Beruflich Dokumente

Kultur Dokumente

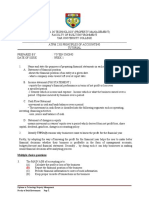

NMCRS Budget Planner

Hochgeladen von

USS Harpers Ferry OmbudsmanOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

NMCRS Budget Planner

Hochgeladen von

USS Harpers Ferry OmbudsmanCopyright:

Verfügbare Formate

1

Wise

Increased Financial Freedom

Is As Easy As:

A-Self-Help Budget Planner from The Navy-Marine Corps Relief Society

INCOME

KNOW YOUR INCOME! Your total rnib3.y income, plus any other money coming to you regularly, is your

income. Information about your military income is shown on your Leave and Earnings Statement (LES). Check

it monthly for changes and accuracy. Contact disbursing if there is an error. Figure your total income here to learn

how much money you control!

MILITARY INCOME

MILITARY EARNINGS . . . . . . . . . . . . . . . . . . . . . . . PER MONTH

BasePay . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Quarters Allowance* (BAH) . . . . . . . . . . . . . . . . . . . . . . .

Subsistence Allowance* (BAS) . . . . . . . . . . . . . . . . . . . . .

SeaISpecialPay . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Overseas Allowances* . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Pay and Allowances . . . . . . . . . . . . . . . . . . . . . . . . .

TOTAL EARNINGS .............................

DEDUCTIONS

Federal Tax (FTlW) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Social Security (FICA) . . . . . . . . . . . . . . . . . . . . . . . . . . .

StateTax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Govt. Life Ins. (SGLI) Both member and spouse . . . . . . . .

DependentDental . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other: Dependent, Bond, Insurance, Meal Deduction, . . .

Loan,Savings, Charity, .....................

Child Support, Advance Pay . . . . . . . . . . . . . . . . .

TOTAL DEDUCTIONS ..........................

MILITARY "TAKE-HOME PAY (Military Earnings Minus Deductions) . . . . . . . .

Plus "D" Dependent Allotment to your household . . . . . . . . . . . . . . . . . . . . . . .

Plus Savings Allotment (for your use) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

TOTAL MILITARY INCOME IS . . . . . . .

OTHER INCOME .

Take-home pay from moonlight job . . . . . . . . . . . . . . .

Spouse's take-home pay . . . . . . . . . . . . . . . . . . . . . . .

Other: Dividends, Interest, SS Benefits (?) SSI f

Rent, Child Support

beingpaidtoyou . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

TOTAL OTHER INCOME IS . . . . . . . . . . . .

YOUR TOTAL MONTHLY INCOME

(Total Military Income plus Total Other Income) ........................

*Allowances are non-taxable income.

EXPENSES

HOW DO YOU USE THIS INCOME?

SAVINGS. Pay yourself first! If you don't have savings for emergencies, start saving now. A

good way to begin is to save at least 5% of take-home pay or $25 in an "S" allotment.

You should have a savings account for emergencies prior to starting an investment plan . . . . . . . . . . .

HOUSING/UTILITIES. Housing costs should not greatly exceed your authorized BAH.

Include the cost of gas, oil, electricity, water, garbage, home or renters insurance in

your total housing. If you are taking a BAH Advance be sure the pay-back fits your

budget. If you have questions about contracts, consult the legal affairs officer . . . . . . . . . . . . . . . . . . . .

FOOD AND HOUSEHOLD NEEDS. Include commissaries, exchanges, supermarkets, and

convenience stores. Cut costs with coupons, sales, menu plans, organized shopping trips ...........

TELEPHONE. WATCH OUT! Communication is important, but there are

ways to save. Check your service options. Try letters, tapes and use government

sponsored services for emergency communication . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

TRANSPORTATION.Include public transportation, taxi and/or personal vehicle. Total all costs.

Include upkeep of a personal vehicle such as license, insurance, routine service, and replacement

parts. A minimum of $50 per month per vehicle should be set a side for maintenance. A personal

vehicle can consume 25% of your net income when all costs are considered . . . . . . . . . . . . . . . . .

