Beruflich Dokumente

Kultur Dokumente

Financial Ratios - Formula Sheet

Hochgeladen von

Duke EphraimCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Financial Ratios - Formula Sheet

Hochgeladen von

Duke EphraimCopyright:

Verfügbare Formate

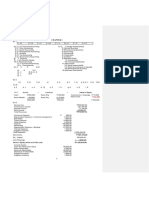

RATIOS - FORMULA SHEET - FINANCIAL MANAGEMENT

(A)

(B)

PROFITABILITY RATIOS

ASSET MANAGEMENT/ACTIVITY RATIOS

(in relation to sales)

Profit after Tax

NET PROFIT RATIO/

=

PROFIT MARGIN

Sales

Gross Profit

GROSS PROFIT RATIO

=

Sales

Credit Sales

DEBTORS TURNOVER

=

Average Debtors

DAYS SALES OUTSTANDING/

COLLECTION PERIOD

=

(days)

Operating Profit*

OPERATING PROFIT

RATIO

CREDITORS TURNOVER

=

Average Creditors

(in relation to investment)

Profit after Tax

RETURN ON EQUITY

=

(ROE)

Common Equity**

Average Creditors X 360

PAYMENTS PERIOD

(days)

INVENTORY TURNOVER

Credit Purchases

Operating Profit*

=

RETURN ON TOTAL

ASSETS (ROA)

Cost of Sales

Capital Employed***

Average Inventory

Profit after Tax

Average Stock X 360

STOCK PERIOD (days)

Average Total Assets

Cost of Sales

Operating Profit*

BASIC EARNING POWER =

(BEP)

Credit Sales

Credit Purchases

Sales

RETURN ON CAPITAL

EMPLOYED (ROCE)

Average Debtors X 360

Sales

TOTAL ASSET TURNOVER

Average Total Assets

Average Total Assets

(C)

SHAREHOLDER'S FUNDS/MARKET VALUE RATIOS

Dividends per share

DIVIDEND YIELD

=

Market Price per share

EARNINGS PER SHARE

DIVIDEND COVER

Profit after Tax - Pref. Div.

Notes

# of Ord. shares in issue

* Operating Profit = Profit before Interest and Taxes

Profit after Tax - Pref. Div.

** Common Equity = Ordinary Shares + All Reserves

or Total Assets - Total Debt

=

Ordinary dividends

Market price per share

Note - Long-Term Debt includes Preference Shares

because they belong to "outside'' owners who are given

preference (to ordinary shareholders) along with debt

holders when a company is liquidated.

PRICE EARNINGS RATIO =

Earnings per share

***Capital Employed=Common Equity+Long-Term Debt

or Total Assets - Short-Term Debt

or Fixed Assets + Working Capital

Market price per share

MARKET TO BOOK

VALUE RATIO

Common Equity

**** Book Value per share

=

Book value per share****

=

# of Ord. shares in issue

Page 1

RATIOS - FORMULA SHEET - FINANCIAL MANAGEMENT

(D)

DEBT RATIOS

TIMES-INTEREST-EARNED/

INTEREST COVER

Operating Profit

=

Interest chagres

Operating profit +

EBITDA

Coverage Ratio

Depreciation +

Lease payments

=

Interest + principal

pmts + lease pmts

Net Cash Flow from

CASH FLOW INTEREST

COVERAGE

Operating Activities +

= Interest Paid+Taxes Paid

Interest Paid

Net Cash Flow from

Operating Activities

OPERATING CASH FLOW

TO SALES

Sales

Net Cash Flow from

Operating Activities

OPERATING CASH FLOW

TO NET PROFIT

Profit after Tax

Long-Term Debt

GEARING RATIO

=

Capital Employed***

Total Debt

DEBT RATIO/

DEBT TO ASSET RATIO

DEBT TO EQUITY

Total Assets

Total Debt

Common Equity

(E)

