Beruflich Dokumente

Kultur Dokumente

Stock Update Yes Bank Stock Update Persistent Systems: Index

Hochgeladen von

Shivam DaveOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Stock Update Yes Bank Stock Update Persistent Systems: Index

Hochgeladen von

Shivam DaveCopyright:

Verfügbare Formate

Visit us at www.sharekhan.

com

April 22, 2015

Index

Stock Update >> Yes Bank

Stock Update >> Persistent Systems

For Private Circulation only

REGISTRATION DETAILS Regd Add: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station,

Kanjurmarg (East), Mumbai 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos. BSE - INB/INF011073351 ; BSE- CD ; NSE - INB/

INF231073330 ; CD-INE231073330 ; MCX Stock Exchange - INB/INF261073333 ; CD-INE261073330 ; DP - NSDL-IN-DP-NSDL-233-2003 ; CDSL-IN-DP-CDSL-2712004 ; PMS-INP000000662 ; Mutual Fund-ARN 20669 ; Commodity trading through Sharekhan Commodities Pvt. Ltd.: MCX-10080 ; (MCX/TCM/CORP/0425) ;

NCDEX-00132 ; (NCDEX/TCM/CORP/0142) ; NCDEX SPOT-NCDEXSPOT/116/CO/11/20626 ; For any complaints email at igc@sharekhan.com ; Disclaimer:

Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and Dos & Donts by MCX & NCDEX and the T & C on www.sharekhan.com

before investing.

investors eye

stock update

Yes Bank

Reco: Buy

Stock Update

Growth momentum continues, asset quality stable

Key points

Company details

Price target:

Rs930

Market cap:

Rs33,241 cr

52 week high/low:

Rs910/429

NSE volume:

(no. of shares)

CMP: Rs796

27.1 lakh

BSE code:

532648

NSE code:

YESBANK

Sharekhan code:

YESBANK

Free float:

(no. of shares)

32.6 cr

Operating performance improves: For Q4FY2015, Yes Bank reported a strong

growth in profits (up 28% YoY to Rs551 crore) contributed by a robust growth in

the net interest income (up 36% YoY). Advances growth remained strong (up

36% YoY), while the net interest margin was stable at 3.2% QoQ. The CASA ratio

improved to 23.1% from 22.6% in Q3FY2015.

Asset quality stays healthy: The asset quality remained stable though

restructured loans (0.5% of advances vs 0.26% in Q3FY2015) increased in

Q4FY2015. Provisions showed a jump of 75% YoY largely due to counter-cyclical

provision of Rs50.7 crore (with a total counter-cyclical provision of Rs105 crore

in FY2015). The management has guided for credit cost of 60-80BPS for FY2016.

Maintain Buy with PT of Rs930: Given the banks thrust on growth, we expect

Yes Bank to grow its advances by 23% CAGR over FY2015-17 resulting in a 22%

growth in earnings. The bank is embarking on its version 3 phase which should

result in further improvement in qualitative parameters. We maintain our Buy

rating on the stock with an unchanged price target of Rs930 (2.4x FY2017 BV).

Shareholding pattern

Results

Price chart

Price performance

(%)

1m

3m

-5.8

-8.4

25.7

82.2

Relative -3.9

to Sensex

-4.5

20.4

47.6

Absolute

6m 12m

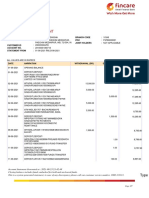

Rs cr

Particulars

Q4FY15

Q4FY14

YoY %

Q3FY15

QoQ %

Interest income

Interest expense

Net interest income

Non-interest income

Net total income

Operating expenses

Employee expenses

Other operating expenses

Pre-provisioning profit

Provisions

Profit before tax

Tax

Profit after tax

Asset quality

Gross NPAs

Gross NPAs (%)

Net NPAs

Net NPAs (%)

Capital adequacy (%)

CAR

Tier I

Key reported ratios (%)

