Beruflich Dokumente

Kultur Dokumente

TNe

Hochgeladen von

muiesibaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TNe

Hochgeladen von

muiesibaCopyright:

Verfügbare Formate

Technician Macro/Fixed Income Research

3/25/2013

Recommendations and opinions in this material are based solely on technical analysis. You can find

fundamentally-based recommendations in our FI & FX CEE Insights.

Current recommendations:

1) Brent long, open @ 108.8, cl @ 116, stop-loss @ 106. Lock in 112/110. Speculation on rebound from 108 level.

Time horizon: 6 weeks

Instrument

Lead

Brent

Direction

short

long

Open Opened

2243 4.3.2013

108.8 25.3.2013

Target

1960

116

Stop-loss

P/L (%) Comment

2310 +2.43%

3 weeks remaining

106

6 weeks remaining

Summary

EUR/CZK

Testing of 25.80 level should continue for some time. Breakthrough of that level is easily possible, because of clearly

prevailing upward momentum without overbought conditions.

EUR/PLN

Consolidation above moving averages seems most likely technical scenario. 4.19 level should cap possible rebound.

EUR/HUF

Euro is clearly overbought, so consolidation or correction is likely.

EUR/RON

Upward momentum is strengthening, so testing of 200-day moving average is likely.

EUR/TRY

Continuation of consolidation is likely. Breakthrough of 200-day moving average is somewhat more likely than breakthrough of 2.36

level/60-day moving average.

EUR/USD

Room for further decline should be limited by still oversold euro, so continuation of consolidation is likely.

EUR/JPY

Consolidation around 123 level/20-day moving average should continue for some time.

EUR/CHF

We expect rebound from 200-day moving average.

Brent

Consolidation around 108 level or even correction to at least 110 level are likely because of oversold conditions.

Analyst: Lubo Mokr

lmokras@csas.cz

Erste Group Technician

Page 1

Technician Macro/Fixed Income Research

3/25/2013

EUR/CZK

Main trend: consolidation

Short-term trend: growth

R1: 25.80 top, consolidation

S1: 25.45 bottom

S2: 25.20 consolidation

S3: 25.00 psychological, bottom

S4: 24.80 consolidation

S5: 24.65 bottom of consolidation range

S6: 24.50 low

S7: 24.20 bottom of consolidation range

Koruna is in consolidation in 25.45-25.80 range and

testing 25.80 level.

MACD is in rising trend above zero level.

Both ROCs are in rising trend above zero level.

RSI is in rising trend below overbought level.

Testing of 25.80 level should continue for some time.

Breakthrough of that level is easily possible, because of

clearly prevailing upward momentum without overbought

conditions.

Daily QEURCZK=

17.8.2012 - 4.4.2013 (GMT)

Price

CZK

SMA; QEURCZK=; 25.3.2013; 25,602; EMA; QEURCZK=; 25.3.2013; 25,493; Cndl; QEURCZK=;

25,8

25.3.2013; 25,760; 25,827; 25,710; 25,740; EMA; QEURCZK=; 25.3.2013; 25,382

25,7

25,6

25,5

25,45

25,4

25,3

25,2

25,2

25,1

25

25

24,9

24,8

24,8

24,7

24,65

24,6

24,5

24,5

24,4

24,3

.123

20 27 03 10 17 24 01 08 15 22 29 05 12 19 26 03 10 17 24 31 07 14 21 28 04 11 18 25 04 11 18 25 01

VIII 12

IX 12

X 12

XI 12

XII 12

I 13

II 13

III 13

Daily QEURCZK=

28.8.2012 - 4.4.2013 (GMT)

MACDF; QEURCZK=

25.3.2013; 0,021

MACD; QEURCZK=

25.3.2013; 0,067; 0,046

Value

CZK

0

-0,1

.123

ROC; QEURCZK=

25.3.2013; 2,763

ROC; QEURCZK=

25.3.2013; 1,060

EMA; ROC(QEURCZK=)

25.3.2013; 1,812

Value

CZK

0

-2

-4

.123

RSI; QEURCZK=

25.3.2013; 61,952

MARSI; QEURCZK=

25.3.2013; 55,505

Value

CZK

80

60

40

20

.123

03

10

17 24

IX 12

01

Erste Group Technician

08

15 22

X 12

29

05

12 19 26

XI 12

03

10

17 24

XII 12

31

07

14 21

I 13

28

04

11

18

II 13

25

04

11

18 25

III 13

01

Page 2

Technician Macro/Fixed Income Research

3/25/2013

EUR/PLN

Zloty rebounded from 4.19 level.

MACD rose above zero level.

Both ROCs are in slow rising trend. ROC20 is testing

zero level. ROC50 is above zero level.

RSI is in correction on rising trend above neutral level.

Consolidation above moving averages seems most

likely technical scenario. 4.19 level should cap possible

rebound.

Main trend: consolidation

Short-term trend: consolidation

R4: 4.527 top, psychological

R3: 4.38 top

R2: 4.2733 Fibonacci level

R1: 4.19 top

S1: 4.15 top, consolidation

S2: 4.07 bottoms, Fibonacci level

S3: 3.973 bottom, consolidation

S4: 3.93 tops

Daily QEURPLN=

17.8.2012 - 4.4.2013 (GMT)

Price

PLN

Cndl; QEURPLN=

25.3.2013; 4,1690; 4,1776; 4,1547; 4,1606

3MA; Cndl(QEURPLN=)

25.3.2013; 4,1548; 4,1461; 4,1490

4,2

4,1917

4,19

4,18

4,17

4,16

4,15

4,14

4,13

4,12

4,11

4,1

4,09

4,08

4,07

50,0% 4,0682

4,06

4,05

.1234

20

27

03

10

VIII 12

17

24

01

08

IX 12

15

22

29

05

X 12

12

19

26

03

10

XI 12

17

24

31

07

14

XII 12

21

28

04

11

I 13

18

25

04

11

II 13

18

25

01

III 13

Daily QEURPLN=

28.8.2012 - 4.4.2013 (GMT)

MACDF; QEURPLN=

25.3.2013; 0,0035

MACD; QEURPLN=

25.3.2013; 0,0042; 0,0007

Value

PLN

0,01

0

-0,01

-0,02

.1234

ROC; QEURPLN=

25.3.2013; 2,126

ROC; QEURPLN=

25.3.2013; 0,087

EMA; ROC(QEURPLN=)

25.3.2013; 1,667

Value

PLN

0

-3

.123

RSI; QEURPLN=

25.3.2013; 51,975

MARSI; QEURPLN=

25.3.2013; 50,846

Value

PLN

80

60

40

20

.123

03

10

17

24

IX 12

Erste Group Technician

01

08

15

X 12

22

29

05

12

19

XI 12

26

03

10

17

XII 12

24

31

07

14

21

I 13

28

04

11

18

II 13

25

04

11

18

25

01

III 13

Page 3

Technician Macro/Fixed Income Research

3/25/2013

EUR/HUF

Forint is in slow rising trend above 300 level.

MACD is in slowing rising trend and is strongly

overbought.

Both ROCs are in sideways trend above zero level.

RSI is overbought.

Euro is clearly overbought, so consolidation or

correction is likely.

