Beruflich Dokumente

Kultur Dokumente

Lanka Floortiles PLC - (Tile) - q4 Fy 15 - Buy

Hochgeladen von

Sudheera IndrajithOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Lanka Floortiles PLC - (Tile) - q4 Fy 15 - Buy

Hochgeladen von

Sudheera IndrajithCopyright:

Verfügbare Formate

Earnings Review Q4 FY 15

65, Braybrooke Place, Colombo 2, Sri Lanka

research@bartleetreligare.com, +94 11 5220200

20 July 2015

BRS Research

Lanka Floortiles PLC (TILE:LKR 116.70)

Head of Research- Nikita Tissera

Asst. Manager - Nusrath Mohideen

Subsidiaries preserve overall margins : BUY

Lower CoGs, finance costs and higher contribution from PARQ made TILEs Q4FY15s EPS rise

53% to LKR 5.78. PARQ has been a consistent contributor to TILEs performance in FY 2015,

pushed by subsidiary Swisstek Aluminum. PARQ contributed LKR 111mn for FY 2015

(+112.6% YoY). However, revenue for the year was a modest 5.1% (FY 2015) on the back of

intense competition encountered in both local and export sales. We feel TILE would grow as

a proxy to national growth and more to workers remittances. We have arrived at a TP of

LKR 126 with a total return of LKR 131 (+11.9% to CMP) and maintain BUY.

Trading Snapshot

Market cap (LKR mn)

6,191

Market cap (USD mn)

46

Outstanding equity shares (mn)

53.1

Public Holding (%) -Mar 15

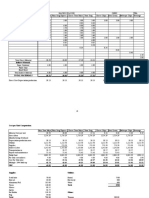

All figures in LKR (mn)

Revenue

2012

2013

2014

2015

3,567

4,559

5,091

5,350

2016E

2017E

5,705

6,047

29.15%

52-week High/Low (LKR)

119.40/87.00

Revenue growth (%)

18.8%

27.8%

11.7%

YTD ASPI return (%)

-3.73%

Gross profit

1,145

1,305

1,639

1,928

2,071

2,176

YTD Stock return (%)

6.09%

EBIT recurring

760

787

900

980

1,014

1,058

Beta

EBIT margin (%)

21.3%

17.3%

17.7%

18.3%

17.8%

17.5%

Profit attributable to equity holders

5.1%

6.6%

6.0%

598

632

652

839

842

864

BRS EPS Adjusted (LKR)

11.28

11.92

12.29

15.82

15.87

16.28

NAV per share (LKR)

52.25

59.67

66.88

77.40

88.77

100.55

0.94

Valuation Summary

DPS (LKR)

4.00

4.10

4.00

4.50

4.50

4.50

CMP (LKR)

116.70

Dividend yield (%)

6.1%

5.9%

5.0%

3.9%

3.9%

3.9%

Intrinsic value (LKR)

126.04

P/E (x)

5.8 x

5.8 x

6.5 x

7.3 x

7.4 x

7.2 x

DPS (LKR)

P/BV (x)

1.2 x

1.2 x

1.2 x

1.5 x

1.3 x

1.2 x

ROE %

26.9%

21.3%

19.4%

21.9%

19.1%

17.2%

Debt/equity (%)

24.7%

44.0%

35.3%

18.1%

16.8%

15.6%

Source: Company data and BRS Research

Local sales are still key and will do so in the forecast period

Local sales continued to dominate TILE revenue with a contribution of 96% for FY 2015. However, the growth in local sales has contracted since last year, from 12.7% YoY in FY 2014 to

4.4% YoY in FY 2015. Despite intense competition TILE has successfully retained its market

share at 23% in FY 2015. Focus on brand building and loyalty schemes such as Tiler Club and

Lanka Tiles Plus Schemes has gained the TILE brand much popularity during the year. The company intends on targeting 4 new branches each in FY 2016 and FY 2017 respectively. Export

sales grew 4.1% YoY to LKR 243mn in FY 2015. However, growth in sales and revenue was constricted due to certain delays in exports and a decline in the Australian forex market. TILE

would continue to focus on export performance going forward.

4.50

Target price based on total return (LKR)

130.54

Valuation method

DCF

Total return %

11.9%

Rating

Buy

TILE Price Vs ASPI Movement

LKR

140

TILE

ASPI

8,000

120

7,000

6,000

100

5,000

80

4,000

60

3,000

Margins supported by lower costs

EBIT margins for the quarter increased to 25.7% (Q4 FY 15) from 17.7% in Q4 FY 14. The growth

was supported by a 8.2% YoY decline in CoGS. Overall EBIT margin improved during the year

owing to the continuous focus on cost reduction and lower global energy prices in FY 2015.

However, we expect admin costs to escalate on the back of aggressive marketing by the company. The reduction in gearing from 26% in FY 2014 to 15% in FY 2015 resulted in lower finance

cost, thereby improving net profit margins to 15.7% in FY 2015 (FY 2014 - 12.8%). To remain

competitive in the market TILE would continue to focus on energy and general efficiency in

their product lines.

40

2,000

20

14-Jul-13

14-Jan-14

14-Jul-14

14-Jan-15

1,000

14-Jul-15

EPS Trend

LKR

18

16

14

12

Valuation: 11.9% total upside with forecasted dividend of LKR 4.50

We see TILEs diversity as a positive given how the variations has added to the overall margin

preservation. Based on a DCF valuation we arrived at a TP of LKR 126.04 (+8.0% to CMP). The

counter is trading at a PER of 7.4x FY 2016E.The sector PER and PBV stands at 20.1x and 2.7x as

at 17.07.2015 respectively.

For analyst certification and other important disclosures, please refer to the Disclosure and

Disclaimer section at the end of this report.

