Beruflich Dokumente

Kultur Dokumente

Chap 2dhtrh

Hochgeladen von

mrinalbohraOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chap 2dhtrh

Hochgeladen von

mrinalbohraCopyright:

Verfügbare Formate

20

ACCOUNTANCY

CHAPTER 2

Theory Base of Accounting

LEARNING OBJECTIVES

After studying this chapter, you will be able to :

comprehend the meaning of Generally Accepted Accounting Principles (GAAP),

state and relate the basic operating guidelines used by accountants in the accounting process,

explain the basic assumptions;

explain the accounting principles;

explain the modifying principles.

21

THEORY BASE OF ACCOUNTING

We have discussed the meaning and

objectives of accounting in the

preceding chapter. It was discussed

that basic objective of accounting is to

provide information to the different

users. This information is embodied in

Profit & Loss Statement and Balance

Sheet which contain ter ms and

concepts, having their basis in the

theoretical foundation of accounting,

usually, referred to as Generally

Accepted Accounting Principles

(GAAP). The set of rules and practices

followed in recording transactions and

preparing financial statements are

usually called Generally Accepted

Accounting Principles. GAAP provides

a set of guidelines to be observed by

the accounting profession for

preparing and reporting the financial

information. The guidelines can be

categorized into basic assumptions,

principles and modifying principles

(figure 2.1).

The understanding of these

guidelines is important for both, the

accountants who prepare the financial

statements, and the users who need

to use these statements. Now, we will

discuss these assumptions and

principles.

2.1 Basic Assumptions

Assumptions are traditions and

customs, which have been developed

over a period of time and wellaccepted by the profession. Basic

accounting assumptions provide a

foundation for recording the transactions and preparing the financial

statements there from. There are four

basic assumptions that are

considered as cornerstones of the

foundation of accounting. These are:

accounting entity, money measurement, going concern and accounting

period which are discussed below:

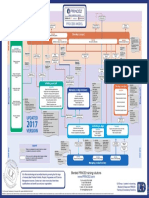

Generally Accepted Accounting Principles

Principles

Modifying

Principles

Accounting Entity

Duality

Cost-benefit

Money Measurement

Going Concern

Accounting Period

Revenue Recognition

Historical Cost

Matching

Full Disclosure

Objectivity

Materiality

Prudence

Consistency

Timeliness

Substance over Legal

form

Industry practice

Fig. 2.1

Assumptions

Accounting

Standards

Issued by

Accounting

Standards Board

(Indian And

International)

22

ACCOUNTANCY

2.1.1 Accounting Entity Assumption

Accounting entity assumption states

that the activities of a business entity

be kept separate from its owners and

all other entities. In other words,

according to this assumption business

unit is considered a distinct entity from

its owners and all other entities having

transactions with it. For example, in

the case of proprietorship, the law does

not make any distinction between the

proprietorship firm and the proprietor

in the event of firms inability to pay

its debts. Hence, in this situation, to

meet the deficit, law requires the

proprietor to pay firms debts from his/

her personal assets. But, these two are

treated as separate entities while

recording business transactions and

preparing the financial statements.

This assumption enables the

accountant to distinguish between the

transactions of the business and those

of the owners. Consequently, the

capital brought into the business and

withdrawals from the business by the

owners will also be recorded in the

same manner as that of transaction

with other entities. For example, if the

owner brings in cash or any other

asset, it will result in increase in assets

of the business and capital of the firm.

This capital represents firms liability

to the owner. The expenses of the

owner paid by the firm assets are

recorded as withdrawals from the

business. This means the profit and

loss account will show the revenues

and expenses related to the business

entity only. Consequently, balance

sheet will show the assets and

liabilities of the business entity only.

This assumption is followed in all

organizations irrespective of their form,

i.e., sole proprietorship, partnership,

cooperative, or company.

A manufacturing company owns different assets such as 200 sq mts of land; building with

40,000 sq feet of built-up area; furniture and fittings comprising of 2 sofa sets, 2 central

tables, 10 chairs, 6 computer tables, 2 steel almirahs and electrical fittings (switches,

wires, tube lights, fans, etc. ); plant and machinery capable of processing 200 units of

output per day; 2 cars, 1 delivery van; 5000 Kgs of raw materials, etc. Since these assets

are expressed in different units of measurement, they cannot be subjected to any

arithmetical calculation. However, all these assets must have been acquired by paying

certain amount of money (i.e., rupees). Hence, using rupee as a unit of measurement,

these can be expressed as follows:

Land

:

Rs. 2,00,000

Building

:

Rs. 13,70,000

Furniture and Fittings

:

Rs.

25,000

Plant and Machinery

:

Rs. 3,85,000

Motor vehicles

:

Rs. 8,75,000

(2 cars + 1 van)

Raw Materials

:

Rs.

75,000

Now, we can say that the total assets owned by the firm amounts to Rs.29,30,000.

Box 2.1

THEORY BASE OF ACCOUNTING

2.1.2 Money Measurement

Assumption

This assumption requires use of

monetary unit as a basis of

measurement, i.e., the currency of the

country where the organization is to

report its operations. This implies that

those transactions which can not be

measured by monetary unit will not

be recorded in the books of accounts.

Monetary unit is supposed to provide

a common yardstick to measure the

assets, liabilities and equity of the

business. The dif ferent items,

expressed in varied basis of

measurement, like area, volume,

numbers, cannot be added together

because of heterogeneity of scales of

measurement. But, once all these are

converted into a homogeneous unit of

money, they can be added together or

subjected to any arithmetical

calculations. It also indicates that

certain infor mation, howsoever

important it may be to state the true

and fair picture of the entity, will not

be recorded in the financial accounting

books if it can not be expressed in

terms of money. For example, the

union-management relations, health of

the key manager, quality of its

manufacturing facilities, etc. can not

be expressed in monetary value, and

hence, are not recorded in books of

accounts.

