Beruflich Dokumente

Kultur Dokumente

Monthlystat 200401

Hochgeladen von

debasishOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Monthlystat 200401

Hochgeladen von

debasishCopyright:

Verfügbare Formate

Eurex Monthly Statistics

Derivatives Market

January 2004

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

ex_monthly

09.02.2004

page 2

Table of Contents

1

EUREX KEY FIGURES

1.1 Monthly Press Release

1.2 Eurex Participants

1.3 Eurex Total

10

1.4 Eurex Summary

13

EUREX - INDEX PRODUCTS

16

2.1 Dow Jones Euro-STOXX 50 Options

16

2.2 Dow Jones Euro STOXX 50 Futures

18

2.3 Dow Jones STOXX 50 Options

19

2.4 Dow Jones STOXX 50 Futures

20

2.5 VDAX Volatility Index

21

22

2.7 DAX Futures

24

2.8 TecDAX Option

26

2.9 TecDAX Future

27

2.10 NEMAX 50 Option

27

2.11 NEMAX 50 Future

29

2.12 SMI Options

30

2.13 SMI Futures

32

2.14 HEX25 Options

34

2.15 HEX25 Futures

35

2.16 Euro STOXX Sector Options

36

2.17 Euro STOXX Sector Options Breakdown by Individual Indices

37

2.18 Euro STOXX Sector Futures

39

2.19 Euro STOXX Sector Futures Breakdown by Individual Indices

40

2.20 STOXX 600 Sector Options

42

2.21 STOXX 600 Sector Options Breakdown by Individual Indices

43

2.22 STOXX 600 Sector Futures

44

2.23 STOXX 600 Sector Futures Breakdown by Individual Indices

46

2.24 Global Titans Options

47

2.25 Global Titans Futures

48

2.6 DAX Options

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

EUREX EQUITY PRODUCTS

ex_monthly

09.02.2004

page 3

49

3.1 Options on German Equities

49

3.2 Options on German Equities Breakdown by Individual Securities

51

3.3 Options on SMI Component Equities

54

3.4 Options on SMI Component Equities Breakdown by Individual

Securities

56

3.5 Options on French Equities

58

3.6 Options on French Equities Breakdown by Individual Securities

60

3.7 Options on Dutch Equities

63

3.8 Options on Dutch Equities Breakdown by Individual Securities

64

3.9 Options on Italian Equities

66

3.10 Options on Italian Equities Breakdown by Individual Securities

67

3.11 Options on Nordic Equities

67

3.12 Options on Nordic Equities Breakdown by Individual Securities

69

3.13 Options on US Equities

70

3.14 Options on US Equities Breakdown by Individual Securities

72

73

EXCHANGE TRADED FUNDS PRODUCTS

4.1 Options on Exchange Traded Funds

73

4.2 Options on Exchange Traded Funds Breakdown by Individual

Securities

75

4.3 Futures on Exchange Traded Funds

76

4.4 Futures on Exchange Traded Funds Breakdown by Individual

Securities

77

78

EUREX FIXED INCOME MARKET PRODUCTS

5.1 One-Month-Euribor Futures

78

5.2 Three-Month Euribor Futures

79

5.3 Options on Three-Month-Euribor Futures

81

5.4 Euro-Schatz Futures

82

5.5 Options on Euro-Schatz Futures

84

5.6 Euro-Bobl Futures

85

5.7 Options on Euro-Bobl Futures

87

5.8 Euro-Bund Futures

88

5.9 Options on Euro-Bund Futures

90

5.10 CONF Futures

91

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

ex_monthly

09.02.2004

page 4

5.11 Deliverable Bonds for Eurex Futures

93

5.12 Delivered Bonds for Eurex Futures

95

96

INTERNATIONAL OPTIONS AND FUTURES EXCHANGES

6.1 Total Turnover

96

6.2 Index Products

98

6.3 International Index Derivatives

100

6.4 Equity Options

114

6.5 Money Market Products

118

6.6 Capital Market Products

120

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

Eurex Key Figures

1.1

Monthly Press Release

ex_monthly

09.02.2004

page 5

Eurex Turns Over More than 91 Million Contracts in January

Record results in equity options and option on DJ Euro STOXX 50 index

Eurex, the international derivatives market, started out the year 2004 with good

results. The world's leading derivatives exchange turned over 91.4 million contracts

in January, about 7 percent higher than the volume posted in January 2003 (85

million contracts). The month's total corresponds to 4.35 million contracts traded

and cleared on a daily a verage. The highest growth rates were achieved in equitybased products, with several record results. Eurex Bonds also got the new year off

to a successful start with turnover of 14.2 billion euros in January, about 11 percent

higher than in January 2003.

A total of about 49 million contracts were traded and cleared in capital market

products at Eurex in January, slightly higher than the volume posted in January last

year (48 million contracts). Of this total, 20.5 million contracts were traded in the

Euro-Bund future, as compared with 22.3 million contracts in January 2003. Trading

in the Euro-Bobl future rose 5.6 percent to 12.9 million contracts. The largest

increase in the capital-market products segment at Eurex was achie ved in EuroSchatz futures with 11.2 million contracts traded, 21 percent higher than the

January 2003 volume.

In equity-based derivatives, 42.5 million contracts were traded at Eurex in January,

comprising 21.3 million contracts in equity-index derivatives, a 7 percent increase,

and 21.2 million contracts in equity options, a 40 percent increase compared with

the volume posted in January 2003. The top equity-index derivatives in January

were the futures and option on the DJ Euro STOXX 50 index, with a combined total

of some 15.1 million contracts traded. A new turnover record was achieved in the

option, with 7 million contracts traded, about 22 percent higher than the volume

posted the year before.

Trading in Dutch and French equity options was especially active in January. Eurex

achieved new record results with 872,000 contracts traded in the Dutch options

(beating the previous record of 816,000 contracts traded in October 2003), and

312,000 contracts traded in the French options (compared with the previous record

of 214,000 contracts in July 2003). Compared with January 2003, Eurex achieved

over two-thirds growth in the number of contracts traded in Dutch equity options,

and a market share of some 13 percent. In the French equity options segment,

Eurex achieved a sixfold increase in volume compared with January 2003, and also

a market share of 13 percent, measured in terms of the nominal value of the equity

options (the nominal value of the transactions).

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

Eurex Bonds, the electronic trading platform that rounds out the Eurex offerings in

the fixed-income segment, turned over 14.2 billion euros (single counting) in

January, which corresponds to an 11 percent increase compared with January 2003

(12.8 billion euros).

ex_monthly

09.02.2004

page 6

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

09.02.2004

page 7

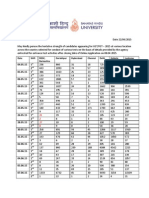

Eurex Participants

Number of Eurex Participants

Austria

Belgium

Denmark

Finland

France

Germany

Gibraltar

Greece

Ireland

Italy

Netherlands

Portugal

Spain

Sweden

Switzerland

United Kingdom

USA

Total

Eurex Participants (*)

