Beruflich Dokumente

Kultur Dokumente

2015 03 27 Amended Motion For Approval of Plan of Distribution

Hochgeladen von

jmaglich1Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2015 03 27 Amended Motion For Approval of Plan of Distribution

Hochgeladen von

jmaglich1Copyright:

Verfügbare Formate

Case 2:11-cv-01165-BSJ Document 2377 Filed 03/27/15 Page 1 of 8

HOLLAND & HART LLP

David K. Broadbent, #0442

Doyle S. Byers, #11440

Cory A. Talbot, #11477

222 S. Main Street, Suite 2200

Salt Lake City, UT 84101

Telephone: 801-799-5800

Facsimile: 801-799-5700

Attorneys for Gil A. Miller as Court-Appointed Receiver

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF UTAH, CENTRAL DIVISION

SECURITIES AND EXCHANGE

COMMISSION,

AMENDED MOTION FOR APPROVAL

OF PLAN OF DISTRIBUTION

Plaintiff,

Civil Action No. 2:11-cv-01165

vs.

MANAGEMENT SOLUTIONS, INC., a

Texas Corporation; WENDELL A.

JACOBSON; ALLEN R. JACOBSON,

Judge Bruce S. Jenkins

Defendants.

Gil A. Miller, the Court-appointed receiver in this matter (the Receiver), submits the

following Amended Motion for Approval of Plan of Distribution (the Motion).

The Receiver first submitted his Motion for Approval of Plan of Distribution on February

27, 2015, attaching the proposed Plan of Distribution. (CM/ECF No. 2311 (the Original

Motion and Exhibit B thereto.) The Receiver now seeks to make a minor modification to the

Case 2:11-cv-01165-BSJ Document 2377 Filed 03/27/15 Page 2 of 8

proposed Plan of Distribution with respect to the treatment of Class 8.1 No other portion of the

proposed Plan of Distribution would be affected by this amendment.

As explained in the Original Motion, in the event the Plan of Distribution is approved,

there is a strong possibility that Class 5 Claimants (Investor Claimants) will receive 100% return

of their Adjusted Investor Claim when considering the combined payments they received from

MSI prior to the initiation of the receivership and the projected distributions they may receive

pursuant to the Plan of Distribution. Thereafter, if funds are available to make distributions to

Class 8 Claimants (also made up of Investor Claimants), those Claimants will receive additional

distributions in excess of 100% of their Adjusted Investor Claim.

The original Plan of Distribution states the following regarding the distributions to Class

8:

Class 8. Amounts available for distribution, if any, after payment

in full of Classes 1, 2, 3, 4, 5, 6, and 7 Allowed Claims shall be

paid to the Class 8 Claimants proportionate to their Adjusted

Investor Claim.

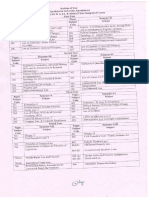

(Article IV, Section 8.) This could be read to mean that all Class 8 Claimants will receive

distributions solely based on the amount of their Adjusted Investor Claim amount without

considering whether they had already received payments from MSI in excess of 100% of their

Adjusted Investor Claim. This is not the intention of the Receiver. As illustrated on the

schedule attached hereto as Exhibit A in the column entitled % Returned Before Distribution,

there are eight Investor Claimants that received amounts from MSI (prior to the receivership) in

Unless otherwise defined herein, capitalized terms are defined in the Original Motion and/or

the Plan of Distribution attached thereto as Exhibit B.

2

Case 2:11-cv-01165-BSJ Document 2377 Filed 03/27/15 Page 3 of 8

excess of 100% of their Adjusted Investor Claim (the Winners).2 The Receiver does not

believe it would be equitable for the Winners to begin receiving distributions simultaneously

with other Investor Claimants in Class 8. Instead, a rising tide method of distribution, as

described in the Original Motion, should be used so that other Investor Claimants will receive

distributions first. A specific Winner will only begin to receive distributions (if at all) when the

other Investor Claimants have received sufficient distributions to allow them to receive the same

Percentage Return as that particular Winner. This is the most equitable way to treat Class 8

Claimants, and the Receiver seeks to modify the proposed Plan of Distribution to effect this

method of distribution. Therefore, the Receiver seeks to modify the language of Article IV,

Section 8 to read as follows:

Class 8. Amounts available for distribution, if any, after payment

in full of Classes 1, 2, 3, 4, 5, 6, and 7 Allowed Claims shall be

paid to the Class 8 Claimants pursuant to the rising tide method

of distribution as described in the discussion regarding the

treatment of Class 5 above, except that, by definition, the

distributions (if any) to Class 8 Claimants will be beyond 100%

Percentage Return.

Attached hereto as Exhibit B is a new version of the proposed Plan of Distribution (exclusive of

exhibits) that incorporates this change.

Attached as Exhibit F to the Original Motion, the Receiver provided the Preliminary

Claims Analysis that provided a preliminary calculation of the anticipated recovery for each

Claimant. For Class 5, the last column indicated a Class 8 Percent Allocation that will now be

Because the Preliminary Claims Analysis is subject to change, the list of Winners may change

too, but that is unlikely.

3

Case 2:11-cv-01165-BSJ Document 2377 Filed 03/27/15 Page 4 of 8

inapplicable. The Receiver has updated3 the Preliminary Claims Analysis and posted it to the

website www.managementsolutionsreceivership.com.4 It also now reflects how a hypothetical

distribution to Class 8 would be calculated.