CLOTHING. Estimate about $50 per month per household member. NMCRS thrift shops can help in

the purchase of uniforms and other clothing at economical prices . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

MEDICALlDENTAL. Know your benefits! Use them! TRICARE and Dependents Dental

Plan help, but have iirnitations. About $5 per dependent per month should be set aside to

pay deductibles and unpaid expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

MISCELLANEOUS EXPENSE. It's more than you think, but some of it is necessary! Keep a

record, for a pay period, of what you spend on: barber, laundry, coffee mess, personal

care items, cigarettes, vending machines, beverages, hobbies, entertainment, meals out,

impulsive and compulsive spending. Be realistic; cut the excess, but don't cut the joy from

yourlife . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

SPOUSE'S WORKING EXPENSES. Figure in the costs of such things as child care, extra

clothes, transportation and purchased meals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

MONTHLY BASIC LIVING EXPENSES ..............................

DEBTS. Unpaid debts for items such as credit cards, "big ticket" items, bank personal loans and vehicles mean

trouble if not kept current. Pay off higher interest rate debts first.

Owed to Whom Interest Rate Debt Balance Monthlv Pavment

(TOTAL DEBT BALANCE FOR YOUR INFORMATION ... )

MONTHLY DEBT PAYMENTS .......................................... 0

CUSHION. For realistic planning and minimal flexibility allow $50 for one or

two people, plus $20 for each additional household member . . . . . . . . . . . . . . . I+ 1

YOUR TOTAL MONTHLY EXPENSES (Monthly Basic Living

Expenses, Monthly Debt Payments Plus Cushion) . . . . . . . . . . . . . . . . . . . . r

YOU ARE BECOMING MONEY WISE-CONTINUE ON

DO YOU HAVE A ...............SURPLUS (Income is more than Expenses)?

OR ...............DEFICIT (Expenses are more than Income)?

TOTAL MONTHLY INCOME TOTAL MONTHLY EXPENSES

TOTALLY MONTHLY EXPENSES - TOTAL MONTHLY INCOME -

SURPLUS ............................................ DEFICIT.. ..............................................

If you have a SURPLUS .................... Stay in control

Save for short-term goals (trip home, furniture, TV)

Plan for long-range objectives (education, home, car)

If you have a DEFICIT......................... Take corrective action TODAY! You do have choices and

can be in control if you:

INCREASE INCOME

O Are you receiving all your military entitlements?

O Are you claiming the right exemptions on your LES for withholding?

O Are any allotments about to expire?

O Is a promotion within your grasp?

O Consider these options:

Part-time employment

Turn a hobby into income

Swap talents and skills

DECREASE EXPENSES

O Use your military benefits, facilities and services

O Keep a log of miscellaneous spending to iden* and cut waste

O Separate needs from wants

O Use spare time to become a wise consumer

O Make changes when:

One category of spending is excessive

An activity becomes habit, not fun

Achieving a goal can be slower paced

REDUCE DEBT

O Make management of debt your first priority

O Use increases in income/decreases in expense to pay off a debt

O Compare interest rates and consider choices before taking on a debt

O Temporarily cut out some spending to concentrate on paying off a debt

O Don't take on new debt until old debt is paid

O Contact creditors if you cannot make payments; negotiate a siew repay plan if you are

willing to stick to it

When you are MONEY-WISE, you have choices and can be in control!

If you need more help in shaping your budget, visit Navy-Marine Corps Relief Society.