NIM

CASA

3,088.4

2,111.3

977.1

590.4

1,567.5

630.0

261.9

368.2

937.5

126.4

811.1

260.2

551.0

2,568.1

1,848.5

719.6

445.5

1,165.1

484.7

203.8

280.8

680.4

72.3

608.1

177.9

430.2

20.3

14.2

35.8

32.5

34.5

30.0

28.5

31.1

37.8

74.8

33.4

46.2

28.1

2,971.7

2,062.6

909.0

536.8

1,445.8

583.1

254.1

329.0

862.7

69.9

792.9

252.6

540.3

3.9

2.4

7.5

10.0

8.4

8.0

3.1

11.9

8.7

80.9

2.3

3.0

2.0

313.4

0.41

87.7

0.12

174.9

0.31

26.1

0.05

79.2

10 BPS

236.5

7 BPS

278.7

0.42

64.5

0.10

12.5

-1 BPS

36.0

2 BPS

15.60

11.50

14.40

9.80

120 BPS

170 BPS

16.70

11.90

-110 BPS

-40 BPS

3.20

23.12

3.00

22.03

20 BPS

109 BPS

3.20

22.61

0 BPS

51 BPS

Sharekhan

April 22, 2015

Home

Next

investors eye

stock update

Strong growth in advances drives NII growth

Asset quality remains stable, restructured loans rise

Yes Banks net interest income (NII) for Q4FY2015 grew

by 36% year on year (YoY) to Rs977 crore (higher than our

estimates) largely driven by a pick-up in advances growth

(up 36% YoY). The incremental growth in advances mainly

came in from commercial banking (up 38% YoY) and

branch-banking activities (partly due to priority sector

related lending). The corporate banking which constitutes

64.7 % of the book showed a growth of 39% YoY. We expect

the bank to sustain above industry growth (23%

compounded annual growth rate [CAGR] over FY2015-17)

over the next two years with an increase in proportion of

small and medium enterprises (SME) and retail loans.

The asset quality was largely maintained during the

quarter as the gross non-performing assets (GNPAs)

declined by 1BPS to 0.41 while net non-performing assets

(NNPAs) were marginally up by 2BPS to 0.12 on a quarterly

basis. The bank has not sold any non-performing assets

(NPAs) during the quarter. However, the restructured book

surged to Rs381 crore (0.5% of advances) from Rs170 crore

in Q3FY2015 (but remains significantly low as compared

with its peer banks). The overall asset quality still remains

largely stable. The provisions during the quarter surged

by 74% YoY mainly due to excess standard asset provision

(counter-cyclical provision) of around Rs50.7 crore.

Advances growth (%)

Asset quality

NIM remains stable and is likely to improve

The net interest margin (NIM) during Q4FY2015 remained

stable at 3.2% quarter on quarter (QoQ) despite a 15-20

-basis point (BPS) drag due to liquidity coverage ratio

requirements. The cost of funds declined by 30BPS QoQ

which was largely offset by a 20-BPS quarter-on-quarter

(Q-o-Q) drop in the yield on loans. The current account

and savings account (CASA) ratio showed an improvement

of 51BPS QoQ to 23% led by a 35% year-on-year (Y-o-Y)

growth in the savings deposits. The granularity of deposits

continues to improve as the share of retail deposits

increased to 48% from 42% YoY.

Non-interest income jumps up by 32%

The non-interest income surged by 32% YoY, mainly driven

by a 116% growth in the financial market income (including

a Rs21-crore gain on the bond book) and a strong 33.6%

growth in the retail fee income. The transaction banking

and financial advisory which together constitute 62% of

the non-interest income grew by 17% and 18% respectively.

The cost to income ratio was stable at 40.2%.

Break-up of non-interest income (Rs cr)

NIM (%)

Sharekhan

April 22, 2015

Home

Next

investors eye

stock update

Capital raising on anvil

further improvement in qualitative parameters. We

maintain our Buy rating on the stock with an unchanged

price target of Rs930 (2.4x FY2017 book value).

The bank has a Tier I capital adequacy ratio (CAR) of

11.5% (total CAR of 15.6%) and the management expects

to sustain the same over the next 12-18 months. However,

the banks board had approved a proposal to raise $1

billion of capital in one or tranches via qualified

institutional placement (QIP) or American depository

receipts (ADR) and may look to raise capital depending

upon suitable opportunities. The capital raising could

potentially dilute the return ratios and may affect the

stocks performance.

One-year forward P/BV band

Valuation and outlook

Given the managements thrust on growth, we expect

Yes Bank to grow its advances by 23% CAGR over FY201517, resulting in a 22% growth in earnings. The bank is

embarking on a version 3 phase which should result in

Profit and loss statement

Particulars

FY15

FY16E FY17E

Net interest income

2,219 2,716 3,488

4,228 5,284

Non-interest income

1,257

1,722

2,046

2,568

3,144

Net total income

3,476

4,438

5,534

6,796

8,428

Operating expenses

1,335

1,750

2,285

2,840

3,356

Pre-provisioning profit

2,142 2,688 3,250

FY13

Provision & contingency

Profit before tax

FY14

216

362

339

1,926 2,326 2,910

Tax

625

Profit after tax

709

905

1,301 1,618 2,005

Particulars

FY13

Per share data (Rs)

Earnings

36.3

Dividend

6.0

Book value

161.7

Adj book value

161.5

Spreads (%)

Yield on advances

12.7

Cost of deposits

7.9

Net interest margins

2.7

Operating ratios (%)

Credit to deposit

70.2

Cost to income

38.4

CASA

18.9

Non-interest income/

total income

36.2

Return ratios (%)

RoE

24.8

RoA

1.5

Assets/Equity (x)

16.5

Asset quality ratios (%)

Gross NPA

0.2

Net NPA

0.0

Growth ratios (%)

Net interest income

37.3

Pre-provisioning profit 39.1

Profit after tax

33.1

Advances

23.7

Deposits

36.2

Valuation ratios (x)

P/E

21.9

P/BV

4.9

P/ABV

4.9

Capital adequacy (%)

