Beruflich Dokumente

Kultur Dokumente

35 - 47 Bond Prices

Hochgeladen von

Julio Alberto Paz CorderoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

35 - 47 Bond Prices

Hochgeladen von

Julio Alberto Paz CorderoCopyright:

Verfügbare Formate

hp calculators

HP 35s Bond Prices

Bond Prices

The Time Value of Money on the HP 35s

Practice solving for the price of a bond

hp calculators

HP 35s Bond Prices

Bond Prices

A bond is a financial instrument where a company, government entity, or individual borrow money with the promise to

pay interest periodically and to repay the initial amount borrowed at a specified future date. Bonds will usually have a

specified interest rate (called the coupon rate) and are most often in denominations of $1,000. Bonds also usually pay

interest every six months. The interest rate the bond pays is fixed when the bond is first sold or issued, but changes in

the market interest rate will change the price of the bond over its lifetime. If market interest rates have gone up since the

bond was purchased, the price of the bond will have gone down. If, however, market interest rates have gone down

since the bond was purchased, the price of the bond will have gone up. The HP 35s can directly solve for bond prices

using the time value of money formula below in simple situations where a bond interest payment is exactly one period

away. For other situations, the answers will be approximations.

The Time Value of Money on the HP 35s

To solve time value of money problems on the HP 35s, the formula below is entered into the flexible equation solver built

into the calculator. This equation expresses the standard relationship between the variables in the time value of money

formula. The formula uses these variables: N is the number of compounding periods; I is the periodic interest rate as a

percentage (for example, if the annual interest rate is 15% and there are 12 payments per year, the periodic interest

rate, i, is 1512=1.25%); B is the initial balance of loan or savings account; P is the periodic payment; F is the future

value of a savings account or balance of a loan.

Equation:

P x 100 x ( 1 - ( 1 + I 100 )^ -N) I + F x ( 1 + I 100 ) ^ -N + B

To enter this equation into the calculator, press the following keys on the HP 35s:

dhP1004141hI100)

zhNhIhF41hI100)z

hNhB

To verify proper entry of the equation, press

and hold down the key. This will display the equations checksum and length. The values displayed should be a

checksum of CEFA and a length of 41.

To solve for the different variables within this equation, the button is used. This key is the right shift of the

d key.

Notes for using the SOLVE function with this equation:

1) If your first calculation using this formula is to solve for the interest rate I, press 1eI before beginning.

2) Press d. If the time value of money equation is not at the top of the list, press or to scroll through the

list until the equation is displayed.

3) Determine the variable for which you wish to solve and press:

a) N to calculate the number of compounding periods.

b) I to calculate the periodic interest rate. Note: this will need to be multiplied by the number of

compounding periods per year to get the annual rate. If the compounding is monthly, multiply by 12.

c) B to calculate the initial balance (or Present Value) of a loan or savings account.

hp calculators

-2-

HP 35s Bond Prices - Version 1.0

hp calculators

HP 35s Bond Prices

d) P to calculate the periodic payment.

e) F to calculate the future value of a loan or savings account.

4) When prompted, enter a value for each of the variables in the equation as you are prompted and press . The

solver will display the variables existing value. If this is to be kept, do not enter any value but press to

continue. If the value is to be changed, enter the changed value and press . If a variable had a value in a

previous calculation but is not involved in this calculation (as might happen to the variable P (payment) when solving

a compound interest problem right after solving an annuity problem), enter a zero for the value and press .

5) After you press for the last time, the value of the unknown variable will be calculated and displayed.

6) To do another calculation with the same or changed values, go back to step 2 above.

The SOLVE feature will work effectively without any initial guesses being supplied for the unknown variable with the

exception noted above about the variable I in this equation. This equation follows the standard convention that money in

is considered positive and money out is negative.

The practice problems below illustrate using this equation to solve a variety of problems involving bond prices.

