Beruflich Dokumente

Kultur Dokumente

Untitled

Hochgeladen von

api-290371470Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Untitled

Hochgeladen von

api-290371470Copyright:

Verfügbare Formate

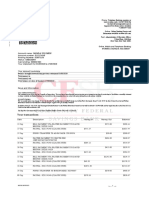

Ranges (Up till 11.

30am HKT)

Currency

Currency

EURUSD

1.0928-48

EURJPY

135.62-89

USDJPY

123.93-124.29

EURGBP

0.70065-16

GBPUSD

1.5579-1.5612

USDSGD

1.3726-57

USDCHF

AUDUSD

0.9665-92

0.7284-0.7306

USDTHB

USDKRW

34.010-17

1167.7-1173

NZDUSD

0.6569-0.6617

USDTWD

31.507-625

USDCAD

1.2991-1.3010

USDCNH

6.2189-6.2219

AUDNZD

1.1020-97

XAU

1084.2-1089.5

Key Headlines

It is called kick a man when he's down Bloomberg

article talked about the Malaysian FX reserves due to

drop because of currency intervention and there is this

blogger who said he travelled to Shanghai, interviewed

the mainland stock investors how much

margin/leveraged they have.

Profit taking dominated Asia, UsdJpy slipped to a low

of 123.93 despite the buying interest from US names

within 124.00. Euro stuck in 1.0928-48 range, buying

from Asian names in the thirties; Nzd is probably the

only one that underperformed.

IMF said it would have no involvement in Greece until

it receives explicit assurances over debt sustainability.

Meanwhile in Athens, Syriza party will hold an

emergency congress in September, after the negotiations

with creditors are done and dusted. What if the creditors

delay the decision in Aug?

FX Flows

New Zealand reported weak July ANZ business

confidence and Nzd fell from 0.6610 to 0.6583. We saw

some guys jumping into AudNzd when the cross broke

above 1.1055. This suppressed the NzdUsd at 0.6569;

cross rose to 1.1094.

AudUsd is supported by the AudNzd interest. There is

also this Aud 0.7250 option expiry NY cut today, worth

about Aud900mio.

Since the IMM closed, Euro got stuck in a 1.0925-36

range in Asia we did 1.0928-48! We saw some Usd

selling, profit taking from North Asian names sent Euro

towards the high but ran out steam and reverted to

1.0938. Am told profit taking activities are seen below

1.0900; 1.0800-20 remains the long term support for

now. Intraday resistance at 1.0940 and the next set of

offers are at 1.0980.

IMF said it would have no involvement in Greece until it

receives explicit assurances over debt sustainability.

Meanwhile in Athens, Syriza party will hold an

emergency congress in September, after the negotiations

with creditors are done and dusted. What if the creditors

delay the decision?

Month-end rebalancing saw UsdJpy trade to low 123.93

trust banks bought dollars post-fix and we returned to

124.05. Tokyo banks said UsdJpy bids are scattered

down to 123.90; offers are planted at 124.50 and lots

more towards 124.70 and 124.90. BOJ will buy Jpy30bn

of ETF today and there is an option strike at 124.00 exp

NY cut.

Spot Gold traded 1084.2-1089.5 with small demand

from Chinese retailers. I hear bids down 1082-1080 from

various names.

Asians

It is called kick a man when he's down best describe

the bloggers out to make a name for themselves.

38 consecutive days, fixing within this 6.11-handle. At

6.1172, not far off from yesterdays 6.1165. Stable fix,

calm in onshore and offshore. However, several China

experts are betting that Yuan will fall. we saw the 12month NDF points rising and CNH swap curve

steepening. WSJ article said bets are rising that Chinas

currency is headed lower with its stock market, a signal

of waning investor confidence in the countrys ability to

manage its economic slowdown and market turmoil.

One blogger wrote that he was recently in Shanghai and

had the opportunity to interview some mainland

participants of the stock market. I seriously wonder how

this English speaking foreigner or Kwai-lo

communicate with the Shanghainese and how he

travelled to the village to see the farmers?