The Receiver believes that this change is more equitable and is necessary to clarify the

proposed Plan of Distribution. Because the change can only negatively impact the Winners, in

additional to filing this Amended Motion with the Court and providing notice to all parties

participating in this action, the Receiver will also provide notice to the Winners at their last

known address. The Receiver requests that the Court approve the proposed Plan of Distribution

as modified.

RESPECTFULLY SUBMITTED this 27th day of March, 2015.

HOLLAND & HART LLP

/s/ Doyle S. Byers

David K. Broadbent

Doyle S. Byers

Cory A. Talbot

Attorneys for Gil A. Miller as Court-Appointed

Receiver

As stated in the Original Motion, the numbers in the Preliminary Claims Analysis are subject to

change, and some minor changes have already occurred. Those changes are also incorporated in

the new Preliminary Claims Analysis posted to the website.

4

Courtesy copies of the schedules regarding Class 5 and Class 8 distributions are also provided

to the Court herewith.

4

Case 2:11-cv-01165-BSJ Document 2377 Filed 03/27/15 Page 5 of 8

CERTIFICATE OF SERVICE

I hereby certify that on the 27th day of March, 2015, I caused to be electronically filed

the foregoing with the Court by CM/ECF, and the Court will send electronic notification to all

counsel.

I also certify that I caused the foregoing to be served via first-class mail, postage prepaid,

on the following:

Lanny Waite

Maxine Waite

P. O. Box 192

Logandale, NV 89021

Pro Se

I also certify that I caused the foregoing to be served via Priority Mail, postage prepaid,

on the following:

Red Castle Inc Retirement Trust

P. O. Box 257

Fountain Green, UT 84632

Daley, Scott R or Ellen

300 West 4000 South

Vernal, UT 84078

Carlson, Sue

1038 West 1750 North

Nephi, UT 84648

Lovell, Brett or Emily

P. O. Box 398

Fountain Green, UT 84632

Jacobson, Bradley G

P. O. Box 372

Fountain Green, UT 84632

Sun Winds, LLC

P.O. Box 372

Fountain Green, UT 84632

Sun Winds, LLC

P. O. Box 372

Fountain Green, UT 84632

Barrett, Dustin

P. O. Box 94

Foutnain Green, UT 84632

Golden J, LLC

P. O. Box 372

Fountain Green, UT 84632

Bailey, Greg B. or Jenny J.

P. O. Box 298

Fountain Green, UT 84632

Case 2:11-cv-01165-BSJ Document 2377 Filed 03/27/15 Page 6 of 8

Provident Development Group, LLC

P. O. Box 372

Fountain Green, UT 84632

Sagewood Capital, LLC

P. O. Box 92819

Southlake, TX 76092

Parkwood Capital, LLC

P. O. Box 92819

Southlake, TX 76092

EJ Edwards Ranch, LP

P. O. Box 92819

Southlake, TX 76092

Dixie Winds, LLC

P. O. Box 76092

Southlake, TN 76092

Circle J Farms Limited Partnership

P. O. Box 92819

Southlake, TX 76092

APS as Admin for the Benefit of Gloria S.

Atienza

4168 West 12600 South, Suite 300

Riverton, UT 84096

Fotheringham, Bob and Kathy

4439 Lily Meadows Lane

Salt Lake City, UT 84124

Colonial Stone Brook Apartment

Homes II, LLC

4515 King Goerge Court

Perry Hall, MD 21128

Thueson, Bryan and Marlynae

9448 South 2100 West

South Jordan, UT 84095

Welling, Eric C. and Mary Katherine

2732 East 6200 South

Salt Lake City, UT 84121

McDermott, Eugene and Mary Ann

1778 Oakridge Drive

Salt Lake City, UT 84106

Nielson, Matthew A and Jill R. etal

7715 North 2625 East

Ephraim, UT 84627

Jacobson, Melba

P. O. Box 400

Fountain Green, UT 84632

Boca Raton, LLC

P. O. Box 400

Fountain Green, UT 84632

Boca Raton, LLC TIC Member of the

Edwards Ranch Development

P. O. Box 400

Fountain Green, UT 84632

Jacobson, Melba

P. O. Box 400

Fountain Green, UT 84632

Wool City, Inc.

P. O. Box 92819

Southlake, TX 76092

Starwood Management Company, Inc.

P. O. Box 92819

Southlake, TX 76092

Jacobson, Brandon W. and April C.

436 W. Bountiful Way

Saratoga Springs, UT 84045

Case 2:11-cv-01165-BSJ Document 2377 Filed 03/27/15 Page 7 of 8

Jacobson, Cami

5184 Caldwell Mill Rd., Ste 204-345

Birmingham, AL 35244

Nycom Apartments, LLC

7918 South 1530 West

West Jordan, UT 84088

Pheasant Wood, LLC

7918 South 1530 West

West Jordan, UT 84088

Jacobson, Laney V.

498 East 100 South

Manti, UT 84642

Douthitt, Sam and Carol

1801 Ritter St.

Chesterton, IN 46304

Coutts, Jason W. and Casey J.

12584 Lucky Ct.

Eastvale, CA 91752

/s/

Doyle S. Byers

Case 2:11-cv-01165-BSJ Document 2377 Filed 03/27/15 Page 8 of 8

INDEX OF EXHIBITS

List of Winners.

Proposed Plan of Distribution (with modification to Article IV, Section 8).

