Beruflich Dokumente

Kultur Dokumente

Technical Analysis

Hochgeladen von

nimbarknimawatOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Technical Analysis

Hochgeladen von

nimbarknimawatCopyright:

Verfügbare Formate

Research paper

IJBARR

ISSN No. 2347 856X

TECHNICAL ANALYSIS IN SELECT STOCKS OF INDIAN COMPANIES

C. Boobalan

Assistant Professor, PG and Research Dept. of Commerce, SVM College.

Abstract

Technical analysts believe that the historical performance of

Stocks and markets are indications of future performance.

Technical Analysis is the forecasting of future financial price movements based on an examination of

past price movements. Technical analysis does not result in absolute predictions about the future with

regard to forecasting. Instead, technical analysis can help investors anticipate what is "possible" to

happen to prices over time. Technical analysis is study of predicting prices of securities for future the

main aim of technical analysis is to generate returns by charter person decide when to enter and when

to exit in the security. Technical Analysis is of the stock market relating to factors affecting the supply

and demand of stocks. It helps in understanding the intrinsic value of shares and knowing whether the

shares are undervalued or overvalued. The stock market indicators would help the investor to identify

major market turning points. This is a significant technical analysis of selected companies which helps

to understand the price behavior of the shares, the signals given by them and the major turning points of

the market price. This paper is aims at carrying out Technical Analysis of the securities of the selected

companies and to assist investment decisions in this Indian Market.

Key Words: Financial Price, Past Price, Prediction Securities, Chart, Price Behavior.

I. Introduction

Technical Analysis can be defined as an art and science of forecasting future prices based on an

examination of the past price movements. Technical analysis is not astrology for predicting prices.

Technical analysis is based on analyzing current demand-supply of commodities, stocks, indices, futures

or any tradable instrument. Technical analysis involve putting stock information like prices, volumes

and open interest on a chart and applying various patterns and indicators to it in order to assess the

future price movements. The time frame in which technical analysis is applied may range from intraday

(5-minute, 10-minutes, 15-minutes, 30-minutes or hourly), daily, weekly or monthly price data to many

years.

There are essentially two methods of analyzing investment opportunities in the security market viz

fundamental analysis and technical analysis. Fundamental information like financial and non-financial

aspects of the company or technical information which ignores fundamentals and focuses on actual price

movements a may be used. The technical analyst assumes that it is 90 percent psychological and 10

percent logical. Technical analysis is a method of evaluating securities by analyzing the statistics

generated by market activity, such as past prices and volume. Technical analysts do not attempt to

measure a securities intrinsic value, but instead use charts and other tools to identify patterns that can

suggest future activity.

International Journal of Business and Administration Research Review, Vol.2, Issue.4, Jan-March, 2014 .

Page 26

Research paper

IJBARR

ISSN No. 2347 856X

The study on technical analysis of selected companies based on Stratified sampling technique is

significant as it helps in understanding the intrinsic value of shares and to know whether the shares are

undervalued or overvalued or correctly priced. Further it helps in understanding the price behaviour of

the shares, the signals given by them and the major turning points of the market price. The concept of

analysis comes into picture when decision has to be made on choosing a particular companys shares for

investment. Technical analysis is a security analysis technique that claims the ability to forecast the

future direction of prices through the study of past market data primarily price and volume.

The Basic Assumptions of Technical Analysis are

1. Market Fluctuations Discount Everything else.

Technical analysts believe that changes in the price of a security and how well it trades in the market

embody all available information about that security from everyone involved with it and therefore

represents the fair value of that security. Sudden changes in how a stock trades often precedes major

news about the company that issued the stock. Technical analysts don't concern themselves with the

price-to-earnings ratio, shareholder equity, return on equity or other factors that fundamental analysts

do.

2.Price Movements can often be Charted and Predicted.

Technical analysts acknowledge that there are periods when prices move randomly, but there are also

times when they move in an identifiable trend. Once a trend is identified, it is possible to make money

from it, either by buying low and selling high during an upward trend (bull market) or by selling short

during a downward trend (bear market). By adjusting the length of time the market is being analyzed, it

is possible to spot both short- and long-term trends.

3.History Repeats Itself.

People don't change their motivations overnight; therefore, traders will react the same way to conditions

as they did in the past when those conditions repeat themselves. Because people react the same way,

technical analysts can use the knowledge of how other traders reacted in the past to profit each time

those conditions repeat them.

