Beruflich Dokumente

Kultur Dokumente

SWOT Analysis Austria

Hochgeladen von

Jay ModiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SWOT Analysis Austria

Hochgeladen von

Jay ModiCopyright:

Verfügbare Formate

ChemicalLogisticsCooperation

inCentralandEasternEurope

SWOTAnalysis

Austria

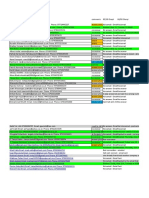

Strengths

Opportunities

Weaknesses

Threats

SWOTAnalysis

Project[ChemLog]

TABLEOFCONTENT

STRUCTURE...........................................................................................................................................................................4

INTRODUCTIONTOREGION/COUNTRY........................................................................................................................................5

2.1

2.2

2.3

2.4

CHEMICALSALES..........................................................................................................................................................8

COMPANYSTRUCTURESIZEOFENTERPRISESANDEMPLOYEES..............................................................................................9

INTERNATIONALTRADE................................................................................................................................................10

REGIONALSTRUCTUREOFCHEMICALINDUSTRY.................................................................................................................11

DESCRIPTIONOFTRANSPORTINFRASTRUCTURE...........................................................................................................................13

3.1

INTRODUCTION..........................................................................................................................................................13

3.2

INTERMODALTRANSPORT.............................................................................................................................................14

3.2.1

ACTUALANDPLANNEDFIGURES............................................................................................................................15

3.2.2

MAINCORRIDORSANDMAJORINFRASTRUCTURE......................................................................................................16

3.2.3

GOVERNMENTPLANSANDPOLITICALPROGRAMS......................................................................................................16

3.3

ROADTRANSPORT......................................................................................................................................................17

3.3.1

ACTUALANDPLANNEDFIGURES(STATUS:2005/2007)............................................................................................17

3.3.2

MAINCORRIDORSANDMAJORINFRASTRUCTURE......................................................................................................18

3.3.3

GOVERNMENTPLANSANDPOLITICALPROGRAMS......................................................................................................19

3.4

RAILWAYTRANSPORT..................................................................................................................................................19

3.4.1

ACTUALANDPLANNEDFIGURES............................................................................................................................20

3.4.2

MAINCORRIDORSANDMAJORINFRASTRUCTURE......................................................................................................20

3.4.3

GOVERNMENTPLANSANDPOLITICALPROGRAMS......................................................................................................21

3.5

WATERWAYTRANSPORT..............................................................................................................................................21

3.5.1

ACTUALANDPLANNEDFIGURES............................................................................................................................22

3.5.2

MAINCORRIDORSANDMAJORINFRASTRUCTURE......................................................................................................22

3.5.3

GOVERNMENTPLANSANDPOLITICALPROGRAMS......................................................................................................23

3.6

PIPELINETRANSPORT..................................................................................................................................................24

3.6.1

ACTUALANDPLANNEDFIGURES............................................................................................................................24

3.6.2

MAINCORRIDORSANDMAJORINFRASTRUCTURE......................................................................................................24

DESCRIPTIONOFCHEMICALLOGISTICSINTHEREGION/COUNTRY...................................................................................................25

INTERNALSTRENGTHSANDWEAKNESSESOFCHEMICALCOMPANIESANDLOGISTICPROVIDERS..............................................................26

5.1

STRENGTHSINPROCUREMENT.......................................................................................................................................26

5.2

STRENGTHSINWAREHOUSINGOFRAWMATERIALS,SEMIFINISHEDANDFINISHEDPRODUCTS.......................................................26

5.3

STRENGTHSINPRODUCTIONLOGISTICS............................................................................................................................26

5.4

STRENGTHSINDISTRIBUTIONANDTRANSPORT...................................................................................................................27

5.5

STRENGTHSINPLANNINGANDCONTROLLING....................................................................................................................28

5.6

STRENGTHSINORDERPROCESSING.................................................................................................................................28

5.7

STRENGTHSININFORMATIONLOGISTICS...........................................................................................................................28

ProjectPartner:AUSTRIA

Page2/47

SWOTAnalysis

Project[ChemLog]

EXTERNALOPPORTUNITIES,CHANCESANDRISKSFORCHEMICALLOGISTICSINCENTRALANDEASTERNEUROPE..........................................29

6.1

ECONOMICTRENDS.....................................................................................................................................................29

6.2

SOCIOCULTURALTRENDS..............................................................................................................................................31

6.3

TECHNOLOGICALTRENDS..............................................................................................................................................32

6.4

ENVIRONMENTANDENERGY.........................................................................................................................................32

6.5

POLITICSANDINNOVATION...........................................................................................................................................33

6.6

TRANSPORTINFRASTRUCTURE.......................................................................................................................................35

6.6.1

RAILWAY........................................................................................................................................................35

6.6.2

WATERWAY.....................................................................................................................................................36

6.6.3

ROAD.............................................................................................................................................................37

6.6.4

INTERMODAL...................................................................................................................................................37

6.6.5

PIPELINE.........................................................................................................................................................37

6.7

SAFETYANDSECURITY.................................................................................................................................................38

6.8

INDUSTRYSECTORANDCOMPETITION..............................................................................................................................38

6.8.1

CUSTOMERS....................................................................................................................................................38

6.8.2

SUPPLIERS.......................................................................................................................................................39

6.8.3

ACCESSTOTHEMARKET.....................................................................................................................................39

NEEDSFORFUTUREACTIONANDIMPROVEMENTSCONCLUSION...................................................................................................41

7.1

NEEDFORFUTUREACTIONSANDIMPROVEMENTSFROMTHELOGISTICALPOINTOFVIEW..........................................................41

7.2

NEEDFORFUTUREACTIONSANDIMPROVEMENTSINTERMSOFPOLITICS,TRANSPORTATIONANDINFRASTRUCTURE.........................45

7.3

NEEDFORFUTUREACTIONSANDIMPROVEMENTSFROMTHEECOLOGICALPOINTOFVIEW.........................................................46

LITERATURE.......................................................................................................................................................................47

8.1

STUDIESANDSTATISTICSUSED.......................................................................................................................................47

8.2

LISTOFEXPERTS.........................................................................................................................................................48

ProjectPartner:AUSTRIA

Page3/47

SWOTAnalysis

Project[ChemLog]

1 STRUCTURE

Literature

Needsforfutureactionsandimprovements Conclusions

Internal

Strengths

ofChemical

Companies

andLogistic

Providers

Internal

Weaknesses

ofChemical

Companies

andLogistic

Providers

External

External

opportunities

Threats,

andchances Problemsand

forchemical

Barriersfor

logisticsin

chemical

Centraland

logisticsin

Eastern

Centraland

Europe

Eastern

Europe

Descriptionofchemicallogisticsintheregion/country

Descriptionoftransportinfrastructure

DescriptionofChemicalIndustry

IntroductiontoRegion/Country

ProjectPartner:AUSTRIA

Page4/47

SWOTAnalysis

Project[ChemLog]

2 INTRODUCTIONTOREGION/COUNTRY

Austriaisafederalparliamentaryrepublic

inCentralEurope,borderinginthenorth

on Germany and Czech Republic, in the

east on Slovak Republic and Hungary, in

thesouthonSloveniaandItalyandinthe

west on Switzerland and Liechtenstein.

Austriaconsistsofninefederalstatesand

thecapitalisVienna.Since1955Austriais

part of the United Nations and member of the European Union since 1995. In westeast

directionAustriaextendstomaximum575kmandinnorthsouthdirectionto294km.About

60%ofthefederalterritoryismountainouswhereasthewidelowlandsareintheeastnear

theDanube.Only32%ofthesurfaceislessthan500mandabout43%areforested.

In 2007 the gross domestic product per capita amounted to approximately 32,600 placing

Austriaatthe8thpositionwithintheEU27countries(24,800averages).Regardingthereal

economic growth Austria ranks above the EU27 average (2.9%) with 3.1%. While the

domestic employment rate is considerably beyond the medial indicator (7.1%) and

amountedin2007sumupat4.4%.Thecontributionoftheeconomicalsectorstothegross

value added is as following: 2% primary sector, 31% secondary sector and 67% tertiary

sector.

For the first time since the Second World War the global economy has to face a severe

recession. For the upcoming year the most important industry sectors will significantly

reduceproductionvolumes.Inspiteofmassivecountersteeringbythefiscalpolicy,Austria

has to anticipate a real decline in gross domestic product by 2.2% according to the latest

forecasts.Whileexportsandinvestmentsarenosediving,consumptionisincreasingslightly

inthefaceoftherecession.Intheyear2010alsointernationalmeasuresforsupportingthe

economicsituationwillbesuccessful.Thiswillstabilizethedemandinsuchwaytoenablean

economicgrowthby0.5%.From2005to2008theemploymentratehasbeencontinuously

decreasedfrom5.2%toactually3.8%.For2009thisindicatorispredictedtogoupto5.0%

andtheyear2010to5.8%.

