Beruflich Dokumente

Kultur Dokumente

Bank Reconciliation

Hochgeladen von

Anonymous Azxx3Kp9Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Bank Reconciliation

Hochgeladen von

Anonymous Azxx3Kp9Copyright:

Verfügbare Formate

Where recording errors

in either cashbook

or statement (note

if identical

error in both statement

no need for reconciliation,

only correction)

Where bank has added funds

to the account as part

of the agreement w/ customer

- interest

Where bank withdraws funds

for its own use as part

of the agreement for maintenance

of bank account bank charges

Where bank instructed

to pay sum directly to

3rd party w/o cheque

-direct debit

Where bank receives

money from 3rd party to

be paid into customer's

a/c - no record would

exists in the cash book

- direct credit

Where cheque used

by 3rd party has

been dishonored b/c

condition has not been

met - returned cheques

Where instructions to

bank to make periodic

equal withdrawals and

pay to 3rd party and no note made

in cash book until

statement is received

- standing order

Where cheques used

to make payment to

3rd party

and recorded in cash

book however 3rd party

has not yet negotiated

the cheque

- unpresented cheques

Where bank hasnt

recorded lodgment

of cash or cheque

-late lodgment

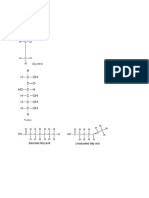

Reasons for

reconciliation

Reconciliation - reconciling

differences between cashbook

and bank statement balances

Reconciliation

Bank Reconciliation

Cash Book vs

Bank Statement

Bank statement periodic record

produced by the bank

recording withdrawals,

lodgments, and bank

charges on the

customer's account

Cash Book is where

customer keeps his record

of all receipts and payments

of cash

(includes any money-cash

or cheques. Reflects

both cash a/c

and bank a/c txns)

Cash Book

vs Bank

Statement

Decrease in balance

- the bank will

debit account

Increase

in Balance The bank will

credit account

Bank Statement

Prepare a reconciliation

statement including only

reconciling items

Balance as updated

cash book to determine

true balance brought down

Update the cashbook

- recording transactions

in the cashbook which

are not in it and found

only in the bank

statement.

Add items to cash book on

the other side

Ensure all items in

cashbook are in bank

statement "on the

other side" - tick

common items

Assume positive balance

unless clearly indicated

otherwise - in cashbook

DR +ve balance

CR -ve balance

Compare opening balances

of cashbook and bank

statement - ensure identical

on opposite sides

(balance b/d on DR side

of cash book = opening

balance on CR side

of the bank statement)

Procedure

Pays out Cash

- Credit Cash

Draw a Cheque

- Credit Bank

Deposit Cheque Debit bank column

Receive Cash - Debit

Cash column

DEBIT | CREDIT

Cash | Bank | Cash | Bank

Cash book

End with opposite

balance to that

at the beginning of the

reconciliation

statement

Add or subtract

Reconciling items

BEGIN WITH

Cashbook or

Bank Statement Balance

Reconciliation Statement

395,000

cheques

18,000

29,000

47,000

348,000

Add

lodgements

not presented on bank statement

15,000

Balance as per cash book

363,000

Balance as per bank statement

Less

unpresented

A. Acorn

B. Orc

PETER CORINTH

BANK RECONCILIATION as at December 31, 2004

Example

Das könnte Ihnen auch gefallen

- Kalinago (Carib) Resistance To European Colonisation of The CaribbeanDokument15 SeitenKalinago (Carib) Resistance To European Colonisation of The CaribbeanAnonymous Azxx3Kp9Noch keine Bewertungen

- Essays in This SectionDokument12 SeitenEssays in This SectionAnonymous Azxx3Kp9Noch keine Bewertungen

- Cambridge Ordinary LevelDokument9 SeitenCambridge Ordinary LevelAnonymous Azxx3Kp9Noch keine Bewertungen

- World War IDokument6 SeitenWorld War IAnonymous Azxx3Kp9Noch keine Bewertungen

- Sinclair (Richard) V Taylor (Vivolyn) - 0Dokument30 SeitenSinclair (Richard) V Taylor (Vivolyn) - 0Anonymous Azxx3Kp9Noch keine Bewertungen

- 20121023Dokument11 Seiten20121023loviebabeNoch keine Bewertungen

- CSEC Study Guide - December 14, 2010Dokument12 SeitenCSEC Study Guide - December 14, 2010Anonymous Azxx3Kp9Noch keine Bewertungen