Main trend: growth

Short-term trend: consolidation

R1: 317 top

S1: 300 tops, psychological

S2: 295 Fibonacci level, top

S3: 290 tops

S4: 283 top

S5: 279 tops

S6: 273 top, Fibonacci level

S7: 270 bottom

Daily QEURHUF=

17.8.2012 - 4.4.2013 (GMT)

Price

HUF

SMA; QEURHUF=

25.3.2013; 301,36

EMA; QEURHUF=

25.3.2013; 296,18

Cndl; QEURHUF=

25.3.2013; 306,50; 307,40; 305,00; 306,34

EMA; QEURHUF=

25.3.2013; 292,32

306

303

300

297

23,6%

296

294

291

290,03

288

285

38,2%

282,95

282

279

279,02

276

.12

20

27

03

10

VIII 12

17

24

01

08

IX 12

15

22

29

05

X 12

12

19

26

03

10

XI 12

17

24

31

07

14

XII 12

21

28

04

11

I 13

18

25

04

11

II 13

18

25

01

III 13

Daily QEURHUF=

28.8.2012 - 4.4.2013 (GMT)

MACDF; QEURHUF=

25.3.2013; 0,29

MACD; QEURHUF=

25.3.2013; 3,32; 3,03

Value

HUF

2

1

0

-1

.12

ROC; QEURHUF=

25.3.2013; 5,283

ROC; QEURHUF=

25.3.2013; 4,194

EMA; ROC(QEURHUF=)

25.3.2013; 5,048

Value

HUF

0

-5

.123

RSI; QEURHUF=

25.3.2013; 68,373

MARSI; QEURHUF=

25.3.2013; 69,266

Value

HUF

80

60

40

20

.123

03

10

17

24

IX 12

Erste Group Technician

01

08

15

X 12

22

29

05

12

19

XI 12

26

03

10

17

XII 12

24

31

07

14

21

I 13

28

04

11

18

II 13

25

04

11

18

25

01

III 13

Page 4

Technician Macro/Fixed Income Research

3/25/2013

EUR/RON

Main trend: consolidation

Short-term trend: consolidation

R3: 4,63 top

R2: 4.56 consolidation, gap

R1: 4.48 consolidation

S1: 4.385 top of consolidation range

S2: 4.365 top

S3: 4.2934 consolidation, top

S4: 4.23 Fibonacci level, bottom of consolidation

S5: 4.19 bottoms

Lei weakened to 200-day moving average.

MACD is in rising trend above zero level.

ROC20 is in stalling uptrend above zero level. ROC50

was in rising trend and rebounded from zero level.

RSI is in sideways trend below overbought level.

Upward momentum is strengthening, so testing of 200day moving average is likely.

Daily QEURRON=

17.8.2012 - 4.4.2013 (GMT)

Price

RON

SMA; QEURRON=

25.3.2013; 4,3825

EMA; QEURRON=

25.3.2013; 4,3988

Cndl; QEURRON=

25.3.2013; 4,4200; 4,4247; 4,4085; 4,4130

EMA; QEURRON=

25.3.2013; 4,4245

4,56

4,53

4,5

4,4799

4,47

4,44

4,41

4,3848

4,38

4,3649

4,35

.1234

20

27

03

10

VIII 12

17

24

01

08

IX 12

15

22

29

05

12

X 12

19

26

03

10

XI 12

17

24

31

07

14

XII 12

21

28

04

11

I 13

18

25

04

11

II 13

18

25

01

III 13

Daily QEURRON=

17.8.2012 - 4.4.2013 (GMT)

MACD; QEURRON=

25.3.2013; 0,0113; 0,0057

MACDF; QEURRON=

25.3.2013; 0,0057

Value

RON

0

-0,01

-0,02

-0,03

.1234

ROC; QEURRON=

25.3.2013; 0,827

ROC; QEURRON=

25.3.2013; -0,675

EMA; ROC(QEURRON=)

25.3.2013; -1,581

Value

RON

0

-2

-4

.123

RSI; QEURRON=

25.3.2013; 61,056

MARSI; QEURRON=

25.3.2013; 56,476

Value

RON

80

60

40

20

.123

20

27

VIII 12

03

10

17

IX 12

Erste Group Technician

24

01

08

15

22

X 12

29

05

12

19

XI 12

26

03

10

17

XII 12

24

31

07

14

21

I 13

28

04

11

18

II 13

25

04

11

18

25

01

III 13

Page 5

Technician Macro/Fixed Income Research

3/25/2013

EUR/TRY

Lira is in consolidation in range defined by 200- and

60-day moving averages.

MACD is in slow rising trend below zero level.

Both ROCs are in sideways trend slightly below zero

level.

RSI is in sideways trend close to neutral level.

Continuation of consolidation is likely. Breakthrough

of 200-day moving average is somewhat more likely than

breakthrough of 2.36 level/60-day moving average.

Main trend: consolidation

Short-term trend: consolidation

R4: 2.57 top

R3: 2.465 top

R2: 2.3934 top

R1: 2.36 tops

S1: 2.34 bottoms

S2: 2.29 top

S3: 2.26 top

S4: 2.188 top of consolidation range

Daily QEURTRY=

17.8.2012 - 4.4.2013 (GMT)

Price

TRY

SMA; QEURTRY=

25.3.2013; 2,3489

EMA; QEURTRY=

25.3.2013; 2,3529

Cndl; QEURTRY=

25.3.2013; 2,3544; 2,3623; 2,3453; 2,3517

2,3601

EMA; QEURTRY=

25.3.2013; 2,3425

2,38

2,36

2,34

2,32

2,3

2,2934

2,28

2,26

2,24

2,22

.1234

20

27

03

10

VIII 12

17

24

01

08

IX 12

15

22

29

05

X 12

12

19

26

03

10

XI 12

17

24

31

07

14

XII 12

21

28

04

11

I 13

18

25

04

11

II 13

18

25

01

III 13

Daily QEURTRY=

28.8.2012 - 4.4.2013 (GMT)

MACDF; QEURTRY=

25.3.2013; 0,0010

MACD; QEURTRY=

25.3.2013; -0,0025; -0,0035

Value

TRY

0,02

0,01

0

-0,01

.1234

ROC; QEURTRY=

25.3.2013; -0,030

ROC; QEURTRY=

25.3.2013; -0,449

EMA; ROC(QEURTRY=)

25.3.2013; 0,164

Value

TRY

4

0

.123

RSI; QEURTRY=

25.3.2013; 48,795

MARSI; QEURTRY=

25.3.2013; 46,816

Value

TRY

80

60

40

20

.123

03

10

17

24

IX 12

Erste Group Technician

01

08

15

X 12

22

29

05

12

19

XI 12

26

03

10

17

XII 12

24

31

07

14

21

I 13

28

04

11

18

II 13

25

04

11

18

25

01

III 13

Page 6

Technician Macro/Fixed Income Research

3/25/2013

EUR/USD

Dollar is in short-term consolidation below 1.30 level

and testing that level.

MACD is in sideways trend below zero level. It is

oversold.

Both ROCs are in sideways trend below zero level.

RSI is in slow rising trend above oversold level.

Room for further decline should be limited by still oversold

euro, so continuation of consolidation is likely.

Main trend: growth

Short-term trend: decline

R5: 1.4119 Fibonacci level, consolidation, tops

R4: 1.38 Fibonacci level, top

R3: 1.3488 Fibonacci level

R2: 1.327 local low

R1: 1.300 psychological

S1: 1.2673 bottom

S2: 1.25 bottom of consolidation range

S3: 1.217 bottoms

S4: 1.19 important bottom

Daily QEUR=

17.8.2012 - 4.4.2013 (GMT)

Price

USD

SMA; QEUR=

25.3.2013; 1,3007

EMA; QEUR=

25.3.2013; 1,3130

61,8%

1,3488

Cndl;

QEUR=

25.3.2013; 1,2947; 1,3048; 1,2927; 1,2945

EMA; QEUR=

25.3.2013; 1,3085

1,36

1,35

1,34

1,33

1,32

1,31

1,3

1,2998

1,29

1,28

1,27

1,26

1,25

100,0% 1,2466

1,24

.1234

20

27

03

10

VIII 12

17

24

01

08

IX 12

15

22

29

05

12

X 12

19

26

03

10

XI 12

17

24

31

07

14

XII 12

21

28

04

I 13

11

18

25

04

II 13

11

18

25

01

III 13

Daily QEUR=

28.8.2012 - 4.4.2013 (GMT)

MACDF; QEUR=; Bid(Last); 12; 26; 9; Exponential

25.3.2013; 0,0003

MACD; QEUR=; Bid(Last); 12; 26; 9; Exponential

25.3.2013; -0,0081; -0,0084

Value

USD

0,01

0,005

0

-0,005

.1234

ROC; QEUR=; Bid(Last); 60

25.3.2013; -1,887

ROC; QEUR=; Bid(Last); 20

25.3.2013; -0,896

EMA; ROC(QEUR=); 20

25.3.2013; -0,790

Value

USD

4

0

.123

RSI; QEUR=; Bid(Last); 14; Wilder Smoothing

25.3.2013; 42,277

MARSI; QEUR=; Bid(Last); 14; Wilder Smoothing; 14

25.3.2013; 39,738

Value

USD

80

60

40

20

.123

03

10

17

24

01

IX 12

Erste Group Technician

08

15

X 12

22

29

05

12

19

XI 12

26

03

10

17

XII 12

24

31

07

14

21

I 13

28

04

11

18

II 13

25

04

11

18

25

01

III 13

Page 7

Technician Macro/Fixed Income Research

3/25/2013

EUR/JPY

Main trend: growth

Short-term trend: consolidation

R3: 129 bottom

R2: 126 top, consolidation

R1: 123 top

S1: 121 tops

S2: 117 tops

S3: 110 psychological

S4: 108.7 bottom

S5: 106.0 bottom

Euro is in consolidation around 123 level/20-day

moving average.