1s UsdMyr NDF opened at 3.8500, onshore kicked off at

3.8140. 1-month NDF points widened to +335 and

backed off to +270. Story in Bloomberg that Malaysias

FX reserves are set to drop below $100bn from

stemming Ringgit decline. I do agree about the

intervention but if one is to put money into betting they

are running out of money, better have a read on the

Chiangmai Initiative Agreement. Malaysia can borrow

up to 2.5 times their contribution and they can always

ring up ASEAN+3 central banks for assistance.

Korean Won strengthened on demand from onshore

exporters, for month end re-balancing. Onshore spot

opened at 1173, which was the high of the session and

slipped to 1167.7.

Interesting words used in this article from the flagship

newspaper of the Communist Party of China following

the removal of Guo Boxiong from CPC. Guo was the

These information have been obtained or derived from sources believed to be reliable, but I make no representation or warranty as to their accuracy or completeness.

Copyright 2013 The Poon Report by Vincent Poon. All rights reserved.

former vice chairman of the Central Military

Commission. The newspaper said "One demon killed, all

demons deterred anti-corruption sword must be

raised high to cut the bud of corruption and make the

corrupt pay a price.

retain a financial interest in a Brevan Howard vehicle,

allowing him to receive long-term incentive payments

based on the hedge funds size.

http://www.theguardian.com/business/2015/jul/30/ba

nk-of-england-mpc-gertjan-vlieghe-scrutiny-treasury

Who said what

FT: Corporate giants sound profits alarm over

China slowdown

Some of the worlds largest companies have sounded the

alarm about the slowdown in the Chinese economy,

warning that weaker growth would hit profits in the

second half of the year. Car companies such as PSA

Peugeot Citron, Audi and Ford have slashed growth

forecasts while industrial goods groups such as

Caterpillar and Siemens have all spoken out on the

negative impact of China. The warnings are a sign that

Chinas weaker growth and its stock market rout this

month are creating a headache for global corporates that

have long relied heavily on the worlds second-largest

economy to drive revenues.

http://www.ft.com/intl/cms/s/0/8dacba88-36c4-11e5b05b-b01debd57852.html#axzz3hKbFAMBo

Japan Aso: Expects the economy to recover in Q3 2015

Japan Aso: Watching Chinese stock market but not

making any predictions

Japan Aso: Transparency an issue in Chinese stock

market

Japan Aso: Declined to comment on TPP talks on FX

manipulation panel

News & Data

South Korea Aug Business Survey Manufacturing at 70

vs 67

South Korea Aug Business Survey Non-Manufacturing

at 71 vs 66

South Korea June Industrial Production SA M/M up

2.3% from -1.3% (revised -1.6%)

South Korea June Industrial Production Y/Y up 1.2%

from -2.8% (revised -3%)

UK July GfK Consumer Confidence at 4 from 7, exp. 5

Japan June Unemployment Rate rose to 3.4% from

3.3%

Japan June Overall Household Spending fell 2% from

+4.8%

Japan June National CPI Y/Y 0.4% from 0.5%

Japan June National CPI Ex-Fresh Food Y/Y

unchanged at 0.1%

Japan June National CPI Ex-Food, Energy Y/Y rose

0.6% from 0.4%

Tokyo July CPI Y/Y at 0.2% from 0.3%

Tokyo July CPI Ex-Fresh Food Y/Y fell 0.1% from 0.1%

Tokyo July CPI Ex-Food, Energy Y/Y 0.3% from 0.2%

New Zealand July ANZ Activity Outlook at 19 from

23.6

New Zealand July ANZ Business Confidence fell 15.3

from -2.3

Australia Q2 PPI Q/Q up 0.3% from 0.5%

Australia Q2 PPI Y/Y at 1.1% from 0.7%

The Guardian - Bank of England: new MPC

member faces scrutiny from Treasury MPs

The Treasury select committee is preparing to challenge

newly appointed member of the Bank of Englands

monetary policy committee, Gertjan Vlieghe, to prove his

independence from the hedge fund Brevan Howard,

where he is a partner. Vlieghes appointment as one of

the four external members of the MPC was announced

earlier this week when the chancellor, George Osborne,

said the hedge fund economist would replace David

Miles on the rate-setting committee from September. It

is a three-year term. Reuters reported that Vlieghe would

Reuters: GE may ship $10 billion in work

overseas as U.S. trade bank languishes

General Electric Co is taking steps to shift some U.S.

