Beruflich Dokumente

Kultur Dokumente

BUS322Tutorial8 Solution

Hochgeladen von

jacklee1918Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BUS322Tutorial8 Solution

Hochgeladen von

jacklee1918Copyright:

Verfügbare Formate

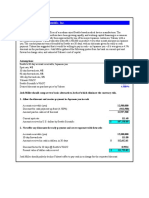

Problem 13.

1 Corcovado Pharmaceuticals

Corcovado Pharmaceuticals cost of debt is 7%. The risk-free rate of interest is 3%. The expected return

on the market portfolio is 8%. After effective taxes, Corcovados effective tax rate is 25%. Its optimal

capital structure is 60% debt and 40% equity.

a. If Corcovados beta is estimated at 1.1, what is its weighted average cost of capital?

b. If Corcovados beta is estimated at 0.8, significantly lower because of the continuing profit prospects

in the global energy sector, what is its weighted average cost of capital?

Assumptions

Corcovado's beta

Cost of debt, before tax

Risk-free rate of interest

Corporate income tax rate

General return on market portfolio

Optimal capital structure:

Proportion of debt, D/V

Proportion of equity, E/V

a.

Values

1.10

7.000%

3.000%

25.000%

8.000%

b.

Values

0.80

7.000%

3.000%

25.000%

8.000%

60%

40%

60%

40%

Cost of debt, after-tax

kd x ( 1 - t )

5.250%

5.250%

Cost of equity, after-tax

ke = krf + ( km - krf )

8.500%

7.000%

WACC

WACC = [ ke x E/V ] + [ ( kd x ( 1 - t ) ) x D/V ]

6.550%

5.950%

Calculation of the WACC

Problem 13.2 Colton Conveyance, Inc.

Colton Conveyance, Inc., is a large U.S. natural gas pipeline company that wants to raise $120 million to finance expansion. Deming wants a capital

structure that is 50% debt and 50% equity. Its corporate combined federal and state income tax rate is 40%. Deming finds that it can finance in the

domestic U.S. capital market at the rates listed below. Both debt and equity would have to be sold in multiples of $20 million, and these cost figures

show the component costs, each, of debt and equtiy if raised half by equity and half by debt.

A London bank advises Deming that U.S. dollars could be raised in Europe at the following costs, also in multiples of $20 million, while maintaining

the 50/50 capital structure.

Each increment of cost would be influenced by the total amount of capital raised. That is, if Deming first borrowed $20 million in the European

market at 6% and matched this with an additional $20 million of equity, additional debt beyond this amount would cost 12% in the United States and

10% in Europe. The same relationship holds for equity financing.

a. Calculate the lowest average cost of capital for each increment of $40 million of new capital, where Deming raises $20 million in the equity market

and an additional $20 in the debt market at the same time.

b. If Deming plans an expansion of only $60 million, how should that expansion be financed? What will be the weighted average cost of capital for

the expansion?

Assumptions

Combined federal and state tax rate

Desired capital structure:

Proportion debt

Proportion equity

Capital to be raised

Costs of Raising Capital in the Market

Up to $40 million of new capital

$41 million to $80 million of new capital

Above $80 million

a. To raise $120,000,000

First $40,000,000

Second $40,000,000

Third $40,000,000

Values

40%

50%

50%

$ 120,000,000

Cost of

Domestic

Equity

12%

18%

22%

Debt Market

European

European

Domestic

Weighted average cost

b. To raise $60,000,000

First $40,000,000

Additional $20,000,000

Weighted average cost

Cost of

Domestic

Debt

8%

12%

16%

Debt Cost

6.00%

10.00%

16.00%

Cost of

European

Equity

14%

16%

24%

Equity Market

Domestic

European

Domestic

10.67%

(equal weights)

Debt Market

European

European

Debt Cost

6.00%

10.00%

7.33%

(2/3 & 1/3 weights)

Equity Market

Domestic

European

Cost of

European

Debt

6%

10%

18%

Equity Cost

Incremental

WACC

12.00%

16.00%

22.00%

7.80%

11.00%

15.80%

16.67%

(equal weights)

11.53%

Equity Cost

Incremental

WACC

12.00%

16.00%

7.80%

11.00%

13.33%

(2/3 & 1/3 weights)

8.87%

Problem 13.3 Trident's Cost of Capital

Market conditions have changed. Maria Gonzalez now estimates the risk-free rate to be 3.60%, the company's

credit risk premium is 4.40%, the domestic beta is estimated at 1.05, the international beta at .85, and the

company's capital structure is now 30% debt. All other values remain the same. For both the domestic CAPM

and ICAPM, calculate:

a. Trident's cost of equity

b. Trident's cost of debt

c. Trident's weighted average cost of capital

Domestic

CAPM

1.05

3.60%

4.40%

8.00%

35%

9.00%

International

ICAPM

0.85

3.60%

4.40%

8.00%

35%

8.00%

30%

70%

30%

70%

a) Trident's cost of equity

ke = krf + ( km - krf )

