Beruflich Dokumente

Kultur Dokumente

MCD Weiss

Hochgeladen von

MinaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

MCD Weiss

Hochgeladen von

MinaCopyright:

Verfügbare Formate

April 19, 2015

NYSE: MCD

MCDONALD'S CORP

BUY

A+

A-

HOLD

B+

Annual Dividend Rate

$3.40

B-

C+

Annual Dividend Yield

3.55%

SELL

C-

D+

Beta

0.36

Sector: Consumer Goods & Svcs

MCD BUSINESS DESCRIPTION

McDonald's Corporation operates and franchises

McDonald's restaurants in the United States,

Europe, the Asia/Pacific, the Middle East, Africa,

Canada, and Latin America. The company's

restaurants offer various food products, soft drinks,

coffee, and other beverages.

Weekly Price: (US$)

D-

E+

E-

Market Capitalization

$91.7 Billion

Sub-Industry: Restaurants

SMA (50)

BUY

52-Week Range

$87.62-$103.78

RATING SINCE

TARGET PRICE

04/23/2008

$110.45

Price as of 4/16/2015

$95.63

Source: S&P

SMA (100)

1 Year

2 Years

113

110

TARGET

TARGET

TARGETPRICE

PRICE

PRICE$110.45

$110.45

$110.45

TARGET

108

105

103

100

STOCK PERFORMANCE (%)

3 Mo.

Price Change

4.52

98

1 Yr.

-5.16

3 Yr (Ann)

-0.33

12 Mo.

-2.37

-14.83

-13.13

3 Yr CAGR

0.53

-4.74

-2.93

95

93

GROWTH (%)

90

Last Qtr

-7.35

-21.44

-19.29

Revenues

Net Income

EPS

RETURN ON EQUITY (%)

MCD

Q4 2014

37.01

Q4 2013

34.89

Q4 2012

35.73

Ind Avg

37.95

21.37

27.03

S&P 500

14.20

14.48

13.11

19.80

33.48

20.57

MCD

Ind Avg

S&P 500

75

50

25

2013

2014

2015

COMPUSTAT for Price and Volume, TheStreet Ratings, Inc. for Rating History

2013

Q4 1.13

Q3 1.09

Q2 1.40

Q1 1.21

Q4 1.40

Q3 1.52

Q2 1.38

43.85% is the gross profit margin for MCDONALD'S CORP which we consider to be strong. Regardless of

MCD's high profit margin, it has managed to decrease from the same period last year. Despite the mixed

results of the gross profit margin, MCD's net profit margin of 16.69% compares favorably to the industry

average.

Q1 1.26

Q4 1.38

Q3 1.43

Q2 1.32

Volume in Millions

HIGHLIGHTS

The return on equity has improved slightly when compared to the same quarter one year prior. This can be

construed as a modest strength in the organization. In comparison to other companies in the Hotels,

Restaurants & Leisure industry and the overall market on the basis of return on equity, MCDONALD'S CORP

has underperformed in comparison with the industry average, but has greatly exceeded that of the S&P 500.

EPS ANALYSIS ($)

Q1 1.23

BUY

RECOMMENDATION

We rate MCDONALD'S CORP (MCD) a BUY. This is based on the convergence of positive investment

measures, which should help this stock outperform the majority of stocks that we rate. The company's

strengths can be seen in multiple areas, such as its notable return on equity, expanding profit margins and

largely solid financial position with reasonable debt levels by most measures. We feel these strengths

outweigh the fact that the company has had sub par growth in net income.

P/E COMPARISON

2012

88

Rating History

2014

NA = not available NM = not meaningful

1 Compustat fiscal year convention is used for all fundamental

data items.

Regardless of the drop in revenue, the company managed to outperform against the industry average of 8.2%.

Since the same quarter one year prior, revenues slightly dropped by 7.3%. Weakness in the company's

revenue seems to have hurt the bottom line, decreasing earnings per share.