2007

InhabitantsinMio

8,315

Areainkm

83.871

GrossDomesticProductinbillionEUR:

2000

2001 2002

2003

2004

2005

2006

2007

207,53 212,50 218,85 223,30 232,78 244,45 257,29 270,84

ProjectPartner:AUSTRIA

Page5/47

SWOTAnalysis

Project[ChemLog]

GrossDomesticProduct/capita:

2000

2001 2002

2003

2004

2005

2006

2007

5.900 26.420 27.070 27.510 28.480 29.690 31.070 32.570

Source:StatistikAustria,www.statistik.at,20090413.

The chemical industry has some unique characteristics: it is a globalized industry sector,

highlyinnovationdrivenandknowledgeintensive.Thecompaniesofthechemicalindustry

areintegratedalongthevaluechainintoitsdownstreamindustriesordirectlytoconsumers.

Chemical production and process technologies are capital and energy intensive. A long

product development time requires stable and predictable policy framework. Due to the

highdegreeofglobalization,competitiontakesplaceatgloballevel.

Worldwide the chemical industry ranks among the most important industry sectors and

especiallyrepresentsakeysuccessfactorfortheAustrianeconomy.10.3%ofthedomestic

workingpopulationisemployedinthisheterogeneousindustrysector,contributing10.6%of

the domestic production value and more than 12% to the gross domestic product of the

Austrianindustry.Productsofthechemicalindustrycanbefoundnearlyineveryproductor

areaoflife.Upstreamsectorsaremainlytradingcompaniesoffuel,ore,metalsandtechnical

chemicals as well as the transport sector as a whole and especially pipelines which are

essential for the service provision of the chemical industry. Furthermore the chemical

industry sources companyrelated services like legal and tax advice, advertisement or

provisionofleasingstaff.

Thechemicalindustrycontributesconsiderablytotheproductionandthevaluecreationof

downstreamsectorsaswellsforinstanceenergy,gasandwatersupply,machinesandmetal

ware industry, electric and electronic sector and paper industry. According to the latest

numbersthechemicalindustryisoneofthebiggestemployingindustrygroupinAustriaas

more than 10% of all industrial staff or more than 43.000 people are employed in 295

chemical companies as well as about 80.000 workplaces are indirect and secondary

employment effects. Impressed by a heterogeneous structure, the chemical industry is

impressedbysmallandmediumsizedcompanieswithabout145employeesatanaverage

andwithanSMEintensityofapproximately85%.ThepersonnelexpensesinAustriaforstaff

withinthechemicalindustryamountto2.23billionEurosintotalandnearly51,000Europer

yearperemployedperson.1

Bnvcp.FCIO(Jahresbericht2008)undwww.fcio.at,20090413.

ProjectPartner:AUSTRIA

Page6/47

SWOTAnalysis

Project[ChemLog]

Production of Chemical Industry 1998-2008

16000

14000

12000

Mio

10000

8000

6000

4000

2000

0

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

Source:FCIOFachverbandderChemischenIndustriesterreichs,April2009.

Itcanbementionedthattheyear2008wastheendofalonglastingeconomicboomwhich

has already been noticed at midyear within the chemical industry. As supplier for several

industry sectors which were affected by the economic crises, the chemical industry was

hardlyhitbytheglobalregression.Inthefirsttermof2008thechemicalsaleswerehigher

thanintheyearbefore,sofromsummeroncompaniesremarkedasharpdeclineinorders

by 11%. Especially exports lag behind expectations as for a long time export growth was

lower than the domestic sales. The domestic market has proved to be a stabilizing factor,

although a high degree of satiation can be determined. Companies are afraid of further

weaknesses in demand, stagnating domestic sales, declining degree of capacity utilization,

reducedworkinghoursandsignificantlosinginsales.Theemploymentsituationreflectsthe

state of the economy. Latest figures show that in July 2008 44.167 people still were

employedinthechemicalindustry,whereasattheendoftheyearthisnumberamounted

onlyto43.000.

InordertoguaranteeasustainabledevelopmentoftheAustrianbusinesslocation,massive

investments for education are vital. The chemical industry demands a broader base for

innovation and research as well as an intensive integration of chemical topics into

educational institutions. A higher number of university graduates and researchers mean a

betterchanceforAustriatosurviveasasustainablebusinesslocationintermsofinnovation,

specializationandqualification.

Forecastsfortheyear2009augurbadly:volumeofordersandcapacityutilizationwillreach

a low, whereas finished goods inventory are predicted to increase significantly. The

dominatingtasksfortheupcomingyearwillberationalizationandadjustmentofcapacities.

Furthermore investments will go back considerably, as in 2007 and 2008 they amounted

beyond 1 billion Euros and are expected to lag clearly behind this range in 2009. In total

investmentswillbereducedbyapproximately13%.

ProjectPartner:AUSTRIA

Page7/47

SWOTAnalysis

Project[ChemLog]

Plasticandrubberproducts:Thefirstthreequarteroftheyear2008broughtanincreasein

salesby5%aswellasexportswhichaugmentedby7.5%.Thelabourmarketshowedpositive

developmentstooasnumberofemployeesenlargedby2.4%untilhalfoftheyear2008.Due

toextremelyhighenergycostsandtheraiseinlabourcosts,theplasticandrubberindustry

facedmassivecostpressureandadditionallywashitbytheeconomicregressionduringthe

last quarter. Especially for suppliers of the automotive industry the decline in orders is

difficulttobear.

Fibres:Afteraworldwideeconomicalboominthefirstquarter2008,thefibressectorhada

remarkabledropinthesecondquarterasthecottonpricesanimportantindicatorforthe

price development of fibres declined massively. Extremely high raw material costs could

notbemovedtothecustomerandhadhighinfluenceonprofit.Forthefuturelatestfigures

showthatprospectivelythefibresboomisoverandlowergrowthandmarginsareexpected.

Paints, varnishes and similar coatings, printing inks and mastics: whereas the growth in

salesofabout6%inthefirsthalfyearof2008leadtooptimisms,theforecastfor2009are

depressingandshowthesamepictureasinothersectorsofthechemicalindustry.

Pesticidesandfertilizer:actuallytheEuropeanUnionplanstoimplementanewregulation

concerning pesticides with massive impacts on the Austrian agriculture sector. Some

substances with acceptable risks for consumer and environment should be banned

completely although a harmonized, transparent and standardized system for evaluation of

substancesisstillmissing.

Detergents, perfumes and toilet preparations: the domestic market for soap, detergents,

perfumes and toilet preparations is saturated, the costs for raw materials and energy are

reachingapeakandthecostpressureisincreasing.Innovativedevelopmentsoftheproduct

portfolio and a broader spectrum of services for consumer sector as well as for industry

enable a positive estimation. Exports were satisfying although yearly growth rates are

decreasing.

Technicalgases:Nearlythewholeyear2008wassuccessfulintermsofeconomicalgrowth.

Onlyattheendoftheyear2008thedifficulteconomicalcircumstancesleadtoareduction

atgassales.Duetohighfuelcoststheexpensesformanufacturingandtransportationwent

upsignificantly,sothattheycouldnotbecompensatedtotallybyoptimizationmeasures.2

2.1 CHEMICALSALES

SalesofchemicalindustryinMioEUR:

2000 2001 2002 2003 2004 2005 2006 2007

Manufactureofbasicchemicals*

2.766 2.768 2.688 2.683 2.859 2.940 3.428

Manufactureofpesticidesandotheragro

chemicalproducts

Manufactureofpaints,varnishesandsimilar

coatings,printinginkandmastics

Manufactureofpharmaceuticals,medicinal

chemicalsandbotanicalproducts**

Manufactureofsoapanddetergents,cleaning

45

69

an

118

127

an

141 n/a

556

582

593

599

635

625

651 n/a

2.901 2.394 2.407 2.624 2.510 2.694 2.798 n/a

462

528

532

577

572

609

672 n/a

Bnvcp.FCIO(Jahresbericht2008),SchneiderSchneider/Brunner/Lengauer/Koller[ChemischeIndustrie2008].

ProjectPartner:AUSTRIA

Page8/47

SWOTAnalysis

Project[ChemLog]

andpolishingpreparations,perfumesand

toiletpreparations

Manufactureofotherchemicalproducts***

453

454

473

445

472

526

Manufactureofmanmadefibres

581

601

642

an

658

688

674 n/a

739 n/a

Manufactureofchemicalsandchemical

products

7.764 7.396 7.394 7.626 7.824 8.209 9.103 n/a

Manufactureofrubberproducts****

Manufactureofplasticproducts*****

988 n/a

3.627 3.817 3.911 3.625 3.905 3.921 4.487 n/a

Manufactureofplasticandrubberproducts

4.391 4.616 4.750 4.474 4.762 4.831 5.475 n/a

Shareofchemicalsalesinprocessing

industry

2000 2001 2002 2003 2004 2005 2006 2007

Manufactureofchemicalsandchemical

products

31%

29% 34,2% 30,6%

30%

28%

28% n/a

Manufactureofplasticandrubberproduct

18%

18%

18%

16%

17% n/a

764

799

839

849

857

910

22%

18%

Source:StatistikAustria[LeistungsundStrukturstatistik20002006].

