Beruflich Dokumente

Kultur Dokumente

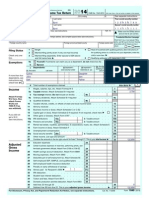

Form 1040

Hochgeladen von

Peng JinOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Form 1040

Hochgeladen von

Peng JinCopyright:

Verfügbare Formate

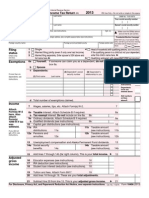

Caution: DRAFTNOT FOR FILING

This is an early release draft of an IRS tax form, instructions, or publication,

which the IRS is providing for your information as a courtesy. Do not file

draft forms. Also, do not rely on draft instructions and publications for

filing. We generally do not release drafts of forms until we believe we have

incorporated all changes. However, unexpected issues sometimes arise, or

legislation is passed, necessitating a change to a draft form. In addition,

forms generally are subject to OMB approval before they can be officially

released. Drafts of instructions and publications usually have at least some

changes before being officially released.

Early releases of draft forms and instructions are at IRS.gov/draftforms.

Please note that drafts may remain on IRS.gov even after the final release is

posted at IRS.gov/downloadforms, and thus may not be removed until there

is a new draft for the subsequent revision. All information about all revisions

of all forms, instructions, and publications is at IRS.gov/formspubs.

Almost every form and publication also has its own easily accessible

information page on IRS.gov. For example, the Form 1040 page is at

IRS.gov/form1040; the Form W-2 page is at IRS.gov/w2; the Publication 17

page is at IRS.gov/pub17; the Form W-4 page is at IRS.gov/w4; the Form

8863 page is at IRS.gov/form8863; and the Schedule A (Form 1040) page is

at IRS.gov/schedulea. If typing in the links above instead of clicking on

them: type the link into the address bar of your browser, not in a Search box;

the text after the slash must be lowercase; and your browser may require the

link to begin with www.. Note that these are shortcut links that will

automatically go to the actual link for the page.

If you wish, you can submit comments about draft or final forms,

instructions, or publications on the Comment on Tax Forms and Publications

page on IRS.gov. We cannot respond to all comments due to the high

volume we receive, but we will carefully consider each one. Please note that

we may not be able to consider many suggestions until the subsequent

revision of the product.

Form

1040

2014

(99)

Department of the TreasuryInternal Revenue Service

U.S. Individual Income Tax Return

For the year Jan. 1Dec. 31, 2014, or other tax year beginning

OMB No. 1545-0074

, 2014, ending

IRS Use OnlyDo not write or staple in this space.

See separate instructions.

, 20

Your first name and initial

Last name

Your social security number

If a joint return, spouses first name and initial

Last name

Spouses social security number

Apt. no.

Home address (number and street). If you have a P.O. box, see instructions.

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

Foreign country name

Filing Status

Check only one

box.

Exemptions

Presidential Election Campaign

Check here if you, or your spouse if filing

jointly, want $3 to go to this fund. Checking

Foreign postal code

a box below will not change your tax or

refund.

You

Spouse

Foreign province/state/county

Single

Married filing jointly (even if only one had income)

2

3

Head of household (with qualifying person). (See instructions.) If

the qualifying person is a child but not your dependent, enter this

childs name here.

Married filing separately. Enter spouses SSN above

and full name here.

6a

b

Qualifying widow(er) with dependent child

Yourself. If someone can claim you as a dependent, do not check box 6a .

Spouse

.

Dependents:

(1) First name

(2) Dependents

social security number

Last name

Make sure the SSN(s) above

and on line 6c are correct.

(4) if child under age 17

qualifying for child tax credit

(see instructions)

(3) Dependents

relationship to you

Boxes checked

on 6a and 6b

No. of children

on 6c who:

lived with you

did not live with

you due to divorce

or separation

(see instructions)

If more than four

dependents, see

instructions and

check here

Dependents on 6c

not entered above

Total number of exemptions claimed

Add numbers on

lines above

DRAFT AS OF

August 28, 2014

DO NOT FILE

Income

Attach Form(s)

W-2 here. Also

attach Forms

W-2G and

1099-R if tax

was withheld.

If you did not

get a W-2,

see instructions.

Adjusted

Gross

Income

Wages, salaries, tips, etc. Attach Form(s) W-2

8a

b

9a

Taxable interest. Attach Schedule B if required .

Tax-exempt interest. Do not include on line 8a .

Ordinary dividends. Attach Schedule B if required

.

.

.

.

.

.

.

8b

. .

8a

9a

10

11

Qualified dividends . . . . . . . . . . .

