Beruflich Dokumente

Kultur Dokumente

F8 AA (Int) Session37 - j08 PDF

Hochgeladen von

Tareq ChowdhuryOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

F8 AA (Int) Session37 - j08 PDF

Hochgeladen von

Tareq ChowdhuryCopyright:

Verfügbare Formate

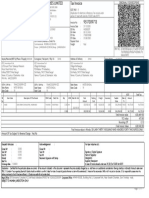

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

OVERVIEW

Objective

To illustrate the contents of work programs for the audit of transactions and balances.

TRANSACTIONS Statement of comprehensive income BALANCES Statement of financial

position

PROPERTY,

PLANT &

EQUIPMENT

SALES

INVENTORY

Tests of detail

RECEIVABLES &

PREPAYMENTS

PURCHASES

Transactions

Existence and ownership

Book value

Property valuation

Capital commitments

Existence and ownership

Valuation

NRV

Interim count

GIT

Physical count

Existence

Valuation

Interim confirmation

Cutoff

Loans

Prepayments

Confirmation summary

Bank balances

Window-dressing

Setting-off

Cash balances

Completeness

Accrued expenses

Reservation of title

Setting-off

Tests of detail

BANK& CASH

WAGES &

SALARIES

Tests of detail

PAYABLES &

ACCRUED

EXPENSES

3701

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

SALES

HASTINGS & WARWICK

Sch. Ref.

CLIENT . . . . . . . . . . . . . . . . . . . . . . . .

PREPARED BY . . . . . . . . . . . .

DATE . . . . . . .

PERIOD . . . . . . . . . . . . . . . . . . . . . . . .

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Audit senior in charge)

AUDIT AREA CREDIT PURCHASES

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Manager)

The purpose of the auditing procedures set out in this section of the program is to obtain

reasonable assurance that credit sales are not materially understated.

RELIANCE ON INTERNAL CONTROL PROCEDURES

1.

Where we have placed reliance on the clients internal control procedures, test that the

controls on which we are relying have been complied with, and record the details of such

tests in the working papers.

TESTS OF DETAIL

Note: Where the maximum values of items in an account can be determined from independent

information or by calculation, use analytical procedures to reduce tests of detail as far as

possible.

2.

Test for omission and other understatement in the accounting records of sales charged to

accounts receivable, by selecting from appropriate records of potential sales transactions1

and tracing the selected items through to the relevant income account in the general

ledger, as follows:

(A) Select from the most appropriate records the items to be examined (see note

below). Test for completeness of these records by examining the system for

preparing and controlling such records, by testing the numerical sequence (if any)

of the records, and/or by any other procedures which are appropriate.

Note: The records from which the sample is selected should as far as possible

satisfy the following requirements:

(1) The records should if practicable be independent of the sales recording system.

(2) The records should be complete in the sense that for each sale that has been

made, there is a related item in the independent records.

(3) The records should if practicable be such that the probability of selecting a

particular item is proportionate to the value of the potential sale.

(4) The records should enable the potential sales to be identified at the earliest

possible stage in the recording process.

(B) Compare the records selected in procedure (A) above with the initial sales records,

for correct quantities.

(C) Check the selling price of these initial sales records with the relevant independent

records (such as official catalogues, price lists, etc.), and check the extensions and

casts.

(D) Check the VAT on sales selected for testing, and test the proper recording of these

items in the VAT account in the general ledger.

(E) Compare these initial sales records with the intermediate and final records, testing

these records for understatement of the casts, and for under-summarisation of the

sales income.

3702

E.g. customers orders

Work

performed

by

Ref. to

supporting

working

paper

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

(F) Compare the credits in the final records examined in procedure (E) above with the

relevant income account(s) in the general ledger.

(G) Test the casts of these income accounts and prove the final balances

arithmetically.

3.

Test the transactions in the last few days of the year to ensure that sales have not been

understated as follows:

Compare major despatches as shown in the despatch records in the last few days of the

year with the copy sales invoices. Trace these copy invoices, via the sales accounting

records, to the credit of the sales account. In doing this, ensure that these despatches

have been included as sales in the year under review.