CAR

18.3

Tier I

9.5

3,956 5,072

526

664

3,429 4,408

1,091

1,403

2,338 3,005

Balance sheet

Particulars

Key ratios

Rs cr

Rs cr

FY13

FY14

FY15

FY16E

FY17E

Liabilities

Networth

5,808

7,122

11,680

13,524

15,893

Deposits

66,956

74,192

91,176

Borrowings

20,922

21,314

26,220

29,477

35,815

5,419

6,388

7,094

5,799

6,882

Other liabilities

& provisions

Total liabilities

111,235 135,150

99,104 109,016 136,170 160,034 193,740

Assets

Cash & balances

with RBI

Balances with banks

& money at call

3,339

4,542

5,241

5,339

6,014

727

1,350

2,317

1,669

2,027

Investments

42,976

40,950

46,605

53,949

64,196

Advances

47,000

55,633

75,550

92,549 113,835

Fixed assets

230

293

319

367

422

Other assets

4,833

6,247

6,139

6,162

7,246

Total assets

99,104 109,016 136,170 160,034 193,740

FY14

FY15

FY16E

FY17E

44.9

8.0

197.2

196.5

48.0

9.0

279.4

272.5

56.0

10.1

323.5

316.0

71.9

12.9

380.2

371.3

12.7

8.0

2.8

12.2

7.8

3.0

12.0

7.7

3.0

12.0

7.6

3.1

75.0

39.4

22.0

82.9

41.3

23.1

83.2

41.8

25.0

84.2

39.8

27.3

38.8

37.0

37.8

37.3

25.0

1.6

16.1

21.3

1.6

13.0

18.6

1.6

11.8

20.4

1.7

12.0

0.3

0.0

0.8

0.4

0.7

0.3

0.6

0.3

22.4

25.5

24.4

18.4

10.8

28.4

20.9

24.0

35.8

22.9

21.2

21.7

16.6

22.5

22.0

25.0

28.2

28.5

23.0

21.5

17.7

4.0

4.1

16.6

2.8

2.9

14.2

2.5

2.5

11.1

2.1

2.1

14.4

9.8

14.6

11.4

16.3

10.9

15.5

10.2

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

Sharekhan

April 22, 2015

Home

Next

investors eye

stock update

Persistent Systems

Reco: Buy

Stock Update

In-line performance; Buy maintained with revised PT of Rs880

Key points

Company details

Price target:

Rs880

Market cap:

Rs5,744 cr

52 week high/low:

Rs961/444

NSE volume:

(no. of shares)

CMP: Rs718

1.1 lakh

BSE code:

533179

NSE code:

PERSISTENT

Sharekhan code:

PERSISTENT

Free float:

(no. of shares)

4.9 cr

Shareholding pattern

Price chart

In-line performance, net income beats estimate led by lower tax rate: For Q4FY2015,

Persistent Systems Ltd (PSL)s performance was in line on both revenues and margin fronts.

Led by lower tax rate and higher than expected other income, the net income was ahead

of estimates. The revenues in terms of dollar were up by 0.6% QoQ to $80 million. The IT

services revenues were up by 1.7% QoQ to $65.5 million (led by 0.7% volume and 1%

improvement in realisation), while the IP-led revenues were down by 4% QoQ. The EBITDA

margin remained stable QoQ at 20.2%. The companys other income for the quarter was

up by 13% QoQ to Rs13 crore and foreign exchange gains were at Rs5 crore against a profit

of Rs13 crore in Q3FY2015. The tax rate has declined to 20.6% as compared with 25.1% in

Q3FY2015, attributed to a tax break in the loss-making US subsidiary. The net income for

the quarter was up by 2.2% QoQ to Rs76 crore.

Enterprise story playing out well, concerns persist on ISV side: PSLs enterprise digital

transformation (EDT) story is playing out well and has already registered a few good

wins in the recent quarters. Also, the revenues from the enterprise side have gradually

increased from 19.7% in Q1FY2015 to 24% in Q4FY2015 (34.7% CAGR). The management

remains confident in delivering a strong growth on the enterprise side in FY2016. Whereas,

ISVs (57.8% of the revenues) continue to remain under pressure owing to change in

business preference in the clients accounts. PSLs revenues from top-clients were down

by 4.4% CAGR in the last four quarters. Overall, the management remains optimistic

about delivering a better growth in FY2016 as compared with FY2015, led by an

improvement in the overall deals funnel and traction in the enterprise side. Also,

acquisitions in the IP space will aid to the overall revenues trajectory.

Attractive risk-reward ratio, maintain buy with a revised price target of Rs880: We

have lowered our earnings estimates for FY2016 and FY2017 by 4.3% and 7.0% respectively,

attributed to a change in the revenues and margins estimates. We have also reset our

currency estimates to Rs62 and Rs61 for FY2016 and FY2017 respectively. Nevertheless,

given PSL being a pure play on the digital spend, strong balance sheet (cash of Rs816

crore at 46% of the balance sheet size) and good corporate governance still make it a

good investment bet for the long-term investors. In the last three months, the stock of

PSL has corrected around 21% which offers an attractive risk-reward ratio. We maintain

our Buy rating on the stock with a revised price target of Rs880.