LIQUIDITY RATIOS

Current Assets

CURRENT RATIO

Current Assets - Stock

QUICK RATIO

Current Liabilities

Current Liabilities

Net Cash Flow from Operating Activities

OPERATING CASH FLOW TO CURRENT LIABILITIES

=

Average Current Liabilities

Page 2

Page 3

Taxes Paid

Page 4

Das könnte Ihnen auch gefallen

- Accounting Ratios FormulasDokument2 SeitenAccounting Ratios Formulastuku67Noch keine Bewertungen

- Cheat Sheet - Financial STDokument2 SeitenCheat Sheet - Financial STMohammad DaulehNoch keine Bewertungen

- Chapter - 04 Financial Statement For Non Profit Making OrganizationDokument71 SeitenChapter - 04 Financial Statement For Non Profit Making OrganizationAuthor Jyoti Prakash rathNoch keine Bewertungen

- Statement of Change in Financial Position-5Dokument32 SeitenStatement of Change in Financial Position-5Amit SinghNoch keine Bewertungen

- Bond Valuation With PluginsDokument23 SeitenBond Valuation With PluginsHu-Jean RussellNoch keine Bewertungen

- CSEC POA June 2017 P2Dokument23 SeitenCSEC POA June 2017 P2Britaney Reid100% (1)

- C.A IPCC Ratio AnalysisDokument6 SeitenC.A IPCC Ratio AnalysisAkash Gupta100% (2)

- Module 2 Introducting Financial Statements - 6th EditionDokument7 SeitenModule 2 Introducting Financial Statements - 6th EditionjoshNoch keine Bewertungen

- Accouting Finals Cheat SheetDokument1 SeiteAccouting Finals Cheat SheetpinkrocketNoch keine Bewertungen

- The Internal Audit Process at A GlanceDokument3 SeitenThe Internal Audit Process at A GlanceDuke EphraimNoch keine Bewertungen

- Corporate Finance NPV and IRR SolutionsDokument3 SeitenCorporate Finance NPV and IRR SolutionsMark HarveyNoch keine Bewertungen

- Financial Ratios - Formula SheetDokument2 SeitenFinancial Ratios - Formula Sheetincubus_yeahNoch keine Bewertungen

- Financial Ratio Summary SheetDokument1 SeiteFinancial Ratio Summary SheetKeith Tomasson100% (1)

- Financial Ratio Analysis FormulasDokument4 SeitenFinancial Ratio Analysis FormulasSreenivas Badiginchala100% (1)

- Financial Ratio AnalysisDokument41 SeitenFinancial Ratio Analysismbapriti100% (2)

- CFA Level II Cheat Sheet: Equity Fixed IncomeDokument1 SeiteCFA Level II Cheat Sheet: Equity Fixed Incomeapi-19918095Noch keine Bewertungen

- Financial MGT TermsDokument14 SeitenFinancial MGT TermsAmit KaushikNoch keine Bewertungen

- Midsem Cheat Sheet (Finance)Dokument2 SeitenMidsem Cheat Sheet (Finance)lalaran123Noch keine Bewertungen

- AUD Financial RatiosDokument3 SeitenAUD Financial RatiosNick HuynhNoch keine Bewertungen

- Activity RatiosDokument7 SeitenActivity RatiosSUBIR100% (1)

- Financial Ratios - Formula SheetDokument4 SeitenFinancial Ratios - Formula SheetAira Dela CruzNoch keine Bewertungen

- Three Basic Accounting Statements:: - Income StatementDokument14 SeitenThree Basic Accounting Statements:: - Income Statementamedina8131Noch keine Bewertungen

- Process CostingDokument20 SeitenProcess CostingkirosNoch keine Bewertungen

- Far Eastern University: Post-Test1-Cash and Cash EquivalentsDokument9 SeitenFar Eastern University: Post-Test1-Cash and Cash EquivalentschristineNoch keine Bewertungen

