Beruflich Dokumente

Kultur Dokumente

Budget Amendment Item 132 #4h

Hochgeladen von

api-258849440 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

55 Ansichten1 SeiteAlbemarle County and the City of Charlottesville entered into a revenue-sharing agreement in 1982. This budget amendment reduces the true property value for Albemarle by 10%. The amendment would correct county's ability-to-pay for education.

Originalbeschreibung:

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenAlbemarle County and the City of Charlottesville entered into a revenue-sharing agreement in 1982. This budget amendment reduces the true property value for Albemarle by 10%. The amendment would correct county's ability-to-pay for education.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

55 Ansichten1 SeiteBudget Amendment Item 132 #4h

Hochgeladen von

api-25884944Albemarle County and the City of Charlottesville entered into a revenue-sharing agreement in 1982. This budget amendment reduces the true property value for Albemarle by 10%. The amendment would correct county's ability-to-pay for education.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

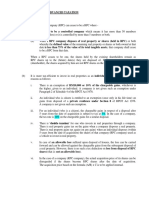

Budget Amendment Item 132 #4h

(Delegate Rob Bell)

Summary

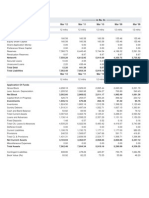

Revenue Sharing Payments from

Endorsed by the Albemarle County Board of Supervisors, Budget

Albemarle County to

Amendment Item 132 #4h will rectify a long-standing inaccuracy in the

Charlottesville:

Composite Index calculations for Albemarle County and the City of

Charlottesville. The current Composite Index formula does not take into o FY07 - $10,134,816

account the revenue-sharing agreement between the two localities, thus o FY08 - $13,212,401

overstating Albemarle’s ability-to-pay for education, and understating o FY09 - $13,633,950

Charlottesville’s revenue available to fund education. This budget

o FY10 - $18,038,878

amendment reduces the true property value for Albemarle by 10%, to

o FY11 - $18,454,658

adjust for the revenue sharing agreement and reflect a more accurate

picture of what Albemarle is actually “able to pay.” Note: The amount of each single-year

payment exceeds the total dollar

Origin of Composite Index Calculation Accuracies amount of all other revenue-sharing

agreements in place statewide,

• Albemarle County and Charlottesville City entered into a revenue combined.

sharing agreement in 1982. This budget amendment only impacts

Albemarle and Charlottesville and does not affect the revenue sharing agreement. It has NO fiscal impact on

the State Budget.

• Albemarle submits a percentage of revenue annually, and Charlottesville agreed not to annex additional land

from Albemarle.*

• At the time of the revenue sharing agreement between Charlottesville and Albemarle, the parties were not

aware of the unintended impact the agreement would have upon the Composite Index and local ability-to-

pay for Albemarle.

• Pursuant to the agreement, Albemarle County annually provides

the equivalent of 10% of its real property tax revenue to

The current Composite Index

Charlottesville (see chart above).

calculations are inaccurate

• The Composite Index formula does not take these real property tax

representations of the actual

payments into consideration. Charlottesville’s state funding is

ability to pay for education for

calculated using their revenues before they receive the large

both Charlottesville and

payment from Albemarle (understating their available revenues),

Albemarle. while Albemarle’s CI is calculated before the large payment is

This amendment would correct subtracted from their available revenues (thus overstating the

county’s ability to pay).

the Composite Index calculation

• The Albemarle County School Board requests this amendment in

to reflect each locality’s actual

order for Albemarle’s Composite Index to accurately reflect its

ability to pay and accurately

revenue, resulting in more funding for Albemarle schools based

allocate state dollars according

upon the Composite Index.

to the state formula.

• This amendment is endorsed by the Albemarle County Board of

Supervisors (vote 2/3/10).

* Cities may no longer involuntarily annex county land, due to a moratorium enacted by the General Assembly January 1, 1987 and

extended by statute until July 1, 2018. As part of this moratorium, cities were granted increased state funding for certain services.