7681804_1

Case 2:11-cv-01165-BSJ Document 2377-1 Filed 03/27/15 Page 1 of 2

EXHIBIT A

Case 2:11-cv-01165-BSJ Document 2377-1 Filed 03/27/15 Page 2 of 2

Management Solutions, Inc., Receivership

Class 5: Investor Claims

Summary of Preliminary Investor Claim Analysis (subject to further review and modification)

SORTED BY NAME

As of March 25, 2015

% Returned

Before

Distribution

Estimated

Receivership

Distribution(s)

Percent of AIC

Returned After

Receivership

Distribution(s)

Class 8

Percent

Allocation

((D+G)/C)

(C / Sum(C))

Amounts Based on Currently Available Information

Claimant Name

Filed

Cash In

Adjusted

Claim Claim Basis at Since

Investor

Payments

Unpaid

Number

12/31/08 12/31/08 Claim ("AIC") Since 12/31/08 Claim

(A + B)

Douthitt, Sam and Carol

Nycom Apartments, LLC

Pheasant Wood, LLC

Fotheringham, Robert and Kathy

American Pension Services as Administrator for the Benefit of Gloria S. Atienza

McDermott, C. Eugene and Mary Ann

Thueson, Bryan or Marlynae

Welling, Eric C. and Mary Katherine

0576

0527

0528

0438

0376

0457

0445

0455

1,211.00

(153,683.00)

205,030.00

11,867.00

5,511.00

6,175,591.00

84,881.00

1,491,239.00

1,211.00

(8,051.34)

(153,683.00)

(733,645.86)

205,030.00

(717,930.01)

11,867.00

(37,815.73)

5,511.00

(11,106.00)

6,175,591.00 (8,446,186.09)

84,881.00

(103,872.85)

1,491,239.00 (1,525,041.65)

(C - D)

-

(D / C)

664.85%

477.38%

350.16%

318.66%

201.52%

136.77%

122.37%

102.27%

664.85%

477.38%

350.16%

318.66%

201.52%

136.77%

122.37%

102.27%

0.00%

-0.08%

0.11%

0.01%

0.00%

3.23%

0.04%

0.78%

Comments

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 1 of 18

EXHIBIT B

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 2 of 18

HOLLAND & HART LLP

David K. Broadbent, #0442

Doyle S. Byers, #11440

Cory A. Talbot, #11477

222 S. Main Street, Suite 2200

Salt Lake City, UT 84101

Telephone: 801-799-5800

Fax: 801-713-6259

Attorneys for Gil A. Miller, as Court-Appointed Receiver

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF UTAH, CENTRAL DIVISION

SECURITIES AND EXCHANGE

COMMISSION,

PLAN OF DISTRIBUTION

Plaintiff,

Civil Action No. 2:11-cv-01165

vs.

MANAGEMENT SOLUTIONS, INC., a

Texas Corporation; WENDELL A.

JACOBSON; ALLEN R. JACOBSON,

Judge Bruce S. Jenkins

Defendants.

The Receiver, Gil A. Miller, hereby submits this proposed Amended Plan of Distribution

(the Amended Plan).

ARTICLE I-INTRODUCTION AND DEFINITIONS

When used in this Plan, the capitalized terms will have the following definitions:

1.

Adjusted Investor Claim shall refer to the resulting amount after the Receiver

calculates and adjusts an Investor Claim pursuant to the following methodology: As part of the

Claims Analysis Report, the Receiver will calculate the Claim Basis for each Investor Claim as

of the Claim Basis Date. The Receiver will add to the Claim Basis the amounts of any additional

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 3 of 18

investments the Investor made following the Claim Basis Date, the sum of which is the Adjusted

Investor Claim. Although payments MSI made to an Investor following the Claim Basis Date

(whether characterized as return of principal or interest) are not included in the calculation of the

Adjusted Investor Claim, such payments are accounted for in the distribution process (see Article

IV, Section 5).

2.

Administrative Expense Claims shall refer to all costs, expenses, and fees

incurred by the Receiver and his agents in connection with his administration of the receivership,

including, but not limited to, consultant fees, accountant fees, auctioneer and/or liquidator fees,

data management and storage fees, legal fees, and all other reasonable costs and expenses.

3.

Allowed Claim shall refer to a Claim that was submitted to the Receiver in a

timely fashion, or is otherwise accepted by the Receiver in his sole discretion, by a Claimant in

accordance with the provisions set forth in the Plan, and that has been approved by the Court as

compensable.

4.

Allowed Claimants shall refer to Claimants with Allowed Claims.

5.

Approval Order shall refer to the order of the Court approving the Plan.

6.

Bar Date shall refer to that date by which a Claim was required to be filed in

order to receive a distribution from the funds or assets held by the Receiver pursuant to this Plan.

The Bar Date was established by order of the Court as September 2, 2014 (see Order at CM/ECF

No. 1955). Claims submitted after the Bar Date are considered untimely, and will not participate

in the Plan unless accepted by the Receiver in the Receivers sole discretion.

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 4 of 18

7.

Claimant shall refer to a Person who claims to be owed money by one or more

receivership entities. A married couple, and any of their wholly-owned affiliates, will be

considered a single Claimant.

8.

Claim shall refer to all of a Claimants purported right(s) to distribution,

whether or not such purported right(s) is (are) reduced to judgment, liquidated, unliquidated,

fixed or contingent, asserted or unasserted, matured, disputed, undisputed, legal, secured or

unsecured, regardless of whether a Claimant submitted multiple claim forms.

9.

Claims Analysis Report shall refer to the report of all Claims submitted to the

Receiver, and such report shall set forth, among other things, the individual Claims, including the

Claim Basis and Adjusted Investor Claim for Investor Claimants (see Article V, Section 2).

10.

Claim Basis shall refer to the amount of an Investors Claim as of the Claim

Basis Date as determined by the Receiver based on capital account balances as reported on K-1s,

principal balances on promissory notes, and other information.

11.

Claim Basis Date shall refer to December 31, 2008.

12.