MACD is in declining trend slightly above zero level.

ROC50 is in declining trend above zero level. ROC20

is in sideways trend close to zero level.

RSI is in sideways trend close to neutral level.

Consolidation around 123 level/20-day moving

average should continue for some time.

Daily QEURJPY=

17.8.2012 - 4.4.2013 (GMT)

Price

JPY

SMA; QEURJPY=

25.3.2013; 123,06

EMA; QEURJPY=

25.3.2013; 120,65

Cndl; QEURJPY=

25.3.2013; 122,22; 123,85; 122,17; 122,63

120,74

EMA; QEURJPY=

25.3.2013; 115,81

123

120

117

115,48

114

111

108,72

108

105

104

102

99

96,99

.12

20

27

03

10

VIII 12

17

24

01

08

IX 12

15

22

29

05

X 12

12

19

26

03

XI 12

10

17

24

31

07

14

XII 12

21

28

04

11

I 13

18

25

04

11

II 13

18

25

01

III 13

Daily QEURJPY=

28.8.2012 - 4.4.2013 (GMT)

MACDF; QEURJPY=; Bid(Last); 12; 26; 9; Exponential

25.3.2013; -0,24

MACD; QEURJPY=; Bid(Last); 12; 26; 9; Exponential

25.3.2013; 0,15; 0,39

Value

JPY

2

1

0

.12

ROC; QEURJPY=; Bid(Last); 60

25.3.2013; 7,165

ROC; QEURJPY=; Bid(Last); 20

25.3.2013; 2,294

EMA; ROC(QEURJPY=); 20

25.3.2013; 11,453

Value

JPY

20

10

0

.123

RSI; QEURJPY=; Bid(Last); 14; Wilder Smoothing

25.3.2013; 47,861

MARSI; QEURJPY=; Bid(Last); 14; Wilder Smoothing; 14

25.3.2013; 53,995

Value

JPY

80

60

40

20

.123

03

10

17

24

IX 12

Erste Group Technician

01

08

15

X 12

22

29

05

12

19

XI 12

26

03

10

17

XII 12

24

31

07

14

21

I 13

28

04

11

18

II 13

25

04

11

18

25

01

III 13

Page 8

Technician Macro/Fixed Income Research

3/25/2013

EUR/CHF

Franc is in consolidation on 200-day moving average.

MACD is in declining trend below zero level.

ROC20 is in rising trend and testing zero level. ROC50

is in sideways trend above zero level.

RSI is in sideways trend above oversold level.

We expect rebound from 200-day moving average.

Main trend: consolidation

Short-term trend: consolidation

R3: 1.30 tops

R2: 1.24 Fibonacci level, bottom

R1: 1.2124 bottom, consolidation

S1: 1.20 psychological

S2: 1.1826 bottom

Daily QEURCHF=

17.8.2012 - 4.4.2013 (GMT)

Price

CHF

SMA; QEURCHF=

25.3.2013; 1,2269

EMA; QEURCHF=

25.3.2013; 1,2255

Cndl; QEURCHF=

25.3.2013; 1,2214; 1,2254; 1,2197; 1,2212

EMA; QEURCHF=

25.3.2013; 1,2205

1,25

1,245

1,24

1,235

1,23

1,225

1,22

1,215

1,212

1,21

1,205

.1234

20

27

03

10

VIII 12

17

24

01

08

IX 12

15

22

29

05

X 12

12

19

26

03

XI 12

10

17

24

31

07

14

XII 12

21

28

04

11

I 13

18

25

04

11

II 13

18

25

01

III 13

Daily QEURCHF=

28.8.2012 - 4.4.2013 (GMT)

MACDF; QEURCHF=; Bid(Last); 12; 26; 9; Exponential

25.3.2013; -0,0011

MACD; QEURCHF=; Bid(Last); 12; 26; 9; Exponential

25.3.2013; -0,0020; -0,0009

Value

CHF

0,006

0,003

0

.1234

ROC; QEURCHF=; Bid(Last); 60

25.3.2013; 1,118

ROC; QEURCHF=; Bid(Last); 20

25.3.2013; 0,279

EMA; ROC(QEURCHF=); 20

25.3.2013; 1,550

Value

CHF

2

0

.123

RSI; QEURCHF=; Bid(Last); 14; Wilder Smoothing

25.3.2013; 40,873

MARSI; QEURCHF=; Bid(Last); 14; Wilder Smoothing; 14

25.3.2013; 48,903

Value

CHF

80

60

40

20

.123

03

10

17

24

IX 12

Erste Group Technician

01

08

15

X 12

22

29

05

12

19

XI 12

26

03

10

17

XII 12

24

31

07

14

21

I 13

28

04

11

18

II 13

25

04

11

18

25

01

III 13

Page 9

Technician Macro/Fixed Income Research

3/25/2013

Brent

Brent broke through 108 level.

MACD is in slowing declining trend below zero level.

ROC50 is in declining trend below zero level. ROC20

is turning upwards and is below zero level.

RSI is testing oversold level.

Consolidation around 108 level or even correction to

at least 110 level are likely because of oversold conditions.

Main trend: consolidation

Short-term trend: decline

R6: 123.0 tops

R5 120.0 top and bottom of consolidation range

R4: 116.0 bottom and top of consolidation range

R3: 112.0 top of consolidation range

R2: 110.0 consolidation

R1: 108.0 bottom of consolidation range

S1: 103.0 bottom

S2: 99.0 top of consolidation range.

Daily QLCOc1; QBRT-ROT-REF

5.9.2012 - 4.4.2013 (LON)

Price

USD

Bbl

Cndl; QLCOc1

25.3.2013; 107,40; 108,48; 106,80; 108,29

3MA; QLCOc1

25.3.2013; 109,89; 112,76; 109,77

118

117

116

116

115

114

113

112

111

110

109

108

108

107

106

105

.12

10

17

24

01

08

z 2012

15

22

29

jen 2012

05

12

19

26

03

listopad 2012

10

17

24

31

07

prosinec 2012

14

21

28

04

leden 2013

11

18

25

04

nor 2013

11

18

25

01

bezen 2013

Daily QBRT-

23.8.2012 - 8.4.2013 (GMT)