10

8

6

4

2012

2013

2014

2015

Page 1

2016E

2017E

Company Information Note

65, Braybrooke Place, Colombo 2, Sri Lanka

research@bartleetreligare.com, +94 11 5220200

20 July 2015

Year Ending 31 March

Lanka Floortiles PLC (TILE)

Company profile

11.28

BRS EPS growth (%)

18.5%

2014

2015

2016E

2017E

6,047

7%

28%

12.29

3.1%

15.82

28.7%

15.87

0.3%

16.28

2.6%

6.5 x

7.3 x

7.4 x

7.2 x

11.28

11.92

12.29

15.8 x

na

na

5.8 x

5.8 x

6.5 x

7.3 x

na

na

Se ctor P/E (x)

17.3 x

10.2 x

13.6 x

21.1 x

na

na

NAV per s ha re LKR a djus te d

P/E on re ported EPS (x)

52.25

59.67

66.88

77.40

88.77

100.55

P/BV (x)

1.2 x

1.2 x

1.2 x

1.5 x

1.3 x

1.2 x

Se ctor P/BV (x)

1.0 x

1.7 x

1.8 x

2.6 x

na

na

DPS LKR

4.00

4.10

4.00

4.50

4.50

4.50

3.9%

Di vi dend yi e l d (%)

6.1%

5.9%

5.0%

3.9%

3.9%

FCFF (LKR mn)

(237)

(191)

437

1,559

570

772

FCFE (LKR mn)

199

125

164

1,165

569

759

(3.34)

(1.71)

(1.34)

17.43

4.35

6.99

P/CFPS (x)

nm

nm

Mkt pri ce

65.10

69.50

We i ghte d a vera ge s ha re s (mn)

6%

5.7%

5.8 x

CFPS LKR

Revenue LKR'mn % Growth (2012-2017E)

11.92

5.8 x

Re ported EPS (LKR)

5%

2013

BRS EPS (LKR) a djus te d

P/E (x)

Lanka Floortiles PLC (TILE) is engaged in the manufacture

and sale of glazed ceramic floor tiles. The ownership of

the company which belonged to the CT Holdings group

under its subsidiary Lanka Ceramics (CERA) was divested

(76.11%) to Royal Ceramics Lanka PLC (RCL) on the 6th of

May 2013.

12%

2012

Summary Information

nm

79.80

6.6 x

26.8 x

16.7 x

115.00

116.70

116.70

53.1

53.1

53.1

53.1

53.1

53.1

Ave ra ge mkt ca p (LKR mn)

3,454

3,687

4,233

6,101

6,191

6,191

Ente rpri s e va l ue (LKR mn)

3,842

4,729

5,102

5,505

5,313

4,887

EV/Sa l e s

1.1 x

1.0 x

1.0 x

1.0 x

0.9 x

0.8 x

EV/EBITDA

4.3 x

4.9 x

4.7 x

4.6 x

4.4 x

3.9 x

Re venue

3,567

4,559

5,091

5,350

5,705

6,047

Gros s profi t

1,145

1,305

1,639

1,928

2,071

2,176

895

967

1,093

1,194

1,199

1,241

(134)

(180)

(193)

(214)

EBIT re curri ng

760

787

900

980

I nte re s t i ncome

I nte re s t expe ns e

(29)

Income Statement (LKR mn)

3,567

EBITDA recurri ng

De pre ci a ti on a nd a morti s a ti on

Sha re of a s s oci a te s /(l os s )

2012

2013

2014

2015

2016E

2017E

2017E

EBIT LKR'mn Growth (2012-2017E)

Exce pti ona l s /non-re curri ngs

10

(120)

9

-

24

(126)

52

-

(185)

1,058

(49)

(46)

111

97

(183)

1,014

(57)

99

-

Ta x e xpens e

(142)

(75)

(174)

(226)

(224)

(237)

Ne t i ncome

598

632

652

839

842

864

Mi nori ti e s & prefe rence di vi dends

Profi t a ttri buta bl e to e qui ty hol ders

598

632

652

839

842

864

Statement of Financial Position (LKR mn)

9%

4%

4%

1,058

14%

760

3%

Ca s h a nd ca s h equi va l ents

35

81

75

847

1,078

1,448

I nve ntori es

782

1,464

1,474

1,137

1,516

1,607

Tra de re cei va bl e s

690

1,006

1,148

899

1,137

1,339

I nve s tme nt prope rty

Long term i nves tments

2,260

2,486

2,584

2,533

2,520

2,488

Goodwi l l

I nta ngi bl e a s s e ts

As s oci a tes

261

270

309

493

590

690

Fi xe d a s s ets

Tota l a s s ets

2012

2013

2014

2015

2016E

2017E

2017E

4,284

5,539

5,725

6,012

6,944

7,675

Tra de pa ya bl e s

575

659

464

536

695

669

I nte re s t be a ri ng de bt -s hort term

305

876

764

361

382

404

I nte re s t be a ri ng de bt -l ong term

379

517

488

384

407

430

Tota l l i a bi l i ti es

1,512

2,374

2,177

1,906

2,234

2,341

Sha re hol de rs e qui ty

2,772

3,166

3,548

4,106

4,709

5,334

2,772

3,166

3,548

4,106

4,709

5,334

649

1,312

1,177

3,456

4,559

4,800

4,851

1,685

Mi nori ti e s

Tota l equi ty

Ne t de bt (ca s h)

Tota l ca pi ta l empl oye d

Profit attributable to equity holders LKR'mn Growth

(2012-2017E)

29%

598

6%

0.28%

3%

864

3%

(288)

5,499

(614)

6,169

Casf flow (LKR mn)

Ca s h fl ow from ope ra ti ons

260

125

567

Ne t worki ng ca pi ta l

(412)

(687)

(348)

Ca pi ta l e xpe ndi ture

(659)

(408)

(237)

Free ca s h fl ow

(399)

(283)

330

I nve s ti ng ca s h fl ows

(837)

(404)

(237)

596

716

573

(458)

(318)

(129)

(171)

(151)

1,556

(197)

Equi ty ca pi ta l

Di vi dends pa i d

(53)