Claims Process shall refer to the procedure established by the Receiver and set

forth in Article V of the Plan.

13.

Class shall refer to a group of Claims that are substantially similar to each other

as classified pursuant to the Plan.

14.

Case shall refer to SEC v. Management Solutions, Inc., et al., Civil No. 2:11-

cv-01165.

15.

Creditor shall refer to any person or entity owed money by MSI who is not an

Investor.

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 5 of 18

16.

Home Owners Association or HOA shall refer to any entity that claims a

lien on, or right to payment of dues or other expenses related to, receivership property pursuant

to a recorded declaration of conditions, covenants, and restrictions or similar document.

17.

Investor shall refer to a person or entity who holds an Investor Claim.

18.

Investor Claim shall refer to a Claim for investments made in or with MSI,

whether characterized as debt or equity by MSI, but shall not include Secured Claims. The term

Investor Claim includes any Claim for unsecured debt made by an Investor.

19.

MSI shall refer, individually and collectively, to Management Solutions, Inc.,

Wendell A. Jacobson, Allen R. Jacobson, Parkwood Management, LLC, Starwood Management

Company, Inc., and the companies and individuals listed in Exhibit A hereto.

20.

Non-Participants shall have the meaning set forth in Article II, below.

21.

Person shall refer to an individual, corporation, partnership, limited liability

company, trust, association, retirement or pension plan, or other entity.

22.

Personal Injury Claim shall refer to a Claim based upon a tort (negligence or an

intentional act) resulting in personal injury or death to a person or damage to tangible property

committed by, or for which, a receivership entity is allegedly responsible.

23.

Secured Claims shall refer to Claims held by Creditors holding perfected liens

on or security interests in property of MSI, and shall include property tax claims.

24.

Secured Creditors shall refer to Creditors holding Secured Claims.

25.

Tax Claims shall refer to Claims of government authorities for the payment of a

tax, including, but not limited to, income taxes, withholding taxes (including FICA and

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 6 of 18

Medicare), personal property or intangible taxes, payroll taxes, and sales taxes, but excluding

property tax claims.

26.

Trade Creditor Claims shall refer to Claims for goods or services provided to

27.

Winner shall refer to an Investor that, following the Claim Basis Date, received

MSI.

from MSI funds in excess of its Adjusted Investor Claim.

ARTICLE II-DEFINITION OF NON-PARTICIPANTS OF THE PLAN

1.

Non-Participants of the Plan will not be considered Allowed Claimants and shall

receive no distribution from the Plan.

2.

Non-Participants of the Plan are defined by the following five categories:

a. Insiders, i.e., individuals or entities that were involved in MSIs investment

scheme, and the affiliates of such individuals or entities. The Receiver

considers MSI as defined above, and the individuals and entities listed on

Exhibit B hereto to be insiders.

b. Investors and Creditors who have settled their Claims with the Receiver and,

in connection with the settlement, waived their Claims.

c. Persons who have valid tenant-in-common (TIC) ownership interests in real

property will not participate in the Plan with respect to such TIC ownership

interests. Nothing in this section will prevent a TIC owner from participating

in the Plan based on other non-TIC Claims.

d. Any HOA that claims an interest in any receivership property that has been

(or will be) abandoned by the Receiver. Also, any HOA that claims an

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 7 of 18

interest in any receivership property for which the proceeds from the sale of

such property are insufficient to satisfy the claim of such HOA will be a NonParticipant to the extent of any deficiency.

e. Any Tax Claim that is specifically for property taxes related to any

receivership property that has been (or will be) abandoned by the Receiver.

Also, any Tax Claim that is specifically for property taxes for any receivership

property for which the proceeds from the sale of such property are insufficient

to satisfy such Tax Claim will be a Non-Participant to the extent of any

deficiency.

f. Investors and Creditors who have not filed a Claim by the Bar Date, unless

otherwise permitted by the Receiver.

3.

The definition of Non-Participants of the Plan may be modified both before and

after approval of the Plan, on such notice and hearing as the Court deems appropriate.

ARTICLE III-CLASSIFICATION OF CLAIMS AND INTERESTS

The Claims are classified as set forth in this Article. The rights of all Claimants, and the

responsibilities of the Receiver with respect to such Claimants, shall be based upon their

classification herein:

1.

Class 1 shall consist of the portion of Secured Claims for principal, contract rate

interest, and reasonable attorneys fees (exclusive of default interest, penalties, late fees,

servicing fees, etc.), but shall not include any amounts that exceed the proceeds from the sale of

the collateral securing the Secured Claims, i.e., deficiency claims. Class 1 shall also consist of

HOA Claims for HOA assessments (exclusive of default interest, penalties, late fees, etc.), but

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 8 of 18

shall not include any amounts that exceed the proceeds from the sale of the receivership property

related to such HOA Claim, i.e., deficiency claims, after payment of Secured Claims.

2.

Class 2 shall consist of Administrative Expense Claims.

3.

Class 3 shall consist of Tax Claims, but for Tax Claims specifically for property

taxes, Class 3 shall not include any amounts that exceed the proceeds from the sale of the

receivership property related to such Tax Claim, i.e., deficiency claims. Also, Class 3 shall not

include any Tax Claim that is specifically for property taxes related to any receivership property

that has been (or will be) abandoned by the Receiver.

4.

Class 4 shall consist of Trade Creditor Claims.

5.

Class 5 shall consist of Investor Claims.

6.

Class 6 shall consist of Claims of Secured Creditors for any amounts in excess of

the principal amount of their claims, contract rate interest, and reasonable attorneys fees, and

any amounts which exceed the proceeds from the sale of the collateral securing the Secured

Claims, i.e., deficiency claims. Class 6 shall not include any Claims by persons or entities

defined as a Non-Participant of the Plan.