10/02 Ambertone Press

Das könnte Ihnen auch gefallen

- Uang Planner - Monthly Budget (English)Dokument20 SeitenUang Planner - Monthly Budget (English)fildaa Kaimuddin50% (2)

- Beginner's Budgeting Guide: How to Determine Income, Expenses and Build a BudgetDokument24 SeitenBeginner's Budgeting Guide: How to Determine Income, Expenses and Build a BudgetAshley Whitmire100% (1)

- Understanding Money HandbookDokument46 SeitenUnderstanding Money HandbookSujata SinghNoch keine Bewertungen

- Life Skills PortfolioDokument66 SeitenLife Skills PortfolioMicheal McDowellNoch keine Bewertungen

- Family Home Budget Planner PDFDokument8 SeitenFamily Home Budget Planner PDFVikaNoch keine Bewertungen

- Monthly BudgetDokument2 SeitenMonthly Budgetprince_misaNoch keine Bewertungen

- 401k MistakesDokument43 Seiten401k MistakesIRS100% (1)

- 5 Minute Journal, 6x9, 120p, No BleedDokument120 Seiten5 Minute Journal, 6x9, 120p, No BleedSkelliNoch keine Bewertungen

- Budget Planner PDFDokument1 SeiteBudget Planner PDFniza100% (1)

- My Best Life PlannerDokument13 SeitenMy Best Life Plannerassistante embNoch keine Bewertungen

- Meal Prep Guide: Healthy Meals in 40 MinutesDokument14 SeitenMeal Prep Guide: Healthy Meals in 40 MinuteskwstikosNoch keine Bewertungen

- Super ShredDokument19 SeitenSuper ShredSara HartsockNoch keine Bewertungen

- Monthly budget trackerDokument3 SeitenMonthly budget trackerLeanna Abdul WahabNoch keine Bewertungen

- Budget Planner PDFDokument5 SeitenBudget Planner PDFYong ClinicNoch keine Bewertungen

- Uang Planner - Monthly Budget (English)Dokument20 SeitenUang Planner - Monthly Budget (English)Jhoody Tandjung100% (1)

- Planner PagesDokument15 SeitenPlanner PagesAshLee WinterroseNoch keine Bewertungen

- 4th Grade Studies Guides All SubjectsDokument44 Seiten4th Grade Studies Guides All Subjectsapi-505796786Noch keine Bewertungen

- New Heritage Doll CompanyDokument4 SeitenNew Heritage Doll Companyvenom_ftwNoch keine Bewertungen

- Create FutureDokument25 SeitenCreate FutureShenbakamNoch keine Bewertungen

- Assets: Elements of The Financial StatementsDokument5 SeitenAssets: Elements of The Financial StatementsSiva PratapNoch keine Bewertungen

- Planning With Kids Free ChecklistsDokument12 SeitenPlanning With Kids Free ChecklistsLuke BackhausNoch keine Bewertungen

- 14-day home workout plan by Action JacquelynDokument1 Seite14-day home workout plan by Action JacquelynMaja ZivanovicNoch keine Bewertungen

- All WeeksDokument50 SeitenAll WeekskannankrivNoch keine Bewertungen

- Mindfulness: Gratitude PracticeDokument3 SeitenMindfulness: Gratitude PracticeTereNoch keine Bewertungen

- Meal Prep 101: ToolkitDokument9 SeitenMeal Prep 101: Toolkitvipgaming fourthNoch keine Bewertungen

- The Spartan Monk Morning Routine PDFDokument5 SeitenThe Spartan Monk Morning Routine PDFAndrew PierdibackNoch keine Bewertungen

- 5 - Mar 1 - LWG - Hourglass Building GuideDokument14 Seiten5 - Mar 1 - LWG - Hourglass Building GuidePeggy RussellNoch keine Bewertungen

- 14 Day Home Workout Guide JournalDokument14 Seiten14 Day Home Workout Guide JournalRosario Abelleira castroNoch keine Bewertungen

- Budget: Submitted By:-JappanjyotDokument16 SeitenBudget: Submitted By:-JappanjyotJappanJyot Kalra100% (1)

- For Students Capital BudgetingDokument3 SeitenFor Students Capital Budgetingwew123Noch keine Bewertungen

- 90 Day Bikini Home Workout - Barbell OnlyDokument7 Seiten90 Day Bikini Home Workout - Barbell OnlyBreann EllingtonNoch keine Bewertungen

- Fitness PlannerDokument24 SeitenFitness PlannerVikas ChoudharyNoch keine Bewertungen