It is clear from the above that

money measurement assumption

makes the accounting records clear,

simple, comparable and under standable. The acceptability of money

as a unit of measurement is not free

23

from problems when we compare the

financial statement over a period of

time or integrate the financial

statements of an entity having

operations in more than one nation.

This is to be noted that the assumption

implies stability of measuring unit over

a period of time. This may not be true

over a period of time because prices of

goods and services may change, hence,

the purchasing power (value) of money

may undergo changes. But these

changes are not usually recorded. This

af fects the comparability of the

financial statements prepared at

different time periods.

2.1.3 Going Concern Assumption

The financial statements are prepared

assuming that the business will have

an indefinite life unless there is

evidence to the contrary. The business

is called going concer n thereby

implying that it will remain in

operation in the foreseeable future

unless it is to be liquidated in the near

future. Since, this assumption believes

in continuity of the business over

indefinite period, it is also known as

continuity assumption. The going

concern assumption facilitates that

distinction made between: (i) fixed

assets and current assets, (ii) Short

term and long term liabilities, and (iii)

capital and revenue expenditure.

2.1.4 Accounting Period Assumption

We have stated in the previous

paragraph that accountants assume

business to be in activities in the

foreseeable future. Therefore, results

24

of business operations cannot be truly

ascertained before the closure of the

business operations. But this period

is too long and the users of the

accounting information cannot wait for

such a long period of time. Hence, the

accountants make the assumption of

accounting period (also known as

periodicity assumption). This

assumption permits the accountant to

divide the lifespan of the business

enterprise into different time periods

known as accounting period

(quarterly, half-yearly, annually) for

the purpose of preparing financial

statements. Hence, financial statements are prepared for an accounting

period and results thereof are reported

on periodic basis.

This assumption requires that the

distinction be made between the

expenditure incurred and consumed

in the period, and the expenditure,

which is to be carried forward to the

future period. The cut off period for

reporting the financial results is

usually considered to be twelve

months. Usually the same is true for

tax purpose. However, in some cases

accounting period may be more or less

than 12 months depending on the

needs of business enterprises. For

example, a company can prepare its

first financial statements for a period

of more than or less than one year.

Currently, the interim reports issued

by the company, though unaudited are

not less reliable. Such information is

considered to be more relevant for

decision-makers because of timeliness

and certainty of information.

ACCOUNTANCY

This assumption requires deferring

of costs that are not related to the

revenues of the current period. The

assumption of continuity allows

depreciation on fixed assets to be

charged in the profit & loss account

and show the assets in the balance

sheet at net book value (cost of

acquisition less depreciation). The

income measurement is done on the

basis of continuity assumption whereby

unexpired costs are carried to next

period as assets and not charged to

current years income. In those cases,

where, it is reasonably certain that the

business will be liquidated in the near

future, the resources may be reported

on the basis of current realizable values

(or liquidation value). Also, in such

a case, this fact needs to be clearly

reported in the financial statements.

2.2 Basic Accounting Principles

Basic accounting principles are the

general decision rules which govern

the development of accounting

techniques. These principles, do not

violate or conflict with the four basic

assumptions discussed above, but

refine the application thereof. The

following are the basic accounting

principles:

Duality (Dual Aspect Principle)

Revenue Recognition Principle

Historical Cost Principle

Matching Principle

Full Disclosure Principle

Objectivity

These are discussed hereunder:

THEORY BASE OF ACCOUNTING

2.2.1 Duality

This principle states that every

transaction has two aspects. It

therefore, implies that minimum two

accounts will be involved in recording

a transaction. When an investment is

made by the owner in the business, it

results in increase in an asset and

increase in owners equity. Thus, this

transaction is recorded considering

these two aspects, i.e. asset and

owners equity. Every transaction will

af fect the accounting equation,

whereby, there will be corresponding

increase or decrease on both sides of

the equation or increase and decrease

on one side of the equation. The

accounting equation is given below:

Assets = Liabilities + Owners

Equity

The enterprise can acquire an asset

by sacrificing another asset, incurring

the liability or receiving it from owner

(resulting in increase in owners

equity). The use of accounting equation

for processing of business transaction

is discussed in the next chapter.

2.2.2 Revenue Recognition Principle

Revenue recognition (Revenue realization) principle helps in ascertaining

the amount and time of recognizing the

revenues from the business activities.

Revenues are the amount a business

ear ns by selling its products or

providing services to the customers.

The revenue is deemed to have been

earned in the period in which the sale

has taken place or services have been

performed to the satisfaction of the

25

customer and the revenue has been

received or becomes receivable.

However, there may be situations

where, within the accounting period,

sale may not have concluded or

services have not been fully rendered.

This poses the problem of revenue

recognition.

Normally, the revenue is recognized at the point of sale when title to

the goods passes from the seller to the

buyer. However, there are few exceptions to this rule of revenue recognition.

In a situation where the

gover nment has appointed an

authority to acquire entire production,

such as refine of gold, the revenue may

be recognized on the completion of the

refining irrespective of the fact of

physical transfer of goods.

In case of work to be completed on

contractual basis taking longer period

of time such as road construction,

bridge construction, the revenue may

be recognized on the basis of cash

received on partially completed and

certified works. In such contracts,

payment is made on the basis of the

terms of contract, which specify partial

payment in relation to the work

certified and completed. On the

completion of contract, the remaining

amount is treated as sales.

In some cases, revenue may be

realized at the time of receiving cash

and not at the time of providing

services. For example, a lawyer may

charge the fee from his client and treat

it as revenue earned for the current

period, whereas legal services may be

provided in future.

26

ACCOUNTANCY

A Ltd. purchased equipment from X Ltd. for Rs. 57,000 on 1 April 1999. The freight and

cartage of Rs. 1,200 is spent to bring the asset to the factory (intended condition of use)

and Rs. 3,000 is incurred on installing the equipment to make it possible for the use

(intended condition of use). In this case, the cost of acquisition which is the historical cost

is Rs. 61,200. This amount can objectively be ascertained from the invoice and hence

verifiable. After the purchase of equipment even if its price increases in the market, the

company will continue to show it at its historical cost, i.e. Rs. 61,200.