7.

Class 7 shall consist of Personal Injury Claims.

8.

Class 8 shall consist of Investor Claims for amounts in excess of the total of the

Adjusted Investor Claims.

9.

Class 9 shall consist of Non-Participants.

The Receiver reserves the right to dispute any Claim or to move a Claim from one Class

to another with approval from the Court or by stipulation with the Claimant.

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 9 of 18

ARTICLE IV-TREATMENT OF CLASSES

1.

Class 1. Class 1 Allowed Claims shall be paid upon sale of the MSI property

securing such Class 1 Allowed Claims from the proceeds of such sale. Class 1 Allowed Claims

shall have priority over all other Allowed Claims.

2.

Class 2. Class 2 Allowed Claims shall be paid from the funds held by the

Receiver pursuant to the procedures set forth in the Courts (1) Order Appointing Receiver

Freezing Assets and Other Relief dated December 15, 2011(CM/ECF No. 4); (2) Order Granting

Receivers Motion for Order Establishing Monthly Fee and Expense Reimbursement Procedures

dated July 7, 2014 (CM/ECF No. 1986); and (3) Order Granting Receivers Motion for an

Extension to the Monthly Fee and Expense Reimbursement Procedures dated August 12, 2014

(CM/ECF No. 2054). Class 2 Allowed Claims shall be accorded priority over all other claims,

except Class 1 Allowed Claims.

3.

Class 3. The Receiver may pay Class 3 Allowed Claims at the time they are due

or at any time thereafter as determined by the Receiver. In the event a Class 3 Allowed Claim

has not been paid when due, funds shall be reserved from the funds held by the Receiver for

payment, and such Class 3 Allowed Claim shall be accorded priority over all other Claims,

except Classes 1 and 2 Allowed Claims.

4.

Class 4. Class 4 Allowed Claims shall be paid from the funds held by the

Receiver. Class 4 Allowed Claims shall be accorded priority over all other Claims, except

Classes 1, 2, and 3 Allowed Claims.

5.

Class 5. Claimants holding Class 5 Allowed Claims shall be eligible for a

distribution from the funds held by the Receiver as follows:

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 10 of 18

Some MSI Investors received payments from MSI and/or made additional cash

investments in MSI following the Claim Basis Date. These payments and investments will be

taken into account in determining distributions under this Plan as described below. In

determining distributions to Class 5 Allowed Claims, the Receiver shall first determine the

Adjusted Investor Claim amount for each Investor Claim. For each Adjusted Investor Claim, the

Receiver will analyze the payments received by the Investor following the Claim Basis Date and

calculate the percentage of the Adjusted Investor Claim returned to the Investor subsequent to

the Claim Basis Date (the Percentage Return). The amount distributed to each Class 5

Claimant will be calculated using the rising tide method of distribution as described below:

a. The first Investors to receive a distribution will be those who did not receive

any payments from MSI following the Claim Basis Date. Those Investors

who did not receive any payments from MSI following the Claim Basis Date

will receive distributions until they have received a Percentage Return equal

to the Percentage Return of the Investors with the lowest non-zero Percentage

Return since the Claim Basis Date. Thereafter, those Investors who did not

receive any payments from MSI following the Claim Basis Date, together

with the Investors with the lowest non-zero Percentage Return since the Claim

Basis Date will receive distributions until they have received a Percentage

Return equal to the Percentage Return of the Investors with the second lowest

non-zero Percentage Return since the Claim Basis Date. This distribution

method will be followed until funds to be distributed are exhausted, or until all

Investors have received 100% Percentage Return.

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 11 of 18

Illustration of Rising Tide Distribution: The following illustration assumes there are only

three investors:

Investor

Adjusted

Investor Claim

$100,000.00

Cash-out

Post Claim

Basis Date

$0.00

Percentage

Return

$200,000.00

$40,000.00

20%

$100,000.00

$80,000.00

80%

0%

Given the above scenario, Investor A would be the first to receive a distribution. Investor

B will not receive a distribution unless and until Investor A has received a 20% Percentage

Return or, in this illustration, distributions of $20,000.00. In the event Investor A receives

$20,000.00 in distributions and there remain additional funds to distribute, Investor B will begin

receiving distributions with Investor A proportionate to their Adjusted Investor Claims. Based

on the above illustration, in the event there is an additional $6,000.00 to distribute, Investor A

would receive $2,000.00, and Investor B would receive $4,000.00. Investors A and B will

continue to receive distributions to the exclusion of Investor C until Investors A and B have both

received a 80% Percentage Return. In the event Investors A and B receive distributions

sufficient for both to receive an 80% Percentage Return and there remain additional funds to

distribute, Investor C will begin receiving distributions with Investors A and B proportionate to

their Adjusted Investor Claims.

Distributions on Class 5 Allowed Claims, plus the total of payments Investors received

from MSI following the Claim Basis Date, shall not exceed the total of the Adjusted Investor

Claims.

10

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 12 of 18

Class 5 Allowed Claims shall be accorded priority over all other Claims, except Classes

1, 2, 3, and 4 Allowed Claims.

6.

Class 6. Class 6 Allowed Claims shall be paid from the funds held by the

Receiver. Class 6 Allowed Claims shall be accorded priority over all other Claims, except

Classes 1, 2, 3, 4, and 5 Allowed Claims. The amount each Class 6 claimant will receive will be

calculated on a pro rata basis, i.e., in proportion to the amount of each Class 6 Allowed Claim.

7.

