Beruflich Dokumente

Kultur Dokumente

Analysis of Some Fundamentals of Price of Crude Oil (WTI) in The US

Hochgeladen von

Eduardo PetazzeOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Analysis of Some Fundamentals of Price of Crude Oil (WTI) in The US

Hochgeladen von

Eduardo PetazzeCopyright:

Verfügbare Formate

Analysis of Some Fundamentals of Price of Crude Oil (WTI) in the US

by Eduardo Petazze

Last Updated: May 10, 2015

Facts inventory of crude oil and active rigs in the US, are commonly used to explain (speculative) movements in crude oil prices.

The paper analyzes these data, under a longer term perspective, in order to limit the impact that such information is given for explaining the

volatility of prices in the international market.

The aim of this working paper is to review and clarify the underlying data of two fundamentals commonly used to explain the movements in the

price of crude oil in the US, in a global context of over-supply of oil.

For an analysis of projected global demand and supply of crude oil, underlying global oil oversupply see: World Crude Oil Market Speculative Projection for 2017

First, is often mentioned the number of rigs in activity as a leading indicator that oil production from the US stop growing at significant rate has

acquired through the development of oil and gas reserves of shale .

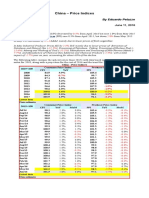

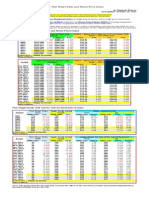

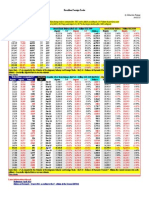

The following table, based on data collected by Baker Hughes on number of active drilling rigs, and our own estimates, shows the impact of

low prices of crude oil in the total amount of active devices, primarily in Canada and the USA

