Beruflich Dokumente

Kultur Dokumente

Terms & Conditions - Individual Accounts

Hochgeladen von

dff_jxOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Terms & Conditions - Individual Accounts

Hochgeladen von

dff_jxCopyright:

Verfügbare Formate

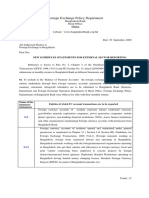

TERMS & CONDITIONS

1.

SAVINGS RULES AND REGULATIONS:

a)

A depositor may deposit money as often as he or she wishes. Cheques and Dividend Warrants will be accepted for collection and credited after realisation to Savings Bank

Account (s) provided the Bank is satisfied as to the identity of the payees.

The minimum balance required to be maintained at all times is Tk. 5,000/- and the bank reserves the right to change the minimum balance requirement and/or to close such account

without prior notice if the balance falls below this amount.

The Bank reserves to itself the right not to pay any cheque presented that contravenes the rules. In the event of a cheque being returned for want of funds, a penalty charge of

Tk. 200/- for each presentation will be made.

Withdrawal is allowed twice a week i.e. eight times a month up to 25% of the total balance in the account. Withdrawal beyond the maximum limit will require 7 days notice,

failure to give notice will entail forfeiture of interest for the month in which the withdrawal occurs.

A depositor cannot withdraw a sum in cash smaller than Tk. 300/Rates in interest may be altered from time to time and this should be ascertained from the Branch concerned. Any alteration in rate will be displayed.

Interest will be allowed only on account bearing a minimum balance of Tk. 2,000/- per calendar month. Subject to the foregoing, calculations will be made for each calendar month

on the lowest credit balance in account for the month.

Should an account be closed within three months of its having been opened, the depositor will be charged Tk. 100/- to cover servicing the account during the period.

It is in the interest of the account holder that every change of address be intimated to the Bank promptly for regularity of records.

The Bank reserves to itself the right to close any account without assigning any reason thereof.

If the provisions of these rules are contravened continually, the Bank will be empowered to levy a service charge at its discretion.

The Bank reserves to itself the right to alter or add to these rules at any time.

To hold the Bank free from any and all responsibility (ies) against any loss or damage to funds, securities or property deposited with the Bank due to any order of Government or

other Authority, law, levy , tax, embargo, moratorium, exchange restriction or any other cause whatsoever beyond its control.

I/We have gone through the above rules and regulations governing the operation of this Account and hereby agree to abide by the same. These rules are subject to change from

time to time at the discretion of the Bank.

b)

c)

d)

e)

f)

g)

h)

i)

j)

k)

l)

m)

n)

Signature ..

Signature ..

Name

Name

2.

GENERAL CONDITIONS GOVERNING ACCOUNTS:

a)

The law, rules and regulations of Bangladesh, usual customs and procedures common to Banks in Bangladesh will apply to and govern the conducts of the account opened with the

Bank.

Any person opening an account will be deemed to have read, understood and accepted the rules governing the account. Minimum balance to be maintained in Current A/C.

Tk. 10,000/- and in Savings A/C. Tk. 5,000/- only.

A suitable introduction by an introducer acceptable to the Bank is required prior to opening of any account. Recent photographs of the account openers duly attested by the

introducer must be produced.

Each account will be given one account number. This number is to be properly quoted on all letters and / or documents addressed to the Bank and on all deposit slips. The Bank

will not be responsible for any loss or damage occurring as a result of wrong quotation of account number.

Interest/commissions/service or maintenance of account charges will be levied by the Bank as determined by the Bank from time to time and as per Bangladesh Bank regulation.

The funds available in any of the account holders account (the customer) with the Bank will be considered by the Bank to be a security for any commitment(s), the Bank is

entitled without giving prior notice to the customer to utilize such funds against the obligation(s) and/or commitment(s) of the customer to the Bank.

