Beruflich Dokumente

Kultur Dokumente

The InsFocus Advantage For Insurance

Hochgeladen von

OluwatobiAdewaleOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The InsFocus Advantage For Insurance

Hochgeladen von

OluwatobiAdewaleCopyright:

Verfügbare Formate

The InsFocus Advantage for Insurance

www.insfocus.com

The InsFocus Advantage for Insurance Companies

1. Executive Summary

InsFocus BI is a comprehensive reporting and analysis software system designed for insurance companies,

which covers all the data warehousing and business intelligence functionalities required for management

and operations.

The systems built-in insurance capabilities make InsFocus the preferred choice for insurance companies.

The InsFocus data model is designed and built by insurance professionals, encompassing profound industry

executive experience, along with years of implementation best practices.

1.1. The System Advantages

Functionality: InsFocus is built for insurance companies providing out-of-the-box insurance-specific

calculations and information analysis solutions.

Data Model: The systems prebuilt, tested, and optimized insurance data model, is the foundation

for its insurance data management.

Insurance Content: The InsFocus definitions library consists of hundreds of insurance measurements,

dimensions, risk factors and sample reports, covering the requirements of insurance business users

such as marketing, sales, underwriting, claims, reinsurance, actuaries, internal auditors and financial

accounting.

Infrastructure: Based on a robust database infrastructure, the system provides information security,

data access control, complete system administration, SOA connectivity and multilingual capabilities.

Self-Service: A user-friendly self-service interface enables business users to create sophisticated

analysis and reports.

Comprehensive Solution: InsFocus manages the full DW/BI lifecycle, without the need for additional

software tools.

1.2. Business Benefits

Improved business performance: Information-based decision-making facilitates business decisionmaking including underwriting control, risk selection, claims reserving and distribution channel

reporting.

Easy creation of operational reports: Customizable operational reports and bordereaux can easily

be created by users to serve various functions in the organization such as claims, reinsurance,

supplier accounts and more.

Short Implementation: Structured implementation methodology ensures a quick and predictable

project.

Risk management: Self-service BI enables insurance professionals such as risk officers and actuaries

to analyze risks and exposures by providing sophisticated data management capabilities.

InsFocus Systems Ltd. 2004-2012

The InsFocus Advantage for Insurance

www.insfocus.com

Table of Contents

1.

Executive Summary

1.1.

The System Advantages

1.2.

Business Benefits

2.

Insurance Value Proposition

2.1.

A pre-built insurance data model

2.2.

An insurance metrics library

2.3.

Insurance specific functionality

2.3.1.

Time rollback

2.3.2.

Time bases

2.3.3.

Dynamic earned premium and unearned reserve calculations

2.3.4.

Sums insured and Exposures

2.3.5.

Complex and changing organization structure

2.3.6.

Product line crossover reporting

2.3.7.

Renewal and lapse comparisons

2.3.8.

Unlimited risk parameters

2.3.9.

Claims activity monitoring

2.3.10.

Claims triangulation statistics

2.3.11.

Claims reserves analysis

2.3.12.

Parametric IBNR allocation

2.3.13.

Multi-currency accounting

2.3.14.

Index-adjusted calculations

3.

Insurance content

3.1.

Measurements (Items)

3.1.1.

Policy items

3.1.2.

Claims items

3.1.3.

Profitability items

3.1.4.

Premium accounting items

3.2.

Dimensions

3.3.

Risk parameters

3.4.

Reports Library

3.4.1.

Executive reports

3.4.2.

Sales and Marketing reports

3.4.3.

Underwriting reports

3.4.4.

Claims reports

3.4.5.

Reinsurance reports

3.4.6.

Actuaries

3.4.7.

Internal Auditors

3.4.8.

Accountants

4.

Reporting and analysis infrastructure

4.1.

Open code calculation templates

4.2.

Data-level, role-level, and restriction-based permissions

4.3.