Class 7. Class 7 Claimants must first look to MSI insurance for recovery on their

Claims. In the event such Claimants are unable to recover through MSI insurance, and their

Claims are allowed by the Court, Class 7 Allowed Claims shall be paid from the funds held by

the Receiver and shall be accorded priority over all other Claims, except Classes 1, 2, 3, 4, 5, and

6 Allowed Claims.

8.

Class 8. Amounts available for distribution, if any, after payment in full of

Classes 1, 2, 3, 4, 5, 6, and 7 Allowed Claims shall be paid to the Class 8 Claimants pursuant to

the rising tide method of distribution as described in the discussion regarding the treatment of

Class 5 above, except that, by definition, the distributions (if any) to Class 8 Claimants will be

beyond 100% Percentage Return .

9.

Class 9. No distribution shall be made to any Class 9 Claimant, and no funds will

be held in reserve for Class 9 Claimants.

The nine (9) classes of claimants set the ordinal priority for payment.

ARTICLE V-CLAIMS PROCESS

1.

Administrative Claims (Class 2) shall be paid pursuant to the procedures set forth

in the Courts (1) Order Appointing Receiver Freezing Assets and Other Relief dated December

11

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 13 of 18

15, 2011(CM/ECF No. 4); (2) Order Granting Receivers Motion for Order Establishing Monthly

Fee and Expense Reimbursement Procedures dated July 7, 2014 (CM/ECF No. 1986); and (3)

Order Granting Receivers Motion for an Extension to the Monthly Fee and Expense

Reimbursement Procedures dated August 12, 2014 (CM/ECF No. 2054). Tax Claims (Class 3)

shall be paid when due and without need for further approval by the Court.

2.

Once the Receiver has reviewed and analyzed all Claims, the Receiver will

prepare the Claims Analysis Report (see Article VI), which will include an analysis of each

Claim submitted. The Claims Analysis Report will include, among other things, the Receivers

proposed classification of each Claim, his calculations of the Claim Basis and the Adjusted

Investor Claim for each Investor Claim, and his proposed amounts for all other Claims.

3.

The Receiver shall complete his proposed Claims Analysis Report within 7 days

of the entry of the Approval Order and shall serve it on all Claimants at their last known address

and post it on the Receivers website at www.managementsolutionsreceivership.com.

Thereafter, Claimants are encouraged to communicate with the Receiver regarding the proposed

classification and treatment of their respective Claims, and may submit additional documentation

or information regarding their respective Claims. The Receiver, in his discretion, may make

alterations to the proposed Claims Analysis Report based on communications and additional

information received from Claimants. The Receiver shall file a motion for approval of the

Claims Analysis Report with the Court within 30 days of the entry of the Approval Order.

4.

Within 14 days of the Receiver filing his motion for approval of the Claims

Analysis Report, Claimants may file and serve any objections they may have to the Claims

Analysis Report, including, without limitation, objections to the Receivers proposed

12

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 14 of 18

classification or amount of Claims. All objections shall be served upon the Receiver and filed

with the Court. Responses to any objections shall be filed by the Receiver no later than 28 days

following the filing of his motion for approval of the Claims Analysis Report.

5.

If a Claimant does not file and serve an objection within 14 days following the

filing of the motion for approval of the Claims Analysis Report, such Claimant has waived any

right to object to the Claims Analysis Report. Moreover, if no Claimant objects to a particular

Claim and its treatment in the Claims Analysis Report, the Claims Analysis Report shall be final

and binding as to that particular Claim.

6.

Claimants objections, which are not otherwise resolved, will be adjudicated by

the Court.

ARTICLE VI-INTERIM DISTRIBUTIONS

Following entry of the Approval Order, and in conjunction with the Claims Process

outlined in Article V, including approval of the Claims Analysis Report, the Receiver will seek

Court approval to begin distributing funds on an interim basis pursuant to the priorities described

herein. The Receiver will hold in reserve any amounts necessary to pay amounts in dispute

based on Claimants objections pending the determination of such objections. The Receiver will

seek approval of subsequent distributions, as well, as additional proceeds become available for

distribution.

ARTICLE VII-RETENTION OF JURISDICTION

1.

The Order Appointing Receiver, Freezing Assets and Other Relief dated

December 15, 2011 (CM/ECF No. 4), and any related orders of the Court dealing with the

Receivers power and authority, shall remain in full force and effect, except as modified in the

13

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 15 of 18

Approval Order, or any subsequent order entered by this Court, until this Court enters an order

concluding this Case and discharging the Receiver.

2.

The Receiver shall retain all powers and authority provided in the Order

Appointing the Receiver until the discharge of the Receiver by this Court.

3.

This Court shall retain jurisdiction over the Case for all purposes allowed by law

including, but not limited to, the following:

a. the interpretation, implementation, enforcement, and consummation of the

Plan;

b. the allowance or disallowance of any Claim;

c. the determination of validity and priority of any Claim;

d. the modification of the Plan as may be necessary to carry out its purposes and

intent;

e. the resolution of all litigation that has been or may be filed by or against the

Receiver;

f. any future plans of distribution; and,

g. the entry of an Order concluding the Case and discharging the Receiver.

ARTICLE VIII-MISCELLANEOUS PROVISIONS.

1.

Upon application of the Commission, the Receiver, or any party of interest, this

Court may issue an order directing any necessary party to execute, deliver, or join in the

extension or delivery of any instrument or document and perform any other act necessary for the

consummation of the Plan.

14

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 16 of 18

2.

The Receiver shall be authorized to exclude from distribution any funds he deems

necessary to pay for the ongoing operations and obligations of the receivership. This amount

shall be used, subject to this and other orders of the Court, to pay administrative expenses of the

receivership, pay any applicable taxes, and for any other purpose approved by this Court.