WORLDWIDE RIG COUNT

8.5

36.7

$43.19

Canada

US Rigs per

WTI $/bl

Rigs per 1.0

1.0 $/bl

$/bl

8.8

82.6

$29.41

11.1

70.8

$27.91

11.9

64.5

$15.02

9.5

48.9

$19.14

12.3

58.7

$15.96

6.6

44.4

$19.59

5.6

41.1

$24.50

5.7

40.1

$21.46

4.7

34.9

$20.57

10.0

40.7

$18.48

15.1

45.1

$17.18

12.5

39.3

$18.40

12.3

35.3

$22.01

18.2

45.8

$20.61

18.0

57.4

$14.43

12.8

32.4

$19.24

11.4

30.3

$30.20

13.2

44.6

$25.90

10.2

31.9

$26.08

12.0

33.2

$31.04

8.9

28.7

$41.40

8.1

24.4

$56.56

7.1

24.9

$66.22

4.8

24.4

$72.31

3.8

18.8

$99.65

3.6

17.6

$61.80

4.4

19.4

$79.53

4.4

19.7

$95.12

3.9

20.4

$94.21

3.6

18.0

$97.97

4.1

20.0

$93.00

3.8

21.5

$57.23

2.8

16.8

$63.48

Latest data

WTI futures contracts

Canada

US Rigs per

Rigs per 1.0

WTI $/bl

1.0 $/bl

$/bl

5.7

19.3

102.93

1.8

21.1

93.49

3.5

20.7

92.22

4.2

20.5

88.18

5.7

18.6

94.37

1.6

18.7

94.22

3.3

16.7

105.83

3.9

18.0

97.46

5.3

18.0

98.68

2.0

18.0

103.00

4.0

19.6

97.17

5.6

26.1

73.15

6.4

28.4

48.54

1.5

16.9

57.75

3.3

20.1

60.81

4.3

21.7

61.80

4.3

19.6

62.68

Latest data

WTI futures contracts

Canada

US Rigs per

Rigs per 1.0

WTI $/bl

1.0 $/bl

$/bl

5.3

18.6

$94.86

6.2

17.6

$100.68

4.5

17.9

$100.51

2.0

18.0

$102.04

1.6

18.3

$101.80

2.3

17.7

$105.15

3.4

18.3

$102.39

4.2

19.8

$96.08

4.4

20.7

$93.03

5.0

22.8

$84.34

5.6

25.4

$75.81

6.3

31.7

$59.29

7.8

35.6

$47.22

7.2

26.7

$50.58

4.1

23.2

$47.82

1.7

18.0

$54.21

1.3

14.9

$59.58

1.7

17.8

$59.47

2.6

19.3

$60.47

3.4

20.3

$60.83

3.8

20.8

$61.13

Latest data

Own estimate

WTI futures contracts

L-T avg

NSA

334

131

101

218

226

Latin

Europe

America

Africa

Middle

East

Asia

Pacific

197

200

179

151

167

161

137

118

153

158

126

128

136

159

166

140

156

179

201

211

230

248

238

265

280

252

265

291

356

372

406

423

440

285

283

246

247

267

271

274

261

243

232

204

181

176

180

173

139

140

157

171

177

197

225

228

241

252

243

269

256

241

246

254

240

234

Middle

East

Asia

Pacific

311

343

390

378

355

368

373

392

400

415

411

399

412

427

432

419

430

250

241

230

242

245

252

241

245

258

249

256

254

235

236

246

245

233

Middle

East

Asia

Pacific

403

396

401

407

414

425

432

406

396

390

403

403

415

415

407

410

433

437

444

431

422

256

259

258

252

243

251

253

255

260

252

255

255

232

240

233

228

238

241

244

245

248

1984

438

203

106

1985

444

231

118

1986

369

183

96

1987

337

153

91

1988

335

169

93

1989

257

148

83

1990

246

158

91

1991

275

166

90

1992

250

134

77

1993

203

112

69

1994

233

107

65

1995

272

112

66

1996

282

120

79

1997

277

113

80

1998

243

99

74

1999

187

81

42

2000

227

83

46

2001

262

95

53

2002

214

88

58

2003

244

83

54

2004

290

70

48

2005

316

70

50

2006

324

77

58

2007

355

78

66

2008

384

98

65

2009

356

84

62

2010

383

94

83

2011

424

118

78

2012

423

119

96

2013

419

135

125

2014

397

145

134

2015

348

136

125

2016

311

131

120

Latest data Source: Baker Hughes

Own estimate

NSA

Latin

Europe

America

Africa

2012Q1

432

112

83

2012Q2

438

117

90

2012Q3

414

117

108

2012Q4

408

129

103

2013Q1

426

134

114

2013Q2

425

133

127

2013Q3

407

140

124

2013Q4

416

133

135

2014Q1

402

135

142

2014Q2

402

149

133

2014Q3

406

148

126

2014Q4

379

148

135

2015Q1

352

132

130

2015Q2

342

129

124

2015Q3

358

141

122

2015Q4

340

141

125

2016Q1

316

129

125

Latest data Source: Baker Hughes

Own estimate

NSA

Latin

Europe

America

Africa

Jan-14

401

126

139

Feb-14

400

132

154

Mar-14

406

148

132

Apr-14

403

151

136

May-14

404

149

140

Jun-14

398

147

123

Jul-14

407

153

137

Aug-14

410

143

125

Sep-14

402

148

117

Oct-14

393

148

125

Nov-14

375

149

142

Dec-14

369

148

138

Jan-15

351

128

132

Feb-15

355

133

132

Mar-15

351

135

125

Apr-15

325

119

120

May-15

351

133

130

Jun-15

350

136

122

Jul-15

358

142

128

Aug-15

360

139

122

Sep-15

356

141

116

Latest data

Based on the first weeks of the month

Own estimate

1,010

271

1,472

2,752

Total

Canada

Intl.

U.S.

