Beruflich Dokumente

Kultur Dokumente

Proactive Procurement Fraud Prevention Model

Hochgeladen von

Zoltan HorvathCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Proactive Procurement Fraud Prevention Model

Hochgeladen von

Zoltan HorvathCopyright:

Verfügbare Formate

Proactive Procurement Fraud Prevention Model

The Association of Certified Fraud Examiners (ACFE) Report to the Nation

for 2002 states that organizations lose 6% of their annual revenues to employee fraud,

waste and abuse. This Report also found that over 90% of the frauds committed by

insiders targeted the Organizations cash accounts. For larger Organizations this risk

centers on accounts payable and purchasing. Accounts payable controls the check book

and purchasing the procurement function. Thus, a proactive approach to fighting fraud in

the procurement and disbursement systems will result in a significant reduction of

internal fraud within an Organization.

The Proactive Procurement Fraud Prevention Model is designed for those large

organizations that wish to stem the rising tide of this type of internal fraud. The design

is based on the authors many years of audit and fraud examination of accounts payable

and procurement systems. The Programs four step process significantly reduces the risk

of fraud in these functions.

Systems Analysis

The first step in effectively using the Model is an analysis of the Organizations

System of Internal Controls, Policies and Procedures over the procurement and

disbursement functions. Similar to a thorough review of internal controls performed by

auditors, the analysis focuses on opportunities for compromise by the fraudster.

Understanding the existing systems enhances the other elements of the model such as

employee training and data mining.

Systems and accounting manuals and other supporting documentation are read

initially. Accounts payable and procurement systems are then flowcharted to understand

the process and flow of documents (both written and electronic) from initiation to final

disposition. These flowcharts are reviewed using a fraud risk questionnaire designed to

identify opportunities of exploitation by the fraudster. Often, detailed flowcharts have

already been prepared by the organization and/or its auditors and may be used or

supplement the Model.

Unfortunately, many systems do not function as portrayed.

Therefore, it is

necessary to perform tests of the system to insure compliance with the understanding

obtained during the flowcharting process. Differences in the test results and the system

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

as portrayed are documented and evaluated. In addition to document examination,

interviews of employees often reveal noncompliance with an Organizations internal

control system. These interviews can often lead to areas of compromise in the system,

where further examination may find ongoing frauds.

Goals of the testing of the system include such items as identifying the controls

that exist, whether those controls operate properly and what controls are periodically

overridden. Upon completion of the assessment of the systems, key internal control

points are identified. These key internal controls include but are not limited to:

o Segregation of Duties

o Supervisory Controls

o Receiving Controls

o Authorization Controls

o Reconciliation Controls

o Recording Controls

The lack of these key internal control points raises the possibility of fraud within

the Organization. Finally, a written report is prepared discussing the review. The report

identifies significant weaknesses (if any) in the systems and recommendations for

improvements. The ACFE study found that improvements in an Organizations internal

controls are the Number 1 method of reducing fraud.

The following flowchart gives the reader an overview of the Systems Analysis

component of the Model:

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

Communication

Communication and training significantly contributes to reducing fraud within the

organization. Procurement and Accounts Payable Employees, as well as Vendors need to

be put on notice and educated as to what constitutes a violation of the Organizations

Code of Ethics. The Organization must provide for a method of reporting suspicious

activity. The ACFE Report found that over 46% of frauds were discovered through tips.

Employees, Vendors and Others need to be aware of the Organizations method of

communications. The flowchart below gives an overview of this component of the

Model:

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

Ethics/Fraud Policy

An Ethics Policy or Code of Conduct articulates the core values of an

Organization.

Typically the Policy proscribes to the employee what behavior is

acceptable and what is not. Unfortunately many Policies are often very general, lacking

in specifics, and do not properly address all the issues that may arise within an

Organization. The Model recommends that the Policy be reviewed for such problems

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

and written to conform to a set of Best Practices which have been developed as part of

the Models implementation.

Likewise, an Organization needs to adopt a Fraud Policy that addresses the

Organizations practices and procedures when fraud is suspected.

Without specific

guidance, managers often confront a suspected fraudster and may jeopardize the

investigation and/or prosecution. The Model recommends a Policy that should be

implemented.

Fraud Awareness Training

Fraud awareness training is a positive experience that educates employees on the

Organizations Ethics and Fraud Policies, while stressing that fraud is both costly and

detrimental to the Organization. Through this training, employees become aware of the

Red Flags to look for of fraudulent activities and their reporting responsibilities.