Results

Rs cr

Particulars

Price performance

(%)

Absolute

1m

3m

6m 12m

-3.3 -22.9

8.8

36.7

Relative -1.3 -19.6

to Sensex

4.2

10.8

Revenues ($ mn)

Derived exch rate (Rs/$)

Net sales

Direct costs

SG&A

EBITDA

Depreciation & amortisation

EBIT

Forex gain/(loss)

Other income

PBT

Tax provision

PAT

Minority interest

Net profit

Equity capital (FV Rs10/-)

EPS (Rs)

Margin (%)

EBITDA

EBIT

NPM

Tax rate

Sharekhan

Q4FY15

Q4FY14

Q3FY15

YoY %

QoQ %

80.0

62.2

497.5

297.5

99.5

100.5

22.7

77.8

5.1

13.0

95.82

19.8

76.1

0.0

76.1

80.0

9.5

72.6

61.5

446.7

255.4

70.7

120.7

26.4

94.2

-8.7

6.8

92.3

25.1

67.2

0.0

67.2

80.0

8.4

79.5

62.2

494.6

295.9

99.2

99.5

24.6

74.9

13.0

11.5

99.4

24.9

74.5

0.0

74.5

80.0

9.3

10.2

1.1

11.4

16.5

40.7

-16.7

-14.0

-17.5

NA

92.5

3.8

-21.3

13.2

0.6

-0.1

0.6

0.5

0.3

1.0

-7.8

3.8

-61.1

13.2

-3.6

-20.6

2.1

13.2

2.1

13.2

2.1

20.2

15.6

15.3

20.6

27.0

21.1

15.0

27.2

20.1

15.1

15.1

25.1

April 22, 2015

-8

Home

Next

investors eye

stock update

Valuations

Particulars

Net sales (Rs cr)

FY14

FY15

FY16E

FY17E

1,669.2

1,891.3

2,185.6

2,538.7

Net profit (Rs cr)

249.3

290.6

331.3

390.0

EBITDA margin (%)

25.8

20.7

20.9

21.8

EPS (Rs)

31.2

36.3

41.4

48.7

Y-o-Y change %

32.8%

16.6%

14.0%

17.7%

PER

23.1

19.8

17.4

14.8

EV/EBITDA

12.2

12.9

10.5

8.1

Price/BV

2.4

4.0

3.4

2.9

RoCE (%)

29.2

28.6

28.6

28.7

RoE (%)

22.3

21.8

21.1

21.1

The company had hedges worth $130 million at the

rate of Rs65.61.

The days sales outstanding (DSO) days decreased by

one day quarter on quarter (QoQ) at 64 days.

The company added 210 people sequentially on a net

basis during the quarter taking the total headcount to

8,506 employees. The companys technical workforce

increased by 197 people to 7,861 employees whereas

the sales and business development employees

increased by 16 people to 224 employees.

Attrition for the quarter was up to 15.5% as compared

with 14.7% in Q3FY2015. The utilisation ratio (blended)

increased by 40 basis points (BPS) to 74.7% for the quarter.

Other result highlights

The cash and cash equivalents for the company stood

at Rs816.5 crore as against Rs816.6 crore reported in

Q3FY2015.

The capital expenditure for FY2016 is expected to be

about Rs100 crore.

Operating metrics

Particulars

Q4FY15 Q4FY14 Q3FY15 YoY %

QoQ %

Remarks

Geography

North Americas (%)

85.4

85.4

84.7

$ mn

68.3

62.0

67.4

Europe (%)

6.8

6.1

7.1

$ mn

5.4

4.4

5.6

RoW (%)

7.8

8.5

8.2

$ mn

6.2

6.2

6.5

10.2

1.5

The business from Europe declined by 3.6% QoQ owing to

cross-currency headwinds.

22.8

-3.6

1.1

-4.3

NA

0.5

Industry verticals*

ISV (%)

57.8

57.9

$ mn

46.3

46.0

Enterprise (%)

24.1

23.1

$ mn

19.3

IP Led (%)

18.1

19.6

19.0

$ mn

14.5

14.2

15.1

Onsite (%)

26.2

21.4

25.1

$ mn

21.0

15.5

20.0

Offshore (%)

55.7

59.0

55.9

$ mn

44.6

42.9

44.5

The enterprise vertical grew by 5.0% QoQ. It is expected to

remain strong in FY2016.

NA

5.0

1.7

-4.1

34.9

5.1

18.4

Mix

This is the fifth consecutive quarter of a shift in the business

mix towards onsite delivery.

4.0

0.3

Cont...