Note: This test should be carried out in conjunction with the cutoff procedures relating

to the overstatement of receivables see paragraph 10 of the AP2 for receivables and

prepayments.

AP = Audit Program

3703

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

PURCHASES

HASTINGS & WARWICK

Sch. Ref.

CLIENT . . . . . . . . . . . . . . . . . . . . . . . .

PREPARED BY . . . . . . . . . . . .

DATE . . . . . . .

PERIOD . . . . . . . . . . . . . . . . . . . . . . . .

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Audit senior in charge)

AUDIT AREA CREDIT PURCHASES

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Manager)

The purpose of the auditing procedures set out in this section of the program is to obtain

reasonable assurance that purchases are not materially overstated.

RELIANCE ON INTERNAL CONTROL PROCEDURES

1.

Where we have placed reliance on the clients internal control procedures, test that the

controls on which we are relying have been complied with, and record the details of such

tests in the working papers.

TESTS OF DETAIL

2.

Select from the general ledger accounts items to be tested for overstatement.

(A) Examine the initial purchase records and supporting documents (such as purchase

orders and goods received records) for:

(1) Approval,

(2) Other independent evidence of validity, and

(3) Correctness of the allocations to the general ledger accounts.

(B) Cast the initial purchase record (usually the purchase invoice).

(C) Examine the terms of sale of suppliers selected for the above tests, and identify

those suppliers that have included reservation of title in their terms of trade. The

end of the reporting period liability to these suppliers should be tested for

understatement (see paragraph 21 (A) of the AP for payables, accrued expenses

and provisions).

Note: Where credit entries (e.g. purchase credits and cash discounts) have been

identified in taking out our debit sample, ensure that these credit entries are being tested

for understatement using the relevant AP.

(D) Examine also the relevant paid cheques for the correctness of the relevant details

(such as the date, the payee, the amount and the signatures), and investigate any

alterations or unusual endorsements.

(E) Where any selected debit entries have not been paid by the end of the reporting

period, ensure that these are included in payables at that date.

(F) List on a working paper the names of the suppliers whose transactions have been

tested. These suppliers will form part of the payables confirmation sample (see

paragraph 3(B) of the AP for payables and accrued expenses).

3.

Test the transactions in the last few days of the year to ensure that purchases have not

been overstated, as follows:

Compare major purchases as shown in the purchases account in the last few days of the

year with the receiving records, to ensure that the goods or services were received or

performed before the end of the reporting period.

Note: This test should be carried out in conjunction with the cutoff procedures relating

to the understatement of liabilities see paragraphs 16 and 17 of the AP for payables,

accrued expenses and provisions.

3704

Work

performed

by

Ref. to

supporting

working paper

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

WAGES AND SALARIES

HASTINGS & WARWICK

Sch. Ref.

CLIENT . . . . . . . . . . . . . . . . . . . . . . . .

PREPARED BY . . . . . . . . . . . .

DATE . . . . . . .

PERIOD . . . . . . . . . . . . . . . . . . . . . . . .

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Audit senior in charge)

AUDIT AREA WAGES AND SALARIES

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Manager)

The purpose of the auditing procedures set out in this section of the program is to obtain

reasonable assurance that wages and salaries are not materially overstated. This section

can be duplicated to support any number of separate payrolls.

Work

performed

by

Ref. to

supporting

working paper

RELIANCE ON INTERNAL CONTROL PROCEDURES

1.

Where we have placed reliance on the clients internal control procedures, test that the

controls on which we are relying have been complied with, and record the details of such

tests in the working papers.

TESTS OF DETAIL

2.

Select individual items for examination using either procedure (A) or procedure (B)

below:

Note: Procedure (B), the payroll selection reconciliation method, can be used in the

following circumstances:

(i) Where we have evaluated the internal control over wages and salaries as good.

(ii) Where we have obtained satisfactory results from our analytical review for

credibility.

(iii) Where we have reviewed the week by week/month by month payroll data, which

is reconciled by management or is closely controlled by management budgets,

and have received satisfactory explanations for all significant discrepancies

revealed by our review.

(A)

(i) From the general ledger payroll accounts select (on the basis of the total debit

entries in these accounts) the accounts to be sampled.

