Beruflich Dokumente

Kultur Dokumente

Labor Laws & Standards Compact 12.26.2007

Hochgeladen von

Twinkle YsulatOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Labor Laws & Standards Compact 12.26.2007

Hochgeladen von

Twinkle YsulatCopyright:

Verfügbare Formate

Basic Labor Laws and Standards taken from the Labor Code of the Philippines

MINIMUM WAGE

Coverage

All covered employees are entitled to receive minimum wages regardless of the following:

a. their positions

b. designations

c. employment status; and

d. the method by which their wages are paid

Monthly-Paid Employees as Distinguished from Daily-Paid Employees

MONTHLY-PAID EMPLOYEES refer to those who are paid every day of the month including unworked rest days, special days and regular

holidays. The Equivalent Monthly Rate of monthly-paid workers should not be less than the Applicable Daily Rate X 365 days and divided

over 12 months.

DAILY-PAID EMPLOYEES refer to those who are paid on the days they actually worked except unworked regular holidays where they are

paid in their basic wage if they are present or on leave with pay on the working day before the regular holiday. Equivalent Monthly Rate of

daily paid employees must not be less than the Applicable Daily Rate X 313 days and divided over 12 months (for workers with 1 rest

day/week) or the Applicable Daily Rate X 261 days and divided over 12 months (for workers with 2 rest days). (as an effect RA 9492 approved

on July 25, 2007)

Applicable Minimum Wage

The daily Cost of Living Allowances (COLA) of P18.50 and P20.00 provided for under Wage Orders RB III-11 & 12

respectively was integrated into the basic wage effective August 03, 2007.

This is pursuant to Section 3 of W.O. RB III-12, which states: one (1) year after the effectivity of this new wage

order, the Cost of Living Allowances (COLA) under Wage Order Nos. RBIII-11 and 12 shall be integrated into the

basic wage of all covered workers. W.O. RB III-12 took effect on August 03, 2006.

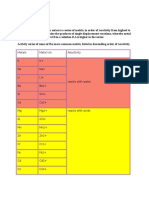

The applicable Daily Minimum Wage rates for the Non-agricultural and Retail/Service sectors in August 03,

2007 shall be as follows:

NON - AGRICULTURAL

P 278.00 (for establishments with total assets of P30M or more)

P 270.50 (for establishments with total assets of less than P30M)

RETAIL/SERVICE

P 267.00 (for establishments with 16 or more employees)

P 253.00 (for establishments with less than 16 employees)

On September 04, 2007, a cost of living allowance (COLA) of P9.00 was granted under W.O. RB III-13 which took effect on

September 27, 2007.

Labor laws & standards compact as of 12.26.2007

LABOR LAWS AND STANDARDS

Thus, as of this date, applicable Daily Minimum Wage rates for the Non-agricultural and Retail/Service sectors

effective September 27, 2007 shall be as follows:

NON - AGRICULTURAL

P 278.00 (for establishments with total assets of P30M or

more)

P 270.50 (for establishments with total assets of less than

P30M)

RETAIL/SERVICE

P 267.00 (for establishments with 16 or more employees)

P 253.00

(for establishments with less than 16

employees)

Plus COLA

9.00

TOTAL

287.00

9.00

279.50

9.00

9.00

276.00

263.00

Basis for Minimum Wage

The normal working hours which shall not be more than eight (8) hours a day shall be the basis for the minimum wage rates prescribed by law.

Workers Paid by Result

All workers paid by results, including those who are paid on piecework, takay, pakyaw, or task basis, shall receive not less than the applicable

statutory minimum wage rates prescribed under the Act for normal working hours which shall not exceed eight (8) hours a day, or a proportion

thereof for work of less than the normal working hours.

The adjusted minimum wage rates for workers paid by results shall be computed in accordance with the following steps:

a) % increase = Amount of Increase in Applicable Minimum Wage

Previous Applicable Minimum Wage X 100

b) Increase in Piece Rate = Existing Rate per Piece X % Increase

c) Adjusted Rate Per Piece = Existing Rate per Piece + Increase in Rate Per Piece

Effect of Wage Distortion

Wage distortion is a situation where an increase in prescribed wage rates results in the elimination of severe contraction of intentional

quantitative differences in wage or salary rates between and among employee groups in an establishment

Wage distortion may be corrected with the use of the following recommended formula:

Minimum Wage under W.O. RB-III No. 13 X

Present Salary

Amount of COLA in

W.O. RB-III No. 13

= Amount of COLA

due to distortion

Effect of the Reduction of Workdays on Wages

In situations where the reduction in the number of regular working days is resorted to by the employer to prevent serious losses due to causes

beyond his control such as when there is a substantial slump in the demand for his goods or services or when there is lack of raw materials,

the employer may deduct the wages corresponding to the days taken off from the workweek, consistent with the principle of no

work, no pay. This is, of course, without prejudice to an agreement or policy which provides otherwise.