- Helping Your Child Get Ready For SchoolDokument50 SeitenHelping Your Child Get Ready For SchoolCarlaNoch keine Bewertungen

- EcoDokument5 SeitenEcojey100% (1)

- Habit TrackerDokument5 SeitenHabit TrackerÄsør ŘoSąNoch keine Bewertungen

- Journal ListDokument9 SeitenJournal ListCashmere AbutanNoch keine Bewertungen

- 3 - Sievert-Play Therapy in The School Setting PGCADokument50 Seiten3 - Sievert-Play Therapy in The School Setting PGCAJoseph Alvin PeñaNoch keine Bewertungen

- Morning Routine: Cheat SheetDokument4 SeitenMorning Routine: Cheat Sheetvipgaming fourthNoch keine Bewertungen

- C - Motivating Child To Learn N Use Exe SkillsDokument9 SeitenC - Motivating Child To Learn N Use Exe SkillsJAC WEINoch keine Bewertungen

- Calendar To Do MasterDokument1 SeiteCalendar To Do MasterAleksandra Živković Ex GavrićNoch keine Bewertungen

- Weekly Spending Tracker: Monday Price Friday PriceDokument9 SeitenWeekly Spending Tracker: Monday Price Friday PriceCashmere AbutanNoch keine Bewertungen

- 14 Day Fit Elite Challenge 17Dokument7 Seiten14 Day Fit Elite Challenge 17Denise LomaxNoch keine Bewertungen

- Rmi Personal Budget Worksheet v05Dokument10 SeitenRmi Personal Budget Worksheet v05api-299736788Noch keine Bewertungen

- Forever Home: Moving Beyond Brokenness to Build a Strong and Beautiful LifeVon EverandForever Home: Moving Beyond Brokenness to Build a Strong and Beautiful LifeNoch keine Bewertungen

- ISKCON Management Guidelines - 2Dokument36 SeitenISKCON Management Guidelines - 2JourneyToKrishna100% (1)

- DHS ResponseDokument20 SeitenDHS ResponseSunlight FoundationNoch keine Bewertungen

- Social Security Form OnlineDokument5 SeitenSocial Security Form OnlineDiego PinedoNoch keine Bewertungen

- Module III-Property Management-April 2013Dokument29 SeitenModule III-Property Management-April 2013Larry ArevaloNoch keine Bewertungen

- Fitness GuideDokument12 SeitenFitness GuideBig DummyNoch keine Bewertungen

- 21 Day Transformation KarenDokument3 Seiten21 Day Transformation KarenKaren HumanNoch keine Bewertungen

- Buku Etika 13 BabDokument494 SeitenBuku Etika 13 BabSalsabila Nst100% (1)

- Lean Portfolio Management Demystified: Practical Patterns For Amplifying The Impact of SafeDokument42 SeitenLean Portfolio Management Demystified: Practical Patterns For Amplifying The Impact of SafeUtsav Patel67% (3)

- Recipe From Emily SkyeDokument1 SeiteRecipe From Emily SkyeDoina Veronica CraciunNoch keine Bewertungen

- Ddpy PlannerDokument46 SeitenDdpy PlannerManuel DenizNoch keine Bewertungen

- Cognitive Flexibility Self-Assessment WorksheetDokument2 SeitenCognitive Flexibility Self-Assessment WorksheetRONG QINoch keine Bewertungen

- 2016 Budget Binder PDFDokument6 Seiten2016 Budget Binder PDFNurul Syafenaz HishamNoch keine Bewertungen

- Daily Planner : GratitudeDokument3 SeitenDaily Planner : GratitudeRoxana Georgiana NicaNoch keine Bewertungen

- Printables 20141009160652Dokument2 SeitenPrintables 20141009160652api-267633380Noch keine Bewertungen

- Food JournalDokument1 SeiteFood JournalBecky Wilkinson PerryNoch keine Bewertungen

- 21-Day-Training-Seven BrttneDokument24 Seiten21-Day-Training-Seven Brttnedaniela mhNoch keine Bewertungen