II. Literature Review

Several studies have been carried out to apply Technical Analysis in practice in various financial

markets. A few of them are quoted below:

Kavajecz and Odders-White (2004) show that support and resistance levels coincide with peaks in

depth on the limit order book 1 and moving average forecasts reveal information about the relative

position of depth on the book. They also show that these relationships stem from technical rules locating

depth already in place on the limit order book.

Practitioners reliance on technical analysis is well documented. Frankel and Froot (1990) noted that

market professionals tend to include technical analysis in forecasting the market.

International Journal of Business and Administration Research Review, Vol.2, Issue.4, Jan-March, 2014 .

Page 27

Research paper

IJBARR

ISSN No. 2347 856X

The guiding principle of technical analysis is to identify and go along with the trend. When there is a

trend, whether started by random or fundamental factors, technical methods will tend to generate signals

in the same direction. This reinforces the original trend, especially when many investors rely on the

technical indicators. Thus, even if the original trend were a random occurrence, the subsequent

prediction made by the technical indicator could be self-fulfilling. This self-fulfilling nature leads to the

formation of speculative bubbles (see, for example, Froot et al., 1992). Conrad and Kaul (1988) found

that weekly returns were positively autocorrelated, particularly for portfolios of small stocks.

Lui and Mole (1998) report the results of a questionnaire survey conducted in February 1995 on the use

by foreign exchange dealers in Hong Kong of fun-damental and technical analyses. They found that over

85% of respondents relyon both methods and, again, technical analysis was more popular at shorter time

horizons.

This paper aims at carrying out Technical Analysis of the securities of the selected companies in Indian

stock market.

III. Objectives

1. To study the relevence of technical analysis in Indian capital market

2. To analyze the performance of select companies in Indian stock market and to predict the future

trends in the share prices through Technical Analysis

3. To find out risk and return for selected securities

4. Technical analysis on selected stocks and interpret on whether to buy or sell

5. To suggesting the investors in making investment decisions in selected stock

IV. Research Methodology

The study aims at analyzing the price movements of selected companys scrip. As the study describes

the existing facts and figures given in the financial statement and the price movements of the selected

companies, the research design followed is descriptive and analytical in nature. For Technical Analysis,

Secondary Data the weekly share price movements of the selected companies in NSE were absorbed for

the 3 years i.e. FEB-2011 to 03-MAR-2014. The closing prices of share prices were taken and the

future price movement was analyzed using various tools. Data were collected from trading of equity

market in NSE, various books, journals, magazines and websites. All the listed companies in the

National Stock Exchange 5 companies which are actively traded in NSE were taken on Stratified

sampling basis for the study. The selected companies are:

1. WIPRO

2. SBIN (State Bank of India )

3. GAIL (Gas Authority of India Limited )

4. ONGC (Oil & Natural Gas Corporation Ltd.)

5. ITC (Imperial Tobacco Company of India Limited)

Time Period of the Study

The period of three years from Feb, 2011 to 3 MAR, 2014 have been taken to carry out the present study.

The major Tools and Techniques used in this study are:

1. Stock (Candlestick) chart

2. Exponential moving average (EMA)

International Journal of Business and Administration Research Review, Vol.2, Issue.4, Jan-March, 2014 .

Page 28

Research paper

IJBARR

ISSN No. 2347 856X

3. Moving average convergence divergence (MACD)

4. Relative strength index (RSI)

Tools of Technical Analysis

Candlestick Chart

Japanese candlestick charts form the basis of the oldest form of technical analysis. Candlestick charts

provide the information as namely open price. High price, low price and Close price, however.

Candlestick charting provide a visual indication of market psychology, market sentiment and potential

weakness making it a rather valuable trading tool.

V. Technical Indicators

Technical indicators are mathematical formulas that, when applied to security prices clearly flash either

buy or sell signals. Price data includes any combination of the open, high, low, or close over a period of

time and most of the indicators use only the closing prices. For analysis purposes, technical indicators

are usually shown in a graphical form above or below a securitys price chart. Once shown in graphical

form, an indicator can then be compared with the corresponding price chart of the security.

Technical indicators offer many uses such as:

(1) To confirm the trends

(2) To generate buy/ sell signals

(3) To predict the direction of future prices.

Moving Averages

Most chart patterns show a lot of variation in price movement. This can make it difficult for traders to

get an idea of a securitys overall trend. One simple method traders use to combat this is to apply

moving averages. A moving average is the average price of a security over a set amount of time. They

smooth a data series and made it easier to spot trends, something that is especially helpful in volatile

markets.