3.

The Receiver shall be authorized, empowered, and permitted to enter into an

agreement or agreements with any Claimant, subsequent to the Approval Order, which

provide(s) for payment or treatment of such Claimant's Claim, subject to Court approval.

4.

The provisions of the Plan, upon confirmation through the Approval Order, shall

be binding upon all Claimants and parties in interest.

5.

The Plan may be modified both before and after approval, on such notice and

hearing as this Court deems appropriate.

6.

Distributions under the Plan shall be made by sending a check in the name of the

Claimant to the last known address of said Claimant or to the address specified by any change of

address notices received by the Receiver before the funds are distributed. Claimants are required

to advise the Receiver, in writing, of any change of address or party in interest.

7.

In the event that a Claimant fails to negotiate a distribution check within 90 days

after the date of the check, which was mailed to the last known address for said Claimant, such

Claim shall be considered abandoned and disallowed in its entirety. The funds, which would

otherwise be distributed to such Claimant, shall revert to the receivership estate.

8.

In the event the Receiver sends a check to a Claimant for payment on a Claim and

receives the check back as undeliverable, the Claim shall be considered abandoned and

15

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 17 of 18

disallowed in its entirety and, the funds, which would otherwise be distributed to such Claimant,

shall revert to the receivership estate.

9.

In the event the Receiver requires information or forms from a Claimant in

relation to making a payment (such as tax forms), the Receiver may condition any payment upon

receiving such information or forms from the Claimant.

10.

The Receiver, his agents, attorneys and employees, shall be held harmless for any

damages or liability that may arise through the discharge of his duties under the Plan, in

accordance with this Courts December 15, 2011, Order Appointing Receiver, Freezing Assets

and Other Relief dated December 15, 2011 (CM/ECF No. 4).

11.

When the Receiver determines that further efforts to liquidate the assets of MSI

are not required or would not be economical, he shall file a motion with this Court to close the

Case wherein he may request such relief as he deems necessary for the final resolution of this

Case.

DATED this ____ day of ______________, 2015.

BY THE COURT:

_________________________________

HONORABLE BRUCE S. JENKINS

U.S. DISTRICT COURT JUDGE

16

Case 2:11-cv-01165-BSJ Document 2377-2 Filed 03/27/15 Page 18 of 18

INDEX OF EXHIBITS

MSI Entity List.

Insiders.

7678753_2

17

Das könnte Ihnen auch gefallen

- Bitclub - Indictment 2 1Dokument27 SeitenBitclub - Indictment 2 1jmaglich1Noch keine Bewertungen

- MJ Capital Funding CEO - Spotlight On Johanna GarciaDokument8 SeitenMJ Capital Funding CEO - Spotlight On Johanna Garciajmaglich1Noch keine Bewertungen

- Complaint: Desouza Law, P.A. 3111 N. University Drive, Suite 301 - Coral Springs, FL 33065 TELEPHONE (954) 603-1340Dokument8 SeitenComplaint: Desouza Law, P.A. 3111 N. University Drive, Suite 301 - Coral Springs, FL 33065 TELEPHONE (954) 603-1340jmaglich1Noch keine Bewertungen

- Ash Narayan, Et AlDokument24 SeitenAsh Narayan, Et AlEllen MeyersNoch keine Bewertungen

- Janvey V MagnessDokument10 SeitenJanvey V Magnessjmaglich1Noch keine Bewertungen

- Order Granting Plaintiff'S Motion For Partial Reconsideration (Dkt. No. 44.)Dokument23 SeitenOrder Granting Plaintiff'S Motion For Partial Reconsideration (Dkt. No. 44.)jmaglich1Noch keine Bewertungen

- Gilmond ComplaintDokument8 SeitenGilmond Complaintjmaglich1Noch keine Bewertungen

- FBI Pleadings DC SolarDokument112 SeitenFBI Pleadings DC Solarjmaglich1100% (5)

- Dottore OrderDokument32 SeitenDottore Orderjmaglich1Noch keine Bewertungen

- Graham Filed ComplaintDokument43 SeitenGraham Filed Complaintjmaglich1Noch keine Bewertungen

- NCUA Motion and Receiver's ResponseDokument30 SeitenNCUA Motion and Receiver's Responsejmaglich1Noch keine Bewertungen

- Graham Filed ComplaintDokument43 SeitenGraham Filed Complaintjmaglich1Noch keine Bewertungen

- 17-56290 - Hoffman V MarkowitzDokument7 Seiten17-56290 - Hoffman V Markowitzjmaglich1Noch keine Bewertungen

- Bond AppealDokument4 SeitenBond Appealjmaglich1Noch keine Bewertungen

- Schwarz IndictmentDokument16 SeitenSchwarz Indictmentjmaglich1Noch keine Bewertungen

- 1Dokument21 Seiten1jmaglich1Noch keine Bewertungen

- Fifth Circuit Opinion (Golf Channel)Dokument5 SeitenFifth Circuit Opinion (Golf Channel)jmaglich1Noch keine Bewertungen

- Comp 23451Dokument19 SeitenComp 23451jmaglich1Noch keine Bewertungen

- 14 4107Dokument49 Seiten14 4107jmaglich1Noch keine Bewertungen

- SEC Aequitas ComplaintDokument30 SeitenSEC Aequitas ComplaintPortland Business JournalNoch keine Bewertungen

- SEC Complaint 2Dokument81 SeitenSEC Complaint 2Anonymous 2zbzrvNoch keine Bewertungen