- PDFDokument4 SeitenPDFacsNoch keine Bewertungen

- IT: Information on System and Application SoftwareDokument10 SeitenIT: Information on System and Application SoftwareAnonymous Azxx3Kp9Noch keine Bewertungen

- ExamDokument27 SeitenExamKashish HoraNoch keine Bewertungen

- GhsbioDokument27 SeitenGhsbioAnonymous Azxx3Kp9Noch keine Bewertungen

- Three Estates Student SheetsDokument2 SeitenThree Estates Student SheetsAnonymous Azxx3Kp9Noch keine Bewertungen

- 36 - ch2 - Reproduction in PlantsDokument21 Seiten36 - ch2 - Reproduction in PlantsAnonymous Azxx3Kp9100% (1)

- 10 - Restriction On Testamentary FreedomDokument1 Seite10 - Restriction On Testamentary FreedomAnonymous Azxx3Kp9Noch keine Bewertungen

- Answer Key Pages 80-89Dokument10 SeitenAnswer Key Pages 80-89Anonymous Azxx3Kp9Noch keine Bewertungen

- Professional Dress in The Court Room - A. SwabyDokument5 SeitenProfessional Dress in The Court Room - A. SwabyAnonymous Azxx3Kp9Noch keine Bewertungen

- Molecudes BiologyDokument3 SeitenMolecudes BiologyAnonymous Azxx3Kp9Noch keine Bewertungen

- 8 - GiftsDokument1 Seite8 - GiftsAnonymous Azxx3Kp9Noch keine Bewertungen

- Grey V PearsonDokument21 SeitenGrey V PearsonAnonymous Azxx3Kp9Noch keine Bewertungen

- Formalities Study NotesDokument7 SeitenFormalities Study NotesAnonymous Azxx3Kp9Noch keine Bewertungen

- The Forgery Act PDFDokument18 SeitenThe Forgery Act PDFAnonymous Azxx3Kp9Noch keine Bewertungen

- 19 - Solvent Distribution of Estate PDFDokument1 Seite19 - Solvent Distribution of Estate PDFAnonymous Azxx3Kp9Noch keine Bewertungen

- Petcom-Atlas Security Contract2Dokument21 SeitenPetcom-Atlas Security Contract2Anonymous Azxx3Kp9Noch keine Bewertungen

- DownSoLong WhyIsItSoHard - PDF Gender InequalityDokument28 SeitenDownSoLong WhyIsItSoHard - PDF Gender InequalityAnonymous Azxx3Kp9Noch keine Bewertungen

- Regina V Harvey Bennett - RM Court DecisionDokument1 SeiteRegina V Harvey Bennett - RM Court DecisionAnonymous Azxx3Kp9Noch keine Bewertungen

- AP 11 Syllabus Final DraftDokument19 SeitenAP 11 Syllabus Final DraftAnonymous Azxx3Kp9Noch keine Bewertungen

- Woman Fined $90K for Fake Passport, Told to Seek Forgiveness at ChurchDokument2 SeitenWoman Fined $90K for Fake Passport, Told to Seek Forgiveness at ChurchAnonymous Azxx3Kp9Noch keine Bewertungen

- The Happy Life Bertrand RussellDokument2 SeitenThe Happy Life Bertrand RussellAnonymous Azxx3Kp9100% (1)

- Final Sexual Offences Definitive Guideline Content Web1Dokument162 SeitenFinal Sexual Offences Definitive Guideline Content Web1Anonymous Azxx3Kp9100% (3)

- FORM TP 2013166: InstructionsDokument10 SeitenFORM TP 2013166: InstructionsSHABBA MADDA POTNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Management Control of Non-Profit Organisations: DR P K Vasudeva 1Dokument7 SeitenManagement Control of Non-Profit Organisations: DR P K Vasudeva 1sunnysiNoch keine Bewertungen

- CHAPTER 6 - Monetary PolicyDokument23 SeitenCHAPTER 6 - Monetary PolicyReggie AlisNoch keine Bewertungen

- Roljack (Company Profile)Dokument20 SeitenRoljack (Company Profile)nathan kleinNoch keine Bewertungen

- Written Assignment Unit 2 Fin MGTDokument2 SeitenWritten Assignment Unit 2 Fin MGTSalifu J TurayNoch keine Bewertungen