The two most popular types of moving averages are:

1. Simple moving average (SMA)

2. Exponential moving average (EMA)

Simple Moving Average (SMA)

A simple moving average is formed by computing the average (mean) price of a security over a

specified number of periods. For example: a 5 day moving average is calculated by adding the closing

prices for the last 5 days and dividing the total by 5.

Exponential Moving Average (EMA)

Exponential moving average is the moving average that is formed by applying weight to the recent price

changes.

EMA (current) = ((price (current) EMA (prev) * Multiplier) + EMA (prev)

The formula for the smoothing constant is:

K = 2/ (1+N)

Where,

N = number of periods for EMA

International Journal of Business and Administration Research Review, Vol.2, Issue.4, Jan-March, 2014 .

Page 29

Research paper

IJBARR

ISSN No. 2347 856X

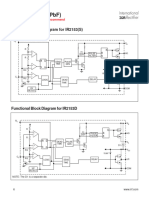

Moving Average Convergence and Divergence (MACD)

Developed by Gerald Appel in the late seventies, moving average convergence divergence (MACD) is

one of the simplest and most effective momentum indicators available. The MACD indicator is one of

the most popular technical analysis tools.

MACD fluctuates above and below the zero line (the centre line) as the moving averages converge,

cross and diverge. Standard MACD is the 12-day exponential moving average (EMA) less the 26-day

EMA. A 9-day EMA of MACD is plotted alongside to act as a signal line to identify turns in the

indicator. The MACD histogram represents the difference between MACD and its 9-day EMA, the

signal line.

Relative Strength Index (RSI)

The relative strength index (RSI) is an extremely useful oscillating momentum indicator that was

developed by J. Welles Wilder and is one of the most widely used indicators in technical analysis. RSI

oscillates between zero and 100. The most popular is the 14 days RSI where the RSI is calculated based

on 14 days values. Traditionally the stock is considered to be over bought when RSI is above 70 and

over sold when RSI is below 30. Signals can also be generated by looking for divergences and central

line crossovers.

The basic formula is:

RSI = 100 [100/(1+RS)]

Where,

RS = average of upward price change over a select number of days / average of downward price change

over the same number of days.

Sources of Data

Primary Data

Primary data are generated through personal investigation on the companies.

Secondary Data

The secondary data has to be collected from the records and published annual reports of the

company, web sites, Journals etc.

1. Data collected from various books and websites.

2. Secondary data collected from news papers & magazines.

3. Data collected from internet.

4. Publication.

5. Information provided by stock broking centers for various places

Limitations

1. For doing this analysis the researcher has taken into consider only limited

parameters.These parameters may not be enough to predict the future price

movements.

2. Technical analysis only for three year is undertaken; from this data we cannot predict prices

accurately.

3. This study can be used only for short term decision making

International Journal of Business and Administration Research Review, Vol.2, Issue.4, Jan-March, 2014 .

Page 30

Research paper

IJBARR

ISSN No. 2347 856X

Chart Analysis & Interpretations

Candlestick chart have been developed to analyses the five selected companies with regard to their price

fluctuations and their connotation to the investors.

WIPRO

Wipro Limited (formerly Western India Products Limited is an Indian multinational information

technology (IT), consulting and

outsourcing service

company

headquartered

in Bangalore,

Karnataka, India. As of September 2013, the company has 147,000 employees serving over 900 clients

with a presence in 61 countries. Wipro is the third largest IT services company in India.

CHART 1 : STOCK PRICE MOVEMENT OF WIPRO

From the chart1 the price is located above the EMA. The chart WIPRO represents the variation in

different price such as open, high, low and close in respect of different weeks which had been taken into

consideration 03/02/2011 to 03/03/2014.

The candlestick chart of WIPRO can the stock prices of WIPRO are in short term and medium term is

bulish. Already triple top breakout on 26/08/2013 at 483 level next replacement targets 592,660 and 760

and stoploss 540 level expected. The MACD and RSI also indicate the even bought trend. On the basis

of the trend investor makes a decision about buy or sell.

Recommendation

Short and medium term bullish

SBIN (State Bank of India)

State Bank of India provides banking products and services in India and at international. It offers

personal banking products and services, which include current accounts, savings accounts, term

deposits, and capital gains account schemes; housing, car, property, educational, personal, festival,

International Journal of Business and Administration Research Review, Vol.2, Issue.4, Jan-March, 2014 .