9.270%

7.340%

b) Trident's cost of debt, after tax

kd x ( 1 - t )

5.200%

5.200%

c) Trident's weighted average cost of capital

WACC = [ ke x E/V ] + [ ( kd x ( 1 - t ) ) x D/V ]

8.049%

6.6980%

Assumptions

Trident's beta,

Risk-free rate of interest, krf

Company credit risk premium

Cost of debt, before tax, kd

Corporate income tax rate, t

General return on market portfolio, km

Optimal capital structure:

Proportion of debt, D/V

Proportion of equity, E/V

Problem 13.4 Trident and Equity Risk Premiums

Using the original cost of capital data for Trident used in the chapter, calculate both the CAPM and ICAPM

costs of capital for the following equity risk premium estimates.

a. 8.00%

b. 7.00%

c. 5.00%

d. 4.00%

Assumptions

Trident's beta,

Risk-free rate of interest, krf

Company credit risk premium

Cost of debt, before tax, kd

Corporate income tax rate, t

Equity risk premium

General return on market portfolio, km

Optimal capital structure:

Proportion of debt, D/V

Proportion of equity, E/V

Answer for part a

Domestic

International

CAPM

ICAPM

1.05

0.85

4.00%

4.00%

4.40%

4.40%

8.40%

8.40%

35%

35%

8.00%

8.00%

12.00%

12.00%

30%

70%

30%

70%

12.400%

10.800%

5.460%

5.460%

10.318%

9.198%

CAPM

ICAPM

a. 8.00%

10.318%

9.198%

b. 7.00%

9.583%

8.603%

c. 5.00%

8.113%

7.413%

d. 4.00%

7.378%

6.818%

a) Trident's cost of equity

ke = krf + ( km - krf )

b) Trident's cost of debt, after tax

kd x ( 1 - t )

c) Trident's weighted average cost of capital

WACC = [ ke x E/V ] + [ ( kd x ( 1 - t ) ) x D/V ]

Differing Equity Risk Premiums

Problem 13.5 Kashmiri's Cost of Capital

Kashmiri is the largest and most successful specialty goods company based in Bangalore, India. It has not entered the North

American marketplace yet, but is considering establishing both manufacturing and distribution facilities in the United States

through a wholly owned subsidiary. It has approached two different investment banking advisors, Goldman Sachs and Bank of

New York, for estimates of what its costs of capital would be several years into the future when it planned to list its American

subsidiary on a U.S. stock exchange. Using the following assumptions by the two different advisors, calculate the prospective

costs of debt, equity, and the

WACC for Kashmiri (U.S.):

Assumptions

Symbol

Goldman Sachs

Bank of New York

Components of beta:

Estimate of correlation between security and market

jm

0.90

0.85

Estimate of standard deviation of Tata's returns

j

24.0%

30.0%

Estimate of standard deviation of market's return

m

18.0%

22.0%

Risk-free rate of interest

Estimate of Tata's cost of debt in US market

Estimate of market return, forward-looking

Corporate tax rate

Proportion of debt

Proportion of equity

krf

kd

km

t

D/V

E/V

3.0%

7.5%

9.0%

35.0%

35%

65%

3.0%

7.8%

12.0%

35.0%

40%

60%

Estimated beta

= ( jm x j ) / ( m )

1.20

1.16

Estimated cost of equity

ke = krf + (km - krf)

ke

10.200%

13.432%

Estimated cost of debt

kd ( 1 - t )

kd (1-t)

4.875%

5.070%

Estimated weighted average cost of capital

WACC = (ke x E/V) + ( (kd x (1-t)) x D/V)

WACC

8.336%

10.087%

Estimating Costs of Capital

Problem 13.6 Cargill's Cost of Capital

Cargill is generally considered to be the largest privately held company in the world. Headquartered in Minneapolis, Minnesota,

the company has been averaging sales of over $113 billion per year over the past 5 year period. Although the company does not

have publicly traded shares, it is still extremely important for it to calculate its weighted average cost of capital properly in order

to make rational decisions on new investment proposals.

Assuming a risk-free rate of 4.50%, an effective tax rate of 48%, and a market risk premium of 5.50%, estimate the weighted

average cost of capital first for companies A and B, and then make a "guesstimate" of what you believe a comparable WACC

would be for Cargill.