9b

Taxable refunds, credits, or offsets of state and local income taxes

Alimony received . . . . . . . . . . . . . . .

.

.

.

.

.

.

.

.

.

.

.

.

10

11

12

13

14

Business income or (loss). Attach Schedule C or C-EZ . . . . . . . . .

Capital gain or (loss). Attach Schedule D if required. If not required, check here

Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . .

12

13

14

15a

16a

17

IRA distributions .

15a

b Taxable amount

. . .

Pensions and annuities 16a

b Taxable amount

. . .

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

15b

16b

17

18

19

20a

Farm income or (loss). Attach Schedule F .

Unemployment compensation . . . .

Social security benefits 20a

18

19

20b

21

22

Other income. List type and amount

Combine the amounts in the far right column for lines 7 through 21. This is your total income

23

Reserved

24

Certain business expenses of reservists, performing artists, and

fee-basis government officials. Attach Form 2106 or 2106-EZ

25

Health savings account deduction. Attach Form 8889

24

25

26

27

28

Moving expenses. Attach Form 3903 . . . . . .

Deductible part of self-employment tax. Attach Schedule SE .

Self-employed SEP, SIMPLE, and qualified plans

. .

26

27

28

29

30

31a

Self-employed health insurance deduction

Penalty on early withdrawal of savings . .

.

.

.

.

.

.

.

.

32

33

34

Alimony paid b Recipients SSN

IRA deduction . . . . . .

Student loan interest deduction .

Reserved . . . . . . .

29

30

31a

.

.

.

.

.

.

.

.

.

.

.

.

32

33

34

35

36

37

Domestic production activities deduction. Attach Form 8903

35

Add lines 23 through 35 . . . . . . . . . . . . .

Subtract line 36 from line 22. This is your adjusted gross income

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

21

22

23

.

.

.

. . . . . .

. . . . . .

b Taxable amount

.

.

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

.

.

.

.

.

.

.

.

36

37

Cat. No. 11320B

Form

1040

(2014)

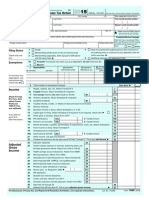

Page 2

Form 1040 (2014)

38

Amount from line 37 (adjusted gross income)

Tax and

Credits

39a

Check

if:

Standard

Deduction

for

People who

check any

box on line

39a or 39b or

who can be

claimed as a

dependent,

see

instructions.

All others:

Single or

Married filing

separately,

$6,200

Married filing

jointly or

Qualifying

widow(er),

$12,400

Head of

household,

$9,100

Other

Taxes

58

59

60a

Unreported social security and Medicare tax from Form:

b

61

First-time homebuyer credit repayment. Attach Form 5405 if required

62

63

Form 8960 c

Taxes from: a

Form 8959 b

Add lines 56 through 62. This is your total tax . .

You were born before January 2, 1950,

Spouse was born before January 2, 1950,

Blind.

Blind.

38

Total boxes

checked 39a

If your spouse itemizes on a separate return or you were a dual-status alien, check here

39b

40

41

Itemized deductions (from Schedule A) or your standard deduction (see left margin)

Subtract line 40 from line 38

. . . . . . . . . . . . . . . . .

.

.

42

43

Exemptions. If line 38 is $152,525 or less, multiply $3,950 by the number on line 6d. Otherwise, see instructions

Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- . .

Form 4972 c

Tax (see instructions). Check if any from: a

Form(s) 8814 b

44

45

46

47

48

49

50

51

Alternative minimum tax (see instructions). Attach Form 6251 .

Excess advance premium tax credit repayment. Attach Form 8962

Add lines 44, 45, and 46

. . . . . . .

Foreign tax credit. Attach Form 1116 if required .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

48

.

.

.

.

40

41

42

43

44

45

46

47

49

50

51

Credit for child and dependent care expenses. Attach Form 2441

Education credits from Form 8863, line 19 . . . . .

Retirement savings contributions credit. Attach Form 8880

Child tax credit. Attach Schedule 8812, if required . . .

DRAFT AS OF

August 28, 2014

DO NOT FILE

Payments

If you have a

qualifying

child, attach

Schedule EIC.

52

53

54

55

56

57

64

65

66a

b

67

68

69

70

71

72

73

74

Refund

75

76a

Third Party

Designee

Sign

Here

Paid

Preparer

Use Only

Self-employment tax. Attach Schedule SE

.

.

Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required

.

.

.

.

.

.

. . .

Instructions; enter code(s)

. . . . . . . . . .

64

Federal income tax withheld from Forms W-2 and 1099 . .

2014 estimated tax payments and amount applied from 2013 return

65

Earned income credit (EIC) . . . . . . . . . . 66a

4137

.