PREMIUM PAY

Premium pay refers to the additional compensation required by law for work performed within eight (8) hours on non-working days such as rest

days and special days.

Premium Pay Rates

The minimum statutory premium pay rates are as follows

Plus 30% of the daily rate of 100% or a total of 130% for work performed on rest days or on special days

Plus 50% of the daily rate of 100% or a total of 150% for work performed on a rest day which is also a special day

Plus 100% of the daily rate of 100% or a total of 200% plus 30% thereof or a total of 260% for work performed on a regular holiday which is

also the employees rest day

OVERTIME PAY

Labor laws & standards compact as of 12.26.2007

LABOR LAWS AND STANDARDS

Overtime pay refers to additional compensation for work performed beyond eight (8) hours a day.

Overtime Pay Rates

The minimum overtime pay rates vary according to the day the overtime work is performed. The computation is as follows:

For overtime work during an ordinary day, an additional compensation equivalent to the employees regular wage plus at least 25% thereof.

For overtime work during a rest day, special holiday or regular holiday, an additional compensation equivalent to the rate of the first eight hours

plus at least 30% thereof.

Labor laws & standards compact as of 12.26.2007

LABOR LAWS AND STANDARDS

Stipulated Overtime Rates

Generally, the premium pay for work performed on the employees rest days or on special days or regular holidays are included as part of the

regular rate of the employee in the computation of overtime pay for any overtime work rendered on said days especially if the employer pays

only the minimum overtime rates prescribed by law. The employees and employer, however, may stipulate in their collective agreement the

payment of overtime rates higher than those provided by law and exclude the premium rates in the computation of overtime pay. Such

agreement may be considered valid only if the stipulated overtime pay rates will yield to the employees not less than the minimum prescribed

by law.

NIGHT SHIFT PAY

Every employee is entitled to a minimum night shift pay of not less than ten (10) percent of their regular wage for each hour of work performed

between 10 oclock in the evening and 6 oclock in the morning.

If overtime work (or work in excess of 8 hours fall within the aforesaid period, premiums for overtime work should first be integrated into the regular

hourly rate of the employees before computing night shift pay.

Computation of Night Shift Pay

1. Where Night Shift (10 PM - 6 AM) Work is Regular Work

a. Plus 10% or a total of 110% of the basic hourly rate on an ordinary day

b. Plus 10% or a total of 110% of the regular hourly rate on an rest day, special day, or regular holiday

2. Where Night Shift (10 PM - 6 AM) Work is Overtime Work

a. Plus 10% or a total of 110% of the overtime hourly rate on an ordinary day

b. Plus 10% of the overtime hourly rate on an rest day, special day, or regular holiday

HOLIDAY PAY

The Holiday Pay Rule stipulates that an employee is entitled to at least 100% of his basic wage even if he did not report for work, provided he/she

is present or is on leave of absence with pay on the work day immediately preceding the holiday. Moreover, when the holiday falls on the

scheduled workday of the employee, work performed on that said day merits an additional 30% of the employees regular holiday rate of 200% or a

total of 260%.

There are now eleven (11) regular holidays as provided under EO 203 (incorporated in EO 292) as amended by R.A. 9492 approved on July 25,

2007, An Act Rationalizing the Celebration of national Holidays amending for the purpose Section 26, Chapter 7, Book 1 of Executive

Order No.292, as amended, otherwise known as the Administrative Code of 1987.

New Years Day

January 1

Maundy Thursday

Movable Date

Good Friday

Movable Date

Araw ng Kagitingan

Monday nearest April 9

Labor Day

Monday nearest May 1

Independence Day

Monday nearest June 12

National Heroes Day

Last Monday of August

Bonifacio Day

Monday nearest November 30

Eidul Fitr

Movable Date

Christmas Day

December 25

Rizal Day

Monday nearest December 30

Special Days

The principle of no work, no pay applies in case of Special Non-Working Holidays provided hereunder as well as on other special days

proclaimed as such by the President.

Labor laws & standards compact as of 12.26.2007

LABOR LAWS AND STANDARDS

Nationwide Special Holidays

Ninoy Aquino Day

Monday nearest August 21

All Saints Day

November 1

Last Day of the Year

December 31

In addition to these three national special days, two special days were also declared for the province --- Jose Abad Santos Day every 7th day

of May and Pampanga Day every 11th day of December.

Work performed on these days merits an additional compensation of not less than 30% on top of the basic pay for a total of 130%. An

additional 50% over and above of the basic pay or a total of 150% if the worker is permitted or suffered to work on that day which falls on

his/her scheduled rest day.

However, workers who do not report for work or were not required or permitted to work on those days are not by law entitled to any

compensation. This however, is without prejudice to any voluntary practice or stipulation in the CBA providing for the payment of wages and

other benefits for days declared as special days even if unworked.