Page 31

Research paper

IJBARR

ISSN No. 2347 856X

career, scholar, and gold loans, as well as loans for pensioners and loans against shares and debentures;

and mobile and Internet banking, demat, ATM, foreign inward remittance, safe deposit locker, public

provident fund, multi-city cheques, money transfer, and mobile wallet services, as well as debit,

business debit, prepaid, and virtual cards. The company operates through 20,325 branches, including

5,509 branches of its 5 associate banks; and 32,752 ATMs. State Bank of India was founded in 1806 and

is based in Mumbai, India.

CHART 2: STOCK PRICE VARIATION OF SBIN

From chart 2 it could be concluded that the price is located below making average. The chart SBIN

represents the variation in different price. Such as open, high, low and close in respect of different weeks

which had been taken into consideration 03/02/2011 to03/03/2014.

The candlestick chart of SBIN can the stock price of SBIN are in short term bullish and medium and

long term bearish trend expected. Double bottom line 1447 breakout next supports at 1250 if buy above

1930 only uptrend generated. MACD and RSI technically indicate weak trend.

Recommendation

Buy SBIN above at 1930

Sell below 1447 down target 1250

GAIL (GAIL India Ltd.)

GAIL (India) Limited operates as a natural gas company in India and abroad. The company operates

through Transmission Services, Natural Gas Trading, Petrochemicals, Liquefied Petroleum Gas (LPG)

and Other Liquid Hydrocarbons, and Other segments. It is involved in the transmission, distribution, and

marketing of natural gas to power and fertilizer sectors, as well as supplies liquefied natural gas to

International Journal of Business and Administration Research Review, Vol.2, Issue.4, Jan-March, 2014 .

Page 32

Research paper

IJBARR

ISSN No. 2347 856X

downstream consumers. The company also markets LPG, propane, pentane, naphtha, MFO, propylene,

and hydrogenated C4 mix; and manufactures and markets petrochemicals, such as high density

polyethylene and linear low density polyethylene under the brand names of G-Lex, G-Lene, and GAIL.

Chart 3 : Stock Price Movement of Gail

Chart 3 the price of GAIL is located above moving average. It is indicated to buy the stock. The charts

and GAIL represents the variation in different price. Such as open, high, low and close in respect of

different had been taken into consideration 03/02/2011 to 03/03/2014. Trend line is between 362 to 394.

It shows the positive note that the price may increase. In moving average analysis, price line is above the

mainly average to it indicates the buy signal. GAIL short term target 396 and medium and long term buy

above 401 next targets 443 and 465 long term trend is bullish. According to RSI & MACD analysis is

technically strong signal to buy.

Recommendation

Short and medium term buy at 382

Long term buy above 400 targets 443 and 465

ONGC (Oil & Natural Gas Corporation Ltd.)

Oil and Natural Gas Corporation Limited is engaged in the exploration, development, and production of

oil and gas in India and internationally. The companys products include crude oil, natural gas, liquefied

petroleum gas, naphtha, ethane/propane, kerosene oil, low sulphur heavy stock, high speed diesel, motor

spirit, aviation turbine fuel, mineral turpentine oil, and others. It is also involved in power generation,

liquefied natural gas supply, and pipeline transportation activities; and the provision of petrochemicals.

Oil and Natural Gas Corporation Limited was incorporated in 1993 and is based in Dehradun, India.

International Journal of Business and Administration Research Review, Vol.2, Issue.4, Jan-March, 2014 .

Page 33

Research paper

IJBARR

ISSN No. 2347 856X

Chart 4 : Stock Price Behaviour of ONGC

Chart 4 kindly indicates the price movements of ONGC located above the support level.

The chart

ONGC represents the variation in prices. Such as open, high, low and close in respect of different weeks

which the period 03/02/2011 to 03/03/2014 was taken for the purposes.

The candlestick chart of ONGC can the spot the share price of ONGC are in short term medium term is

bullish and long team bearish trend. The ONGC range bound between 262 to 308 if break 308 next

upper targets levels at 319.8 and 345 and it break 262 level downtrend targets 244. Short term according

to RSI &MACD analysis ONGC is technically strong. On the basis of this trend investor makes a

decision buy and sell.

Recommendation

Short and medium term buy at 308 targets 319 and 345 &

Sell below 262 target 244

ITC (ITC Ltd.)