Practice solving for the price of a bond

Example 1: A bond with 20 years left has a 5% coupon rate and pays interest semiannually. If the market interest

rate is now 6%, compounded semiannually, for what price should this bond be selling?

Solution:

First, enter the time value of money equation into the HP 35s solver as described earlier in this document.

Then press d and press or to scroll through the equation list until the time value

of money equation is displayed. Then press:

B

The HP 35s SOLVER displays the first variable encountered in the equation as it begins its solution.

The value of 0.0000 is displayed below if this is the first time the time value of money equation has been

solved on the HP 35s calculator. If any previous equations have used a variable used in the time value of

money equation, they may already have been assigned a value that would be displayed on your HP 35s

display. Follow the keystrokes shown below and the solution should be found as described.

Figure 1

The payment is found by multiplying the coupon interest rate, 5%, by the face value of the bond, $1,000,

then dividing the result by 2 for the semiannual interest payment amount, $25.

In RPN mode, press:

0510002

In algebraic mode, press: 0510002

Figure 2

hp calculators

-3-

HP 35s Bond Prices - Version 1.0

hp calculators

HP 35s Bond Prices

In RPN mode, press:

62

In algebraic mode, press: 62

Figure 3

In RPN mode, press:

202

In algebraic mode, press: 202

Figure 4

In either RPN or algebraic mode, press:

1000

Figure 5

Answer:

The price of the bond is $884.43.

Example 2: A bond with 10 years left until it matures has a 6% coupon rate and pays interest semiannually. What is the

price of this bond, if the market interest rate is 5%, compounded semiannually?

Solution:

First, enter the time value of money equation into the HP 35s solver as described earlier in this document.

Then press d and press or to scroll through the equation list until the time value

of money equation is displayed. Then press:

B

The HP 35s SOLVER displays the first variable encountered in the equation as it begins its solution.

The displays shown in the figures below assume the preceding example has just been worked. Follow

the keystrokes shown below and the solution should be found as described.

Figure 6

The payment is found by multiplying the coupon interest rate, 6%, by the face value of the bond, $1,000,

then dividing the result by 2 for the semiannual interest payment amount.

hp calculators

-4-

HP 35s Bond Prices - Version 1.0

hp calculators

HP 35s Bond Prices

In RPN mode, press:

0610002

In algebraic mode, press: 0610002

Figure 7

In RPN mode, press:

52

In algebraic mode, press: 52

Figure 8

In RPN mode, press:

102

In algebraic mode, press: 102

Figure 9

In either RPN or algebraic mode, press:

1000

Figure 10

Answer:

The price of the bond is $1,077.95.

Example 3: A bond with 13 years left until it matures has a 5.5% coupon rate and pays interest semiannually. What

is the price of this bond, if the market interest rate is 6.15%?

Solution:

First, enter the time value of money equation into the HP 35s solver as described earlier in this document.

Then press d and press or to scroll throu7gh the equation list until the time value

of money equation is displayed. Then press:

B

The HP 35s SOLVER displays the first variable encountered in the equation as it begins its solution.

The displays for these prompts are not shown in this example. Follow the keystrokes shown below and

the solution should be found as described.

hp calculators

-5-

HP 35s Bond Prices - Version 1.0

hp calculators

HP 35s Bond Prices

In RPN mode, press:

05510002

6152

132

1000

(Enters P)

(Enters I)

(Enters N)

(Enters F)

In algebraic mode, press: 05510002

6152

132

1000

(Enters P)

(Enters I)

(Enters N)

(Enters F)

Figure 11

Answer:

hp calculators

The price of the bond is $942.40.