Explanations:TheProcessingIndustryconsistsofthepapermanufacturing,manufacturingof

chemicalsandchemicalproducts,manufacturingofmetalsandofthemanufactureofplastic

and rubber product (usually not part of the processing industry): 32.411 Mio EUR sales in

total

2.2 COMPANYSTRUCTURESIZEOFENTERPRISESANDEMPLOYEES

Numberofenterprises

2000 2001 2002 2003 2004 2005 2006 2007

Manufactureofchemicalsandchemical

products

370

440

412

423

420

438

429

19employees

145

254

223

238

231

252

1049employees

117

105

106

104

110

109

242 n/a

111 n/a

50249employees

83

59

59

57

55

54

250employees

25

23

24

24

24

23

560

576

611

617

619

625

19employees

271

287

303

305

312

327

1049employees

171

170

188

197

188

181

50249employees

90

92

93

87

92

90

82 n/a

179 n/a

250employees

28

28

27

28

27

27

28 n/a

Manufactureofplasticandrubberproduct

an

54 n/a

22 n/a

574 n/a

273 n/a

Numberofemployees

2000

2001

2002

2003

2004

2005

Manufactureofchemicalsand

chemicalproducts

27.141

25.676

25.999

26.247

26.798

2006 2007

26.552 26.558 n/a

Manufactureofplasticand

rubberproduct

29.601

29.713

29.217

27.633

27.833

27.496 28.112 n/a

Source:StatistikAustria[LeistungsundStrukturstatistik20002006].

Explanations:Numbersof2007willbepublishesinJune2009

ProjectPartner:AUSTRIA

Page9/47

SWOTAnalysis

Project[ChemLog]

2.3 INTERNATIONALTRADE

Exportquotain%

Manufactureofchemicalsand

chemicalproducts

Manufactureofplasticandrubber

products

2.000

34%

2.001 2.002 2.003 2.004 2.005

36%

37%

37%

37%

39%

2.006

42%

2.007

42%

6%

6%

5%

5%

6%

6%

6%

6%

Relationbetweenexportsandthegrossdomesticproduct.

ImportofchemicalsinMioEUR

(Einfuhr)

Manufactureofbasicchemicals*

Manufactureofpesticidesandother

agrochemicalproducts

Manufactureofpaints,varnishesand

similarcoatings,printinginkandmastics

Manufactureofpharmaceuticals,

medicinalchemicalsandbotanical

products**

Manufactureofsoapanddetergents,

cleaningandpolishingpreparations,

perfumesandtoiletpreparations

Manufactureofotherchemical

products***

Manufactureofmanmadefibres

Manufactureofchemicalsandchemical

products

Manufactureofrubberproducts****

Manufactureofplasticproducts*****

Manufactureofplasticandrubber

products

2.000

2.001

2.002

2.003

2.004

21.487

22.336

20.782

21.935

725

822

724

749

886

2.652

2.855

2.671

3.150

3.201

22.249

27.416

32.325

6.548

6.653

15.116

2.005

24.979 29.716

2.006

2.007

33.518

37.059

882

932

3.524

3.710

3.922

31.864

30.897 34.412

39.596

42.112

7.398

7.827

7.855

8.388

8.592

8.780

15.359

15.973

16.622

18.255 18.786

20.354

21.357

749

69.527

668

76.108

684

80.559

685

82.833

667

602

560

86.740 96.311 107.263

442

113.673

7.949

3.791

11.740

8.493

4.176

12.669

8.401

4.427

12.828

8.721

4.318

13.039

9.223 9.637

4.365 4.488

13.588 14.126

9.974

3.214

13.188

2.000

2.001

2.002

2.003

17.445

830

18.957

1.347

18.218

929

18.539

1.095

18.740 19.957

1.319 1.721

25.568

1.633

30.205

0

1.850

1.958

2.013

2.249

2.465

2.727

2.777

2.985

20.315

23.521

30.806

29.840

28.956 36.288

43.629

46.442

2.424

3.194

3.595

4.079

3.855

4.099

4.749

4.913

8.290

8.762

19.124

19.084

20.661 22.537

22.342

27.210

9.227

4.508

13.735

ExportofchemicalsinMioEUR

(Ausfuhr)

Manufactureofbasicchemicals*

Manufactureofpesticidesandother

agrochemicalproducts

Manufactureofpaints,varnishesand

similarcoatings,printinginkandmastics

Manufactureofpharmaceuticals,

medicinalchemicalsandbotanical

products**

Manufactureofsoapanddetergents,

cleaningandpolishingpreparations,

perfumesandtoiletpreparations

Manufactureofotherchemical

products***

ProjectPartner:AUSTRIA

2.004

2.005

2.006

Page10/47

2.007

SWOTAnalysis

Project[ChemLog]

Manufactureofmanmadefibres

Manufactureofchemicalsandchemical

products

Manufactureofrubberproducts****

Manufactureofplasticproducts*****

Manufactureofplasticandrubber

products

2.994

54.148

3.200

60.937

3.575

78.260

3.522

78.409

4.036 4.320

4.387

80.031 91.649 105.084

5.171

2.678

7.849

5.556

3.228

8.784

4.985

3.359

8.344

5.256

3.594

8.850

5.851

3.884

9.734

5.956

3.698

9.654

5.507

3.186

8.693

5.238

116.994

6.513

2.701

9.214

Source:StatistikAustria[LeistungsundStrukturstatistik20002006].

Geographicbreakdownofchemicals

exportin%(Ausfuhr)

2.000 2.001 2.002 2.003 2.004 2.005

EU27

71%

EU15

Estonia,Latvia,Lithuania,Malta,Poland,

Slovakia,Slovenia,CzechRepublic,Hungary,Cyprus

12%

7%

2%

6%

1%

0%

Bulgaria,Rumania

RestofEurope

NAFTA

LatinAmericaandtheCaribbean

Asia

Africa

Australia/Oceania

Geographicbreakdownofchemicals

importin%(Einfuhr)

69%

68%

71%

13%

7%

2%

7%

1%

0%

14%

9%

2%

6%

1%

1%

14%

7%

1%

6%

1%

1%

71%

69%

15%

5%

1%

6%

1%

1%

17%

5%

2%

6%

1%

0%

2.000 2.001 2.002 2.003 2.004 2.005

EU27

84%

EU15

Estonia,Latvia,Lithuania,Malta,Poland,

Slovakia,Slovenia,CzechRepublic,Hungary,Cyprus

Bulgaria,Rumania

RestofEurope

NAFTA

LatinAmericaandtheCaribbean

Asia

Africa

Australia/Oceania

5%

5%

0%

5%

0%

0%

84%

84%

84%

5%

5%

0%

5%

0%

0%

6%

5%

0%

4%

0%

0%

7%

5%

0%

4%

0%

0%

84%

79%

6%

4%

1%

5%

0%

0%

10%

4%

1%

5%

0%

0%

2.006

2.007

68%

67%

17%

5%

2%

6%

1%

1%

17%

5%

2%

7%

1%

0%

2.006

2.007

78%

78%

11%

4%

1%

5%

0%

0%

10%

5%

1%

6%

0%

0%

2.4 REGIONALSTRUCTUREOFCHEMICALINDUSTRY

AdditionallytochemicalproductionsitestherearetwomainchemicalindustryparksinLinz

andKrems.InLinztheproducerAMIAgrolinzMelamineInternational,DSMFineChemicals

Austria GmbH and Borealis GmbH as well as numerous service providers for the chemical

companies are situated there. In Krems there is an industrial park too, especially for

chemicalindustry.

The following table shows the Top 30 ranking regarding turnover in Mio EUR of Austrian

chemicalcompanies:

ProjectPartner:AUSTRIA

Page11/47

SWOTAnalysis

Project[ChemLog]

MajorCompaniesandchemicalsites

AlplaWerkeAlwinLehnerGmbH&CoKG

HENKELCENTRALEASTERNEUROPEGESELLSCHAFTMBH

BorealisPolyolefineGmbH

SandozGmbH

LenzingAktiengesellschaft

BaxterAktiengesellschaft

BoehringerIngelheimRCVGmbH&CoKG

M.Kaindl

NycomedAustriaGmbH

AMIAgrolinzMelamineInternationalGmbH

DSMFineChemicalsAustriaNfgGmbH&CoKG

SemperitTechnischeProdukteGesellschaftm.b.H.

UnileverAustriaGmbH

GreinerPackagingGmbH

Kromberg&SchubertAustriaGesellschaftm.b.H.&Co.KG.