Even though the current debt-to-equity ratio is 1.17, it is still below the industry average, suggesting that this

level of debt is acceptable within the Hotels, Restaurants & Leisure industry. Regardless of the somewhat

mixed results with the debt-to-equity ratio, the company's quick ratio of 1.20 is sturdy.

MCDONALD'S CORP's earnings per share declined by 19.3% in the most recent quarter compared to the same

quarter a year ago. The company has suffered a declining pattern of earnings per share over the past two

years. However, we anticipate this trend to reverse over the coming year. During the past fiscal year,

MCDONALD'S CORP reported lower earnings of $4.83 versus $5.56 in the prior year. This year, the market

expects an improvement in earnings ($4.90 versus $4.83).

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: April 19, 2015

PAGE 1

April 19, 2015

NYSE: MCD

MCDONALD'S CORP

Sector: Consumer Goods & Svcs Restaurants Source: S&P

Annual Dividend Rate

$3.40

Annual Dividend Yield

3.55%

PEER GROUP ANALYSIS

30%

CMG

V

FA

AB

OR

LE

QSR

YUM

DNKN

MCD

R

VO

FA

LE

AB

-20%

UN

Revenue Growth (TTM)

DRI

ARMK

SBUX

PNRA

5%

WEN

55%

EBITDA Margin (TTM)

Companies with higher EBITDA margins and

revenue growth rates are outperforming companies

with lower EBITDA margins and revenue growth

rates. Companies for this scatter plot have a market

capitalization between $3.9 Billion and $91.7 Billion.

Companies with NA or NM values do not appear.

*EBITDA Earnings Before Interest, Taxes, Depreciation and

Amortization.

REVENUE GROWTH AND EARNINGS YIELD

30%

Market Capitalization

$91.7 Billion

52-Week Range

$87.62-$103.78

Price as of 4/16/2015

$95.63

INDUSTRY ANALYSIS

The hotels, restaurant, and leisure industry consists of hotels, restaurants, casinos, cruise lines, resorts, and

theme parks. Demand is driven by a fairly consistent group of factors throughout the whole of the industry:

personal income levels, total employment, and consumer confidence. In recent years, catastrophic weather,

fear of terrorism, and health epidemics directly impacted the industry in a material way. The industry is

capital, marketing, personnel, energy, maintenance, and technology intensive. Major players include

Intercontinental Hotels Group (IHG), Marriott International Inc. (MAR), Las Vegas Sands (LVS), MGM Resorts

International (MGM), McDonalds (MCD), and Yum! Brands (YUM).

REVENUE GROWTH AND EBITDA MARGIN*

DPZ

Beta

0.36

CMG

The foodservice industry employs more than 12 million people, making it Americas second largest employer

after the U.S. government. Not only is the industry huge, its growing, as factors - such as a rise in

two-income households - have been leading to increasing levels of dining out. In recent years, restaurant

sales have risen roughly 5% annually according to National Restaurant Association estimates. However,

despite its growth rate, the industry should be seen as mature. Companies within the industry generally earn

thin margins and face stiff competition. As a result, M&A activity is frequent as competitors look to spread

fixed costs across more locations.

Both tourism and business travel remain vital to the industry, and as a result, U.S. GDP growth, consumer

confidence, and corporate earnings remain vital to the industrys success. The expansion in capital spending

has been in response to projected demand. However, overdevelopment in certain areas is a concern. Looking

forward, any prolonged low occupancy rates could threaten hotels that are heavily leveraged. As for metrics,

occupancy, average daily room rate, and revenue per available room should be considered when analyzing

the industry or a player within the industry.

Casinos generate roughly $68 billion in revenues annually, and typically, 50% of a casino hotels revenues

come from gaming, 20% from hotel rooms, 15% from food and beverages, and 15% from retail stores, shows,

and other entertainment offerings. Expansion and consolidation have been recent trends of note. In 2005

alone, MGM Resorts International purchased Mandalay Resort Group for close to $8 billion and Harrahs

bought Caesars for over $9 billion. Recent years have also seen a good amount of new casino construction in

the $700 million range as competitors jockey to attract visitors by providing more elaborate offerings. Looking

ahead, further capacity expansion may threaten margins. Meanwhile, most of the industrys top-line growth

has come from Native American casinos, which at present generate roughly $16 billion in revenues annually.