-6-

HP 35s Bond Prices - Version 1.0

Das könnte Ihnen auch gefallen

- Chapter 6 Problems PDFDokument4 SeitenChapter 6 Problems PDFThinh Doan100% (1)

- Chapter 5 ModelDokument3 SeitenChapter 5 ModelJiaxiang Chea100% (2)

- CFA Level 1 Quantitative Analysis E Book - Part 1Dokument26 SeitenCFA Level 1 Quantitative Analysis E Book - Part 1Zacharia VincentNoch keine Bewertungen

- EESA06 Final Exam PDFDokument16 SeitenEESA06 Final Exam PDFAsh S0% (1)

- HP 12c Solutions Handbook-2Dokument19 SeitenHP 12c Solutions Handbook-2George VassilogluNoch keine Bewertungen

- (Solutions Manual) Fourier and Laplace Transform - AntwoordenDokument87 Seiten(Solutions Manual) Fourier and Laplace Transform - AntwoordenSiddharth N. Meshram100% (1)

- International Business Chapter 14Dokument21 SeitenInternational Business Chapter 14Rabiatul AndawiyahNoch keine Bewertungen

- Circle Rate Notification 04.02.2011Dokument3 SeitenCircle Rate Notification 04.02.2011Sanchit SinghNoch keine Bewertungen

- Michel Aglietta, Antoine Reberioux - Corporate Governance Adrift - A Critique of Shareholder Value (Saint-Gobain Centre For Economic Studies) (2005)Dokument321 SeitenMichel Aglietta, Antoine Reberioux - Corporate Governance Adrift - A Critique of Shareholder Value (Saint-Gobain Centre For Economic Studies) (2005)Ricardo ValenzuelaNoch keine Bewertungen

- PruLink Surrender Form PDFDokument4 SeitenPruLink Surrender Form PDFHui Jia JunnNoch keine Bewertungen

- Introduction To Forex - Forex Made Easy PDFDokument33 SeitenIntroduction To Forex - Forex Made Easy PDFKundan Kadam100% (1)

- 35 - 45 Sinking FundsDokument6 Seiten35 - 45 Sinking FundsJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 46 Present ValuesDokument6 Seiten35 - 46 Present ValuesJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 54 Loan Down PaymentsDokument5 Seiten35 - 54 Loan Down PaymentsJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 51 House PaymentsDokument5 Seiten35 - 51 House PaymentsJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 52 Property AppreciationDokument5 Seiten35 - 52 Property AppreciationJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 53 House QualificationDokument6 Seiten35 - 53 House QualificationJulio Alberto Paz CorderoNoch keine Bewertungen

- 10 Bi I Simple Compound InterestDokument4 Seiten10 Bi I Simple Compound Intereststeven_c22003Noch keine Bewertungen

- KWK 4th Append DDokument6 SeitenKWK 4th Append DAnonymous O5asZmNoch keine Bewertungen

- G10489 EC Calculator Practice Problems WorksheetDokument11 SeitenG10489 EC Calculator Practice Problems WorksheetiamdarshandNoch keine Bewertungen

- Interest Bond CalculatorDokument6 SeitenInterest Bond CalculatorfdfsfsdfjhgjghNoch keine Bewertungen

- Finance Growth and Decay Author Maths at SharpDokument37 SeitenFinance Growth and Decay Author Maths at SharpRhaiven Carl YapNoch keine Bewertungen

- Coupon Rate: Current Yield: Yield-to-MaturityDokument2 SeitenCoupon Rate: Current Yield: Yield-to-MaturityManuj RathoreNoch keine Bewertungen

- Bonds Valuation Practice ProblemsDokument6 SeitenBonds Valuation Practice ProblemsMaria Danielle Fajardo CuysonNoch keine Bewertungen

- HA 222 Finance Practice Prob Chap 7Dokument7 SeitenHA 222 Finance Practice Prob Chap 7anishpra73Noch keine Bewertungen

- 35 - 48 Trend LinesDokument6 Seiten35 - 48 Trend LinesJulio Alberto Paz CorderoNoch keine Bewertungen

- Topic6 Interest Rates and Bond ValuationDokument2 SeitenTopic6 Interest Rates and Bond ValuationJaskeerat SinghNoch keine Bewertungen