MACDF; QBRT-; Last Quote(Last); 12; 26; 9; Exponential

25.3.2013; -0,09

MACD; QBRT-; Last Quote(Last); 12; 26; 9; Exponential

25.3.2013; -1,80; -1,71

Value

USD

Bbl

2

1

0

-1

.12

ROC; QBRT-; Last Quote(Last); 60

25.3.2013; -1,903

ROC; QBRT-; Last Quote(Last); 20

25.3.2013; -6,024

EMA; ROC(QBRT-); 20

25.3.2013; -0,342

Value

USD

Bbl

20

10

0

.123

RSI; QBRT-; Last Quote(Last); 14; Wilder Smoothing

25.3.2013; 36,831

MARSI; QBRT-; Last Quote(Last); 14; Wilder Smoothing; 14

25.3.2013; 31,170

Value

USD

Bbl

60

40

20

.123

27

03

VIII 12

10

17

24

IX 12

Erste Group Technician

01

08

15

X 12

22

29

05

12

19

XI 12

26

03

10

17

XII 12

24

31

07

14

21

I 13

28

04

11

18

II 13

25

04

11

18

25

02

08

III 13

Page 10

Technician Macro/Fixed Income Research

3/25/2013

Closed trading ideas

Instrument

EURRON

EURHUF

EURUSD

Copper

EURUSD

Gold

EURCZK

EURPLN

EURUSD

EURJPY

Oil Brent

Copper

Lead

Gold

Platinum

Brent

EURHUF

Oil Brent

Brent

EURJPY

EURPLN

EURHUF

EURUSD

Copper

Gold

EURCHF

Platinum

EURUSD

EURRON

EURJPY

Platinum

Lead

Brent

Copper

EURRON

EURROL

EURUSD

EURCHF

EURJPY

Platinum

Lead

EURRON

EURCHF

Copper

EURPLN

EURUSD

EURCZK

Gold

EURJPY

Gold

EURPLN

EURJPY

EURUSD

EURJPY

Lead

Oil Brent

EURCZK

Direction

long

short

long

long

long

long

long

short

long

long

long

long

short

short

long

long

long

long

long

long

short

short

long

short

long

short

short

short

long

long

short

long

long

long

short

short

short

long

long

short

short

short

long

long

short

long

long

long

long

long

short

short

long

long

long

long

long

Erste Group Technician

Open

3.529

233.86

1.4788

357.23

1.4605

774.2

24.128

3.343

1.418

156.23

101.7

314.33

1858

896.4

1087.5

85.2

251.2

76

69.6

136.7

3.55

268.38

1.3428

223.85

730

1.4412

751

1.2462

3.744

116.41

859

1225

47.64

175

3.80

4.3145

1.3355

1.4883

118.57

947.5

1159

4.2465

1.5032

149.6

4.818

1.2588

28.18

932.7

117.15

914.65

4.4458

128

1.3005

131.58

1286

51.45

27.45

Opened

18.8.2008

25.8.2008

25.8.2008

25.8.2008

1.9.2008

15.9.2008

15.9.2008

15.9.2008

15.9.2008

22.9.2008

22.9.2008

29.9.2008

29.9.2008

29.9.2008

29.9.2008

6.10.2008

6.10.2008

13.10.2008

20.10.2008

13.10.2008

13.10.2008

20.10.2008

20.10.2008

20.10.2008

27.10.2008

27.10.2008

27.10.2008

27.10.2008

10.11.2008

27.10.2008

10.11.2008

24.11.2008

24.11.2008

10.11.2008

24.11.2008

12.1.2009

12.1.2009

12.1.2009

19.1.2009

19.1.2009

26.1.2009

26.1.2009

26.1.2009

19.1.2009

16.2.2009

2.3.2009

2.3.2009

2.3.2009

16.2.2009

9.3.2009

16.3.2009

16.3.2009

16.3.2009

23.3.2009

16.3.2009

23.3.2009

30.3.2009

Target

3.660

229.00

1.5600

398.00

1.5600

860

24.90

3.22

1.56

168.0

118

330

1770

870

1230

80

258

90

90.0

156.0

3.28

245.0

1.4300

145.0

830

1.3620

600

1.1830

3.970

140.0

595

1475

65

300

3.60

4.070

1.275

1.570

133.0

880

1055

4.0700

1.57

240.0

4.42

1.2980

29.80

985.0

128.0

985

3.95

117

1.43

150

1500

70

28.70

Stop-loss

3.40

236.00

1.4580

355.00

1.4480

745

23.90

3.365

1.44

153.8

98

309

1895

910

1060

87

248

74.5

68.0

133.0

3.63

274.0

1.3220

190.0

740.0

1.4650

775

1.2650

3.650

120.0

905

1175

44.8

145

3.88

4.420

1.365

1.46

116.0

975

1220

4.32

1.483

155.0

4.87

1.2450

28.00

920.0

121.0

920

4.55

129.5

1.35

128

1180

47

26.90

P/L (%) Comment

+0.45% closed on time

-1.13% closed stop-loss

-1.41% closed stop-loss

-0.62% closed stop loss

-0.86% closed stop loss

+11.11%closed on target

-0.9% closed stop loss

-0.65% closed stop loss

+1.55% closed lock in

-1.56% closed stop loss

-3.64% closed stop loss

-1.7% closed stop loss

+4.97% closed on target

-1.49% closed stop loss

-2.53% closed stop loss

+6.5% closed on target

-1.27% closed stop loss

+2.56% closed lock in

-2.30% closed stop loss

-2.71% closed stop loss

-2.20% closed stop loss

-2.05% closed stop loss

-1.94% closed stop loss

+17.82% closed lock in

+1.37% closed lock in

-1.62 closed stop loss

-3.1% closed stop loss

-1.49% closed stop loss

+0.96% closed lock in

+3.08% closed lock in

+2.44% closed on time

-4.08% closed stop loss

-6.02% closed stop loss

-17.14% closed stop loss

-2.06% closed stop loss

+1.28% closed lock in

+3.1% closed on time

+1.01% closed on time

-2.17% closed stop loss

-2.27% closed on time

+3.95% closed on time

-1.7% closed stop loss

-1.34% closed stop loss

+3.61% %closed lock in

-1.07% closed stop loss

-0.18% closed on time

-0.64% closed stop loss

-1.36% closed stop loss

+6.10% closed on time

+0.58% closed lock in

-2.29% closed stop loss

-1.16% closed stop loss

+3.81% closed lock in

-2.40% closed stop loss

+3.42% closed on time

-8.65% closed stop loss

-2.32% closed stop loss

Page 11

Technician Macro/Fixed Income Research

EURUSD

EURPLN

EURCZK

Copper

EURPLN

EURUSD

Gold

EUR/PLN

Brent

EURUSD

EURCZK

Platinum

EURJPY

Gold

Platinum

EURJPY

EURPLN

Copper

EURJPY

Gold

Platinum

Brent

Lead

EURCZK

EURHUF

EURJPY

EURHUF

EURJPY

Copper

Brent

EURJPY

EURUSD

EURCZK

Copper

Lead

EURJPY

EURCHF

Platinum

Brent

Copper

Gold

EURUSD

EURJPY

Brent

Lead

Platinum

Gold

Copper

EURPLN

Lead

EURRON

Platinum

Copper

EURRON

Platinum

EURON

Copper

Gold

Lead

EURHUF

Lead

short

short

long

long

short

long

long

short

short

short

short

short

short

short

short

short

short

short

short

short

long

short

short

short

short

long

short

long

short

long

long

long

short

long

short

long

long

long

long

short

short

long

short

long

long

long

short

short

long

long

long

long

short

short

long

short

long

long

short

long

long

Erste Group Technician

1.3194 30.3.2009

4.4351 6.4.2009

26.591 6.4.2009

147.15 23.2.2009

4.382 11.5.2009

1.351 18.5.2009

929.4 18.5.2009

4.409 25.5.2009

70.51 15.6.2009

1.386 22.6.2009

26.03 22.6.2009

1183.5 29.6.2009

132.67 22.6.2009

953.25 10.8.2009

1242 10.8.2009

132.87 17.8.2009

4.1105 24.8.2009

288.12 17.8.2009

133.04 31.8.2009

999.0 14.9.2009

1349.5 19.10.2009

78.59 26.10.2009

2304.852.11.2009

26.11 30.11.2009

273.05 30.11.2009

130.4 30.11.2009

273.69 14.12.2009

129.6 14.12.2009

316

14.12.2009

73.21 21.12.2009

129.94 21.12.2009

1.436 21.12.2009

26.26 4.1.2010

339.5 18.1.2010

2250.3 25.1.2010

127.66 25.1.2010

1.4722 1.2.2010

1530 1.2.2010

72.17 1.2.2010

308.6 1.2.2010

1122.7522.2.2010

1.362 22.2.2010