Box 2.2

The basic test, as discussed above,

is used to ascertain the revenue. The

revenue from permitting other entities

to use the enterprises asset is to be

recognized as the time passes or as the

asset is used. The rent from the

premises let out or interest on money

loaned will be recognized on the basis

of passage of time. The royalty may be

recognized on the basis of production/

sale of the products.

2.2.3 Historical Cost Principle

Historical cost principle requires that

all transactions should be recorded at

their acquisition cost. The cost of

acquisition refers to the cost of

purchasing the asset and expenses

incurred in bringing the asset to the

intended condition and location of use.

In other words acquisition cost is equal

to buying price plus all expenses

incurred to put the asset to use. The

cost is historical in nature and will not

change year after year. This implies

that no adjustment is made for any

change in the market value of such

assets.

The advantage of using historical

cost for recording the transactions is

that it is objective, verifiable and

reliable. Thus, it imparts reliability to

the financial statements.

2.2.4 Matching Principle

Matching principle requires that the

expenses should be matched with the

revenues generated in the relevant

period. The simple rule that followed

in this context is, let expenses follow

revenues.

The Matching Principle by relating

expenses to the associated revenues

helps in measuring income (profit) for

the given period. It is of great

significance since the performance of

an entity is usually measured in terms

of income earned by the entity.

We do not recognize the expense

when cash is paid or when a product

is produced. It is recognized when the

service or the product actually

contributes to the revenue. Therefore,

expenses are not related to the period

of cash outflow but to the period in

which the revenues are generated. The

matching principle requires that part

of the cost of fixed assets used in the

operations of the business, known as

depreciation, is treated as expense of

the period. Likewise, in case revenues

received in advance for which the

27

THEORY BASE OF ACCOUNTING

services have not been rendered will

be treated as unearned income, and

hence, it will be carried forward to the

following accounting period.

2.2.5 Full Disclosure Principle

Full disclosure principle requires that

all those facts that are necessary for

discharging the accountability and

proper understanding of the financial

statements must be revealed. All

material infor mation should be

disclosed fully and completely, which

is relevant for decisions to be taken by

users. The infor mation may be

disclosed in the main body of the

financial statements, schedules and

annexure, and the footnotes appended

thereto. Further, it requires that any

significant event, which takes place

after the balance sheet date and is

likely to affects the financial status of

the enterprise significantly, should

also be reported in notes to financial

statements. There might be some

claims pending against the firm, which

if not revealed in the financial

statements will mislead the users. The

regulatory bodies like SEBI mandates

disclosures to be made by the

companies to portray true and fair view

of business operations to ensure

discharge of accountability. Accountability is said to have been discharged

if complete information is delivered

with due diligence by the prepares

(management and accountants) of that

information, so that the economic

interest of the users of the information

is not adversely affected.

2.2.6 Objectivity Principle

The principle of objectivity implies that

the accounting data should be

verifiable and free from any bias. In

fact, to generate the reliable

accounting information, the basic

requirements are neutrality (free from

bias) and verifiability. The historical

cost recorded in the books is on the

basis of original documents, which

contain the information, which is not

af fected by the personal bias.

Therefore, the accounting entries are

recorded on the objective basis and is

verifiable from the source documents.

Historical cost accounting, therefore,

is preferred inspite of its shortcomings

due to objectivity.

2.3 Modifying Principles

The basic assumptions and accounting

principles discussed above provide a

set of operating guidelines for the

preparation of financial statements.

These guidelines are used while

preparing the financial statements

with the basic objective of making the

information useful for the users. The

information is considered to be useful

if it is reliable and relevant. The

information is said to be reliable when

it is free from error and bias and

faithfully represents what it seeks to

represent. The information must be

believed to be reliable by the users for

a given purpose. To ensure that

information is reliable it must be

verifiable, neutral and faithful in

representing the economic condition.

Information is said to be relevant if it

28

influences the decision. For financial

information to be useful, apart from

it being reliable and relevant should

be understandable and comparable.

The financial infor mation is

comparable when policies used are

consistent at inter -firm and interperiod levels.

Generally, the financial statements

are prepared keeping in view the basic

principles and assumptions of

accounting. However, difficulties are

encountered in relation to the

application of accounting principles in

certain situations which call for the

modified application of the principles

and assumptions of accounting. These

constraints are referred to as

modifying principles. These are cost

benefit, materiality, consistency,

prudence, timeliness substance over

legal form and industry-practices

which need to be considered for

making the information useful. In the

following paragraphs these modifying

principles are discussed.

2.3.1 Cost Benefit

This modifying principle states that

cost of generating the information

should not exceed the benefits to be

derived from it. Sometimes application

of a particular principle may be

desirable but will not be beneficial

because it does not generate materially

significant information but cost of

generating the information by using

the principle is higher. This modifying

principle, implies that the cost of

applying the principle should not

exceed its benefits. It thus, plays a role

ACCOUNTANCY

in weeding out the redundancy in

information. For example, companies

registered under The Companies Act,

1956 were earlier required to give

unabridged annual report to all its

shareholders. But, as the number of

shareholders increased manifold and

the cost of paper and printing rose

considerably, The Act was amended,

where by, companies are now required

to give abridged reports to the

shareholders. In many developed

countries, the companies were

required to give, on supplementary

basis, the effect of price level changes

on its financial results. Since evidences

from recent studies suggesting that the

additional benefits from such

disclosures were not more than the

cost of providing additional

infor mation, this practice has

therefore, been discontinued.

A few years before, companies were

required to disclose detailed

information about employees such as

qualification, experience, previous

employment and relationship with

directors if any for those drawing

salary above Rs. 36,000 per annum.

Though, the information was quite

crucial in its intent, but due to increase

in salaries due to inflation, even the

employees at low levels such as drivers,

peons would figure in the list. Had

the limit not been raised, this would

have marred the quality of information.

Therefore, government was persuaded

to increase the limit of the emoluments

draws by employees to improve the

quality of information and reduction

of cost of information.