- Keryc IndictmentDokument70 SeitenKeryc Indictmentjmaglich1Noch keine Bewertungen

- Comp 23432Dokument24 SeitenComp 23432jmaglich1Noch keine Bewertungen

- Comp 23421Dokument21 SeitenComp 23421jmaglich1Noch keine Bewertungen

- 11.30.2015 Trial Judgment Entered Against Wayne PalmerDokument13 Seiten11.30.2015 Trial Judgment Entered Against Wayne Palmerjmaglich1Noch keine Bewertungen

- JPM AmicusDokument54 SeitenJPM Amicusjmaglich1100% (1)

- Motion SubstititionDokument5 SeitenMotion Substititionjmaglich1Noch keine Bewertungen

- US V HolcombDokument16 SeitenUS V Holcombjmaglich1Noch keine Bewertungen

- IndictmentDokument7 SeitenIndictmentjmaglich1Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Clat LLB & LLM - 2019 PDFDokument7 SeitenClat LLB & LLM - 2019 PDFBikashNoch keine Bewertungen

- 14134407legal and Ethical Essentials of Health Care Admini - Chapter 3 Tort Law and ReformDokument40 Seiten14134407legal and Ethical Essentials of Health Care Admini - Chapter 3 Tort Law and ReformKristin McCounaughy (Cutie)Noch keine Bewertungen

- Law of Tort ProjectDokument32 SeitenLaw of Tort ProjectLoveleen Mishra100% (3)

- Persons and Family Relations Session 4 CasesDokument39 SeitenPersons and Family Relations Session 4 CasesKim Muzika PerezNoch keine Bewertungen

- LS 100 - Local Government LawDokument111 SeitenLS 100 - Local Government Lawchisangakennedy06Noch keine Bewertungen

- Reception: of English Law in Malay StatesDokument20 SeitenReception: of English Law in Malay StatesKarrywangNoch keine Bewertungen

- LW ENG - Sept 22-Aug 23 FinalDokument16 SeitenLW ENG - Sept 22-Aug 23 FinalLuv MeNoch keine Bewertungen

- Registered Owner Rule and Quasi-Delicts LiabilityDokument15 SeitenRegistered Owner Rule and Quasi-Delicts LiabilityFRANCIS PATRAYNoch keine Bewertungen

- Petitioner Vs Vs Respondent: Third DivisionDokument7 SeitenPetitioner Vs Vs Respondent: Third DivisionLala PastelleNoch keine Bewertungen

- T. Ivonne Martin v. Washington Metropolitan Area Transit Authority, 667 F.2d 435, 4th Cir. (1981)Dokument3 SeitenT. Ivonne Martin v. Washington Metropolitan Area Transit Authority, 667 F.2d 435, 4th Cir. (1981)Scribd Government DocsNoch keine Bewertungen

- Hein Warner c24 PM 9308139 Parts BookDokument6 SeitenHein Warner c24 PM 9308139 Parts Bookrhonda100% (48)

- US Navy Ship Damages Philippine ReefDokument16 SeitenUS Navy Ship Damages Philippine Reefcarlo_tabangcuraNoch keine Bewertungen

- Ce - Law PT.1Dokument48 SeitenCe - Law PT.1rylNoch keine Bewertungen

- Hotel Pool Accident LiabilityDokument22 SeitenHotel Pool Accident LiabilityShamcy GonzNoch keine Bewertungen

- Sas 5Dokument2 SeitenSas 5chantoy bersalesNoch keine Bewertungen

- Case Digest 2Dokument4 SeitenCase Digest 2Noela Glaze Abanilla DivinoNoch keine Bewertungen

- Ababoo v. The Ladies Shop II - ComplaintDokument17 SeitenAbaboo v. The Ladies Shop II - ComplaintSarah BursteinNoch keine Bewertungen

- MxCatia UsersGuide 10.7.SP1Dokument71 SeitenMxCatia UsersGuide 10.7.SP1khiladi2Noch keine Bewertungen

- Tort Against Person and Personal RelationshipDokument13 SeitenTort Against Person and Personal RelationshipKarishma100% (2)

- Adminguide PDFDokument292 SeitenAdminguide PDFidoscribdNoch keine Bewertungen

- CH 10 Quiz W Answers RevisedDokument15 SeitenCH 10 Quiz W Answers RevisedFred FlinstoneNoch keine Bewertungen

- Tort Lecture NotesDokument98 SeitenTort Lecture Notesmarija.kutalovskaja24Noch keine Bewertungen

- Material CasesDokument15 SeitenMaterial Casesvinay sharmaNoch keine Bewertungen

- Satellogic Albania Government Master Servicdes AgreementDokument33 SeitenSatellogic Albania Government Master Servicdes AgreementTettsNoch keine Bewertungen

- Torts Essay PrepDokument3 SeitenTorts Essay Prepsbniru7073Noch keine Bewertungen

- Sulpicio Lines vs NLRC jurisdictional disputeDokument3 SeitenSulpicio Lines vs NLRC jurisdictional disputemargaserranoNoch keine Bewertungen

- All Syllabus 2016-17 Compressed PDFDokument144 SeitenAll Syllabus 2016-17 Compressed PDFGourav VermaNoch keine Bewertungen

- Student Registration Agreement SampleDokument7 SeitenStudent Registration Agreement SampleMoolani MoolaniNoch keine Bewertungen

- Torts IIDokument28 SeitenTorts IILindaNoch keine Bewertungen

- Test Bank For Legal Environment of Business 9th Edition CheesemanDokument36 SeitenTest Bank For Legal Environment of Business 9th Edition Cheesemanjustinfrancisnrbqgpdeoa100% (20)