Accounts Payable personnel are trained on what to look for in processing

invoices, controls that are crucial to their department, Red Flags of procurement fraud,

and how to report suspicious activities within the Organization.

Procurement personnel are trained on what to look for in selecting vendors and

processing purchase orders, controls that are crucial to their department, Red Flags of

procurement fraud, and how to report suspicious activities within the Organization.

The program stresses the importance of internal controls and the fact that

personnel need to take ownership of those controls.

Procurement Fraud Training for Auditors/Security

Auditors and Security personnel receive training in auditing for and investigating

procurement fraud under the Model.

The five days of training provides extensive

coverage of the following topics:

Introduction to the Proactive Procurement Fraud Prevention Model

Auditing for and Investigating Internal Procurement Fraud

Auditing for and Investigating External Procurement Fraud

Performing the Vendor Audit

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

The training is designed to heighten the fraud awareness, investigative skills,

documentation of fraud cases, forensic auditing knowledge of the auditors and security

personnel, completing and prosecuting a fraud examination.

Employee Notices

Employees must be put on notice that they have an obligation to report to the

Organizations Compliance Officer when they observe red flags of fraud or are

approached by unscrupulous vendors or other employees.

These notices should be

incorporated into the Organizations:

Employment Application

Bulletin Board Postings in and around the work area

Annual Conflict of Interests Disclosures

Intranet Postings

The Model recommends that examples of violations of the Organizations Ethics

Policies be posted on the Organizations Intranet.

These examples help to clarify

questions that may arise by the employee and reinforce the Organizations No

Tolerance attitude.

Annual Conflicts of Interests Disclosures is a form of confirmation by the

employee.

The statement should acknowledge that the employee understands the

Organizations Ethics Policy, has complied with it, and is unaware of any violations with

it, except as disclosed.

It is not unusual for the fraudster not to return the Disclosure

form, if a follow-up system is not in place. Therefore, data mining or other follow-ups of

these disclosures may lead to ongoing fraud schemes.

Vendor Notices

Organization vendors need to be placed on notice of the Organizations Ethics

Policy, as well. One effective method in reducing the likelihood of fictitious vendors and

conflicts of interest is performing thorough due diligence of the vendor. The Model

requires the use of a vendor application process that discloses ownership, financial

condition and references.

Use of a Right to Audit Provision helps to ensure the integrity of the

procurement system. Vendor Audits are an integral part of the Model, therefore it

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

recommends that this Provision be communicated to the vendors during the application

process, as well as, contained in any contracts and included on all purchase orders issued

by the Organization.

An annual letter is to be sent to all vendors reminding them as to the Companys

Ethics Policy. The Organizations audit or compliance departments should send the

letters and control the mailing, including those returned as non-deliverable.

The

Organization may want to use this letter also as a positive confirmation and follow-up on

those letters that are not returned.

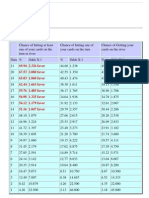

Data Mining

The Fraudster in the commission of his crime often uses computers.

The

Computer is also a very effective weapon in combating fraud within an Organization.

Over time, sophisticated data mining techniques have been developed to identify

indicators of fraud within the procurement system. Data rich environments are ideal for

continuous monitoring.

The following flowchart shows some, but not all, of these

techniques:

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

Employee Master and Earnings Files

As the reader can see, the model focuses not only on procurement systems, such

as accounts payable and purchasing documents, but employee information files as well.

The master employee files generally contain identifier information for the Organizations

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

employees. Comparisons of addresses, tax identification numbers, telephone numbers,

and electronic funds transfer routing information between the Master Employee File and

like information found in the Master Vendor File may lead to discovery of Conflicts of

Interest situations and fictitious vendors.

Many fraudsters in the commission of their crimes form fictitious businesses to

receive the fruits of their crimes. It is not unusual that the fraudster reports these

activities on their income tax returns and have additional taxes withheld from their

paychecks to pay these taxes. An analysis of net earnings as a percentage of gross

earnings may reveal those employees.

Master Vendor File

An Organizations Master Vendor File is an often overlooked and extremely

important control in fighting fraud.

It contains information used in processing

disbursements of the Organizations cash and provides the Fraudster with plenty of

opportunities. Data Mining techniques can be used to detect various fraud schemes.

Many of the tests are designed to locate fictitious companies such as address comparisons

to employees, Postal Box and Mail Drop addresses. Examinations of existing audit logs

for address changes may reveal other schemes. Another benefit of finding duplicate

addresses is it provides a method for cleaning up the file of duplicate vendor entries.