V

FA

AB

OR

PEER GROUP: Hotels, Restaurants & Leisure

LE

SBUX

DPZ

DRI

PNRA

DNKN

ARMK

YUM

MCD

R

VO

FA

LE

AB

-20%

UN

Revenue Growth (TTM)

QSR

-4%

WEN

6%

Earnings Yield (TTM)

Companies that exhibit both a high earnings yield

and high revenue growth are generally more

attractive than companies with low revenue growth

and low earnings yield. Companies for this scatter

plot have revenue growth rates between -17.1% and

27.8%. Companies with NA or NM values do not

appear.

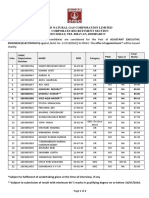

Ticker

MCD

DRI

ARMK

SBUX

DPZ

DNKN

PNRA

WEN

YUM

QSR

CMG

Company Name

MCDONALD'S CORP

DARDEN RESTAURANTS INC

ARAMARK

STARBUCKS CORP

DOMINO'S PIZZA INC

DUNKIN' BRANDS GROUP INC

PANERA BREAD CO

WENDY'S CO

YUM BRANDS INC

RESTAURANT BRANDS INTL INC

CHIPOTLE MEXICAN GRILL INC

Recent

Price ($)

95.63

66.43

30.65

48.24

100.43

48.11

182.89

10.52

79.49

39.30

681.55

Market

Cap ($M)

91,721

8,356

7,281

72,341

5,586

4,654

4,652

3,867

34,450

26,544

21,161

Price/

Earnings

19.80

67.10

39.81

29.24

35.12

28.98

27.50

32.88

34.71

NM

48.23

Net Sales

TTM ($M)

27,441.30

6,535.70

14,772.19

17,011.40

1,993.83

748.71

2,529.20

2,061.06

13,279.00

1,197.30

4,108.27

Net Income

TTM ($M)

4,757.80

690.70

189.69

2,510.50

162.59

176.36

179.29

121.43

1,051.00

158.00

445.37

The peer group comparison is based on Major Restaurants companies of comparable size.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: April 19, 2015

PAGE 2

April 19, 2015

NYSE: MCD

MCDONALD'S CORP

Sector: Consumer Goods & Svcs Restaurants Source: S&P

Annual Dividend Rate

$3.40

Annual Dividend Yield

3.55%

COMPANY DESCRIPTION

McDonald's Corporation operates and franchises

McDonald's restaurants in the United States, Europe, the

Asia/Pacific, the Middle East, Africa, Canada, and Latin

America. The company's restaurants offer various food

products, soft drinks, coffee, and other beverages. As of

December 31, 2014, it operated 36,258 restaurants,

including 29,544 franchised restaurants comprising

20,774 franchised to conventional franchisees, 5,228

licensed to developmental licensees, and 3,542 licensed

to foreign affiliates; and 6,714 company-operated

restaurants. The company was founded in 1940 and is

based in Oak Brook, Illinois.

MCDONALD'S CORP

One McDonald's Plaza

Oak Brook, IL 60523

USA

Phone: 630-623-3000

http://www.aboutmcdonalds.com

Beta

0.36

Market Capitalization

$91.7 Billion

52-Week Range

$87.62-$103.78

Price as of 4/16/2015

$95.63

STOCK-AT-A-GLANCE

Below is a summary of the major fundamental and technical factors we consider when determining our

overall recommendation of MCD shares. It is provided in order to give you a deeper understanding of our

rating methodology as well as to paint a more complete picture of a stock's strengths and weaknesses. It is

important to note, however, that these factors only tell part of the story. To gain an even more comprehensive

understanding of our stance on the stock, these factors must be assessed in combination with the stocks

valuation. Please refer to our Valuation section on page 5 for further information.