Central system administration

4.4.

Report scheduler

4.5.

Secure SOA with REST services

4.6.

Excel Connector

4.7.

Pre-aggregation mechanism

4.8.

Data warehouse-centric ETL

5.

User interface features

5.1.

Graphical report library

5.2.

Intuitive report definitions

5.3.

Result viewing & manipulation

5.4.

Flexible drill-down and drill-through

5.5.

Batch run

5.6.

Measurement filters

5.7.

Banding (risk profiling)

6.

Summary

InsFocus Systems Ltd. 2004-2013

The InsFocus Advantage for Insurance

www.insfocus.com

Whereas a regular insurance DW project takes a companys data and business processes and creates a

specific model based on them, an InsFocus DW project maps the companys data and business processes

into the products model adjusting definitions where needed. (Don Canning, Microsofts director of

insurance for its worldwide financial services group).

2. Insurance Value Proposition

2.1. A pre-built insurance data model

The InsFocus DW model is a star-schema dimensional model1, adapted specifically for insurance company

data and optimized for insurance reporting and analysis. The systems data model is seamlessly designed for

performance optimization and stores granular policy, coverage, claim and claimant details, enabling flexible

drill-down functionality and line reporting.

2.2. An insurance metrics library

InsFocus includes over 280 items - insurance metrics and KPIs (Key Performance Indicators), such as sumsinsured, outstanding claims, loss ratios, loss frequencies, exposures etc.

Item calculations are stored in the systems definitions library which can be edited and customized to meet

the companys accounting conventions and business rules.

2.3. Insurance specific functionality

The following features are pre-built into InsFocus and provide out-of-the-box reporting and analysis

functionalities required to effectively manage an insurance enterprise:

2.3.1. Time rollback

This feature allows users to reconstruct any report to any particular historical date, thus enabling insurance

professionals to review underwriting decisions as they were made in the past and review financial results as

of their effective date.

2.3.2. Time bases

Insurance time dependencies are built into the systems data model and calculation methods, offering

analysis capabilities from different time perspectives and meeting the information needs of marketing

executives, underwriters, claims and reinsurance managers, actuaries and accountants.

Time bases include operational, financial, underwriting, accident and snapshot options, altering the way

measurements are calculated and providing full analysis of time base interdependencies.

2.3.3. Dynamic earned premium and unearned reserve calculations

InsFocus provides calculation templates for dynamic earned and unearned calculations at any selected date.

Calculations are done on pro-rata temporis basis and are defined for each relevant time base. Calculations

are performed at any information level, from the individual policy coverage to the companys entire product

line. This feature allows executives to monitor their portfolio profitability on a daily basis and detect trends

ahead of time.

Ralph Kimball type model

InsFocus Systems Ltd. 2004-2012

The InsFocus Advantage for Insurance

www.insfocus.com

2.3.4. Sums insured and Exposures

InsFocus provides insurers with pre-built calculation methods and measurements to analyze and monitor

their sums insured and unit-exposures. Measurements are calculated on underwriting period, exposure

period and snapshot basis.

2.3.5. Complex and changing organization structure

The system supports asymmetric organizational structures and multiple hierarchy chains. It also provides

as-is and as-if views when the organizational structure changes. This ensures correct reporting of

distribution channel performance, as well as correcting distortions as a result of reorganization.

2.3.6. Product line crossover reporting

The majority of insurance products are made up of sections or coverages representing different insurance

coverages, insured objects, or a combination of both. InsFocus data model and query building

functionalities provide seamless analysis for both insurance products and lines, giving the companys

underwriters invaluable insight into their portfolio behavior.

2.3.7. Renewal and lapse comparisons

Policies and premiums coming up for renewal are grouped by their renewal date. The system provides

renewal lists, lapse analysis and comparison of renewal to expiring rates. These functionalities highlight

product characteristics and distribution channel behavior, as well as offering active marketing and sales

support.