Any statement of account dispatched to the customer will be considered as approved unless any discrepancy(-ies) is/are notified in writing to the Bank within 15 days from the date

of dispatch. The Bank is not responsible for delays or non-delivery due to mail problems. Statement of account to be picked up will be considered as approved even if not picked

up 15 days after the date they are produced. Statements of account are not produced when there is no operation during the month. Those can be obtained on special request.

Account holders must provide maximum security to the cheque books in their possession and the Bank is not responsible for any loss occurring due to inadequacy of security. Any

cheque book loss or misuse must be immediately reported to the Bank and confirmed in writing without any delay.

When cheque deposited are payable by other Banks or outstation, they are available after clearing or collection only. Service charge will be charged @ Tk. 100/- in Current A/C.

and Savings A/C Half yearly or as changed by the bank from time to time as and when required.

The Bank reserves the right to close any account without giving prior notice if the conduct of the account is unsatisfactory in the opinion of the Bank or for any other reason(s)

whatsoever.

The balance in the account(s) is payable solely at ONE Bank Limited and shall be governed by and subject to laws in effect in Bangladesh. As used herein Laws will include

Bank Circulars, Modifications, Regulations and Orders of the Government and Bangladesh Bank including practice of banking.

The Bank reserves the right to amend the present rules at any time in any manner with or without giving prior notice to the account holder(s) separately or to the public. The

cheque book will not be issued unless and until all the required formalities are completed.

b)

c)

d)

e)

f)

g)

h)

i)

j)

k)

l)

3.

AGREEMENT:

I/We hereby agree to the above general conditions.

Signature of the applicant/

Authorised signature

Signature of the applicant/

Authorised signature

Signature of the applicant/

Authorised signature

Signature of the applicant/

Authorised signature

TERMS & CONDITIONS OF SCHEME DEPOSITS

MONTHLY MONEY MAKER

1.

Duration

: 5 years (Deposited principal amount will be returned on maturity)

2.

Amount

: Tk. 50,000/- (Taka Fifty thousand) only and its multiple(s)

3.

Procedures for paying monthly income:

a)

b)

c)

4.

Eligibility for Monthly Money Maker:

a)

b)

c)

5.

A person of 18 years of age and above having a sound mind will be eligible to open an account in his/her own name.

An account cannot be transferred from one branch to another branch. However, a client will have the option of collecting the income and / or principal via Banks collection mechanism and banks usual charge

will apply.

A person can open more than one account in his/her/their name(s) in the same Branch or any Branch of the Bank.

Nomination:

a)

b)

c)

d)

e)

6.

The payment of monthly income will start from the subsequent month after a clear minimum gap of 1 (one) month from the date of deposit.

The account holder will receive monthly income in any SB/CD account of same name maintained with the branch. In case, the Account holder(s) do(es) not have any SB/CD account with the branch,

he/she/they will have to open a SB/CD account for receiving the monthly income. The minimum balance requirement will be waived for these types of account for a new customer. However, a minimum

initial deposit of Tk. 500/- will have to be deposited.

Applicable Government Taxes and charges, if any, are deductible from monthly income.

An account holder can nominate maximum 3(three) persons as his/her/their nominees who will be able to receive the monthly income in the event of the death of the account holder.

At the time of opening MMM, an account holder will fix the amount payable to each nominee by fixing the share amount receivable by such nominee (s) in case the number of nominees is more than one

person.

The nomination will be cancelled, if the nominee dies in the lifetime of the account holder. The account holder in such a case will inform the Bank and also nominate a new nominee(s).

In case of death or permanent mental disability of the account holder, deposited amount will be payable to nominee(s) as prior allocation of share recorded in the Bank and as per the rate of interest mentioned

in clause 7. In that case a succession certificate will not be required and the matter will be finalized at the branch level.

A minor can also be made a nominee. In that case the minors legal guardian will receive payment on his/her/their behalf.

Pre-mature closure of the Account:

An account holder may close the account at anytime by a written application. In that case Tk. 200/- will be charged as Banks charge for servicing the account and following rules will be applicable:

a)

b)

c)

d)

e)

7.