13th MONTH PAY

The 13th month pay required by Presidential Decree 851 is additional income based on wage but not part of the wage. It is 1/12 of the total basic

salary earned by an employee within calendar year. All rank-and-file employees regardless of their designation or employment status and

irrespective of the method by which their wages are paid, are entitled to this benefit, provided that hey have worked for at least one month during

the calendar year. If the employee worked for only a portion of the year, the 13th month pay is computed pro rata.

The basic salary of an employee for the purpose of computing the 13th month pay shall include all remuneration or earnings paid by the employer

for services rendered. However, this does not include allowances and monetary benefits which are considered or integrated as part of the regular

or basic salary, such as cash equivalent of unused vacation and sick leave credits, overtime, premium, night differential and holiday pay, and costof-living allowances. However, those salary-related benefits may be included as part of the basic salary in the computation of the 13th month pay if

by individual or collective agreement, company practice or policy, the same are treated as part of the basic salary of an employee.

Time of Payment

The required 13th month pay shall be paid not later than December 14 of each year. An employer, however, may give to his employees

one half () of the required 13th pay before the opening of the regular school year and the other half on or before the 24th of December of

every year. The frequency of payment of this monetary benefit may be the subject of agreement between the employer and the

recognized/collective bargaining agent of the employees.

13th Month Pay for Employees Paid by Results

Employees who are paid on piece work basis are by law entitled to the 13th month pay. Employees who are paid a fixed or guaranteed wage

plus commissions are also entitled to the mandated 13th month pay, based on their total earnings during the calendar year, i.e. both their fixed

or guaranteed wage and commission.

13th Month Pay for Resigned or Separated Employee

An employee who resigned or whose services are terminated at any time before the time of payment of the 13th month pay is entitled to this

monetary benefit in proportion to the length of time he worked during the year, reckoned from the time he started working during the calendar

year up to the time of his resignation or termination from the service. Thus, if he worked only from January up to September, his proportionate

13th month pay should be equivalent of 1/12 of his total basic salary he earned during the period.

The payment of the 13th month pay may be demanded by the employee upon the cessation of employer-employee relationship. This

is consistent with the principle of equity that as the employer can require the employee to clear himself of all liabilities and property

accountability, so can the employee demand payment of all benefits due him upon termination of the relationship.

Non-inclusion in the Regular Wage

The mandated 13th month pay need not be credited a part of regular wage of employees for purposes of determining overtime and

premium pays, fringe benefits as well as contributions to the state insurance fund, Social Security, Medicare and companys retirement plans.

SERVICE INCENTIVE LEAVE

Labor laws & standards compact as of 12.26.2007

LABOR LAWS AND STANDARDS

Every employee who has rendered at least one (1) year of service is entitled to a yearly service incentive leave of five (5) days with pay. The

service incentive leave may be used for sick and vacation leave purposes.

Meaning of one year of service.

The phrase one year of service of the employee means service within 12 months, whether continuous or broken, reckoned from the date the

employee started working. The period includes authorized absences, unworked weekly rest days, and paid regular holidays.

Commutation to Cash

The unused service incentive leave is commutable to its money equivalent at the end of the year. In computing, the basis shall be the salary

rate at the date of commutation.

Labor laws & standards compact as of 12.26.2007

LABOR LAWS AND STANDARDS

PATERNITY LEAVE

Paternity Leave refers to leave credits granted to all married male employees to allow him to earn compensation for seven (7) working days without

reporting for work, provided that his spouse has delivered a child or had a miscarriage or an abortion for the purpose of lending support to his wife

during her period of recovery and/or the nursing of the newly born child.

Coverage

Every married male employee cohabiting or residing with his wife shall be entitled to Paternity Leave benefits of seven (7) working days with

full pay only for the first four (4) deliveries by his lawful spouse.

Availment

The benefit may be enjoyed before, during or after the delivery by his wife; that the total number of days shall not exceed seven (7) working

days for each delivery; that the benefit shall be availed of not later than sixty (60) days after the date of said delivery.

Non-conversion of benefits

In the event that the paternity leave benefit is not availed of, said leave shall not be convertible to cash.

MATERNITY BENEFITS

1. Every pregnant woman in the private sector, whether married or unmarried is entitled to the daily maternity benefit of 100% of the average daily

salary credit for a compensable for the following periods:

Sixty (60) days in case of normal delivery, abortion or miscarriage;

Seventy-eight (78) days in case of cesarean delivery

2. To be entitled to the maternity benefit, the employee:

must be an SSS member employed at the time of delivery, miscarriage or abortion;

must have given the required notification to the SSS thru her employers; and

her employers must have paid at least three (3) months of maternity contributions within the twelve-month period immediately before the

date of contingency.

PAG-IBIG FUND or HOUSING DEVELOPMENT MUTUAL FUND

The coverage of the Pag-IBIG Fund or Housing Development Mutual Fund (HDMF) shall be mandatory upon all employees covered by the Social

Security System (SSS) and/or the Government Service Insurance System (GSIS), and their respective employers. However, the coverage of the

employees whose monthly compensation is less than four thousand pesos (P4,000) shall be voluntary.