29

THEORY BASE OF ACCOUNTING

2.3.2 Materiality Principle

The term materiality refers to the relative importance of an item. It requires

that while recording and presenting

the financial information, the focus

should be on material items. Immaterial items/events should be ignored.

An item or event is considered to be

material if it is likely to be relevant to

the user of financial statements. According to this modifying principle items

of insignificant effect or which are not

relevant to the user need not be disclosed.

The items of insignificant effect are

to be viewed in relation to the size of a

company. It is not possible to define

materiality precisely since it is a

relative term. An item of expense may

be insignificant for a big organization,

and need not be reported separately,

may not be true for a small

organization. The amounts reported in

balance sheet and income statement

may be reported by approximating it

to the nearest thousands, lacs,

millions, or crores of rupees depending

upon the amounts under individual

heads to be reported. For the sake of

better understanding while reporting

the items in financial statements

approximate numbers are preferred to

precise numbers. The purchase of

certain items of small amount may be

treated as expense whereas in real life

these may be carried over to next

year. For example, stationery items

like pens, stapler, scissors, etc. may

be treated as expense once issued

to employees for work and may

be clubbed under the head of

Office stationery expense. However,

mate-riality varies from industry to

industry as well as country to country.

2.3.3 Consistency Principle

The Consistency principle requires

that the accounting policies, which are

used from period to period, should not

change. Hence, their application is

assumed to be consistent. This implies

that users of the financial statement

have a right to assume that accounting

policies have been followed on

consistently followed from time to

time. In case there is a change in any

of the accounting policies in a

particular accounting period, the

revised statement of accounting policy,

as well as, its impact on the reported

income of the year should be disclosed

clearly. The same is true when different

firms operating in an industry follow

the same accounting policies and

reporting method. This helps in

comparing the financial results across

the firms and over a period of time.

The consistency helps in comparing

the accounting reports.

However, consistency principle

does not prohibit the change in the

accounting policy/method when it is

preferable to old one since the new

method will result in more meaningful

information. It also requires that the

nature and effect of change in the

accounting

method

and

the

justification for the change must be

disclosed in the financial statements

in the form of footnotes. It will enable

the users of accounting information to

be aware of such facts and consider

them while using these statements.

30

2.3.4 Prudence (Conservatism)

The Prudence principle is applied

when more than one alternative is

available to record the transaction. The

principle of prudence implies that the

profit should not be over stated but all

anticipated losses should be recognized and related. The implication of

this is that all anticipated losses

should be recognized and recorded,

but no unrealized gain should be

recognized and recorded in the books

of account. If the market price of

investment is lower than the cost, then

the investments are recorded at

market price, whereas, if the market

price is above the cost, investments

will be reported at cost only. In a

consistently falling market price

situation, the inventories will be valued

at lower of cost or market price. Here,

inventory is not valued at market price

by sacrificing the historical cost

principle but because of prudence,

which dictates that future loss should

be accounted for immediately. Hence,

market price, which is lower than cost,

is a well-accepted principle for

valuation of inventories.

This modifying principle is applied

by choosing the alternative resulting

in reporting income/assets at lower

figure in case of great uncertainty and

doubt. This implies that errors

resulting in measuring income and

assets are preferred in the direction of

understatement rather than over statement. Prudence, thus, as

explained earlier, suggests that profits

are recognized only when realized

(need not necessarily be in cash) but

ACCOUNTANCY

all anticipated losses must be

immediately accounted for.

2.3.5 Timeliness

An information is useful for a decision

maker if it is relevant and reliable.

Information looses its relevance if it is

not available in time. Timeliness refers

to the fact that information must be

available to the users before it looses

its capacity to influence decisions. The

Companies Act, therefore, requires

that the annual reports must be

submitted to the Registrar and made

available to users within a specified

period of time after the close of financial year. It also requires companies

to publish unaudited quarterly reports

in the national newspapers.

2.3.6 Substance Over Legal Form

The transactions and events recorded

in the books of accounts and presented

in the financial statements, according

to this modifying principle, should be

governed by the substance of such

transactions and not the legality of

such transactions. In certain cases,

therefore, the transactions presented

may not represent the true legal

position. For example, in contrast to

outright purchase, under hire

purchase system assets are used for

business purpose but ownership does

not rest with the hire. Purchaser till

the last installment is paid. Yet, these

are recorded at cash price as assets of

the business. In this case, therefore,

we see that substance of the

transaction gets preference over legal

position.

THEORY BASE OF ACCOUNTING

2.3.7 Industry Practice

The GAAP are followed by the

enterprises but sometimes certain

practical considerations require that

the enterprises in an given industry

depart for m GAAP. The unique

characteristics of some industries may

require varied application of the

principles. For example, banks are

governed by the Banking Companies

(regulation) Act, therefore, the

reporting format for banks is strikingly

dif ferent from other companies

governed by the Companies Act, 1956.

Banks and insurance companies are

required to report certain investment

securities at cost rather than lower of

cost or market.

2.4 Accounting Standards

Accounting is considered as a language

of business. Even language has its own

grammar providing certain set of rules,

which are required to be followed.

Likewise, accounting has certain

norms to be observed by the accountants in recording of transactions and

preparation of financial statements.

These norms become accounting

standards when a professional body

codifies and makes them mandatory

for recording and reporting purposes.

These rules reduce the vagueness and

chances of misunderstanding by

harmonizing the varied applications

and practices. Similarly, accounting

also requires adherence to certain set

of rules, and guidelines, which reduces

31

the flexibility in preparation of financial

statements.

In 1977, the Institute of Chartered

Accountants of India set up the

Accounting Standards Board (ASB)

with the responsibility of developing

accounting standards and issuing

guidelines for implementation thereof.

For the purpose of income tax, Central

Board of Direct Taxes (CBDT) has also

set up its own standards setting body

to take care of the accounting practice

with regard to computation of income

and wealth for taxation purposes.

Currently, the members of the ASB are

drawn from the members of council of

ICAI, representatives from Industry,

Bank, Company Law Board, Central

Board of Direct Taxes, Comptroller and

Auditor General of India, Security

Exchange Board of India, etc.