In case the account is closed within 6 months, no benefit including interest will be paid to the account holder.

In case the account is closed after 6 months but within 1 year, the client will be paid back principal amount with interest at the Banks the then prevailing Saving Account Rate.

In case the account is closed after 1 year but within 3 years, The client will be paid back principal amount with simple interest which would be 0.5% above the Banks the than prevailing Saving Account Rate.

In case the account is closed after 3 years but within 5 years, The client will be paid back principal amount with simple interest which would be 1% above the Banks the than prevailing Saving Account Rate.

If the amount of monthly income already paid to the account holder exceeds the amount payable under above mentioned circumstance, the difference will be realized from the principal amount.

Credit Facility:

The account holder can avail Loan/ Overdraft facility against the lien on the balance of the above MMM account as per Banks prescribed rates and rules.

8.

Special Instructions:

a)

b)

c)

d)

e)

No cheque book will be issued to the client under this Scheme.

Nominee(s) will not be able to continue the account after the death of the account holder.

In case where no nominee(s) was named by the account holder, after his death a Succession Certificate will be required and the deposited principal amount and interest will be paid to the legal heirs of the

account holder and the account will be closed automatically.

In case the account holder dies after availing loan against the Scheme, in that case nominees/heir will be paid balance amount only after making full adjustment of the loan amount including interest and other

Bank charges.

The Bank on its own initiative has introduced this Scheme. Hence the Bank reserves the right to make changes/alterations/amendment/addition/modifications etc. to the Scheme and to its related, fees etc. at any

time/stage without assigning any reason whatsoever.

EDUSAVE/PENSAVE/MARRYSAVE

1.

Rules:

a)

The Applicant will apply in the Banks prescribed from along with one copy of attested passport size photograph.

b)

One copy of passport size photograph of each of the Nominees should be submitted.

c)

The Account should be opened within the first 10 days of any month. After the 10th day, an Account can be opened on the condition that the deposit will be treated as advance deposit for the following month.

d)

The Account cannot be opened in joint names.

e)

The Depositor cannot change the installment size or tenor after deposit of the first installment.

f)

A person can open more than one Account of similar/different installment size(s).

g)

Account can be opened in the name of a minor but is to be operated by the legal guardian of the minor.

h)

The Depositor must immediately report to the Bank in the event of any change of his/her address.

2.

Procedures for Depositing Monthly Installment:

a)

b)

c)

d)

3.

Withdrawal Terms:

a)

b)

c)

4.

If the deposited amount is withdrawn within one year, no interest will be paid.

If the deposited amount is withdrawn after one year but before the end of tenor, interest will be given at the prevailing Savings Interest Rate.

On completion of the tenor, the entire payables will be paid to the Depositor after one month from the date of last monthly installment deposited.

Auto Closure of the Account:

a)

b)

5.

Each monthly installment must be deposited within first 10 days of every month. If the 10th day falls on a holiday, the installment may be deposited on the next working day.

In case the Account Holder fails to pay any installment within the 10th day of the month, a penalty of 5% of the delayed installment amount must be paid along with the installment of the following month.

Installment(s) can be paid in advance.

Monthly installment can also be realized automatically by the Bank from the Savings/Current Account of the Depositor under a Standing Instruction of the Depositor.

If any depositor fails to pay three consecutive installments, the Account will be closed automatically. In that case, the Account Holder will be refunded with the amount in line with rules outlined in clause 4

above.

On the death of the Depositor, the account will be closed automatically. The entire deposited amount will be refunded to the Nominee(s) in line with rules outlined in clause 4 above.

Nomination:

a)

b)

c)

d)

The Depositor may nominate one or more persons as Nominee(s) for the Account.

The Depositor may change the nomination by written application before maturity of the deposit.

In case of death of the Nominee, the nomination will stand cancelled.