Total

World

259

311

178

181

196

130

138

121

96

185

259

230

271

375

260

246

344

342

266

372

369

458

470

344

379

221

351

423

365

355

380

217

178

2,429

1,976

970

937

937

870

1,008

862

718

753

774

724

777

944

829

622

916

1,155

831

1,032

1,190

1,380

1,648

1,767

1,878

1,086

1,541

1,875

1,919

1,761

1,862

1,230

1,066

3,917

3,562

2,220

2,097

2,164

1,919

2,052

1,892

1,671

1,711

1,767

1,712

1,841

2,128

1,843

1,457

1,913

2,242

1,829

2,174

2,395

2,746

3,043

3,116

3,336

2,304

2,985

3,465

3,518

3,412

3,578

2,718

2,480

Total

Canada

Intl.

U.S.

Total

World

592

173

326

368

536

155

349

378

526

202

385

407

309

89

200

269

268

1,991

1,970

1,906

1,809

1,758

1,761

1,769

1,757

1,780

1,852

1,903

1,911

1,380

975

1,223

1,341

1,231

3,771

3,372

3,491

3,436

3,569

3,221

3,403

3,456

3,644

3,401

3,636

3,632

2,950

2,321

2,722

2,879

2,732

Total

Canada

Intl.

U.S.

Total

World

1,769

1,769

1,803

1,835

1,859

1,861

1,876

1,904

1,930

1,925

1,925

1,882

1,682

1,348

1,110

976

890

1,058

1,165

1,232

1,273

3,598

3,736

3,597

3,388

3,371

3,445

3,608

3,642

3,659

3,657

3,670

3,570

3,308

2,986

2,557

2,268

2,249

2,445

2,640

2,736

2,790

1,228

1,276

1,072

980

1,032

920

907

909

857

773

734

759

793

809

755

588

652

745

732

771

836

908

925

1,005

1,079

997

1,094

1,167

1,234

1,296

1,337

1,272

1,236

1,189

1,229

1,260

1,260

1,274

1,306

1,285

1,320

1,337

1,348

1,348

1,315

1,261

1,258

1,299

1,269

1,234

1,325

1,341

1,345

1,349

1,350

1,344

1,382

1,339

1,323

1,308

1,324

1,313

1,258

1,275

1,251

1,202

1,285

1,286

1,316

1,297

1,283

504

626

449

204

162

240

350

399

406

424

421

375

368

363

196

90

75

101

159

207

234

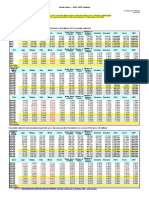

Second, the argument of increased commercial crude oil inventories in the US.

The following table, based on data from the US EIA in the Weekly Petroleum Status Report shows, in addition to the raw data, trend and

seasonally adjusted crude oil inventory, as number of days of net oil processed by US refineries.

You can see an upward trend in the number of days of inventory, an effect of increased levels of domestic production, which necessarily

includes the expansion of tankage in fields, headers and pipeline terminals and other facilities. The historical average 1982 / 2017

(projected), the average inventory is equal to 23.6 days oil local processing.

US Commercial Oil Stock - (000) US Net crude oil refining barrels

(000) bl/d

Week

4-week avg.

Week 4-week avg.

360,567

368,923

16,247

16,136

358,085

354,297

15,049

15,353

363,822

362,473

15,212

15,226

380,092

377,104

15,315

15,086

399,357

393,818

15,954

15,721

397,576

397,182

15,904

15,863

398,523

398,279

15,667

15,876

391,297

396,688

15,949

15,869

392,954

395,088

15,851

15,843

389,523

393,074

16,057

15,881

384,935

386,575

16,218

15,709

365,618

369,776

16,393

16,542

359,570

362,402

16,428

16,401

356,635

358,876

15,689

16,135

380,205

377,052

15,485

15,286

379,335

380,477

16,356

15,995

382,393

383,750

16,420

16,360

413,060

401,356

15,544

15,401

444,374

430,504

15,113

15,341

471,444

461,379

15,728

15,499

482,393

469,756

15,929

15,656

483,687

476,051

16,212

15,850

489,002

481,632

15,982

15,963

490,912

486,499

16,100

16,056

487,030

487,658

16,347

16,160

483,833

487,694

15,827

16,064

481,736

485,878

15,677

15,988

480,689

483,322

15,957

15,952

476,872

480,783

16,507

15,992

462,969

467,706

16,837

16,795

454,964

457,665

16,717

16,690

450,836

452,837

15,967

16,417

461,738

458,239

15,397

15,572

461,650

461,213

16,227

16,050

459,053

460,559

16,627

16,267

459,215

459,206

16,647

16,680

465,050

462,676

15,807

15,662

338,085

14,301

.