Sharekhan

April 22, 2015

Home

Next

investors eye

stock update

Operating metrics

Particulars

Q4FY15 Q4FY14 Q3FY15 YoY %

QoQ %

Remarks

Clients contribution

Top clients (%)

16.5

21.1

17.5

$ mn

13.2

15.3

13.9

Top 5 clients (%)

34.1

39.4

35.0

$ mn

27.3

28.6

27.8

Top 10 clients (%)

43.2

48.5

44.2

$ mn

34.6

35.2

35.1

Other than Top 10 clients (%)

56.8

51.5

55.8

$ mn

45.5

37.4

44.4

Headcount

8506

7857

8296

Attrition (%)

15.5

13.4

14.7

Utilisation

74.7

69.2

74.3

64

63

65

DSO

-13.8

-5.1

The revenues from the top clients were down by 5% QoQ

owing to a change in business preference.

-4.6

-1.9

-1.9

-1.6

21.5

2.4

649

210

The company made net addition of 210 employees during

the quarter, taking the total headcount to 8,506 employees.

*Industry classification disclosure started from Q4FY2015.

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

Sharekhan

April 22, 2015

Home

Next

Sharekhan Stock Ideas

Apollo Tyres

Ashok Leyland

Bajaj Auto

Gabriel India

HeroMotoCorp

M&M

Maruti Suzuki India

Rico Auto Industries

TVS Motor Company

Infrastructure / Real estate

Gayatri Projects

ITNL

IRB Infra

Jaiprakash Associates

Larsen & Toubro

Pratibha Industries

Punj Lloyd

Automobiles

Oil & gas

Oil India

Reliance Ind

Selan Exploration Technology

Pharmaceuticals

Aurobindo Pharma

Cadila Healthcare

Cipla

Divi's Labs

JB Chemicals & Pharmaceuticals

Glenmark Pharmaceuticals

Ipca Laboratories

Lupin

Sun Pharmaceutical Industries

Torrent Pharma

Banks & Finance

Allahabad Bank

Andhra Bank

Axis (UTI) Bank

Bajaj Finserv

Bajaj Finance

Bank of Baroda

Bank of India

Capital First

Corp Bank

Federal Bank

HDFC

HDFC Bank

ICICI Bank

IDBI Bank

LIC Housing Finance

Punjab National Bank

PTC India Financial Services

SBI

Union Bank of India

Yes Bank

Consumer goods

GSK Consumers

Godrej Consumer Products

Hindustan Unilever

ITC

Jyothy Laboratories

Marico

Zydus Wellness

IT / IT services

Firstsource Solutions

HCL Technologies

Infosys

Persistent Systems

Tata Consultancy Services

Wipro

Capital goods / Power

Bharat Heavy Electricals

CESC

Crompton Greaves

Finolex Cables

Greaves Cotton

Kalpataru Power Transmission

PTC India

Skipper

Triveni Turbine

Thermax

V-Guard Industries

Va Tech Wabag

Building materials

Grasim

Orient Paper and Industries

Shree Cement

The Ramco Cements

UltraTech Cement

Discretionary consumption

Cox & Kings

Century Plyboards (India)

Eros International Media

KDDL

KKCL

Raymond

Relaxo Footwears

Speciality Restaurants

Sun TV Network

Thomas Cook (India)

Zee Entertainment Enterprises

Diversified / Miscellaneous

Aditya Birla Nuvo

Bajaj Holdings

Bharti Airtel

Bharat Electronics

Gateway Distriparks

Max India

Ratnamani Metals and Tubes

Supreme Industries

Technocraft Industries (India)

UPL

To know more about our products and services click here.

Disclaimer

This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity to which it is addressed to. This document may contain confidential and/or privileged material and is not for any type of circulation and any

review, retransmission, or any other use is strictly prohibited. This document is subject to changes without prior notice. This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such.

While we would endeavour to update the information herein on a reasonable basis, SHAREKHAN, its subsidiaries and associated companies, their directors and employees (SHAREKHAN and affiliates) are under no obligation to update or keep the information

current. Also, there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment

decision. Recipients of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The user assumes the entire risk of any use made of this information. Each recipient

of this document should make such investigations as he deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and risks involved), and should consult his own

advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to advise you as to any change of our views. Affiliates of SHAREKHAN may have issued other

reports that are inconsistent with and reach different conclusion from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to

law, regulation or which would subject SHAREKHAN and affiliates to any registration or licencing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons

in whose possession this document may come are required to inform themselves of and to observe such restriction. Either SHAREKHAN or its affiliates or its directors or employees/representatives/clients or their relatives may have position(s), make market, act

as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind. The analyst certifies that all of the views expressed in this document accurately reflect his or her personal views about the subject company or companies

and its or their securities and do not necessarily reflect those of SHAREKHAN. Further, no part of the analysts compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this document.

