Beruflich Dokumente

Kultur Dokumente

04 Cases On Liability Products - Operational Aspects

Hochgeladen von

VikashKumarOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

04 Cases On Liability Products - Operational Aspects

Hochgeladen von

VikashKumarCopyright:

Verfügbare Formate

4

Retail banking Liability Products

Operational Provisions and Cases

Advise your decision in the following situations:

1.

You have a amount Rs. 5 lakh surplus for another five years after which you need these funds.

But you want to keep liquidity for 40% of these funds for any family emergency. Your friend has

suggested you to keep this amount in a savings account with a bank.

i.

Whether you will chose a Public sector bank, a Private sector bank or a Foreign bank for opening the

savings bank account and why?

ii.

Do you think there are any risks you run if you keep entire amount of deposit of Rs. 5 lakh in a savings

bank account with ICICI Bank, Greater Noida branch ?

iii.

Will the risk profile change if you transfer an amount of Rs. 2 lakh ( out of Rs 5 lakh) from ICICI Bank

Greater Noida branch into a fixed deposit for a period of 5 years and keep with the Sector 62, Noida

branch of ICICI Bank.

iv.

Will there be any change in your risk profile if you transfer from ICICI Bank another sum of Rs. 1 lakh

to a Fixed Deposit account with HDFC Bank at Greater Noida branch.

v.

Do you perceive any risk in keeping a deposit of Rs. 5 lakh as above ? If you do not feel any risk is there,

why so? If you perceive any risk , what is that risk and the strategy you will adopt to manage that risk?

2.

A customer has fixed deposit of Rs.15,000 and interest thereon is Rs.6000 due today. The customer

wants cash payment of interest on due date and wants the principal amount to be credited to his savings

bank account with the same branch. Will bank agree?

3.

A customer has three fixed deposits of Rs.5000. Rs.10,000 and Rs.8,000 due on 03.10.12, 05.04.13,

and 01.06.13, respectively. On 03.010.12, the due date for FDR for Rs.5000, (plus accrued interest of

Rs.1, 500) customer wants to get cash payment of this deposit only. Will bank pay cash?

4.

A having lost his fixed deposit receipt, requests for a duplicate fixed deposit receipt. Will bank issue

Duplicate fixed deposit? What formalities bank will insist?

5.

Mrs. A brings the fixed deposit receipt in name of A on due date for payment to her as her husband has

been missing for the last 5 years. She has got a copy of missing persons FIR with the police in this

regard. Will the Bank pay to Mrs. A ?

6.

Mr. Ram Kapoor and his wife Mrs. Rashmi Kapoor have joint fixed deposit (Either or Survivor). Mrs.

Kapoor brings the Fixed deposit receipt and requests in writing for addition of name of their 19 years

old son Jas Kapoor. Will the bank agree?

7.

A customer got issued a fixed deposit for 1 year @8% p.a. interest. After 6 months, the interest rates for

1 year were raised to 9.5%. Customer wants to avail of the benefit of increased interest rates and

requests the bank to re-issue the FDR without penalty for premature breach of earlier contract. What the

bank will do as per rules?

8.

A customer has several deposit accounts with a bank. TDS on interest income above Rs.10,000 will

apply to which types of following accounts : Tick mark correct option:

i. Fixed deposits

ii. Fixed deposits and savings banks deposits

iii. Fixed deposits, savings deposits and recurring deposits

iv. None of the above

9.

The Income Tax Exemption is available on interest income up to Rs.10,000 from Financial year 201213 for the following types of accounts : Tick mark correct option:

i. Savings bank accounts

ii. Savings and Fixed deposit accounts

iii, S/B, FD and RD accounts

iv. None of the above

10. Income tax exemption on investment in bank deposits up to Rs.1 lakh overall under section 80 C is

available for following banks deposit accounts: Tick mark correct option:

i. Recurring deposits accounts

ii. All term deposit accounts

iii. Deposits under Bank Term deposit scheme- 2006 (5 years term)

iv. All of the above

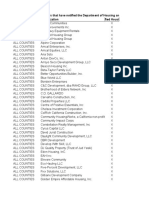

11. Ranbir Kapoor has following account balances with SBI and Standard Chartered Bank .

Sr

Bank

Account Name

Type of Account

SBI, New Delhi

SBI, Noida

SBI , Mumbai

Ranbir Kapoor and Nitu Kapoor

Ranbir Kapoor

Ranbir Kapoor and Rishi Kapoor

Savings account

Savings account

Fixed deposit

Balance

(Rs.)

1,26,000

98,000

1,00,000

SBI , Mumbai

Standard Chatered

Bank Mumbai

Ranbir Kapoor and Nitu Kapoor

Ranbir Kapoor and Nitu Kapoor

Fixed deposit

Fixed deposit

50,000

100,000

Work out if both banks are liquidated, what amount will be paid by DICGC and to whom.