Australia

1.2

ex_monthly

Total

Total

Total

Total

Total

Total

Total

Total

1

1

1

2

3

2

3

4

5

5

1

3

3

4

4

4

4

1

3

3

2

2

2

5

16

14

12

12

12

11

15

26

34

30

30

30

29

94

114

121

141

136

135

124

102

2

2

2

2

4

1

4

6

1

1

2

5

6

6

6

4

2

11

11

12

11

9

7

8

11

20

26

28

29

27

1

2

1

1

1

1

7

19

19

17

15

14

1

4

7

6

4

7

6

6

43

45

44

42

39

38

14

25

66

70

72

68

72

75

2

6

20

38

50

57

63

66

135

177

313

414

429

427

424

406

2004 1. Quarter

12

29

103

27

14

37

76

66

408

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

1

1

1

1

1

1

1

1

1

1

1

1

1

5

5

5

5

5

5

5

5

5

5

5

5

5

4

4

4

4

5

5

4

4

4

4

4

4

4

2

2

2

2

2

2

2

2

2

2

2

2

2

12

12

12

12

12

12

12

12

12

12

12

12

12

31

31

30

30

29

29

29

29

29

29

29

29

29

119

116

114

115

113

110

108

109

106

106

104

102

103

2

2

2

2

2

2

2

2

4

4

4

4

4

4

4

4

4

4

5

6

6

6

6

6

6

7

6

5

5

5

5

5

5

4

4

4

4

4

4

11

11

10

10

10

10

10

10

9

9

9

9

9

28

28

28

28

28

28

28

28

28

28

28

27

27

1

1

1

1

1

1

1

1

1

1

1

1

1

14

14

14

14

14

14

14

14

14

14

14

14

14

4

4

4

5

6

6

6

6

6

7

7

7

7

39

39

38

38

38

38

39

39

39

38

38

38

37

72

71

72

73

74

74

72

73

73

73

74

75

76

66

65

65

66

66

66

67

67

67

67

68

66

66

421

415

411

415

415

413

411

412

410

410

410

406

408

2004 Total

12

29

103

27

14

37

76

66

408

1996

1997

1998

1999

2000

2001

2002

2003

(*) Exchange Participants before September 28, 1998, only at Eurex Deutschland (former DTB).

Number of Eurex Participants

500

450

400

350

300

250

200

150

100

50

0

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

1.2.1

ex_monthly

09.02.2004

page 8

New and resigned Participants at Eurex

Eurex Participants ID

Eurex Participants

Clearingtype

Country

Baader Wertpapierhandelsbank Aktiengesellschaft

Bank of Piraeus Bank S.A.

Barclays Capital Securities Ltd.

Concord Trading GmbH

Prudential Financial Derivatives, LLC

NCM

NCM

NCM

NCM

NCM

Germany

Griechenland

Grobritannien

Germany

USA

ABN AMRO Bank (Deutschland) AG

FIMAT Switzerland AG

Prudential Equity Group, Inc.

GCM

NCM

NCM

Germany

Schweiz

USA

New Participants

BALFR

PIRAT

BACLO

COTFR

PFDNY

Resigned Participants

AARFR

FIMZH

PRUNY

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

09.02.2004

page 9

Turnover of Eurex Participants by Country

2004 1. Quarter

Switzerland

United Kingdom

2.63%

3.43%

3.81%

0.41%

0.38%

0.21%

0.54%

0.49%

0.60%

0.73%

0.68%

1.31%

1.47%

1.97%

2.39%

0.00%

0.02%

0.02%

0.02%

0.02%

1.13%

1.13%

1.09%

1.14%

1.04%

0.06%

0.16%

0.40%

0.40%

0.14%

13.99%

13.20%

8.84%

8.21%

7.91%

24.93%

29.98%

33.01%

40.93%

44.96%

6.43%

7.80%

9.75%

10.85%

11.32%

USA

Sweden

0.02%

0.03%

0.07%

Spain

0.02%

0.07%

0.08%

0.12%

0.26%

Portugal

40.83%

32.39%

30.87%

24.94%

20.33%

Netherlands

7.99%

8.93%

9.24%

9.54%

9.29%

Italy

Germany

0.27%

0.38%

0.45%

0.36%

0.26%

Ireland

France

0.18%

0.19%

0.10%

0.15%

0.12%

Greece

Finland

0.56%

0.35%

0.25%

0.21%

0.33%

Gibraltar

Denmark

0.07%

0.13%

0.11%

0.13%

0.14%

Austria

0.00%

0.00%

Australia

1999 Total

2000 Total

2001 Total

2002 Total

2003 Total

Belgium

Turnover of Eurex Participants by Country based on the contracts traded

0.10%

0.33%

0.12%

0.24%

9.26%

19.09%

0.08%

0.58%

0.80%

2.84%

0.02%

0.81%

0.21%

7.08%

48.13%

10.30%

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

0.01%

0.01%

0.00%

-

0.10%

0.11%

0.16%

0.17%

0.15%

0.12%

0.14%

0.11%

0.15%

0.15%

0.15%

0.18%

0.10%

0.27%

0.24%

0.45%

0.29%

0.24%

0.31%

0.26%

0.29%

0.31%

0.49%

0.36%

0.35%

0.33%

0.12%

0.11%

0.12%

0.12%

0.11%

0.12%

0.13%

0.16%

0.11%

0.14%

0.15%

0.12%

0.12%

0.28%

0.28%

0.29%

0.24%

0.26%

0.20%

0.19%

0.21%

0.32%

0.21%

0.20%

0.41%

0.24%

9.02%

8.73%

9.76%

8.60%

9.36%

9.41%

8.52%

8.78%

10.27%

9.21%

9.78%

9.75%

9.23%

19.82%

19.98%

20.51%

19.68%

19.85%

21.59%

20.30%

21.14%

20.08%

18.89%

20.18%

22.29%

19.03%

0.08%

0.18%

0.10%

0.19%

0.19%

0.18%

0.20%

0.16%

0.46%

0.28%

0.38%

0.86%

0.30%

0.05%

0.06%

0.05%

0.05%

0.05%

0.05%

0.06%

0.09%

0.12%

0.07%

0.13%

0.06%

0.08%

0.37%

0.33%

0.31%

0.37%

0.39%

0.32%

0.32%

0.34%

0.40%

0.44%

0.50%

0.55%

0.58%

0.83%

0.84%

0.65%

0.69%

0.70%

0.68%

0.73%

0.64%

0.68%

0.79%

0.86%

0.71%

0.80%

2.44%

2.29%

1.80%

2.60%

2.52%

1.91%

2.35%

2.58%

2.38%

2.78%

2.89%

2.46%

2.83%

0.03%

0.02%

0.02%

0.02%

0.02%

0.03%

0.02%

0.02%

0.02%

0.03%

0.02%

0.02%

0.02%

1.04%

1.20%

1.10%

1.06%

1.14%

1.03%

0.98%

0.88%

1.04%

1.08%

1.02%

0.91%

0.81%

0.19%

0.10%

0.13%

0.13%

0.11%

0.19%

0.16%

0.15%

0.11%

0.13%

0.17%

0.17%

0.21%

7.73%

7.84%

9.59%

8.59%

6.65%

8.13%

6.22%

8.18%

8.22%

6.39%

7.46%

9.92%

7.06%

45.66%

46.01%

44.93%

45.58%

45.89%

45.03%

45.50%

43.83%

44.87%

47.68%

45.26%

41.72%

47.98%

11.97%

11.66%

10.03%

11.63%

12.35%

10.70%

13.93%

12.45%

10.46%

11.26%

10.51%

9.17%

10.27%

2003 Total

0.00%

0.10%

0.33%

0.12%

0.24%

9.23%

19.03%

0.30%

0.08%

0.58%

0.80%

2.83%

0.02%

0.81%

0.21%

7.06%

47.98%

10.27%

Exchange Participants before September 28, 1998, only at Eurex Deutschland (former DTB).