(239)

(244)

(212)

(157)

(349)

Ne t borrowi ngs

505

(102)

425

564

(171)

(151)

(239)

(239)

462

427

(177)

(91)

18.8%

27.8%

11.7%

5.1%

6.6%

6.0%

7.7%

3.5%

14.4%

8.8%

3.5%

4.3%

Gros s profi t ma rgi n (%)

32.1%

28.6%

32.2%

36.0%

36.3%

36.0%

EBITDA ma rgi n (%)

25.1%

21.2%

21.5%

22.3%

21.0%

20.5%

EBIT ma rgi n (%)

21.3%

17.3%

17.7%

18.3%

17.8%

17.5%

ROCE %

28.7%

19.6%

19.2%

20.3%

19.6%

18.1%

ROE %

26.9%

21.3%

19.4%

21.9%

19.1%

17.2%

Pa yout ra ti o (%)

35.5%

34.4%

32.5%

28.4%

28.4%

27.6%

De bt/equi ty (%)

24.7%

44.0%

35.3%

18.1%

16.8%

15.6%

Ne t de bt/e qui ty (%)

23.4%

41.5%

33.2%

-2.5%

-6.1%

-11.5%

Ge a ri ng (%)

19.8%

30.6%

26.1%

I nte re s t cover (x)

26.5 x

6.5 x

7.1 x

Ne t ca s h fl ow

(71)

925

45

45

231

371

Key ratios

Re venue growth (%)

EBIT growth (%)

2012

2013

2014

2015

2016E

2017E

Source: TILE Annual Reports and BRS Research

2017E

15.3%

19.9 x

14.4%

22.1 x

Page 2

13.5%

18.5 x

BRS Equity Research

Local Vs. Export Sales Performance Q4 FY 15

120%

Local Sales

Export Sales

100%

80%

60%

97%

97%

40%

20%

3%

3%

Q4 FY 14

Q4 FY 15

0%

Q4 FY 15 Performance

All figures in LKR 'mn

Q4 FY 15

Revenue

YoY Growth %

QoQ Growth %

Q4 FY 14

1,426.8

1,392.7

2.4%

11.7%

-10.4%

-5.5%

Gross profit

589.7

480.7

Gross profit margin %

41.3%

34.5%

Recurring net profit to equity holders

305.9

199.8

YoY Growth %

53.1%

-22.6%

QoQ Growth %

21.4%

1.5%

BRS EPS as adjusted (LKR)

NAV per share (LKR)

5.77

3.77

77.40

66.88

Net debt/ equity (%)

-2.5%

33.2%

Gearing (%)

15.3%

26.1%

EV/Sales (x)

0.9

1.0

EV/EBITDA (x)

4.2

4.5

Valuation estimates

Based on a free cash flow valuation we have arrived at a target price of LKR

126.04 Our valuations are based on the following estimates:

WACC 12.0%

Terminal growth rate 1.5%

Risk free rate 8.24%

Beta 0.94 (based on TILE vs. ASPI share price movement)

Equity risk premium- 5%

Sensitivity of Target Price to Risk Free Rate

Risk free rate

Terminal growth

www.bartleetreligare.com

126.04

7.00%

7.50%

8.24%

8.50%

9.00%

9.50%

1.0%

136.35

130.51

122.69

120.15

115.55

111.27

1.5%

140.70

134.41

126.04

123.33

118.43

113.89

2.0%

145.53

138.73

129.72

126.82

121.58

116.74

Page 3

BRS Equity Research

Financial Analysis

Income Statement- Lanka Floortiles PLC

Year Ending 31st March

LKR mn

2012

2013

2014

2015

2017E

5,705

6,047

Revenue net of tax

3,567

4,559

5,091

YoY growth %

18.8%

27.8%

11.7%

5.1%

6.6%

6.0%

Cost of sales

(2,422)

(3,253)

(3,452)

(3,422)

(3,634)

(3,871)

YoY growth %

25.4%

34.3%

Gross profit

1,145

1,305

1,639

YoY growth %

14.0%

25.5%

17.6%

7.4%

5.1%

0.0%

Gross profit margin %

32.1%

28.6%

32.2%

36.0%

36.3%

36.0%

38

33

25

27

31

Other operating income

6.1%

5,350

2016E

-0.9%

1,928

6.2%

2,071

6.5%

2,176

SG & A Expenses

(388)

(556)

(772)

(972)

(1,084)

(1,149)

YoY growth %

1.4%

43.3%

38.8%

26.0%

11.5%

6.0%

Depreciation and amortisation

(134)

(180)

(193)

(214)

760

787

900

980

EBIT including non-recurring items

Non-recurring items

EBIT excluding non-recurring items

YoY growth %

EBIT Margin %

EBITDA excluding non-recurring items

YoY growth %

EBITDA Margin %

Finance cost

Share of results of associates

Profit before tax

Taxation

Net profit

760

787

900

980

(185)

1,014

(183)

1,058

1,014

1,058

7.7%

3.5%

14.4%

8.8%

3.5%

4.3%

21.3%

17.3%

17.7%

18.3%

17.8%

17.5%

895

967

1,093

1,194

1,199

1,241

4.7%

8.1%

13.0%

9.2%

0.5%

3.5%

25.1%

21.2%

21.5%

22.3%

21.0%

20.5%

(30)

(82)

(126)

(25)

(46)

(57)

10

52

111

97

99

741

715

827

1,065

1,065

1,100

(142)

(75)

(174)

(226)

(224)

(237)

598

632

652

839

842

864

YoY growth %

18.5%

5.7%

3.1%

28.7%

0.3%

2.6%

Net profit margin %

16.8%

13.9%

12.8%

15.7%

14.8%

14.3%

Reported EPS (Note 1)

11.28

11.92

12.29

15.82

15.87

16.28

BRS EPS adjusted (Note 2)