ASB is assigned with the task of

formulating the standards by giving

due consideration to the International

Accounting Standards because India

is a member of International Accounting settings body. It tries to integrate

IAS to the extent possible considering

the practices prevailing in the country.

ASB has issued twenty-seven

accounting standards and one

exposure draft on interim reporting

as on as on 8 February 2002. The

standards issued in the recent years

have been based on IAS issued by

IASC. The list of Accounting

Standards and exposure draft issued

by ASB is given in the Appendix to

this chapter.

32

ACCOUNTANCY

Terms Introduced in the Chapter

Accounting Entity

Duality

Money Measurement

Accounting Period

Full Disclosure

Modifying Principles

Accounting Standards

Objectivity

Basic Assumption

Generally Accepted

Accounting Principles

[GAAP]

Basic Principles

Operating

Guidelines

Comparability

Prudence

Conservatism

Revenue Recognition

Consistency

Substance Over

form

Cost Benefit

Going Concern

Historical Cost

Industry Practice

Matching Principle

Materiality

SUMMARY WITH REFERENCE TO LEARNING OBJECTIVES

The transactions are recorded and financial statements prepared there from by

following certain rules and practices. These rules and guidelines are usually referred

to Generally Accepted Accounting Principles. The understanding of these guidelines

is important for both who prepare the financial statements, and the users who

need to use these statements.

1. Meaning of (GAAP)

Generally Accepted Accounting Principles are the set of rules and practices that are

followed while recording transactions and preparing the financial statements.

2. Basic Operating Guidelines

Basic operating guidelines refer to assumptions, accounting principles and modifying

principles. These guidelines are well-established and accepted in accounting.

3. Basic Assumptions

Assumptions have been developed over a period of time and considered as

cornerstones of the foundation of accounting. The four basic assump-tions are

accounting entity, money measurement, going concern and accounting period.

Accounting Entity: Accounting entity assumption, states that the activities

of a business entity be kept separate from its owners and all other entities.

Money Measurement: Money measurement assumption requires use of money

as a unit of measurement that is the currency of the country where the

organization is to report its operations.

THEORY BASE OF ACCOUNTING

Going Concern: This assumption states that the business will have an

indefinite life unless there is evidence to the contrary.

Accounting Period Assumption: This assumption permits the accountant to

divide the lifespan of the business enterprise into different time period known

as accounting period for the purpose of preparing financial statements

4. Basic Accounting Principles

The accounting principles are the general decisions rules, which govern the

development of the accounting techniques.

Duality: This principle states that every transaction must be viewed from

two aspects. It therefore, necessitates that minimum two accounts will be

involved in recording a transaction.

Revenue Recognition Principle: The revenue is deemed to have occurred in

the period in which the sale has taken place or services have been performed.

There are some exceptions to the sale basis of revenue recognition.

Historical Cost Principle: Historical principle requires that all the transactions

should be recorded at their monetary cost.

Matching Principle: Matching Principle requires that the expenses should be

matched with the revenues generated in the relevant period.

Full Disclosure Principle: Full disclosure principle requires that all those

facts that are necessary for proper understanding of the financial statements

must be revealed.

Objectivity Principle: The principle of objectivity requires that the accounting data

should be verifiable and free from any bias.

5. Modifying Principles

There may be certain difficulties encountered while applying the accounting

principles in a given situation. Modifying principles guide in such a situation how

to encounter such difficulties and provide more reliability and understandability to

the accounting information.

Cost Benefit: This modifying principle states that cost of generating the

information should not exceed the benefits to be derived from it.

Materiality Principle: The term materiality refers to the relative importance

of an item. It requires that while recording and presenting the financial

information, the focus should be on material items.

Consistency Principle: The consistency principle requires that the accounting

policies which are used from period to period should not change.

Prudence: The prudence principle requires that when more than one

alternative is permissible to record a transaction, the one which results in

least favourable in immediate effect on profit or owners equity usually should

be adopted.

Timeliness: Timeliness refers to the fact that information must be available

to the users before it looses its capacity to influence decisions.

Substance over legal form: The transactions and events recor-ded in the

books of account and presented in the financial statements, according to

this modifying principle, should be governed by the substance of such

transactions and not the legality of such transactions.

33

34

ACCOUNTANCY

Industry Practice: The unique characteristics of some indus-tries may require

a different approach and procedure to make the financial statements more

useful.

EXERCISES

1. State the accounting assumption/basic principle/modifying principle involved

in each of the following situation:

(i)

During the life time of an entity, accountants prepare

financial statements at arbitrary points in time

(ii) The tendency of accountants to resolve uncertainty

and doubt in favour of overstating liabilities and

expenses and understanding assets and revenues

(iii) Revenue is generally recorded at the point sale

(iv) The accountants assume that the business will not

be liquidated in the near foreseeable future

(v) The assets are recorded in books at the cost incurred

in acquisition of such assets

(vi) Expenses need to be recorded in the period in which the

associated revenues are recognized

(vii) The cash withdrawn by the owner to meet personal

expenses is recorded in the books of the business

as drawings

(viii) The benefits to be derived from accounting information

should exceed its cost

(ix) The inventory are to be recorded at lower of cost or

market value.

(x) The insignificant items or events, having an

insignificant economic effect need not be disclosed

_______________

_______________

_______________

_______________

_______________

_______________

_______________

_______________

_______________

_______________

2. State True or False

(i)

The accountants prudence states that preference should be given for errors

in measuring assets and recognizing revenues in the direction of

understatement rather than overstatement.

(ii) The benefits to be derived from information should not exceed its cost.

(iii) The expenses of the owners of the business need to be recorded as expenses

of business.

(iv) All transactions that affect the business must be recorded.

(v) The accounting data should be verifiable and free from any bias.

3.

Fill in the blanks below with the accounting principle, assumption or related

item that best completes each sentence:

(i)

Companies must prepare financial statements at least yearly due to

the _____________ assumption.