120.59 1.3.2010

72.17 15.2.2010

2181 1.3.2010

1550 1.3.2010

1125.9 8.3.2010

338.6 22.3.2010

3.893 22.3.2010

2186 29.3.2010

4.1225 12.4.2010

1725.5 12.4.2010

353.3 26.4.2010

4.1161 26.4.2010

1744.5 26.4.2010

4.126 3.5.2010

329.6 3.5.2010

1183 3.5.2010

2230 3.5.2010

273.7 10.5.2010

2110 10.5.2010

3/25/2013

1.28

4.15

27.90

240.0

4.12

1.280

980

4.16

49.5

1.3617

24.80

1120

115.5

910

1110

128

3.98

255

126.5

955.0

1440

72.1

2250

25.45

264

135

266

134.5

285

78

138

1.53

25.55

400

2080

138

1.4950

1640

82

280

1060

1.408

117

82.0

2350

1640

1064

290

4.05

2600

4.23

2000

342

3.95

2200

3.95

362

1215

2020

269

2200

1.3325

4.55

26.30

200.0

4.42

1.365

918

4.46

70.0

1.395

26.45

1210

136.5

973

1330

135.3

4.155

295

134.5

1010.000

1335

80.6

2350

26.55

276.5

128.5

276.5

128.0

330

71

127.5

1.415

26.55

325

2285

125

1.4620

1475

70.5

316

1145

1.342

122.3

79.5

2240

1520

1145

345

3.87

2080

4.10

1670

357

4.145

1640

4.165

325

1165

2275

275.5

2070

-0.98% closed stop loss

+2.29% closed on time

-0.94% closed on time

+35.92% closed lock in

-0.86% closed stop loss

-1.03% closed stop loss

+5.44% closed profit target

-1.1% closed stop loss

+0.73% closed lock in

-0.65% closed stop loss

+0.5% closed on time

+3.54% closed on time

-2.81% closed stop loss

+1.61% closed on time

-1.00% closed on time

-1.80% stop loss

+0.26% closed on time

-2.33% closed stop loss

+0.54% closed on time

-1.08% closed stop loss

-1.07% closed stop loss

+4.09% closed lock in

+0.34% closed on time

+1.3% closed on time

+1.31% closed on time

-0.61% closed on time

-0.66% closed stop loss

-1.23% closed stop loss

-2.80% closed on time

+6.54% closed profit target

+3.36% closed on time

+0.08% closed on time

+1.54% closed on time

-4.27% stop loss

+8.19% closed profit target

-2.08% stop loss

-0.69% stop loss

+1.31% lock in

+3.23% lock in

+6.53% closed on time

+0.53% closed on time

-0.85% closed on time

-1.40% stop loss

+10.16%lock in

+2.71% lock in

+4.13% closed on time

+2.10% closed on time

-1.86% stop loss

-0.59% stop loss

+0.87% closed on time

+0.76% closed on time

-3.22% stop loss

+3.3% closed profit target

-0.7% stop loss

-5.99% stop loss

-0.94% stop loss

-1.40% stop loss

-1.52% stop loss

+10.4% closed profit target

-0.65% stop loss

-1.90% stop loss

Page 12

Technician Macro/Fixed Income Research

Copper

Gold

EURJPY

Brent

Copper

Lead

Copper

Brent

Platinum

Lead

EURJPY

EURPLN

Copper

Gold

EURPLN

EURJPY

EURCHF

Brent

Lead

Platinum

Gold

EURCHF

Gold

Brent

Platinum

Lead

Platinum

Lead

Brent

Gold

Gold

Lead

Brent

Copper

EURUSD

Platinum

EURJPY

EURTRY

Copper

Gold

Copper

Platinum

Gold

EURHUF

Brent

Lead

Platinum

Lead

Gold

Lead

Brent

EURCHF

EURCHF

Gold

EURUSD

Lead

EURCHF

Gold

Lead

Copper

Gold

long

short

long

long

long

short

long

long

long

short

long

short

short

short

short

long

long

short

long

long

long

long

short

short

long

long

long

short

long

short

short

short

short

long

short

long

long

short

short

long

long

short

long

long

short

short

short

long

short

long

short

long

long

short

short

short

long

short

short

short

long

Erste Group Technician

321.45 10.5.2010

1193.4 10.5.2010

114.6 17.5.2010

74.17 17.5.2010

305.25 17.5.2010

1903 17.5.2010

305.25 17.5.2010

69.63 25.5.2010

1526 25.5.2010

1830 25.5.2010

111.95 25.5.2010

4.10

25.5.2010

307.15 31.5.2010

1216.2 31.5.2010

4.0322 21.6.2010

112.98 21.6.2010

1.3729 21.6.2010

77.24 28.6.2010

1840 28.6.2010

1561.5 31.5.2010

1202.6 12.7.2010

1.3371 12.7.2010

1188.5 26.7.2010

82.02 2.8.2010

1545 26.7.2010

2110.7 2.8.2010

1529.5 16.8.2010

2050 23.8.2010

77.0

6.9.2010

1249 6.9.2010

1244 13.9.2010

2216 13.9.2010

78.9

20.9.2010

329.3 2.8.2010

1.3468 27.9.2010

1672 4.10.2010

113.44 27.9.2010

1.9663 11.10.2010

383.55 18.10.2010

1390.2 8.11.2010

395

8.11.2010

1747. 8.11.2010

1365.5 15.11.2010

276.1 15.11.2010

87.5

15.11.2010

2430 15.11.2010

1633.5 29.11.2010

2277 29.11.2010

1411 6.12.2010

2336 6.12.2010

92.1

13.12.2010

1.2635 27.12.2010

1.2486 3.1.2011

1418.953.1.2011

1.291 10.1.2011

2616 10.1.2011

1.2543 10.1.2011

1350 20.1.2011

2665 17.1.2011

434.75 24.1.2011

1365 8.2.2011

3/25/2013

335

1080

120

79

325

1600

325

79

1640

1520

119

3.86

295

1140

3.87

126

1.395

74.00

2000

1740

1240

1.3758

1140

76

1700

2380

1600

1850

82.0

1215

1215

2050

74.2

400

1.303

1740

119.5

1.9000

340.00

1360.0

383

1810

1410

290.3

79

2000

1500

2600

1370

2600

79

1.370

1.380

1365

1.247

2200

1.380

1220

2200

370

1420

315

1215

112

73

298

1950

298

67

1450

1860

108

4.22

314

1230

4.08

111

1.367

78.00

1815

1500

1195

1.3255

1205

83.5

1515

2045

1495

2105

76.0

1255

1250

2250

80.2

319

1.354

1648

112.5

1.9820

385.80

1402.0

398

1735

1345

272.5

87.5

2520

1675

2230

1425

2270

93.5

1.240

1.235

1432

1.305

2670

1.280

1335

2400

446

1340

-2.01% stop loss

-1.78% stop loss

-2.27% stop loss

-1.58% stop loss

-2.38% stop loss

+7.51% lock in

-2.61% stop loss

-3.78% stop loss

+2.39% closed on time

+7.65% lock in

-2.82% closed on time

+0.61% closed on time

+4.12% closed profit target

-1.12% stop loss

-1.17% stop loss

-1.75% stop loss

-0.43% stop loss

+4.38% closed profit target

-1.36% stop loss

-3.94% stop loss

-0.63% stop loss

+1.5% closed on time

-1.37% stop loss

-1.80% stop loss

-1.94% stop loss

+2.34% lock in

-1.54% closed on time

-1.91% closed on time

-1.30% stop loss

-0.48% stop loss

-0.48% stop loss

-1.51% stop loss

-1.62% stop loss

+13.1% closed on time

-0.53% stop loss

+0.87% closed on time

-0.83% stop loss

-0.79% stop loss

-0.58% stop loss

-0.84% stop loss

-0.75% stop loss

-0.72% stop loss

-1.50% stop loss

-1.30% stop loss

+2.94% lock in

+8.00% lock in

-2.24% stop loss

-2.06% stop loss

-0.98% stop loss

+2.74% lock in

-1.50% stop loss

-1.86% stop loss

+0.91% lock in

+3.88% closed profit target

-1.07% stop loss

-2.02% stop loss

+2.12% lock in

+1.12% lock in

+11.0% lock in

-2.52% stop loss

+2.71% closed on time

Page 13

Technician Macro/Fixed Income Research

Platinum

EURTRY

Brent

Copper

Lead

Gold

Copper

Brent

Gold

Copper

Copper

Platinum

EURRON

EURTRY

Brent

Gold

Platinum

EURPLN

Lead

Copper

Gold

Brent

Copper

Lead

Brent

Copper

Brent

EURCHF

Gold

Lead

Lead

Copper