11.28

11.92

12.29

15.82

15.87

16.28

Source: Company Financial Reports and BRS Equity Research

Note 1: Based on earnings as reported (unadjusted for non-recurring) share data adjusted for splits

Note 2: EPS adjusted for share split, consolidations and non recurring information

www.bartleetreligare.com

Page 4

BRS Equity Research

Financial Analysis

Statement of Financial Position- Lanka Floortiles PLC

As at 31st March

LKR mn

2012

2013

2014

2015

2016E

2017E

ASSETS

Non- current assets

Property, plant and equipment

Capital work in progress

Intangible assets

Investments in subsidiaries

Investments in associates

Goodwill

Related party loans

Finance lease assets

Total non current assets

2,260

2,486

2,584

2,533

2,520

87

65

24

23

23

261

-

270

-

166

309

-

166

2,774

2,988

493

-

110

1

80

590

80

2,488

23

690

80

3,028

3,130

3,213

3,281

Current assets

Inventories

782

1,464

1,474

1,137

1,516

1,607

Trade and other receivables

690

1,006

1,148

899

1,137

1,339

0.17

Short term investments

Cash and cash equivalents

35

81

75

847

1,078

1,448

Total current assets

1,510

2,551

2,697

2,883

3,730

4,394

Total assets

4,284

5,539

5,725

6,012

6,944

7,675

EQUITY

Stated capital

Reserves

Amalgamation reserve

Total equity

901

901

901

901

901

901

1,411

1,804

2,647

2,745

3,348

3,973

460

460

2,772

3,166

3,548

460

460

460

4,106

4,709

5,334

LIABILITIES

Non-current liabilities

Borrowings

379

517

488

384

407

430

Deferred income tax liabilities

179

173

379

361

382

404

Retirement benefit obligations

Total non current liabilities

63

78

88

111

122

132

621

768

917

870

904

938

Current liabilities

Trade and other payables

Current income tax liabiities

Borrowings

Bank overdraft

Dividends payable

575

659

464

536

695

669

11

70

33

140

253

329

361

382

404

219

508

379

86

368

385

891

1,606

1,260

1,036

1,330

1,403

Total liabilities

1,512

2,374

2,177

1,906

2,234

2,341

Total equity and liabilities

4,284

5,539

5,725

6,012

6,944

7,675

Total current liabilities

Source: Company Financial Reports and BRS Equity Research

www.bartleetreligare.com

Page 5

BRS Equity Research

Financial Analysis

Cashflow Statement - Lanka Floortiles PLC

Year Ending 31st March

LKR mn

2012

2013

2014

2015

2016E

2017E

Cash flows from operating activities

EBIT

760

787

900

980

1014

1058

Depreciation

134

180

193

214

185

183

Gratuity charge

15

16

16

Profit/loss on disposal of property, plant and equipment

(2)

(4)

(1)

Provision for slow moviong inventories

(31)

Proportionate interest of the unrealized profit on SCP

and SAL inventories held by LFP

Reversal of provision for spares

Exchange loss from foreign currency loan

(12)

Operating profit before working capital changes

876

951

1,105

1,227

1,215

1,257

Changes in working capital

(412)

(687)

(348)

573

(458)

(318)

Cash generated from operations

464

264

758

1800

757

939

Interest paid

(29)

(120)

(150)

(49)

(46)

(57)

21

Interest received

Gratuity paid

Tax paid

Net cash generated from operating activities

(2)

(7)

(5)

(6)

(174)

(19)

(41)

(81)

(110)

(160)

(203)

(139)

(191)

(115)

(161)

(223)

260

125

567

596

716

(659)

(408)

(237)

(171)

(151)

1,685

Cash flows from investing activities

Purchase of property, plant and equipment

Proceeds from sale of property, plant and equipment

37

Purchase of shares in associates

Proceeds from sale of shares in associates

Expenditure incurred on capital work in progress

Purchance of shares on rights issue

Net cash generated from/(used in) investing activities

(215)

(837)

(404)

(129)

(237)

(35)

(197)

(171)

(151)

Cash flow from financing activities

Return from rights issue

Expenses on reserve capitalization

Dividends paid

(53)

Repayment of finance lease

(10)

Proceeds from borrowings

558

948

600

Repayment of borrowings

(96)

(521)

Net cash generated from/(used in) financing activities

400

188

Net increase/decrease in cash and cash equivalents

(177)

(91)

(239)

(244)

(212)

(3)

(239)

(239)

335

200

200

(757)

(683)

(155)

(155)

(401)

(563)

(194)

(194)

(71)

925

231

371

Source: Company Financial Reports and BRS Equity Research

www.bartleetreligare.com

Page 6

BRS Equity Research

Top 20 Shareholders as at 31st March 2015

Name of shareholder

1 Lanka Walltiles PLC

No. of shares

36,189,195

68.22%

2 Employees Provident Fund

5,295,602

9.98%

3 Mellon-Frontaura Global Frontier Fund LLC

3,255,228

6.14%

4 Royal Ceramics Lanka PLC

1,388,481

2.62%

5 Bank of Ceylon No.1 Account

973,200

1.83%

6 Mr. K.R. Kamon

537,628

1.01%

7 Mr. A. A. Page

433,939

0.82%

8 Rubber Investment Trust Limited A/C NO 1

259,765

0.49%

9 Pinnacle Trust (Pvt) Ltd

214,800

0.41%

10 Deutsche Bank AG-Comtrust equity fund

138,631

0.26%

11 The Sri Lanka Fund

131,267

0.25%

12 Aruna Enterprises (Pvt) Ltd

128,500

0.24%

13 Mr.S.M. Fernando

126,446

0.24%

14 Mrs.A.A. Merchant

125,000

0.24%

15 HSBC Intl nom Ltd - USB Ag Zurich

115,164

0.22%

16 Mr.Y.H. Abdulhessein

104,833

0.20%

17 Mr.S.N. Kumar

100,600

0.19%

18 Mr.H.N. Esufally

87,240

0.16%

19 Mr. M A H Esufally

87,217

0.16%

20 Mrs. B C Sansoni

63,000

0.12%

Source: Q4 FY 15 TILE statements

www.bartleetreligare.com

Page 7

BRS Equity Research

DISCLAIMER

Important Disclosures

This report was prepared by Strategic Research Limited for clients of Bartleet Religare Securities.