Note: If a costing system is used it may be necessary to select directly from

payroll records and prove the postings to the general ledger in total.

(ii) From each payroll account selected under procedure (i) above select individual

payrolls to be examined, testing the casts of the debit entries in these accounts

for overstatement.

(iii) From each payroll selected under procedure (ii) above select individual

employees pay to be examined, testing the casts of the payroll for

overstatement.

(B) Where we can use the payroll reconciliation method, select three payrolls for

testing as follows:

(i)

At the interim audit visit select two payrolls for testing one a current payroll

and the other selected at random.

(ii) At the final audit visit select a further payroll at random.

(iii) Where we only carry out one audit visit select three payrolls from the year at

random.

For each payroll selected under (i) to (iii) above select individual employees pay

to be examined using a reduced sampling interval.

(C) In addition, we should select all individuals who prepare, handle or approve

employee status change documents, payroll master files or payrolls.

3705

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

3.

Carry out the following procedures in respect of each employee selected for examination:

(A) Obtain evidence of employment by examining independent employee records, by

personal contact, or by enquiry of other independent employees.

(B) Examine the relevant supporting documents (such as employee status change

documents, payroll master files, and employees time, piece and bonus records)

for:

(1) Approval.

(2) Other independent evidence of validity and,

(3) Correctness of the gross pay calculations.

(C) Obtain the payroll for the pay period from which the employee was selected, and

scrutinise it for possible duplicate payments to that employee.

(D) Test that deductions from pay have been properly accounted for, as follows:

Note: Where the maximum rates of deductions from pay can be determined from

independent information or by calculation, use analytical procedures to reduce as

far as possible the tests of detail in 3(D)(i) below.

(i)

Test for understatement of credit entries in the deduction accounts in the

general ledger. Use the sample of the employees checked under procedures (A)

to (C) above. For each employee selected check that the various deductions

from gross pay have been correctly recorded in the initial, intermediate and

final records and in the general ledger deduction accounts. Test for

undercasting of deductions in each of these records.

(ii) In respect of the payrolls dealt with in 2, check that the total deductions plus the

total net pay equals the total gross pay.

(E) For employees paid in cash, observe the making up of pay packets and the

distribution of pay to employees, paying special attention to unclaimed pay.

When we, use the payroll selection reconciliation method we should attend the

payout of the current payroll week selected at the interim audit.

(F) For employees paid by cheque, examine the paid cheque for the correctness of the

relevant details (such as the date, the payee, the amount and the signatures), and

investigate any alterations or unusual endorsements.

4.

Check the total net pay recorded on all the payrolls selected in 2 above to the paid cheque

or other payment details.

5.

Where we have used the payroll selection reconciliation method of selecting individuals

for testing, carry out the following additional procedures:

(A) For each employee selected review the cumulative pay for the year for amounts

over basic pay.

(B) Cast the selected payrolls and compare the totals of gross pay and deductions of

the selected weeks or months with the equivalent totals of all other payrolls in the

year.

(C) Cast all the weekly or monthly payroll summaries and agree the postings to the

general ledger.

(D) Scan the general ledger payroll accounts to ensure that there are no payroll

postings which have not been checked under (C) above.

3706

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

PROPERTY, PLANT AND EQUIPMENT

HASTINGS & WARWICK

Sch. Ref.

CLIENT . . . . . . . . . . . . . . . . . . . . . . . .

PREPARED BY . . . . . . . . . . . .

DATE . . . . . . .

PERIOD . . . . . . . . . . . . . . . . . . . . . . . .

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Audit senior in charge)

AUDIT AREA NON-CURRENT ASSETS

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Manager)

The purpose of the auditing procedures set out in this section of the program is to obtain

reasonable assurance that property, plant and equipment are not materially overstated.

Work

performed

by

Ref. to

supporting

working paper

RELIANCE ON INTERNAL CONTROL PROCEDURES

1.

Where we have placed reliance on the clients internal control procedures, test that the

controls on which we are relying have been complied with, and record the details of such

tests in the working papers.

TESTS OF DETAIL

EXAMINING THE TRANSACTIONS DURING THE YEAR

2.