Sharekhan

April 22, 2015

Compliance Officer: Ms. Namita Amod Godbole; Tel: 022-6115000; e-mail: compliance@sharekhan.com Contact: myaccount@sharekhan.com

Home

Next

Das könnte Ihnen auch gefallen

- TransactionsDokument7 SeitenTransactionsBHARAT TECHNoch keine Bewertungen

- Indusind Bank (Indba) : Treading Well Relative To PeersDokument12 SeitenIndusind Bank (Indba) : Treading Well Relative To Peersarun_algoNoch keine Bewertungen

- Indusind Bank (Indba) : Consistent Performance On All Fronts..Dokument12 SeitenIndusind Bank (Indba) : Consistent Performance On All Fronts..arun_algoNoch keine Bewertungen

- Yes Bank: Emergin G StarDokument5 SeitenYes Bank: Emergin G StarAnkit ModaniNoch keine Bewertungen

- Indusind Bank (Indba) : Healthy Quarter Growth Momentum To SustainDokument12 SeitenIndusind Bank (Indba) : Healthy Quarter Growth Momentum To Sustainarun_algoNoch keine Bewertungen

- City Union Bank - DolatDokument8 SeitenCity Union Bank - DolatDarshan MaldeNoch keine Bewertungen

- Stock Update PTC India: IndexDokument6 SeitenStock Update PTC India: IndexRam NarayananNoch keine Bewertungen

- Qs - Bfsi - Q1fy16 PreviewDokument8 SeitenQs - Bfsi - Q1fy16 PreviewratithaneNoch keine Bewertungen

- Axis Bank Q4FY12 Result 30-April-12Dokument8 SeitenAxis Bank Q4FY12 Result 30-April-12Rajesh VoraNoch keine Bewertungen

- IDFC Bank: CMP: Inr50 TP: INR65 (+30%)Dokument12 SeitenIDFC Bank: CMP: Inr50 TP: INR65 (+30%)darshanmaldeNoch keine Bewertungen

- HDFC Bank Rs 485: All Around Strong Performance HoldDokument8 SeitenHDFC Bank Rs 485: All Around Strong Performance HoldP VinayakamNoch keine Bewertungen

- Union Bank of India: Earnings Affected by High Provisions, Fresh Slippages ModerateDokument4 SeitenUnion Bank of India: Earnings Affected by High Provisions, Fresh Slippages Moderateajd.nanthakumarNoch keine Bewertungen

- Shriram Transport Finance LTD.: Concerns OverdoneDokument17 SeitenShriram Transport Finance LTD.: Concerns OverdoneDhina KaranNoch keine Bewertungen

- IndusInd Bank-2QFY14 Result Update - 15 October 2013 Longtermgrp++ NBDokument4 SeitenIndusInd Bank-2QFY14 Result Update - 15 October 2013 Longtermgrp++ NBdarshanmaldeNoch keine Bewertungen

- FinalDokument36 SeitenFinalapi-3701467Noch keine Bewertungen

- Icici Subsidiaries Ar 2015 16Dokument492 SeitenIcici Subsidiaries Ar 2015 16RAHIM KHANNoch keine Bewertungen

- VCB - Jul 8 2014 by HSC PDFDokument6 SeitenVCB - Jul 8 2014 by HSC PDFlehoangthuchienNoch keine Bewertungen

- Cholamandalam Investment & Finance: Revving Up On The TarmacDokument12 SeitenCholamandalam Investment & Finance: Revving Up On The TarmacAnonymous y3hYf50mTNoch keine Bewertungen

- Sharekhan Top Picks: February 02, 2013Dokument7 SeitenSharekhan Top Picks: February 02, 2013nit111Noch keine Bewertungen

- Development Credit B... R - QuarterlyUpdateFirstCutDokument1 SeiteDevelopment Credit B... R - QuarterlyUpdateFirstCutDheeraj KohliNoch keine Bewertungen

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDokument24 SeitenStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNoch keine Bewertungen

- Zee Entertainment Enterprises: Reco: Buy Good Show, Ads Growth and Margins Surprise Positively CMP: Rs418Dokument3 SeitenZee Entertainment Enterprises: Reco: Buy Good Show, Ads Growth and Margins Surprise Positively CMP: Rs418Marutisinh RajNoch keine Bewertungen

- Investment Idea HDFCLTD Hold 101021001914 Phpapp01Dokument2 SeitenInvestment Idea HDFCLTD Hold 101021001914 Phpapp01yogi3250Noch keine Bewertungen

- IDirect RBIActions Dec15Dokument5 SeitenIDirect RBIActions Dec15umaganNoch keine Bewertungen

- Stock of The Funds Advisory Today - Buy Stock of Union Bank's With Target Price Rs.152/shareDokument28 SeitenStock of The Funds Advisory Today - Buy Stock of Union Bank's With Target Price Rs.152/shareNarnolia Securities LimitedNoch keine Bewertungen

- Indian Bank Investment Note - QIPDokument5 SeitenIndian Bank Investment Note - QIPAyushi somaniNoch keine Bewertungen

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDokument7 SeitenSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNoch keine Bewertungen

- Motilal REc ResearchDokument10 SeitenMotilal REc ResearchhdanandNoch keine Bewertungen