- Val Quiz 1 ReviewDokument20 SeitenVal Quiz 1 Reviewshafkat rezaNoch keine Bewertungen

- Cheat Sheet - AccountingDokument2 SeitenCheat Sheet - AccountingJeffery KaoNoch keine Bewertungen

- Financial Statement AnalysisDokument37 SeitenFinancial Statement Analysischris100% (1)

- 1 - Introduction To Management and Cost AccountingDokument10 Seiten1 - Introduction To Management and Cost AccountingMohamed Yousif HamadNoch keine Bewertungen

- Ch-5 Cash Flow AnalysisDokument9 SeitenCh-5 Cash Flow AnalysisQiqi GenshinNoch keine Bewertungen

- Preparing SFP of Single Propriertorship BusinessDokument18 SeitenPreparing SFP of Single Propriertorship Businessjudith100% (2)

- Currency DerivativesDokument25 SeitenCurrency DerivativesDarshitSejparaNoch keine Bewertungen

- BKM Solution Manual Chapter 1-4Dokument36 SeitenBKM Solution Manual Chapter 1-4Noel LamNoch keine Bewertungen

- Basics Accounting PrinciplesDokument22 SeitenBasics Accounting PrincipleshsaherwanNoch keine Bewertungen

- Aula 4 - Colunas - Parte 1Dokument9 SeitenAula 4 - Colunas - Parte 1Anas ShamsudinNoch keine Bewertungen

- Financial Statement AnalysisDokument95 SeitenFinancial Statement Analysisputri handayaniNoch keine Bewertungen

- Sainsburry Ratio Analysis Year 2021Dokument20 SeitenSainsburry Ratio Analysis Year 2021aditya majiNoch keine Bewertungen

- CH2 FinmaDokument3 SeitenCH2 Finmamervin coquillaNoch keine Bewertungen

- Fin Cheat SheetDokument3 SeitenFin Cheat SheetChristina RomanoNoch keine Bewertungen

- Beta Leverage and The Cost of CapitalDokument3 SeitenBeta Leverage and The Cost of CapitalpumaguaNoch keine Bewertungen

- Financial RatioDokument69 SeitenFinancial RatioSwaroop VarmaNoch keine Bewertungen

- Foreign Currency Derivatives (Chapter 8) : Forwards, Futures and OptionsDokument52 SeitenForeign Currency Derivatives (Chapter 8) : Forwards, Futures and Optionsarmando.chappell1005Noch keine Bewertungen

- BFIN 300 SP 19 Final Guideline AnswersDokument9 SeitenBFIN 300 SP 19 Final Guideline AnswersZafran AqilNoch keine Bewertungen

- Financial Statement Analysis ExamDokument21 SeitenFinancial Statement Analysis ExamKheang Sophal100% (2)

- Auditing Finance and Accounting FunctionsDokument14 SeitenAuditing Finance and Accounting FunctionsApril ManjaresNoch keine Bewertungen

- Financial Analysis 1Dokument38 SeitenFinancial Analysis 1Crestine Joyce Mirabel DelaCruzNoch keine Bewertungen

- FM PPT Ratio AnalysisDokument12 SeitenFM PPT Ratio AnalysisHarsh ManotNoch keine Bewertungen

- Financial Management: Short-Term Financial PlanningDokument23 SeitenFinancial Management: Short-Term Financial PlanningRao786Noch keine Bewertungen

- Irish Spring ReportDokument11 SeitenIrish Spring ReportAri EngberNoch keine Bewertungen

- Company Accounts: - in Law, Company' Is Termed As An Entity Which Is Formed andDokument9 SeitenCompany Accounts: - in Law, Company' Is Termed As An Entity Which Is Formed andAnshul BajpaiNoch keine Bewertungen

- Cpa Questions Part XDokument10 SeitenCpa Questions Part XAngelo MendezNoch keine Bewertungen