Market Share of Eurex Participants - Country of Origin

60.00%

50.00%

Market Share in 2002

40.00%

Market Share in 2003

30.00%

20.00%

10.00%

US

A

Sw

itze

rla

nd

Un

ite

dK

ing

do

m

Sw

ed

en

Sp

ain

Po

rtu

ga

l

Ne

the

rla

nd

s

Ita

ly

Ire

lan

d

Gr

ee

ce

Gi

bra

lta

r

Ge

rm

an

y

Fra

nc

e

Fin

lan

d

De

nm

ark

Be

lgi

um

Au

str

ia

0.00%

Au

stra

lia

1.2.2

ex_monthly

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

1.3

Eurex Total

1.3.1

Eurex Total Volume in EUR million

Index Products

page 10

Change YoY

2,270,843

3,093,409

3,396,874

4,759,859

5,860,396

7,087,331

7,545,643

36.22%

9.81%

40.12%

23.12%

20.94%

6.47%

299,482

447,499

402,617

558,660

710,773

571,552

376,884

2004 1. Quarter

734,121

25.14%

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

586,651

485,513

796,640

511,750

493,492

740,090

538,946

495,143

901,928

701,680

621,256

672,555

734,121

18.56%

-2.84%

26.73%

7.46%

2.70%

-4.99%

-32.01%

-8.79%

24.93%

11.20%

25.26%

23.62%

25.14%

2004 Total

734,121

25.14%

8,000,000

09.02.2004

Equity Products

Change YoY

1997 Total

1998 Total

1999 Total

2000 Total

2001 Total

2002 Total

2003 Total

ex_monthly

Fixed Income Products

Change YoY

49.42%

-10.03%

38.76%

27.23%

-19.59%

-34.06%

9,052,551

20,226,524

31,175,761

31,140,790

44,365,991

48,344,467

63,327,567

48,840

54.71%

5,480,412

31,569

23,571

27,185

28,414

28,917

39,076

35,332

30,119

35,580

34,365

32,554

30,201

48,840

-56.80%

-57.20%

-50.62%

-61.51%

-58.20%

-18.47%

-29.24%

-9.46%

9.49%

10.57%

10.74%

42.06%

54.71%

5,399,726

4,857,754

6,567,898

4,853,068

5,130,126

6,698,802

5,909,626

4,269,903

5,887,624

5,858,368

4,314,295

3,580,378

5,480,412

48,840

54.71%

5,480,412

1.49%

XTF Products

Total

Change YoY

123.43%

54.13%

-0.11%

42.47%

8.97%

30.99%

Change YoY

177

684

11,633,841

23,768,082

34,975,252

36,459,308

50,937,159

56,003,527

71,250,778

1.49%

70

-35.36%

6,263,443

4.08%

26.93%

40.00%

70.54%

47.40%

40.02%

80.63%

35.20%

-8.08%

16.93%

6.40%

17.47%

24.56%

1.49%

109

69

150

138

40

25

24

36

30

17

22

24

70

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

109.44%

-85.85%

-35.36%

6,018,055

5,366,908

7,391,873

5,393,370

5,652,574

7,477,992

6,483,929

4,795,201

6,825,163

6,594,430

4,968,127

4,283,157

6,263,443

24.81%

33.36%

63.00%

40.36%

34.15%

64.88%

24.36%

-8.17%

17.88%

6.91%

18.35%

24.51%

4.08%

70

-35.36%

6,263,443

4.08%

Volume (bars) and Open Interest (lines) in EUR million

104.30%

47.15%

4.24%

39.71%

9.95%

27.23%

1,200,000

7,000,000

1,000,000

6,000,000

Volume

4,000,000

600,000

3,000,000

400,000

2,000,000

200,000

1,000,000

0

0

Jan

Feb

Mar

Apr

May

Jun

Jul

2003

Aug

Sep

Oct

Nov

Dec

Jan

2004

Open Interest

800,000

5,000,000

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

1.3.2

ex_monthly

09.02.2004

page 11

Eurex Total Traded Contracts

Index Products

Equity Products

Change YoY

1997 Total

1998 Total

1999 Total

2000 Total

2001 Total

2002 Total

2003 Total

44,455,743

45,455,822

65,608,952

75,794,263

131,988,426

210,705,224

264,234,616

Change YoY

Fixed Income Products

Change YoY

26.83%

44.34%

15.52%

74.14%

59.64%

25.40%

42,695,173

60,958,770

64,805,177

89,237,816

132,543,515

143,304,584

188,239,823

42.78%

6.31%

37.70%

48.53%

8.12%

31.36%

64,581,401

141,793,628

248,734,510

289,039,427

409,625,922

447,128,870

562,199,527

XTF Products

Total

Change YoY

Change YoY

119.56%

75.42%

16.20%

41.72%

9.16%

25.74%

62,195

258,346

315.38%

151,983,100

248,222,487

379,148,639

454,071,506

674,157,863

801,200,873

1,014,932,312

63.32%

52.75%

19.76%

48.47%

18.84%

26.68%

2004 1. Quarter

21,289,020

-1.63%

21,235,975

39.81%

48,819,887

1.44%

19,121

-51.73%

91,364,003

7.49%

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

21,641,969

19,085,299

32,838,414

19,860,312

18,565,180

25,733,752

18,348,089

16,306,389

29,373,623

22,811,766

19,725,334

19,944,489

21,289,020

78.63%

50.42%

123.23%

75.86%

54.63%

17.20%

-25.36%

-5.13%

16.39%

-0.57%

14.86%

6.02%

-1.63%

15,188,649

11,795,089

14,937,178

15,601,098

14,678,794

18,587,607

17,210,855

15,552,143

17,582,418

17,415,287

15,815,752

13,874,953

21,235,975

11.44%

-1.75%

27.65%

14.54%

14.13%

78.11%

40.19%

76.28%

37.48%

30.35%

26.22%

49.64%

39.81%

48,125,650

42,761,131

58,508,179

43,331,606

44,926,319

58,027,165

51,999,985

37,992,336

52,623,921

52,760,374

38,981,446

32,161,415

48,819,887

21.53%

31.99%

60.91%

39.33%

29.83%

67.21%

28.04%

-10.71%

15.35%

5.01%

16.77%

23.92%

1.44%

39,611

28,141

63,247

55,550

14,679

8,717

8,322

11,888

9,090

5,669

6,710

6,722

19,121

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

133.72%

-88.67%

-51.73%

84,995,879

73,669,660

106,347,018

78,848,566

78,184,972

102,357,241

87,567,251

69,862,756

99,589,052

92,993,096

74,529,242

65,987,579

91,364,003

30.08%

29.04%

69.41%

40.76%

31.47%

52.55%

13.03%

1.90%

19.06%

7.45%

18.13%

21.98%

7.49%

2004 Total

21,289,020

-1.63%

21,235,975

39.81%

48,819,887

1.44%

19,121

-51.73%

91,364,003

7.49%

Traded Contracts (bars) and Open Interest (lines) in Contracts

70,000,000

60,000,000

Traded Contracts

100,000,000

50,000,000

80,000,000

40,000,000

60,000,000

30,000,000

40,000,000

20,000,000

20,000,000

10,000,000

0

Jan

Feb

Mar

Apr

May

Jun

Jul

2003

Aug

Sep

Oct

Nov

Dec

Jan

2004

Open Interest

120,000,000

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

1.3.3

09.02.2004

page 12

Eurex Total Value of Open Interest in EUR million

####

Index Products

Equity Products

Change YoY

1997

1998