- PNB1-Jan 2008Dokument2 SeitenPNB1-Jan 2008Neeraj BagadeNoch keine Bewertungen

- Indusind Bank (Indba) : Core Strength SustainsDokument12 SeitenIndusind Bank (Indba) : Core Strength Sustainsarun_algoNoch keine Bewertungen

- ABL Half Yearly 2015Dokument52 SeitenABL Half Yearly 2015hamzaNoch keine Bewertungen

- Assignment: Banking & InsuranceDokument9 SeitenAssignment: Banking & InsuranceAshu GumberNoch keine Bewertungen

- Strong Beat, Improving Visibility - Re-Rating To Follow: Q2FY16 Result HighlightsDokument9 SeitenStrong Beat, Improving Visibility - Re-Rating To Follow: Q2FY16 Result HighlightsgirishrajsNoch keine Bewertungen

- Triveni Turbines: Growth On Track Maintain BuyDokument3 SeitenTriveni Turbines: Growth On Track Maintain Buyajd.nanthakumarNoch keine Bewertungen

- India Equity Analytics: HCLTECH: "Retain Confidence"Dokument27 SeitenIndia Equity Analytics: HCLTECH: "Retain Confidence"Narnolia Securities LimitedNoch keine Bewertungen

- Icici Bank: CMP: INR902 TP: INR1,100 BuyDokument12 SeitenIcici Bank: CMP: INR902 TP: INR1,100 BuyAnkit SuriNoch keine Bewertungen

- Dewan Housing: CMP: INR331 TP: INR540 BuyDokument6 SeitenDewan Housing: CMP: INR331 TP: INR540 BuySUKHSAGAR1969Noch keine Bewertungen

- 4QFY16 Top Picks Equity ResearchDokument3 Seiten4QFY16 Top Picks Equity ResearchJason Soans100% (1)

- ABL 1st Qtry 2014Dokument44 SeitenABL 1st Qtry 2014Mir Zain Ul HassanNoch keine Bewertungen

- SBI Securities Morning Update - 13-01-2023Dokument7 SeitenSBI Securities Morning Update - 13-01-2023deepaksinghbishtNoch keine Bewertungen

- HDFC Bank: CMP: INR537 TP: INR600 NeutralDokument12 SeitenHDFC Bank: CMP: INR537 TP: INR600 NeutralDarshan RavalNoch keine Bewertungen

- TopPicks 020820141Dokument7 SeitenTopPicks 020820141Anonymous W7lVR9qs25Noch keine Bewertungen

- Investment Funds Advisory Today - Buy Stock of State Bank of India and Neutral View On Sun Pharmaceuticals Industries LimitedDokument23 SeitenInvestment Funds Advisory Today - Buy Stock of State Bank of India and Neutral View On Sun Pharmaceuticals Industries LimitedNarnolia Securities LimitedNoch keine Bewertungen

- Allahabad Bank - SPA - 1 SeptDokument4 SeitenAllahabad Bank - SPA - 1 SeptanjugaduNoch keine Bewertungen

- Allahabad Bank: 15.8% Growth in Loan BookDokument4 SeitenAllahabad Bank: 15.8% Growth in Loan Bookcksharma68Noch keine Bewertungen

- ICICI KotakDokument4 SeitenICICI KotakwowcoolmeNoch keine Bewertungen

- (Kotak) ICICI Bank, January 31, 2013Dokument14 Seiten(Kotak) ICICI Bank, January 31, 2013Chaitanya JagarlapudiNoch keine Bewertungen

- Mauritius Commercial Bank: RatingDokument10 SeitenMauritius Commercial Bank: RatingMowjsing YuvanNoch keine Bewertungen

- HDFC CenturionDokument4 SeitenHDFC CenturionurmishusNoch keine Bewertungen

- Happy ForgingsDokument7 SeitenHappy ForgingsArshChandraNoch keine Bewertungen

- Annual Report 2009-10 of Federal BankDokument88 SeitenAnnual Report 2009-10 of Federal BankLinda Jacqueline0% (1)

- HDFC Bank - Visit Update - Oct 14Dokument9 SeitenHDFC Bank - Visit Update - Oct 14Pradeep RaghunathanNoch keine Bewertungen

- Stock Update Housing Development Finance Corporation: IndexDokument5 SeitenStock Update Housing Development Finance Corporation: IndexRajasekhar Reddy AnekalluNoch keine Bewertungen

- Sharekhan Top Picks: November 30, 2012Dokument7 SeitenSharekhan Top Picks: November 30, 2012didwaniasNoch keine Bewertungen

- ICICIdirect HDFCBank ReportDokument21 SeitenICICIdirect HDFCBank Reportishan_mNoch keine Bewertungen

- Sharekhan Top Picks: October 26, 2012Dokument7 SeitenSharekhan Top Picks: October 26, 2012Soumik DasNoch keine Bewertungen

- Analysis: Retail Focus, Treasury Gains Drive ICICI Bank's PerformanceDokument4 SeitenAnalysis: Retail Focus, Treasury Gains Drive ICICI Bank's PerformancegowthamvenNoch keine Bewertungen