- Practice Solving Bonds ProblemsDokument3 SeitenPractice Solving Bonds ProblemsJuan Leyton ZabaletaNoch keine Bewertungen

- HA 222 Finance Practice Prob Chap 7Dokument6 SeitenHA 222 Finance Practice Prob Chap 7Ben Kramer50% (2)

- Chapter 5 FinanceDokument9 SeitenChapter 5 Financexuzhu5Noch keine Bewertungen

- Lesson 02c Time Value of MoneyDokument32 SeitenLesson 02c Time Value of MoneyVjion BeloNoch keine Bewertungen

- Unit 3 TVM Live SessionDokument43 SeitenUnit 3 TVM Live Sessionkimj22614Noch keine Bewertungen

- HP 12 C ConversionDokument4 SeitenHP 12 C ConversionCélio ChagasNoch keine Bewertungen

- Ch05 Mini CaseDokument8 SeitenCh05 Mini CaseTia1977Noch keine Bewertungen

- Topic 2 Principles of Money-Time RelationshipDokument28 SeitenTopic 2 Principles of Money-Time RelationshipJeshua Llorera0% (1)

- Debt & Equity ValuationDokument4 SeitenDebt & Equity ValuationMatthew SkinnerNoch keine Bewertungen

- ch4 3Dokument8 Seitench4 3kevinpuraNoch keine Bewertungen

- HP12 CbondsDokument4 SeitenHP12 CbondsfedemauNoch keine Bewertungen

- Chapter 4 Time Value of MoneyDokument64 SeitenChapter 4 Time Value of Moneysubash shresthaNoch keine Bewertungen

- Yield To CallDokument16 SeitenYield To CallSushma MallapurNoch keine Bewertungen

- Advanced Bond ConceptsDokument8 SeitenAdvanced Bond ConceptsEllaine OlimberioNoch keine Bewertungen

- HP Calculators: HP 17bII+ Discounting & DiscountedDokument7 SeitenHP Calculators: HP 17bII+ Discounting & Discountedanon-803684100% (3)

- Bond ValuationDokument10 SeitenBond ValuationVivek SuranaNoch keine Bewertungen

- Advanced Bond ConceptsDokument32 SeitenAdvanced Bond ConceptsJohn SmithNoch keine Bewertungen

- Abdul Qadir Khan (Fixed Income Assignement No.5)Dokument10 SeitenAbdul Qadir Khan (Fixed Income Assignement No.5)muhammadvaqasNoch keine Bewertungen

- Compound Interest: The Mathematical Constant eDokument33 SeitenCompound Interest: The Mathematical Constant emhrscribd014Noch keine Bewertungen

- MATHINVS - Simple Annuities 3.6Dokument7 SeitenMATHINVS - Simple Annuities 3.6Kathryn SantosNoch keine Bewertungen

- C1 - M2 - Basics of Bond Valuation+answer KeyDokument5 SeitenC1 - M2 - Basics of Bond Valuation+answer KeyVikaNoch keine Bewertungen

- Chapter 2 - Nominal and Effective Interest RatesDokument16 SeitenChapter 2 - Nominal and Effective Interest RatesTanveer Ahmed HakroNoch keine Bewertungen

- BU SM323 Midterm+ReviewDokument23 SeitenBU SM323 Midterm+ReviewrockstarliveNoch keine Bewertungen

- FM12 CH 05 Tool KitDokument31 SeitenFM12 CH 05 Tool KitJamie RossNoch keine Bewertungen

- Basic Business Finance AbmDokument26 SeitenBasic Business Finance AbmK-Cube Morong100% (2)

- Lesson 03a Understanding MoneyDokument29 SeitenLesson 03a Understanding MoneyVjion BeloNoch keine Bewertungen

- Interest Rates and Bond Valuation: Solutions To Questions and ProblemsDokument7 SeitenInterest Rates and Bond Valuation: Solutions To Questions and ProblemsFelipeNoch keine Bewertungen