2.3.8. Unlimited risk parameters

The InsFocus data model supports unlimited number of risk parameters2 for each insurance product, in a

single unified structure. These views provide essential pricing information at the underwriters fingertips.

2.3.9. Claims activity monitoring

InsFocus incorporates claims transactional information, including outstanding claim estimates, claim

payments, indemnity and expense components, event codes, subrogations and deductibles. The systems

built-in metrics provide claims managers with the full spectrum of information required to monitor claims

activity, including analysis of opened, closed, and re-opened claims.

2.3.10. Claims triangulation statistics

A built-in triangulation statistics mechanism provides the ability to compare measurements on any time base

to any dependent time base (e.g. claim payments by financial year can be compared to accident year or

underwriting year). Using a built-in Chain-Ladder extrapolation mechanism, the companys actuaries can

estimate the IBNR reserves required for a particular line of business.

2.3.11. Claims reserves analysis

The systems Claim-Status-Filter provides out-of-the-box runoff statistics, comparing historic reserves to the

actual values at which claims were finalized. This tool is very useful for auditing outstanding claims estimates

at financial statement closure.

E.g. - vehicle type and driver age for motor vehicle insurance, building type and floor for home insurance, and

occupation and health status for health and accident insurance.

InsFocus Systems Ltd. 2004-2012

The InsFocus Advantage for Insurance

www.insfocus.com

2.3.12. Parametric IBNR allocation

InsFocus calculation mechanism is based on reusable calculation templates. Such templates are available for

allocation of global IBNR reserves to an individual policy and claim level. This mechanism, which must be

customized according to the insurance companys claim reserving practices, gives executives the power to

drill down from a company-wide profit-loss analysis to agency, product, geographical area, or even individual

client levels.

2.3.13. Multi-currency accounting

InsFocus features multi-currency management that enables reporting by both base and original currencies.

This mechanism supports different conversion schemes including mid-quarter R.O.E. conversions used in

reinsurance accounting.

2.3.14. Index-adjusted calculations

Seamless index-adjusted reporting is especially useful for preparing historic long-tail claim statistics used for

pricing of excess of loss protections for motor and liability lines. The system supports multiple index bases

and can be customized to specific territorial indexation standards.

3. Insurance content

InsFocus contains predefined insurance measurements (items), dimensions, risk parameters, and sample

reports which can be customized and edited using the InsFocus System Center.

3.1. Measurements (Items)

3.1.1. Policy items

Measurements derived from policy data, such as premiums (new or renewed), sales targets, earned and

unearned premiums, sums insured (issued or exposed), agent commissions, number of policies,

endorsements, cancellations, days elapsed, coverage sections and exposures.

3.1.2. Claims items

Measurements derived from claims data, such as claims paid, outstanding, incurred, number of claims

(opened, closed, reopened), claim elements (indemnity, expenses), deductibles, subrogations and reporting

delays.

3.1.3. Profitability items

Items that combine policies and claims information, such as loss ratio, loss frequency, underwriting

profitability and risk premium.

3.1.4. Premium accounting items

Items that monitor the companys premium billing and collection process, such as collected premiums, open

premiums, amounts paid in time, amounts overdue and average days open debt.

3.2. Dimensions

Model dimensions are customized to fit a companys portfolio according to geographic risk location, clients

information, marketing information, policy administration process, currencies, product and coverage

definitions, operational information, claim event types, claimant information and claim parties.

InsFocus Systems Ltd. 2004-2012

The InsFocus Advantage for Insurance

www.insfocus.com

3.3. Risk parameters

InsFocus provides a unique risk parameter mechanism that holds the different insurance products specific

attributes into a single uniform data model.