1999

2000

2001

2002

2003

1.3.4

ex_monthly

Change YoY

Total

Total

Total

Total

Total

Total

Total

53,744

67,556

137,814

196,686

282,658

355,803

377,211

25.70%

104.00%

42.72%

43.71%

25.88%

6.02%

30,733

24,295

41,930

58,402

78,102

54,587

56,480

2004 1. Quarter

456,534

15.17%

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

396,401

424,668

387,572

419,651

442,239

365,604

396,100

429,392

433,751

464,029

492,942

377,211

456,534

20.85%

13.16%

13.41%

12.09%

8.10%

3.10%

-5.38%

-4.44%

6.02%

1.34%

1.14%

6.02%

15.17%

2004 Total

456,534

15.17%

Fixed Income Products

Change YoY

-20.89%

72.58%

39.28%

33.73%

-30.11%

3.55%

104,712

170,613

266,622

295,793

336,053

314,835

350,948

62.94%

56.27%

10.94%

13.61%

-6.31%

11.47%

72,782

11.87%

65,061

69,562

61,893

66,055

71,618

58,938

69,184

75,960

73,458

80,279

84,498

56,480

72,782

-32.49%

-35.13%

-34.22%

-37.67%

-31.41%

-26.27%

-21.32%

-14.74%

-5.60%

-2.85%

-3.61%

3.55%

11.87%

464,096

469,902

501,486

488,672

465,883

395,483

443,922

433,661

364,275

401,106

422,708

384,435

350,948

464,096

72,782

11.87%

464,096

-1.24%

XTF Products

Total

Change YoY

Change YoY

42

71

0.00%

240,504

262,465

446,366

550,881

696,813

725,224

784,649

38.53%

70.07%

23.41%

26.49%

4.08%

8.19%

-1.24%

28

-71.31%

993,439

6.65%

20.58%

61.01%

58.61%

39.70%

28.81%

39.77%

16.35%

2.98%

4.28%

-1.09%

18.10%

11.47%

-1.24%

96

71

118

226

238

37

37

49

36

37

36

9

28

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

245.23%

-77.57%

-71.31%

931,460

995,787

938,255

951,815

909,577

868,502

898,982

869,677

908,351

967,053

961,911

784,649

993,439

14.42%

25.42%

26.12%

16.95%

10.85%

15.47%

2.24%

-2.52%

4.22%

-0.08%

6.81%

8.19%

6.65%

28

-71.31%

993,439

6.65%

Eurex Total Open Interest

Index Products

Equity Products

Change YoY

1997

1998

1999

2000

2001

2002

2003

Change YoY

Fixed Income Products

Change YoY

Total

Total

Total

Total

Total

Total

Total

1,916,582

1,777,293

3,327,406

4,296,448

8,478,306

13,595,766

14,768,479

24.14%

87.22%

29.12%

97.33%

60.36%

8.63%

3,187,776

4,547,852

7,694,031

10,681,036

17,201,593

22,096,244

27,691,362

43.64%

69.18%

38.82%

61.05%

28.45%

25.40%

609,701

804,853

1,764,368

2,562,555

2,961,548

2,724,330

2,992,136

32.01%

119.22%

45.24%

15.57%

-8.01%

9.83%

2004 1. Quarter

17,396,663

10.67%

34,906,398

24.96%

4,027,486

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

15,718,959

17,223,667

16,168,159

17,129,622

18,160,658

15,201,686

16,387,452

17,693,389

17,809,963

18,878,863

19,972,051

14,768,479

17,396,663

57.04%

48.51%

57.60%

52.34%

45.93%

32.52%

14.12%

12.93%

18.77%

11.18%

10.19%

8.63%

10.67%

27,933,581

30,372,305

28,384,219

31,583,215

34,390,410

28,992,873

34,069,489

37,513,533

35,875,625

39,632,270

41,515,311

27,691,362

34,906,398

32.32%

27.64%

38.59%

40.74%

50.85%

59.68%

64.33%

67.16%

30.18%

30.02%

24.78%

25.40%

24.96%

2004 Total

17,396,663

10.67%

34,906,398

24.96%

XTF Products

Total

Change YoY

Change YoY

13,634

28,726

-77.65%

5,720,552

7,129,998

12,785,805

17,540,039

28,641,447

38,416,340

45,454,996

36.75%

79.32%

37.18%

63.29%

34.13%

18.32%

-2.36%

7,994

-77.65%

56,338,541

17.83%

4,124,811

4,371,614

4,288,980

4,082,838

3,356,596

3,768,915

3,716,101

3,023,066

3,422,627

3,667,315

3,323,921

2,992,136

4,027,486

19.39%

59.85%

55.44%

37.14%

22.69%

33.16%

12.57%

-2.07%

2.39%

-2.33%

17.87%

9.83%

-2.36%

35,764

28,726

49,656

87,869

91,111

12,860

12,397

16,736

11,731

12,301

11,787

3,019

7,994

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

0.00%

311.41%

-77.86%

-77.65%

47,813,115

51,996,312

48,891,014

52,883,544

55,998,775

47,976,334

54,185,439

58,246,724

57,119,946

62,190,749

64,823,070

45,454,996

56,338,541

38.29%

36.37%

45.95%

44.24%

47.45%

47.81%

41.13%

41.39%

24.45%

21.42%

19.56%

18.32%

17.83%

4,027,486

-2.36%

7,994

-77.65%

56,338,541

17.83%

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

1.3.5

ex_monthly

09.02.2004

page 13

Eurex Total Paid Premiums, Market Share per Account Group and Trades

Trades

1997

1998

1999

2000

2001

2002

2003

Market Share per Account Group

Agent

Principal Market Maker

Paid Premiums in EUR

Calls

Puts

Total

Change YoY

Total

Total

Total

Total

Total

Total

Total

6,270,766

10,481,417

17,329,128

20,415,123

30,736,158

44,589,428

56,208,089

35.66%

41.56%

44.55%

42.06%

47.05%

45.01%

46.42%

24.90%

22.56%

22.39%

25.45%

25.57%

22.45%

21.51%

39.44%

35.87%

33.06%

32.49%

27.37%

32.54%

32.07%

19,818,803,670

26,436,879,060

27,871,080,199

43,601,361,853

52,574,214,398

61,816,915,990

63,263,544,042

11,864,999,670

21,829,972,259

22,489,503,139

42,765,677,518

90,604,845,968

95,777,325,652

62,712,916,385

31,680,730,537

48,261,217,070

50,349,387,211

86,360,107,069

143,176,376,566

157,594,241,642

125,976,460,427

52.34%

4.33%

71.52%

65.79%

10.07%

-20.06%

2004 1. Quarter

4,473,739

46.12%

22.02%

31.86%

7,156,258,966

5,206,016,176

12,362,275,142

-16.30%

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

5,081,657

4,470,392

5,750,394

4,680,222

4,512,753

5,102,621

5,009,744

3,950,611

5,028,252

5,216,846

4,144,313

3,260,284

4,473,739

45.17%

46.66%

49.06%

47.18%

47.03%

47.07%

44.68%

43.58%

47.45%

47.05%

45.25%

45.13%

46.12%

22.90%

22.38%

20.63%

21.42%

21.70%

20.91%

23.22%

21.43%

19.48%

21.89%

22.06%

20.65%

22.02%

31.93%

30.96%

30.31%

31.40%

31.26%

32.02%

32.10%

34.99%

33.07%

31.06%

32.69%

34.22%

31.86%

5,786,869,485

4,379,819,127

6,098,260,104

5,649,512,994

4,581,731,255