DICGC

Claim

Das könnte Ihnen auch gefallen

- 06 D Hints MCQs Securities and Charges Margin DP InsuranceDokument11 Seiten06 D Hints MCQs Securities and Charges Margin DP InsuranceVikashKumarNoch keine Bewertungen

- Bank Financials & RatiosDokument50 SeitenBank Financials & RatiosVikashKumarNoch keine Bewertungen

- Marketing Applications: Media Selection ProblemDokument4 SeitenMarketing Applications: Media Selection ProblemVikashKumarNoch keine Bewertungen

- Operations ResearchDokument22 SeitenOperations ResearchVikashKumarNoch keine Bewertungen

- 06 Hints Class Quiz Securities and ChargesDokument2 Seiten06 Hints Class Quiz Securities and ChargesVikashKumarNoch keine Bewertungen

- Operations ResearchDokument46 SeitenOperations ResearchVikashKumarNoch keine Bewertungen

- 05 Hints MCQs Payment System and Fee Based ServicesDokument2 Seiten05 Hints MCQs Payment System and Fee Based ServicesVikashKumarNoch keine Bewertungen

- 06 A Bank Loan Policy and Retail AssetsDokument6 Seiten06 A Bank Loan Policy and Retail AssetsVikashKumarNoch keine Bewertungen

- 06 Class Quiz MCQs Securities and Charges Margin DP InsuranceDokument4 Seiten06 Class Quiz MCQs Securities and Charges Margin DP InsuranceVikashKumarNoch keine Bewertungen

- 05 Payment Systems and Fee Based ServicesDokument7 Seiten05 Payment Systems and Fee Based ServicesVikashKumarNoch keine Bewertungen

- 06 B Securities and Charges (Table)Dokument4 Seiten06 B Securities and Charges (Table)VikashKumarNoch keine Bewertungen

- Collaborative and Iterative Translation: An Alternative Approach To Back TranslationDokument15 SeitenCollaborative and Iterative Translation: An Alternative Approach To Back TranslationVikashKumarNoch keine Bewertungen

- 06 C MCQs Securities and Charges Margin DP InsuranceDokument6 Seiten06 C MCQs Securities and Charges Margin DP InsuranceVikashKumarNoch keine Bewertungen

- 05 MCQs Payment System and Fee Based ServicesDokument2 Seiten05 MCQs Payment System and Fee Based ServicesVikashKumarNoch keine Bewertungen

- 01retail Banking Today in IndiaDokument6 Seiten01retail Banking Today in IndiaVikashKumarNoch keine Bewertungen

- 04 Hints On Liability Products Operational AspectsDokument3 Seiten04 Hints On Liability Products Operational AspectsVikashKumarNoch keine Bewertungen

- 04 Liability Products - Operational AspectsDokument7 Seiten04 Liability Products - Operational AspectsVikashKumarNoch keine Bewertungen

- 02 Cases On Banker Customer RelationshipDokument4 Seiten02 Cases On Banker Customer RelationshipVikashKumar100% (1)

- 02 Hints On Caselets Banker Customer RelationshipDokument9 Seiten02 Hints On Caselets Banker Customer RelationshipVikashKumarNoch keine Bewertungen

- 03 Hints On Special Types of Customers of A Bank CasesDokument7 Seiten03 Hints On Special Types of Customers of A Bank CasesVikashKumarNoch keine Bewertungen

- 01 Banking Industry and RBI As A RegulatorDokument8 Seiten01 Banking Industry and RBI As A RegulatorVikashKumarNoch keine Bewertungen

- 5 Things People Reading Your Resume Wish YouDokument19 Seiten5 Things People Reading Your Resume Wish YouVikashKumarNoch keine Bewertungen

- 02 Banker & Customer RelationshipDokument6 Seiten02 Banker & Customer RelationshipVikashKumarNoch keine Bewertungen

- 03 Special Types of Customers of A Bank CasesDokument4 Seiten03 Special Types of Customers of A Bank CasesVikashKumarNoch keine Bewertungen

- On Improving The Conceptual Foundations of International Marketing ResearchDokument23 SeitenOn Improving The Conceptual Foundations of International Marketing Researchvivekwalia1986Noch keine Bewertungen

- Valuing Captal Investment ProjectsDokument5 SeitenValuing Captal Investment ProjectsVikashKumarNoch keine Bewertungen

- Capital Budgeting 1Dokument6 SeitenCapital Budgeting 1VikashKumarNoch keine Bewertungen

- Baines2e ch20Dokument27 SeitenBaines2e ch20VikashKumarNoch keine Bewertungen

- Customer ProfitabilityDokument30 SeitenCustomer ProfitabilityVikashKumarNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Helsingborg EngDokument8 SeitenHelsingborg EngMassaCoNoch keine Bewertungen