In case of death of the depositor and the Nominee, the deposit will be handed over to the successor(s) of the Depositor upon submission of the succession Certificate.

TERMS & CONDITIONS

(CONTD.)

6. Credit Facility:

After payment of Installment(s) for 3 years regularly, a Depositor can avail Loan/Advance up

applicable for Loans & Advances extended by the Bank.

7.

to 80% (maximum) of deposited amount upon fulfillment of terms and conditions

General:

a)

b)

The Bank reserves the right to alter, modify, rectify or cancel any rules or terms of this Scheme at any time without citing any reason whatsoever.

If the income generated from the deposit is taxable, the Bank will deduct the same at the time of final payment.

ONE-2-3 DEPOSIT SCHEME

For Banks use only

Receipt No.

Face Value

Received & Verified by

1.

Date of Issue

Authorised Signature

Date of Maturity

Terminal Value*

Authorised Signature

Amount/Face value of deposit:

Tk. 5,000/- or its multiple without any restriction on maximum.

2.

Procedure to Apply:

While submitting the Application Form, one copy of passport size photograph (attested) is to be submitted by the Applicant(s) and each of the Nominees.

3.

Deposit Receipt:

a)

b)

4.

A ONE-2-3 Deposit Receipt will be issued at the time of opening the account.

In case of loss or damage of the Deposit Receipt, at the request of Depositor(s), the bank may issue a Duplicate Receipt. Rules pertaining to Issuance of Duplicate Receipt will then

apply

Pre-mature Encashment:

Deposit may be withdrawn at any point in time, in case of emergency.

5.

Nomination:

a)

b)

c)

d)

6.

Depositor(s) can nominate a maximum of 3 persons as Nominee(s) who will be paid the amount of deposit (including accrued interest as per rules pertaining top Premature

Encashment) in the event of death of the Depositor(s)

The nomination will stand cancelled if the Nominee expires during the lifetime of the Depositor(s). The Depositor(s), in such event, are eligible to nominate fresh Nominee(s).

In absence of any nomination, the deposit (including accrued interest as per rules pertaining to premature Encashment) will be paid to the legal heirs of the Depositor(s) on

production of Succession Certificate.

Nominees/Successors may continue with the Deposit Scheme for the full term.

Credit facility:

a)

b)

Depositor(s) can avail Loan/Overdraft facility against pledge of Deposit Receipt up to 90% of the deposit upon fulfillment of terms and conditions applicable for Loans &

Advances extended by the Bank.

If the Depositor expires after availing a Loan/Overdraft, Nominees/Heirs will be paid the balance amount after making full adjustment of Loan/Overdraft including accrued interest

and other charges, if any.

7. General:

The Bank reserves the right to make changes/alterations/amendments/additions/modifications etc. to any of the terms and conditions under the Scheme including charges, fees etc. at

any time/stage without assigning any reason whatsoever.

* Amount before deduction of applicable taxes and other charges.

Das könnte Ihnen auch gefallen

- May 192009 Fepd 04 eDokument3 SeitenMay 192009 Fepd 04 edff_jxNoch keine Bewertungen

- HD Seagate 5400 PDFDokument48 SeitenHD Seagate 5400 PDFJorge GalezoNoch keine Bewertungen

- Nov 032009 Fepd 21 eDokument9 SeitenNov 032009 Fepd 21 edff_jxNoch keine Bewertungen

- Sep 302009 Fepd 16 eDokument15 SeitenSep 302009 Fepd 16 edff_jxNoch keine Bewertungen

- Intel 965 Express Chipset Family Memory Technology and Configuration GuideDokument18 SeitenIntel 965 Express Chipset Family Memory Technology and Configuration Guidedff_jxNoch keine Bewertungen

- Hpul MeuDokument10 SeitenHpul MeuRomeo RomeoNoch keine Bewertungen

- IFRS EngDokument1 SeiteIFRS Engdff_jxNoch keine Bewertungen

- Dos CLN 10 09052017 BDokument11 SeitenDos CLN 10 09052017 Bdff_jxNoch keine Bewertungen