7,610,675,831

4,406,490,549

4,322,056,505

5,811,221,302

5,627,192,567

4,995,600,104

3,994,114,219

7,156,258,966

8,982,567,862

7,474,465,366

7,883,810,527

4,868,916,939

4,950,270,029

4,701,691,171

3,943,573,710

3,825,188,473

5,541,096,384

4,108,839,924

3,702,707,093

2,729,788,905

5,206,016,176

14,769,437,347

11,854,284,493

13,982,070,631

10,518,429,934

9,532,001,284

12,312,367,002

8,350,064,259

8,147,244,978

11,352,317,686

9,736,032,491

8,698,307,197

6,723,903,124

12,362,275,142

-6.96%

26.98%

60.84%

-31.46%

-47.58%

5.33%

-50.35%

-27.10%

-16.34%

-41.07%

-26.56%

-21.31%

-16.30%

2004 Total

4,473,739

46.12%

22.02%

31.86%

7,156,258,966

5,206,016,176

12,362,275,142

-16.30%

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

1.4

Eurex Summary

1.4.1

Volume in EUR and Traded Contracts

Traded Contracts

Jan-04

ex_monthly

09.02.2004

page 14

Volume in EUR millions

Jan-04

Dec-03

Dec-03

Jan-03

Y-T-D

Chg YoY

Jan-03

Y-T-D

Chg YoY

6,997,540

104

25,648

84

0

3,051,647

2,888

100

308,523

450

10,386,984

4,173,179

595

57,335

2

0

2,509,078

1,638

575

214,965

1,510

6,958,877

5,730,380

7,325

197,686

2,500

0

3,521,433

1,072

381,733

0

9,842,129

6,997,540

104

25,648

84

0

3,051,647

2,888

100

308,523

450

10,386,984

22.11%

-98.58%

-87.03%

-96.64%

-13.34%

-90.67%

-19.18%

5.54%

195,391

3

328

1

0

60,102

19

0

10,836

7

266,686

108,156

15

741

0

0

46,842

10

0

7,201

24

162,997

137,415

195

2,327

36

0

51,754

0

11,501

0

203,965

195,391

3

328

1

0

60,102

19

0

10,836

7

266,686

42.19%

-98.58%

-85.91%

-96.21%

16.13%

-87.13%

-5.78%

30.75%

DJ Euro STOXX 50

DJ STOXX 50

DJ Euro STOXX Sector Indexes

DJ STOXX 600 Sector Indexes

Dow Jones Global Titans 50

DAX

TecDAX

NEMAX 50

SMI

HEX25

Index Futures

8,191,117

39,884

45,332

5,838

0

2,079,360

18,636

3,169

517,628

1,072

10,902,036

9,402,025

132,163

217,593

17,915

1,730

2,286,961

49,887

53,902

815,548

7,888

12,985,612

8,831,456

49,611

97,708

2,136

2

2,113,291

118,296

586,970

370

11,799,840

8,191,117

39,884

45,332

5,838

0

2,079,360

18,636

3,169

517,628

1,072

10,902,036

-7.25%

-19.61%

-53.60%

173.31%

-100.00%

-1.61%

-97.32%

-11.81%

189.73%

-7.61%

233,795

1,082

589

80

0

213,043

112

2

18,716

17

467,435

253,563

3,434

2,745

249

34

220,937

268

30

28,148

121

509,558

208,099

1,165

1,105

29

0

153,748

45

17,376

5

382,686

233,795

1,082

589

80

0

213,043

112

2

18,716

17

467,435

12.35%

-7.13%

-46.73%

175.42%

-100.00%

38.57%

-95.49%

7.71%

249.15%

22.15%

All Index Products

21,289,020

19,944,489

21,641,969

21,289,020

-1.63%

734,121

672,555

586,651

734,121

25.14%

Options Exchange Traded Funds

Futures on Exchange Traded Funds

3,478

15,643

4,526

2,196

3,142

36,469

3,478

15,643

10.69%

-57.11%

13

57

16

8

9

99

13

57

33.95%

-41.99%

All XTF Products

19,121

6,722

39,611

19,121

-51.73%

70

24

109

70

-35.36%

German Equities

SMI Components

French Equities

Dutch Equities

Italian Equities

Nordic Equities

U.S. Equities

13,912,492

4,805,860

312,700

872,576

6,791

1,323,343

2,213

9,477,837

2,981,560

163,435

392,066

15,328

842,818

1,909

9,206,213

3,942,227

59,744

517,537

9,999

1,449,917

3,012

13,912,492

4,805,860

312,700

872,576

6,791

1,323,343

2,213

51.12%

21.91%

423.40%

68.60%

-32.08%

-8.73%

-26.53%

32,859

10,666

1,278

1,908

15

2,108

6

20,630

6,817

725

740

44

1,241

5

19,832

8,042

258

994

40

2,395

8

32,859

10,666

1,278

1,908

15

2,108

6

65.69%

32.62%

396.11%

91.88%

-62.41%

-12.00%

-19.01%

All Equity Products

21,235,975

13,874,953

15,188,649

21,235,975

39.81%

48,840

30,201

31,569

48,840

54.71%

0

48,118

0

0

11,200,325

12,932,673

20,538,867

0

10,547

44,730,530

0

49,238

0

0

7,202,705

9,227,155

13,434,122

0

32,892

29,946,112

0

38,391

0

161

9,262,553

12,244,884

22,301,183

0

11,853

43,859,025

0

48,118

0

0

11,200,325

12,932,673

20,538,867

0

10,547

44,730,530

25.34%

-100.00%

20.92%

5.62%

-7.90%

-11.02%

1.99%

0

47,120

0

0

1,188,306

1,441,044

2,345,982

0

865

5,023,317

0

48,157

0

0

760,064

1,014,973

1,510,197

0

2,680

3,336,073

0

37,384

0

39

979,651

1,364,350

2,542,580

0

990

4,925,058

0

47,120

0

0

1,188,306

1,441,044

2,345,982

0

865

5,023,317

26.04%

-100.00%

21.30%

5.62%

-7.73%

-12.64%

2.00%

819,957

720,307

2,549,093

4,089,357

465,879

560,764

1,188,660

2,215,303

1,187,716

458,637

2,620,272

4,266,625

819,957

720,307

2,549,093

4,089,357

-30.96%

57.05%

-2.72%

-4.15%

86,969

79,990

290,135

457,094

49,127

61,594

133,584

244,305

125,809

50,933

297,926

474,668

86,969

79,990

290,135

457,094

-30.87%

57.05%

-2.62%

-3.70%

All Fixed Income Products

48,819,887

32,161,415

48,125,650

48,819,887

1.44%

5,480,412

3,580,378

5,399,726

5,480,412

1.49%

All Eurex Products

91,364,003

65,987,579

84,995,879

91,364,003

7.49%

6,263,443

4,283,157

6,018,055

6,263,443

4.08%

Index Products

Index Options

DJ Euro STOXX 50 Option

DJ STOXX 50 Option

DJ Euro STOXX Sector Indexes

DJ STOXX 600 Sector Indexes

Dow Jones Global Titans 50

DAX Option

TecDAX Option

NEMAX 50 Option

SMI Option

HEX25 Option

Index Options

Index Futures

XTF Products

Equity Products

Equity Options

Fixed Income Products

Fixed Income Futures

One-Month-Euribor Future

Three-Month-Euribor Future

Opt. on Three-Month-Euribor Fut.

One-Month-EONIA Future

Euro-Schatz Future

Euro-Bobl Future

Euro-Bund Future

Euro-Buxl Future

CONF Future

All Fixed Income Futures

Options on Fixed Income Futures

Opt. on Euro-Schatz Future

Opt. on Euro-Bobl Future

Opt. on Euro-Bund Future

All Opt. on Fixed Income Fut.