Vendor Invoice/Payment History Files

Analyses of these files search for anomalies in amounts, invoice numbering,

unusual period changes and other red flags of fraud. The data mining techniques use

Benfords Law that focuses on the frequency of numbers in large data sets to find unusual

patterns that may be indicative of fraud. Examinations of large and unusual amounts are

also performed.

Organizations often establish risk levels such as all checks less than $10,000 are

machine signed. Fraudsters learn of these levels and construct their schemes to target

amounts just below these levels.

Therefore, an effective data mining method is to

examine those amounts.

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

Purchase Order File

Data Mining of the Purchase Order file may lead to other indicators of fraud such

as increasing unit prices, unusual amendments and different ship to addresses. Purchase

Order files may also be mined to look for patterns of orders, requisitioners, noncompliance with policies and other anomalies.

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

Vendor Audit

Performing a detailed vendor audit is the most effective means to discover:

Fictitious (Shell) Companies

Corruption Schemes

Vendor Frauds

An additional byproduct of this process is building effective and trusting relations with

the Organizations Vendors. In the Model the Vendor Audit is used as an investigative

step when fraud is suspected.

The following flowchart depicts the common steps in performing a Vendor Audit

as a part of a fraud examination:

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

Vendor Research

Prior to performing the vendor audit, intelligence needs to be gathered as to the

Vendors business, organization and principals. The Model recommends that searches be

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Proactive Procurement Fraud Prevention Model

performed of public records, Dun & Bradstreet, the Internet and other sources to gain an

understanding of the Vendor and its principals. It is not unusual to find circumstantial

evidence from the research that enhances the fraud examination.

Forensic Examination of Vendor Documents

Prior to the Vendor Audit, A detailed forensic examination of the Vendors

documents in the possession of the Organization is performed. The examination focuses

on errors, anomalies, or other irregularities contained in these documents. Like the

research discussed above, circumstantial evidence may be found during the examination.

Onsite Examination

The onsite examination focuses on the credibility of the Vendor. A combination

of interviewing and document examination techniques often leads to a confession if

wrongdoing is involved.

Depending on the case, the Model suggests a number of

procedures to be performed.

2002 Craig L. Greene, CFE, CPA Confidential and Proprietary Information

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Poker Odds HandBookDokument8 SeitenThe Poker Odds HandBookZoltan Horvath100% (1)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Insider Secrets To Playing Texas Hold'Em Online Poker by Theo CageDokument209 SeitenInsider Secrets To Playing Texas Hold'Em Online Poker by Theo CageZoltan HorvathNoch keine Bewertungen

- Easy Game Volume IIDokument97 SeitenEasy Game Volume IIDenis Gnidash100% (4)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Obligations and Contracts CasesDokument293 SeitenObligations and Contracts CasesKaye DinamlingNoch keine Bewertungen

- Global SourcingDokument8 SeitenGlobal SourcingZoltan HorvathNoch keine Bewertungen

- 28 Ligot v. RepublicDokument2 Seiten28 Ligot v. RepublicMeg Reyes100% (3)

- Holdem Brain by King Yao Poker EbookDokument119 SeitenHoldem Brain by King Yao Poker EbookZoltan Horvath100% (2)

- The Poker Puzzle by Oliver (Improva) MarxDokument91 SeitenThe Poker Puzzle by Oliver (Improva) MarxZoltan HorvathNoch keine Bewertungen

- The Poker Puzzle by Oliver (Improva) MarxDokument91 SeitenThe Poker Puzzle by Oliver (Improva) MarxZoltan HorvathNoch keine Bewertungen

- Sample Memo To EmployeesDokument3 SeitenSample Memo To EmployeesJudith Tito Bularon100% (2)

- San Juan de Dios v. NLRC (Case Digest)Dokument2 SeitenSan Juan de Dios v. NLRC (Case Digest)Czarina Louise NavarroNoch keine Bewertungen

- Trip G Torts Flow ChartDokument8 SeitenTrip G Torts Flow ChartGeeth Mp100% (1)

- People vs. EstebiaDokument5 SeitenPeople vs. EstebiaAdrianne BenignoNoch keine Bewertungen

- Intestate Estate of Don Mariano San Pedro v. Court of Appeals, GR No. 103727, Dec. 1, 1996Dokument3 SeitenIntestate Estate of Don Mariano San Pedro v. Court of Appeals, GR No. 103727, Dec. 1, 1996Jamiah Obillo HulipasNoch keine Bewertungen

- Divided We Govern Coalition Politics in Modern IndiaDokument506 SeitenDivided We Govern Coalition Politics in Modern IndiaAnindya NandiNoch keine Bewertungen

