Beruflich Dokumente

Kultur Dokumente

FASB Ends Pooling of Interests in Accounting For Mergers and Acquisitions at Riker Danzig

Hochgeladen von

Tolulola Olusegun LawalOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FASB Ends Pooling of Interests in Accounting For Mergers and Acquisitions at Riker Danzig

Hochgeladen von

Tolulola Olusegun LawalCopyright:

Verfügbare Formate

15/02/2015

FASB Ends Pooling of Interests in Accounting for Mergers and Acquisitions at Riker Danzig

(/)

Publications

Articles (http://www.riker.com/publications)

Newsletters (http://www.riker.com/publications/newsletters)

FASB Ends Pooling of Interests in Accounting

for Mergers and Acquisitions

[Return to list (http://www.riker.com/publications/all)]

Title:

FASB Ends Pooling of Interests in Accounting for Mergers and Acquisitions

Date:

April 1, 2001

Area(s) of Practice:

Corporate (http://www.riker.com/practices/corporate)

On January 23, 2001 the Financial Accounting Standards Board ("FASB"), the independent board

responsible for establishing and interpreting generally accepted accounting principles, voted

unanimously to effect an important change in the accounting treatment of "business combinations,"

which include most mergers and acquisitions. Specifically, in a move widely opposed by the business

community, the FASB determined that all business combinations should be accounted for using the

"purchase method" of accounting rather than the widely favored "pooling of interests method" of

accounting. Certain proposed changes in the implementation of the purchase method of accounting,

however, should allay the concerns of most in the business community who opposed the change in

methods.

The significance of the change in methods, and the basis of the business community's opposition to

the change, derives from the manner in which goodwill is treated under each method, and the

consequent effect on reportable earnings. Under the "pooling of interests method," the balance sheets

(assets and liabilities) of the two "combining" companies are simply added together, item by item.

Any premium paid over the market value of the assets or "goodwill" is not reflected in the merger or

acquisition and, as such, does not need to be amortized and expensed on a going forward basis. In

contrast, under the "purchase method," any premium paid over the fair market value is reflected on the

acquirer/survivor's balance sheet as goodwill which would ordinarily be amortized and expensed over

a twenty (20) year period. Thus, the "pooling of interests method" has no effect on reported earnings,

while the purchase method generates goodwill amortization expenses and a consequent drag on

reported earnings. For this reason, the pooling of interests method was widely favored by the business

community.

The FASB's desire to eliminate the pooling of interest method of accounting for business

combinations was predicated upon its interest in "improving the quality of information provided to

investors and users of financial statements." In a prepared statement, the FASB explained that "the

purchase method, as modified by the board during deliberations, reflects the underlying economics of

http://www.riker.com/publications/fasb-ends-pooling-of-interests-in-accounting-for-mergers-and-acquisitions

1/2

15/02/2015

FASB Ends Pooling of Interests in Accounting for Mergers and Acquisitions at Riker Danzig

business combinations by requiring that the current values of the assets and liabilities exchanged be

reported to investors. Without the information that the purchase method provides, investors are left

in the dark as to the real cost of one company buying another and, as a result, are unable to track

future returns on the investment."

The elimination of the pooling of interests method in favor of the purchase method, however, may not

result in the impact on earnings once feared by the business community. An important compromise

appears to have emerged regarding the treatment of goodwill when accounting for business

combinations under the purchase method.

Specifically, as part of its general rulemaking, the FASB has tentatively decided to use a

"nonamortization approach" to account for purchased goodwill. Under that approach, goodwill would

still be recognized for accounting purposes, but it would not be amortized and expensed as originally

proposed. Rather, goodwill would be subject to a test for "impairment." For example, when

expectations for the reporting unit have been significantly reduced, goodwill of the reporting unit will

have to be tested. Goodwill would have to be written down and expensed against earnings only if,

after that test, the recorded value of goodwill exceeded its implied fair value.

This revised treatment of goodwill should lessen the impact of a termination of the pooling of interests

method and provide the structure for an acceptable compromise.

The FASB's final statement on the matter will not be released until late June.

Twitter (https://twitter.com/RikerDanzig) LinkedIn (http://www.linkedin.com/company/riker-danzig-scherer-hyland&perretti-llp)

Copyright Riker Danzig Scherer Hyland & Perretti LLP. All rights reserved.

ATTORNEY ADVERTISING | Legal Disclaimer (http://www.riker.com/legal-disclaimer) | Sitemap

(http://www.riker.com/sitemap)

http://www.riker.com/publications/fasb-ends-pooling-of-interests-in-accounting-for-mergers-and-acquisitions

2/2

Das könnte Ihnen auch gefallen

- May 2016 Professional Examination Public Sector Accounting & Finance (2.5) Examiner'S Report, Questions and Marking SchemeDokument24 SeitenMay 2016 Professional Examination Public Sector Accounting & Finance (2.5) Examiner'S Report, Questions and Marking SchemeTolulola Olusegun LawalNoch keine Bewertungen

- Ican Pilot Pe 2Dokument183 SeitenIcan Pilot Pe 2sylv00975% (4)