Latest data Seasonally adjusted is our own estimate

Own estimate

Commercial Oil Stocks in Days of Refiner Input

NSA

Seasonally

Date

Week 4-week avg adjusted

Dec 27, 13

22.2

22.9

24.0

Jan 31, 14

23.8

23.1

23.5

Feb 28, 14

23.9

23.8

22.4

Mar 28, 14

24.8

25.0

23.3

Apr 25, 14

25.0

25.1

23.1

May 2, 14

25.0

25.0

23.6

May 9, 14

25.4

25.1

23.7

May 16, 14

24.5

25.0

23.1

May 23, 14

24.8

24.9

23.3

May 30, 14

24.3

24.8

23.6

Jun 27, 14

23.7

24.6

24.2

Aug 1, 14

22.3

22.4

23.7

Aug 29, 14

21.9

22.1

23.2

Sep 26, 14

22.7

22.2

23.1

Oct 31, 14

24.6

24.7

24.4

Nov 28, 14

23.2

23.8

24.0

Jan 2, 15

23.3

23.5

24.1

Jan 30, 15

26.6

26.1

25.5

Feb 27, 15

29.4

28.1

27.6

Mar 27, 15

30.0

29.8

27.9

Apr 3, 15

30.3

30.0

28.3

Apr 10, 15

29.8

30.0

27.7

Apr 17, 15

30.6

30.2

28.3

Apr 24, 15

30.5

30.3

28.4

May 1, 15

29.8

30.2

28.4

May 8, 15

30.6

30.4

28.8

May 15, 15

30.7

30.4

29.6

May 22, 15

30.1

30.3

29.2

May 29, 15

28.9

30.1

28.7

Jun 26, 15

27.5

27.8

28.2

Jul 31, 15

27.2

27.4

28.5

Aug 28, 15

28.2

27.6

29.0

Sep 25, 15

30.0

29.4

30.6

Oct 23, 15

28.4

28.7

29.0

Oct 30, 15

27.6

28.3

28.8

Nov 27, 15

27.6

27.5

28.7

Jan 1, 16

29.4

29.5

29.8

Long-Term Avg. 23.6

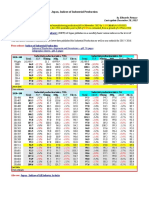

Addendum: Impact on US Fixed Investment

It is estimated that US fixed investment in O&G Exploration and Production was reduced by 36.6% in 2015

bn USD

Fixed Investment - Mining exploration, shafts, & wells

Other

US Rrig O&G investment per

Total

O&G

YoY

Mining

Count

Rig (in million USD)

22.3

21.2

0.95%

1.1

829

25.6

18.3

17.3

-18.40%

1.0

622

27.8

23.7

22.4

29.48%

1.3

916

24.4

34.6

33.3

48.66%

1.3

1,155

28.8

30.2

28.0

-15.92%

2.3

831

33.7

38.5

36.4

30.00%

2.1

1,032

35.3

47.3

43.7

20.05%

3.6

1,190

36.7

69.4

64.4

47.37%

5.0

1,380

46.7

96.0

88.0

36.65%

8.0

1,648

53.4

102.2

94.9

7.84%

7.4

1,767

53.7

117.0

110.1

16.02%

6.9

1,878

58.6

75.0

69.4

-36.97%

5.6

1,086

63.9

86.2

79.6

14.70%

6.6

1,541

51.7

112.3

101.5

27.51%

10.8

1,875

54.1

133.1

122.6

20.79%

10.5

1,919

63.9

139.7

130.1

6.12%

9.6

1,761

73.9

153.9

145.0

11.45%

8.9

1,862

77.9

92.0

-36.55%

1,230

74.8

72.8

-20.92%

1,066

68.2

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

Latest data

Provisional data based on official data for the entire mining industry

Own estimate

Fixed Investment - Mining exploration, shafts, & wells

Other

US Rrig O&G investment per

bn USD

Total

O&G

QoQ

Mining

Count

Rig (in million USD)