Copper

Platinum

Silver

Lead

Brent

Copper

Platinum

Gold

Brent

Copper

EURUSD

Platinum

Copper

Brent

Gold

Silver

Gold

Copper

Brent

Silver

Brent

Silver

Brent

Gold

Lead

Gold

Brent

Gold

Gold

long

short

long

short

short

short

short

short

short

long

short

long

short

short

short

short

long

short

short

long

short

long

short

short

short

long

short

long

long

short

short

short

short

long

long

short

short

long

long

long

short

short

short

long

long

long

long

long

short

long

long

short

long

short

short

long

short

long

short

long

long

Erste Group Technician

1820

2.139

104.11

447.3

2664

1408.8

447.3

117.16

1426.2

417.8

431.75

1750

4.12

2.17

127.38

1469

1798

3.9676

2491

418.2

1500

113.09

398

2400

115.58

416.5

115.58

416.5

1498

2668

2663.3

437.25

439

1760.5

40.54

2682

114.54

332.4

1511.5

1659

109.5

361.55

1.378

1655

336.8

112.5

1745.6

28.95

1642

370

110.4

33.42

110.8

33.15

120.15

1715.2

2265

1745

126.8

1655.5

1630

14.2.2011

14.2.2011

21.2.2011

21.2.2011

21.2.2011

28.2.2011

7.3.2011

7.3.2011

14.3.2011

14.3.2011

21.3.2011

21.3.2011

28.3.2011

28.3.2011

11.4.2011

11.4.2011

11.4.2011

11.4.2011

2.5.2011

2.5.2011

9.5.2011

9.5.2011

16.5.2011

23.5.2011

30.5.2011

30.5.2011

30.5.2011

30.5.2011

27.6.2011

4.7.2011

11.7.2011

11.7.2011

25.7.2011

18.7.2011

25.7.2011

25.7.2011

5.9.2011

10.10.2011

10.10.2011

10.10.2011

31.10.2011

31.10.2011

7.11.2011

8.11.2011

28.11.2011

5.12.2011

5.12.2011

9.1.2012

16.1.2012

17.1.2012

23.1.2012

30.1.2012

30.1.2012

6.2.2012

13.2.2012

6.2.2012

30.1.2012

21.2.2012

27.2.2012

19.3.2012

22.3.2012

3/25/2013

1860

1.980

110

370

2410

1370

412

103

1320

450.0

370.0

1850

4.19

1.96

116.5

1420

1855

3.87

2350

450

1400

124

370

2250

109

450

109

450

1540

2350

2350

410

420

1840

46

2350

102

370

1750

1800

102

322

1.320

1750

370

116.5

1800

31.00

1560

400

116

31.4

116

30.7

108

1800

2000

1800

116

1700

1700

1795

2.170

102

435

2550

1425

456

113

1405

408

440.0

1715

4.10

2.21

129.0

1485

1770

4.01

2530

410

1515

112

410

2505

117.5

413.5

117.5

413.5

1485

2710

2725

445

445

1740

39.5

2730

117

325

1480

1630

112.5

372

1.387

1615

327

111

1728

28.40

1645

355

108

34.2

108

33.8

123

1680

2160

1710

129

1640

1646

+1.21% closed on time

-1.43% stop loss

+5.66% closed profit target

+2.83% lock in

+4.47% lock in

-1.14% stop loss

+8.57% closed profit target

+3.68% lock in

+1.51% lock in

-2.35% stop loss

-1.88% stop loss

-1.40% closed on time

-0.49% stop loss

-1.81% stop loss

+2.84% closed on time

-1.08% stop loss

-1.56% stop loss

+0.64% closed on time

+6.0% closed profit target

-1.96% stop loss

-0.99% stop loss

-2.27% stop loss

-2.93% stop loss

-4.19% stop loss

-1.63% stop loss

-0.72% stop loss

-2.91% stop loss

-1.30% stop loss

-0.87% stop loss

-1.55% stop loss

-2.32% stop loss

-0.68% closed on time

-1.35% stop loss

+1.90% closed on time

-2.57% stop loss

+14.13%closed profit target

-2.10% stop loss

-2.23% stop loss

-2.08% stop loss

+0.61% closed on time

-2.67% stop loss

+1.56% closed on time

+1.15% closed on time

-2.42% closed on time

+5.40% closed on time

-1.33% stop loss

-1.01% stop loss

+2.94% closed on time

-0.18% stop loss

+3.84% closed on time

-2.17% stop loss

-2.28% stop loss

+3.47% closed on time

-1.92% stop loss

-2.31% stop loss

+0.95% closed on time

+4.86% Lock in

-2.01% stop loss

-1.71% stop loss

-0.94% stop loss

-0.97% stop loss

Page 14

Technician Macro/Fixed Income Research

Brent

Copper

Brent

Silver

EURJPY

Silver

Platinum

Copper

Gold

Copper

Brent

Platinum

Brent

Lead

Silver

Brent

Platinum

Silver

Brent

Platinum

Gold

Lead

Gold

Platinum

Lead

Gold

Platinum

EURTRY

Brent

short

short

long

long

long

long

long

long

long

short

long

long

short

short

long

short

long

short

long

long

long

short

long

long

short

long

short

short

short

Erste Group Technician

126.5

362.3

109.1

28.4

99.5

29.0

1438.8

339.2

1572.4

329.2

89.48

1436.7

99.2

1863

27.15

103.6

1414.7

28.02

109.5

1400.8

1782.5

2094

1720

1575

2287

1666.8

1677

2.3426

117.7

26.3.2012

16.4.2012

28.5.2012

28.5.2012

28.5.2012

4.6.2012

11.6.2012

18.6.2012

28.6.2012

28.6.2012

28.6.2012

2.7.2012

9.7.2012

9.7.2012

9.7.2012

16.7.2012

16.7.2012

13.8.2012

3.8.2012

30.7.2012

1.10.2010

22.10.2010

31.10.2010

13.11.2010

17.12.2012

14.1.2013

28.1.2013

4.3.2013

28.2.2013

3/25/2013

118.0

325.0

116.0

32.0

105.0

34.0

1540.0

368.0

1625.0

305.0

100.0

1575

90

1760

29

90

1475

27

128

1575

2000

1920

2000

1720

2000

1780

1520

2.27

108.0

123

372

106.5

27.6

98.0

28.3

1395.0

332.0

1548.0

338.0

90.0

1397

102.2

1890

26.6

106.3

1400

28.36

115.5

1500

1740

2060

1695

1550

2330

1640

1710

2.36

114

+7.2% closed profit target

-2.61% stop loss

-2.38% stop loss

-2.82% stop loss

-1.51% stop loss

-2.41% stop loss

+3.56% Lock in

-2.12% stop loss

-1.55% stop loss

-2.60% stop loss

+11.76%closed profit target

+2.32% Lock in

-2.94% stop loss

-0.11% closed on time

-2.03% stop loss

-2.54% stop loss

-1.04% stop loss

-1.2% stop loss

+5.48% Lock in

+7.08% Lock in

-2.36% stop loss

+1.65% Lock in

-1.45% stop loss

-1.59% stop loss

-1.85% stop loss

-1.11% closed on time

-1.93% stop loss

+0.1% closed on time

+8.98% closed profit target

Page 15

Technician Macro/Fixed Income Research

Treasury - Erste Bank Vienna

Contacts

Head of Group Research

Friedrich Mostbck, CEFA

Major Markets & Credit Research

Head: Gudrun Egger, CEFA

Adrian Beck (Fixed income AT, CH)

Benedikt Blum (Quant, Euro)

Hans Engel (Equity US)

Christian Enger, CFA (Covered Bonds)

Mildred Hager-Germain (Fixed income Euro, US)

Alihan Karadagoglu (Corporates)

Peter Kaufmann (Corporates)

Stephan Lingnau (Equity Europe)

Elena Statelov, CIIA (Corporates)

Thomas Unger; CFA (Agencies)

Macro/Fixed Income Research CEE

Head CEE: Juraj Kotian (Macro/FI)

Chief Analyst: Birgit Niessner (CEE Macro/FI)

CEE Equity Research

Head: Henning Ekuchen

Chief Analyst: Gnther Artner, CFA (CEE Equities)

Gnter Hohberger (Banks)

Franz Hrl, CFA (Steel, Construction)

Daniel Lion, CIIA (IT)

Christoph Schultes, CIIA (Insurance, Utility)

Vera Sutedja, CFA (Telecom)

Vladimira Urbankova, MBA (Pharma)

Martina Valenta, MBA (Real Estate)

Gerald Walek, CFA (Machinery)