manufacturing work overseas now that the U.S. ExportImport Bank will be shuttered at least until September,

the industrial giant's global operations boss told Reuters

on Thursday. GE Vice Chairman John Rice said the

conglomerate is bidding on over $10 billion worth of

projects that require support from an export credit

agency (ECA) like Ex-Im. With Ex-Im unable to extend

new loans or guarantees thanks to an effort by

congressional Republicans to shut it down, GE is

arranging with ECAs in other countries to finance the

deals involved, with much of the production going to GE

plants in those foreign locations. The prospective

government partners include Canada, the United

Kingdom, France, Germany, China and Hungary, he

said.

http://www.reuters.com/article/2015/07/30/us-usaeximbank-general-electric-idUSKCN0Q42J920150730?

feedType=RSS&feedName=topNews&utm_source=twitt

er

WSJ: Cargills Black River Asset Management

Shutting Four Hedge Funds

Cargill Inc.s Black River Asset Management LLC plans

to shutter four of its hedge funds and return more than

$1 billion to investors over the next several months,

Black River executives said. The closure of the funds

marks the latest blow for Black River, which earlier lost a

chunk of its assets under management due to the

decision last year by the California Public Employees

Retirement System to exit its hedge-fund investments.

These information have been obtained or derived from sources believed to be reliable, but I make no representation or warranty as to their accuracy or completeness.

Copyright 2013 The Poon Report by Vincent Poon. All rights reserved.

Cargill recently decided to withdraw its money from the

four funds being closed.

http://www.wsj.com/articles/cargills-black-river-assetmanagement-shutting-four-hedge-funds-1438292912?

mod=wsj_nview_latest

WSJ: U.S. Banks Take Global Lead

In the trans-Atlantic rivalry for investment-banking

supremacy, the Americans are running up the score. The

diverging paths are now clear, at least to investors. Over

the past five years, the shares of J.P. Morgan Chase &

Co., Bank of America Corp., Citigroup Inc., Goldman

Sachs Group Inc. and Morgan Stanley have climbed, on

average, by 45%. In the same period, European banks

Barclays, Credit Suisse Group AG, Deutsche Bank, UBS

Group AG and Royal Bank of Scotland PLC are down

17%.

http://www.wsj.com/articles/u-s-banks-take-globalleadu-s-banks-take-global-lead-1438300606

WSJ: Canadian Oil Sands Posts Loss on Lower

Crude Prices

Canadian Oil Sands Ltd. on Thursday reported a net loss

in the second quarter, citing lower prices for its crude

and the effect of a two percentage point corporate tax

hike in the Western Canadian province where it

operates. The largest owner of the Syncrude oil sands

project in northern Alberta lost 128 million Canadian

dollars ($98.4 million), or 26 Canadian cents a share, in

the three months to June 30, compared with a net profit

of C$176 million, or 36 Canadian cents a share, in the

year-earlier period.

http://www.wsj.com/articles/canadian-oil-sands-postsloss-on-lower-crude-prices-1438296801?

mod=wsj_nview_latest

WSJ: Greeces Syriza Will Hold Emergency

Congress in September

Greeces ruling Syriza party decided Thursday to hold an

emergency congress in September, shifting the problem

of dealing with the partys far-left dissenters until after

the negotiations with the countrys international

creditors over a third bailout package are concluded. The

roughly 200 members of Syrizas central committee

voted against a proposal to carry out a congress

immediately, a decision that could derail the continuing

negotiations on an up to 86 billion euro bailout. But the

tense atmosphere during the gathering at an old movie

theater made clear that the partys split is unavoidable. A

formal division within Syriza would strip Greek Prime

Minister Alexis Tsiprass coalition and force snap

elections. Snap national elections are expected to follow

the congress in fall.

http://www.wsj.com/articles/greek-prime-ministeralexis-tsipras-calls-for-syriza-party-vote-to-address-

divisions-over-bailout-1438264372?