Assumptions

Total sales

Company's beta

Company credit rating

Risk-free rate of interest

Market risk premium

Weighted average cost of debt

Corporate tax rate

Debt to total capital ratio

Equity to total capital ratio

International sales as % of total sales

Symbol

Sales

S&P

krf

km-krf

kd

t

D/V

E/V

Estimating Costs of Capital

Symbol

Cost of equity

ke = krf + (km - krf)

Cost of debt, after-tax

Weighted average cost of capital

WACC = (ke x E/V) + ( (kd x (1-t)) x D/V)

Comparables

Company A

Company B

$10.5 billion

$45 billion

0.83

0.68

AA

A

4.5%

4.5%

5.5%

5.5%

6.885%

7.125%

48.0%

48.0%

34%

41%

66%

59%

11%

34%

Cargill

$113 billion

0.90

AA

4.5%

5.5%

6.820%

48.0%

28%

72%

54%

Company A

Company B

Cargill

ke

9.065%

8.240%

9.450%

kd ( 1 - t )

3.580%

3.705%

3.546%

WACC

7.200%

6.381%

7.797%

Once the data is organized, the absence of a beta for Cargill is the obvious data deficiency.

A series of observations is then helpful:

1. Note that beta and credit ratings do not necessarily parallel one another

2. Credit rating and cost of debt do follow expected norms; lower the rating, the higher the cost

3. Both comparable companies, in the same industry as Cargill (commodities), possess relatively low betas

4. Cargill's sales are twice that of the next largest firm

5. Cargill's sales are significantly more internationally diversified than either of the other two companies; the question

is whether this is a positive or negative factor for the estimation of Cargill's cost of equity?

If we take the approach that the beta for Cargill has to pick up all the incremental information, the beta would then fall

between say 0.80 and 1.00. If the higher degree of international sales was interpreted as increasing risk, beta would

be on the higher end; yet being a commodity firm in the current market, its beta would rarely surpass 1.0. A value of

0.90 is shown here giving a WACC of 7.797%. A series of sensitivities would find a WACC between 7.1% and 7.9%.

Problem 13.7 The Tombs

You have joined your friends at the local watering hole, The Tombs, for your weekly debate on international finance. The topic this week is whether the

cost of equity can ever be cheaper than the cost of debt. The group has chosen Brazil in the mid 1990s as the subject of the debate. One of the group

members has torn the following table of data out of a book, which table is then the subject of the analysis.

Larry argues that it's all about expected versus delivered. You can talk about what equity investors expect, but they often find that what is delivered for

years at a time is so small even sometimes negative that in effect the cost of equity is cheaper than the cost of debt.

Moe interrupts: But youre missing the point. The cost of capital is what the investor requires in compensation for the risk taken going into the

investment. If he doesnt end up getting it, and that was happening here, then he pulls his capital out and walks.

Curly is the theoretician. Ladies, this is not about empirical results; it is about the fundamental concept of risk-adjusted returns. An investor in equities

knows he will reap returns only after all compensation has been made to debt providers. He is therefore always subject to a higher level of risk to his return

than with debt instruments, and as the capital asset pricing model states, equity investors set their expected returns as a risk-adjusted factor over and above

the returns to risk-free instruments.

At this point both Larry and Mo simply stare at Curly, pause, and order more beer. Using the Brazilian data presented, comment on this weeks debate at

the Tombs.

Brazilian Economic Performance

Inflation rate (IPC)

Bank lending rate

Exchange rate (reais/$)

Equity returns (Sao Paulo Bovespa)

1995

23.20%

53.10%

0.972

16.0%

1996

10.00%

27.10%

1.039

28.0%

1997

4.80%

24.70%

1.117

30.2%

1998

1.00%

29.20%

1.207

33.5%

1999

10.50%

30.70%

1.700

151.9%

All three are on the right track. It is mostly a matter of finding the linkages beween their individual arguments.

1. Theoretically, Curly is correct in that CAPM assumes that all equity returns are over and above risk-free rates. These are of course,

expected returns, and are the investor's expectations or requirements going INTO the investment.

2. Mo is also correct in arguing that regardless of what investors may EXPECT, the results are often quite different, sometimes disappointing.

Theoretically, when the investment does not yield at least the expected return, the investor should indeed liquidate their position. However,

in reality, many investors for a variety of reasons (tax implications, investment horizon, etc.), may stay in the investment and just complain

about the past and hope about the future.

3. Larry also is on the right track arguing that actual market returns will often result in less than various interest or debt instruments. One of

the more helpful arguments here is that equity returns and interest returns arise from very different economic and financial processes. Most

interest rate charges are stated and contracted for up front, and represent lenders' perception of an adequate risk-adjusted return over the

expected rate of inflation for the coming period. Equity returns, however, are that mystical process of equity markets in which the many

different motives of equity investors combine to move markets in sometimes mysterious ways, independent of interest rates, inflation rates,

or any other fundamental money price.

Mean

9.90%

32.96%

120.7%

51.92%

Problem 13.8 Genedak-Hogan Cost of Equity

Use the following information to answer questions 8 through 10. Genedak-Hogan is an American conglomerate that is actively

debating the impacts of international diversification of its operations on its capital structure and cost of capital. The firm is

planning on reducing consolidated debt after diversification.