- Better Body-Image-Journal-1Dokument16 SeitenBetter Body-Image-Journal-1JessNoch keine Bewertungen

- Meal Plan & Grocery List GuideDokument7 SeitenMeal Plan & Grocery List GuideSarah ChryslerNoch keine Bewertungen

- Elementary Balance Lesson 3Dokument5 SeitenElementary Balance Lesson 3api-271045706100% (1)

- Kids 4 Kindness 4-Sample LessonDokument15 SeitenKids 4 Kindness 4-Sample LessonRomelynn SubioNoch keine Bewertungen

- 31 Decisions That Make A Person Of Value: Essential Values Of Great PeopleVon Everand31 Decisions That Make A Person Of Value: Essential Values Of Great PeopleNoch keine Bewertungen

- Wedding Itinerary and Reception ProgramDokument5 SeitenWedding Itinerary and Reception ProgramJoyce BaborNoch keine Bewertungen

- 8146DV Essential Physical Fitness 1 PDFDokument52 Seiten8146DV Essential Physical Fitness 1 PDFJamillah Therese Jeziah YsabelleNoch keine Bewertungen

- Understanding Money: How To Make It Work For YouDokument46 SeitenUnderstanding Money: How To Make It Work For YouMonique BagaporoNoch keine Bewertungen

- March 2011Dokument16 SeitenMarch 2011USS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Businesses Offering Military DiscountsDokument7 SeitenBusinesses Offering Military DiscountsUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Gtown 02-11Dokument15 SeitenGtown 02-11USS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Ombudsman Speech For Deployment or FRG IntroDokument2 SeitenOmbudsman Speech For Deployment or FRG IntroUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Welcome Aboard LTRDokument1 SeiteWelcome Aboard LTRUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Gtown 01-11Dokument16 SeitenGtown 01-11USS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Dec 2010 NewsltrDokument15 SeitenDec 2010 NewsltrUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- MTG Sign in (Blank)Dokument3 SeitenMTG Sign in (Blank)USS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Family Info FormDokument2 SeitenFamily Info FormUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- What Military Teens Want You To Know ToolkitDokument18 SeitenWhat Military Teens Want You To Know ToolkitUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Questions For CommandDokument2 SeitenQuestions For CommandUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- MWR Ticket PricesDokument3 SeitenMWR Ticket PricesUSS Harpers Ferry Ombudsman100% (1)

- American Red CrossDokument1 SeiteAmerican Red CrossUSS Harpers Ferry Ombudsman100% (1)

- Social Media Handbook: Navy OmbudsmanDokument20 SeitenSocial Media Handbook: Navy OmbudsmanUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Deploy CKListDokument1 SeiteDeploy CKListUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Dec News LTR 2008Dokument6 SeitenDec News LTR 2008USS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Children&DeploymentDokument1 SeiteChildren&DeploymentUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Mar News LTR 2010 FinalDokument9 SeitenMar News LTR 2010 FinalUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- SeaLegs (Shorttakes)Dokument2 SeitenSeaLegs (Shorttakes)USS Harpers Ferry OmbudsmanNoch keine Bewertungen

- June News LTR 2009Dokument5 SeitenJune News LTR 2009USS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Feb News LTR 2010Dokument6 SeitenFeb News LTR 2010USS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Sea LegsDokument82 SeitenSea LegsUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Social CustomsDokument52 SeitenSocial CustomsUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Feb News LTR 2010Dokument6 SeitenFeb News LTR 2010USS Harpers Ferry OmbudsmanNoch keine Bewertungen

- April News LTR 2009Dokument5 SeitenApril News LTR 2009USS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Facebook SettingsDokument2 SeitenFacebook SettingsUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Spouses of IADokument56 SeitenSpouses of IAUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Bluf 01-10 FinalDokument13 SeitenBluf 01-10 FinalUSS Harpers Ferry OmbudsmanNoch keine Bewertungen