- FRC's Letter On Application of ISA 720 (REVISED) in Issuing Auditor's ReportDokument1 SeiteFRC's Letter On Application of ISA 720 (REVISED) in Issuing Auditor's Reportdff_jxNoch keine Bewertungen

- bcc950 Quickstart Guide PDFDokument8 Seitenbcc950 Quickstart Guide PDFOka GianNoch keine Bewertungen

- FRC Audit Firm Enlistment RegulationsDokument31 SeitenFRC Audit Firm Enlistment Regulationsdff_jxNoch keine Bewertungen

- SSD Endurance: HP WorkstationsDokument4 SeitenSSD Endurance: HP Workstationsdff_jxNoch keine Bewertungen

- Gazette Definition of PIEsDokument1 SeiteGazette Definition of PIEsdff_jxNoch keine Bewertungen

- PRAKTICA 'mini' 3.2MP Digital Camera with 4x ZoomDokument2 SeitenPRAKTICA 'mini' 3.2MP Digital Camera with 4x Zoomdff_jxNoch keine Bewertungen

- Seagate Laptop Thin HDD: Product ManualDokument36 SeitenSeagate Laptop Thin HDD: Product Manualdff_jxNoch keine Bewertungen

- Accu-Check Active User GuideDokument60 SeitenAccu-Check Active User GuideDibyajyoti KonwarNoch keine Bewertungen

- Rpas PDFDokument12 SeitenRpas PDFdff_jxNoch keine Bewertungen

- The Journey To ERM 2.0: A Guide For The Public Sector in SingaporeDokument28 SeitenThe Journey To ERM 2.0: A Guide For The Public Sector in Singaporedff_jxNoch keine Bewertungen

- BinaryDokument1 SeiteBinarydff_jxNoch keine Bewertungen

- LimitationsDokument1 SeiteLimitationsdff_jxNoch keine Bewertungen

- WD Scorpio Blue: Mobile Hard DrivesDokument3 SeitenWD Scorpio Blue: Mobile Hard Drivesdff_jxNoch keine Bewertungen

- SP800 123Dokument53 SeitenSP800 123梁偉立Noch keine Bewertungen

- ICAB Fees Schedule 2016Dokument17 SeitenICAB Fees Schedule 2016dff_jx100% (2)

- Mini Digital CameraDokument1 SeiteMini Digital Cameradff_jxNoch keine Bewertungen

- Amendment To The Merchant Bankers Rule-06.3.11Dokument3 SeitenAmendment To The Merchant Bankers Rule-06.3.11dff_jxNoch keine Bewertungen

- Interim FSDokument3 SeitenInterim FSdff_jxNoch keine Bewertungen

- Court Fees3Dokument1 SeiteCourt Fees3dff_jxNoch keine Bewertungen

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Dokument16 SeitenEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1dff_jxNoch keine Bewertungen

- Court Fees3Dokument1 SeiteCourt Fees3dff_jxNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Manual Analizador Fluoruro HachDokument92 SeitenManual Analizador Fluoruro HachAitor de IsusiNoch keine Bewertungen

- SD8B 3 Part3Dokument159 SeitenSD8B 3 Part3dan1_sbNoch keine Bewertungen

- Evaluating Sources IB Style: Social 20ib Opvl NotesDokument7 SeitenEvaluating Sources IB Style: Social 20ib Opvl NotesRobert ZhangNoch keine Bewertungen

- 5511Dokument29 Seiten5511Ckaal74Noch keine Bewertungen

- Trading As A BusinessDokument169 SeitenTrading As A Businesspetefader100% (1)

- Casting Procedures and Defects GuideDokument91 SeitenCasting Procedures and Defects GuideJitender Reddy0% (1)