Special Disclosures

Special Disclosures for certain additional disclosure statements (if applicable).

Intended Recipients

This report is intended only for the use of the individual or entity named above and may contain information that is confidential and privileged. It is intended only

for the perusal of the individual or entity to whom it is addressed and others who are authorized to receive it. If you are not the intended recipient of this report,

you are hereby on notice that any disclosure, dissemination, distribution, copying or taking action relying on the contents of this information is strictly prohibited

and illegal.

BRS, is not liable for the accurate and complete transmission of the information contained herein nor any delay in its receipt. If you have received this email in

error, please notify us immediately by return email and please destroy the original message

This report is not intended for citizens (individual or corporate) based in the United States of America.

Analyst Certification

Each of the analysts identified in this report certifies, with respect to the companies or securities that the individual analyses, that the views expressed in this report

reflect his or her personal views about all of the subject companies and all of the securities and No part of his or her compensation was, is or will be directly or

indirectly dependent on the specific recommendations or views expressed in this report. If the lead analyst holds shares of the coverage; that will be listed here.

Stock Ratings

Recommendation

Expected absolute returns (%) over 12 months

Buy

More than 10%

Hold

Between 10% and 0

Sell

Less than 0%

Expected absolute returns are based on the share price at market close unless otherwise stated. Stock recommendations are based on absolute upside (downside)

and have a 12-month horizon. Our target price represents the fair value of the stock based upon the analysts discretion. We note that future price fluctuations

could lead to a temporary mismatch between upside/downside for a stock and our recommendation.

General Disclaimers

This report is strictly confidential and is being furnished to you solely for your information purposes.

SRL has not taken any measures to guarantee in any way that the securities referred to herein are suitable investments for any particular investor. SRL

will not under any circumstance, consider recipients as its customers by virtue of them receiving the report. The investments or services contained or

referred to in this report may not be suitable for you and it is highly recommended that you consult an independent investment advisor if you are in

any doubt about such investments or related services.

Further, nothing in this report constitutes investment, legal, accounting or tax advice or a representation that any investment or strategy is suitable or

appropriate to your individual circumstances, investment needs or otherwise construes a personal recommendation to you.

Information and opinions presented herein were obtained or derived from sources that SRL believes to be relied upon, but SRL makes no representations or warranty, express or implied, as to their accuracy or completeness or correctness.

SRL accepts no liability whatsoever for any loss arising from the use of the material presented in this report.

Past performance should not be taken as any indication or guarantee of future performance, and no representation or warranty, express or implied, is

made regarding future performance.

Information, opinions and estimates contained in this report reflect a judgment of its original date of publication by SRL and are subject to change

without notice. The price, value of and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The

value of securities and financial instruments is subject to exchange rate fluctuation that may have a positive or adverse effect on the price or income of

such securities.

SRL may or may not seek to do business with companies covered in our research report. As a result, investors should be aware that the firm may have

a conflict of interest that could affect the objectivity of research produced by SRL. Investors should consider our research as only a single factor in

making their investment decision.

The information, tools and material presented in this report are not to be used or considered as an offer or solicitation of an offer to sell or to purchase

or subscribe for securities.

This report is not to be relied upon as a substitute for the exercise of independent judgment. SRL may have issued, and may in the future issue, a

trading call regarding this security. Trading calls are short term trading opportunities based on market events and catalysts, while stock ratings reflect

investment recommendations based on expected absolute return over a 12-month period as defined in the disclosure section. Because trading calls

and stock ratings reflect different assumptions and analytical methods, trading calls may differ directionally from the stock rating.

Any reference to a third party research material or any other report contained in this report represents the respective research organization's estimates and views

and does not represent the views and opinions of SRL. SRL, its officers and employees do not accept any liability or responsibility whatsoever with respect to the

accuracy or correctness of such information. Further, SRL has included such reports or made reference to such reports in good faith (bona fide).

www.bartleetreligare.com

Page 8

Bartleet Religare Securities (Pvt) Ltd

www.bartleetreligare.com

BRS Equity Research - research@bartleetstock.com

Page 9

Das könnte Ihnen auch gefallen

- Equity ValuationDokument2.424 SeitenEquity ValuationMuteeb Raina0% (1)

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosVon EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNoch keine Bewertungen

- 2 - Accounting For Note ReceivableDokument10 Seiten2 - Accounting For Note ReceivableReese AyessaNoch keine Bewertungen

- Eclerx Services (Eclser) : Chugging Along..Dokument6 SeitenEclerx Services (Eclser) : Chugging Along..shahavNoch keine Bewertungen

- L&T 4Q Fy 2013Dokument15 SeitenL&T 4Q Fy 2013Angel BrokingNoch keine Bewertungen

- BSIT Accounting EquationDokument4 SeitenBSIT Accounting EquationRascelleGrepo89% (9)

- Double Entry Book Keeping Rules Chapter - 03Dokument10 SeitenDouble Entry Book Keeping Rules Chapter - 03Ramainne RonquilloNoch keine Bewertungen

- Vesuvius India: Performance HighlightsDokument12 SeitenVesuvius India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Blue Dart Express LTD.: CompanyDokument5 SeitenBlue Dart Express LTD.: CompanygirishrajsNoch keine Bewertungen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- TVS Srichakra Result UpdatedDokument16 SeitenTVS Srichakra Result UpdatedAngel Broking0% (1)

- Lakshmi Machine Works: Performance HighlightsDokument11 SeitenLakshmi Machine Works: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Tulip Telecom LTD: Results In-Line, Retain BUYDokument5 SeitenTulip Telecom LTD: Results In-Line, Retain BUYadatta785031Noch keine Bewertungen