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

ex_monthly

09.02.2004

page 15

Eurex Summary

1.4.2

Open Interest, Value of Open Interest and Paid Premiums

Open Interest in Contracts

Jan-04

Jan-03

Index Products

Index Options

DJ Euro STOXX 50

DJ STOXX 50

DJ Euro STOXX Sector Indexes

DJ STOXX 600 Sector Indexes

Dow Jones Global Titans 50

DAX

TecDAX Option

NEMAX 50

SMI

HEX25

Index Options

Chg YoY

Open Interest in EUR millions

Jan-04

Jan-03

Chg YoY

Paid Premiums in EUR millions

Jan-04

Dec-03

Jan-03

Y-T-D

Chg YoY

11,083,045

4,833

163,166

8,049

0

3,733,247

9,009

2,683

460,478

75

15,464,585

7,946,184

16,004

546,971

18,465

40

4,245,263

77,801

575,652

0

13,426,380

39.48%

-69.80%

-70.17%

-56.41%

-100.00%

-12.06%

-96.55%

-20.01%

15.18%

297,423

119

1,836

121

0

66,277

53

2

15,030

1

380,863

226,456

428

7,075

344

1

80,922

74

19,115

0

335,642

31.34%

-72.10%

-74.06%

-64.88%

-100.00%

-18.10%

-96.71%

-21.37%

13.47%

7,180

0

12

0

0

1,592

1

0

253

0

9,038

3,710

1

13

0

0

1,440

1

0

149

0

5,314

8,317

19

157

1

0

2,901

0

419

0

11,841

7,180

0

12

0

0

1,592

1

0

253

0

9,038

-13.66%

-99.56%

-92.41%

-96.41%

-45.13%

-88.15%

-39.78%

-23.67%

1,317,246

37,824

80,520

12,127

415

302,372

21,525

25,475

131,997

2,577

1,932,078

1,521,497

48,170

106,222

10,933

28

278,119

162,543

162,159

2,908

2,292,579

-13.42%

-21.48%

-24.20%

10.92%

1382.14%

8.72%

-84.33%

-18.60%

-11.38%

-15.72%

37,530

1,020

1,067

172

8

30,843

133

17

4,840

41

75,670

34,274

1,083

1,119

142

1

19,190

59

4,563

35

60,759

9.50%

-5.81%

-4.69%

20.60%

1539.56%

60.72%

-71.97%

6.08%

16.89%

24.54%

17,396,663

15,718,959

10.67%

456,534

396,401

15.17%

9,038

5,314

11,841

9,038

-23.67%

Options Exchange Traded Funds

Futures on Exchange Traded Funds

4,551

3,443

6,598

29,166

-31.02%

-88.20%

15

12

22

74

-31.59%

-83.27%

1

-

1

-

0

-

1

-

78.08%

-

All XTF Products

7,994

35,764

-77.65%

28

96

-71.31%

78.08%

German Equities

SMI Components

French Equities

Dutch Equities

Italian Equities

Nordic Equities

U.S. Equities

21,440,652

8,986,641

401,971

1,646,432

16,130

2,409,589

4,983

15,658,418

8,020,636

54,904

915,892

10,856

3,269,500

3,375

36.93%

12.04%

632.13%

79.76%

48.58%

-26.30%

47.64%

45,187

19,099

1,533

3,019

32

3,897

15

38,063

18,680

240

1,921

44

6,104

9

18.72%

2.24%

539.75%

57.17%

-27.17%

-36.16%

65.23%

2,580

454

67

108

0

113

0

1,015

247

45

36

3

62

0

2,141

454

15

98

2

217

0

2,580

454

67

108

0

113

0

20.50%

0.02%

351.86%

10.30%

-85.97%

-47.85%

-14.67%

All Equity Options

34,906,398

27,933,581

24.96%

72,782

65,061

11.87%

3,323

1,409

2,928

3,323

13.49%

0

21,680

0

0

689,416

757,593

996,159

0

9,173

2,474,021

0

17,416

0

97

680,974

631,615

824,032

0

10,266

2,164,400

24.48%

-100.00%

1.24%

19.95%

20.89%

-10.65%

14.31%

0

21,164

0

0

73,055

84,232

113,385

0

752

292,588

0

16,955

0

24

72,100

70,662

94,661

0

859

255,316

24.82%

-100.00%

1.32%

19.20%

19.78%

-12.47%

14.60%

468,774

326,350

758,341

1,553,465

842,203

330,841

787,367

1,960,411

-44.34%

-1.36%

-3.69%

-20.76%

49,683

36,047

85,778

171,508

89,211

36,313

89,062

214,586

-44.31%

-0.73%

-3.69%

-20.07%

Index Futures

DJ Euro STOXX 50

DJ STOXX 50

DJ (Euro) STOXX Sector Indexes

DJ STOXX 600 Sector Indexes

Dow Jones Global Titans 50

DAX

TecDAX

NEMAX 50

SMI

HEX25

Index Futures

All Index Products

XTF Products

Equity Products

Equity Options

Capital Market Products

Capital Market Futures

One-Month-Euribor Future

Three-Month-Euribor Future

Opt. on Three-Month-Euribor Fut.

One-Month-EONIA Future

Euro-Schatz Future

Euro-Bobl Future

Euro-Bund Future

Euro-Buxl Future

CONF Future

Capital Market Futures

Options on Capital Market Futures

Opt. on Euro-Schatz Future

Opt. on Euro-Bobl Future

Opt. on Euro-Bund Future

Opt. on Capital Market Fut.