Senior management at Genedak-Hogan is actively debating the implications of diversification on its cost of equity. Although both

parties agree that the companys returns will be less correlated with the reference market return in the future, the financial advisors

believe that the market will assess an additional 3.0% risk premium for "going international" to the basic CAPM cost of equity.

Calculate Genedak-Hogan's cost of equity before and after international diversification of its operations, with and without the

hypothetical additional risk premium, and comment on the discussion.

Before

After

Assumptions

Symbol

Diversification

Diversification

Correlation between G-H and the market

jm

0.88

0.76

Standard deviation of G-H's returns

j

28.0%

26.0%

Standard deviation of market's returns

m

18.0%

18.0%

Risk-free rate of interest

krf

3.0%

3.0%

Additional equity risk premium for internationalization

RPM

0.0%

3.0%

Estimate of G-H's cost of debt in US market

kd

7.2%

7.0%

Market risk premium

km-krf

5.5%

5.5%

Corporate tax rate

t

35.0%

35.0%

Proportion of debt

D/V

38%

32%

Proportion of equity

E/V

62%

68%

Estimating Costs of Capital

Estimated beta

= ( jm x j ) / ( m )

1.37

1.10

Estimated cost of equity

ke = krf + (km - krf)

ke

10.529%

9.038%

ke + RPM

10.529%

12.038%

Estimated cost of equity with additional risk premium

ke* = krf + (km - krf) + RPM

This may be a case in which everyone is correct. When G-H's beta is recalculated, it falls in value as a result of

the reduced correlation of its returns with the home market (diversification benefit). This then creates a standard cost of

equity, which is cheaper at 9.038% (previous cost of equity was 10.529%).

If, however, the market was to add an additional risk premium to the firm's cost of equity as a result of internationally

diversifying operations, and if that risk premium were on the order of 3.0%, the final risk-adjusted cost of equity would

indeed be higher, 12.038% compared to the before value of 10.529%.

Problem 13.9 Genedak-Hogan's WACC

Calculate the weighted average cost of capital for Genedak-Hogan for before and after international diversification.

a. Did the reduction in debt costs reduce the firms weighted average cost of capital? How would you describe the impact of

international diversification on its costs of capital?

b. Adding the hypothetical risk premium to the cost of equity introduced in problem 8 (an added 3.0% to the cost of equity because

of international diversification), what is the firms WACC?

Assumptions

Correlation between G-H and the market

Standard deviation of G-H's returns

Standard deviation of market's returns

Risk-free rate of interest

Additional equity risk premium for internationalization

Estimate of G-H's cost of debt in US market

Market risk premium

Corporate tax rate

Proportion of debt

Proportion of equity

Symbol

jm

j

m

krf

RPM

kd

km-krf

t

D/V

E/V

Estimating Costs of Capital

Before

Diversification

0.88

28.0%

18.0%

3.0%

0.0%

7.2%

5.5%

35.0%

38%

62%

After

Diversification

0.76

26.0%

18.0%

3.0%

3.0%

7.0%

5.5%

35.0%

32%

68%

Before

Diversification

After

Diversification

Estimated beta

= ( jm x j ) / ( m )

1.37

1.10

Estimated cost of equity

ke = krf + (km - krf)

ke

10.529%

9.038%

ke + RPM

10.529%

12.038%

4.680%

4.550%

8.306%

7.602%

8.306%

9.642%

Estimated cost of equity with additional risk premium

ke* = krf + (km - krf) + RPM

Cost of debt, after-tax

kd ( 1 - t )

kd (1-t)

Weighted average cost of capital

WACC = (ke x E/V) + ( (kd x (1-t)) x D/V)

WACC

Weighted average cost of capital with RPM

WACC = (ke* x E/V) + ( (kd x (1-t)) x D/V)

WACC*

There are a number of different factors at work here. First, as a result of international diversification, the firm's access to debt

has improved, resulting in a lower cost of debt capital. This is not fully appreciated, however, as the firm has chosen to

reduce its overall use of debt post-diversification (common among MNEs).

The firm's WACC does indeed drop for the standardized case. If, however, the market assesses an additional equity risk

premium of 3.0%, the benefits are swamped by the higher required return on equity by the market.

Problem 13.10 Genedak-Hogan's WACC and Effective Tax Rate

Many MNEs have greater ability to control and reduce their effective tax rates when expanding international operations. If

Genedak-Hogan was able to reduce its consolidated effective tax rate from 35% to 32%, what would be the impact on its WACC?