2009Q1

103.4

95.9

-19.34%

7.5

1,326

72.3

2009Q2

72.5

67.1

-30.03%

5.4

936

71.7

2009Q3

61.4

56.7

-15.50%

4.7

973

58.3

2009Q4

62.6

57.7

1.76%

4.9

1,108

52.1

2010Q1

74.1

68.6

18.89%

5.5

1,345

51.0

2010Q2

85.2

78.8

14.87%

6.4

1,508

52.3

2010Q3

91.7

84.6

7.36%

7.1

1,622

52.2

2010Q4

93.8

86.2

1.89%

7.6

1,687

51.1

2011Q1

98.4

89.0

3.25%

9.4

1,716

51.9

2011Q2

106.5

96.3

8.20%

10.2

1,830

52.6

2011Q3

116.3

105.2

9.24%

11.1

1,945

54.1

2011Q4

127.8

115.5

9.79%

12.3

2,010

57.5

2012Q1

132.4

121.4

5.11%

11.0

1,991

61.0

2012Q2

136.2

125.2

3.13%

11.0

1,970

63.5

2012Q3

133.1

122.7

-2.00%

10.4

1,906

64.4

2012Q4

130.5

120.9

-1.47%

9.6

1,809

66.8

2013Q1

134.1

124.5

2.98%

9.6

1,758

70.8

2013Q2

140.8

130.9

5.14%

9.9

1,761

74.3

2013Q3

143.4

133.6

2.06%

9.8

1,769

75.5

2013Q4

140.5

131.4

-1.65%

9.1

1,757

74.8

2014Q1

145.0

136.6

3.96%

8.4

1,780

76.7

2014Q2

153.8

145.0

6.15%

8.8

1,852

78.3

2014Q3

157.0

148.0

2.07%

9.0

1,903

77.8

2014Q4

159.6

150.4

1.62%

9.2

1,911

78.7

2015Q1

133.2

124.0

-17.55%

9.2

1,380

89.9

2015Q2

76.0

-38.71%

975

78.0

2015Q3

84.0

10.53%

1,223

68.7

2015Q4

84.0

0.00%

1,341

62.6

2016Q1

83.0

-1.19%

1,231

67.4

Latest data

Provisional data based on official data for the entire mining industry

Own estimate

Also see: USA - Oil and Gas Extraction - Estimated Impact by Low Prices on Economic Aggregates

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Turkey - Gross Domestic Product, Outlook 2016-2017Dokument1 SeiteTurkey - Gross Domestic Product, Outlook 2016-2017Eduardo PetazzeNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Germany - Renewable Energies ActDokument1 SeiteGermany - Renewable Energies ActEduardo PetazzeNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- WTI Spot PriceDokument4 SeitenWTI Spot PriceEduardo Petazze100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Highlights, Wednesday June 8, 2016Dokument1 SeiteHighlights, Wednesday June 8, 2016Eduardo PetazzeNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Analysis and Estimation of The US Oil ProductionDokument1 SeiteAnalysis and Estimation of The US Oil ProductionEduardo PetazzeNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- China - Price IndicesDokument1 SeiteChina - Price IndicesEduardo PetazzeNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- India - Index of Industrial ProductionDokument1 SeiteIndia - Index of Industrial ProductionEduardo PetazzeNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- China - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaDokument1 SeiteChina - Demand For Petroleum, Energy Efficiency and Consumption Per CapitaEduardo PetazzeNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- U.S. Employment Situation - 2015 / 2017 OutlookDokument1 SeiteU.S. Employment Situation - 2015 / 2017 OutlookEduardo PetazzeNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- U.S. New Home Sales and House Price IndexDokument1 SeiteU.S. New Home Sales and House Price IndexEduardo PetazzeNoch keine Bewertungen