Upon membership, employers and employees shall contribute an amount according to the following percentages but not exceeding one hundred

pesos (P100):

a. Employees earning not more than one thousand five hundred pesos (P1,500) per month shall contribute one percent (1%)

b. Employees earning more than one thousand five hundred pesos (P1,500) per month shall contribute two percent (2%)

c. All employers --- two percent (2%) of the monthly compensation of the covered employees.

SERVICE CHARGES

Sharing

Employees of employers collecting service charges are entitled to 85% of the total of such charges, except managerial employees. The

remaining 15% of the charges may be retained by management to answer for losses and breakages and for distribution to managerial

employees (at the discretion of management in the latter case). Service charges are collected by most hotels and some restaurants, night

clubs, cocktail lounges, among others.

Payments

Labor laws & standards compact as of 12.26.2007

LABOR LAWS AND STANDARDS

The shares of the employees in the service charges have to be distributed to them not less often than once every two (2) weeks or twice a

month at intervals not exceeding sixteen (16) days.

Where the company stopped collecting service charges, the average share previously enjoyed by the employees shall be integrated into

their basic wages.

TERMINATION PAY

The amount of separation pay an employee is by law entitled to receive depends on the reason and grounds for the termination of his services.

One (1) or One Half (1/2) month Pay Per Year of Service

An employee is entitled to receive as termination pay the equivalent of one (1) or one-half (1/2) month pay for every year of service, a fraction

of at least six (6) months being considered as one whole year, if his separation from service is due to any of the following causes:

a. Retrenchment to prevent losses (i.e. reduction of personnel affected by management to prevent losses);

b. Closure or cessation of operation of an establishment not due to serious losses or financial reverses;

c. When the employee is suffering from a disease not curable within a period of six months and his continued employment is prejudicial to

his health or to the health of his co-employees.

The computation of termination pay should be based on either one (1) month or one-half (1/2) months pay, whichever will yield a

higher separation pay taking into consideration his length of service. It can be seen that if an employee has served for at least six (6)

months, in no case will he/she get less than one (1) month separation pay if the separation is due to above stated causes. Thus, if an

employee has been in the service for at least six (6) months, he is entitled to one (1) full months pay as his termination pay if the separation is

due to the causes enumerated above. But if he has to his credit ten (10) years of service, he is entitled to five (5) months pay, thus being

higher than one (1) months pay.

One (1) Month Pay Per Year of Service

An employee is entitled to termination pay equivalent to his one (1) months pay for every year of service, a fraction of at least (6) months

being considered as one (1) whole year, if his separation from service is due to any of the following:

a. Installation of labor-saving device such as the replacement of employees by machineries;

b. Redundancy, as when the position of the employee has been found to be unnecessary in the operation of the enterprise;

c. Impossible reinstatement of the employee to his former or to a substantially equivalent position for reasons not attributable to the fault of

the employer, as when the reinstatement ordered by a competent authority cannot be implemented due to closure or cessation of

operations of the establishment, or the position to which he is to be reinstated no longer exists and there is no substantially equivalent

position in the establishment to which he can be assigned.

Notice of Termination

The employer may terminate the employment of any employee due to installation of labor-saving devices, redundancy, retrenchment to

prevent losses or the closing or cessation of operation of the establishment or undertaking unless the closing is for the purpose of

circumventing the law, by serving a written notice on the workers and the Department of Labor and Employment through the regional offices

having jurisdiction over the place of business at least one (1) month before the intended date thereof.

Basis of Termination Pay

The computation of the termination pay of an employee shall be based on his last salary rate, unless the same is reduced by the employer to

defeat the intention of the law, in which case the basis of computation shall be the rate before its reduction.

RETIREMENT PAY

Coverage

All employees regardless of their position, designation or status and irrespective of the method by which their wages are paid are entitled to

retirement benefits provided under Republic Act 7641 upon compulsory retirement at the age of sixty-five (65) or upon optional retirement at

sixty (60) or more but not 65.

This benefit does not apply to the following:

Labor laws & standards compact as of 12.26.2007

LABOR LAWS AND STANDARDS

a. Government Employees

b. Domestic helpers and persons in the personal service of another

c. Employees of retail, service and agricultural establishments or operations regularly employing not more than ten (10) employees

d. Other benefits that may be agreed upon by employer and employee for inclusion

To Illustrate:

One Half Month Salary

= (15 x latest daily salary) + (5 x latest daily salary) + 1/12 of 13th month pay

Minimum Retirement Pay = No. Of Years in service x One Half Month salary

For covered employees who are paid by result, the basis for computing their salary for fifteen days shall be their Average Daily Salary (ADS).

The ADS may be derived by dividing the total salary or earnings for the last 12 months by the number of actual working days.

Compulsory

In the absence of a retirement plan or applicable agreement in an establishment, an employee shall be retired upon reaching the age of sixty

five (65) an shall be entitled to the retirement pay illustrated above.