- Portfolio ManagementDokument28 SeitenPortfolio Managementagarwala4767% (3)

- Chapter 10 PowerPointDokument89 SeitenChapter 10 PowerPointcheuleeeNoch keine Bewertungen

- Chapter 08 Stock ValuationDokument34 SeitenChapter 08 Stock Valuationfiq8809Noch keine Bewertungen

- Real Estate and Other Tangible InvestmentDokument35 SeitenReal Estate and Other Tangible InvestmentBagus NugrohoNoch keine Bewertungen

- Quiz 2Dokument5 SeitenQuiz 2Muhammad Irfan ZafarNoch keine Bewertungen

- Types of Financial Statements: Statement of Profit or Loss (Income Statement)Dokument4 SeitenTypes of Financial Statements: Statement of Profit or Loss (Income Statement)LouiseNoch keine Bewertungen

- Chapter 4 SolutionsDokument85 SeitenChapter 4 SolutionssevtenNoch keine Bewertungen

- Business Finance - ACC501 Handouts PDFDokument194 SeitenBusiness Finance - ACC501 Handouts PDFHamid Mahmood100% (1)

- FAR Notes Chapter 3Dokument3 SeitenFAR Notes Chapter 3jklein2588Noch keine Bewertungen

- Chapter 4 - Analysis of Financial StatementsDokument50 SeitenChapter 4 - Analysis of Financial Statementsnoor_maalik100% (1)

- Risks and Cost of CapitalDokument8 SeitenRisks and Cost of CapitalSarah BalisacanNoch keine Bewertungen

- Sales Mix VarianceDokument6 SeitenSales Mix Variance'Qy Qizwa Andini'Noch keine Bewertungen

- Solution Manual For Accounting 2nd Canadian Edition by WarrenDokument47 SeitenSolution Manual For Accounting 2nd Canadian Edition by Warrena239005954Noch keine Bewertungen

- Bu283 Midterm 2 NotesDokument8 SeitenBu283 Midterm 2 NotesSally MarshallNoch keine Bewertungen

- Lecture5 6 Ratio Analysis 13Dokument39 SeitenLecture5 6 Ratio Analysis 13Cristina IonescuNoch keine Bewertungen

- Projected Balance SheetDokument1 SeiteProjected Balance Sheetr.jeyashankar9550100% (1)

- A Bank Is A Financial Institution Licensed by A GovernmentDokument14 SeitenA Bank Is A Financial Institution Licensed by A GovernmentDuke EphraimNoch keine Bewertungen

- Report of Agrani BankDokument58 SeitenReport of Agrani Bankshafatmostafa100% (2)

- NCC Bank - AboutDokument9 SeitenNCC Bank - AboutDuke EphraimNoch keine Bewertungen

- Guideline For InternshiGuideline For Internship Reportp ReportDokument5 SeitenGuideline For InternshiGuideline For Internship Reportp ReportDuke EphraimNoch keine Bewertungen

- AbandonmentDokument5 SeitenAbandonmentDuke EphraimNoch keine Bewertungen

- Global MarketingDokument13 SeitenGlobal MarketingDuke EphraimNoch keine Bewertungen

- Financial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 29112018Dokument36 SeitenFinancial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 29112018DSddsNoch keine Bewertungen

- IFRS PresentationDokument49 SeitenIFRS Presentationunni Krishnan100% (9)

- Comprehensive Budgeting Example: © The Mcgraw-Hill Companies, Inc., 2006. All Rights ReservedDokument14 SeitenComprehensive Budgeting Example: © The Mcgraw-Hill Companies, Inc., 2006. All Rights Reservedzelalem kebedeNoch keine Bewertungen

- Fund Flow Statemen1tDokument12 SeitenFund Flow Statemen1tYogesh SharmaNoch keine Bewertungen

- CH 10 Revision 2Dokument14 SeitenCH 10 Revision 2Deeb. DeebNoch keine Bewertungen