Examples of such risk parameters may be:

Home insurance - building type, number of stories

Property insurance - industry code, fire classification

Motor insurance - vehicle, model, manufacturing year, driver age

Accident insurance - age, gender, occupation, lifestyle

More mechanism allows defining an unlimited number of parameters

3.4. Reports Library

InsFocus reports library addresses business issues concerning executive management, sales and marketing,

underwriting, claims, reinsurance, actuarial analysis, internal auditing and accounting.

3.4.1. Executive reports

Dashboards displaying ongoing performance, profitability and KPIs.

3.4.2. Sales and Marketing reports

Comparative sales figures by distribution channel, product and marketing campaigns

Reports highlighting exceptional cancellation and commission ratios

Lapse analysis and renewal rate comparisons

Detailed renewal lists

Administration reports keeping track of operations

Cross-selling and up-selling lists to support sales initiatives

3.4.3. Underwriting reports

Profitability analysis by underwriting years and line of business

Loss ratio and loss frequency analysis of coverage sections

Products claims experience by claim type

Analysis by risk parameters

Section take-up of multi-peril policies

3.4.4. Claims reports

Monitor opened, closed and reopened claims

Report claims payments and outstanding reserves

Control cash flows vis--vis claim parties and service providers

Latency and service-level reports, showing days elapsed between relevant dates in a claims lifecycle

Runoff reports to validate outstanding reserve estimates

3.4.5. Reinsurance reports

Aggregate exposures

Target risk lists

Risk profiles

Index-adjusted large claims development

InsFocus Systems Ltd. 2004-2012

The InsFocus Advantage for Insurance

www.insfocus.com

Cession margin analysis

Treaty experience

3.4.6. Actuaries

Claims development triangulations are available on a paid or incurred basis, along with the ability to

compare between time bases.

3.4.7. Internal Auditors

InsFocus enables generating exception lists on policy and claims activity by predefined criteria, serving to

highlight suspected fraudulent activities.

3.4.8. Accountants

Daily profit-and-loss pro-forma reports, extraction lists for generating regulatory reports, and management

expense allocation assist accountants in preparation of financial reports.

4. Reporting and analysis infrastructure

InsFocus leverages a robust data querying and management infrastructure built on top of Microsoft SQL

Server 2005/2008. The data integration module resides on Microsoft SQL Server Integration Services (SSIS).

4.1. Open code calculation templates

The systems business logic is based on reusable open code SQL calculation templates that can be created

and adapted by the companys IT professionals. These templates are integrated into InsFocus System Center

(The systems metadata management module), providing a platform for complex business calculations.

4.2. Data-level, role-level, and restriction-based permissions

InsFocus incorporates enterprise security measures that control user functionality and data permissions on

three levels:

Data-level permissions allow users to view only the data defined in their organizational domain.

Role-level permissions prevent users from performing technical actions prohibited by their roles

within the organization.

Restriction-based permissions control which items and dimensions are accessible to each user

group (e.g. claims-users, reinsurance-users, etc.).

4.3. Central system administration

The System Center provides tools to perform administrative tasks, view logs, change settings, define new

users, change user restrictions and edit item and dimension definitions.

4.4. Report scheduler

Any user with appropriate permissions can schedule reports to run automatically on predefined schedules:

Reports can be scheduled to run daily, weekly, or monthly.

Schedules can include both reports saved in a library and unsaved queries.

Results can be sent as emails or SMS messages.

InsFocus Systems Ltd. 2004-2012

The InsFocus Advantage for Insurance

www.insfocus.com

4.5. Secure SOA with REST services

InsFocus BI is fully SOA-based, exposing all system functionalities as secure HTTP web services. These web

services follow common REST (Representational State Transfer architecture) patterns, allowing easy

discovery and use of services. This feature is extremely useful in connecting InsFocus to other applications in

the organization. Results can be returned as XML (used in all high-level languages), JSON (used in JavaScript),

and HTML (for direct display).

4.6. Excel Connector

An external connector mechanism integrates InsFocus reports into Excel, saving connector definitions

internally and allowing users to reopen the sheets and refresh data. This feature is extremely useful for

comptrollers, actuaries and users that want to create their own Excel analytics based on data extracted from

the data warehouse.