Optional

An employee below sixty five (65) years of age may retire and shall be entitled to retirement pay under RA 7641 if:

a. there is no retirement plan or applicable agreement on retirement benefits in an establishment

b. he has reached sixty (60) years or more; and

c. if he has served for at least five (5) years in the said establishment

Retirement under the collective bargaining agreement/applicable contract

Any employee may retire or be retired by his employer upon reaching the age established in the CBA or other applicable agreement contract

and shall receive the benefits granted therein. Such benefits shall not be less than the amount required by law. Any difference shall be paid

by the employer.

Where both the employer and employee contribute to a retirement fund subject of the applicable agreement, the employers total contributions

and the accrued interest thereof shall not be less than the total retirement benefits to which the employee would have been entitled had there

been no such retirement fund. If such total portion from the employer is less, the employer shall pay the deficiency.

EMPLOYMENT STATUS

Regular Employment

Article 280 of the Labor Code on Regular and Casual Employment specifies that the provisions of a written agreement to the contrary

notwithstanding and regardless of the oral agreement of the parties, an employment shall be deemed to be regular where the employee has

been engaged to perform activities which are usually necessary or desirable in the usual business or trade of the employer. An exception is

when the employment has been fixed for a specific project or undertaking the completion of which has been determined at the time of the

engagement of the employee or where the work or services to be performed is seasonal in nature and the employment is for the duration of

the season.

Casual Employment

An employment is deemed to be casual if it is not covered by the preceding paragraph: Provided, that, any employee who has rendered at

least one year of service, whether such service is continuous or broken, shall be considered a regular employee with respect to the activity in

which he is employed and his employment shall continue while such activity exists.

What determines regularity or casualness is not the employment contract, written or otherwise, but the nature of the job.

Probationary Employment

Article 281 of the Labor Code stipulates that probationary employment shall not exceed six (6) months from the date the employee started

working unless it is covered by an apprenticeship agreement stipulating a longer period. The services of an employee who has been engaged

on a probationary basis may be terminated for a just cause or when he/she fails to qualify as a regular employee in accordance with

Labor laws & standards compact as of 12.26.2007

10

LABOR LAWS AND STANDARDS

reasonable standards made known by the employer to the employee at the time of his engagement. An employee who is allowed to work

after a probationary period shall be considered a regular employee.

TERMINATION

Termination by Employer

Grounds for Termination

An employer may terminate an employment for any of the following causes:

a. Serious misconduct or willful disobedience by employee of the lawful orders of his employer or representative in connection with his/her

work;

b. Gross and habitual neglect by the employee of his duties;

c. Fraud or willful breach by the employee of the trust reposed in him by his employer or duly authorized representative;

d. Commission of a crime or offense by the employee against the person of his employer or any immediate member of his family or his duly

authorized representative; and

e. Other causes analogous to the foregoing.

Dismissal Procedure

It is not enough for an employer who wishes to dismiss an employee to charge him/her with theft or some other wrongdoing. The validity of the

charge must be established in a manner consistent with due process. Accusation cannot take the place of proof. A suspicion or belief no

matter how sincerely felt cannot substitute for factual findings carefully established through an orderly procedure.

The law requires that the employer must furnish the worker sought to be dismissed with two written notices before termination of employment

can be legally effected:

1. notice which apprises the employee of the particular acts or omissions for which his/her dismissal is sought; and

2. the subsequent notice which informs the employee of the employers decision to dismiss him/her.

Failure to comply with the requirements taints the dismissal with illegality. This procedure is mandatory, in the absence of which, any

judgment reached by management is void and inexistent.

An employee is likewise deemed constructively dismissed where his status is changed from regular to casual.

Preventive Suspension

Preventive suspension is justified where the employees continued employment poses a serious and imminent threat to the life of property of

the employer or of his/her co-workers.

The suspension may last for thirty (30) days; beyond that, the suspension may continue but the employee becomes entitled to his pay and

benefits.

Closure of the establishment and Reduction of Personnel

The employer may also terminate the employment of any employee due to the following:

a. Installation of labor saving devices;

b. Redundancy;

c. Retrenchment to prevent losses; or

d. the closing or cessation of operation of operation of the establishment or undertaking unless the closing is for the purpose of circumventing

the above provisions.

The employer must serve a written notice on the worker and the Department of Labor and Employment at least one (1) month before the

intended date thereof. In case of termination due to the installation of labor saving devices or redundancy, the worker affected thereby shall be

entitled to a separation pay equivalent to at least one (1) month pay or to at least one (1) month pay for every year of service, whichever is

higher. In case of retrenchment to prevent losses and in case of closure or cessation of operations of establishment or undertaking not due to

serious losses or financial reverses, the separation pay shall be equivalent to one (1) month pay or at least one-half (1/2) month pay for every

year of service, whichever is higher. A fraction of at least six (6) months shall be considered as one (1) whole year.

