventh Consecutive QuarterDokument5 SeitenSteady Leasing Pushed Down Vacancy For The Seventh Consecutive QuarterAnonymous Feglbx5Noch keine Bewertungen

- Mills 3Q15 ResultsDokument17 SeitenMills 3Q15 ResultsMillsRINoch keine Bewertungen

- 3) Current Market InformationDokument6 Seiten3) Current Market Informationjwingo1Noch keine Bewertungen

- Cbre Florida PDFDokument7 SeitenCbre Florida PDFAnonymous Feglbx5Noch keine Bewertungen

- Mills 3Q16 ResultsDokument17 SeitenMills 3Q16 ResultsMillsRINoch keine Bewertungen

- Global Office Index Q2 2016Dokument12 SeitenGlobal Office Index Q2 2016Mohamed BakryNoch keine Bewertungen

- Atlanta Office Market Report Q3 2011Dokument2 SeitenAtlanta Office Market Report Q3 2011Anonymous Feglbx5Noch keine Bewertungen

- 3Q11 Washington DC Office Market ReportDokument8 Seiten3Q11 Washington DC Office Market ReportAnonymous Feglbx5Noch keine Bewertungen

- Global Office Real Estate ReviewDokument30 SeitenGlobal Office Real Estate ReviewfilipandNoch keine Bewertungen

- UntitledDokument7 SeitenUntitledMillsRINoch keine Bewertungen

- Office Q2 2016 FullReportDokument17 SeitenOffice Q2 2016 FullReportWilliam HarrisNoch keine Bewertungen

- Executive Summary: Positive Momentum: Building SpotlightDokument6 SeitenExecutive Summary: Positive Momentum: Building SpotlightScott W. JohnstoneNoch keine Bewertungen

- 2010 ReviewDokument4 Seiten2010 ReviewednairNoch keine Bewertungen

- Shree New Price List 2016-17Dokument13 SeitenShree New Price List 2016-17ontimeNoch keine Bewertungen

- Fulltext 4 PDFDokument4 SeitenFulltext 4 PDFSubhadip Banerjee0% (1)

- 3rd Quarter Exam (Statistics)Dokument4 Seiten3rd Quarter Exam (Statistics)JERALD MONJUANNoch keine Bewertungen

- Keiilf: Training ManualDokument53 SeitenKeiilf: Training ManualGary GouveiaNoch keine Bewertungen

- G1CDokument12 SeitenG1CKhriz Ann C ÜNoch keine Bewertungen

- Fully Automatic Coffee Machine - Slimissimo - IB - SCOTT UK - 2019Dokument20 SeitenFully Automatic Coffee Machine - Slimissimo - IB - SCOTT UK - 2019lazareviciNoch keine Bewertungen

- Dawn of Solar PV CookingDokument5 SeitenDawn of Solar PV CookingAbhinav AgrawalNoch keine Bewertungen

- Middle Range Theory Ellen D. Schulzt: Modeling and Role Modeling Katharine Kolcaba: Comfort TheoryDokument22 SeitenMiddle Range Theory Ellen D. Schulzt: Modeling and Role Modeling Katharine Kolcaba: Comfort TheoryMerlinNoch keine Bewertungen

- Cargo ManagementDokument45 SeitenCargo ManagementShubham Chaurasia75% (8)

- FYP ProposalDokument11 SeitenFYP ProposalArslan SamNoch keine Bewertungen

- Parts Catalogue of Foton: (TC2A504-034K)Dokument132 SeitenParts Catalogue of Foton: (TC2A504-034K)МаксимNoch keine Bewertungen

- Module 4 Active Faults and Other Earthquake Sources: Learning OutcomeDokument3 SeitenModule 4 Active Faults and Other Earthquake Sources: Learning OutcomeFatima Ybanez Mahilum-LimbagaNoch keine Bewertungen

- S TR GEN ID (Component Marking) (Rev 3 2009) - AN Marked UpDokument6 SeitenS TR GEN ID (Component Marking) (Rev 3 2009) - AN Marked UpsnclgsraoNoch keine Bewertungen

- Indor Lighting DesignDokument33 SeitenIndor Lighting DesignRajesh MalikNoch keine Bewertungen

- Gemh 108Dokument20 SeitenGemh 108YuvrajNoch keine Bewertungen

- Flow Chart - QCDokument2 SeitenFlow Chart - QCKarthikeyan Shanmugavel100% (1)

- Texto EBAU 1Dokument2 SeitenTexto EBAU 1haridianrm13Noch keine Bewertungen

- Lecture 12Dokument8 SeitenLecture 12Mechanical ZombieNoch keine Bewertungen

- Bảng giá FLUKEDokument18 SeitenBảng giá FLUKEVăn Long NguyênNoch keine Bewertungen

- 02-Building Cooling LoadsDokument3 Seiten02-Building Cooling LoadspratheeshNoch keine Bewertungen

- Rail Vehicle DynamicsDokument55 SeitenRail Vehicle DynamicsdfNoch keine Bewertungen

- The Acceptability of Rubber Tree Sap (A As An Alternative Roof SealantDokument7 SeitenThe Acceptability of Rubber Tree Sap (A As An Alternative Roof SealantHannilyn Caldeo100% (2)

- Column, Slab, Footing and Wall Footing Foundations: Class A MixingDokument47 SeitenColumn, Slab, Footing and Wall Footing Foundations: Class A MixingGioharry Nul PanambulanNoch keine Bewertungen

- Pediatric EmergenciesDokument47 SeitenPediatric EmergenciesahmedNoch keine Bewertungen

- Fig. 4 Phasor Diagram of P.TDokument31 SeitenFig. 4 Phasor Diagram of P.Tdon aNoch keine Bewertungen

- Chapter 3.c (Centroid by Intergration)Dokument15 SeitenChapter 3.c (Centroid by Intergration)Ariff AziziNoch keine Bewertungen

- 2015 Nos-Dcp National Oil Spill Disaster Contingency PlanDokument62 Seiten2015 Nos-Dcp National Oil Spill Disaster Contingency PlanVaishnavi Jayakumar100% (1)

- Sika - Bitumen: Bitumen Emulsion Waterproof & Protective CoatingDokument3 SeitenSika - Bitumen: Bitumen Emulsion Waterproof & Protective Coatingdinu69inNoch keine Bewertungen

- Plastics and Polymer EngineeringDokument4 SeitenPlastics and Polymer Engineeringsuranjana26Noch keine Bewertungen

- Mahindra & MahindraDokument13 SeitenMahindra & MahindraAbhishek DharmadhikariNoch keine Bewertungen

- University of Chicago Press Fall 2009 CatalogueVon EverandUniversity of Chicago Press Fall 2009 CatalogueBewertung: 5 von 5 Sternen5/5 (1)

- University of Chicago Press Fall 2009 Distributed TitlesVon EverandUniversity of Chicago Press Fall 2009 Distributed TitlesBewertung: 1 von 5 Sternen1/5 (1)