Beruflich Dokumente

Kultur Dokumente

Question Paper

Hochgeladen von

Aminul Haque RusselCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Question Paper

Hochgeladen von

Aminul Haque RusselCopyright:

Verfügbare Formate

Theory & Practices of Banking (BBA Program)

Aminul Haque Russel

Introduction

1. Define the terms Bank. Discuss the characteristics or features of a bank.

2. Who is a Banker? State the essential qualities of a successful banker.

3. Define the term Banking. Distinguish between Bank and Banking.

4. Discuss the objectives of a modern bank.

5. Define the term: Garnishee order, Barter system.

6. Describe the various type of bank classified on the basis of functions.

7. Discuss the functions of a modern bank.

8. Mention the various utility services provide by commercial banks.

9. What are the functions of commercial banking to the development of the economy of

BD.?

10. What are the services produced by the modern bank?

11. Distinguish between primary function and secondary function.

12. What is unit banking? Explain the advantages and disadvantages unit banking.

13. What is branch banking? Explain the advantages and disadvantages branch banking.

14. Distinguish between branch banking and unit banking.

15. What is the expectation of the society and the nation from the nationalized banks?

16. Deposit is the blood of bank and bank is the blood of an economy of a country. Justify the statement.

17. Discuss the dissimilarity between industrial bank and commercial bank.

18. What are the existing problems of banking business in Bangladesh?

19. What are the ways to removing existing problem in banking business in Bangladesh?

20. Difference between commercial bank and co-operative bank.

21. What are different types of account? Explain.

22. What is merchant banking? What are the functions carried out in merchant banking?

23. Define central bank. Why does a central bank regulate credit?

Theory & Practices of Banking (BBA Program)

Aminul Haque Russel

24. Central bank is the lender of the last resort Explain.

25. Explain the function of a central bank others then credit control.

26. What is the credit control? Describe the methods of credit control used by the central

bank of a country.

27. Distinguish between central and commercial bank.

28. What do you define commercial bank? Discuss the role of private commercial bank to the

development of the economy of Bangladesh.

29. What is credit creation? Explain the mechanism of credit creation by commercial bank.

Use an example.

30. Discuss the limitation of credit creation.

Banker- Customer Relationship

1. Define customer?

2. What are the features of a bankers right of general lien?

3. The balance of a joint account in the name of x, y & z was paid to Y& z on the death x.

states the legal position of the banker.

4. Particular lien vs. General lien.

5. Give a brief occasions bank is justified in disclosing the state of his customers account?

6. Discuss the obligation of a banker to a customer.

7. What are the measures that bank may take to develop banker & customer relationship?

8. Explain the different types of account can be opened in a bank?

9. What risk does a banker incur in opening an account with trustees and executors?

10. What are the modern relationships between banker & customer?

11. Who can open bank account?

12. Discuss the common formalities for opening deposit accounts by depositors.

Theory & Practices of Banking (BBA Program)

Aminul Haque Russel

Negotiable Instrument

1. What is the negotiable Instrument?

2. What are the essential features of a negotiable instrument?

3. What is the difference between negotiability and transferability?

4. Write down the distinguishing features of cheque, bill of exchange and promissory note.

5. Distinguish between holder and holder in due course.

6. What precautions are taken by banks to check forgery of cheque?

7. What is the difference between bill of exchange and promissory note?

8. What is the dishonor of negotiable instrument and what is the action taken against this?

9. Define bill of exchange?

10. Mention the precautionary measure to develop bill of exchange?

11. Write the Importance of the bill of exchange in international trade?

12. As a paying banker, when will you refuse for the payment of a cheque? Discuses

13. Discusses the duty and responsibility of a paying banker.

14. As a collecting banker, what precautions should you take for your safety?

15. How can a negotiable instrument be dishonored?

Loan and advance

1. Distinguish between cash credit and over draft.

2. Mention the different types of loans.

3. Discuses the various forms of bank credit.

4. What do you mean by credit management policy?

5. Define pledge? What are the essential of pledge?

6. Pledge is preferable to lenders but hypothecation is preferable to borrowers explain.

7. Mention briefly the salient feature of the different types of mortgages

Theory & Practices of Banking (BBA Program)

Aminul Haque Russel

8. Narrate briefly the right and liability of guarantor?

9. How can you justify the suitability of a security provide by a client?

10. Explain the various types of collateral security used by banks.

11. Explain the various forms of security.

12. What are the measures that a bank may take to overcome fraudary in loan procedure?

13. Determine the criteria of quality mortgagee.

14. Write about secured vs. unsecured loan.

Lending Policy

1. Explain the various approaches for determining the credit worthiness of borrowers.

2. Who can borrow from a bank?

3. State the element of sound lending policy of a bank.

4. Loan credit deposits do you agree with this statement? Explain.

5. How do you define good loans and bad loans?

6. What are the general principles of good lending? How do you select a borrower?

Discuss the various forms of funded and non-founded credit?