mod=wsj_nview_latest

BBC Greek debt crisis: IMF wary of third bailout

The International Monetary Fund (IMF) is very wary of

any financial contribution to a third Greek bailout. The

implication of remarks by an IMF official is that it is very

unlikely to provide funds at the first stage. The fund

could however join in later, provided both the eurozone

and Athens take steps to address IMF concerns.

http://www.bbc.com/news/business-33727276

Kathimerini: Tsipras grapples with party

dissenters over bailout, unity

The outlook for the fragile cohesion of SYRIZA, and the

prospects for a deal with international creditors,

appeared unclear late on Thursday night as members of

the leftist party remained locked in tensed discussions

over both issues. A session of the partys central

committee which started at around noon ran late into

the night as MPs and officials discussed how to address

serious objections within the party to the prospect of

further austerity. The options being discussed included a

party referendum on whether the government should

continue bailout talks with creditors and seal a deal, or a

party congress.

http://www.ekathimerini.com/200103/article/ekathime

rini/news/tsipras-grapples-with-party-dissenters-overbailout-unity

Bangkok Post: Thai Navy argues subs protect

seas

The navy has launched a nine-page white paper on the

urgent need to purchase submarines to safeguard

lucrative national maritime interests and maintain

security during maritime conflicts. Critics earlier this

month condemned the navy's proposal to spend roughly

36 billion baht on Chinese submarines. The white paper,

ordered by Deputy Prime Minister Prawit Wongsuwon,

appears to be an attempt to drum up public support for

the submarines.

http://www.bangkokpost.com/news/security/639592/n

avy-argues-subs-protect-seas

These information have been obtained or derived from sources believed to be reliable, but I make no representation or warranty as to their accuracy or completeness.

Copyright 2013 The Poon Report by Vincent Poon. All rights reserved.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Mrs Janada Solomon 500 Laurel Lane, Midland, Texas 79701Dokument2 SeitenMrs Janada Solomon 500 Laurel Lane, Midland, Texas 79701SolomonNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Chapter 11Dokument23 SeitenChapter 11narasimha50% (6)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- State Bank of India Strategy AnalysisDokument25 SeitenState Bank of India Strategy AnalysisVineet Raj Goel85% (20)

- Temenos Enterprise ArchitectureDokument46 SeitenTemenos Enterprise ArchitectureSanjay Rana100% (1)

- World Bank GlossaryDokument435 SeitenWorld Bank Glossarydon_isauroNoch keine Bewertungen

- Islamic Commercial BankingDokument26 SeitenIslamic Commercial BankingjmfaleelNoch keine Bewertungen

- News SummaryDokument21 SeitenNews Summaryapi-290371470Noch keine Bewertungen

- News SummaryDokument14 SeitenNews Summaryapi-290371470Noch keine Bewertungen

- News Summary: Ar04 - 16 PDFDokument10 SeitenNews Summary: Ar04 - 16 PDFapi-290371470Noch keine Bewertungen

- News SummaryDokument19 SeitenNews Summaryapi-290371470Noch keine Bewertungen

- News SummaryDokument15 SeitenNews Summaryapi-290371470Noch keine Bewertungen

- News SummaryDokument14 SeitenNews Summaryapi-290371470Noch keine Bewertungen

- News SummaryDokument17 SeitenNews Summaryapi-290371470Noch keine Bewertungen

- Ranges (Up Till 12.20pm HKT) : Currency CurrencyDokument2 SeitenRanges (Up Till 12.20pm HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 12.30pm HKT) : Currency CurrencyDokument2 SeitenRanges (Up Till 12.30pm HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- News SummaryDokument12 SeitenNews Summaryapi-290371470Noch keine Bewertungen

- Ranges (Up Till 11.50am HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 11.50am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 11.28am HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 11.28am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 11.30am HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 11.30am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDokument2 SeitenRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 11.59am HKT) : Currency CurrencyDokument2 SeitenRanges (Up Till 11.59am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 11.05am HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 11.05am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDokument2 SeitenRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 11.45am HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 11.45am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 11.55am HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 11.55am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 11.40am HKT) : Currency CurrencyDokument4 SeitenRanges (Up Till 11.40am HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 12.20pm HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 12.20pm HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Ranges (Up Till 12.00pm HKT) : Currency CurrencyDokument3 SeitenRanges (Up Till 12.00pm HKT) : Currency Currencyapi-290371470Noch keine Bewertungen