- Hitachi Home & Life Solutions: Performance HighlightsDokument13 SeitenHitachi Home & Life Solutions: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Kajaria Ceramics: Upgrade in Price TargetDokument4 SeitenKajaria Ceramics: Upgrade in Price TargetSudipta BoseNoch keine Bewertungen

- Ceat Result UpdatedDokument11 SeitenCeat Result UpdatedAngel BrokingNoch keine Bewertungen

- Hartalega Holdings (HART MK) : Malaysia DailyDokument4 SeitenHartalega Holdings (HART MK) : Malaysia DailyPiyu MahatmaNoch keine Bewertungen

- Selan Exploration TechnologyDokument3 SeitenSelan Exploration TechnologyPaul GeorgeNoch keine Bewertungen

- Alok Industries LTD: Q1FY12 Result UpdateDokument9 SeitenAlok Industries LTD: Q1FY12 Result UpdatejaiswaniNoch keine Bewertungen

- Supreme Industries FundamentalDokument8 SeitenSupreme Industries FundamentalSanjay JaiswalNoch keine Bewertungen

- Coal India: Performance HighlightsDokument11 SeitenCoal India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Performance Highlights: Company Update - AutomobileDokument13 SeitenPerformance Highlights: Company Update - AutomobileZacharia VincentNoch keine Bewertungen

- ABG ShipyardDokument9 SeitenABG ShipyardTejas MankarNoch keine Bewertungen

- Aitken Spence Hotel Holdings (AHUN) (Ticker) Aitken Spence Hotel Holdings (AHUN) (Ticker) Aitken Spence Hotel Holdings (AHUN) (Ticker)Dokument11 SeitenAitken Spence Hotel Holdings (AHUN) (Ticker) Aitken Spence Hotel Holdings (AHUN) (Ticker) Aitken Spence Hotel Holdings (AHUN) (Ticker)Randora LkNoch keine Bewertungen

- Havells India 3QF14 Result Review 30-01-14Dokument8 SeitenHavells India 3QF14 Result Review 30-01-14GaneshNoch keine Bewertungen

- Misc (Hold, Eps ) : HLIB ResearchDokument3 SeitenMisc (Hold, Eps ) : HLIB ResearchJames WarrenNoch keine Bewertungen

- V-Guard Industries: CMP: INR523 TP: INR650 BuyDokument10 SeitenV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaNoch keine Bewertungen

- Relaxo Footwear 1QFY2013RU 070812Dokument12 SeitenRelaxo Footwear 1QFY2013RU 070812Angel BrokingNoch keine Bewertungen

- Petronet LNG: Performance HighlightsDokument10 SeitenPetronet LNG: Performance HighlightsAngel BrokingNoch keine Bewertungen

- CTC - 2013 Earnings Note - SELL - 12 Feb 2014Dokument5 SeitenCTC - 2013 Earnings Note - SELL - 12 Feb 2014Randora LkNoch keine Bewertungen

- Market Outlook Market Outlook: Dealer's DiaryDokument9 SeitenMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Relaxo Footwear, 7th February, 2013Dokument12 SeitenRelaxo Footwear, 7th February, 2013Angel BrokingNoch keine Bewertungen

- Sembawang Marine 3 August 2012Dokument6 SeitenSembawang Marine 3 August 2012tansillyNoch keine Bewertungen

- Colgate: Performance HighlightsDokument9 SeitenColgate: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Blue Star Q1FY14 Result UpdateDokument5 SeitenBlue Star Q1FY14 Result UpdateaparmarinNoch keine Bewertungen

- Container Corp of India: Valuations Appear To Have Bottomed Out Upgrade To BuyDokument4 SeitenContainer Corp of India: Valuations Appear To Have Bottomed Out Upgrade To BuyDoshi VaibhavNoch keine Bewertungen

- TA Securities: Pantech Group Holdings BerhadDokument2 SeitenTA Securities: Pantech Group Holdings BerhadcrickdcricketNoch keine Bewertungen

- John Keells Holdings PLC (JKH) - Q3 FY 16 - BUYDokument10 SeitenJohn Keells Holdings PLC (JKH) - Q3 FY 16 - BUYSudheera IndrajithNoch keine Bewertungen

- GAIL India: Performance HighlightsDokument12 SeitenGAIL India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Bharat Petroleum Corporation Limited - Oil & Gas: CMP-'728.1 "Hold" TP-'794.0Dokument4 SeitenBharat Petroleum Corporation Limited - Oil & Gas: CMP-'728.1 "Hold" TP-'794.0sakiv1Noch keine Bewertungen

- CCL Products (India) LTD: Key Financial IndicatorsDokument4 SeitenCCL Products (India) LTD: Key Financial IndicatorsRk ParmarNoch keine Bewertungen

- Brs-Ipo Document Peoples Leasing Company LimitedDokument13 SeitenBrs-Ipo Document Peoples Leasing Company LimitedLBTodayNoch keine Bewertungen

- Asian Paints Result UpdatedDokument10 SeitenAsian Paints Result UpdatedAngel BrokingNoch keine Bewertungen

- Nestle India: Performance HighlightsDokument9 SeitenNestle India: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Havell Q4 FY2011Dokument6 SeitenHavell Q4 FY2011Tushar DasNoch keine Bewertungen

- Maybank Nestle ResearchDokument7 SeitenMaybank Nestle ResearchCindy SimNoch keine Bewertungen

- Gail LTD: Better Than Expected, AccumulateDokument5 SeitenGail LTD: Better Than Expected, AccumulateAn PNoch keine Bewertungen

- CIL (Maintain Buy) 3QFY12 Result Update 25 January 2012 (IFIN)Dokument5 SeitenCIL (Maintain Buy) 3QFY12 Result Update 25 January 2012 (IFIN)Gaayaatrii BehuraaNoch keine Bewertungen