.

.

.

.

.

.

.

67

American opportunity credit from Form 8863, line 8 .

Net premium tax credit. Attach Form 8962 . . . .

Amount paid with request for extension to file . . .

.

.

.

.

.

.

68

69

70

71

72

Credits from Form: a

2439 b

Reserved c

Reserved d

73

Add lines 64, 65, 66a, and 67 through 73. These are your total payments .

Excess social security and tier 1 RRTA tax withheld

Credit for federal tax on fuels. Attach Form 4136

.

.

Full-year coverage

Health care: individual responsibility (see instructions)

Nontaxable combat pay election

66b

Additional child tax credit. Attach Schedule 8812 .

.

.

.

.

.

.

Household employment taxes from Schedule H

.

.

8919

.

.

.

.

.

.

55

56

57

58

59

60a

60b

61

62

63

74

.

.

If line 74 is more than line 63, subtract line 63 from line 74. This is the amount you overpaid

75

Amount of line 75 you want refunded to you. If Form 8888 is attached, check here

76a

b

d

No

Personal identification

number (PIN)

Phone

no.

Designees

name

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Your signature

Date

Your occupation

Daytime phone number

Spouses signature. If a joint return, both must sign.

Date

Spouses occupation

If the IRS sent you an Identity Protection

PIN, enter it

here (see inst.)

PTIN

Check

if

self-employed

Joint return? See

instructions.

Keep a copy for

your records.

.

.

c Type:

Routing number

Checking

Savings

Account number

Amount of line 75 you want applied to your 2015 estimated tax 77

77

78

Amount you owe. Subtract line 74 from line 63. For details on how to pay, see instructions 78

79

Estimated tax penalty (see instructions) . . . . . . .

79

Do you want to allow another person to discuss this return with the IRS (see instructions)?

Yes. Complete below.

Direct deposit?

See

instructions.

Amount

You Owe

52

Residential energy credit. Attach Form 5695 . . . . .

53

3800 b

8801 c

Other credits from Form: a

54

Add lines 48 through 54. These are your total credits . . . . .

Subtract line 55 from line 47. If line 55 is more than line 47, enter -0-

Print/Type preparers name

Firms name

Preparers signature

Date

Firm's EIN

Firms address

Phone no.

www.irs.gov/form1040

Form 1040 (2014)

Das könnte Ihnen auch gefallen

- Chapter 10 MERGEDDokument10 SeitenChapter 10 MERGEDola69% (13)

- Week 2 Form 1040Dokument2 SeitenWeek 2 Form 1040Linda100% (2)

- Santos Return PDFDokument14 SeitenSantos Return PDFMark Long75% (4)

- Income Tax Fundamentals Chapter 4 Comprehensive Problem 1Dokument2 SeitenIncome Tax Fundamentals Chapter 4 Comprehensive Problem 1AU Sharma0% (1)

- Form 1040Dokument2 SeitenForm 1040Jessi100% (6)

- F 1040Dokument2 SeitenF 1040Kevin RowanNoch keine Bewertungen

- NATH f1040Dokument2 SeitenNATH f1040Spencer NathNoch keine Bewertungen

- Example Tax ReturnDokument6 SeitenExample Tax Returnapi-252304176Noch keine Bewertungen

- 2014 Federal 1040 (Esther)Dokument2 Seiten2014 Federal 1040 (Esther)Abdirahman Abdullahi Omar43% (7)

- DDM Tutorial Questions 1Dokument2 SeitenDDM Tutorial Questions 1phuongfeoNoch keine Bewertungen

- f1040 Draft 2015Dokument3 Seitenf1040 Draft 2015Anonymous IpryXQAKZNoch keine Bewertungen

- FTF1301242185129Dokument3 SeitenFTF1301242185129Donna SchatzNoch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax ReturnadrianaNoch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax Returnapi-173610472Noch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax ReturnHamzah B ShakeelNoch keine Bewertungen

- Schauer 2013 Tax ReturnDokument3 SeitenSchauer 2013 Tax ReturnDetroit Free Press0% (1)

- Chapter 4 For FilingDokument9 SeitenChapter 4 For Filinglagurr100% (1)

- Ivan Incisor CH 2 Tax Return - For - FilingDokument4 SeitenIvan Incisor CH 2 Tax Return - For - FilingShakilaMissz-KyutieJenkins100% (1)

- F 1040Dokument2 SeitenF 1040Sue BosleyNoch keine Bewertungen

- Chapter 12 TR Assignment Kelsey EwellDokument22 SeitenChapter 12 TR Assignment Kelsey Ewellapi-272863459Noch keine Bewertungen