(ii) The _____________ principle requires that the same accounting method

should be used from one accounting period to the next.

35

THEORY BASE OF ACCOUNTING

(iii) Recognition of expenses in the same period as associated revenues is

known as the __________ principle.

(iv) Transactions between owner and business are recorded due to

_______________ assumption.

Short Answer Questions

4.

Why do accounting principles emphasize the use of historical cost as a

basis for measuring assets?

5. Why it is necessary for accountants to make going concern assumption?

6. When should revenue be recognized?

7. What are the exceptions to the general rule of revenue recognition.

8. Describe the following modifying principles:

(a) Cost Benefit (b) Materiality

9. What is accounting entity assumption?

10. What is the monetary unit assumption? Does it hold good when the prices

are not stable?

11. Why is periodicity assumption necessary for preparing the financial

statements?

12. What is the matching principle?

Essay Type Questions

13. Name the basic assumptions that underlie the financial accounting

structure?

14. Explain the effect of going concern and periodicity assumptions on financial

statements.

15. What is substance over form? Explain the implications by giving suitable

examples.

16. Explain the effect of revenue recognition principle and matching principle

on financial statements.

17. What are modifying principles? What role they play in preparation of financial

statements.

18. Explain the constraints that require the accounting principles to be modified?

Check-list of Key Letters/Words

Q 1.

i. Periodicity

ii. Prudence

iii. Revenue Recognition

iv. Going Concern

v. Historical Cost

vi. Matching

vii. Accounting Entity

viii. Cost Benefit

ix. Prudence

x. Materiality

Q 2.

i.

ii.

iii.

iv.

v.

True

True

False

False

True

Q 3.

i.

ii.

iii.

iv.

Periodicity

Consistency

Matching

Accounting Entity

36

ACCOUNTANCY

Appendix

Accounting Standards (AS)

The ICAI has issued the following standards as on 8.2.2002:

(Date of issue)

AS1

Disclosure of Accounting Policies (Jan 1979)

This Standard deals with the disclosure of significant accounting

policies followed in preparing and presenting financial statements.

Such policies should form part of the financial statements and be

disclosed in one place.

AS2

Valuation of Inventories (June 1981)

This Standard deals with the principles of valuing inventories for

financial statements. For this purpose inventories include tangible

property held for sale in ordinary course of business, or in the

process of production for such sale, or for consumption in the

production of goods or services for sale, including maintenance

supplies and consumables other than machinery spares.

AS3

Cash Flow Statements (June 1981, Revised in March 1992)

This Standard deals with the financial statement which

summarises for a given period the sources and applications of

funds of an enterprise. This Standard supersedes Accounting

Standard (AS) 3, Changes in Financial Position, issued in June

1981. The cash flows are to be classified into three categories, viz.

operating activities, investing activities and financing activities.

AS4

Contingencies and Events Occurring after the Balance Sheet

Date (November 1982, Revised in April 1995)

This Standard deals with the treatment if financial statements of

contingencies and events occurring after the balance sheet date.

The Standard, however, does not cover contingency situations

relating to the liabilities of life insurance and general insurance

enterprises arising from policies issued; obligations under

retirement benefit plan; and commitments arising from long-term

lease contracts.

AS5

Net Profit or Loss for the Period, Prior Period Items and Changes

in Accounting Policies (November 1992, Revised in February 1997)

This Standard deals with the treatment in the financial statements

of prior period and extraordinary items and changes in accounting

policies. The Standard does not deal with the tax implications of

prior period items, extraordinary items and changes in accounting

THEORY BASE OF ACCOUNTING

policies and estimates for which appropriate adjustments will have

to be made depending on the circumstances. It also does not deal

with adjustments arising out of revaluation of assets.

AS6

Depreciation Accounting (November 1982)

This Standard applies to all depreciable assets. The Standard does

not apply to assets in the category of forests, plantations and similar

natural resources; wasting assets including expenditure on the

exploration for natural non-regenerative resources; expenditure on

research and development; goodwill and live stock. This also does

not apply to land unless it has a limited useful life for the enterprise.

AS7

Accounting for Construction Contracts (December 1983, Revised

in April 2003)

This Standard deals with accounting for construction contracts

in the financial statements of contractors. The contracts may fall

into the category of fixed price contracts or cost plus contracts.

The accounting for such contracts may be follow either of the

percentage of completion method or completed contract method.

AS8 -

Accounting for Research and Development (January 1985)

This Standard deals with the treatment of costs of research and

development in financial statements. This Standard, however, does

not deal with the accounting implications of the following

specialized activities: (i) research and development activities

conducted for others under a contract; (ii) exploration for oil, gas

and mineral deposits; and (iii) research and development activities

of enterprises at the construction stage.

AS9

Revenue Recognition (November 1985)

This Standard deals with this bases for recognition of revenue in

the statement of profit and loss of an enterprise. The Standard is

concerned with the recognition of revenue arising in the course of

the ordinary activities of the enterprise from the sale of goods, the

rendering of services, and the use by others of enterprise resources

yielding interest, royalties and dividends.

AS10

Accounting for Fixed Assets (November 1985)

This Standard deals with fixed assets grouped into various

categories, such as land, buildings, plant and machinery, vehicles,

furniture and fittings, goodwill, patents, trademarks and designs.

This Standard does not deal with the specialized aspects of

accounting for fixed assets that arise under a comprehensive

system reflecting the effects of changing prices but applies to

37

38

ACCOUNTANCY

financial statements prepared on historical cost basis. This also

does not deal with accounting for following assets: (i) forests,

plantations and similar regenerative natural resources; (ii) wasting

assets including mineral rights, expenditure on the exploration

for and extraction of minerals, oil, natural gas and similar nonregenerative resources; (iii) expenditure on real estate

development; and (iv) livestock.

AS11

Accounting for the Effects of Changes in Foreign Exchange Rates

(August 1991)

This Standard deals with the issues relating to accounting for

effect of changes in foreign exchange rates. This applies to

accounting for transactions in foreign currencies and translating

the financial statements of foreign branches for inclusion in the

financial statements of the enterprise.