FACTOR

SCORE

2.0

Growth

out of 5 stars

weak

Measures the growth of both the company's income statement and

cash flow. On this factor, MCD has a growth score better than 30% of

the stocks we rate.

strong

4.0

Total Return

out of 5 stars

weak

Measures the historical price movement of the stock. The stock

performance of this company has beaten 70% of the companies we

cover.

strong

5.0

Efficiency

out of 5 stars

weak

Measures the strength and historic growth of a company's return on

invested capital. The company has generated more income per dollar of

capital than 90% of the companies we review.

strong

4.0

Price volatility

out of 5 stars

weak

Measures the volatility of the company's stock price historically. The

stock is less volatile than 70% of the stocks we monitor.

strong

4.0

Solvency

out of 5 stars

weak

Measures the solvency of the company based on several ratios. The

company is more solvent than 70% of the companies we analyze.

strong

4.5

Income

out of 5 stars

weak

Measures dividend yield and payouts to shareholders. The company's

dividend is higher than 80% of the companies we track.

strong

THESTREET RATINGS RESEARCH METHODOLOGY

TheStreet Ratings' stock model projects a stock's total return potential over a 12-month period including both

price appreciation and dividends. Our Buy, Hold or Sell ratings designate how we expect these stocks to

perform against a general benchmark of the equities market and interest rates. While our model is

quantitative, it utilizes both subjective and objective elements. For instance, subjective elements include

expected equities market returns, future interest rates, implied industry outlook and forecasted company

earnings. Objective elements include volatility of past operating revenues, financial strength, and company

cash flows.

Our model gauges the relationship between risk and reward in several ways, including: the pricing drawdown

as compared to potential profit volatility, i.e.how much one is willing to risk in order to earn profits; the level of

acceptable volatility for highly performing stocks; the current valuation as compared to projected earnings

growth; and the financial strength of the underlying company as compared to its stock's valuation as

compared to projected earnings growth; and the financial strength of the underlying company as compared

to its stock's performance. These and many more derived observations are then combined, ranked, weighted,

and scenario-tested to create a more complete analysis. The result is a systematic and disciplined method of

selecting stocks.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: April 19, 2015

PAGE 3

April 19, 2015

NYSE: MCD

MCDONALD'S CORP

Sector: Consumer Goods & Svcs Restaurants Source: S&P

Annual Dividend Rate

$3.40

Annual Dividend Yield

3.55%

Consensus EPS Estimates ($)

IBES consensus estimates are provided by Thomson Financial

1.06

4.90 E

5.31 E

Q1 FY15

2015(E)

2016(E)

Market Capitalization

$91.7 Billion

52-Week Range

$87.62-$103.78

Price as of 4/16/2015

$95.63

FINANCIAL ANALYSIS

MCDONALD'S CORP's gross profit margin for the fourth quarter of its fiscal year 2014 is essentially

unchanged when compared to the same period a year ago. Sales and net income have dropped, although the

growth in net income underperformed the average competitor within the industry, the revenue growth did not.

MCDONALD'S CORP has average liquidity. Currently, the Quick Ratio is 1.20 which shows that technically this

company has the ability to cover short-term cash needs. The company's liquidity has decreased from the

same period last year, indicating deteriorating cash flow.

During the same period, stockholders' equity ("net worth") has decreased by 19.71% from the same quarter

last year. Together, the key liquidity measurements indicate that it is relatively unlikely that the company will

face financial difficulties in the near future.

STOCKS TO BUY: TheStreet Quant Ratings has identified a handful of stocks that can potentially TRIPLE in the

next 12-months. To learn more visit www.TheStreetRatings.com.