- f1040 PDFDokument3 Seitenf1040 PDFjc75aNoch keine Bewertungen

- Ivan Incisor CH 3 2014 Tax Return - For - FilingDokument6 SeitenIvan Incisor CH 3 2014 Tax Return - For - FilingShakilaMissz-KyutieJenkinsNoch keine Bewertungen

- FTF1327867575806Dokument3 SeitenFTF1327867575806erzahler0% (1)

- FTF1302745105156Dokument5 SeitenFTF13027451051562sly4youNoch keine Bewertungen

- U.S. Individual Income Tax Return 1040A: Filing StatusDokument3 SeitenU.S. Individual Income Tax Return 1040A: Filing StatusYosbanyNoch keine Bewertungen

- TaxDokument9 SeitenTaxKuan ChenNoch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument2 SeitenU.S. Individual Income Tax Returnapi-310622354Noch keine Bewertungen

- Form 1040Dokument2 SeitenForm 1040karthu48Noch keine Bewertungen

- U.S. Individual Income Tax ReturnDokument3 SeitenU.S. Individual Income Tax Returnyupper2014Noch keine Bewertungen

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDokument3 SeitenCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnSarah Kuldip50% (4)

- Jeff Bell 2012 Tax ReturnDokument71 SeitenJeff Bell 2012 Tax ReturnRaylene_Noch keine Bewertungen

- U.S. Nonresident Alien Income Tax Return: Please Print or TypeDokument5 SeitenU.S. Nonresident Alien Income Tax Return: Please Print or TypepdizypdizyNoch keine Bewertungen

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDokument2 SeitenAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesKel TranNoch keine Bewertungen

- 2022 Draft Schedule ADokument2 Seiten2022 Draft Schedule ARiley CareNoch keine Bewertungen

- Alice Tax FormDokument6 SeitenAlice Tax FormShrey MangalNoch keine Bewertungen

- Taxes Are FunDokument2 SeitenTaxes Are Funlfoirirjrkjbghghg999Noch keine Bewertungen

- Form 9465 (Installment Agreement Request)Dokument2 SeitenForm 9465 (Installment Agreement Request)Benne JamesNoch keine Bewertungen

- TaxReturn PDFDokument7 SeitenTaxReturn PDFChristine WillisNoch keine Bewertungen

- 2011 Irs Tax Form 1040 A Individual Income Tax ReturnDokument3 Seiten2011 Irs Tax Form 1040 A Individual Income Tax ReturnscribddownloadedNoch keine Bewertungen

- Joint Astronomy Centre - Birthday Stars - FinalDokument2 SeitenJoint Astronomy Centre - Birthday Stars - Finalhail2pigdumNoch keine Bewertungen

- MO-1040A Fillable Calculating - 2015 PDFDokument3 SeitenMO-1040A Fillable Calculating - 2015 PDFAnonymous 3RVba19mNoch keine Bewertungen

- 1040x2 PDFDokument2 Seiten1040x2 PDFolddiggerNoch keine Bewertungen

- Mikeandjennykelly@Gmail - Com 2011Dokument6 SeitenMikeandjennykelly@Gmail - Com 2011Melanie RoseNoch keine Bewertungen

- F 1040 NRDokument5 SeitenF 1040 NRsrao_919525Noch keine Bewertungen

- 2015 TaxReturn GregAbbottDokument14 Seiten2015 TaxReturn GregAbbottDana ThompsonNoch keine Bewertungen

- Form 9465-PDF Reader ProDokument2 SeitenForm 9465-PDF Reader ProEdward FederisoNoch keine Bewertungen

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)Dokument4 SeitenWithholding Certificate For Pension or Annuity Payments: Personal Allowances Worksheet (Keep For Your Records.)ts0m3Noch keine Bewertungen

- Glacier Tax User GuideDokument5 SeitenGlacier Tax User Guideinter4ever77Noch keine Bewertungen

- AlaAL ZAALIG2011Dokument5 SeitenAlaAL ZAALIG2011Ala AlzaaligNoch keine Bewertungen

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDokument6 SeitenCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax Returnapi-252942620Noch keine Bewertungen

- U.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Dokument2 SeitenU.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Renee Leon100% (1)

- Tax Return ProjectDokument62 SeitenTax Return ProjectGiovaniPerez100% (1)

- Health Savings Accounts (Hsas)Dokument2 SeitenHealth Savings Accounts (Hsas)Anonymous LaV8mFnemNoch keine Bewertungen

- Zuckerman2015 Tax ReturnDokument3 SeitenZuckerman2015 Tax ReturnAnonymous 2zbzrvNoch keine Bewertungen