JohnsonControlsAustriaGmbH&CoOHG

TeichAktiengesellschaft

KAINDLFLOORINGGmbH

FACCAG

AHTCoolingSystemsGmbH

OMYAGmbH

ISOVOLTAAG

InternormBauelementeGmbH

FreseniusKabiAustriaGmbH

TUPACKVerpackungenGesellschaftm.b.H.

ZizalaLichtsystemeGmbH

EBEWEPharmaGes.m.b.H.Nfg.KG

JungbunzlauerAustriaAG

BrenntagCEEGmbH

RfixAG

ProjectPartner:AUSTRIA

Turnover

Location/chemicalsite

2007inmio

2.270 Hard

2.241 Wien

1.509 Schwechat

1.300 Kundl

1.261 Lenzing

424 Wien

390 Wien

371 Wals

356 Linz

329 Linz

322 Linz

300 Wien

299 Wien

291 Kremsmnster

288 Oberpullendorf

285 Mandling

275 OberGrafendorf

271 WalsbeiSalzburg

252 RiedimInnkreis

210 Rottenmann

210 Gummern

204 WienerNeudorf

203 Traun

192 GrazPuntigam

186 Wien

185 WieselburganderErlauf

185 Unterach

182 Wien

181 Wien

178 SulzRthis

Numberof

employees

10.000

13.000

779

2.818

6.043

3.086

1.035

655

549

798

941

831

316

2.584

160

871

713

147

1.451

521

275

608

1.333

582

663

1.200

292

281

316

540

Page12/47

SWOTAnalysis

Project[ChemLog]

3 DESCRIPTIONOFTRANSPORTINFRASTRUCTURE

3.1 INTRODUCTION3

Awellperformingandmoderntransportationinfrastructureisanimportantrequirementfor

economic growth in an economic system. Through the expansion of transportation

infrastructure essential national and international connections are guaranteed in order to

secure the competition of the Austrian business location. Aiming at strengthening the

Austrian business location within the international competition and at the same time to

reduce the gap in reach ability between the federal provinces, social and environmental

issueshavetobetakenintoaccount.Regardingthefreightvolumeroadtransportationisthe

dominatingmodeoftransport,especiallyfordomestictraffic.Intermsofcrossbordertraffic

the dominance of road attenuates significantly. In the last year all carriers have reached

considerable growth rates, all in all the freight volume increased from 2000 to 2007 by

nearly25%.Railwayandroadtogetherrecordedthehighestmedialyearlygrowthratesof

freightvolumeof+5%and+4%.Shortlyafterfollowswaterwayandpipelinewhichexpanded

theirfreightvolumeyearlyby+2%and+1%.Thefollowingtablegivesanoverviewaboutthe

freight volume in 2007 according to traffic areas, which means the division into domestic

traffic,crossbordertrafficandtransit.

intons2007

Road

Railway

Waterway

Pipeline

Domestic

314.135.804 33.220.271

972.156

Crossborder

entrance

15.916.577 34.628.561 6.264.069

Crossborderdispatch 16.054.922 20.504.921 1.547.234

Transit

3.080.795 27.172.081 3.323.081

Otherintern.Traffic

5.090.415

0

0

Total

349.188.098 115.525.834 12.106.540 63.037.783

Air

860

115.451

77.268

21.750

0

215.329

Pipeline:duetoconcealmentreasonsnodivisionintotrafficmodes

Source:StatistikAustria(sterreichischeVerkehrsstatistik2007)

On the basis of the figures the modal split, which is presented in the following graph,

demonstratesthedominanceoftheroadtransportationinAustria.Continuingwithrailway

(about 20%) and Pipeline (12%) share in the total freight volume. Waterway (2%) and

Airfreightinsignificantvolumescomparedtototalfreightvolumebringuptherear.

Pipeline

12%

Air

0%

ModalSplit2007

W aterway

2%

Railway

20%

Road

66 %

cp.StatistikAustria(Verkehrsstatistik2007),BVMIT(VerkehrinZahlen2007).

ProjectPartner:AUSTRIA

Page13/47

SWOTAnalysis

Project[ChemLog]

ThefollowinggraphrepresentsanoverviewofthemaincorridorsinAustriaaswellastheir

connection to other EU member states. Furthermore important logistic nodes or node

regionsaremarkedinred.

Connection to neighbour countries

Intermodal nodes or node-region

3.2 INTERMODALTRANSPORT

Geographical and economical basic conditions, systemrelated characteristics of traffic

carrieraswellasdemandsofcustomersandsuppliersrequiretheuseofdifferentmeansof

transportandtheirintermodalalliance.Recentlytwonewmodernterminalswereopenedin

Graz (Werndorf) and Lambach. The modal split of road and rail is steadily about 65:20

although regarding domestic traffic railway is less competitive. Regarding crossborder

transportation railwaypossesses a higher share in modalsplit (44%). The attractiveness of

railwayincreaseswithhighdistances(>300km)4.Inmostofthecasesintermodaltransport

isappliedbythemeansofrailandroad,whereasthepreandpostcarriagearecarriedout

by road and main transport done by railway. In terms of intermodal handling it has to be

remarked that oftentimes distances between the terminals and connection points to high

rankingroadinfrastructurearehuge.

The following table gives a detailed overview about the intermodal terminals in Austria

(status2006):

Puwein[Energieverteuerung2006].

ProjectPartner:AUSTRIA

Page14/47

SWOTAnalysis

Project[ChemLog]

80

14

35

150

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

X ;

; ;

; X

X ;

; ;

; X

; ;

; X ;

; ; X

; X ;

X

;

X

X

;

;

;

X

X

X

X

X

X

Rollinghighway

Transloadingof

dangerous goods

780

750

350

500

n.A.

800

600

120

200

260

n.A.

360

226

350

630

250

Cereal/Agroterminal

700

750

550

630

650

630

700

160

600

260

550

720

400

600

580

550

Transloadingofheavycargo

4

4

2

3

11

2

4

1

1

1

2

1

2

2

10

2

Transloadingofbulkcargo

8

6

8

11

11

2

n.A

2

3

1

3

2

2

4

10

6

Transloadingofunitload

Containerhandling

X

X

X

X

X

X

X

X

X

numberofpiers

;

;

;

lengthofcargoquayinm

X

X

max.trainlenghtinm

max.parallelyhandledtrains

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

Numberofloadingtracks

Railway

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

;

Waterway

Road

CCGCargoCenterGraz

ContainerterminalEnns

ContainerterminalViennaNorthWest

CTSContainerTerminalSalzburg

PortKrems

PortLinz

PortVienna

TerminalBludenz

TerminalHallinTirol

TerminalKapfenberg

TerminalLambach

TerminalSt.Michael

TerminalSt.Plten

TerminalVillachSouth

TerminalWels

TerminalWolfurt

Quelle:BMVIT,HubsinAustria

Totalareain1,000m

2003 650 900

1994 3030 600

1982 22

n.A.

1980 66

850

1939 430 440

1939 1500 1000

1962 3500 1500

1981 11

n.A.

1996 30

200

1978

1

200

2003 180 480

1992 10

n.A.

1975

3

160

1984 35

n.A.

1985 100 n.A.

1983 54

n.A.

openingintheyear

max.totalhandlingcapacity

inTEU/day

IntermodalTerminalsinAustria2006

GeneralInformation Transportationmode

Road,RailwayandWaterway Servicesandtransloadedproducts

X

X

X

X

X

X

X

X

X

X

X

X

X

Goodstrafficaccordingtotransportmodesquantity

GoodstrafficinMiotons

2000 2001 2002 2003 2004 2005 2006 2007

Total(withoutair)

427,6 437,8 440,4 451,0 445,7 449,0 538,7 537,7

Road

277,0 283,9 285,5 297,2 283,3 288,2 358,8 354,3

Railway

80,8

82,6

83,9

82,2

85,7

81,9 103,9 108,3

Inlandwaterway

10,9

11,6

12,3

10,7

11,9

12,1

10,8

12,1

Pipeline

58,9

59,7

58,7

60,9

64,8

66,8

65,2

63,0

Source:StatistikAustria[Verkehrsstatistik2007]

Goodstrafficperformancein1000tkm(quantity*km):

2000

2001

2002

2003

2004

2005

2006

2007

Road

17.153.323 17.555.777 17.826.702 18.140.753 17.378.618 16.889.199 18.845.612 18.648.320

Railway

16.601.664 16.895.387 17.132.167 16.869.110 17.931.090 17.064.177 20.219.454 20.364.490

Inlandwaterway

2.443.509 2.557.349 2.845.660 2.276.387 2.808.843 2.759.577 2.418.692 2.596.618

Pipeline

n.A. n.A

n.A

n.A

n.A

n.A

n.A

n.A

Source:StatistikAustria[sterreichischeVerkehrsstatistik2007]

ProjectPartner:AUSTRIA

;

X

;

X

3.2.1 ACTUALANDPLANNEDFIGURES

Total(withoutair)

;

;

;

;

X

; X ;

; ; X ; ; X

; ; X X ; X

; ; X X X ;

Source:BMVIT[VerkehrinZahlen2007].