INCOME STATEMENT

Net Sales ($mil)

EBITDA ($mil)

EBIT ($mil)

Net Income ($mil)

Beta

0.36

Q4 FY14

6,572.20

2,219.10

1,811.60

1,097.50

Q4 FY13

7,093.20

2,523.60

2,115.00

1,397.00

Q4 FY14

2,077.90

34,281.40

14,989.70

12,853.40

Q4 FY13

2,798.70

36,626.30

14,129.80

16,009.70

Q4 FY14

43.85%

33.76%

27.56%

0.80

13.87%

37.01%

Q4 FY13

44.43%

35.57%

29.82%

0.77

15.25%

34.89%

Q4 FY14

1.52

0.54

147.80

12.26

Q4 FY13

1.59

0.47

133.50

15.84

Q4 FY14

963

0.85

1.13

13.35

NA

7,406,968

Q4 FY13

990

0.81

1.40

16.16

NA

6,211,139

BALANCE SHEET

Cash & Equiv. ($mil)

Total Assets ($mil)

Total Debt ($mil)

Equity ($mil)

PROFITABILITY

Gross Profit Margin

EBITDA Margin

Operating Margin

Sales Turnover

Return on Assets

Return on Equity

DEBT

Current Ratio

Debt/Capital

Interest Expense

Interest Coverage

SHARE DATA

Shares outstanding (mil)

Div / share

EPS

Book value / share

Institutional Own %

Avg Daily Volume

2 Sum of quarterly figures may not match annual estimates due to

use of median consensus estimates.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: April 19, 2015

PAGE 4

April 19, 2015

NYSE: MCD

MCDONALD'S CORP

Sector: Consumer Goods & Svcs Restaurants Source: S&P

Annual Dividend Rate

$3.40

Annual Dividend Yield

3.55%

RATINGS HISTORY

Our rating for MCDONALD'S CORP has not changed

since 3/2/2004. As of 4/16/2015, the stock was

trading at a price of $95.63 which is 7.9% below its

52-week high of $103.78 and 9.1% above its 52-week

low of $87.62.

BUY: $103.04

2 Year Chart

Beta

0.36

Market Capitalization

$91.7 Billion

$105

$100

Price/Earnings

$95

$90

2014

MOST RECENT RATINGS CHANGES

Date

Price

Action

4/16/13

$103.04 No Change

Price reflects the closing price as of the date listed, if available

RATINGS DEFINITIONS &

DISTRIBUTION OF THESTREET RATINGS

(as of 4/16/2015)

29.21% Hold - We do not believe this stock offers

conclusive evidence to warrant the purchase or sale of

shares at this time and that its likelihood of positive total

return is roughly in balance with the risk of loss.

TheStreet Ratings

14 Wall Street, 15th Floor

New York, NY 10005

www.thestreet.com

Research Contact: 212-321-5381

Sales Contact: 866-321-8726

Price/Sales

discount

MCD 13.68

Peers 16.28

Discount. The P/CF ratio, a stocks price divided by

the company's cash flow from operations, is useful

for comparing companies with different capital

requirements or financing structures.

MCD is trading at a discount to its peers.

Price to Earnings/Growth

premium

discount

MCD 12.00

Peers 3.81

Premium. The PEG ratio is the stocks P/E divided by

the consensus estimate of long-term earnings

growth. Faster growth can justify higher price

multiples.

MCD trades at a significant premium to its peers.

Earnings Growth

lower

5

higher

MCD -13.13

Peers 314.17

Lower. Elevated earnings growth rates can lead to

capital appreciation and justify higher

price-to-earnings ratios.

However, MCD is expected to significantly trail its

peers on the basis of its earnings growth rate.

Sales Growth

discount

MCD 3.36

Peers 3.05

Premium. In the absence of P/E and P/B multiples,

the price-to-sales ratio can display the value

investors are placing on each dollar of sales.

MCD is trading at a premium to its industry on this

measurement.

premium

discount

MCD 7.16

Peers 14.64

Discount. A lower price-to-book ratio makes a

stock more attractive to investors seeking stocks

with lower market values per dollar of equity on the

balance sheet.

MCD is trading at a significant discount to its peers.

premium

23.35% Sell - We believe that this stock is likely to

decline by more than 10% over the next 12 months, with

the risk involved too great to compensate for any

possible returns.

MCD 18.01

Peers 28.31

Discount. A lower price-to-projected earnings ratio

than its peers can signify a less expensive stock or

lower future growth expectations.

MCD is trading at a significant discount to its peers.