ITC Limited engages in fast moving consumer goods, paperboards and packaging, hotels, and agri

businesses in India and internationally. The company offers cigarettes under the Insignia, India Kings,

Lucky Strike, Classic, Gold Flake, Navy Cut, Players, Scissors, Capstan, Berkeley, Bristol, Flake, Silk

Cut, and Duke & Royal brands; Armenteros hand rolled cigars; ready to eat foods, staples, confectionery

products, and snack foods under the Aashirvaad, Sunfeast, Bingo!, Kitchens of India. ITC Limited

provides information technology services and solutions to various industries. The company was

incorporated in 1910 and is based in Kolkata, India.

International Journal of Business and Administration Research Review, Vol.2, Issue.4, Jan-March, 2014 .

Page 34

Research paper

IJBARR

ISSN No. 2347 856X

Chart 5 : Stock Price Movement of ITC

ITC chart 5 signifies the sideways price movement for the last four months the chart ITC represents the

variation in different price. Such as open, high, low and close in respect of different weeks which the

periods 03/02/2011 to 03/03/2014 was taken for the purposes.

The candlestick chart of ITC can the current share price of ITC are in Head and Shoulder pattern after

that sideway trend created the crucial points 305 and 340. It breaks 305 next supports 285 and if breaks

282 heavy falls expected upper stop loss 335 and buy above 340 levels upper targets 365 and 380. RSI

and MACD short term bullish signal.

Recommendation

Short and medium term buy at 340 targets 365 and 380 &

Sell below 282

Conclusion

Technical analysis is a technique which gives an idea about future share prices of selected companies in

which we invest. On the basis of the knowledge of technical analysis one can predict the perfect

investment decision of the stock market. By using the technical indicators the future market of securities

would be known in which to invest. The more accurate prediction of stock prices of selected companies

the investor to carry out fundamental analysis of stock prices, they can predict of future trend of stock

prices. On the basis of prediction of five companies (i.e. WIPRO, SBIN, GAIL, ONGC, ITC) different

pattern of stock prices of these companies give an idea of future trend of these companies could be

analyzed with the right technical analysis tools, technical analysis of utmost importance to predict trend

of short and medium term price movement and help the investors to select the right plan and decisions to

invest in the remunerative stocks. The technician also required a fundamental knowledge, which would

clear an idea about the investment decision. Both Technical and Fundamental analysis helps in

International Journal of Business and Administration Research Review, Vol.2, Issue.4, Jan-March, 2014 .

Page 35

Research paper

IJBARR

ISSN No. 2347 856X

investment decision in the stock market and predict the future trend of the selected companies in which

we have invested. Both the analysis gives guidance to the investors.

There is only one side to the stock market and it is not the bull side or the bear side but the right side.

Technical analysis can be used, when to buy and to when to sell the stock.

References

Books

1. Security Analysis & Portfolio Management - Fishers & Jordon.

2. Investment analysis and portfolio Management, Chandra, McGraw Hill2009.

3. Pring Martin J. (1991): Technical Analysis, Explained The Successful Investors Guide to

Spotting Investment Trends and Turning Points, McGraw Hill, 1991.

Research Report

1. Cheol-Ho Park, Scott H. Irwin (2004). The Profitability of Technical Analysis: Project

Research Report No. 2004-04.

2. IJMBS Vol. 1, Issue 1, March 2011 Technical Analysis on Selected Stocks of Energy Sector

R.Chitra.

3. International Journal of Advanced Research (2013), Volume 1, Issue 4, 430-446 : Technical

Analysis for Selected Companies of Indian IT Sector - Hemal Pandya.

Websites

1.

2.

3.

4.

5.

6.

www.moneycontrol.com

www.nseindia.com

www.google.com

www.indiainfoline.com

www.yahoofinance.com

http://www.icharts.in/charts.html

International Journal of Business and Administration Research Review, Vol.2, Issue.4, Jan-March, 2014 .