4.7. Pre-aggregation mechanism

The system builds a set of aggregation tables at the end of each ETL session, each based on company-specific

definitions. These tables enable InsFocus to return commonly used queries in seconds, while retaining

unlimited drill-down and reporting capabilities.

4.8. Data warehouse-centric ETL

The data integration module is written over Microsoft SSIS to handle loading InsFocus BIs data warehouse

model from a large number of source systems. The module is designed to integrate data from sources that

include relational databases, such as SQL, Oracle or DB2, text (flat) files, Excel tables, XML files, and websites.

The data integration processes provide solutions to common data warehousing issues, including slowly

changing dimensions, staging area maintenance, surrogate key generation, erroneous data handling, process

logging and incremental loading.

The module is completely table-driven and can be fully customized to fit an insurance companys data

structures.

5. User interface features

InsFocus user interface is the single point of contact between the user and the system for report creation,

report viewing, analysis and dashboards.

5.1. Graphical report library

Reports are displayed and accessed from a graphical reports library. Each user has a private library for their

reports. The public library contains the company's master reports.

Each report is displayed with a graphical preview for easy browsing.

5.2. Intuitive report definitions

Defining new reports requires only a few simple steps, which business users can learn in a very short period.

Users can define ad-hoc queries independently without the need to engage the companys IT department.

Additionally library reports can be used as a basis for creating and saving their personal versions.

InsFocus Systems Ltd. 2004-2012

The InsFocus Advantage for Insurance

www.insfocus.com

5.3. Result viewing & manipulation

Results returned by the system can be visually presented using split-screen tables, charts, and gauges. An

Excel-like tab control enables users to view multiple sheets of information in the same report. Results can be

extensively manipulated by the user through an array of controls, such as sorting, advanced filtering, result

highlighting, contribution view, cumulative view and user-defined calculations.

5.4. Flexible drill-down and drill-through

Unlike systems with rigid drill-down hierarchy, InsFocus BI enables drill-down (row/column) and drill-through

(cell) to any defined dimension, organizational member or time period as far down as the client, policy or

individual claim level. This helps users understand the facts underlying any displayed result.

5.5. Batch run

This feature enables running the same report on a large number of organizational members and creating

individual files containing their organizational data that can be sent by mail, printed or placed in a portal.

5.6. Measurement filters

Data can be filtered not only by static dimensions, but by dynamic calculations. For example, a user may ask

to see a profitability report for clients with more than five policies and having over $100,000 premiums. Such

filters can be defined on multiple selections (e.g. business emanating from California, Nevada etc.) or on

exclude basis (e.g. all motor business except Jaguar cars).

5.7. Banding (risk profiling)

Banding is the process of splitting insurance data into dynamically created bands. This can be simple data,

such as policy sums insured or insureds age; or complex data such as loss-frequency. Banding is heavily used

in insurance, where reports such as risk profiling, client segmentation etc. are needed on a regular basis.

InsFocus BI allows to dynamically define bands by:

Dimension attributes (e.g. client year of birth, policy number)

Risk parameters (e.g. engine size, year of manufacture, floor number)

Measurement items (e.g. loss-frequency, sum insured, number of policies)

6. Summary

With its combination of insurance business domain expertise and application development skills, InsFocus is

the best choice for insurance companies looking to advance to the next level of reporting and analytics.