- Reflections On The Greek Crisis and The Level of EmploymentDokument1 SeiteReflections On The Greek Crisis and The Level of EmploymentEduardo PetazzeNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- India 2015 GDPDokument1 SeiteIndia 2015 GDPEduardo PetazzeNoch keine Bewertungen

- Commitment of Traders - Futures Only Contracts - NYMEX (American)Dokument1 SeiteCommitment of Traders - Futures Only Contracts - NYMEX (American)Eduardo PetazzeNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Singapore - 2015 GDP OutlookDokument1 SeiteSingapore - 2015 GDP OutlookEduardo PetazzeNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- USA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesDokument1 SeiteUSA - Oil and Gas Extraction - Estimated Impact by Low Prices On Economic AggregatesEduardo PetazzeNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- South Africa - 2015 GDP OutlookDokument1 SeiteSouth Africa - 2015 GDP OutlookEduardo PetazzeNoch keine Bewertungen

- México, PBI 2015Dokument1 SeiteMéxico, PBI 2015Eduardo PetazzeNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- US Mining Production IndexDokument1 SeiteUS Mining Production IndexEduardo PetazzeNoch keine Bewertungen

- Highlights in Scribd, Updated in April 2015Dokument1 SeiteHighlights in Scribd, Updated in April 2015Eduardo PetazzeNoch keine Bewertungen

- U.S. Federal Open Market Committee: Federal Funds RateDokument1 SeiteU.S. Federal Open Market Committee: Federal Funds RateEduardo PetazzeNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- China - Power GenerationDokument1 SeiteChina - Power GenerationEduardo PetazzeNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- European Commission, Spring 2015 Economic Forecast, Employment SituationDokument1 SeiteEuropean Commission, Spring 2015 Economic Forecast, Employment SituationEduardo PetazzeNoch keine Bewertungen

- Mainland China - Interest Rates and InflationDokument1 SeiteMainland China - Interest Rates and InflationEduardo PetazzeNoch keine Bewertungen

- Chile, Monthly Index of Economic Activity, IMACECDokument2 SeitenChile, Monthly Index of Economic Activity, IMACECEduardo PetazzeNoch keine Bewertungen

- US - Personal Income and Outlays - 2015-2016 OutlookDokument1 SeiteUS - Personal Income and Outlays - 2015-2016 OutlookEduardo PetazzeNoch keine Bewertungen

- Japan, Indices of Industrial ProductionDokument1 SeiteJapan, Indices of Industrial ProductionEduardo PetazzeNoch keine Bewertungen

- Japan, Population and Labour Force - 2015-2017 OutlookDokument1 SeiteJapan, Population and Labour Force - 2015-2017 OutlookEduardo PetazzeNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Brazilian Foreign TradeDokument1 SeiteBrazilian Foreign TradeEduardo PetazzeNoch keine Bewertungen

- South Korea, Monthly Industrial StatisticsDokument1 SeiteSouth Korea, Monthly Industrial StatisticsEduardo PetazzeNoch keine Bewertungen

- United States - Gross Domestic Product by IndustryDokument1 SeiteUnited States - Gross Domestic Product by IndustryEduardo PetazzeNoch keine Bewertungen

- Final Participants List - TightReservoirsWS2015Dokument1 SeiteFinal Participants List - TightReservoirsWS2015dudunoNoch keine Bewertungen

- 2014 Award Recipients: 2014 Outstanding Student ChaptersDokument5 Seiten2014 Award Recipients: 2014 Outstanding Student ChaptersErma PrastyaNoch keine Bewertungen

- TexagoDokument14 SeitenTexagoHoàng Thiên LamNoch keine Bewertungen

- Arabian DieselDokument1 SeiteArabian DieselArabian DieselNoch keine Bewertungen