- NavyLegalSW (20 Mar 09)Dokument2 SeitenNavyLegalSW (20 Mar 09)USS Harpers Ferry OmbudsmanNoch keine Bewertungen

- Let's Hear It For The BoyDokument48 SeitenLet's Hear It For The Boyapi-26032005Noch keine Bewertungen

- General Financial Rules 2017 - Chapter 6: Procurement of Goods and ServicesDokument18 SeitenGeneral Financial Rules 2017 - Chapter 6: Procurement of Goods and ServicesProf. Manpreet Singh GillNoch keine Bewertungen

- Practice Questions On Fiscal PolicyDokument5 SeitenPractice Questions On Fiscal PolicyJaime SánchezNoch keine Bewertungen

- VI SemesterDokument20 SeitenVI Semesterabduljawad007Noch keine Bewertungen

- Capital Budgeting DecisionsDokument88 SeitenCapital Budgeting Decisionsthenikkitr100% (1)

- Multiple Choice Questions: Diploma in Technology Property Management Faculty of Built EnvironmentDokument2 SeitenMultiple Choice Questions: Diploma in Technology Property Management Faculty of Built EnvironmentKarCheeNoch keine Bewertungen

- Ethiopia's Sustainable Development and Poverty Reduction ProgramDokument225 SeitenEthiopia's Sustainable Development and Poverty Reduction ProgramTWWNoch keine Bewertungen

- Activity 3 in StatDokument13 SeitenActivity 3 in StatIanna ManieboNoch keine Bewertungen

- Coralville Von Maur ResolutionDokument7 SeitenCoralville Von Maur ResolutionThe GazetteNoch keine Bewertungen

- Topic Iv - Local Taxation and Fiscal MattersDokument48 SeitenTopic Iv - Local Taxation and Fiscal MattersJean Ashley Napoles AbarcaNoch keine Bewertungen

- MI CHAPTER 4567 TrungDokument23 SeitenMI CHAPTER 4567 TrungBảo Trân NguyễnNoch keine Bewertungen

- 9.hilton 9E Global Edition Solutions Manual Chapter08 (Exercise+problem)Dokument22 Seiten9.hilton 9E Global Edition Solutions Manual Chapter08 (Exercise+problem)Anisa VrenoziNoch keine Bewertungen

- Final Exam - Ba 213Dokument6 SeitenFinal Exam - Ba 213api-408647155100% (1)

- Platinum Aura Edge Benefit GuideDokument20 SeitenPlatinum Aura Edge Benefit GuideNaveen KumarNoch keine Bewertungen

- Ocr Ms 08 Legacy Gce JunDokument24 SeitenOcr Ms 08 Legacy Gce JunAhamed LafirNoch keine Bewertungen

- Job Description - Accounts OfficerDokument2 SeitenJob Description - Accounts Officerjamil AhmadNoch keine Bewertungen

- Letter of IntentDokument86 SeitenLetter of IntentarunceNoch keine Bewertungen

- FRS 15, Tangible Fixed Assets - Technical Articles - ACCADokument7 SeitenFRS 15, Tangible Fixed Assets - Technical Articles - ACCARamen PandeyNoch keine Bewertungen

- Guidance on Auditing Fixed AssetsDokument8 SeitenGuidance on Auditing Fixed Assetsmandarab76Noch keine Bewertungen

- Media Budgeting & PlanningDokument19 SeitenMedia Budgeting & PlanningFaizan AhmadNoch keine Bewertungen

- HISD Board Meeting Budget Presentation 030311Dokument17 SeitenHISD Board Meeting Budget Presentation 030311enm077486Noch keine Bewertungen

- Local Budget Circular No 121Dokument19 SeitenLocal Budget Circular No 121Jefford Vinson ValdehuezaNoch keine Bewertungen

- CPA REVIEW SCHOOL OF THE PHILIPPINES - STANDARD COSTING & VARIANCE ANALYSISDokument2 SeitenCPA REVIEW SCHOOL OF THE PHILIPPINES - STANDARD COSTING & VARIANCE ANALYSISHannah CorpuzNoch keine Bewertungen