- Republic of The Philippines V. Sandiganbayan, Et Al. G.R. Nos. 166859, 169203 and 180702, 12 April 2011, EN BANC (Bersamin, J.) Doctrine of The CaseDokument5 SeitenRepublic of The Philippines V. Sandiganbayan, Et Al. G.R. Nos. 166859, 169203 and 180702, 12 April 2011, EN BANC (Bersamin, J.) Doctrine of The CaseJerald-Edz Tam AbonNoch keine Bewertungen

- Types of Bank Accounts in IndiaDokument5 SeitenTypes of Bank Accounts in IndiaNikita DesaiNoch keine Bewertungen

- BRMDokument30 SeitenBRMRushali KhannaNoch keine Bewertungen

- Utility Pricing ModelsDokument45 SeitenUtility Pricing ModelsMatthew Rees100% (1)

- Practice Problem 2 Cash ReconDokument5 SeitenPractice Problem 2 Cash ReconKhyla DivinagraciaNoch keine Bewertungen

- A Case Study On FINODokument9 SeitenA Case Study On FINOPiyush Singh PrasannaNoch keine Bewertungen

- Partial Withdrawal FormDokument1 SeitePartial Withdrawal Formmohd uzaini mat jusohNoch keine Bewertungen

- BTS Accounting Firm Trial Balance December 31, 2014Dokument4 SeitenBTS Accounting Firm Trial Balance December 31, 2014Trisha AlaNoch keine Bewertungen

- Circular PuzzleDokument72 SeitenCircular PuzzleVishwambarNoch keine Bewertungen

- Internet BankingDokument2 SeitenInternet Bankingapi-323535487Noch keine Bewertungen

- 59 ABEJUELA Vs PEOPLEDokument2 Seiten59 ABEJUELA Vs PEOPLENorway AlaroNoch keine Bewertungen

- Insular Savings Bank Vs CA June 15, 2005Dokument2 SeitenInsular Savings Bank Vs CA June 15, 2005Sam FajardoNoch keine Bewertungen

- OTM Debit Mandate Form NACH/ ECS/ Direct Debit: Unit Holder InformationDokument6 SeitenOTM Debit Mandate Form NACH/ ECS/ Direct Debit: Unit Holder InformationTirthGanatraNoch keine Bewertungen

- P 1 Aug 29Dokument1 SeiteP 1 Aug 29hlaldinmawiaNoch keine Bewertungen

- Addresses and Helpline Nos of Grievances Redressal Cell - SBI BankDokument3 SeitenAddresses and Helpline Nos of Grievances Redressal Cell - SBI Banklil johnNoch keine Bewertungen

- The Business As Usual Behind The Slaughter - Lars SchallDokument17 SeitenThe Business As Usual Behind The Slaughter - Lars SchallAlonso Muñoz PérezNoch keine Bewertungen

- World Islamic Mint: NewsletterDokument16 SeitenWorld Islamic Mint: NewsletterNurindah 'indah' SariiNoch keine Bewertungen

- International Trade Documentation At: Reva Textiles Pvt. LTDDokument30 SeitenInternational Trade Documentation At: Reva Textiles Pvt. LTDMohnish NagpalNoch keine Bewertungen

- DeregulationDokument60 SeitenDeregulationMalika BatraNoch keine Bewertungen

- Arvind 190101010048 State Bank of India. What Is Online SBI ?Dokument2 SeitenArvind 190101010048 State Bank of India. What Is Online SBI ?arvind singhalNoch keine Bewertungen

- Principales Organismos ReguladoresDokument5 SeitenPrincipales Organismos Reguladoresholger azael murillo gomezNoch keine Bewertungen

- Investment BankingDokument36 SeitenInvestment BankingMidul KhanNoch keine Bewertungen

- 10 Myths About Financial DerivativesDokument6 Seiten10 Myths About Financial DerivativesArshad FahoumNoch keine Bewertungen

- Investors Exchange Investment FundDokument53 SeitenInvestors Exchange Investment FundOlivierNoch keine Bewertungen