7. What are the sources of information required to prepare a credit proposal?

8. What is credit worthiness? State 6cs or 7cs credit worthiness.

9. Differentiate market rate from bank rate with example.

10. What indicates the poor lending policy of a bank?

11. What are the indicators of bad loans?

Payment instrument

1. What is cheque?

2. State the different features of a cheque?

3. Explain the different types of cheques?

4. Write the characteristics of bearer cheque, cross cheque and order cheque.

Theory & Practices of Banking (BBA Program)

Aminul Haque Russel

5. Explain the various types of payment instruments used by banks?

6. What is bank draft? How come it is different from a cheque?

7. What risk does a banker in use in honoring a post-dated chaque?

Crossing of cheque

1. What do you mean by crossing of cheque?

2. Describe the various types of crossing a cheque.

3. Why is crossing of cheque important?

4. Is crossing a materials alteration?

5. What will you do a banker when a materially altered cheque is presented for payment?

ACTS

1. What us money laundering? Discuss briefly the steps involved in the money laundering

process.

2. Explain the provisions related to prohibition of inside lending and capital requirement as

contained in bank company act 1991.

3. Lending banker will not files suit before selling of securities-Explain the procedure of selling

securities by lending banker under money loan court Act-2003.

4. Write short note on aurtho-rin court Act.

5. State the purpose bank company Act 1991.

6. Under the Banking Company Act of 1991, in what types of business a banking company may

engage itself?

Investment in securities

1. Lending is the principle business of books yet banks invests in securities. Explain why?

2. What is portfolio?

Short Note

1. Either or survivor clause.

2. Fined and floating charge.

Theory & Practices of Banking (BBA Program)

Aminul Haque Russel

3. CRR vs. SLR

4. IMF

5. Online banking.

6. Credit Monitoring.

7. ATM operation

8. Clearing house

9. Notary Public

10. Q-cash

11. Mobile banking

12. Collateral security.

13. Cash credit

14. Letter of credit.

15. Merchant banking

16. Operation of credit card.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Staple GoodsDokument1 SeiteStaple GoodsAminul Haque RusselNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- PLSDokument1 SeitePLSAminul Haque RusselNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Business ResearchDokument1 SeiteBusiness ResearchAminul Haque RusselNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Production & Operations Management: Group ListDokument2 SeitenProduction & Operations Management: Group ListAminul Haque RusselNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Financial LeverageDokument1 SeiteFinancial LeverageAminul Haque RusselNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Bank Job General KnowledgeDokument6 SeitenBank Job General KnowledgeAminul Haque RusselNoch keine Bewertungen

- Chapter Insurance CompaniesDokument22 SeitenChapter Insurance CompaniesAminul Haque RusselNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Chapter - Investment CompaniesDokument16 SeitenChapter - Investment CompaniesAminul Haque RusselNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

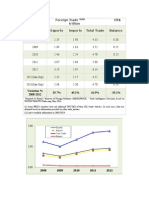

- Foreign TradeDokument4 SeitenForeign TradeAminul Haque RusselNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Financial System of BangladeshDokument2 SeitenFinancial System of BangladeshAminul Haque Russel100% (1)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- E-Cmrc AssignmentDokument34 SeitenE-Cmrc AssignmentAminul Haque RusselNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- RiskDokument2 SeitenRiskAminul Haque RusselNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Question PaperDokument6 SeitenQuestion PaperAminul Haque RusselNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Topics of Project ReportDokument1 SeiteTopics of Project ReportAminul Haque RusselNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- SMLDokument1 SeiteSMLAminul Haque RusselNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Growth in India: InfrastructureDokument2 SeitenGrowth in India: InfrastructureAminul Haque RusselNoch keine Bewertungen

- Project Appraisal: The First Step of Project Appraisal Is To Estimate The Potential Size ofDokument3 SeitenProject Appraisal: The First Step of Project Appraisal Is To Estimate The Potential Size ofAminul Haque RusselNoch keine Bewertungen

- Business, Management, Economics, Finance Submission EmailDokument1 SeiteBusiness, Management, Economics, Finance Submission EmailAminul Haque RusselNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Syllabus BankingDokument1 SeiteSyllabus BankingAminul Haque RusselNoch keine Bewertungen

- Question ListDokument5 SeitenQuestion ListAminul Haque RusselNoch keine Bewertungen

- Inventory Policy SystemDokument3 SeitenInventory Policy SystemAminul Haque Russel0% (1)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- InsuranceDokument3 SeitenInsuranceAminul Haque Russel100% (1)

- Chapter 8Dokument5 SeitenChapter 8Aminul Haque RusselNoch keine Bewertungen

- Short Notes MGTDokument9 SeitenShort Notes MGTAminul Haque RusselNoch keine Bewertungen

- Insurance Company RatingDokument2 SeitenInsurance Company RatingAminul Haque RusselNoch keine Bewertungen

- DifferenceDokument2 SeitenDifferenceAminul Haque RusselNoch keine Bewertungen

- Main Characteristics of ManagementDokument3 SeitenMain Characteristics of ManagementAminul Haque RusselNoch keine Bewertungen