Page 36

Das könnte Ihnen auch gefallen

- Project AppraisalDokument25 SeitenProject AppraisalAman MehtaNoch keine Bewertungen

- Economic EnvironmentDokument37 SeitenEconomic EnvironmentAnuja KulshrestaNoch keine Bewertungen

- Social and Environment Impact AnalysisDokument1 SeiteSocial and Environment Impact Analysistaman siswaNoch keine Bewertungen

- Socio Cultural EnvironmentDokument12 SeitenSocio Cultural EnvironmentNidhi Hada JainNoch keine Bewertungen

- Industrial AdvertisingDokument29 SeitenIndustrial AdvertisingRamanGouda S PatilNoch keine Bewertungen

- Global Climate Change Death Penalty ElectionDokument10 SeitenGlobal Climate Change Death Penalty ElectionAar Tech CareNoch keine Bewertungen

- Reaction Paper # 3 Marketing ManagementDokument1 SeiteReaction Paper # 3 Marketing ManagementMara Shaira SiegaNoch keine Bewertungen

- Smoke Filtering DeviceDokument18 SeitenSmoke Filtering DeviceLeonah MunozNoch keine Bewertungen

- Organization Study ReportDokument44 SeitenOrganization Study ReportGovind ChowdharyNoch keine Bewertungen

- Air PurifierDokument4 SeitenAir Purifiervemuri sakethNoch keine Bewertungen

- Economics For Managers GTU MBA Sem 1 Chapter 4Dokument24 SeitenEconomics For Managers GTU MBA Sem 1 Chapter 4Rushabh VoraNoch keine Bewertungen

- Industrial Safety Management-IISM IndiaDokument10 SeitenIndustrial Safety Management-IISM IndiaNakul SharmanNoch keine Bewertungen

- GROUP 2 Operational AnalysisDokument2 SeitenGROUP 2 Operational AnalysisMayeterisk R100% (1)

- The Interdependence of Philosophy and EducationDokument2 SeitenThe Interdependence of Philosophy and EducationWella InfanteNoch keine Bewertungen

- Panunumpa NG PropesyonalDokument71 SeitenPanunumpa NG PropesyonalHenry SyNoch keine Bewertungen

- Unit 5 Nature and Purpose of OrganizingDokument49 SeitenUnit 5 Nature and Purpose of OrganizingAnkit Patidar100% (1)

- E-Business Strategic Initiative: E-School (Virtual Learning Environment)Dokument14 SeitenE-Business Strategic Initiative: E-School (Virtual Learning Environment)Raman PalNoch keine Bewertungen

- Unit 3 Socio Cultural EnvironmentDokument14 SeitenUnit 3 Socio Cultural EnvironmentPrabal Shrestha100% (2)

- Development of A Household Coconut Punch-cum-SplitDokument7 SeitenDevelopment of A Household Coconut Punch-cum-SplitRam PandeyNoch keine Bewertungen

- 01 Introduction To The Learning ProcessDokument4 Seiten01 Introduction To The Learning ProcessAzraai AhmadNoch keine Bewertungen

- Rural Marketing ResearchDokument25 SeitenRural Marketing ResearchashilNoch keine Bewertungen

- Self Assessment Report - MBA (General)Dokument25 SeitenSelf Assessment Report - MBA (General)Ambreen ZainebNoch keine Bewertungen

- Legal Aspects of MarketingDokument6 SeitenLegal Aspects of MarketingKorazon Talib AbdullahNoch keine Bewertungen

- GAURAV KUMAR-customer Perception HundaiDokument71 SeitenGAURAV KUMAR-customer Perception HundaiEr Mohsin KhanNoch keine Bewertungen

- Theory of SellingDokument15 SeitenTheory of Sellinganindya_kunduNoch keine Bewertungen

- Job PreferenceDokument18 SeitenJob PreferenceSamima AkteriNoch keine Bewertungen

- Doing Business in India A Country Commercial Guide For U S CompaniesDokument181 SeitenDoing Business in India A Country Commercial Guide For U S CompaniesInsideout100% (19)

- Introduction To Bussiness ReserchDokument60 SeitenIntroduction To Bussiness ReserchBiniam MershaNoch keine Bewertungen

- HRD Experiences in Indian IndustryDokument45 SeitenHRD Experiences in Indian IndustryMunagala BhargavNoch keine Bewertungen

- Investment Pattern and Awareness of Salaried Class Investors in Tiruvannamalai District of TamilnaduDokument9 SeitenInvestment Pattern and Awareness of Salaried Class Investors in Tiruvannamalai District of Tamilnadumurugan_muruNoch keine Bewertungen

- Final Report ICSSRDokument80 SeitenFinal Report ICSSRritesh rachnalifestyleNoch keine Bewertungen

- The Service Industry TriangleDokument6 SeitenThe Service Industry Triangleplybz18Noch keine Bewertungen

- Conclusions and Recommendations: Chapter-7Dokument35 SeitenConclusions and Recommendations: Chapter-7Sourav VaidNoch keine Bewertungen