GoodstrafficinMio

tons

;

;

Page15/47

SWOTAnalysis

Project[ChemLog]

Reliable and selected results of forecasts about the development of the modal split are

presented by the German Ministry in charge:5changes in modal split will be about 3%,

whereas the highest growth rates will be recorded at rail traffic (+2%). Share of road

transportationwillslightlyincreaseby1%andshareofwaterwaytransportationwilldecline

by2%.

3.2.2 MAINCORRIDORSANDMAJORINFRASTRUCTURE

ThefollowingpictureshowstheAustriannetworkofterminalsaswellasroad,railwayand

waterwayinfrastructure:

3.3.3Governmentplansandpoliticalprograms

Extensionplans,financingPPP,investmentvolume,focusoncorridors,etc.

Cargo Terminal

autobahn

highway

state road

Railway

danube

province borders

Source:BMVIT,HubsinAustria,http://www.verkehre.co.at/hubs/15.11.2006

3.2.3 GOVERNMENTPLANSANDPOLITICALPROGRAMS6

ThebasisoftheEuropeanpolicyoftrafficandtransportationistheWhitepaper2001.Inthe

year2006thehalftimestatusquowasevaluatedandtheresultsoftheAccessStudyforced

the European Commission to adjust the objectives realistically. The increase of railway

transportby35%until2010hadbeenoriginallyplannedandwasweakened2006toasimple

recommendation to use railway transportation for longdistances and overloaded routes.

FurthermorenumerousToDosintermsofintermodaltransportweredefined:

5

6

cp.BMVBS[Gterverkehrsentwicklung2007].

cp.BMVIT[HalbzeitbilanzVerkehrsweibuch2006].

ProjectPartner:AUSTRIA

Page16/47

SWOTAnalysis

Project[ChemLog]

o Increaseofintermodaltransport

o Optimizationofthepotentialsofeachtransportationmode

o Futureoriented and innovative solutions in order to guarantee efficient traffic

andtransportationsystems.

TheimplementationofTENcorridorsisbehindschedule.Sothemainobjectiveforthenext

yearistheoptimizationoftheTENnetworksaccordingtoaperennialinvestmentprogram

(mobilization of available sources). Austriarelated TEN projects with relevance for

intermodaltransportareasfollows:

o Railway:

BerlinVerona/MilanoBolognaNeapelMessinaPalermo;

Paris

StraburgStuttgartViennaBratislava;

AthensSofiaBudapestViennaPraha

Nrnberg/Dresden

o Road:DanzigWarsawBrno/BratislavaVienna

o Inlandwaterway:Rhein/MaasMainDanube

3.3 ROADTRANSPORT

The total length of the road network in Austria came to 106.987 km in 2005. The high

ranking road network (highways and autobahn) held a length of about 2,050 km (2%),

whereastherestisdistributedtocountrysidehighways(32%)andruralroads(66%).From

2000to2005theroadinfrastructureincreasedby117km(+6%).EmbossedbytheAlpsthe

Austrian road infrastructure possesses a high number of tunnels and bridges. In the year

2004thenumberofhighwaybridgescameto3.918whereas137tunnelslongways290km

in2005.Intheyear2007Austrianroadtransportationmodesmoved354.3Mtonsmeaning

aslightreductionby1.3%comparedthepreviousyear.Onthesubjectofthetransportation

performance (transportation volume * kilometres transported) a decrease of 4.6% to 37.4

Billion tkm. Volumes of domestic traffic amounted to 314.1 M tons cargo of crossborder

entrance and dispatch to 15.9 M tons and 16.1 M tons as well as transit to 3.1 M tons.

Domestic transportation took the highest share of 88.7% of goods traffic whereas cross

border entrance and dispatch both had a share of 4.5%. Transit and other transportation

abroad completed the list with 1.4% and 0.9% of goods traffic in 2007. Products most

transported in 2007 were mineral raw materials and substances with a cargo volume of

183.9Mtonsandashareof51.9%intotaltransportationvolumes.Inthisranking,machines,

agriculturalproductsandfoodarefollowing.7

3.3.1 ACTUALANDPLANNEDFIGURES(STATUS:2005/2007)

Actualandplannedroadnetworkinkm

Highway

Stateroad

inoperation

inprogress

planned

total

1.696,068

18,700

91,686

1.787,956

416,672

6,772

304,922

711,567

Source:StatistikAustria[Verkehrsstatistik2007].

cp.BMVIT[VerkehrinZahlen2007],StatistikAustria[Verkehrsstatistik2007].

ProjectPartner:AUSTRIA

Page17/47

SWOTAnalysis

Project[ChemLog]

Goodstrafficin%accordingtotraffic

arearoad

2000 2001 2002 2003 2004 2005 2006 2007

Domestictraffic

87,0

86,0

86,2

Crossborderentrance

5,0

5,5

5,3

5,5

Crossborderdispatch

5,3

5,6

5,7

Transit

1,5

1,6

Othertransportationabroad

1,2

1,3

86,1 85,3

86,2

88,0

88,7

5,8

5,4

4,7

4,5

5,7

6,0

5,4

4,5

4,5

1,6

1,5

1,5

1,4

1,0

0,9

1,2

1,3

1,4

1,6

1,8

1,4

Source:StatistikAustria[Verkehrsstatistik2007].

A reliable forecast about the future development of road traffic was generated by the

AMTC Academy8predicting an increase in transportation performance of 65% until 2030

(inrelationto2005).Asthehighrankingroadnetworkwillonlygrowby30%,itisprojected

that the infrastructure of road and rail wont keep up with the development of the

transportation performance. According to experts opinions the only way to face that

economicalandecologicalunfavourabledevelopmentarepricemeasures,sotosaypricing

ofexternaleffects.

3.3.2 MAINCORRIDORSANDMAJORINFRASTRUCTURE

ThefollowinggraphgivesadetailedoverviewabouttheroadinfrastructureinAustria:

Source:StatistikAustria(sterreichischeVerkehrsstatistik2007)

autobahn

highway

3.3.3Governmentplansandpoliticalprograms

selected state roads

Extensionplans,financingPPP,investmentvolume,focusoncorridors,etc.

remaining state roads

province borders

Source:StatistikAustria[Verkehrsstatistik2007].

cp.AMTCAcademy[Mobilitt2015/20302007].

ProjectPartner:AUSTRIA

Page18/47

SWOTAnalysis

Project[ChemLog]

3.3.3 GOVERNMENTPLANSANDPOLITICALPROGRAMS

On the basis of the Austrian General Traffic Plan9a strategic expansion programme for

transportationinfrastructure(road,railwayandwaterwaynetwork)wasdevelopedin2002,

whereas these plans are not legally fixed. The main objective of the expansion of

infrastructure is the sustainable development of the business location Austria within the

international competition and to provide the infrastructural requirements for the Austrian

economy to stay competitive. The operative implementation of the infrastructure projects

shouldbedonebytheresponsiblegovernmentalinfrastructurecompanies.Particularlythe

focusisputonthefollowingmaincorridors:

o

o

o

o

o

o

Danubecorridor:DPassau/SalzburgLinzViennaSK/H

Southcorridor:CZViennaGrazVillachI(BaltischAdriatisch,Pontebbana)

Brennercorridor:DWrglInnsbruckI

Tauerncorridor:DSalzburgVillachSLO

Pyhrncorridor:CZLinzGrazSLO

Arlbergcorridor:InnsbruckFeldkirch/BregenzCH

Theextensionplansforroadwithinternationalrelevanceareconcentratedonthehighway

connectionsfromLinz/ViennatoCzechRepublicandSlovakiaaswellasGrazHungary.End

of 2007 the highway to Bratislava was opened. 2010 the implementation of the highway

connectiontoBrnowillfollow.Inordertorealizethementionedinfrastructureprojectsan

investmentvolumeofaboutEUR4.5billiondedicatedfortheperiod20082010andEUR8.1

in total until 2013 s budgeted. The financing is done via road pricing, vignettes and other

congestioncharges(Arlberg,Brenner,Tauern,Pyhrn).

3.4 RAILWAYTRANSPORT

FundamentallytheAustrianrailway networkwasnearlyunmodifiedforalongtime.Since

1990 investments into railway infrastructure have been forced, especially in the course of

the European integration and along the Transeuropean axes. The length of the railway

network stayed constant between 1970 and 1999. Since 2000 there has been a steadily

reductionfromoriginally6,841kmto6,273kmintheuptotheyear2007.Particularlythe

easternpartofAustriahasahighdensityduetoalargenumberofbranchlines.Compared

to member states of the European Union (0.4 m per capita), Austria ranks aboveaverage

with0.7m percapita.Similartoroadinfrastructureahighnumberoftunnelsandbridges

arecharacteristicfortherailwaynetworkinAustria.In2000266tunnelsalongtherailway

network existed. In comparison to road transportation, railway is hardly marked by

internationalizationandcrossbordertrafficas70%arecrossborderandtransitflows.