- Operational IssuesDokument4 SeitenOperational IssuesAminul Haque RusselNoch keine Bewertungen

- Principles of ManagementDokument3 SeitenPrinciples of ManagementAminul Haque RusselNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Kunal Jain 29589438528759262180371182184Dokument1 SeiteKunal Jain 29589438528759262180371182184trav baeNoch keine Bewertungen

- Bank Reconciliation StatementDokument12 SeitenBank Reconciliation StatementMuhammad BilalNoch keine Bewertungen

- 79.02 - Trinidad and Tobago Central Bank ActDokument80 Seiten79.02 - Trinidad and Tobago Central Bank ActOilmanGHNoch keine Bewertungen

- Analysis of Notes Receivable and Related AccountsqDokument5 SeitenAnalysis of Notes Receivable and Related AccountsqCJ alandyNoch keine Bewertungen

- SeatworkDokument2 SeitenSeatworkPEÑAS, CHARY ANN C.Noch keine Bewertungen

- Howard MarksDokument15 SeitenHoward Marksa4agarwalNoch keine Bewertungen

- CL Exercises SolutionDokument32 SeitenCL Exercises SolutionJas AlbosNoch keine Bewertungen

- Banking + Current Affairs Questions For SBI PODokument4 SeitenBanking + Current Affairs Questions For SBI POsruthyaNoch keine Bewertungen

- RFBT Special Laws Part 1Dokument29 SeitenRFBT Special Laws Part 1Bernice EmpleoNoch keine Bewertungen

- Wpiea2022105 Print PDFDokument44 SeitenWpiea2022105 Print PDFZahraaNoch keine Bewertungen

- Products and Services Offered by Islamic Banks.Dokument6 SeitenProducts and Services Offered by Islamic Banks.Jaffer J. KesowaniNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Complete Filled Blank Mrunal Economy Handouts2 PDFDokument604 SeitenComplete Filled Blank Mrunal Economy Handouts2 PDFQueen MNoch keine Bewertungen

- Wilmington Trust IndictmentDokument6 SeitenWilmington Trust IndictmentPhiladelphiaMagazineNoch keine Bewertungen

- NIC Asia (Repaired)Dokument55 SeitenNIC Asia (Repaired)Dikshita Shrestha67% (3)

- Jurnal Josiah Aduda and Nancy Kingoo KenyaDokument20 SeitenJurnal Josiah Aduda and Nancy Kingoo KenyaJennifer WijayaNoch keine Bewertungen

- Bank Reconmciliation ProcessDokument13 SeitenBank Reconmciliation ProcessRachelleNoch keine Bewertungen

- CAMEL Ratios ExplainedDokument2 SeitenCAMEL Ratios Explainedsrinath121Noch keine Bewertungen

- Non-Performing Assets - Dissertation - Final Report PDFDokument51 SeitenNon-Performing Assets - Dissertation - Final Report PDFShubham Sakhuja100% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument3 SeitenStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceKrishna Prasad KanchojuNoch keine Bewertungen

- FriDec23001442GMT05002022 PDFDokument2 SeitenFriDec23001442GMT05002022 PDFAli JanjuaNoch keine Bewertungen

- Small Lace Quotation: Guangzhou T-Mart Trading LimitedDokument11 SeitenSmall Lace Quotation: Guangzhou T-Mart Trading LimitedIsrael LopezNoch keine Bewertungen

- Self Help Groups (SHGS)Dokument24 SeitenSelf Help Groups (SHGS)abhinavjogNoch keine Bewertungen

- Financial Cards and Payments in VietnamDokument15 SeitenFinancial Cards and Payments in VietnamVinh NguyenNoch keine Bewertungen

- 1222222222222222222222222222222Dokument3 Seiten1222222222222222222222222222222Jessica Anne TulaliNoch keine Bewertungen

- 00000000002001133432Dokument3 Seiten00000000002001133432Luna M Al-HowidiNoch keine Bewertungen

- Cancellation Form-Multiple SipDokument1 SeiteCancellation Form-Multiple SipPrashant A UNoch keine Bewertungen

- Unit Test 4Dokument12 SeitenUnit Test 4Tin Nguyen0% (1)

- Export Bank GuaranteesDokument3 SeitenExport Bank GuaranteesJoytu DasNoch keine Bewertungen

- A Study On Cryptocurrency in IndiaDokument12 SeitenA Study On Cryptocurrency in IndiaReetika JainNoch keine Bewertungen

- Credit RiskDokument30 SeitenCredit RiskVineeta HNoch keine Bewertungen

- Introduction to Negotiable Instruments: As per Indian LawsVon EverandIntroduction to Negotiable Instruments: As per Indian LawsBewertung: 5 von 5 Sternen5/5 (1)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorVon EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorBewertung: 4.5 von 5 Sternen4.5/5 (63)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpVon EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpBewertung: 4 von 5 Sternen4/5 (214)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorVon EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorBewertung: 4.5 von 5 Sternen4.5/5 (132)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesVon EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesBewertung: 4 von 5 Sternen4/5 (1)