- Week 3Dokument13 SeitenWeek 3sdfklmjsdlklskfjdNoch keine Bewertungen

- TMVTBDokument17 SeitenTMVTBShantam RajanNoch keine Bewertungen

- Time Value MoneyDokument9 SeitenTime Value MoneySharmin ReulaNoch keine Bewertungen

- Compound InterestDokument5 SeitenCompound InterestLegaspi AllanNoch keine Bewertungen

- Chap 005 MasterDokument116 SeitenChap 005 MasterEstela VelazcoNoch keine Bewertungen

- Finance Valuation On Calculator (T-84)Dokument36 SeitenFinance Valuation On Calculator (T-84)BobbyNicholsNoch keine Bewertungen

- Bonds - Chapt. 8 in RWJJDokument10 SeitenBonds - Chapt. 8 in RWJJHaris FadzanNoch keine Bewertungen

- 35 - 49 Cost EstimationDokument6 Seiten35 - 49 Cost EstimationJulio Alberto Paz CorderoNoch keine Bewertungen

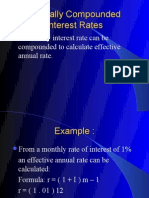

- Annually Compounded Interest RatesDokument11 SeitenAnnually Compounded Interest RatesNaveed HafeezNoch keine Bewertungen

- Fin Calculator GuideDokument40 SeitenFin Calculator GuideAman LuthraNoch keine Bewertungen

- Personal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyVon EverandPersonal Money Management Made Simple with MS Excel: How to save, invest and borrow wiselyNoch keine Bewertungen

- Finance for Non-Financiers 1: Basic FinancesVon EverandFinance for Non-Financiers 1: Basic FinancesNoch keine Bewertungen

- 35 - 01 Introduction Training AidsDokument3 Seiten35 - 01 Introduction Training Aidswillis6767Noch keine Bewertungen

- 35 - 11 Mean and DeviationDokument4 Seiten35 - 11 Mean and DeviationaapaulosNoch keine Bewertungen

- 35 - 53 House QualificationDokument6 Seiten35 - 53 House QualificationJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 55 Average Sales PricesDokument4 Seiten35 - 55 Average Sales PricesJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 36 Working With FlagsDokument6 Seiten35 - 36 Working With FlagsJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 49 Cost EstimationDokument6 Seiten35 - 49 Cost EstimationJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 48 Trend LinesDokument6 Seiten35 - 48 Trend LinesJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 50 Percentages and Percentage ChangesDokument4 Seiten35 - 50 Percentages and Percentage ChangesJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 44 Simulation Random NumbersDokument5 Seiten35 - 44 Simulation Random NumbersJulio Alberto Paz CorderoNoch keine Bewertungen

- Mohr Circle Hp35sDokument3 SeitenMohr Circle Hp35sAlfredo Romero GNoch keine Bewertungen

- 35 - 43 Applications MedicalDokument8 Seiten35 - 43 Applications MedicalJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 39 General Applications2Dokument3 Seiten35 - 39 General Applications2Julio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 41 Applications EEDokument3 Seiten35 - 41 Applications EEJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 35 Indirect Registers Data PackingDokument6 Seiten35 - 35 Indirect Registers Data PackingJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 38 General Applications1Dokument3 Seiten35 - 38 General Applications1Julio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 40 General Applications3Dokument3 Seiten35 - 40 General Applications3Julio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 37 Converting Labels To Line NumbersDokument4 Seiten35 - 37 Converting Labels To Line NumbersJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 31 Working With VectorsDokument3 Seiten35 - 31 Working With VectorsJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 29 Roots of PolynomialsDokument5 Seiten35 - 29 Roots of PolynomialsJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 34 Accessing Stack in ProgramDokument4 Seiten35 - 34 Accessing Stack in ProgramJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 33 Line AddressingDokument3 Seiten35 - 33 Line AddressingJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 32 Simple ProgramDokument6 Seiten35 - 32 Simple ProgramJulio Alberto Paz CorderoNoch keine Bewertungen