Labor laws & standards compact as of 12.26.2007

LABOR LAWS AND STANDARDS

11

Labor laws & standards compact as of 12.26.2007

12

LABOR LAWS AND STANDARDS

Disease as Ground for Termination

An employer may terminate the services of an employee who has been found to be suffering from any disease and whose continued

employment is prohibited by law or is prejudicial to his health as well as to the health of his co-employees: Provided, that he is paid a

separation pay equivalent to at least one (1) month salary or to one-half (1/2) month salary for every year of service, whichever is greater, a

fraction of at least six (6) months being considered as one (1) whole year.

Termination by Employee

Termination with a just cause

An employee may terminate the employer-employee relationship with just cause by serving a written notice to the employer at least one

(1) month in advance. The employer upon whom no such notice was served may hold the employee liable for damages.

Termination without a just cause

An employee may put an end to the relationship without serving any notice on the employer for any of the following just causes:

a. Serious insult by the employer or his representative on the honor and person of the employee;

b. Inhuman and unbearable treatment accorded the employee by the employer or his representative;

c. Commission of a crime or offense by the employer or his representative against the person of the employee or any of the immediate

members of his family; and

d. Other causes analogous to the foregoing.

When employment is not deemed terminated

The bona fide suspension of the operation of a business or undertaking for a period not exceeding six (6) months, or the fulfillment by the

employee of a military or civic duty shall not terminate employment. In all such cases, the employer shall reinstate the employee to his former

position without loss of seniority rights if he indicates his desire to resume his work not later than one (1) month from the resumption of

operations of his employer or from his relief from the military or civic duty.

CONTRACTING AND SUB-CONTRACTING (DEPARTMENT ORDER 18-2002)

Contracting and subcontracting arrangements are expressly allowed by law, but may be subject to regulations consistent with the promotion of

employment, protection of workers welfare, and enhancement of industrial peace and the rights of the workers to self-organization and collective

bargaining.

Contractors and subcontractors as well as other employees, are entitled to all the rights and privileges, and are subject to all the duties and

responsibilities which the Labor Code, as amended, attaches to every employee-employer relationship.

Term or duration of contractual employment

The term or duration of contractual employment shall be coextensive with the term or duration of the contract between the principal and

contractor or subcontractor. However, where the contract is divisible into phases such that substantially different skills are required for each

phase, the term or duration of the contractual employment may be made coextensive with each phase.

For purposes of this Rule, the phrase substantially different skills refer to those skills the acquisition of which requires specialized knowledge

or training .

Permissible contracting or subcontracting

The principal may engage the services of a contractor or subcontractor for the performance of any of the following:

a.

Works or services temporarily or occasionally needed to meet abnormal increase in the demand of product or services, provided that

normal production capacity or regular workforce of the principal cannot reasonably cope with such demand;

b.

Works or services temporarily or occasionally needed by the principal for undertakings requiring expert or highly technical personnel to

improve the management or operations of the enterprise;

c.

Services temporarily needed for the introduction or promotion of new products, only for the duration of the introductory or promotional

period;

d.

Works or services not directly related or not integral to the main business or operation of the principal, including casual work, janitorial,

security, landscaping, and messengerial services, and work not related to manufacturing processes in manufacturing establishments;

Labor laws & standards compact as of 12.26.2007

13

LABOR LAWS AND STANDARDS

e.

Services involving the public display of manufacturers products which does not involve the act of selling or issuance of receipts or

invoices;

f.

Specialized works involving the use of some particular, unusual or peculiar skills, expertise, tools or equipment the performance of which

is beyond the competence of the regular workforce or production capacity of the principal; and

g.

Unless a reliever system is placed among the regular workforce, substitute services for absent regular employees, provided that the

period of service shall be coextensive with the period of absence and the same is made clear to the substitute employee at the time of

engagement. The phrase absent regular employees includes those who are serving suspensions or other disciplinary measures not

amounting to termination of employment meted out by the principal, but excludes those on strike where all the formal requisites for the

legality of the strike have been prima facie complied with based on records filed with the National Conciliation & Mediation Board.

Prohibitions

The following are hereby declared prohibited for being contrary to law or public policy :

a. Labor-only contracting;

b. Contracting out of a job work or service when not done in good faith and justified by the exigencies of the business and the same results in

the termination of regular employees and reduction of work hours or splitting of the bargaining unit.

c. Contracting out of work with cabo as defined in Section 1 (ii), Rule 1, Book V of these Rules;

d. Taking undue advantage of the economic situation of lack of bargaining strength of the contractual employee, or undermining his security

of tenure or basic rights or circumventing the provisions of regular employment, in any of the following instances:

d.i In addition to his assigned functions, requiring the contractual employee to perform functions which are currently being performed

by the regular employees of the principal or of the contractor or subcontractor;

d.ii Requiring him to sign, as a precondition to employment or continued employment , an antedated resignation letter, a blank payroll: a

waiver of labor standards including minimum wages and social welfare benefits; or a quitclaim releasing the principal, contractor or

subcontractor from any liability as to payment of future claims; and

d.iii Requiring him to sign a contract fixing the period of employment to a term shorter than the term of the contract between the principal

and the contractor or subcontractor, unless the latter contract is divisible into phases for which substantially different skills are

required and this is made known to the employee at the time of engagement;

e. Contracting out of a job, work or service through an in-house agency as defined herein;

f. Contracting out of a job, work or service directly related to the business or operation of the principal by reason of strike or lockout whether

actual or imminent; and

g. Contracting out of a job, work or service being performed by union members when such will interfere with, restrain or coerce employees in

the exercise of their rights to self organization as provided in Art. 248 (c) of the Labor Code as ammended.