- Find Brand by Service CategoryDokument35 SeitenFind Brand by Service CategoryKaly7Noch keine Bewertungen

- LTPN ®Dokument21 SeitenLTPN ®LTPN (Jet Fuel A1)Noch keine Bewertungen

- BALANCES MONITORING T6 As of Jan 28 2020Dokument137 SeitenBALANCES MONITORING T6 As of Jan 28 2020Harvey Ian Pagatpatan AquinoNoch keine Bewertungen

- Dittmer - Overview of Worldwide Petroleum Crude Refineries PDFDokument47 SeitenDittmer - Overview of Worldwide Petroleum Crude Refineries PDFShayne229Noch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- API GravityDokument3 SeitenAPI GravityAbhijit Bapat0% (1)

- Share Resin and Resin CombinationsDokument74 SeitenShare Resin and Resin CombinationsItz Hamza100% (1)

- Wells LegendDokument2.228 SeitenWells Legend10manbearpig01Noch keine Bewertungen

- Contactin CUDokument1 SeiteContactin CUProject Sales CorpNoch keine Bewertungen

- World Oil Production & Consumption 1Dokument31 SeitenWorld Oil Production & Consumption 1Suleiman BaruniNoch keine Bewertungen

- CMAX-1824 - Sunguard SNX 60 HT 10mm Temperado 16ARGTGIPRT Laminado Incolor 66.2mmDokument1 SeiteCMAX-1824 - Sunguard SNX 60 HT 10mm Temperado 16ARGTGIPRT Laminado Incolor 66.2mmFilipe SousaNoch keine Bewertungen

- Fpso Jasmine Venture Mv7 - Modec Fpso - Fso ProjectDokument2 SeitenFpso Jasmine Venture Mv7 - Modec Fpso - Fso ProjectjeffreymacaseroNoch keine Bewertungen

- Base Oil GroupsDokument2 SeitenBase Oil GroupswaleedtanvirNoch keine Bewertungen

- Asahimas Company ProfileDokument6 SeitenAsahimas Company ProfileTharra AyurianyNoch keine Bewertungen

- Activity MapAo Feb2018Dokument1 SeiteActivity MapAo Feb2018perry wangNoch keine Bewertungen

- Packing Slip PGDokument1 SeitePacking Slip PGmeghadurganNoch keine Bewertungen

- Glass Art (Assignment)Dokument14 SeitenGlass Art (Assignment)Noveed Tahsin AminNoch keine Bewertungen

- Syrian Petroleum Company (SPC) : DescriptionDokument8 SeitenSyrian Petroleum Company (SPC) : DescriptionAiham AltayehNoch keine Bewertungen

- Case TEXAGODokument3 SeitenCase TEXAGOtrang nguyenNoch keine Bewertungen

- Oil and Gas Company Profile (Petron)Dokument3 SeitenOil and Gas Company Profile (Petron)ERWIN CAYL CABANGALNoch keine Bewertungen

- Gums and Resins-Their Occurrence Properties and Uses 1918 PDFDokument134 SeitenGums and Resins-Their Occurrence Properties and Uses 1918 PDFJd DiazNoch keine Bewertungen

- Howard BevanDokument11 SeitenHoward Bevanxtrooz abiNoch keine Bewertungen

- Shubh Gateway SizesDokument3 SeitenShubh Gateway SizesAyushman DaycareNoch keine Bewertungen

- LPGDokument19 SeitenLPGAdin HujicNoch keine Bewertungen

- Door Window Schedule-Hsr Units OnlyDokument2 SeitenDoor Window Schedule-Hsr Units OnlySachin KothvalNoch keine Bewertungen

- D&M Resut CheckDokument25 SeitenD&M Resut Checkosama aldresyNoch keine Bewertungen

- BP and The Consolidation of The Oil Industry - Group 9Dokument8 SeitenBP and The Consolidation of The Oil Industry - Group 9Shruti BhargavaNoch keine Bewertungen