- A2frc MetricDokument1 SeiteA2frc MetricSudar MyshaNoch keine Bewertungen

- Psychological Attitude Towards SafetyDokument17 SeitenPsychological Attitude Towards SafetyAMOL RASTOGI 19BCM0012Noch keine Bewertungen

- PDFDokument18 SeitenPDFDental LabNoch keine Bewertungen

- Ab 1486 Developer Interest ListDokument84 SeitenAb 1486 Developer Interest ListPrajwal DSNoch keine Bewertungen

- Mercantile Law Zaragoza Vs Tan GR. No. 225544Dokument3 SeitenMercantile Law Zaragoza Vs Tan GR. No. 225544Ceasar Antonio100% (1)

- Panch ShilDokument118 SeitenPanch ShilSohel BangiNoch keine Bewertungen

- EE FlowchartDokument1 SeiteEE Flowchartgoogley71Noch keine Bewertungen

- Riba, Its Types and ImplicationsDokument37 SeitenRiba, Its Types and Implicationsmahamamir012Noch keine Bewertungen

- E Rpms Portfolio Design 3 1Dokument52 SeitenE Rpms Portfolio Design 3 1jebNoch keine Bewertungen

- 2 Players The One With Steam BaronsDokument1 Seite2 Players The One With Steam BaronsBrad RoseNoch keine Bewertungen

- Far160 Pyq Feb2023Dokument8 SeitenFar160 Pyq Feb2023nazzyusoffNoch keine Bewertungen

- Notes On Mass and Energy Balances For Membranes 2007 PDFDokument83 SeitenNotes On Mass and Energy Balances For Membranes 2007 PDFM TNoch keine Bewertungen

- Chapter 10 Outline PDFDokument2 SeitenChapter 10 Outline PDFjanellennuiNoch keine Bewertungen

- Hyflow: Submersible PumpsDokument28 SeitenHyflow: Submersible PumpsmanoNoch keine Bewertungen

- Pfmar SampleDokument15 SeitenPfmar SampleJustin Briggs86% (7)

- Hardening'-Australian For Transformation: A Monograph by MAJ David J. Wainwright Australian Regular ArmyDokument89 SeitenHardening'-Australian For Transformation: A Monograph by MAJ David J. Wainwright Australian Regular ArmyJet VissanuNoch keine Bewertungen

- Hood Design Using NX Cad: HOOD: The Hood Is The Cover of The Engine in The Vehicles With An Engine at Its FrontDokument3 SeitenHood Design Using NX Cad: HOOD: The Hood Is The Cover of The Engine in The Vehicles With An Engine at Its FrontHari TejNoch keine Bewertungen

- Philippine First Insurance V HartiganDokument3 SeitenPhilippine First Insurance V HartiganAlexander Genesis DungcaNoch keine Bewertungen

- SMPLEDokument2 SeitenSMPLEKla AlvarezNoch keine Bewertungen

- 15.910 Draft SyllabusDokument10 Seiten15.910 Draft SyllabusSaharNoch keine Bewertungen

- WTO & MFA AnalysisDokument17 SeitenWTO & MFA Analysisarun1974Noch keine Bewertungen

- HRM OmantelDokument8 SeitenHRM OmantelSonia Braham100% (1)

- BBI2002 SCL 7 WEEK 8 AdamDokument3 SeitenBBI2002 SCL 7 WEEK 8 AdamAMIRUL RIDZLAN BIN RUSIHAN / UPMNoch keine Bewertungen

- ShinojDokument4 SeitenShinojArish BallanaNoch keine Bewertungen

- Pertemuan - 12 MetopenDokument40 SeitenPertemuan - 12 MetopenulviaNoch keine Bewertungen

- An Analytical Study On Impact of Credit Rating Agencies in India 'S DevelopmentDokument14 SeitenAn Analytical Study On Impact of Credit Rating Agencies in India 'S DevelopmentRamneet kaur (Rizzy)Noch keine Bewertungen

- Evaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewDokument14 SeitenEvaluating The Policy Outcomes For Urban Resiliency in Informal Settlements Since Independence in Dhaka, Bangladesh: A ReviewJaber AbdullahNoch keine Bewertungen

- Lozada V Bracewell DigestDokument3 SeitenLozada V Bracewell DigestMickey OrtegaNoch keine Bewertungen

- PT Shri Krishna Sejahtera: Jalan Pintu Air Raya No. 56H, Pasar Baru Jakarta Pusat 10710 Jakarta - IndonesiaDokument16 SeitenPT Shri Krishna Sejahtera: Jalan Pintu Air Raya No. 56H, Pasar Baru Jakarta Pusat 10710 Jakarta - IndonesiaihsanlaidiNoch keine Bewertungen