Assumptions

Correlation between G-H and the market

Standard deviation of G-H's returns

Standard deviation of market's returns

Risk-free rate of interest

Additional equity risk premium for internationalization

Estimate of G-H's cost of debt in US market

Market risk premium

Corporate tax rate

Proportion of debt

Proportion of equity

Symbol

jm

j

m

krf

RPM

kd

km-krf

t

D/V

E/V

Estimating Costs of Capital

Before

Diversification

0.88

28.0%

18.0%

3.0%

0.0%

7.2%

5.5%

35.0%

38%

62%

After

Diversification

0.76

26.0%

18.0%

3.0%

3.0%

7.0%

5.5%

32.0%

32%

68%

Before

Diversification

After

Diversification

Estimated beta

= ( jm x j ) / ( m )

1.37

1.10

Estimated cost of equity

ke = krf + (km - krf)

ke

10.529%

9.038%

ke + RPM

10.529%

12.038%

4.680%

4.760%

8.306%

7.669%

8.306%

9.709%

Estimated cost of equity with additional risk premium

ke* = krf + (km - krf) + RPM

Cost of debt, after-tax

kd ( 1 - t )

kd (1-t)

Weighted average cost of capital

WACC = (ke x E/V) + ( (kd x (1-t)) x D/V)

WACC

Weighted average cost of capital with RPM

WACC = (ke* x E/V) + ( (kd x (1-t)) x D/V)

WACC*

The reduction in the effective tax rate obviously affects WACC through the cost of debt. This does have substantial

benefits in the company's WACC -- as long as additional equity risk premiums are not assessed. Then, even the lower

effective tax rate does not offset the higher equity costs associated with the international risk premium.

Das könnte Ihnen auch gefallen

- Chapter 11Dokument17 SeitenChapter 11mark lee100% (1)

- Ch07 SSolDokument7 SeitenCh07 SSolvenkeeeee100% (1)

- Bus 322 Tutorial 5-SolutionDokument20 SeitenBus 322 Tutorial 5-Solutionbvni50% (2)

- Week 5 Tutorial ProblemsDokument6 SeitenWeek 5 Tutorial ProblemsWOP INVESTNoch keine Bewertungen

- BUS322Tutorial9 SolutionDokument15 SeitenBUS322Tutorial9 Solutionjacklee1918100% (1)

- Problem 11.3Dokument1 SeiteProblem 11.3SamerNoch keine Bewertungen

- 6.18 East Asiatic CompanyDokument2 Seiten6.18 East Asiatic Companydummy yummyNoch keine Bewertungen

- FX II PracticeDokument10 SeitenFX II PracticeFinanceman4Noch keine Bewertungen

- BUS322Tutorial5 SolutionDokument20 SeitenBUS322Tutorial5 Solutionjacklee191825% (4)

- Chap08 Pbms SolutionsDokument25 SeitenChap08 Pbms SolutionsDouglas Estrada100% (1)

- Week 3 Tutorial ProblemsDokument6 SeitenWeek 3 Tutorial ProblemsWOP INVESTNoch keine Bewertungen

- MBF13e Chap08 Pbms - FinalDokument25 SeitenMBF13e Chap08 Pbms - FinalBrandon Steven Miranda100% (4)

- Chapter 11Dokument2 SeitenChapter 11atuanaini0% (1)

- IFM11 Solution To Ch09 P11 Build A ModelDokument18 SeitenIFM11 Solution To Ch09 P11 Build A ModelDiana SorianoNoch keine Bewertungen

- FX IV PracticeDokument10 SeitenFX IV PracticeFinanceman4100% (4)

- Problem 7.1 Amber Mcclain: A. B. C. Assumptions Values Values ValuesDokument25 SeitenProblem 7.1 Amber Mcclain: A. B. C. Assumptions Values Values Valuesveronika100% (1)

- Chap12 Pbms MBF12eDokument10 SeitenChap12 Pbms MBF12eBeatrice BallabioNoch keine Bewertungen

- Problem 8.1 Peregrine Funds - JakartaDokument5 SeitenProblem 8.1 Peregrine Funds - JakartaAlexisNoch keine Bewertungen

- Summer 2021 FIN 6055 New Test 2Dokument2 SeitenSummer 2021 FIN 6055 New Test 2Michael Pirone0% (1)

- MBF14e Chap05 FX MarketsDokument20 SeitenMBF14e Chap05 FX MarketsHaniyah Nadhira100% (1)

- MBF14e Chap10 Transaction PbmsDokument19 SeitenMBF14e Chap10 Transaction PbmsQurratul Asmawi100% (2)

- Assignment Worksheet Swaps SolutionsDokument427 SeitenAssignment Worksheet Swaps SolutionsRimpy Sondh0% (1)

- CH 7Dokument7 SeitenCH 7Asad Ehsan Warraich100% (3)

- Chapter 6 Excel - CIA1Dokument10 SeitenChapter 6 Excel - CIA1tableroof100% (1)