- Nama: Yetri Muliza Nim: 180101152 Bahasa Inggris V Reading Comprehension A. Read The Text Carefully and Answer The Questions! (40 Points)Dokument3 SeitenNama: Yetri Muliza Nim: 180101152 Bahasa Inggris V Reading Comprehension A. Read The Text Carefully and Answer The Questions! (40 Points)Yetri MulizaNoch keine Bewertungen

- 3ccc PDFDokument20 Seiten3ccc PDFKaka KunNoch keine Bewertungen

- EIN CP 575 - 2Dokument2 SeitenEIN CP 575 - 2minhdang03062017Noch keine Bewertungen

- Leaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeDokument6 SeitenLeaked David Fry II Conversation Regarding Loopholes and Embezzlement at AFK Gamer LoungeAnonymous iTNFz0a0Noch keine Bewertungen

- Acne Treatment Strategies and TherapiesDokument32 SeitenAcne Treatment Strategies and TherapiesdokterasadNoch keine Bewertungen

- April 26, 2019 Strathmore TimesDokument16 SeitenApril 26, 2019 Strathmore TimesStrathmore Times100% (1)

- Chapter 3 of David CrystalDokument3 SeitenChapter 3 of David CrystalKritika RamchurnNoch keine Bewertungen

- Steam Turbine Theory and Practice by Kearton PDF 35Dokument4 SeitenSteam Turbine Theory and Practice by Kearton PDF 35KKDhNoch keine Bewertungen

- John Hay People's Alternative Coalition Vs Lim - 119775 - October 24, 2003 - JDokument12 SeitenJohn Hay People's Alternative Coalition Vs Lim - 119775 - October 24, 2003 - JFrances Ann TevesNoch keine Bewertungen

- Theory of Linear Programming: Standard Form and HistoryDokument42 SeitenTheory of Linear Programming: Standard Form and HistoryJayakumarNoch keine Bewertungen

- Mazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedDokument5 SeitenMazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedAnderson LodiNoch keine Bewertungen

- Inorganica Chimica Acta: Research PaperDokument14 SeitenInorganica Chimica Acta: Research PaperRuan ReisNoch keine Bewertungen

- TOGAF 9 Foundation Part 1 Exam Preparation GuideDokument114 SeitenTOGAF 9 Foundation Part 1 Exam Preparation GuideRodrigo Maia100% (3)

- Interpretation of Arterial Blood Gases (ABGs)Dokument6 SeitenInterpretation of Arterial Blood Gases (ABGs)afalfitraNoch keine Bewertungen

- Bharhut Stupa Toraa Architectural SplenDokument65 SeitenBharhut Stupa Toraa Architectural Splenအသွ်င္ ေကသရNoch keine Bewertungen

- Nokia MMS Java Library v1.1Dokument14 SeitenNokia MMS Java Library v1.1nadrian1153848Noch keine Bewertungen

- Maj. Terry McBurney IndictedDokument8 SeitenMaj. Terry McBurney IndictedUSA TODAY NetworkNoch keine Bewertungen

- Merchandising Calender: By: Harsha Siddham Sanghamitra Kalita Sayantani SahaDokument29 SeitenMerchandising Calender: By: Harsha Siddham Sanghamitra Kalita Sayantani SahaSanghamitra KalitaNoch keine Bewertungen

- Logic and Set Theory PropositionDokument3 SeitenLogic and Set Theory PropositionVince OjedaNoch keine Bewertungen

- Case 5Dokument1 SeiteCase 5Czan ShakyaNoch keine Bewertungen

- Energy AnalysisDokument30 SeitenEnergy Analysisca275000Noch keine Bewertungen

- Rubber Chemical Resistance Chart V001MAR17Dokument27 SeitenRubber Chemical Resistance Chart V001MAR17Deepak patilNoch keine Bewertungen

- HCW22 PDFDokument4 SeitenHCW22 PDFJerryPNoch keine Bewertungen

- Ancient Greek Divination by Birthmarks and MolesDokument8 SeitenAncient Greek Divination by Birthmarks and MolessheaniNoch keine Bewertungen