In the year 2007 108.3 M tons were transported to, from and within Austria, while this

signifies an augment by 4.3% from the previous year. The volumes in domestic traffic

amounted to 33.2 M tons, whereas about 74 M tons belong to the crossborder traffic in

total(entrance,dispatchandtransit).In2007morethan95%ofthetransportationvolume

wasforwardedbyAustriancompanies.

cp.BMVIT[Generalverkehrsplan2002].

ProjectPartner:AUSTRIA

Page19/47

SWOTAnalysis

Project[ChemLog]

Most important countries in international transportation were the neighbour countries

GermanyandHungarywithcargovolumeaddingupto16.0and10.1MtonsandItalyand

Sloveniacomingto6.3and5.9Mtons.Regardingtheinternationalflowofgoodsintermsof

borderregionsthenorthsouthdimensiondominatedasacrossthenorthernbordersabout

45Mtonsand31Mtonsweretransportedintheyear2007acrossthesouthernborders.

Whereastheeastwestcorridorwith24and8Mtonsshowedlesscargovolume.10

3.4.1 ACTUALANDPLANNEDFIGURES

Actualandplannedrailwaynetworkinkm

inoperation

inprogress

Public

5.703

Private

570

n.A.

n.A.

6.273

n.A.

Total

planned

n.A.

Total

n.A.

n.A.

n.A.

n.A.

n.A.

Source:StatistikAustria[Verkehrsstatistik2007].

Goodstrafficin%accordingtotraffic

arearailway

2000 2001 2002 2003 2004 2005 2006 2007

Domestictraffic

25,1

24,5

24,5

23,7

25,1

27,5

29,4

30,7

Crossborderentrance

35,1

34,5

35,5

36,3

35,4

33,8

34,6

32,0

Crossborderdispatch

21,5

22,2

22,3

22,4

21,7

21,7

19,4

18,9

Transit

18,3

18,8

17,7

17,6

17,8

17,0

16,6

18,4

Source:StatistikAustria[Verkehrsstatistik2007].

3.4.2 MAINCORRIDORSANDMAJORINFRASTRUCTURE

ThefollowinggraphgivesadetailedoverviewabouttherailwayinfrastructureinAustria:

BB (public) - electrified

double or multi-tracked

single tracked

BB (public) non electrified

Private railways

Province borders

Source:StatistikAustria[Verkehrsstatistik2007].

10

cp.BMVIT[VerkehrinZahlen2007],StatistikAustria[Verkehrsstatistik2007].

ProjectPartner:AUSTRIA

Page20/47

SWOTAnalysis

Project[ChemLog]

3.4.3 GOVERNMENTPLANSANDPOLITICALPROGRAMS

Highestprioritywithinthegovernmentalplansforrailwaywithinternationalrelevanceisthe

expansion of the WestEast rail network (WienLinz) to 4 rail tracks. Until 2015 a cross

borderprojecttointegratetheViennaairportandtheKlederingerSchleifetoachievean

interconnectingoftheEastrailnetwork,theairportandthehighway(WienBratislava).This

project is mainly financed by the European Union. The finalization of the BrennerBasis

Tunnelprojectisrescheduledfor2020,highlysupportedbytheEuropeanUnionduetothe

importancefortransittraffic.VitalforthesouthareaofAustriaistherealizationofthenew

South rail network SemmeringBasisTunnel and Koralm railway as the main axis

between Poland and Italy. Possibly bringing into service will be 2018. Further expansion

plans focus the Arlberg, Tauernaxe and the Phyrnaxe. The investment volume for all

railwayprojectsfortheyears20082013comesto10.7billionEUR.11

3.5 WATERWAYTRANSPORT

Thelengthofthedomesticwaterway,theAustrianpartoftheDanube,is350km,thereof21

km is periphery with Germany, 322 km domestic section and 7 km borderline to Slovakia.

AlongsidetheAustrianpart16biggerportsarelocated.Mostimportantaretradeportand

tank port of Linz, port of Enns, port of Krems as well as the ports of Vienna (Albern,

Freudenau, Lobau). The nine locks alongside the Danube are in Aschach, Ottensheim,

Abwinden, Wallsee, Persenbeug, Melk, Altenwrth, Greifenstein and Freudenau. Freight

volume on the Danube increased in total from 2000 2007 by 10.3% with a medial yearly

growthrateof+2%.Theyear2002showedthehighestfreightvolumeof12.3Mtons,mainly

due to the ending of the Balkan crisis. About 50% of total cargo volume was dedicated to

terminatingtraffictoAustria,whereas2/3issuppliedfromtheEast.Shareoftransitcameto

30%.

In the year 2007 about 12.1 M tons were transported at the Austrian part of the Danube

whereas the volumes increased by 4.3% from 2006 to the actual reporting period. The

transportation performance mounted up to 2.6 billion tkm, which signifies an augment of

7.4%between2006and2007.Goodflowsviacrossborderentrancehavebeentakingthe

highest share according to the traffic area coming to steadily 50% approximately. The

domestictrafficofgoodsviawaterwaydecreasedfrom2006to2007significantly,although

thesepercentageshavebeenvaryingsince2000.Thereductionincargovolumeofdomestic

transportationtracebacktothefact,thatdredgingoftheDanubewascarriedouttoalesser

extent.Highestincreaseincargovolumeintermsofproductgroupscorrespondedtoores

andmetalscrap(3.429.480tons),duetoanuppernumberoftransportsfromSlovakiaand

UkrainetoAustria.

MostimportantportsinAustriaareLinz,Enns,Ybbs,KremsandVienna.Allportshavebeen

recordedasignificantplusoftheirwatersidehandlingvolumeforthelastyear.Especially

from2006to2007theportofLinzcameupwithaplusof14.5%(5,252,512tons),Vienna

increased their waterside handling volume by 12.6% (1,655,243 tons) and Enns was

11

cp.BMVIT[Generalverkehrsplan2002].

ProjectPartner:AUSTRIA

Page21/47

SWOTAnalysis

Project[ChemLog]

successful in handling plus 13.4% (765,982 tons). Only the port of Krems had to face a

reductionduetoreducedballasthandling.12

3.5.1 ACTUALANDPLANNEDFIGURES

Goodstrafficin%accordingtotraffic

areawaterway

2000 2001 2002 2003 2004 2005 2006 2007

Domestictraffic

10,4

10,4

4,5

8,6

1,6

3,0

10,5

8,0

Crossborderentrance

49,6

48,2

51,2

48,7

50,7

50,2

44,4

51,7

Crossborderdispatch

10,8

10,8

12,6

14,6

13,7

13,7

13,3

12,8

Transit

39,6

30,6

31,7

28,1

34,0

33,1

31,8

35,5

Source:StatistikAustria[Verkehrsstatistik2007].

3.5.2 MAINCORRIDORSANDMAJORINFRASTRUCTURE

The following table gives information about the infrastructure of the most important

DanubeportsinAustria:

InfrastructureofimportantDanubeports(status2003)

Area

(m)

Linz

Linz Industrial Port

Enns-Ennsdor

Ybbs

Water surface Basin Water depth allowed drafd landing winter rail connection

(m)

(number)

(m)

(m)

(number) port

length (km)

road connection

distance to road

infrastructure (km)

1.500.000

450.000

6,0

7,0

2,7

35

yes

27,0

n.A.

2.000

1,0

8,0

n.A.

yes

0,1

3.030.000

500.000

2,0

3,0

2,7

80

yes

1.420,0

60.000

325

1,0

5,0

3,8

yes

2,5

Krems

250

70.000

2,0

8,0

5,0

yes

6,5

Vienna

3.500.000

665.000

3,0

2,5

1,5

150

yes

45,0

Source:viadonau[ManualonDanubePorts2003].

12

cp.BMVIT[VerkehrinZahlen2007],StatistikAustria[Verkehrsstatistik2007].

ProjectPartner:AUSTRIA

Page22/47

SWOTAnalysis

Project[ChemLog]

OnthechartbelowtheimportantportsandbarrageswithlocksovertheAustrianpartofthe

Danubearepresented:

Important ports

Barrages with locks

Provinve borders

Source:StatistikAustria[Verkehrsstatistik2007].

3.5.3 GOVERNMENTPLANSANDPOLITICALPROGRAMS

Extension plans for inland waterway with international relevance are concentrated on the

part of the Danube between Vienna and Bratislava. The objectives are to reduce the

bottlenecks StraubingVilshofen (D) and Nagymaros (H). A very difficult issue is the nature

meadDonauMarchThayaastheexpansionofthisareaishighlydiscussedduetoecological

reasons.Extensionplansintermsofregulationoflowfloworreconstructionofbankshave

tobeagreedwithnatureandecologygroups.Until2015thebottlenecksshallbeabandoned

withaninvestmentbudgetof270MEUR,inordertoguaranteeapermanentwaterdepthof

2.2m.13

13

Cp.BMVIT[Generalverkehrsplan2002].