- UOB Kayhian Hartalega 1Q2014Dokument4 SeitenUOB Kayhian Hartalega 1Q2014Piyu MahatmaNoch keine Bewertungen

- Performance Highlights: CMP '203 Target Price '248Dokument10 SeitenPerformance Highlights: CMP '203 Target Price '248Angel BrokingNoch keine Bewertungen

- Aditya Birla Nuvo: Consolidating Growth BusinessesDokument6 SeitenAditya Birla Nuvo: Consolidating Growth BusinessesSouravMalikNoch keine Bewertungen

- Asian Paints: Performance HighlightsDokument10 SeitenAsian Paints: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Lakshmi Machine WorksDokument11 SeitenLakshmi Machine WorksAngel BrokingNoch keine Bewertungen

- Eclerx Services LTD IER Quarterly Update First CutDokument1 SeiteEclerx Services LTD IER Quarterly Update First CutSakshi YadavNoch keine Bewertungen

- Performance Highlights: 2QFY2012 Result Update - Oil & GasDokument10 SeitenPerformance Highlights: 2QFY2012 Result Update - Oil & GasAngel BrokingNoch keine Bewertungen

- Wah Seong 4QFY11 20120223Dokument3 SeitenWah Seong 4QFY11 20120223Bimb SecNoch keine Bewertungen

- Maruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsDokument9 SeitenMaruti Suzuki India LTD (MARUTI) : Uptrend To Continue On Price & MarginsAmritanshu SinhaNoch keine Bewertungen

- Allcargo Global Logistics LTD.: CompanyDokument5 SeitenAllcargo Global Logistics LTD.: CompanyjoycoolNoch keine Bewertungen

- BIMBSec - Digi Company Update - 20120502Dokument3 SeitenBIMBSec - Digi Company Update - 20120502Bimb SecNoch keine Bewertungen

- Apollo Hospitals Enterprise LTD: Q4FY11 First CutDokument7 SeitenApollo Hospitals Enterprise LTD: Q4FY11 First CutVivek YadavNoch keine Bewertungen

- Coal India, 15th February 2013Dokument10 SeitenCoal India, 15th February 2013Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument10 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Jyoti Structures: Performance HighlightsDokument10 SeitenJyoti Structures: Performance HighlightsAngel BrokingNoch keine Bewertungen

- Dishman 2QFY2013RUDokument10 SeitenDishman 2QFY2013RUAngel BrokingNoch keine Bewertungen

- Trader's Daily Digest 15.11.2022Dokument8 SeitenTrader's Daily Digest 15.11.2022Sudheera IndrajithNoch keine Bewertungen

- Trader's Daily Digest 14.09.2021Dokument8 SeitenTrader's Daily Digest 14.09.2021Sudheera IndrajithNoch keine Bewertungen

- GSM BSS Network KPI (SDCCH Call Drop Rate) Optimization ManualDokument26 SeitenGSM BSS Network KPI (SDCCH Call Drop Rate) Optimization ManualJohn PinedaNoch keine Bewertungen

- BRS End of The Week Results Snapshot - 21.10.2022Dokument9 SeitenBRS End of The Week Results Snapshot - 21.10.2022Sudheera IndrajithNoch keine Bewertungen

- Sunday Aruna 14-112021Dokument47 SeitenSunday Aruna 14-112021Sudheera IndrajithNoch keine Bewertungen

- BRS Morning Shout 03.09.2021Dokument2 SeitenBRS Morning Shout 03.09.2021Sudheera IndrajithNoch keine Bewertungen

- BRS Weekly Report 14.10.2022Dokument13 SeitenBRS Weekly Report 14.10.2022Sudheera IndrajithNoch keine Bewertungen

- BRS Morning Shout - 15.02.2022Dokument2 SeitenBRS Morning Shout - 15.02.2022Sudheera IndrajithNoch keine Bewertungen

- 02 WO - NP2002 - E01 - 0 UMTS Coverage Estimation P29Dokument29 Seiten02 WO - NP2002 - E01 - 0 UMTS Coverage Estimation P29fatehmeNoch keine Bewertungen

- WO - NP2003 - E01 - 0 UMTS Capacity Estimation P37Dokument33 SeitenWO - NP2003 - E01 - 0 UMTS Capacity Estimation P37Sudheera IndrajithNoch keine Bewertungen

- Trader's Daily Digest 30.08.21Dokument7 SeitenTrader's Daily Digest 30.08.21Sudheera IndrajithNoch keine Bewertungen

- BRS Market Report: Week IVDokument7 SeitenBRS Market Report: Week IVSudheera IndrajithNoch keine Bewertungen

- GERAN ZGB-03-05-001 Coding Scheme CS1 CS4 Feature GuideDokument17 SeitenGERAN ZGB-03-05-001 Coding Scheme CS1 CS4 Feature GuideSudheera IndrajithNoch keine Bewertungen

- Wo - Nast3013 - E01 - 0 Umts Radio Network Kpi p38Dokument37 SeitenWo - Nast3013 - E01 - 0 Umts Radio Network Kpi p38Sudheera IndrajithNoch keine Bewertungen

- Trader's Daily Digest - 15.05.2019Dokument7 SeitenTrader's Daily Digest - 15.05.2019Sudheera IndrajithNoch keine Bewertungen

- Trader's Daily Digest - 15.05.2019Dokument7 SeitenTrader's Daily Digest - 15.05.2019Sudheera IndrajithNoch keine Bewertungen

- Colombo Dockyard PLC (DOCK SL) - 4Q FY19E PreviewDokument9 SeitenColombo Dockyard PLC (DOCK SL) - 4Q FY19E PreviewSudheera IndrajithNoch keine Bewertungen

- GO - BT1004 - E01 - 0 GPRS and EDGE Introduction-41Dokument38 SeitenGO - BT1004 - E01 - 0 GPRS and EDGE Introduction-41Sudheera IndrajithNoch keine Bewertungen