- International FinanceDokument10 SeitenInternational FinancelabelllavistaaNoch keine Bewertungen

- Chap 6 ProblemsDokument5 SeitenChap 6 ProblemsCecilia Ooi Shu QingNoch keine Bewertungen

- Ex - TransExposure SOLDokument5 SeitenEx - TransExposure SOLAlexisNoch keine Bewertungen

- Growth of Corporation Occurs Through 1. Internal Expansion That Is Growth 2. MergersDokument8 SeitenGrowth of Corporation Occurs Through 1. Internal Expansion That Is Growth 2. MergersFazul Rehman100% (1)

- Chapter 13 - Class Notes PDFDokument33 SeitenChapter 13 - Class Notes PDFJilynn SeahNoch keine Bewertungen

- DerivativeDokument16 SeitenDerivativeShiro Deku100% (1)

- MBF13e Chap06 Pbms - FinalDokument20 SeitenMBF13e Chap06 Pbms - Finalaveenobeatnik100% (2)

- Chap11 Translation PbmsDokument10 SeitenChap11 Translation Pbmskk100% (2)

- MBF13e Chap10 Pbms - FinalDokument17 SeitenMBF13e Chap10 Pbms - FinalYee Cheng80% (5)

- MBF14e Chap06 Parity Condition PbmsDokument23 SeitenMBF14e Chap06 Parity Condition PbmsKarl100% (18)

- Fund 4e Chap07 PbmsDokument14 SeitenFund 4e Chap07 Pbmsjordi92500100% (1)

- Shapiro Chapter 07 SolutionsDokument12 SeitenShapiro Chapter 07 SolutionsRuiting Chen100% (1)

- Problem 19.1 Trefica de Honduras: Assumptions ValuesDokument2 SeitenProblem 19.1 Trefica de Honduras: Assumptions ValueskamlNoch keine Bewertungen

- Answer Chapter 7Dokument7 SeitenAnswer Chapter 7Lya_daNoch keine Bewertungen

- FNE306 Assignment 6 AnsDokument9 SeitenFNE306 Assignment 6 AnsCharles MK ChanNoch keine Bewertungen

- Finance - Module 7Dokument3 SeitenFinance - Module 7luckybella100% (1)

- Chapter 7Dokument10 SeitenChapter 7rcraw87Noch keine Bewertungen

- Problem 10.5Dokument1 SeiteProblem 10.5SamerNoch keine Bewertungen

- MBF14e Chap06 Parity Condition PbmsDokument23 SeitenMBF14e Chap06 Parity Condition Pbmsanon_355962815Noch keine Bewertungen

- Chapter 5: The Market For Foreign ExchangeDokument19 SeitenChapter 5: The Market For Foreign ExchangeDang ThanhNoch keine Bewertungen

- Swaps: Problem 7.1Dokument4 SeitenSwaps: Problem 7.1Hana LeeNoch keine Bewertungen

- MBF13eChap10Pbms Final GEDokument17 SeitenMBF13eChap10Pbms Final GEFelix MorelNoch keine Bewertungen

- MF 6Dokument29 SeitenMF 6Hueg HsienNoch keine Bewertungen

- TB Chapter 20Dokument14 SeitenTB Chapter 20Mon LuffyNoch keine Bewertungen

- Week 2 Tut SolsDokument8 SeitenWeek 2 Tut SolsDivya chandNoch keine Bewertungen

- MBF14e Chap02 Monetary System PbmsDokument13 SeitenMBF14e Chap02 Monetary System PbmsKarlNoch keine Bewertungen

- Spot Exchange Markets. Quiz QuestionsDokument14 SeitenSpot Exchange Markets. Quiz Questionsym5c2324100% (1)

- PROBLEMS in ForexDokument2 SeitenPROBLEMS in ForexPrethivi RajNoch keine Bewertungen

- Bilal Hyder I170743 20-SEPDokument10 SeitenBilal Hyder I170743 20-SEPUbaid0% (1)

- Chapter 2 - Part 2 - Problems - AnswersDokument3 SeitenChapter 2 - Part 2 - Problems - Answersyenlth940% (2)

- IntCorpFin Exercises CoC InvDecisionsDokument5 SeitenIntCorpFin Exercises CoC InvDecisionscolorfulsalemNoch keine Bewertungen

- (A) Equity SharesDokument15 Seiten(A) Equity SharesJaya SuryaNoch keine Bewertungen

- Tutorial 9 & 10-Qs-2Dokument2 SeitenTutorial 9 & 10-Qs-2YunesshwaaryNoch keine Bewertungen

- WACC - Ejercicio Clase Grupo 3 23072023Dokument19 SeitenWACC - Ejercicio Clase Grupo 3 23072023HADA KARINA MUÑOZ VALENZUELANoch keine Bewertungen