AS12

Accounting for Government Grants (August 1991)

This Standard deals with accounting for government grants.

Government grants are sometimes called by other names such

as subsidies, cash incentives, duty drawbacks, etc. This Standard

does not deal with: (i) the special problems arising in accounting

for government grants in financial statements reflecting the effects

of changing prices or in supplementary information of a similar

nature; (ii) government assistance other than in the form of

government grants; and (iii) government participation in the

ownership of the enterprise.

AS13

Accounting for Investments (September 1993)

This Standard deals with accounting for investments in the

financial statements of the enterprise and related disclosure

requirements. The issues relating to recognition of interest,

dividends and rentals earned on investments, operating or finance

lease and investment of retirement benefits plans and life

insurance enterprise are not within the purview of this standard.

AS14

Accounting for Amalgamations (October 1994)

This Standard deals with the accounting treatment of any

resultant goodwill or reserves in amalgamation of companies. This

does not apply to the cases of acquisitions where one company

purchase the shares in whole or in part of other company in

consideration of cash or by issue of shares or other securities (In

such a case the entity of acquired company continues).

THEORY BASE OF ACCOUNTING

AS15

Accounting for Retirement Benefits in the Financial Statements of

Employers (January 1995)

This Standard deals with accounting for retirement benefits in

the financial statements of employers. For this purpose, the

retirement benefits considered may be in the form of provident

fund, superannuation/pension, gratuity, leave encashment

benefits on retirement, post-retirement health and welfare scheme

and any other retirement benefits.

AS16

Borrowing Costs (May 2000)

This Standard deals with the issues involved relating to

capitalization of interest on borrowing for purchase of fixed assets.

This standard deals with issues related to identify the assets which

qualify for capitalization of interest, the period for which the interest

is to be capitalized and the amount of interest that can be

capitalized.

AS17

Segment Reporting (October 2000)

This Standard applies to companies which have an annual turnover

of Rs. 50 crores or more. This standard requires that the accounting

information should be reported on segment basis. The segments

may be based on products, services, geographical area, etc.

AS18

Related Party Disclosure (October 2000)

This Standard requires certain disclosure which must be made

for transactions between the enterprise and related parties. The

standard recognised related party as an enterprise which has a

common control with reporting enterprise, associate or joint

venture of reporting enterprise, individual having direct/indirect

interest in the voting power of reporting enterprise, key

management personnel, and enterprise over which any person

having direct/indirect interest in voting power or key management

personnel is able to exercise significance influence.

AS19

Leases (January 2001)

This Standard deals with the accounting treatment of transactions

related to lease agreements. For this purpose the standard divides

the agreements into operating and financing lease.

AS20

Earnings Per Share (January 2001)

This standard deals with the presentation and computation of

Earning Per Share (EPS). This Standard requires that the EPS need

to be calculated on consolidated basis as well as for the parent

39

40

ACCOUNTANCY

(holding) company while presenting the financial statements of

the parent company. The standard requires to compute and present

basic as well as diluted EPS.

AS21

Consolidated Financial Statements (1.4.2001)

This Standard deals with the to preparation of consolidated

financial statements with an intention provide information about

the activities of a group (parent company and companies under

its control referred to as subsidiary companies).

AS22

Accounting for Taxes on Income (1.4.2001)

This Standard deals with determination of the amount of tax

expenses for the related revenues. The tax expense will comprise

of current tax and deferred tax for the purpose of determing the

net profit (loss) for the period.

AS23

Accounting for Investments in Associates in Consolidated Financial

Statements (July 2001)

This Standard deals with the principles and procedures to be

followed for recognizing, in the consolidated financial statements,

the effect of the investments in associates on the financial position

and operating results of a group.

AS24

Discontinued Operations (February 2002)

This Standard lays down the principles for reporting information

about discontinued operations, with an objective to enhance the

ability of users of financial statements to make projection of

enterprises cash flows, earnings generating capacity, and

financial position by segregating information about discontinued

operations from information about continuing operations.

AS25

Interim Financial Reporting (February 2002)

This Standard deals with the minimum content of interim financial

report and prescribes the principles for recognition and

measurement in complete or condensed financial statements for

an interim period. This Standard does not say anything about the

frequency of such reporting.

AS26

Intangible Assets (February 2002)

This Standard prescribes the accounting treatment for intangible

assets which are not covered by any other specific accounting

standard.

THEORY BASE OF ACCOUNTING

AS27

Financial Reporting of Interests in Joint Ventures (February 2002)

This Standard sets out principles and procedures for accounting

for interests in joint ventures and reporting of joint ventures assets,

liabilities, income and expenses in the financial statements of

venturers and investors.

All the above standar ds issued by Accounting Standar ds Board ar e

recommended for use by companies listed on a recognized stock exchange and

other large commercial, industrial and business enterprises in the public and

private sectors.

41

Das könnte Ihnen auch gefallen

- Actl 2267 Bonus 2022Dokument29 SeitenActl 2267 Bonus 2022mrinalbohra100% (1)

- Vishal Aadhar PDFDokument1 SeiteVishal Aadhar PDFmrinalbohraNoch keine Bewertungen

- IRDA Training CertificateDokument1 SeiteIRDA Training CertificatemrinalbohraNoch keine Bewertungen

- RESUME Jagdish TayadeDokument3 SeitenRESUME Jagdish TayademrinalbohraNoch keine Bewertungen

- Journey Ticket Mobile View PNRDokument1 SeiteJourney Ticket Mobile View PNRmrinalbohraNoch keine Bewertungen

- Science City TicketDokument1 SeiteScience City TicketmrinalbohraNoch keine Bewertungen

- Form For Suitability AnalysisDokument19 SeitenForm For Suitability AnalysismrinalbohraNoch keine Bewertungen

- Annual Report 2017 18Dokument1 SeiteAnnual Report 2017 18mrinalbohraNoch keine Bewertungen