Prohibitions against labor-only contracting:

Labor-only contracting is hereby declared prohibited. For this purpose, labor-only contracting shall refer to an arrangement where the contractor or

subcontractor merely recruits, supplies or places workers to perform a job, work or service for a principal and any of the following elements are

present:

1.

The contractor or subcontractor does not have substantial capital or investment to actually perform job, work or service to be performed and

the employees recruited, supplied or placed by such contractor or subcontractor are performing activities which are directly related to the main

business of the principal; or

2.

The contractor does not exercise the right to control over the performance of the work of the contractual employee.

Contract between contractor or subcontractor and contractual employee

Notwithstanding oral or written stipulations to the contrary, the contract between the contractor or subcontractor and the contractual employee

shall include the following terms and conditions:

a. The specific description of the job, work or service to be performed by the contractual employee;

b. The place of work and terms and conditions of employment , including a statement of the wage rate applicable to the individual

contractual employee; and

Labor laws & standards compact as of 12.26.2007

14

LABOR LAWS AND STANDARDS

c. The term or duration of employment, which shall be coextensive with the contract between the principal and contractor or subcontractor, or

with the specific phase for which the contractual employee is engaged, as the case may be.

The contractor or subcontractor shall inform the contractual of the foregoing terms and conditions on or before the first day of his employment.

Registration of Contractors or Subcontractors

The registration of contractors and subcontractors shall be necessary for purposes of establishing an effective labor market information and

monitoring.

Failure to register shall give rise to the presumption that the contractor is engaged in labor-only contracting.

Delisting of contractors or subcontractors

Subject to due process, the Regional Director shall cancel the registration of contractors or subcontractors based on any of the following

grounds:

(a) Non-submission of contracts between principal and the contractor or subcontractor when required to do so;

(b) Non-submission of Annual Report

(c) Finding through arbitration that the contractor or subcontractor has engaged in labor-only contracting and the prohibited activities as

provided in Section 6 of D.O. 18-2002

(d) Non-compliance with labor standards and working conditions

Rights of the contractual employee

The contractual employee shall be entitled to all the rights and privileges due a regular employee, including but not limited to the right to

working conditions and standards, service incentive leave, rest days, overtimes and holidays, health, safety and social and welfare benefits,

self-organization and collective bargaining and security of tenure.

In cases of termination of employment prior to the expiration of the contract between the principal and the contractor or subcontractor, the right

of the contractual employee to separation pay or other related benefits shall be governed by the applicable law and jurisprudence on

termination of employment. Where the termination results from the expiration of the contract between the principal and the contractor or

subcontractor, or from the completion of the phase of the job, work or service for which the contractual employee is engaged, the latter shall

not be entitled to separation pay. However, this shall be without prejudice to completion bonuses or other emoluments, including retirement

pay as may be provided by law or in the contract between the principal and the contractor or subcontractor.

Solidary liability

The principal shall be deemed as the direct employer of the contractual employees and therefore, solidarily liable with the contractor or

subcontractor for whatever monetary claims the contractual employee may have against the former in the case of violations as provided for in

Section 5 (Labor-only contracting), 6 (Prohibitions) 8 (Rights of Contractual Employee) and 16 (Delisting) of these rules.

Labor laws & standards compact as of 12.26.2007

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Blank Deed of Sale of Motor Vehicle TemplateDokument1 SeiteBlank Deed of Sale of Motor Vehicle TemplateAileen Algas Ordonez67% (109)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Request Letter To DPWHDokument7 SeitenRequest Letter To DPWHLhexor Diapera Doble100% (4)

- Counter AffidavitDokument3 SeitenCounter Affidavitatty_gie374375% (4)

- Raffle mechanics for municipal officials and attendeesDokument1 SeiteRaffle mechanics for municipal officials and attendeesLhexor Diapera DobleNoch keine Bewertungen

- Bill of Rights Reviewer FullDokument2 SeitenBill of Rights Reviewer FullLhexor Diapera DobleNoch keine Bewertungen

- FHM Philippines 2014 02Dokument1 SeiteFHM Philippines 2014 02Lhexor Diapera DobleNoch keine Bewertungen

- UST GN 2011 - Civil Law ProperDokument1 SeiteUST GN 2011 - Civil Law ProperLhexor Diapera DobleNoch keine Bewertungen