All Capital Market Products

All Eurex Products

4,027,486

4,124,811

-2.36%

464,096

469,902

-1.24%

56,338,541

47,813,115

17.83%

993,439

931,460

6.65%

12,362

6,724

14,769

12,362

-16.30%

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

Eurex - Index Products

2.1

Dow Jones Euro-STOXX 50 Options

2.1.1

Traded Contracts

Trades

1998

1999

2000

2001

2002

2003

OTC-Trades

in Contracts

Traded Contracts

Calls

ex_monthly

09.02.2004

page 16

Puts

Total

Change YoY

2983.94%

116.21%

132.34%

107.26%

56.53%

Volume in EUR million

Calls

Puts

Total

Change YoY

2,603

73,619

227,981

429,930

642,266

776,018

1,212

71,130

189,588

331,264

509,650

704,063

3,815

144,750

417,568

761,194

1,151,916

1,480,081

3694.11%

188.48%

82.29%

51.33%

28.49%

Total

Total

Total

Total

Total

Total

1,266

37,703

68,424

166,142

213,200

305,054

0

0

220,730

2,880,011

15,811,446

37,797,180

81,907

1,797,774

4,137,487

9,987,750

20,194,338

29,841,967

41,044

1,993,964

4,060,512

9,059,143

19,283,092

31,952,706

122,951

3,791,738

8,197,999

19,046,893

39,477,430

61,794,673

2004 1. Quarter

22,227

4,562,578

3,100,185

3,897,355

6,997,540

22.11%

96,286

99,105

195,391

42.19%

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

26,796

22,075

33,646

23,133

22,569

26,780

24,598

23,381

38,309

22,971

22,150

18,646

22,227

3,583,014

3,003,719

3,722,065

2,743,084

2,496,842

3,039,294

2,599,314

2,916,439

4,428,507

3,689,549

3,183,918

2,391,435

4,562,578

2,730,504

2,454,309

3,397,150

2,664,870

2,073,512

2,479,465

1,973,773

1,929,284

2,915,123

3,064,262

2,322,605

1,837,110

3,100,185

2,999,876

2,418,427

2,842,141

2,102,182

2,266,214

2,481,410

2,248,328

2,503,444

3,923,547

2,882,353

2,948,715

2,336,069

3,897,355

5,730,380

4,872,736

6,239,291

4,767,052

4,339,726

4,960,875

4,222,101

4,432,728

6,838,670

5,946,615

5,271,320

4,173,179

6,997,540

160.66%

143.17%

266.68%

167.20%

85.28%

66.51%

-14.58%

26.15%

51.70%

9.53%

15.81%

18.48%

22.11%

72,811

61,308

78,807

66,763

52,049

62,499

51,902

52,348

79,403

81,953

64,493

51,681

96,286

64,605

49,500

54,943

43,300

47,295

53,748

49,948

56,924

91,028

66,911

69,387

56,474

99,105

137,415

110,808

133,750

110,063

99,344

116,248

101,850

109,272

170,431

148,864

133,880

108,156

195,391

70.24%

51.35%

107.49%

69.74%

20.42%

23.76%

-28.82%

12.65%

48.92%

10.53%

15.93%

23.53%

42.19%

2004 Total

22,227

4,562,578

3,100,185

3,897,355

6,997,540

22.11%

96,286

99,105

195,391

42.19%

250,000

Volume (columns) and Open Interest (lines) in EUR million

350,000

300,000

200,000

Open Interest

250,000

200,000

100,000

150,000

Volume

150,000

100,000

50,000

50,000

0

Jan

Feb

Mar

Apr

May

Jun

Jul

2003

Aug

Sep

Oct

Nov

Dec

Jan

2004

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

ex_monthly

09.02.2004

page 17

Dow Jones Euro STOXX 50 Options

2.1.2

Open Interest and Market Share per Account Group

Market Share per Account Group

Agent

Principal Market Maker

2.1.3

Open Interest in Contracts

Calls

Puts

Open Interest in EUR million

Calls

Puts

Total

Change YoY

1761.54%

33.97%

160.70%

121.14%

29.38%

1,171

18,881

38,796

74,324

124,863

136,773

Total

Change YoY

355

17,777

24,078

50,873

83,219

103,942

1,526

36,657

62,874

125,197

208,082

240,715

2302.75%

71.52%

99.12%

66.20%

15.68%

1998 Total

1999 Total

2000 Total

2001 Total

2002 Total

2003 Total

44.64%

55.58%

56.36%

60.09%

53.78%

37.52%

10.59%

4.74%

8.54%

7.95%

3.68%

3.11%

44.78%

39.68%

35.10%

31.96%

42.54%

59.37%

37,162

431,639

698,725

1,740,363

3,820,910

4,675,565

12,385

490,696

536,892

1,480,868

3,302,545

4,540,557

49,547

922,335

1,235,617

3,221,231

7,123,455

9,216,122

2004 1. Quarter

38.29%

1.71%

60.00%

5,553,275

5,529,770

11,083,045

39.48%

167,239

130,184

297,423

31.34%

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

45.86%

45.92%

42.03%

39.75%

40.38%

35.99%

33.84%

33.33%

33.93%

32.00%

33.44%

32.88%

38.29%

2.19%

2.78%

4.68%

3.05%

2.48%

3.79%

2.10%

3.31%

1.67%

2.02%

4.92%

4.73%

1.71%

51.95%

51.31%

53.30%

57.20%

57.14%

60.21%

64.05%

63.36%

64.39%

65.98%

61.64%

62.39%

60.00%

4,286,305

4,722,278

4,639,057

4,973,530

5,295,566

4,733,595

4,898,919

5,141,778

5,317,054

5,712,785

5,873,237

4,675,565

5,553,275

3,659,879

3,979,802

3,885,991

4,209,142

4,538,204

4,164,887

4,567,192

5,056,792

5,262,865

5,398,985

5,719,258

4,540,557

5,529,770

7,946,184

8,702,080

8,525,048

9,182,672

9,833,770

8,898,482

9,466,111

10,198,570

10,579,919

11,111,770

11,592,495

9,216,122

11,083,045

113.77%

113.59%

127.48%

122.10%

106.85%

96.57%

58.11%

49.83%

51.26%

36.50%

32.18%

29.38%

39.48%

136,276

146,841

139,329

149,236

157,114

137,423

142,052

149,300

155,479

166,334

171,262

136,773

167,239

90,180

95,885

89,984

96,768

103,358

92,230

101,182

112,671

119,464

122,459

130,014

103,942

130,184

226,456

242,726

229,313

246,004

260,472

229,653

243,234

261,972

274,943

288,793

301,276

240,715

297,423

57.78%

54.63%

57.31%

54.29%

44.00%

40.38%

19.80%

16.63%

24.48%

15.92%

13.47%

15.68%

31.34%

2004 Total

38.29%

1.71%

60.00%

5,553,275

5,529,770

11,083,045

39.48%

167,239

130,184

297,423

31.34%

Paid Premiums

Paid Premiums - Contract in EUR

Calls

Puts

1998

1999

2000

2001

2002

2003

Total

Paid Premiums in EUR

Calls

Puts

Total

Change YoY

Total

Total

Total

Total

Total

Total

2,433

1,871

1,883

1,603

1,472

1,191

1,582

1,255

1,437

1,449

1,408

1,100

2,149

1,547

1,662

1,530

1,441

1,144

199,307,567

3,364,520,318

7,789,999,059

16,008,917,644

29,735,270,114

35,544,182,758

64,944,596

2,502,692,062

5,833,698,337

13,129,254,989

27,155,707,845

35,144,063,683

264,252,153

5,867,212,380

13,623,697,396

29,138,172,633

56,890,977,959

70,688,246,441

2120.31%

132.20%

113.88%

95.25%

24.25%

2004 1. Quarter

1,192

894

1,026

3,695,644,622

3,484,812,391

7,180,457,013

-13.66%

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

1,273

1,122

1,166

1,239

1,146

1,595

1,085

1,171

1,148

1,070

1,153

1,098

1,192

1,614

1,698

1,567

1,191

1,062

1,112

937

929

869

810

748

725

894

1,451

1,408

1,349

1,217

1,102

1,353

1,006

1,034

988

944

927

889

1,026

3,474,805,531

2,754,023,400

3,961,983,921

3,300,831,614

2,376,420,909

3,953,635,490

2,142,118,580

2,258,283,610

3,347,886,457

3,279,203,133

2,678,270,198

2,016,719,915

3,695,644,622

4,842,086,839

4,106,223,468

4,452,766,240

2,502,763,309

2,407,002,976

2,760,003,294

2,105,700,308

2,324,964,230

3,408,489,327

2,333,895,745

2,206,833,277

1,693,334,670

3,484,812,391

8,316,892,370

6,860,246,868

8,414,750,161

5,803,594,923

4,783,423,885

6,713,638,784

4,247,818,888

4,583,247,840

6,756,375,784

5,613,098,878

4,885,103,475

3,710,054,585

7,180,457,013

173.25%

142.38%

232.61%

146.09%

37.52%

75.12%

-43.28%

-11.40%

-0.05%

-35.96%

-21.91%

-15.16%

-13.66%

2004 Total

1,192

894

1,026

3,695,644,622

3,484,812,391

7,180,457,013

-13.66%

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