- Girish KSDokument3 SeitenGirish KSSudha PrintersNoch keine Bewertungen

- Sandino and Other Superheroes The Function of Comic Books in Revolutionary NicaraguaDokument41 SeitenSandino and Other Superheroes The Function of Comic Books in Revolutionary NicaraguaElefante MagicoNoch keine Bewertungen

- Advanced Accounting Baker Test Bank - Chap011Dokument67 SeitenAdvanced Accounting Baker Test Bank - Chap011donkazotey100% (7)

- LV Capacitor Bank Vendor ListDokument3 SeitenLV Capacitor Bank Vendor Listsreejith123456Noch keine Bewertungen

- Top 10 Myths and Misconceptions About AfricaDokument2 SeitenTop 10 Myths and Misconceptions About Africa01tttNoch keine Bewertungen

- MITI Weekly Bulletin Volume 135 - 29 March 2011Dokument19 SeitenMITI Weekly Bulletin Volume 135 - 29 March 2011Dawson LamNoch keine Bewertungen

- Notice: Initiation of Antidumping Duty Investigation: Circular Welded Austenitic Stainless Pressure Pipe From The Peoples Republic of ChinaDokument6 SeitenNotice: Initiation of Antidumping Duty Investigation: Circular Welded Austenitic Stainless Pressure Pipe From The Peoples Republic of ChinaJustia.comNoch keine Bewertungen

- View Property Tax Details for Ex-Service ManDokument3 SeitenView Property Tax Details for Ex-Service ManAMALAADINoch keine Bewertungen

- Finanzas Corporativas I: Semana #9: Politica de Capital de TrabajoDokument53 SeitenFinanzas Corporativas I: Semana #9: Politica de Capital de TrabajoChristian Sebastian Warthon AzurinNoch keine Bewertungen

- 6 PakistanDokument62 Seiten6 PakistanKhalil Ur Rehman YousafzaiNoch keine Bewertungen

- Interviewing An EntrepreneurDokument7 SeitenInterviewing An EntrepreneurDarshan BhattaraiNoch keine Bewertungen

- Ellis Marshall Global: UK Economy Returns To GrowthDokument2 SeitenEllis Marshall Global: UK Economy Returns To GrowthPR.comNoch keine Bewertungen

- Foundations That Provide Small Grants To NgosDokument4 SeitenFoundations That Provide Small Grants To NgosDevan BhallaNoch keine Bewertungen

- Communist Mannifesto in CornishDokument36 SeitenCommunist Mannifesto in CornishJacob KatzenmeyerNoch keine Bewertungen

- First Security Islami Bank LTD/ Ratio AnalysisDokument22 SeitenFirst Security Islami Bank LTD/ Ratio AnalysisManzurul KarimNoch keine Bewertungen

- S.Noname of CompanyDokument11 SeitenS.Noname of CompanyramNoch keine Bewertungen

- Complete Integration of The Soviet Economy Into The World Capitalist Economy by Fatos NanoDokument4 SeitenComplete Integration of The Soviet Economy Into The World Capitalist Economy by Fatos NanoΠορφυρογήςNoch keine Bewertungen

- BULLISH MARUBOZU, Technical Analysis ScannerDokument2 SeitenBULLISH MARUBOZU, Technical Analysis ScannerNithin BairyNoch keine Bewertungen

- BI in FMCGDokument30 SeitenBI in FMCGrajatdeshwal100% (1)

- Exercise 1Dokument2 SeitenExercise 1Muneeb_2kNoch keine Bewertungen

- Business ModelsDokument3 SeitenBusiness ModelsSteven KimNoch keine Bewertungen

- Worksheet On Accounting For Partnership - Admission of A Partner Board QuestionsDokument16 SeitenWorksheet On Accounting For Partnership - Admission of A Partner Board QuestionsCfa Deepti BindalNoch keine Bewertungen

- World Happiness Report 2023Dokument3 SeitenWorld Happiness Report 2023Muhammad Nisar Khan SoduzaiNoch keine Bewertungen

- Chapter Two Environment and Resource AnalysisDokument47 SeitenChapter Two Environment and Resource AnalysisSehabom GeberhiwotNoch keine Bewertungen

- Disagreeing with Laissez-Faire Principles to Protect National EconomyDokument3 SeitenDisagreeing with Laissez-Faire Principles to Protect National EconomyHastarya YudhaNoch keine Bewertungen

- Essay Pa YunanDokument1 SeiteEssay Pa YunannoprectiNoch keine Bewertungen