ProjectPartner:AUSTRIA

Page23/47

SWOTAnalysis

Project[ChemLog]

3.6 PIPELINETRANSPORT

PipelinesinAustriaareusedforthetransportoftherawmaterialsoilandgas.From2001to

2007therewasasteadyreductionintransportvolumeofoilbyyearlyrateof2%,whereas

gasincreasedcontinuouslyby28%intotal(from2000to2007).Duetodataprotectionthere

hasnotbeenanyinformationaboutoriginofquantity.Thefreightvolumeaddedupto63.0

Mtonsin2007,meaningadecreaseby2.2Mtons(3.4%)from2006to2007.Thereasons

forthisreductioncanbeattributedtoamassivedeclineintransportationofoil.14

3.6.1 ACTUALANDPLANNEDFIGURES

Pipelinetransportin

thousandsoftons

2000

2001

2002

2003

2004

2005

2006

2007

Oil

34.888 37.216

36.163

35.507

34.639

35.417

34.611

32.381

Gas

23.993 22.519

22.557

25.418

30.129

31.334

30.611

30.657

Total

58.882 59.735

58.720

60.925

64.768

66.751

65.221

63.037

Source:StatistikAustria[Verkehrsstatistik2007].

3.6.2 MAINCORRIDORSANDMAJORINFRASTRUCTURE

ThefollowinggraphgivesadetailedoverviewaboutthepipelineinfrastructureinAustria:

Transitpipeline

3.6.3Governmentplansandpoliticalprograms

Extensionplans,financingPPP,investmentvolume,focusoncorridors,etc.

Gaspipeline

Inoperation

Planned

Supply

Throughdomestictransitpipelines

Throughintern.Transitpipelines

14

cp.BMVIT[VerkehrinZahlen2007],StatistikAustria[Verkehrsstatistik2007].

ProjectPartner:AUSTRIA

Page24/47

SWOTAnalysis

Project[ChemLog]

4 DESCRIPTIONOFCHEMICALLOGISTICSINTHEREGION/COUNTRY

Logistics has an important role within the Austrian economy as in 2005 more than 14,600

logisticcompaniesdeliveredavalueaddingofabout12billionEUR.Saleswithinthelogistic

sector came up to 35.2 billion EUR. Nearly 222,000 people are employed and contribute

considerably to the development of the Austrian economy. In the year 2005 gross

investmentsmountedto5.2billionEUR.15

ChemicalsitesinAustriaareinlandlocationswithspecificrequirementsregardinglogistics.

Handling chemical goods requires giving security and safety highest priority. Strict

regulations regarding environment and quality have to be considered alongside the whole

supply chain and especially in transport and warehousing. Therefore chemical companies

needreliablelogisticpartnerswhoareinvolvedinsectorandproductspecificissues.Many

logisticprovidersexpandtheirservicefromtransportandwarehousingtocontractingand/or

valueadded services typical for the chemical industry like filling, temperature control or

securityandsafetyadvices.AfurtheradvantageofthecollaborationwithspecializedLogistic

ServiceProvidersistheavailabilityofspecialequipment(productspecificmodeoftransport

like tank lorries, silo vehicles, tank wagons and associated specialized equipment) for the

transportofvariousdangerousgoods.Furthermorepartnerscantakeontheroleofexternal

hazardousmaterialssafetyadvisorforallcarriers(road,rail,inlandwater,deepseaandair).

There are numerous logistic companies in Austria offering logistic services for chemical

industry. Most of them are specialized business units of big companies focussing on the

individual requirements of chemical logistics. Selected logistic companies in Austria

specializedinchemicallogisticsareasfollows:

o

o

o

o

o

o

o

o

o

o

o

o

o

o

o

ChemservIndustrieServiceGmbH

DonauTankschifffahrtsGmbH(DTSG)

DanubeShippingManagementServiceGmbH(DSMS)

ETGGtertransportGmbH

HoyerAustriaGes.m.b.H.Intern.Fachspedition

IndustrieLogistikLinz

InterlinerTransporte&SpeditionsGmbH

IntermodalContainerLogisticsGmbHICL

LOGOTRADELogistikserviceWuger&QuehenbergerGes.m.b.H.

LogServLogistikServiceGmbH

LogwinSolutionsAustria

PantaRhei(PR)BefrachtungsundSpeditionGmbH

RCARailCargoAustriaAG

VTGAustriaGesmbH

Etc.

15

cp.StatistikAustria[LeistungsundStrukturstatistik2006].

ProjectPartner:AUSTRIA

Page25/47

SWOTAnalysis

Project[ChemLog]

5 INTERNALSTRENGTHSANDWEAKNESSESOFCHEMICALCOMPANIESAND

LOGISTICPROVIDERS

Whatareactuallyinternalinfluenceablestrengthsfromacompanyspointofviewregarding

chemicallogisticsinCentralandEasternEurope?

5.1 STRENGTHSINPROCUREMENT

Procurementoffreights(freightmanagement):freightsarehandledonthebasisofcontracts

orviaspotsforthetransportationmodeswaterway,road,railwayandcontainer.Regarding

the procurement of raw materials suppliers are located globally. Chemical sites in Austria

havetofaceadisadvantageoussituationasimportantmaterialsandproductsaresupplied

from overseas markets. Some Austrian chemical companiesrely on justintime delivery of

rawmaterialsasespeciallywithinthecommoditysector,highvolumesofrawmaterialsare

supplied, whereas companies try to avoid huge inventory. There are numerous but

unreliable raw material producers in Eastern Europe and due to obsolete sites and

technologiesjustintimedeliveryofrawmaterialsisnotpossibleunderthosecircumstances.

Inordertopreventdeviationsofrawmaterials,pricesoftenareagreedmonthlyinsteadof

quarterly.

5.2 STRENGTHSINWAREHOUSINGOFRAWMATERIALS,SEMIFINISHEDANDFINISHED

PRODUCTS

Theshareofrawmaterialsonproductioncostsisratherhigh.Furthermorerawmaterialsare

stored over long periods, due to comparably long delivery times and unreliable suppliers.

Withinthechemicalindustryproductsandmaterialsareproducedonstock(makesostock)

or on the basis of sales forecast. Only few companies choose maketoorder strategies.

Expertsfromchemicalcompaniesclaimlimitedinventorycapacitiesforrawmaterials,semi

finished and finished products. Furthermore productspecific characteristics and

requirements are limiting the inventory time. In Eastern Europe warehousing facilities are

availablealthoughinmostofthecasesadjustmentsarenecessary,owninvestmentshaveto

beplacedandqualificationsofstaffarelow.

5.3 STRENGTHSINPRODUCTIONLOGISTICS

ChemicalcompaniesinAustriareportaboutstabileproductionprocesseswithextremelylow

scraprates.Ingeneraldurationofproductionprocessesforfinishedproductslastsabout2

days.Inmostofthechemicalcompaniesproductionisorganisedbythreeshiftmodelsand

in some cases also on weekends. Basic chemicals party have to face longer durations for

productionchanges(setupsandcleaningofreactors).Productionplanningissupportedby

ITTools and major objectives are to maximize delivery reliability and productivity.

Furthermorecompaniestrytominimizesetupandcleaningtimes.

ProjectPartner:AUSTRIA

Page26/47

SWOTAnalysis

Project[ChemLog]

5.4 STRENGTHSINDISTRIBUTIONANDTRANSPORT

Highlydifferentproductspecificsleadtospecialrequirementsfordistribution.Evenwithin

sectorsofthechemicalindustry(e.g.commodities),customerdemandsvaryregardingcosts

andqualityofdistributionlogistics(e.g.fertilizer:highcostpressure,acceptablequality,little

timeslotsfordeliveryormelamine:highqualitydemands,exactmeetingofdeliverydatesor

urea: high quality demand, not that timecritical as melamine). Chemical companies try to

shift volumes from road to railway; in particular commodities are suited for railway

transportation(bulkloads).

Multimodal transport is difficult due to insufficient transloading facilities and railway

connections.Transhipmentofcargodemandsspecialequipment,butefficiencyisdepending

onvolumesandregularproductorvolumeflows.Thiscanonlybeachievedbygenerating

synergiesandcooperationwithpartners.Thereforemajorproblemremainsthelastmileand

the low utilization. Additionally interoperability between rail systems in West and East

Europe,bureaucraticbarriers,lackofqualityofequipmentandinflexibilityaswellasalack

ofterminalstructureforintermodaltransportpreventcompaniestoshiftvolumestorailway.

Duetoexpertsviewrailwaytransportationischallengedbylimitedavailabilityofwagons,

which are sometimes in a poor condition and badly cleaned. Furthermore it could be the

casethatsomeequipmentorwagons(e.g.NH3wagons)areunsafeintheirhandling.