- Problem Review Set Cost of Capital With SolutionsDokument8 SeitenProblem Review Set Cost of Capital With SolutionsAnonymous o7bJ7zR100% (2)

- Problemset5 AnswersDokument11 SeitenProblemset5 AnswersHowo4DieNoch keine Bewertungen

- Powerpoint Lecture 8Dokument22 SeitenPowerpoint Lecture 8jacklee1918Noch keine Bewertungen

- BUS328 TM 2015 Tutorial QuestionsDokument16 SeitenBUS328 TM 2015 Tutorial Questionsjacklee19180% (1)

- Ict349 Ict649 Topic 04Dokument116 SeitenIct349 Ict649 Topic 04jacklee1918Noch keine Bewertungen

- Apis PHP enDokument708 SeitenApis PHP enbheghezhetNoch keine Bewertungen

- 68 264 1 PBDokument18 Seiten68 264 1 PBjacklee1918Noch keine Bewertungen

- Ict349 Ict649 Topic 04Dokument116 SeitenIct349 Ict649 Topic 04jacklee1918Noch keine Bewertungen

- Advice Bus325 Ts 2013Dokument3 SeitenAdvice Bus325 Ts 2013jacklee1918Noch keine Bewertungen

- MBF13eChap10Pbms Final GEDokument17 SeitenMBF13eChap10Pbms Final GEFelix MorelNoch keine Bewertungen

- Fund 4e Chap09 PbmsDokument12 SeitenFund 4e Chap09 Pbmsbobbyx12100% (1)

- BUS322Tutorial5 SolutionDokument20 SeitenBUS322Tutorial5 Solutionjacklee191825% (4)

- 2012Dokument6 Seiten2012jacklee1918Noch keine Bewertungen

- 2013Dokument6 Seiten2013jacklee1918Noch keine Bewertungen

- Hewlett-Packard: Creating A Virtual Supply Chain (A) Case No. Imd161Dokument5 SeitenHewlett-Packard: Creating A Virtual Supply Chain (A) Case No. Imd161jacklee1918100% (1)

- CPT Program Overview AUG09 WEBDokument18 SeitenCPT Program Overview AUG09 WEBjacklee1918Noch keine Bewertungen

- Supply Chain Innovations For Competitive Advantage Hewlett-Packard Case StudyDokument26 SeitenSupply Chain Innovations For Competitive Advantage Hewlett-Packard Case StudyGaurav MoorjaniNoch keine Bewertungen

- Vmi Retail SCDokument17 SeitenVmi Retail SCIwan VitryawanNoch keine Bewertungen

- 85823945Dokument85 Seiten85823945jacklee1918Noch keine Bewertungen

- Effective Collaboration PDFDokument6 SeitenEffective Collaboration PDFjacklee1918Noch keine Bewertungen

- DELL Supply Chain IntegrationDokument19 SeitenDELL Supply Chain IntegrationdeepakashwaniNoch keine Bewertungen

- Marketing Project On HP LaptopsDokument36 SeitenMarketing Project On HP Laptopsjacklee1918100% (1)

- Haimeng WangDokument52 SeitenHaimeng Wangjacklee1918Noch keine Bewertungen

- HP SolutionDokument20 SeitenHP SolutionPutu Ratih WijayanthiNoch keine Bewertungen

- 6927 21795 1 PBDokument12 Seiten6927 21795 1 PBkothanzawoo1979Noch keine Bewertungen

- Wilkins Thakur-Weigold Wagner 2012 Managing Demand UncertaintyDokument5 SeitenWilkins Thakur-Weigold Wagner 2012 Managing Demand Uncertaintyjacklee1918Noch keine Bewertungen

- The Marketing Strategies of Laptop Companies During The Ordering ProcessDokument4 SeitenThe Marketing Strategies of Laptop Companies During The Ordering Processjacklee1918Noch keine Bewertungen

- p2p DG Technical Adaptive ChallengesDokument3 Seitenp2p DG Technical Adaptive Challengesjacklee1918Noch keine Bewertungen

- 6927 21795 1 PBDokument12 Seiten6927 21795 1 PBkothanzawoo1979Noch keine Bewertungen

- Leadership in An Age of UncertaintyDokument4 SeitenLeadership in An Age of UncertaintyShahnil SinghNoch keine Bewertungen

- The Role, History, and Direction of Management AccountingDokument18 SeitenThe Role, History, and Direction of Management AccountingRavi DesaiNoch keine Bewertungen

- Unclaimed Balances LawDokument17 SeitenUnclaimed Balances LawFritchel Mae QuicosNoch keine Bewertungen

- The Valuation of Long-Term SecuritiesDokument83 SeitenThe Valuation of Long-Term SecuritiesThida WinNoch keine Bewertungen