- Fssai MCQSDokument7 SeitenFssai MCQSmrinalbohra0% (1)

- Fssai NOTES MRINALDokument19 SeitenFssai NOTES MRINALmrinalbohra100% (1)

- Delhi Public School Syllabus GrgdoneDokument2 SeitenDelhi Public School Syllabus GrgdonemrinalbohraNoch keine Bewertungen

- YOGESH SHARMA Training Certificate Irda ExamDokument1 SeiteYOGESH SHARMA Training Certificate Irda ExammrinalbohraNoch keine Bewertungen

- Subject: Application Submission Confirmation From: To: Date: Friday, 3 February 2017 8:26 AMDokument1 SeiteSubject: Application Submission Confirmation From: To: Date: Friday, 3 February 2017 8:26 AMmrinalbohraNoch keine Bewertungen

- Feb Electricity Paid BillDokument1 SeiteFeb Electricity Paid BillmrinalbohraNoch keine Bewertungen

- Po Admit CardDokument2 SeitenPo Admit CardmrinalbohraNoch keine Bewertungen

- Chap 1trht6Dokument19 SeitenChap 1trht6mrinalbohraNoch keine Bewertungen

- Mba Summer Training Internship ReportDokument46 SeitenMba Summer Training Internship Reportmrinalbohra100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- HistogramDokument7 SeitenHistogramTesfaye MinaleNoch keine Bewertungen

- Global SAP Access and Operations Workplan v7-2017 ERPDokument87 SeitenGlobal SAP Access and Operations Workplan v7-2017 ERPJenniferNoch keine Bewertungen

- Compulsory CounterclaimDokument4 SeitenCompulsory CounterclaimAlexandria FernandoNoch keine Bewertungen

- "Article Critique" Walden University Methods For Evidence-Based Practice, Nursing 8200 January 28, 2019Dokument5 Seiten"Article Critique" Walden University Methods For Evidence-Based Practice, Nursing 8200 January 28, 2019Elonna AnneNoch keine Bewertungen

- Calderon de La Barca - Life Is A DreamDokument121 SeitenCalderon de La Barca - Life Is A DreamAlexandra PopoviciNoch keine Bewertungen

- CV Template - 2018-2020Dokument2 SeitenCV Template - 2018-2020Rahul AbhishekNoch keine Bewertungen

- Instrumentation. Between Science, State and IndustryDokument271 SeitenInstrumentation. Between Science, State and IndustryMichel GautamaNoch keine Bewertungen

- DLL - English 4 - Q2 - W8Dokument4 SeitenDLL - English 4 - Q2 - W8BenjNoch keine Bewertungen

- Cri 192Dokument5 SeitenCri 192Reyn CagmatNoch keine Bewertungen

- Sand Casting Lit ReDokument77 SeitenSand Casting Lit ReIxora MyNoch keine Bewertungen

- Thousand 6, One Thousand 7, One Thousand 8, One Thousand 9, One Thousand 10Dokument7 SeitenThousand 6, One Thousand 7, One Thousand 8, One Thousand 9, One Thousand 10Nhazie NyzeNoch keine Bewertungen

- MIS Tutorial 4 AnswerDokument8 SeitenMIS Tutorial 4 AnswerChia Kong Haw0% (1)

- Cinderella: From The Blue Fairy Book of Andrew LangDokument7 SeitenCinderella: From The Blue Fairy Book of Andrew LangnizamianNoch keine Bewertungen

- Gender Stereotypes and Performativity Analysis in Norwegian Wood Novel by Haruki Murakami Devani Adinda Putri Reg No: 2012060541Dokument35 SeitenGender Stereotypes and Performativity Analysis in Norwegian Wood Novel by Haruki Murakami Devani Adinda Putri Reg No: 2012060541Jornel JevanskiNoch keine Bewertungen

- Srs For College WebsiteDokument6 SeitenSrs For College WebsiteShree Kumar33% (3)

- Isc Class 11 Maths Sample Paper Model 1Dokument2 SeitenIsc Class 11 Maths Sample Paper Model 1Gaurav ShuklaNoch keine Bewertungen

- Filters SlideDokument17 SeitenFilters SlideEmmanuel OkoroNoch keine Bewertungen

- MarshallingDokument7 SeitenMarshallinggeetika singhNoch keine Bewertungen

- Republic Act No. 1125Dokument8 SeitenRepublic Act No. 1125Jazlynn WongNoch keine Bewertungen

- Introduction To Consumer Behavior: by Dr. Kevin Lance JonesDokument18 SeitenIntroduction To Consumer Behavior: by Dr. Kevin Lance JonesCorey PageNoch keine Bewertungen

- Time UntimeDokument10 SeitenTime UntimeMacmillan Publishers11% (27)

- (OCM) Chapter 1 Principles of ManagementDokument23 Seiten(OCM) Chapter 1 Principles of ManagementMehfooz PathanNoch keine Bewertungen

- MacbethDokument2 SeitenMacbethjtwyfordNoch keine Bewertungen

- Wulandari - Solihin (2016)Dokument8 SeitenWulandari - Solihin (2016)kelvinprd9Noch keine Bewertungen

- ShakespeareDokument12 SeitenShakespeareapi-510189551Noch keine Bewertungen

- Javier Guzman v. City of Cranston, 812 F.2d 24, 1st Cir. (1987)Dokument4 SeitenJavier Guzman v. City of Cranston, 812 F.2d 24, 1st Cir. (1987)Scribd Government DocsNoch keine Bewertungen

- Making Effective Pres. Academic Lit I. Weeks 4 5Dokument27 SeitenMaking Effective Pres. Academic Lit I. Weeks 4 5irfanaNoch keine Bewertungen

- Technology in EducationDokument3 SeitenTechnology in EducationDinesh MadhavanNoch keine Bewertungen

- MAT 120 NSU SyllabusDokument5 SeitenMAT 120 NSU SyllabusChowdhury_Irad_2937100% (1)

- p2 Process Model 2017Dokument1 Seitep2 Process Model 2017Miguel Fernandes0% (1)