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesVon EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNoch keine Bewertungen

- Bangladesh Quarterly Economic Update: June 2014Von EverandBangladesh Quarterly Economic Update: June 2014Noch keine Bewertungen

- Alert: Developments in Preparation, Compilation, and Review Engagements, 2017/18Von EverandAlert: Developments in Preparation, Compilation, and Review Engagements, 2017/18Noch keine Bewertungen

- Implementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesVon EverandImplementing Results-Based Budget Management Frameworks: An Assessment of Progress in Selected CountriesNoch keine Bewertungen

- 29,000 RecordsDokument2.886 Seiten29,000 RecordsAjay RajNoch keine Bewertungen

- Bodal Chemica S LTD.: Sub: Conflnnatlon Certificate in The Matter Regulatlon 74 (5) SEBI (Depositories andDokument2 SeitenBodal Chemica S LTD.: Sub: Conflnnatlon Certificate in The Matter Regulatlon 74 (5) SEBI (Depositories andrahuNoch keine Bewertungen

- Cisco CioDokument12 SeitenCisco Ciochandrashekar_ganesan0% (1)

- Sandeepmadan: Enjoy Individual Support With Upgraded PlansDokument3 SeitenSandeepmadan: Enjoy Individual Support With Upgraded Planssandeep madanNoch keine Bewertungen

- 1india Top 100 Companies PDF FreeDokument10 Seiten1india Top 100 Companies PDF Freerajeshyoyo1993Noch keine Bewertungen

- RK ProjectDokument82 SeitenRK ProjectRitika KhuranaNoch keine Bewertungen

- Presentation of KarvyDokument8 SeitenPresentation of KarvyJatin GuptaNoch keine Bewertungen

- Groww Stock Account Opening FormDokument21 SeitenGroww Stock Account Opening FormPranjal RanaNoch keine Bewertungen

- NSE Nifty Stocks ListDokument10 SeitenNSE Nifty Stocks ListsandhyaojhaNoch keine Bewertungen

- Bankers ListDokument2 SeitenBankers ListRohit ChhabraNoch keine Bewertungen

- List of Stock Exchanges in IndiaDokument7 SeitenList of Stock Exchanges in Indiasadanand100% (5)

- Anatomy of A Market Bottom - CLSADokument21 SeitenAnatomy of A Market Bottom - CLSASaeed JafferyNoch keine Bewertungen

- Reliance Dual Advantage Fixed Tenure Fund - III - Plan D: BackgroundDokument5 SeitenReliance Dual Advantage Fixed Tenure Fund - III - Plan D: BackgroundOneCharuNoch keine Bewertungen

- Pid 14 MT23 160412Dokument20 SeitenPid 14 MT23 160412Amol ChavanNoch keine Bewertungen

- Current Account New MewaDokument15 SeitenCurrent Account New MewaSonu F1Noch keine Bewertungen

- What Is A Stock Exchange All About? The Institution Where Buying and Selling of Shares Essentially Takes Place Is The Stock ExchangeDokument24 SeitenWhat Is A Stock Exchange All About? The Institution Where Buying and Selling of Shares Essentially Takes Place Is The Stock ExchangeJinson JohnNoch keine Bewertungen

- Winter SoyebDokument252 SeitenWinter SoyebSoyeb JindaniNoch keine Bewertungen

- Film FinancingDokument45 SeitenFilm FinancingKuldeep BatraNoch keine Bewertungen

- LeveragedGrowth Monthly-Snapshot-February24 240304 195607Dokument26 SeitenLeveragedGrowth Monthly-Snapshot-February24 240304 195607Tanay SawantNoch keine Bewertungen

- HHW 11Dokument6 SeitenHHW 11pandhi2000Noch keine Bewertungen

- Test Your General KnowledgeDokument108 SeitenTest Your General KnowledgeNimit Chaudhry0% (1)

- Paytm - One 97 Communications Limited ProspectusDokument497 SeitenPaytm - One 97 Communications Limited Prospectuschiranjeevimd2991 MDNoch keine Bewertungen

- Option Stock List With Lot SizeDokument14 SeitenOption Stock List With Lot Sizesarthak sanwalNoch keine Bewertungen

- Truba College of EngineeringDokument37 SeitenTruba College of Engineeringprashantgole19Noch keine Bewertungen

- Project On RaymondDokument36 SeitenProject On Raymonddinesh beharaNoch keine Bewertungen

- CEO List-UpdatedDokument18 SeitenCEO List-UpdatedManan TyagiNoch keine Bewertungen

- Vadodara Stock Exchange Ltd.Dokument97 SeitenVadodara Stock Exchange Ltd.Ashwin KevatNoch keine Bewertungen

- Swot of AbmlDokument24 SeitenSwot of AbmlGaurav SinghNoch keine Bewertungen

- Exchange Code Mic MappingDokument34 SeitenExchange Code Mic MappingyiboNoch keine Bewertungen