- Trader's Daily Digest - 12.03.2020Dokument8 SeitenTrader's Daily Digest - 12.03.2020Sudheera IndrajithNoch keine Bewertungen

- Project PlannerDokument19 SeitenProject Plannerraahul_nNoch keine Bewertungen

- 2058-34 15.02.2018 Public Officer PermitDokument2 Seiten2058-34 15.02.2018 Public Officer PermitSudheera IndrajithNoch keine Bewertungen

- GERAN ZGB-02!01!001 Paging Feature GuideDokument17 SeitenGERAN ZGB-02!01!001 Paging Feature GuideSudheera IndrajithNoch keine Bewertungen

- BRS Quarterly Results Snapshot - 1Q FY 19Dokument4 SeitenBRS Quarterly Results Snapshot - 1Q FY 19Sudheera IndrajithNoch keine Bewertungen

- Tems Cel File FormatDokument2 SeitenTems Cel File FormatSudheera IndrajithNoch keine Bewertungen

- Comment:-: Page 1 of 1Dokument1 SeiteComment:-: Page 1 of 1Sudheera IndrajithNoch keine Bewertungen

- Licence Rene Val ApplicationformDokument3 SeitenLicence Rene Val ApplicationformSudheera IndrajithNoch keine Bewertungen

- Filename Cellid Secno. Rru Number Ant Number Antinfo Ul FrequencDokument3 SeitenFilename Cellid Secno. Rru Number Ant Number Antinfo Ul FrequencSudheera IndrajithNoch keine Bewertungen

- 1-WO - NP2001 - E01 - 1 UMTS Radio Network Planning Process-++-P65Dokument65 Seiten1-WO - NP2001 - E01 - 1 UMTS Radio Network Planning Process-++-P65Sudheera IndrajithNoch keine Bewertungen

- Cell Selection and ReselectionDokument16 SeitenCell Selection and ReselectionjangkrikbossNoch keine Bewertungen

- Chess Results ListDokument8 SeitenChess Results ListSudheera IndrajithNoch keine Bewertungen

- Mas ReviewerDokument14 SeitenMas ReviewerMichelle AvilesNoch keine Bewertungen

- UEMS 21 Aug 2023 RHBDokument8 SeitenUEMS 21 Aug 2023 RHBJun Li KhorNoch keine Bewertungen

- Textbook Grade 9 Accounting 2nd Edition PDFDokument226 SeitenTextbook Grade 9 Accounting 2nd Edition PDFMartyn Van ZylNoch keine Bewertungen

- Cashflow QuestionsDokument21 SeitenCashflow Questionsreebass18Noch keine Bewertungen

- DCF Valuation: 1.inputDokument25 SeitenDCF Valuation: 1.inputDushyant yadavNoch keine Bewertungen

- Standard Balance SheetDokument1 SeiteStandard Balance SheetNurul patimahNoch keine Bewertungen

- 2011 AFR LGUs Vol3ADokument475 Seiten2011 AFR LGUs Vol3ANom-de PlumeNoch keine Bewertungen

- FAR Activity Feb 19 With AnswersDokument16 SeitenFAR Activity Feb 19 With AnswersCybill AiraNoch keine Bewertungen

- Ruble 4Dokument43 SeitenRuble 4anelesquivelNoch keine Bewertungen

- BUS 591 WK 6 Template - 092417Dokument43 SeitenBUS 591 WK 6 Template - 092417kapil sharma100% (2)

- Accounting ExamDokument13 SeitenAccounting ExamLowry GuettaNoch keine Bewertungen

- Session 1.3. Preparing Financial Statements Income Statement and Balance Sheet Part 2 Sync PDFDokument57 SeitenSession 1.3. Preparing Financial Statements Income Statement and Balance Sheet Part 2 Sync PDFSriNoch keine Bewertungen

- Ias 12 Income TaxesDokument5 SeitenIas 12 Income TaxessomicaNoch keine Bewertungen

- © The Institute of Chartered Accountants of IndiaDokument56 Seiten© The Institute of Chartered Accountants of IndiaTejaNoch keine Bewertungen

- FINMAN Cash-Flow-Analysis-Practice-Problem-2Dokument2 SeitenFINMAN Cash-Flow-Analysis-Practice-Problem-2stel mariNoch keine Bewertungen

- Summary OutlineDokument5 SeitenSummary OutlineMary Jullianne Caile SalcedoNoch keine Bewertungen

- El Muebles Company Trial Balance As of September 30, 2020: Total 691,245.00 691,245.00Dokument6 SeitenEl Muebles Company Trial Balance As of September 30, 2020: Total 691,245.00 691,245.00PaupauNoch keine Bewertungen

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-2Dokument5 SeitenUltimate Book of Accountancy: Class - XII Accountancy Chapter - 05 (Part - B) : Cash Flow Statement Part-2Pramod VasudevNoch keine Bewertungen

- Financial Accounting Digital Assignment 3Dokument5 SeitenFinancial Accounting Digital Assignment 3Jayagokul SaravananNoch keine Bewertungen

- SDokument8 SeitenSdebate ddNoch keine Bewertungen

- FS Rolling StoreDokument21 SeitenFS Rolling StoreAmie Jane MirandaNoch keine Bewertungen

- Provisional Balance Sheet of 2021-22Dokument3 SeitenProvisional Balance Sheet of 2021-22Hemendra KapadiaNoch keine Bewertungen

- Unit .2 The Accounting CycleDokument29 SeitenUnit .2 The Accounting CycleYonasNoch keine Bewertungen

- Financial Ratio Analysis Case StudyDokument10 SeitenFinancial Ratio Analysis Case StudyGracel Joy VicenteNoch keine Bewertungen

- Receivables TheoriesDokument4 SeitenReceivables TheoriesRENZ ALFRED ASTRERONoch keine Bewertungen

- CH 08Dokument81 SeitenCH 08Noheul KimNoch keine Bewertungen