Das könnte Ihnen auch gefallen

- Jim Duncan's Market ReportDokument6 SeitenJim Duncan's Market ReportJim DuncanNoch keine Bewertungen

- Courtesy of Jim Duncan - Nest Realty Group, Charlottesville, Virginia 434-242-7140Dokument6 SeitenCourtesy of Jim Duncan - Nest Realty Group, Charlottesville, Virginia 434-242-7140api-25884944Noch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market Reportapi-25884944Noch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market Reportapi-25884944Noch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market ReportJim DuncanNoch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market ReportJim DuncanNoch keine Bewertungen

- Jim Duncan's Market ReportDokument6 SeitenJim Duncan's Market ReportJim DuncanNoch keine Bewertungen

- Jim Duncan's Market ReportDokument2 SeitenJim Duncan's Market Reportapi-25884944Noch keine Bewertungen

- Jim Duncan's Market Report Market UpdateDokument10 SeitenJim Duncan's Market Report Market UpdateJim DuncanNoch keine Bewertungen

- Albemarle County, VA Market UpdateDokument2 SeitenAlbemarle County, VA Market Updateapi-25884944Noch keine Bewertungen

- Jim Duncan's Market ReportDokument2 SeitenJim Duncan's Market Reportapi-25884944Noch keine Bewertungen

- Albemarle County, VA Market UpdateDokument2 SeitenAlbemarle County, VA Market Updateapi-25884944Noch keine Bewertungen

- Jim Duncan's Market ReportDokument6 SeitenJim Duncan's Market ReportJim DuncanNoch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market Reportapi-25884944Noch keine Bewertungen

- Albemarle County, VA Market UpdateDokument2 SeitenAlbemarle County, VA Market Updateapi-25884944Noch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market Reportapi-25884944Noch keine Bewertungen

- Albemarle County, VA Market UpdateDokument2 SeitenAlbemarle County, VA Market Updateapi-25884944Noch keine Bewertungen

- Crozet Trails Group Meeting: DraftDokument2 SeitenCrozet Trails Group Meeting: Draftapi-25884944Noch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market ReportJim DuncanNoch keine Bewertungen

- Jim Duncan's Market ReportDokument6 SeitenJim Duncan's Market ReportJim DuncanNoch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market ReportJim DuncanNoch keine Bewertungen

- Jim Duncan's Market ReportDokument6 SeitenJim Duncan's Market Reportapi-25884944Noch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market ReportJim DuncanNoch keine Bewertungen

- Jim Duncan's Market ReportDokument6 SeitenJim Duncan's Market ReportJim DuncanNoch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market Reportapi-25884944Noch keine Bewertungen

- Jim Duncan's Market ReportDokument6 SeitenJim Duncan's Market Reportapi-25884944Noch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market Reportapi-25884944Noch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market Reportapi-25884944Noch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market ReportJim DuncanNoch keine Bewertungen

- Jim Duncan's Market ReportDokument10 SeitenJim Duncan's Market Reportapi-25884944Noch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- New Tax RatesDokument2 SeitenNew Tax RatesSIVAKUMARNoch keine Bewertungen

- Nepal Open University: Faculty of Management and Law Office of The Dean Final Exam-2077Dokument2 SeitenNepal Open University: Faculty of Management and Law Office of The Dean Final Exam-2077Diksha PaudelNoch keine Bewertungen

- SSCDokument4 SeitenSSCRaman LuxNoch keine Bewertungen

- Itr-V Indian Income Tax Return VerificatDokument1 SeiteItr-V Indian Income Tax Return VerificatMOHD AslamNoch keine Bewertungen

- الانتقال من النتيجة المحاسبية إلى النتيجة الجبائية على ضوء الفروقات بين النظام المحاسبي المالي والنظام الجبائي الجزائري .Dokument16 Seitenالانتقال من النتيجة المحاسبية إلى النتيجة الجبائية على ضوء الفروقات بين النظام المحاسبي المالي والنظام الجبائي الجزائري .hocine_kashi100% (2)