- Controlling Hazardous Fumes and Gases During WeldingDokument2 SeitenControlling Hazardous Fumes and Gases During WeldingMohd MustafhaNoch keine Bewertungen

- Study of Logistics in IndiaDokument41 SeitenStudy of Logistics in IndiaDevavrat JalanNoch keine Bewertungen

- Project On SharekhanDokument55 SeitenProject On SharekhanjatinNoch keine Bewertungen

- 2 WeldingDokument30 Seiten2 WeldingAndronicoll Mayuga NovalNoch keine Bewertungen

- Research and DevelopmentDokument32 SeitenResearch and DevelopmentPutri Agus Wijayati Rochajat100% (1)

- Marketing Research AssignmentDokument5 SeitenMarketing Research AssignmentSamie ElahiNoch keine Bewertungen

- Personal SellingDokument37 SeitenPersonal SellingOpebi Olalekan100% (3)

- Hofstede's Cultural DimensionsDokument8 SeitenHofstede's Cultural DimensionsKhoirul AnamNoch keine Bewertungen

- Political and Legal EnvironmentDokument32 SeitenPolitical and Legal EnvironmentRavi NagarathanamNoch keine Bewertungen

- Synopsis of The ChapterDokument28 SeitenSynopsis of The ChapterShweta MurarkaNoch keine Bewertungen

- Sheth Model, Industrial Buyer BehaviourDokument9 SeitenSheth Model, Industrial Buyer BehavioursolomonNoch keine Bewertungen

- FIANL-FIANL - Factors Influencing Investment DecisionsDokument60 SeitenFIANL-FIANL - Factors Influencing Investment DecisionsCabigas WonhamayNoch keine Bewertungen

- Index Number Unit-4 FinalDokument57 SeitenIndex Number Unit-4 FinalSachin KirolaNoch keine Bewertungen

- Environmental AnalysisDokument4 SeitenEnvironmental AnalysisShara Mae GarciaNoch keine Bewertungen

- Element of CostDokument16 SeitenElement of CostcwarekhaNoch keine Bewertungen

- Principle Steps in Sample SurveyDokument3 SeitenPrinciple Steps in Sample SurveyPurani SwethaNoch keine Bewertungen

- Taxable Event and Supply: Presentation By: - Ranvir Singh Rahul Banger Rollno: - 2024550Dokument14 SeitenTaxable Event and Supply: Presentation By: - Ranvir Singh Rahul Banger Rollno: - 2024550Gurinder SinghNoch keine Bewertungen

- Industrial Markeing MMS - Sem - IDokument37 SeitenIndustrial Markeing MMS - Sem - INitesh NagdevNoch keine Bewertungen

- 7 Effects of Shielding GasDokument4 Seiten7 Effects of Shielding GasloboandiNoch keine Bewertungen

- Fostering Innovation Through Experiential LearningDokument14 SeitenFostering Innovation Through Experiential LearningAndrew TranNoch keine Bewertungen

- Hero and Honda SplitDokument11 SeitenHero and Honda SplitTanya SharmaNoch keine Bewertungen

- Ddugky Welding Lab ManualDokument15 SeitenDdugky Welding Lab ManualprakashNoch keine Bewertungen

- 1 Technical AnalysisDokument12 Seiten1 Technical Analysismonik shahNoch keine Bewertungen

- Technic AnalysisDokument66 SeitenTechnic AnalysisqrweqtweqtqNoch keine Bewertungen

- Technical Analysis SynopsisDokument15 SeitenTechnical Analysis Synopsisfinance24100% (1)

- Technic AnalysisDokument82 SeitenTechnic AnalysiswqewqdefeNoch keine Bewertungen

- The Market For Long Term Securities Like Bonds, Equity Stocks andDokument76 SeitenThe Market For Long Term Securities Like Bonds, Equity Stocks andRohit AggarwalNoch keine Bewertungen

- AE Notification 2015 NPDCLDokument24 SeitenAE Notification 2015 NPDCLSuresh DoosaNoch keine Bewertungen

- China Training WCDMA 06-06Dokument128 SeitenChina Training WCDMA 06-06ryanz2009Noch keine Bewertungen

- SubaruDokument7 SeitenSubaruclaude terizlaNoch keine Bewertungen

- Catheter Related InfectionsDokument581 SeitenCatheter Related InfectionshardboneNoch keine Bewertungen