- 35 - 30 Advanced LogarithmsDokument4 Seiten35 - 30 Advanced LogarithmsJulio Alberto Paz CorderoNoch keine Bewertungen

- Stockholders Voting RightsDokument6 SeitenStockholders Voting RightsMareca DomingoNoch keine Bewertungen

- Damodaran Corp Fin Quiz 1Dokument37 SeitenDamodaran Corp Fin Quiz 1praveen_bpgc100% (1)

- Pawan 115ja JCDokument35 SeitenPawan 115ja JCKapasi TejasNoch keine Bewertungen

- Revitalising Gower's Legacy Reformingcompany Law in GhanaDokument10 SeitenRevitalising Gower's Legacy Reformingcompany Law in GhanaNana Kwaku Duffour KoduaNoch keine Bewertungen

- Selected Topic: The Role of Financial Derivatives in Emerging MarketsDokument18 SeitenSelected Topic: The Role of Financial Derivatives in Emerging MarketsAna RomeroNoch keine Bewertungen

- ActDokument2 SeitenActJeffrey Garcia IlaganNoch keine Bewertungen

- Advanced Accounting 7e Hoyle - Chapter 6Dokument13 SeitenAdvanced Accounting 7e Hoyle - Chapter 6Leni RosiyaniNoch keine Bewertungen

- Instapdf - in Hindenburg Research Adani Report 192Dokument137 SeitenInstapdf - in Hindenburg Research Adani Report 192Fasi HaiderNoch keine Bewertungen

- FM SolvedDokument16 SeitenFM SolvedHridesh BadaniNoch keine Bewertungen

- Aljazira Capital 2012Dokument14 SeitenAljazira Capital 2012fathalbabNoch keine Bewertungen

- Annual Report 2017: Towards Infinite PossibilitiesDokument460 SeitenAnnual Report 2017: Towards Infinite PossibilitiesrakhalbanglaNoch keine Bewertungen

- Resume Sunil Kumar Bahri 2Dokument3 SeitenResume Sunil Kumar Bahri 2bahri_sunilNoch keine Bewertungen

- Variable Mock Exam UpdatedDokument14 SeitenVariable Mock Exam UpdatedOliver papaNoch keine Bewertungen

- Econ 2020 Term PaperDokument5 SeitenEcon 2020 Term Paperapi-273009910Noch keine Bewertungen

- GLG Law Chambers ProfileDokument5 SeitenGLG Law Chambers ProfileGarvit KhandelwalNoch keine Bewertungen

- Cir MemoW&MDokument2 SeitenCir MemoW&Mnmsusarla9990% (1)

- Proproom Recaps 2017Dokument10 SeitenProproom Recaps 2017FitzNoch keine Bewertungen

- SIFMA Capital Markets Fact Book - 2020 DataDokument186 SeitenSIFMA Capital Markets Fact Book - 2020 DataÂn TrầnNoch keine Bewertungen

- Transurban and Its Monopoly On The Toll Road IndustryDokument4 SeitenTransurban and Its Monopoly On The Toll Road IndustryNaren PlaythatfunkymusicNoch keine Bewertungen

- Bank NIFTY Components and WeightageDokument2 SeitenBank NIFTY Components and WeightageUptrend0% (2)

- China SkyDokument13 SeitenChina Sky靳雪娇100% (1)

- Common and Preferred StockDokument12 SeitenCommon and Preferred StockAmna ImranNoch keine Bewertungen

- FCF Motivation LetterDokument1 SeiteFCF Motivation LetterDaniel GaravagliaNoch keine Bewertungen

- Broadcom's Highly Compelling Proposal To Acquire Qualcomm: February 13, 2018Dokument46 SeitenBroadcom's Highly Compelling Proposal To Acquire Qualcomm: February 13, 2018Trust Us Security And Allied ServicesNoch keine Bewertungen