- Fernando Vazquez567935467Dokument21 SeitenFernando Vazquez567935467Richivee100% (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnVon EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNoch keine Bewertungen

- Features of SBI Simply Save CardDokument2 SeitenFeatures of SBI Simply Save CardPradyumna CbNoch keine Bewertungen

- Vyuptakesh Sharan - Fundamentals of Financial Management (2011, Pearson Education) PDFDokument550 SeitenVyuptakesh Sharan - Fundamentals of Financial Management (2011, Pearson Education) PDFShivaang Maheshwari67% (3)

- TimeDokument88 SeitenTimeprashantNoch keine Bewertungen

- Assigment On LLPDokument50 SeitenAssigment On LLPDikshant GopaliaNoch keine Bewertungen

- Succession ApplicationDokument220 SeitenSuccession ApplicationRaja Khan50% (2)

- 信安基金- 投資報告Dokument20 Seiten信安基金- 投資報告ming fungNoch keine Bewertungen

- Picard Vs Avellino and BienesDokument111 SeitenPicard Vs Avellino and BienesjpeppardNoch keine Bewertungen

- Wallstreetjournalasia 20170523 The Wall Street Journal AsiaDokument24 SeitenWallstreetjournalasia 20170523 The Wall Street Journal AsiaJohn Paul (eschatology101 info)Noch keine Bewertungen

- Chapter 2 PPT - UpdatedDokument58 SeitenChapter 2 PPT - UpdatedmmNoch keine Bewertungen

- Mathematics Statistics PDFDokument8 SeitenMathematics Statistics PDFSanket SalviNoch keine Bewertungen

- Sirisha 1234 PDFDokument54 SeitenSirisha 1234 PDFAMAR NATHNoch keine Bewertungen

- Bunker HedgingDokument30 SeitenBunker Hedgingukhalanthar100% (6)

- Proxy Tax On Web (ENG)Dokument3 SeitenProxy Tax On Web (ENG)Saša TepićNoch keine Bewertungen

- Consultant Application Form BookDokument2 SeitenConsultant Application Form Bookhetalben bhatt100% (1)

- Tally Model Question PaperDokument2 SeitenTally Model Question PaperMahaveer Choudhary100% (1)

- Practical Application of Cluster IndicatorsDokument15 SeitenPractical Application of Cluster IndicatorsahlawamarhabaNoch keine Bewertungen

- Upgrad Campus - Financial Modelling & Analysis Program With PWC IndiaDokument11 SeitenUpgrad Campus - Financial Modelling & Analysis Program With PWC Indiarakesh naskarNoch keine Bewertungen

- Airtel Bill PDFDokument3 SeitenAirtel Bill PDFrameez qamarNoch keine Bewertungen

- Limine, 'On The Institution of Proceedings Against Him.' He Must, Moreover, Point Out To TheDokument2 SeitenLimine, 'On The Institution of Proceedings Against Him.' He Must, Moreover, Point Out To TheCelinka ChunNoch keine Bewertungen

- Financial Statement Group 2 Assignment 1Dokument4 SeitenFinancial Statement Group 2 Assignment 1Bryan LesmadiNoch keine Bewertungen

- Final CostDokument8 SeitenFinal CostPaul Mark DizonNoch keine Bewertungen

- 41129a99-de3e-4008-a328-78db2520feb0Dokument25 Seiten41129a99-de3e-4008-a328-78db2520feb0Palash TahasildarNoch keine Bewertungen

- Apuntes ContabilidadDokument206 SeitenApuntes ContabilidadclaudiazdeandresNoch keine Bewertungen

- Ipcr - Recio 1st Sem 2022Dokument2 SeitenIpcr - Recio 1st Sem 2022Angelic RecioNoch keine Bewertungen

- Chapter Seven: Cost-Volume-Profit AnalysisDokument35 SeitenChapter Seven: Cost-Volume-Profit AnalysisMade Ari HandayaniNoch keine Bewertungen

- Technical Asssistance For Policy Development For Enabling The Housing Market To Work in Indonesia. HOMIDokument580 SeitenTechnical Asssistance For Policy Development For Enabling The Housing Market To Work in Indonesia. HOMIOswar MungkasaNoch keine Bewertungen

- Pif 12 VoDokument10 SeitenPif 12 VoJohn Lee PueyoNoch keine Bewertungen

- Objection Preliminary Objection of The Ad H - ObjectionDokument18 SeitenObjection Preliminary Objection of The Ad H - ObjectionDistressedDebtInvestNoch keine Bewertungen

- NSPLDokument21 SeitenNSPLAkshayNoch keine Bewertungen