- DirectionDokument1 SeiteDirectionJessica BacaniNoch keine Bewertungen

- Engleza Referat-Pantilimonescu IonutDokument13 SeitenEngleza Referat-Pantilimonescu IonutAilenei RazvanNoch keine Bewertungen

- Analysis of Rates (Nh-15 Barmer - Sanchor)Dokument118 SeitenAnalysis of Rates (Nh-15 Barmer - Sanchor)rahulchauhan7869Noch keine Bewertungen

- ISA InTech Journal - April 2021Dokument50 SeitenISA InTech Journal - April 2021Ike EdmondNoch keine Bewertungen

- Financial Market - Bsa 2A Dr. Ben E. Bunyi: Imus Institute of Science and TechnologyDokument3 SeitenFinancial Market - Bsa 2A Dr. Ben E. Bunyi: Imus Institute of Science and TechnologyAsh imoNoch keine Bewertungen

- A Literature Review of Retailing Sector and BusineDokument21 SeitenA Literature Review of Retailing Sector and BusineSid MichaelNoch keine Bewertungen

- Instant Download Business in Action 7Th Edition Bovee Solutions Manual PDF ScribdDokument17 SeitenInstant Download Business in Action 7Th Edition Bovee Solutions Manual PDF ScribdLance CorreaNoch keine Bewertungen

- COK - Training PlanDokument22 SeitenCOK - Training PlanralphNoch keine Bewertungen

- Ch-10 Human Eye Notes FinalDokument27 SeitenCh-10 Human Eye Notes Finalkilemas494Noch keine Bewertungen

- Safety Bulletin 09 - Emergency Escape Breathing Device - Product RecallDokument2 SeitenSafety Bulletin 09 - Emergency Escape Breathing Device - Product RecallMuhammadNoch keine Bewertungen

- Very Narrow Aisle MTC Turret TruckDokument6 SeitenVery Narrow Aisle MTC Turret Truckfirdaushalam96Noch keine Bewertungen

- PlateNo 1Dokument7 SeitenPlateNo 1Franz Anfernee Felipe GenerosoNoch keine Bewertungen

- Hele Grade4Dokument56 SeitenHele Grade4Chard Gonzales100% (3)

- Alchemy of The HeartDokument7 SeitenAlchemy of The HeartAbdul RahimNoch keine Bewertungen

- Niveshdaily: From Research DeskDokument53 SeitenNiveshdaily: From Research DeskADNoch keine Bewertungen

- Applying For A Job: Pre-ReadingDokument5 SeitenApplying For A Job: Pre-ReadingDianitta MaciasNoch keine Bewertungen

- Pediatrics: The Journal ofDokument11 SeitenPediatrics: The Journal ofRohini TondaNoch keine Bewertungen

- Mueller Hinton Agar (M-H Agar) : CompositionDokument2 SeitenMueller Hinton Agar (M-H Agar) : CompositionRizkaaulyaaNoch keine Bewertungen

- Fuzzy Gain Scheduled Pi Controller For ADokument5 SeitenFuzzy Gain Scheduled Pi Controller For AOumayNoch keine Bewertungen

- Quotation of Suny PDFDokument5 SeitenQuotation of Suny PDFHaider KingNoch keine Bewertungen

- Caring For Women Experiencing Breast Engorgement A Case ReportDokument6 SeitenCaring For Women Experiencing Breast Engorgement A Case ReportHENINoch keine Bewertungen

- 3D Printing & Embedded ElectronicsDokument7 Seiten3D Printing & Embedded ElectronicsSantiago PatitucciNoch keine Bewertungen

- Gis Data Creation in Bih: Digital Topographic Maps For Bosnia and HerzegovinaDokument9 SeitenGis Data Creation in Bih: Digital Topographic Maps For Bosnia and HerzegovinaGrantNoch keine Bewertungen

- IR2153 Parte6Dokument1 SeiteIR2153 Parte6FRANK NIELE DE OLIVEIRANoch keine Bewertungen

- Diogenes Laertius-Book 10 - Epicurus - Tomado de Lives of The Eminent Philosophers (Oxford, 2018) PDFDokument54 SeitenDiogenes Laertius-Book 10 - Epicurus - Tomado de Lives of The Eminent Philosophers (Oxford, 2018) PDFAndres Felipe Pineda JaimesNoch keine Bewertungen

- VimDokument258 SeitenVimMichael BarsonNoch keine Bewertungen