- FY21 QBOA Module 4 Reporting Supplemental GuideDokument69 SeitenFY21 QBOA Module 4 Reporting Supplemental Guideva.amazonsellercentralNoch keine Bewertungen

- Ifrs AssignmentDokument13 SeitenIfrs Assignmentarijit nathNoch keine Bewertungen

- 11 Accountancy SP 01Dokument33 Seiten11 Accountancy SP 01Abhay ChoudharyNoch keine Bewertungen

- Q2 - Week 7 8Dokument4 SeitenQ2 - Week 7 8Winston MurphyNoch keine Bewertungen

- Topic 1 - Ch01&2 - The Role of Accounting and Financial Statments For Decision MakingDokument44 SeitenTopic 1 - Ch01&2 - The Role of Accounting and Financial Statments For Decision MakingNhân HuỳnhNoch keine Bewertungen

- Polytechnic University of The Philippines College of Accountancy and Finance Sta. Mesa, Manila Junior Philippine Institute of AccountantsDokument12 SeitenPolytechnic University of The Philippines College of Accountancy and Finance Sta. Mesa, Manila Junior Philippine Institute of AccountantsChristine Joyce MagoteNoch keine Bewertungen

- Acctg 13 - Unit Test Final Answer KeyDokument4 SeitenAcctg 13 - Unit Test Final Answer Keyjohn.18.wagasNoch keine Bewertungen

- Partnership and Corporation Accounting Chapter 1 SolManDokument11 SeitenPartnership and Corporation Accounting Chapter 1 SolManDavid BarletaNoch keine Bewertungen

- Lesson 3. CONSOLIDATED FINANCIAL STATEMENTSDokument5 SeitenLesson 3. CONSOLIDATED FINANCIAL STATEMENTSangelinelucastoquero548Noch keine Bewertungen

- Establish and Maintain Accrual Accounting SystemDokument28 SeitenEstablish and Maintain Accrual Accounting SystemTegene TesfayeNoch keine Bewertungen

- Financial Statement Analysis UpdatedDokument8 SeitenFinancial Statement Analysis UpdatedEmmanuel PenullarNoch keine Bewertungen

- SOP Visma Reconciliations in VB Vs 1.1Dokument52 SeitenSOP Visma Reconciliations in VB Vs 1.1Zven BlackNoch keine Bewertungen

- LCD European Quarterly 1Q16Dokument11 SeitenLCD European Quarterly 1Q16Shawn PantophletNoch keine Bewertungen

- FR111. FFA Solution CMA January 2022 ExaminationDokument5 SeitenFR111. FFA Solution CMA January 2022 ExaminationMohammed Javed UddinNoch keine Bewertungen

- Module 9 Inter Corporate InvestmentsDokument24 SeitenModule 9 Inter Corporate Investmentsdsantin84Noch keine Bewertungen

- Stevens Textiles S 2010 Financial Statements Are Shown BelowDokument1 SeiteStevens Textiles S 2010 Financial Statements Are Shown BelowAmit PandeyNoch keine Bewertungen

- Project Report: OF M/S Maa Janki Warehouse (Proprietor: Brijlata Chouhan) (Finance Required: 120 Lakhs)Dokument17 SeitenProject Report: OF M/S Maa Janki Warehouse (Proprietor: Brijlata Chouhan) (Finance Required: 120 Lakhs)SHUBHAM SHRIVASTAVANoch keine Bewertungen

- Far 2 Exercise 5 Page 286Dokument5 SeitenFar 2 Exercise 5 Page 286Kay HispanoNoch keine Bewertungen

- 11th Accountancy EM Book Back 1 Mark Questions 1 English Medium PDF DownloadDokument38 Seiten11th Accountancy EM Book Back 1 Mark Questions 1 English Medium PDF Downloadlnandhini023Noch keine Bewertungen