Editor Research CEE

Brett Aarons

Research, Croatia/Serbia

Head: Mladen Dodig (Equity)

Head: Alen Kovac (Fixed income)

Anto Augustinovic (Equity)

Ivana Rogic (Fixed income)

Davor Spoljar, CFA (Equity)

Research, Czech Republic

Head: David Navratil (Fixed income)

Petr Bittner (Fixed income)

Head: Petr Bartek (Equity)

Vaclav Kminek (Media)

Katarzyna Rzentarzewska (Fixed income)

Martin Krajhanzl (Equity)

Martin Lobotka (Fixed income)

Lubos Mokras (Fixed income)

Josef Novotn (Equity)

Research, Hungary

Head: Jzsef Mir (Equity)

Andrs Nagy (Equity)

Orsolya Nyeste (Fixed income)

Tams Pletser, CFA (Oil&Gas)

Zoltan Arokszallasi (Fixed income)

Research, Poland

Head: Magdalena Komaracka, CFA (Equity)

Marek Czachor (Equity)

Adam Rzepecki (Equity)

Michal Zasadzki (Equity)

Research, Romania

Head: Mihai Caruntu (Equity)

Head: Dumitru Dulgheru (Fixed income)

Chief Analyst: Eugen Sinca (Fixed income)

Dorina Cobiscan (Fixed Income)

Raluca Ungureanu (Equity)

Marina Alexandra Spataru (Equity)

Research Turkey

Head: Can Yurtcan

Evrim Dairecioglu (Equity)

M. Grkem Gker (Equity)

Sezai Saklaroglu (Equity)

Sevda Sarp (Equity)

Nilufer Sezgin (Fixed income)

Research, Slovakia

Head: Maria Valachyova, (Fixed income)

Martin Balaz (Fixed income)

Research, Ukraine

Head: Igor Zholonkivskyi (Fixed income)

Lesya Khripta (Fixed Income)

Inna Zvyagintseva (Fixed Income)

Erste Group Technician

3/25/2013

+43 (0)5 0100 11902

+43 (0)5 0100 11909

+43 (0)5 0100 11957

+43 (0)5 0100 11961

+43 (0)5 0100 19835

+43 (0)5 0100 84052

+43 (0)5 0100 17331

+43 (0)5 0100 19633

+43 (0)5 0100 11183

+43 (0)5 0100 16574

+43 (0)5 0100 19641

+43 (0)5 0100 17344

+43 (0)5 0100 17357

+43 (0)5 0100 18781

+43 (0)5 0100 19634

+43 (0)5 0100 11523

+43 (0)5 0100 17354

+43 (0)5 0100 18506

+43 (0)5 0100 17420

+43 (0)5 0100 16314

+43 (0)5 0100 11905

+43 (0)5 0100 17343

+43 (0)5 0100 11913

+43 (0)5 0100 16360

+420 956 711 014

+381 11 22 09 178

+385 62 37 1383

+385 62 37 2833

+385 62 37 2419

+385 62 37 2825

+420 224 995 439

+420 224 995 172

+420 224 995 227

+420 224 995 289

+420 224 995 232

+420 224 995 434

+420 224 995 192

+420 224 995 456

+420 224 995 213

+361 235 5131

+361 235-5132

+361 373 2026

+361 235-5135

+361 373 2830

+48 22 330 6256

+48 22 330 6254

+48 22 330 6252

+48 22 330 6251

+40 21 311 2754

+40 37226 1029

+40 37226 1026

+40 37226 1028

+40 21311 2754

+40 21311 2754

+90 212 371 2540

+90 212 371 2535

+90 212 371 2534

+90 212 371 2533

+90 212 371 2537

+90 212 371 2536

Saving Banks & Sales Retail

Head: Thomas Schaufler

Equity Retail Sales

Head: Kurt Gerhold

Fixed Income & Certificate Sales

Head: Uwe Kolar

Treasury Domestic Sales

Head: Markus Kaller

Corporate Sales AT

Head: Christian Skopek

+43 (0)5 0100 84225

+43 (0)5 0100 84232

+43 (0)5 0100 83214

+43 (0)5 0100 84239

+43 (0)5 0100 84146

Fixed Income & Credit Institutional Sales

Institutional Sales

Head: Manfred Neuwirth

Bank and Institutional Sales

Head: Jrgen Niemeier

Institutional Sales AT, GER, LUX, CH

Head: Thomas Almen

Margit Hraschek

Rene Klasen

Marc Pichler

Martin Seydel

Sabine Vogler

Bank and Savingsbanks Sales

Head: Marc Friebertshuser

Mathias Gindele

Andreas Goll

Ulrich Inhofner

Sven Kienzle

Manfred Meyer

Jrg Moritzen

Michael Schmotz

Bernd Thaler

Klaus Vosseler

Institutional Sales CEE

Head: Jaromir Malak

Central Bank and International Sales

Abdalla Bachu

Antony Brown

Fiona Chan

Institutional Sales SEE

Tomasz Karsznia

Pawel Kielek

Piotr Zagan

Institutional Sales Slovakia

Head: Peter Kniz

Sarlota Sipulova

Institutional Sales Czech Republic

Head: Ondrej Cech

Milan Bartos

Radek Chupik

Pavel Zdichynec

Institutional Sales Croatia

Antun Buric

Neven Kaic

Natalija Zujic

Institutional Sales Hungary

Norbert Siklosi

Attila Hollo

Institutional Sales Romania

Head: Ciprian Mitu

Ruxandra Carlan

Institutional Solutions and PM

Head: Zachary Carvell

Brigitte Mayr

Mikhail Roshal

Christopher Lampe-Traupe

+43 (0)5 0100 84250

+49 (0)30 8105800 5503

+43 (0)5 0100 84323

+43 (0)5 0100 84117

+49 (0)30 8105800 5521

+43 (0)5 0100 84118

+49 (0)30 8105800 5523

+49 (0)30 8105800 5543

+49 (0)711 810400 5540

+49 (0)711 810400 5562

+49 (0)711 810400 5561

+43 (0)50100 85544

+49 (0)711 810400 5541

+43 (0)5 0100 83213

+49 (0)30 8105800 5581

+43 (0)5 0100 85542

+43 (0)5 0100 85583

+49 (0)711 810400 5560

+43 (0)50100 84254

+44 207623 4159

+44 207623 4159

+852-9138 6109

+48 22 538 6281

+48 22 538 6223

+43 (0)50100 84256

+421 2 4862 5624

+421 2 4862 5629

+420 2 2499 5577

+420 2 2499 5562

+420 2 2499 5565

+420 2 2499 5590

+385 (0)6237 2439

+385 (0)6237 2345

+385 (0)6237 1638

+36 1 2355 584

+36 1 2355 846

+40 213121199 6200

+40 21 310-4449 612

+43 (0)50100 83308

+43 (0)50100 84781

+43 (0)50100 84787

+49 (0)30 8105800 5507

+421 2 4862 4185

+421 2 4862 4762

+38 044 593 1784

+38 044 593 9214

+38 044 593 9188

Page 16

Technician Macro/Fixed Income Research

3/25/2013

Erste Group Bank AG

1010 Wien, Brsegasse 14/DG1

Telefon: +43 (0)5 0100 11902

Disclaimer

This publication has been prepared by EG Research. This report is for information purposes only.

Publications in the United Kingdom are available only to investment professionals, not private customers, as defined

by the rules of the Financial Services Authority. Individuals who do not have professional experience in matters

relating to investments should not rely on it.

The information contained herein has been obtained from public sources believed by EGB to be reliable, but which

may not have been independently justified. No guarantees, representations or warranties are made as to its accuracy,

completeness or suitability for any purpose.

This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument or any other

action and will not form the basis or a part of any contract.

Neither EGB nor any of its affiliates, its respective directors, officers or employers accepts any liability whatsoever (in

negligence or otherwise) for any loss howsoever arising from any use of this document or its contents or otherwise

arising in connection therewith. Any opinion, estimate or projection expressed in this publication reflects the current

judgement of the author(s) on the date of this report. They do not necessarily reflect the opinions of EGB and are

subject to change without notice. EGB has no obligation to update, modify or amend this report or to otherwise notify a

reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth

herein, changes or subsequently becomes inaccurate.