Price/Book

Price/CashFlow

discount

premium

47.44% Buy - We believe that this stock has the

opportunity to appreciate and produce a total return of

more than 10% over the next 12 months.

discount

premium

To

Buy

MCD 19.80

Peers 33.48

Discount. A lower P/E ratio than its peers can

signify a less expensive stock or lower growth

expectations.

MCD is trading at a significant discount to its peers.

Price/Projected Earnings

From

Buy

Price as of 4/16/2015

$95.63

VALUATION

BUY. The current P/E ratio indicates a significant discount compared to an average of 33.48 for the Hotels,

Restaurants & Leisure industry and a value on par with the S&P 500 average of 20.57. To use another

comparison, its price-to-book ratio of 7.16 indicates a significant premium versus the S&P 500 average of 2.84

and a significant discount versus the industry average of 14.64. The current price-to-sales ratio is well above

the S&P 500 average and above the industry average, indicating a premium. Upon assessment of these and

other key valuation criteria, MCDONALD'S CORP proves to trade at a discount to investment alternatives

within the industry.

premium

2013

52-Week Range

$87.62-$103.78

lower

5

higher

MCD -2.37

Peers 13.17

Lower. A sales growth rate that trails the industry

implies that a company is losing market share.

MCD significantly trails its peers on the basis of

sales growth

DISCLAIMER:

The opinions and information contained herein have been obtained or derived from sources believed to be reliable, but

TheStreet Ratings cannot guarantee its accuracy and completeness, and that of the opinions based thereon. Data is provided

via the COMPUSTAT Xpressfeed product from Standard &Poor's, a division of The McGraw-Hill Companies, Inc., as well as

other third-party data providers.

TheStreet Ratings is a division of TheStreet, Inc., which is a publisher. This research report contains opinions and is provided

for informational purposes only. You should not rely solely upon the research herein for purposes of transacting securities or

other investments, and you are encouraged to conduct your own research and due diligence, and to seek the advice of a

qualified securities professional, before you make any investment. None of the information contained in this report constitutes,

or is intended to constitute a recommendation by TheStreet Ratings of any particular security or trading strategy or a

determination by TheStreet Ratings that any security or trading strategy is suitable for any specific person. To the extent any of

the information contained herein may be deemed to be investment advice, such information is impersonal and not tailored to the

investment needs of any specific person. Your use of this report is governed by TheStreet, Inc.'s Terms of Use found at

http://www.thestreet.com/static/about/terms-of-use.html.

This report is for information purposes only and should not be considered a solicitation to buy or sell any security. Neither TheStreet Ratings nor any other party guarantees its accuracy

or makes warranties regarding results from its usage. Redistribution is prohibited without the express written consent of TheStreet Ratings. Copyright(c) 2006-2015. All rights reserved.

Report Date: April 19, 2015

PAGE 5

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Hidden Tools of Comedy The Serious Business of Being Funny PDFDokument190 SeitenThe Hidden Tools of Comedy The Serious Business of Being Funny PDFMina89% (19)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Secret To Becoming The Alpha Male of Any Group - Bonus EbookDokument17 SeitenThe Secret To Becoming The Alpha Male of Any Group - Bonus EbookDaniel BarrosNoch keine Bewertungen

- Fastest Way To Build Chi and Martial PowerDokument22 SeitenFastest Way To Build Chi and Martial PowerOualid Kun Memecenter100% (4)

- Fastest Way To Build Chi and Martial PowerDokument22 SeitenFastest Way To Build Chi and Martial PowerOualid Kun Memecenter100% (4)

- Fastest Way To Build Chi and Martial PowerDokument22 SeitenFastest Way To Build Chi and Martial PowerOualid Kun Memecenter100% (4)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Shaolin IsometricsDokument16 SeitenShaolin Isometrics---80% (5)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Reliance Private Car Vehicle Certificate Cum Policy ScheduleDokument1 SeiteReliance Private Car Vehicle Certificate Cum Policy ScheduleBarry Peterson100% (4)