- pp07-Chapter7EditedDokument70 Seitenpp07-Chapter7EditedTolulola Olusegun LawalNoch keine Bewertungen

- Elementis plc2010 PDFDokument94 SeitenElementis plc2010 PDFTolulola Olusegun LawalNoch keine Bewertungen

- Elementis plc2010 PDFDokument94 SeitenElementis plc2010 PDFTolulola Olusegun LawalNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- AP-100 (Audit of Shareholders' Equity)Dokument8 SeitenAP-100 (Audit of Shareholders' Equity)Gwyneth CartallaNoch keine Bewertungen

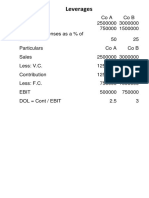

- AFM IBSB Leverages WordDokument16 SeitenAFM IBSB Leverages WordSangeetha K SNoch keine Bewertungen

- FarmFresh - Annual Report 20221Dokument118 SeitenFarmFresh - Annual Report 20221qNoch keine Bewertungen

- Shouq AlmutairiDokument8 SeitenShouq AlmutairiSeu4EduNoch keine Bewertungen

- The Goodwill Attributable To Parent As of December 31, 20x1 IsDokument14 SeitenThe Goodwill Attributable To Parent As of December 31, 20x1 IsDenise Jane RoqueNoch keine Bewertungen

- Entrep Week 11-20Dokument14 SeitenEntrep Week 11-20RC VeraNoch keine Bewertungen

- Doctors Mowtain Lawrence and Curley Are Radiologists Living in YukvilleDokument1 SeiteDoctors Mowtain Lawrence and Curley Are Radiologists Living in YukvilleAmit PandeyNoch keine Bewertungen

- As Accounting Sole Trader AccountsDokument17 SeitenAs Accounting Sole Trader AccountsGill SabNoch keine Bewertungen

- Role of The Investment Corporation of Bangladesh ICB in Development of Capital Market in BangladeshDokument45 SeitenRole of The Investment Corporation of Bangladesh ICB in Development of Capital Market in BangladeshAuishee BaruaNoch keine Bewertungen

- Intermediate Accounting Vol 1 Canadian 3rd Edition Lo Test Bank 1Dokument97 SeitenIntermediate Accounting Vol 1 Canadian 3rd Edition Lo Test Bank 1anthony100% (44)

- Suggested Jan 2021Dokument25 SeitenSuggested Jan 2021just Konkan thingsNoch keine Bewertungen

- Flash Memory IncDokument9 SeitenFlash Memory Incxcmalsk100% (1)

- Candela CorporationDokument5 SeitenCandela Corporationk_cordner523Noch keine Bewertungen

- Quiz in Investment AnswersDokument7 SeitenQuiz in Investment AnswersLenny Ramos VillafuerteNoch keine Bewertungen

- CFAS Reviewer - Module 3Dokument8 SeitenCFAS Reviewer - Module 3Lizette Janiya SumantingNoch keine Bewertungen

- Case Study Krispy KremeDokument14 SeitenCase Study Krispy KremeIsay IbañezNoch keine Bewertungen

- Partnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyDokument11 SeitenPartnership Formation, Operation, Dissolution, and Liquidation by Lump Sum OnlyJoyce Ann Cortez100% (2)

- BN1190 - IT in BusinessDokument17 SeitenBN1190 - IT in BusinessAshar Sultan KayaniNoch keine Bewertungen

- Case 7B FRC M. Gerry Naufal 29123123Dokument7 SeitenCase 7B FRC M. Gerry Naufal 29123123m.gerryNoch keine Bewertungen

- MCQ Sample 3 PDFDokument8 SeitenMCQ Sample 3 PDFlohitacademyNoch keine Bewertungen

- Used Auto Sales Business PlanDokument38 SeitenUsed Auto Sales Business PlanPrabhat Ranjan100% (1)

- Cash Flow Statement ExerciseDokument3 SeitenCash Flow Statement ExerciseVikas YadavNoch keine Bewertungen

- Poa Week 8 LectureDokument14 SeitenPoa Week 8 LectureTabsheer KamranNoch keine Bewertungen

- Intro To FA Quiz 1Dokument2 SeitenIntro To FA Quiz 1Rami DouakNoch keine Bewertungen

- Strategic Management Case Study: Under Armour, Inc., 2013Dokument56 SeitenStrategic Management Case Study: Under Armour, Inc., 2013Diana Azira Darwira100% (8)

- Part2 Revenue Regulations 2018Dokument194 SeitenPart2 Revenue Regulations 2018April CaringalNoch keine Bewertungen

- CompanyDokument2 SeitenCompanyhusse fokNoch keine Bewertungen

- Spit NotesDokument8 SeitenSpit NotesCherith Inna MonteroNoch keine Bewertungen

- Cash FlowsDokument15 SeitenCash FlowsAkshat DwivediNoch keine Bewertungen

- Lesson 1: Theory of Costs Module Title:: Polytechnic College of BotolanDokument14 SeitenLesson 1: Theory of Costs Module Title:: Polytechnic College of BotolanRodrick RamosNoch keine Bewertungen