- Tender Documents PKG 4 Shaheed Benazir Bhutto BridgeDokument133 SeitenTender Documents PKG 4 Shaheed Benazir Bhutto BridgeAbn e MaqsoodNoch keine Bewertungen

- Map4c Skills 5 1 by P HannaDokument8 SeitenMap4c Skills 5 1 by P Hannaapi-268810190Noch keine Bewertungen

- Linear Programming ApplicationsDokument12 SeitenLinear Programming ApplicationsManoranjan DashNoch keine Bewertungen

- HT Connection DocumentsDokument2 SeitenHT Connection Documentsdan_geplNoch keine Bewertungen

- 4 L GST Certificate New PDFDokument3 Seiten4 L GST Certificate New PDFSuhas SuviNoch keine Bewertungen

- P&L - CPCDokument35 SeitenP&L - CPCRadouane ZaamiNoch keine Bewertungen

- Chapter 9 Saving, Investment and The Financial SystemDokument24 SeitenChapter 9 Saving, Investment and The Financial SystemPhan Minh Hiền NguyễnNoch keine Bewertungen

- 1.guess Questions - Theory - Questions and AnswersDokument44 Seiten1.guess Questions - Theory - Questions and AnswersKrishnaKorada100% (14)

- Multinational CorporationsDokument26 SeitenMultinational CorporationsHarshal ShindeNoch keine Bewertungen

- Strategic Alliance v. Radstock DigestDokument9 SeitenStrategic Alliance v. Radstock DigestLeighNoch keine Bewertungen

- NFO Mirae Asset India Opportunities FundDokument3 SeitenNFO Mirae Asset India Opportunities FundDrashti Investments100% (2)

- Graduated - Tax Base Is Net Income 8% - Tax Base Is Gross IncomeDokument9 SeitenGraduated - Tax Base Is Net Income 8% - Tax Base Is Gross IncomeFrancis Kyle Cagalingan SubidoNoch keine Bewertungen

- MollyDokument18 SeitenMollyYS FongNoch keine Bewertungen

- Foreign Exchange MarketDokument35 SeitenForeign Exchange Marketnautynidhi75% (8)

- 1 s2.0 S1572308923000323 MainDokument13 Seiten1 s2.0 S1572308923000323 MainAnditio Yudha PurwonoNoch keine Bewertungen

- Corporate Banking Chapter 2 PDFDokument38 SeitenCorporate Banking Chapter 2 PDFMuhammad shazibNoch keine Bewertungen

- A Study On Working Capital Management With Reference To Maruti Suzuki PVT LTD, KanchikacherlaDokument11 SeitenA Study On Working Capital Management With Reference To Maruti Suzuki PVT LTD, KanchikacherlarambabuNoch keine Bewertungen

- The Future Is Not What It Used To Be Thoughts On The Shape of The Next NormalDokument7 SeitenThe Future Is Not What It Used To Be Thoughts On The Shape of The Next NormalAnna Maria HernandezNoch keine Bewertungen

- Petunjuk: Ujian Kompetensi Dasar I Program Pascasarjana Teknik Industri Universitas Sebelas MaretDokument4 SeitenPetunjuk: Ujian Kompetensi Dasar I Program Pascasarjana Teknik Industri Universitas Sebelas MaretriadNoch keine Bewertungen

- Careers In: Financial MarketsDokument71 SeitenCareers In: Financial MarketsHemant AgrawalNoch keine Bewertungen

- BUS 5111 - Financial Management - Written Assignment Unit 7Dokument4 SeitenBUS 5111 - Financial Management - Written Assignment Unit 7LaVida Loca100% (1)

- The Standard Trade Model: Slides Prepared by Thomas BishopDokument56 SeitenThe Standard Trade Model: Slides Prepared by Thomas BishopNguyên BùiNoch keine Bewertungen

- Isae 3400Dokument9 SeitenIsae 3400baabasaamNoch keine Bewertungen

- Daftar Akun Pt. Manunggal (Hilma)Dokument4 SeitenDaftar Akun Pt. Manunggal (Hilma)Adhitya RamadhanNoch keine Bewertungen

- The Anatomy of A Transaction 020311Dokument1 SeiteThe Anatomy of A Transaction 020311ealpeshpatelNoch keine Bewertungen

- P.O Box 1770, Rahim Pur Khichian Said Pur Road Sialkot-Pakistanphone:-+92-52 - 4268188,4260850-1 Fax: - +92-52-4262852Dokument56 SeitenP.O Box 1770, Rahim Pur Khichian Said Pur Road Sialkot-Pakistanphone:-+92-52 - 4268188,4260850-1 Fax: - +92-52-4262852adeelbajwaNoch keine Bewertungen

- Wallstreetjournal 20160125 The Wall Street JournalDokument40 SeitenWallstreetjournal 20160125 The Wall Street JournalstefanoNoch keine Bewertungen