- Approaching Without Rejection - Strategy Series Month 2Dokument15 SeitenApproaching Without Rejection - Strategy Series Month 2Mina100% (1)

- Maxick Muscle ControlDokument140 SeitenMaxick Muscle ControlDerek Espinoza100% (1)

- LethalDokument80 SeitenLethalekc_1971Noch keine Bewertungen

- 101 Ways TestosteroneDokument32 Seiten101 Ways Testosteroneertyuio456788Noch keine Bewertungen

- Saturn in LibraDokument13 SeitenSaturn in Librasands109Noch keine Bewertungen

- Unclaimed Balances LawDokument17 SeitenUnclaimed Balances LawFritchel Mae QuicosNoch keine Bewertungen

- (Martial Arts) Fitness TipsDokument7 Seiten(Martial Arts) Fitness Tipsbrogan100% (21)

- (Martial Arts) Fitness TipsDokument7 Seiten(Martial Arts) Fitness Tipsbrogan100% (21)

- Dating Skills Review - Top 13 Products Cheat SheetDokument28 SeitenDating Skills Review - Top 13 Products Cheat SheetandycreedNoch keine Bewertungen

- Trading With Equivolume: Dick ArmsDokument26 SeitenTrading With Equivolume: Dick ArmsKevin BunyanNoch keine Bewertungen

- DC Soccer Cost-Benefit Analysis FINALDokument406 SeitenDC Soccer Cost-Benefit Analysis FINALBenjamin FreedNoch keine Bewertungen

- Withdrawal Request Form: Please Fill in All Required InformationDokument1 SeiteWithdrawal Request Form: Please Fill in All Required InformationMinaNoch keine Bewertungen

- Republic Act No. 4726 The Condominium Act: What Is A Condominium?Dokument4 SeitenRepublic Act No. 4726 The Condominium Act: What Is A Condominium?Vic CajuraoNoch keine Bewertungen

- 01 - How To Gain Instant Rapport With ProspectsDokument3 Seiten01 - How To Gain Instant Rapport With ProspectsMinaNoch keine Bewertungen

- Consepts & IDEASDokument13 SeitenConsepts & IDEASMinaNoch keine Bewertungen

- IntegrationDokument2 SeitenIntegrationMinaNoch keine Bewertungen

- MBM - High-Value Profile Builder PDFDokument25 SeitenMBM - High-Value Profile Builder PDFMinaNoch keine Bewertungen

- 5 - Module Four - Modelling Being A Man and Taking RisksDokument1 Seite5 - Module Four - Modelling Being A Man and Taking Risksrazvan123456Noch keine Bewertungen

- Upwork Freelancer GuideDokument21 SeitenUpwork Freelancer Guideapi-287459898Noch keine Bewertungen

- Iias NL40 09Dokument1 SeiteIias NL40 09takeyama907Noch keine Bewertungen

- Michael Winn - Chi Kung Fundamentals 1 - CD Audio Guide PDFDokument1 SeiteMichael Winn - Chi Kung Fundamentals 1 - CD Audio Guide PDFJoãoTorres100% (1)

- How To Draw Anime For Beginner (ENG)Dokument153 SeitenHow To Draw Anime For Beginner (ENG)yuu12399% (194)

- Self-Clinching Studs/ Pins - PennEngineeringDokument28 SeitenSelf-Clinching Studs/ Pins - PennEngineeringMinaNoch keine Bewertungen

- ACT JahnkeDokument7 SeitenACT JahnkeMinaNoch keine Bewertungen

- Self-Clinching Studs/ Pins - PennEngineeringDokument28 SeitenSelf-Clinching Studs/ Pins - PennEngineeringMinaNoch keine Bewertungen

- Commerce & Accountancy Scholarship Guidelines - 2Dokument1 SeiteCommerce & Accountancy Scholarship Guidelines - 2MinaNoch keine Bewertungen

- Latest Scheme BrochureDokument46 SeitenLatest Scheme Brochurerohit klshaanNoch keine Bewertungen