InsomeEasternEuropeancountriesroadtransportationsuffersisinfluencedbylowquality

and inefficiency of the road infrastructure and in particular countryspecific administrative

regulations(e.g.digitaltachometer).Manycompaniesremarkthatthecustomerdefinesthe

mode of transport according to their requirements in terms flexibility. Safety and Security

whenloadinggoodsat chemicalsitesinEasternEuropeis challengingcompaniesaspartly

staffdoesnotwearpersonalsafetyequipmentandthereisalackofmeansforcargosafety.

Transportation and freight management is often outsourced. Transports to CEE countries

usually are organised via international freight carriers, whereas transports within CEE

countriesoftenarecarriedoutbylocalcarriers.Mainproblemisthelackofutilitiesforcargo

securingandinsufficientuseofpersonalprotectiveequipmentwhentransloadingcargoin

CEE countries. In general the equipment and the condition of the freight vehicles are

inadequate. Coordination and communication with Logistic Service Providers in CEE

countries is sometimes difficult due to language barriers and there is an absence of

harmonization of social standards (e.g. driving hours). In addition experts partly claim the

nonavailabilityofpeoplewithexcellentlogisticalbackgroundintermsofcollaborationswith

Logistic Service Providers in CEE. In general experts see high potential in the development

and improvement of the road infrastructure especially in those CEE countries, recently

joinedtheEuropeanUnion.

Inlandwaterwayisthemostimportantmodeoftransportationintermsofhigh quantities

andbulkcargoespeciallyforcommodities.TheavailabilityandeffectivenessoftheDanube

ishardlycalculableduetoexternalinfluenceslikeflood,lowwaterandicing.

ProjectPartner:AUSTRIA

Page27/47

SWOTAnalysis

Project[ChemLog]

Therefore this mode of transportation is not suitable for time critical cargo. Furthermore

modernunloadingfacilitieswithinportsinCEEcountriesaremissing(e.g.roofedterminals).

In terms of hazardous goods, dedicated transports are necessary although availability of

vesselsissometimesnotgiven.Lowoutboundvolumessignifylowutilization,whichmakes

theinlandwaterwaylesscompetitive.

5.5 STRENGTHSINPLANNINGANDCONTROLLING

Accuracy and reliability in Demand and Supply Planning or Forecasting with customers is

accordingtoexpertsviewrarelyrealizable.Thesectorisaffectedbythenecessitytoactand

reactflexiblytoplanproduction,distribution,procurementofrawmaterialsandinventory

levels.

5.6 STRENGTHSINORDERPROCESSING

Companiesseetheirstrengthsinastandardizedandstableorderprocess.

5.7 STRENGTHSININFORMATIONLOGISTICS

PPSSystems are uses for production planning in order to maximize productivity and

adherencetodeliveryschedulesaswellastominimizecleaningandsetuptimes.Inmany

companies software to manage the Supply Chain is in use. ERP and MRP systems are in

actionfororderprocessing,procurement,production,inventoryandtransport.

Inordertogainrepresentativeresultsforopportunitiesandthreatsexpertworkshopswere

organizedduringtheRegionalStakeholderMeetings.Themainobjectivewastogetasmuch

information as possible about external non influenceable opportunities and chances for

chemicallogisticsinCentralandEasternEurope?Representativesofthechemicalindustry,

logistic service providers as well as experts from other stakeholder groups attended the

workshops.

ProjectPartner:AUSTRIA

Page28/47

SWOTAnalysis

Project[ChemLog]

6 EXTERNALOPPORTUNITIES,CHANCESANDRISKSFORCHEMICALLOGISTICSIN

CENTRALANDEASTERNEUROPE

6.1 ECONOMICTRENDS

Internationalizationofsellingmarkets

Themajorityofexpertsfeelthattheinternationalizationofsourcingmarketsposesachance

for the chemical industry in total, whereas the opinions in terms of selling markets were

differentiated.Consequentlythisleadstoanenlargementofthesupplychainaswellasto

longertransportationdistances.Thesourcingofenergyisputonregionalsuppliers,butonly

with limitations. Many experts think that the internationalization of sourcing markets is a

hugechanceforthelogisticsector.Fromthesalespointofviewtheinternationalizationof

sellingmarketsleadstohigherproductvariety.

Thecurrenteconomicsituationisvastlydifficultforthechemicalindustry,butshouldrather

be regarded as chance and not as a threat. According to experts opinions and based on

experiencesinthesectorsofbulk,fineandspecialitychemicals,Germancompaniesexamine

the economical crisis more critical than Austrian chemical companies. An increasing

replacementofproductionsiteshasbeenremarkedwithinthelastyears,althoughexperts

arenotsurehowlongthistendencywillproceedinthatintensityaslabourcostsinEastern

Europe are expected to increase further on. In Far East both labour costs and quality of

chemicalproductsarelow.EventthoughexpertspredictthatqualitywilladjusttoEuropean

levelwithinthenextfewyears.Qualityawarenessstaysaquestionofmentality.

Intensifiedcompetition/globalcostpressure

Necessarilyrepresentativeofthechemicalindustrymean,thatintensifiedcompetitionand

asaconsequenthighercostpressureisseenasanopportunity.Thecompetitionisvitalfor

innovations and new distribution canals. Although there is a risky situation as European

chemicalcompanieshaveacomparativepriceandfeedstockdisadvantageinsomeproducts

and their derivatives (e.g. Olefins) and are facing an upcoming wave of petrochemical

capacity additions, especially in Middle East. In terms of logistics intensified competition

securessimilarbasicconditions.Someexpertsremarkanaugmentingshakeoutormarket

adjustmentpartlytracedbacktotheeconomicalcrisis.Neverthelessaclearmarketposition

nowadaysplaysanimportantrole.

Individualizationofproductsandservices

Individualizationofproductsandservicesisamustespeciallywithinthefinechemicalsector.

Forthebasicchemicalssectorindividualizationisseenasaneutralfactor,althoughspecial

marketsdemandindividualizedproductsandservices.Forthementionedsectorthisfactor

could be seen as opportunity as long as the customers are prepared to pay. From the

logisticalpointofviewsmallandmediumcompaniesareoptimistictothepotentialofvalue

added services which is not fully tapped yet, especially in the field of infrastructure. The

customeristhepushingfactorandoftentimesvalueaddedservicesinthefieldoflogistics

areseenasamust.

ProjectPartner:AUSTRIA

Page29/47

SWOTAnalysis

Project[ChemLog]

AdjustmentofEasternEuropeanwageleveltoCentralEuropeanslevel

Labour costs in the EU chemical industry are high in a worldwide context with high

differences within EU 27, although ULC levels in the EU are competitive with most

countries.16DuetotheadjustmentoftheEasternEuropeanwageleveltoCentralEuropean

level,expertsfeelthatAustriacompanieswillbemorecompetitiveduetoeducationallevel

astherewillbelessfocusonstaffcosts.Thechallengeistohandthathighercostsontothe

customer. In terms of logistics Austrian companies benefit from the lower wagelevel in

Eastern Europe as in the future the mentioned trend will result in higher logistic costs.

Actuallyrailpricesareadvantageousandpartiallythatcanbeleadbacktoalowwagelevel

in Eastern Europe. On the other hand logistic experts possibly expect an opportunity

especiallyforfreightmanagementduetothepullbackofbusinesstoAustria.

RegionaldevelopmentofproductionandlabourcostscomparedtoCEE

Mostoftheexpertsregardthatfuturedevelopmentasneutralwhereastheremainingpart

oftheworkshopgrouptendstoseeitasadvantageous.Reasonforthatshallbeapredicted

price in production costs in CEE. Although Austria does not possess own energy or raw

material sources, experts expect an increase in taxation in terms of environment (carbon

dioxideemissions).Anywaytheopinionsagreeonleveling.TraderestrictionstoEU27and

the reduction in demand for fertilizer are further mentioned as risks for the chemical

industryorrespectivelyforchemicallogistics.

Currently international acting companies rather disregard a regional or local economic

developmentfocusingonthedomesticorregionaleconomywilltakesometime.

Changeofimageofthechemicalindustry

Associations of the different countries have started campaigns in order to create chemical

companies more open, especially in terms of environment, climate protection as well as

regardingsustainability,safetyandsecurity.Ingeneralthefocusisputonrestructuringand

redesign of the communication policy and public relations. Main objective is to re

experiencethechemicalindustry,likelivingchemicalindustry.

Trendtowardssmallerproductionlots

Inthecourseofthistrend,thedoseratesareincreasedsignificantlyinordertoreducethe

production lots, especially within the pharmaceutical industry. Thereby a more valuable

effectisachievedaswellasleadtohigherrequirementsregardingquality.

PartnerswithcompetencesinR&D

CustomerstendtowardspartnerswithwelldevelopedstrengthsinthefieldofResearchand