Visit us: www.insfocus.com

Email: info@insfocus.com

InsFocus Systems Ltd. 2004-2012

The InsFocus Advantage for Insurance

www.insfocus.com

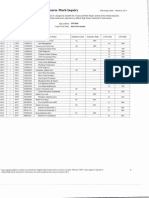

InsFocus Reports Library conveniently navigate through the variety of out-of-the-box report templates

Graphical dashboard display presents information in tables, charts and gauges

InsFocus Systems Ltd. 2004-2012

10

The InsFocus Advantage for Insurance

www.insfocus.com

Daily profitability analysis of insurance portfolio

Pre-built actuarial calculations support claims reserving

InsFocus Systems Ltd. 2004-2012

11

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Detail Design Drawings: OCTOBER., 2017 Date Span Carriage WayDokument26 SeitenDetail Design Drawings: OCTOBER., 2017 Date Span Carriage WayManvendra NigamNoch keine Bewertungen

- Tese Beatbox - Florida PDFDokument110 SeitenTese Beatbox - Florida PDFSaraSilvaNoch keine Bewertungen

- Colfax MR Series CompresorDokument2 SeitenColfax MR Series CompresorinvidiuoNoch keine Bewertungen

- Implementing A Data-Driven Security Model in SSAS: © Pariveda Solutions. Confidential & ProprietaryDokument33 SeitenImplementing A Data-Driven Security Model in SSAS: © Pariveda Solutions. Confidential & ProprietaryOluwatobiAdewaleNoch keine Bewertungen

- Background Synopsis: ReferenceDokument3 SeitenBackground Synopsis: ReferenceOluwatobiAdewaleNoch keine Bewertungen

- Tuning SSAS Processing PerformanceDokument24 SeitenTuning SSAS Processing PerformanceOluwatobiAdewaleNoch keine Bewertungen

- Agile BiDokument28 SeitenAgile BiOluwatobiAdewaleNoch keine Bewertungen

- MSBM Programmes Brochure (2015)Dokument49 SeitenMSBM Programmes Brochure (2015)OluwatobiAdewaleNoch keine Bewertungen

- Analyzing Money: SQL Server ProDokument3 SeitenAnalyzing Money: SQL Server ProOluwatobiAdewaleNoch keine Bewertungen

- LookUpCube Function MDX Query Performance TestDokument6 SeitenLookUpCube Function MDX Query Performance TestOluwatobiAdewaleNoch keine Bewertungen

- SQL SERVER - 2008 - Creating Primary Key, Foreign Key and Default Constraint - Journey To SQL Authority With Pinal DaveDokument32 SeitenSQL SERVER - 2008 - Creating Primary Key, Foreign Key and Default Constraint - Journey To SQL Authority With Pinal DaveOluwatobiAdewaleNoch keine Bewertungen

- The Forefront IdentityDokument4 SeitenThe Forefront IdentityOluwatobiAdewaleNoch keine Bewertungen

- Active Directory Import For SharePoint 2013Dokument4 SeitenActive Directory Import For SharePoint 2013OluwatobiAdewaleNoch keine Bewertungen

- Insert, Update, and Delete Destination Table With SSIS - Reza Rad's Technical BlogDokument17 SeitenInsert, Update, and Delete Destination Table With SSIS - Reza Rad's Technical BlogOluwatobiAdewaleNoch keine Bewertungen

- SSAS SunilKadimdiwan RI BIDokument36 SeitenSSAS SunilKadimdiwan RI BIOluwatobiAdewaleNoch keine Bewertungen

- CFD Turbina Michell BankiDokument11 SeitenCFD Turbina Michell BankiOscar Choque JaqquehuaNoch keine Bewertungen

- A P P E N D I X Powers of Ten and Scientific NotationDokument5 SeitenA P P E N D I X Powers of Ten and Scientific NotationAnthony BensonNoch keine Bewertungen

- Manuel SYL233 700 EDokument2 SeitenManuel SYL233 700 ESiddiqui SarfarazNoch keine Bewertungen

- Mecha World Compendium Playbooks BWDokument12 SeitenMecha World Compendium Playbooks BWRobson Alves MacielNoch keine Bewertungen

- Literature Review Template DownloadDokument4 SeitenLiterature Review Template Downloadaflsigfek100% (1)

