Beruflich Dokumente

Kultur Dokumente

Written Report Bank Acco

Hochgeladen von

Karren Esplana0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

27 Ansichten2 SeitenBANK ACCOUNTING

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenBANK ACCOUNTING

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

27 Ansichten2 SeitenWritten Report Bank Acco

Hochgeladen von

Karren EsplanaBANK ACCOUNTING

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

3.

Renewal/ Extensions of Loans

a) Renewal

- presupposes that the loan has been paid and the borrower is requesting for the

restoration under the same terms and conditions.

b) Extension

- presupposes partial payment on principal another interest; the borrower is

requesting for extension to prolong the payment.

4. Collection Process

The Term as specified in the loan is a fixed portion or the due date that the loan

must be paid. Thus for every credit granted carries with it a term agreed by the debtor

who may pay in full or on a staggered basis. He is even allowed to prepay his loan

before maturity date.

If you havent paid your bills or debts soon after the due date, your creditor will

probably send you formal notices or letters requesting prompt payment. Debt collectors

and creditors may also commence a process to recover the debt by initially starting

to call you and demanding payment.

The Stages of Collection Process

1. Sending of Notice of Collection/ Telephone Follow-up

Reminder to the borrower (one week before the due date)

2. Sending of Past Due Notice/ Telephone Follow-up

A) 1st ast Due Notice

One day after the due date

B) 2nd Past Due Notice

One week Past Due

C) 3rd Past Due Notice

At least one (1) month Past Due

D) 4th Past Due Notice

More than one month Past Due

3. Demand letter must be sent and must be complemented by telephone calls

as well as sending bank collectors.

A letter of demand comes from your creditor or debt collector and usually warns

that if you dont pay the debt within a certain time period (often seven days) they

intend to sue you in court to recover the debt.

4. Past Due

A loan payment that has not been paid as of its due date. A borrower who

is past due may be subject to late fees, unless the borrower is still within a grace

period. Failure to repay a loan on time could have negative implications for the

borrower's credit status or cause the loan terms to be permanently adjusted.

How a customer is treated on a past-due payment will often come down to

their payment history; if there is a pattern of late payments, the grace period may

be shortened or removed.

5. Items in Litigation

When collection becomes impossible, the loan is referred to the legal

Office/ Department who shall initiate legal proceedings against the borrower.

The term debt litigation can refer to a couple of different kinds of legal

actions. In some cases, debt litigation is a type of lawsuit filed by a creditor in

order to recover delinquent payments from a debtor.

Interest

-is a charge on borrowed money. It is the charge for the privilege of borrowing money,

typically expressed as an annual percentage rate.

Interest Rate

-is the percentage on the amount of borrowed money. The amount charged, expressed

as a percentage of principal, by a lender to a borrower for the use of assets. Interest

rates are typically noted on an annual basis, known as theannual percentage

rate (APR).

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Bank of America StatementDokument12 SeitenBank of America StatementAmin Sahil0% (1)

- 2.02 Policies & Procedures Front Office, 99 PagesDokument4 Seiten2.02 Policies & Procedures Front Office, 99 Pagesorientalhospitality100% (7)

- Digital Marketing QuizDokument2 SeitenDigital Marketing QuizpankajnidhiNoch keine Bewertungen

- Nurse Leader Nurs 440Dokument8 SeitenNurse Leader Nurs 440api-273238350Noch keine Bewertungen

- Information Security White PaperDokument10 SeitenInformation Security White PaperiadhinathNoch keine Bewertungen

- Bdwbu: B Jku WBK I Avaywbk E VswksDokument12 SeitenBdwbu: B Jku WBK I Avaywbk E VswksmoonahaNoch keine Bewertungen

- Insurance Abbrevations PDFDokument36 SeitenInsurance Abbrevations PDFATUL CHAUHANNoch keine Bewertungen

- Chantera LeeDokument2 SeitenChantera Leeapi-393982288Noch keine Bewertungen

- Payment SystemDokument24 SeitenPayment SystemTooba HashmiNoch keine Bewertungen

- Cisco Umbrella at A GlanceDokument4 SeitenCisco Umbrella at A GlanceKiril PetkovNoch keine Bewertungen

- Cloud Paks Foundational Services Level 1 Quiz Attempt Review PDFDokument9 SeitenCloud Paks Foundational Services Level 1 Quiz Attempt Review PDFameltonayn100% (1)

- Principles of Marketing: RetailingDokument26 SeitenPrinciples of Marketing: RetailingDevanshu BaberwalNoch keine Bewertungen

- Telecom Reforms 2021 VOL 2Dokument172 SeitenTelecom Reforms 2021 VOL 2testtrial forcloudNoch keine Bewertungen

- Tamil NaduDokument260 SeitenTamil NaduRishi WadhwaniNoch keine Bewertungen

- Product Dissection For PAYTMDokument7 SeitenProduct Dissection For PAYTMashikal70Noch keine Bewertungen

- 004 Problems in Foundations of AccountingDokument39 Seiten004 Problems in Foundations of AccountingsubratcoolNoch keine Bewertungen

- ZZZ CZ 1110 GR 004J enDokument2 SeitenZZZ CZ 1110 GR 004J enNataliiaNoch keine Bewertungen

- 3GPP TS 38.304Dokument28 Seiten3GPP TS 38.304holapaquitoNoch keine Bewertungen

- Report of The Steering Committee On Fintech - 1Dokument150 SeitenReport of The Steering Committee On Fintech - 1Trilochan Sai ChNoch keine Bewertungen

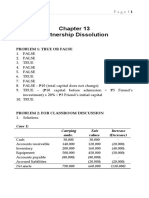

- Sol. Man. - Chapter 13 - Partnership DissolutionDokument16 SeitenSol. Man. - Chapter 13 - Partnership DissolutionJaymark RueloNoch keine Bewertungen

- SAE Claim FormDokument5 SeitenSAE Claim FormNovaPNoch keine Bewertungen

- Chapter 4 - Business ServicesDokument15 SeitenChapter 4 - Business ServicesAkashdeep MukherjeeNoch keine Bewertungen

- Star TopologyDokument8 SeitenStar TopologyAbigail ParungaoNoch keine Bewertungen

- AmazonDokument2 SeitenAmazonMostafa IbrahimNoch keine Bewertungen

- Unit I Scope and Standards of Med-Surg Nursing PracticeDokument9 SeitenUnit I Scope and Standards of Med-Surg Nursing PracticeGlory Mimi100% (1)

- Services HS CodesDokument4 SeitenServices HS CodesKaleem ullah100% (1)

- MCQs Chapter 9 - The Money Supply ProcessDokument45 SeitenMCQs Chapter 9 - The Money Supply ProcessDinh NguyenNoch keine Bewertungen

- ERP Comparison SAP ERP Vs Open ERP Vs OpenbravoDokument3 SeitenERP Comparison SAP ERP Vs Open ERP Vs OpenbravoMD ABUL KHAYERNoch keine Bewertungen

- Computer Networks Kcs603Dokument2 SeitenComputer Networks Kcs603Vijay Kumar YadavNoch keine Bewertungen

- Soalan-Soalan Lazim Berkenaan Muamalat Ar-Rahnu /: Faqs On Muamalat Pawn Broking-I Ciri-Ciri Produk AnswerDokument5 SeitenSoalan-Soalan Lazim Berkenaan Muamalat Ar-Rahnu /: Faqs On Muamalat Pawn Broking-I Ciri-Ciri Produk AnswermatinNoch keine Bewertungen