- Philippine ZIP CodesDokument22 SeitenPhilippine ZIP CodesKenneth Alfonso Manalansan EsturasNoch keine Bewertungen

- 1.transferable Lessons Re Examining The Institutional Prerequisites of East Asian Economic Policies PDFDokument22 Seiten1.transferable Lessons Re Examining The Institutional Prerequisites of East Asian Economic Policies PDFbigsushant7132Noch keine Bewertungen

- Jittipat Poonkham - Russia's Pivot To Asia: Visionary or Reactionary?Dokument8 SeitenJittipat Poonkham - Russia's Pivot To Asia: Visionary or Reactionary?Jittipat PoonkhamNoch keine Bewertungen

- List of PublicationDokument3 SeitenList of PublicationBiswajit JenaNoch keine Bewertungen

- PWC To Acquire PRTMDokument2 SeitenPWC To Acquire PRTMBRR_DAGNoch keine Bewertungen

- Dalwadi SirDokument4 SeitenDalwadi SirVinod NairNoch keine Bewertungen

- Telecommuting Report FormDokument1 SeiteTelecommuting Report FormCarlo OroNoch keine Bewertungen

- Managerial. EcoDokument15 SeitenManagerial. EcomohitharlaniNoch keine Bewertungen

- The Truth About EtawahDokument4 SeitenThe Truth About EtawahPoojaDasgupta100% (1)

- Overview of Energy Systems in Northern CyprusDokument6 SeitenOverview of Energy Systems in Northern CyprushaspyNoch keine Bewertungen

- Chapter 7: Financial Reporting and Changing Prices: International Accounting, 6/eDokument26 SeitenChapter 7: Financial Reporting and Changing Prices: International Accounting, 6/eapi-241660930Noch keine Bewertungen

- Initial Project Screening Method - Payback Period: Lecture No.15 Contemporary Engineering EconomicsDokument32 SeitenInitial Project Screening Method - Payback Period: Lecture No.15 Contemporary Engineering EconomicsAfiq de WinnerNoch keine Bewertungen

- Coca Cola Company PresentationDokument29 SeitenCoca Cola Company PresentationVibhuti GoelNoch keine Bewertungen

- Abstract Sustainable Renewable Energy Development Program (Suredep) Through Gender Power Upstreaming For Bicol Region (Phase I) .Docx - 0Dokument1 SeiteAbstract Sustainable Renewable Energy Development Program (Suredep) Through Gender Power Upstreaming For Bicol Region (Phase I) .Docx - 0Norlijun V. HilutinNoch keine Bewertungen

- Chapter 7 AbcDokument5 SeitenChapter 7 AbcAyu FaridYaNoch keine Bewertungen

- Disney Ceramic Reusable Bottle 34oz 1,000ml - Frank Green AustraliaDokument1 SeiteDisney Ceramic Reusable Bottle 34oz 1,000ml - Frank Green Australiad96677q568Noch keine Bewertungen

- A True History of Oil and GasDokument2 SeitenA True History of Oil and GasKaiysse YoukéNoch keine Bewertungen

- Ecological Solid Waste DraftDokument27 SeitenEcological Solid Waste DraftKhryz CallëjaNoch keine Bewertungen

- Expectations-At The End of This UnitDokument23 SeitenExpectations-At The End of This Unitxx101xx100% (1)

- Irma Irsyad - Southwest Case StudyDokument27 SeitenIrma Irsyad - Southwest Case StudyIrma IrsyadNoch keine Bewertungen

- Final Draft of Toledo City LSPDokument21 SeitenFinal Draft of Toledo City LSPapi-194560166Noch keine Bewertungen

- 25 Important Model IBPS Banking Awareness QuestionsDokument5 Seiten25 Important Model IBPS Banking Awareness Questionsjaved alamNoch keine Bewertungen

- 945-Jeevan Umang: Prepared byDokument7 Seiten945-Jeevan Umang: Prepared byVishal GuptaNoch keine Bewertungen

- Aee Electronics 1Dokument2 SeitenAee Electronics 1Rashi SharmaNoch keine Bewertungen