- Institutional Group Agencies For EducationDokument22 SeitenInstitutional Group Agencies For EducationGlory Aroma100% (1)

- Yale Revision WorksheetDokument3 SeitenYale Revision WorksheetYASHI AGRAWALNoch keine Bewertungen

- Sample CVFormat 1Dokument2 SeitenSample CVFormat 1subham.sharmaNoch keine Bewertungen

- Universal Ultrasonic Generator For Welding: W. Kardy, A. Milewski, P. Kogut and P. KlukDokument3 SeitenUniversal Ultrasonic Generator For Welding: W. Kardy, A. Milewski, P. Kogut and P. KlukPhilip EgyNoch keine Bewertungen

- (20836104 - Artificial Satellites) Investigation of The Accuracy of Google Earth Elevation DataDokument9 Seiten(20836104 - Artificial Satellites) Investigation of The Accuracy of Google Earth Elevation DataSunidhi VermaNoch keine Bewertungen

- SIVACON 8PS - Planning With SIVACON 8PS Planning Manual, 11/2016, A5E01541101-04Dokument1 SeiteSIVACON 8PS - Planning With SIVACON 8PS Planning Manual, 11/2016, A5E01541101-04marcospmmNoch keine Bewertungen

- Arithmetic QuestionsDokument2 SeitenArithmetic QuestionsAmir KhanNoch keine Bewertungen

- SafetyRelay CR30Dokument3 SeitenSafetyRelay CR30Luis GuardiaNoch keine Bewertungen

- PD3 - Strategic Supply Chain Management: Exam Exemplar QuestionsDokument20 SeitenPD3 - Strategic Supply Chain Management: Exam Exemplar QuestionsHazel Jael HernandezNoch keine Bewertungen

- J.K. Brimacombe - Design of Continuous Casting MachinesDokument13 SeitenJ.K. Brimacombe - Design of Continuous Casting MachinesJavier GómezNoch keine Bewertungen

- Pathogenic Escherichia Coli Associated With DiarrheaDokument7 SeitenPathogenic Escherichia Coli Associated With DiarrheaSiti Fatimah RadNoch keine Bewertungen

- Victor 2Dokument30 SeitenVictor 2EmmanuelNoch keine Bewertungen

- Safety Data Sheet SDS For CB-G PG Precision Grout and CB-G MG Multipurpose Grout Documentation ASSET DOC APPROVAL 0536Dokument4 SeitenSafety Data Sheet SDS For CB-G PG Precision Grout and CB-G MG Multipurpose Grout Documentation ASSET DOC APPROVAL 0536BanyuNoch keine Bewertungen

- Vitamins - CyanocobalaminDokument12 SeitenVitamins - CyanocobalaminK PrashasthaNoch keine Bewertungen

- Grammar and Vocabulary TestDokument5 SeitenGrammar and Vocabulary TestLeonora ConejosNoch keine Bewertungen

- Highlights ASME Guides Preheat PWHT IDokument4 SeitenHighlights ASME Guides Preheat PWHT IArul Edwin Vijay VincentNoch keine Bewertungen

- Importance of Skill Based Education-2994Dokument5 SeitenImportance of Skill Based Education-2994João Neto0% (1)

- G2 Rust Grades USA PDFDokument2 SeitenG2 Rust Grades USA PDFSt3fandragos4306Noch keine Bewertungen

- ADokument54 SeitenActyvteNoch keine Bewertungen

- Img 20150510 0001Dokument2 SeitenImg 20150510 0001api-284663984Noch keine Bewertungen

- Pediatrics: The Journal ofDokument11 SeitenPediatrics: The Journal ofRohini TondaNoch keine Bewertungen

- 444323735-Chem-Matters-Workbook-2E-Teacher-s-Edn-pdf 16-16Dokument1 Seite444323735-Chem-Matters-Workbook-2E-Teacher-s-Edn-pdf 16-16whatisNoch keine Bewertungen