The past performance of financial instruments is not indicative of future results. No assurance can be given that any

financial instrument or issuer described herein would yield favourable investment results.

EGB, its affiliates, principals or employees may have a long or short position or may transact in the financial

instrument(s) referred to herein or may trade in such financial instruments with other customers on a principal basis.

EGB may act as a market maker in the financial instruments or companies discussed herein and may also perform or

seek to perform investment banking services for those companies. EGB AG may act upon or use the information or

conclusion contained in this report before it is distributed to other persons.

This report is subject to the copyright of EGB. No part of this publication may be copied or redistributed to persons or

firms other than the authorised recipient without the prior written consent of EGB.

By accepting this report, a recipient hereof agrees to be bound by the foregoing limitations.

Copyright: 2013 EGB AG. All rights reserved.

Erste Group Technician

Page 17

Das könnte Ihnen auch gefallen

- The Ten Brazilian Jiu-Jitsu Moves Every Cop Should KnowDokument7 SeitenThe Ten Brazilian Jiu-Jitsu Moves Every Cop Should KnowmyoxygenNoch keine Bewertungen

- Enn TESREZDokument13 SeitenEnn TESREZmuiesibaNoch keine Bewertungen

- Chartbo46 01Dokument140 SeitenChartbo46 01muiesibaNoch keine Bewertungen

- Tor KLDokument49 SeitenTor KLmuiesibaNoch keine Bewertungen

- Balo PaiDokument1 SeiteBalo PaimuiesibaNoch keine Bewertungen

- PalmistryDokument44 SeitenPalmistryLam-ang MagitingNoch keine Bewertungen

- Laminar Diffusion FlamesDokument59 SeitenLaminar Diffusion Flamesgaero5Noch keine Bewertungen

- The Millionaire Blueprint: Portfolio Strategies For Tomorrow's MillionaireDokument46 SeitenThe Millionaire Blueprint: Portfolio Strategies For Tomorrow's MillionairemuiesibaNoch keine Bewertungen

- Laminar Diffusion FlamesDokument59 SeitenLaminar Diffusion Flamesgaero5Noch keine Bewertungen

- Dicutii Alex CDokument7 SeitenDicutii Alex CmuiesibaNoch keine Bewertungen

- Laminar Diffusion FlamesDokument59 SeitenLaminar Diffusion Flamesgaero5Noch keine Bewertungen

- The Millionaire Blueprint: Portfolio Strategies For Tomorrow's MillionaireDokument46 SeitenThe Millionaire Blueprint: Portfolio Strategies For Tomorrow's MillionairemuiesibaNoch keine Bewertungen

- Link-Uri RlcoDokument3 SeitenLink-Uri RlcomuiesibaNoch keine Bewertungen

- Abraham'sDokument6 SeitenAbraham'smuiesibaNoch keine Bewertungen

- Abraham'sDokument6 SeitenAbraham'smuiesibaNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Why Choose Medicine As A CareerDokument25 SeitenWhy Choose Medicine As A CareerVinod KumarNoch keine Bewertungen

- THE DOSE, Issue 1 (Tokyo)Dokument142 SeitenTHE DOSE, Issue 1 (Tokyo)Damage85% (20)

- Guide To Raising Capital From Angel Investors Ebook From The Startup Garage PDFDokument20 SeitenGuide To Raising Capital From Angel Investors Ebook From The Startup Garage PDFLars VonTurboNoch keine Bewertungen

- Dermatology Study Guide 2023-IvDokument7 SeitenDermatology Study Guide 2023-IvUnknown ManNoch keine Bewertungen

- Guia de Usuario GPS Spectra SP80 PDFDokument118 SeitenGuia de Usuario GPS Spectra SP80 PDFAlbrichs BennettNoch keine Bewertungen

- Wheeled Loader L953F Specifications and DimensionsDokument1 SeiteWheeled Loader L953F Specifications and Dimensionssds khanhNoch keine Bewertungen

- Correlation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesiDokument8 SeitenCorrelation Degree Serpentinization of Source Rock To Laterite Nickel Value The Saprolite Zone in PB 5, Konawe Regency, Southeast SulawesimuqfiNoch keine Bewertungen

- Empanelment of Architect-Consultant - Work Costing More Than 200 Lacs. (Category-B)Dokument6 SeitenEmpanelment of Architect-Consultant - Work Costing More Than 200 Lacs. (Category-B)HARSHITRAJ KOTIYANoch keine Bewertungen

- Extrajudicial Settlement of Estate Rule 74, Section 1 ChecklistDokument8 SeitenExtrajudicial Settlement of Estate Rule 74, Section 1 ChecklistMsyang Ann Corbo DiazNoch keine Bewertungen

- Mutual Fund PDFDokument22 SeitenMutual Fund PDFRajNoch keine Bewertungen

- Inborn Errors of Metabolism in Infancy: A Guide To DiagnosisDokument11 SeitenInborn Errors of Metabolism in Infancy: A Guide To DiagnosisEdu Diaperlover São PauloNoch keine Bewertungen

- Ielts Practice Tests: ListeningDokument19 SeitenIelts Practice Tests: ListeningKadek Santiari DewiNoch keine Bewertungen

- U2 All That You Can't Leave BehindDokument82 SeitenU2 All That You Can't Leave BehindFranck UrsiniNoch keine Bewertungen

- The Smith Generator BlueprintsDokument36 SeitenThe Smith Generator BlueprintsZoran AleksicNoch keine Bewertungen

- Induction ClassesDokument20 SeitenInduction ClassesMichelle MarconiNoch keine Bewertungen

- Oxygen Cost and Energy Expenditure of RunningDokument7 SeitenOxygen Cost and Energy Expenditure of Runningnb22714Noch keine Bewertungen

- HVAC Master Validation PlanDokument51 SeitenHVAC Master Validation Plannavas197293% (30)

- Cab&Chaissis ElectricalDokument323 SeitenCab&Chaissis Electricaltipo3331100% (13)

- MA1201 Calculus and Basic Linear Algebra II Solution of Problem Set 4Dokument10 SeitenMA1201 Calculus and Basic Linear Algebra II Solution of Problem Set 4Sit LucasNoch keine Bewertungen

- Paper 4 (A) (I) IGCSE Biology (Time - 30 Mins)Dokument12 SeitenPaper 4 (A) (I) IGCSE Biology (Time - 30 Mins)Hisham AlEnaiziNoch keine Bewertungen

- Human Rights Alert: Corrective Actions in Re: Litigation Involving Financial InstitutionsDokument3 SeitenHuman Rights Alert: Corrective Actions in Re: Litigation Involving Financial InstitutionsHuman Rights Alert - NGO (RA)Noch keine Bewertungen

- Anti Jamming of CdmaDokument10 SeitenAnti Jamming of CdmaVishnupriya_Ma_4804Noch keine Bewertungen

- Hydraulics Engineering Course OverviewDokument35 SeitenHydraulics Engineering Course Overviewahmad akramNoch keine Bewertungen

- Business Case PresentationDokument27 SeitenBusiness Case Presentationapi-253435256Noch keine Bewertungen

- Individual Performance Commitment and Review Form (Ipcrf) : Mfos Kras Objectives Timeline Weight Per KRADokument4 SeitenIndividual Performance Commitment and Review Form (Ipcrf) : Mfos Kras Objectives Timeline Weight Per KRAChris21JinkyNoch keine Bewertungen

- AA ActivitiesDokument4 SeitenAA ActivitiesSalim Amazir100% (1)

- Form 4 Additional Mathematics Revision PatDokument7 SeitenForm 4 Additional Mathematics Revision PatJiajia LauNoch keine Bewertungen

- Precision Machine Components: NSK Linear Guides Ball Screws MonocarriersDokument564 SeitenPrecision Machine Components: NSK Linear Guides Ball Screws MonocarriersDorian Cristian VatavuNoch keine Bewertungen

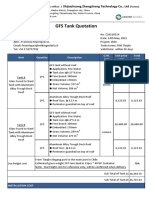

- GFS Tank Quotation C20210514Dokument4 SeitenGFS Tank Quotation C20210514Francisco ManriquezNoch keine Bewertungen

- Assignment - Final TestDokument3 SeitenAssignment - Final TestbahilashNoch keine Bewertungen