- Corporation Law Memory Aid San BedaDokument2 SeitenCorporation Law Memory Aid San BedaLhexor Diapera DobleNoch keine Bewertungen

- Last Minute Tips in CIVIL LAWDokument1 SeiteLast Minute Tips in CIVIL LAWLhexor Diapera DobleNoch keine Bewertungen

- 209 - Suggested Answers in Civil Law Bar Exams (1990-2006)Dokument1 Seite209 - Suggested Answers in Civil Law Bar Exams (1990-2006)Lhexor Diapera DobleNoch keine Bewertungen

- RAPE (Complaint Affidavit)Dokument1 SeiteRAPE (Complaint Affidavit)Lhexor Diapera DobleNoch keine Bewertungen

- Red Notes: Criminal LawDokument1 SeiteRed Notes: Criminal LawLhexor Diapera DobleNoch keine Bewertungen

- LEGAL ETHICS - 20 Cases (Digested)Dokument6 SeitenLEGAL ETHICS - 20 Cases (Digested)Lhexor Diapera DobleNoch keine Bewertungen

- Civil Law (AdMU)Dokument1 SeiteCivil Law (AdMU)Lhexor Diapera DobleNoch keine Bewertungen

- Position PaperDokument1 SeitePosition PaperLhexor Diapera DobleNoch keine Bewertungen

- Petition For Legal SeparationDokument1 SeitePetition For Legal SeparationLhexor Diapera DobleNoch keine Bewertungen

- Sample Pre-Trial Brief (Final)Dokument2 SeitenSample Pre-Trial Brief (Final)Lhexor Diapera DobleNoch keine Bewertungen

- Asia 4586Dokument1 SeiteAsia 4586Lhexor Diapera DobleNoch keine Bewertungen

- Counter AffidavitDokument9 SeitenCounter AffidavitLhexor Diapera DobleNoch keine Bewertungen

- Plays were divided into three acts and written in verse. The classical unities of time and place were disregarded although that of action was retained. The plot that carried the action was frequently supported by a relevant comic or serious subplot, and a comic character (the gracioso) was often present. Lope overturned classical decorum by mixing comic and tragic elements, and having both nobles (even royalty) and peasants appearing on the stage at the same time. Thematically, Lope drew inspiration from a wide variety of sources: e.g. history, classical mythology, the Bible, lives of saints, Italian literature. However, two themes he worked with particular success were amorous cloak and dagger intrigues (comedias de capa y espada) and honour conflicts, especially between the peasantry and nobility. Fuenteovejuna is an historical play, based on an uprising in the village of Fuenteovejuna (North West of Córdoba) in 1476. It was composed probably between 1612 and 1614. The action ofDokument1 SeitePlays were divided into three acts and written in verse. The classical unities of time and place were disregarded although that of action was retained. The plot that carried the action was frequently supported by a relevant comic or serious subplot, and a comic character (the gracioso) was often present. Lope overturned classical decorum by mixing comic and tragic elements, and having both nobles (even royalty) and peasants appearing on the stage at the same time. Thematically, Lope drew inspiration from a wide variety of sources: e.g. history, classical mythology, the Bible, lives of saints, Italian literature. However, two themes he worked with particular success were amorous cloak and dagger intrigues (comedias de capa y espada) and honour conflicts, especially between the peasantry and nobility. Fuenteovejuna is an historical play, based on an uprising in the village of Fuenteovejuna (North West of Córdoba) in 1476. It was composed probably between 1612 and 1614. The action ofLhexor Diapera DobleNoch keine Bewertungen

- Sample of ResolutionDokument1 SeiteSample of ResolutionLhexor Diapera DobleNoch keine Bewertungen

- Petition For Legal Separation (Legal Form)Dokument31 SeitenPetition For Legal Separation (Legal Form)Lhexor Diapera DobleNoch keine Bewertungen

- Petition For Legal SeparationDokument1 SeitePetition For Legal SeparationLhexor Diapera DobleNoch keine Bewertungen

- COMPLAINT-AFFIDAVIT MUrderDokument15 SeitenCOMPLAINT-AFFIDAVIT MUrderLhexor Diapera DobleNoch keine Bewertungen

- Sample Resolution On Frustrated MurderDokument1 SeiteSample Resolution On Frustrated MurderLhexor Diapera DobleNoch keine Bewertungen

- Sample of ResolutionDokument1 SeiteSample of ResolutionLhexor Diapera DobleNoch keine Bewertungen

- Counter AffidavitDokument9 SeitenCounter AffidavitLhexor Diapera DobleNoch keine Bewertungen

- Conflict of Laws Case DigestDokument1 SeiteConflict of Laws Case DigestLhexor Diapera DobleNoch keine Bewertungen

- PcconfigDokument1 SeitePcconfigLhexor Diapera DobleNoch keine Bewertungen

- Conflict of Laws Case DigestDokument1 SeiteConflict of Laws Case DigestLhexor Diapera DobleNoch keine Bewertungen