2.2

Dow Jones Euro STOXX 50 Futures

2.2.1

Traded Contracts

Trades

1998

1999

2000

2001

2002

2003

Total

Total

Total

Total

Total

Total

2004 1. Quarter

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

2004 Total

ex_monthly

09.02.2004

page 18

OTC-Trades

in Contracts

Traded Contracts

Calls

Puts

Traded Contracts

Total

Change YoY

Volume in EUR million

Total

18,834

340,799

2,213,643

7,213,111

13,690,887

14,240,248

0

0

0

0

3,571,004

13,326,683

0

0

0

0

0

0

0

0

0

0

0

0

366,435

5,341,864

14,315,518

37,828,500

86,354,731

116,035,326

1357.79%

167.99%

164.25%

128.28%

34.37%

11,231

208,872

729,342

1,452,948

2,482,723

2,787,848

1759.78%

249.18%

99.21%

70.87%

12.29%

Change YoY

858,382

1,202,460

8,191,117

-7.25%

233,795

12.35%

1,503,248

1,331,248

1,797,400

1,388,492

1,287,520

1,271,595

1,093,902

806,813

1,098,849

1,098,206

885,703

677,272

858,382

812,637

667,809

755,108

585,181

597,153

729,374

675,460

764,373

3,151,555

966,092

848,836

2,773,105

1,202,460

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

0

8,831,456

8,099,894

16,490,153

8,373,235

7,758,279

12,451,143

7,751,236

6,412,161

13,500,846

9,309,030

7,655,868

9,402,025

8,191,117

127.31%

103.16%

195.62%

129.63%

95.16%

27.28%

-26.26%

-11.94%

8.25%

-5.25%

17.86%

5.46%

-7.25%

208,099

175,382

345,780

187,546

177,845

306,043

190,659

162,028

344,667

235,490

200,745

253,563

233,795

44.93%

24.16%

65.86%

42.09%

28.38%

0.16%

-34.41%

-17.26%

13.83%

-0.31%

20.84%

14.40%

12.35%

858,382

1,202,460

8,191,117

-7.25%

233,795

12.35%

Volume (columns) and Open Interest (lines) in EUR million

400,000

45,000

40,000

350,000

35,000

Open Interest

300,000

30,000

Volume

250,000

25,000

200,000

20,000

150,000

15,000

100,000

10,000

50,000

5,000

0

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2003

2.2.2

Jan

2004

Open Interest and Market Share per Account Group

Market Share per Account Group

Agent

Principal Market Maker

1998

1999

2000

2001

2002

2003

Open Interest in Contracts

Total

Change YoY

Open Interest in EUR million

Total

Change YoY

Total

Total

Total

Total

Total

Total

73.64%

70.85%

50.47%

49.35%

50.24%

46.91%

7.53%

14.32%

27.71%

24.52%

19.42%

19.42%

18.83%

14.83%

21.82%

26.14%

30.34%

33.67%

59,626

302,933

470,624

820,256

1,120,754

1,290,355

408.06%

55.36%

74.29%

36.63%

15.13%

2,022

15,020

22,647

31,422

26,830

35,576

642.65%

50.78%

38.75%

-14.62%

32.60%

2004 1. Quarter

39.05%

28.47%

32.48%

1,317,246

-13.42%

37,530

9.50%

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

47.05%

47.44%

48.98%

45.92%

45.16%

51.22%

43.71%

42.08%

48.59%

40.58%

41.82%

53.28%

39.05%

18.20%

18.88%

14.73%

19.07%

20.35%

15.65%

22.28%

22.94%

18.37%

25.40%

25.21%

19.89%

28.47%

34.75%

33.68%

36.29%

35.01%

34.49%

33.13%

34.01%

34.97%

33.04%

34.02%

32.97%

26.84%

32.48%

1,521,497

1,644,866

1,540,983

1,528,717

1,582,949

1,236,673

1,294,297

1,402,239

1,411,021

1,482,692

1,593,400

1,290,355

1,317,246

78.03%

60.07%

96.19%

73.92%

57.93%

25.35%

-5.95%

10.02%

10.69%

17.27%

19.71%

15.13%

-13.42%

34,274

35,013

31,017

35,038

36,912

30,018

32,545

35,968

33,936

38,329

42,039

35,576

37,530

9.07%

-6.29%

5.87%

11.91%

7.60%

-3.66%

-11.87%

3.53%

19.08%

20.37%

19.69%

32.60%

9.50%

2004 Total

39.05%

28.47%

32.48%

1,317,246

-13.42%

37,530

9.50%

Eurex

Eurex

Monthly Statistics Derivatives Market

January 2004

2.3

Dow Jones STOXX 50 Options

2.3.1

Traded Contracts

Trades

1998

1999

2000

2001

2002

2003

Total

Total

Total

Total

Total

Total

1,916

2,354

1,697

1,210

472

879

2004 1. Quarter

2.3.2

OTC-Trades

in Contracts

Traded Contracts

Calls

0

0

0

0

9,770

20,225

34,021

30,432

24,957

21,870

15,579

17,313

09.02.2004

page 19

Puts

Total

Change YoY

39,758

49,822

36,573

22,530

24,015

38,104

73,779

80,254

61,530

44,400

39,594

55,417

8.78%

-23.33%

-27.84%

-10.82%

39.96%

Volume in EUR million

Calls

1,088

1,154

1,262

889

497

480

Puts

Total

1,205

1,800

1,557

831

686

855

2,293

2,954

2,820

1,720

1,184

1,335

Change YoY

28.83%

-4.54%

-39.01%

-31.17%

12.77%

64

40

104

-98.58%

-98.58%

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

109

132

123

31

58

44

122

141

56

8

32

23

6

2,040

0

4,842

1,000

0

8,258

0

0

2,585

1,500

0

0

0

2,626

2,358

5,213

114

185

4,008

850

0

1,699

48

20

192

64

4,699

2,914

8,655

2,502

1,965

7,565

761

4,402

2,181

1,515

542

403

40

7,325

5,272

13,868

2,616

2,150

11,573

1,611

4,402

3,880

1,563

562

595

104

180.33%

36.09%

1399.24%

3014.29%

168.41%

303.52%

17.16%

81.30%

-23.38%

18.41%

-94.27%

-92.95%

-98.58%

76

72

145

2

4

104

25

0

45

1

1

5

2

119

65

189

59

38

155

18

106

49

35

13

10

1

195

137

334

61

42

259

43

106

93

36

13

15

3

107.23%

0.95%

876.14%

1923.88%

50.31%

180.33%

12.84%

49.90%

-26.88%

-1.49%

-94.48%

-94.75%

-98.58%

2004 Total

64

40

104

-98.58%

-98.58%

Open Interest and Market Share per Account Group

Market Share per Account Group

Agent

Principal Market Maker

2.3.3

ex_monthly

Open Interest in Contracts

Calls

Puts

Total

Change YoY

Open Interest in EUR million

Calls

Puts

Total

Change YoY

1998 Total

1999 Total

2000 Total

2001 Total

2002 Total

2003 Total

8.76%

15.88%

24.80%

28.73%

56.08%

45.62%

3.07%

1.70%

11.98%

21.67%

5.51%

10.14%

88.18%

82.43%

63.23%

49.60%

38.41%

44.24%

6,225

3,508

4,645

6,079

7,383

846

6,036

9,209

4,037

4,522

7,285

3,953

12,261

12,717

8,682

10,601

14,668

4,799

3.72%

-31.73%

22.10%

38.36%

-67.28%

202

145

236

253

232

24

177

345

191

158

155

95

379

490

426

410

388

119

29.35%

-13.00%

-3.78%

-5.44%

-69.43%

2004 1. Quarter

50.00%

0.00%

50.00%

842

3,991

4,833

-69.80%

24

96

119

-72.10%

2003 Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

2004 Jan

44.48%

26.30%

50.42%

41.44%

31.86%

48.34%

40.04%

66.58%

38.42%

50.00%

41.99%

32.35%

50.00%

3.95%

0.00%

7.68%

17.39%

0.00%

22.36%

2.48%

7.80%

0.00%

47.98%

0.00%

15.13%

0.00%

51.56%

73.70%

41.90%

41.17%

68.14%

29.30%

57.48%

25.61%

61.58%

2.02%

58.01%

52.52%

50.00%

8,678

7,960

9,007

8,987

8,927

9,213

9,293

9,243

8,157

8,171

8,171

846

842

7,326

9,718

11,693

12,151

12,322

12,455

12,655

14,430

13,212

11,710

11,672

3,953

3,991

16,004

17,678

20,700

21,138

21,249

21,668

21,948

23,673

21,369

19,881

19,843

4,799

4,833

50.13%

68.03%

397.24%

446.91%

363.85%

504.58%

421.58%

421.78%

148.51%

137.73%

141.08%

-67.28%

-69.80%

268

242

263

262

261

275

277

275

247

248

248

24

24

160

214

249

261

266

271

276

319

295

260

259

95

96

428

456

512

523

527

546

553

594

542

508

507

119

119

3.72%

11.71%

196.03%

221.87%

180.61%

354.05%

305.98%

323.87%

127.87%

119.04%

122.27%

-69.43%

-72.10%

2004 Total

50.00%

0.00%

50.00%

842

3,991

4,833

-69.80%

24

96

119

-72.10%

Paid Premiums

Paid Premiums - Contract in EUR

Calls

Puts

1998

1999