- Learning To Play Strong Poker by Jonathan SchaefferDokument12 SeitenLearning To Play Strong Poker by Jonathan SchaefferZoltan HorvathNoch keine Bewertungen

- Alano V Planter's Development BankDokument1 SeiteAlano V Planter's Development BankKC NicolasNoch keine Bewertungen

- Single Table Tournament StrategyDokument6 SeitenSingle Table Tournament StrategyZoltan HorvathNoch keine Bewertungen

- ACI PHILIPPINES, INC. V COQUIADokument1 SeiteACI PHILIPPINES, INC. V COQUIAChilzia RojasNoch keine Bewertungen

- Metropolitan Bank V GonzalesDokument1 SeiteMetropolitan Bank V GonzalesYasuhiro Kei100% (1)

- Ople V Torres Due ProcessDokument2 SeitenOple V Torres Due ProcessLester Nazarene OpleNoch keine Bewertungen

- Negotiation in PurchasingDokument20 SeitenNegotiation in PurchasingZoltan Horvath100% (1)

- PEOPLE V InoveroDokument6 SeitenPEOPLE V InoveroAurea Mhay CallanganNoch keine Bewertungen

- Proactive Procurement V2Dokument40 SeitenProactive Procurement V2Zoltan HorvathNoch keine Bewertungen

- Poker Math Made Easy by Roy RounderDokument39 SeitenPoker Math Made Easy by Roy RounderZoltan HorvathNoch keine Bewertungen

- The No-Limit Hold'Em Workbook by Tri Nguyen (Slowhabit)Dokument119 SeitenThe No-Limit Hold'Em Workbook by Tri Nguyen (Slowhabit)Zoltan HorvathNoch keine Bewertungen

- Golden Rules of PokerDokument1 SeiteGolden Rules of PokerZoltan HorvathNoch keine Bewertungen

- Positive Aspects of Poker BT David SklanskyDokument16 SeitenPositive Aspects of Poker BT David SklanskyZoltan HorvathNoch keine Bewertungen

- Banking Law Case CommentDokument3 SeitenBanking Law Case CommentnPrakash ShawNoch keine Bewertungen

- Forest RightDokument2 SeitenForest RightAmit KumarNoch keine Bewertungen

- FranchisingDokument36 SeitenFranchisingMukesh Raj PurohitNoch keine Bewertungen

- Malaysian Studies Assignment 3Dokument3 SeitenMalaysian Studies Assignment 3Kai Jie100% (1)

- 11 Cangco V Manila RailroadDokument3 Seiten11 Cangco V Manila RailroadluigimanzanaresNoch keine Bewertungen

- History of FIFADokument2 SeitenHistory of FIFAankitabhat93Noch keine Bewertungen

- 420 Case DiaryDokument2 Seiten420 Case DiaryAnil SharmaNoch keine Bewertungen

- United States v. Townes, C.A.A.F. (2000)Dokument4 SeitenUnited States v. Townes, C.A.A.F. (2000)Scribd Government DocsNoch keine Bewertungen

- Finance (CMPC) Department, Fort St. George, Chennai - 600 009Dokument2 SeitenFinance (CMPC) Department, Fort St. George, Chennai - 600 009Gowtham Raj100% (1)

- Case #9 CELDRAN VS PEOPLE - G.R. 220127Dokument3 SeitenCase #9 CELDRAN VS PEOPLE - G.R. 220127Save AngelesNoch keine Bewertungen

- 42 Political ScienceDokument5 Seiten42 Political Scienceshyamananda LeimakhujamNoch keine Bewertungen

- UPS Firearm Shipping Agreement RedactedDokument6 SeitenUPS Firearm Shipping Agreement RedactedAmmoLand Shooting Sports NewsNoch keine Bewertungen

- Azhiya Osceola DCF ReportsDokument4 SeitenAzhiya Osceola DCF ReportsHorrible CrimeNoch keine Bewertungen

- 151.CIR Vs Asalus CorpDokument7 Seiten151.CIR Vs Asalus CorpClyde KitongNoch keine Bewertungen

- Davao Smoking LawDokument4 SeitenDavao Smoking LawJohn Remy HerbitoNoch keine Bewertungen

- Calalang V WilliamsDokument1 SeiteCalalang V WilliamsErca Gecel BuquingNoch keine Bewertungen

- Robina Farms Cebu Vs VillaDokument10 SeitenRobina Farms Cebu Vs VillaMargarita SisonNoch keine Bewertungen