- F. HTAX230-1-Jan-June2024-FA1-AP-V2-23012024Dokument12 SeitenF. HTAX230-1-Jan-June2024-FA1-AP-V2-23012024kashmeerpunwasiNoch keine Bewertungen

- C. Commissioner of Internal Revenue, Petitioner, vs. S.C. Johnson and Son, Inc.Dokument2 SeitenC. Commissioner of Internal Revenue, Petitioner, vs. S.C. Johnson and Son, Inc.Junmer OrtizNoch keine Bewertungen

- Re Care PackageDokument1 SeiteRe Care PackageYuvraj BanwaitNoch keine Bewertungen

- Identity Theft and Suspicious Activity Declaration Form For Individual, Business and TrustDokument2 SeitenIdentity Theft and Suspicious Activity Declaration Form For Individual, Business and TrustJennifer LeetNoch keine Bewertungen

- Balance Sheet and P&L of CiplaDokument2 SeitenBalance Sheet and P&L of CiplaPratik AhluwaliaNoch keine Bewertungen

- Tax Invoice I Nithin Kumar: Billing Period Invoice Date Amount Payable Due Date Amount After Due DateDokument3 SeitenTax Invoice I Nithin Kumar: Billing Period Invoice Date Amount Payable Due Date Amount After Due Datenithin itikalaNoch keine Bewertungen

- AVERAGEDokument4 SeitenAVERAGEClyde RamosNoch keine Bewertungen

- Invoice ManishDokument1 SeiteInvoice ManishNupurNoch keine Bewertungen

- U.S. Individual Income Tax Return: Chavis 246-23-6504 Shawn EDokument7 SeitenU.S. Individual Income Tax Return: Chavis 246-23-6504 Shawn ELillian Chavis100% (1)

- FabHotels Invoice L417CGDokument1 SeiteFabHotels Invoice L417CGSimran MehrotraNoch keine Bewertungen

- Ent Prac 1Dokument2 SeitenEnt Prac 1lubaajamesNoch keine Bewertungen

- Solved Parent Corporation S Current Year Taxable Income Included 100 000 Net Income FromDokument1 SeiteSolved Parent Corporation S Current Year Taxable Income Included 100 000 Net Income FromAnbu jaromia0% (1)

- Payslip May2017 SF396Dokument1 SeitePayslip May2017 SF396abhilash H100% (1)

- Fw8eci PDFDokument1 SeiteFw8eci PDFAnonymous qaI31HNoch keine Bewertungen

- RMC No. 92-102-2020Dokument5 SeitenRMC No. 92-102-2020nathalie velasquezNoch keine Bewertungen

- Revised InvoiceDokument1 SeiteRevised InvoiceShaik NoorshaNoch keine Bewertungen

- Scope of Total Income and Residential StatusDokument3 SeitenScope of Total Income and Residential StatusSandeep SinghNoch keine Bewertungen

- Important Information - M269602760Dokument2 SeitenImportant Information - M269602760jason masciNoch keine Bewertungen

- Offer Letter-IntelenetDokument2 SeitenOffer Letter-Intelenetkkarthi557Noch keine Bewertungen

- Certificate Under Section 13Dokument5 SeitenCertificate Under Section 13DEEPA ignatiusNoch keine Bewertungen

- AbDokument1.714 SeitenAbkanchan mauryaNoch keine Bewertungen

- BBFT3024 T3 Ans 4a, B, C RPGT - RPCDokument2 SeitenBBFT3024 T3 Ans 4a, B, C RPGT - RPCsomethingNoch keine Bewertungen

- Form 15 AaDokument3 SeitenForm 15 AaTrans TradesNoch keine Bewertungen

- SMR RV PDFDokument2 SeitenSMR RV PDFRoselle ManaysayNoch keine Bewertungen

- Your Reservation: Deluxe King Bed Room - 1 RoomDokument2 SeitenYour Reservation: Deluxe King Bed Room - 1 RoomnurulNoch keine Bewertungen