Obtain or prepare working papers of non-current asset balances and a summary of the

related general ledger transactions (including depreciation) and test that these have been

properly prepared, as follows:

(A) Agree the totals with the general ledger accounts.

(B) Test the casts for overstatement.

(C) Agree the totals with the subsidiary records of property, plant and equipment (e.g.

tangible fixed asset registers).

3.

(A)

Select the property, plant and equipment to be examined, as follows:

(1) Select from the list of non-current assets at cost at the beginning of the financial

year; and

(2) Select additions to non-current assets in the financial year by selecting from the

debit entries in the non-current asset control account in the general ledger. Test

the casts of the debit entries in this account for overstatement.

(B) Test the additions selected in procedure (A) (2) above with the relevant supporting

records and documents for:

(1) Approval by the board of directors or by other designated officials.

(2) Other independent evidence of validity.

(3) Correctness of the allocations to the general ledger accounts.

(C)

For the items selected in procedure (A) (2) above, examine the paid cheque for the

correctness of the relevant details.

(D)

For each item selected under procedures (A) (1) and (2) above:

(1) Where the asset has not been disposed of, check that it is correctly included in

the non-current asset control account at the end of the reporting period.

(2) Where the non-current asset has been sold or otherwise disposed of during the

financial year, check with the supporting evidence (e.g. correspondence,

scrapping note, etc.) and ensure that the profit or loss on disposal has been

properly computed and has been correctly recorded in the general ledger

accounts. Determine that the client has made a reasonable scrap recovery in the

case of assets which have been scrapped.

3707

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

CONFIRMING THE EXISTENCE AND OWNERSHIP OF FIXED ASSETS

4.

Confirm the existence and ownership of all property, plant and equipment which have

been examined under procedure 3(D) (1) above, as follows:

(A) In respect of freehold property, inspect the title deeds or obtain confirmation from

independent third-party custodians.

(B) In respect of leasehold property, inspect the leases or obtain confirmation from

independent third-party custodians.

(C) In respect of plant and equipment, review the evidence of physical counts, or

inspect the assets, or use other appropriate procedures. If the asset is permanently

idle or obsolete, review the value of this asset in the accounts.

CONFIRMING THE BOOK VALUE OF PROPERTY, PLANT AND EQUIPMENT

5.

Test that depreciation has been correctly calculated, by applying either procedure (A) or

procedure (B) below:

(A) Prove the amount of depreciation in total.

(B) Test the amounts of depreciation on individual items selected in procedure 3(A)

above, by checking with the authorised depreciation rates and by checking the

calculations in order to ensure that such items are not already fully depreciated.

Also, test the casts of the depreciation records and the postings to the general

ledger accounts.

6.

Investigate and test the clients procedure which ensures that all amounts expended by the

client on the acquisition of property, plant and equipment are correctly recorded as noncurrent assets.

Note: This procedure ensures that the test for understatement of the accumulated

provision for depreciation (in paragraph 5 above) is based on a population of property,

plant and equipment that is not materially understated.

7.

Ensure that depreciation:

(A) Has been provided on a basis which is consistent with that of the previous year.

(B) Is adequate but not excessive, by reviewing gains and losses on disposals or by

other appropriate methods.

PROPERTY VALUATION

8.

(A)

Review the details of any valuation of assets made in the year, whether or not such

valuations have been reflected in the accounts.

(B) Where there is reason to believe that the current market value of a property could

be significantly different from the amount at which it is included in the accounts,

and no valuation has been made in the current year, discuss with the manager the

need to request the client to make such a valuation.

(C) Assess whether or not a true and fair view is shown by the statement of financial

position if the current market value is materially below the book value and, if

appropriate, consult the manager or partner.

REVIEWING AND TESTING CAPITAL COMMITMENTS

9.

Obtain or prepare a working paper of capital commitments.

10. Test that they are correctly stated.

11. Consider possible additional commitments. Discuss these with responsible client

officials and include in the working papers the date and outcome of the discussions and

the names and status of the officials concerned.

3708

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

INVENTORY

HASTINGS & WARWICK

Sch. Ref.

CLIENT . . . . . . . . . . . . . . . . . . . . . . . .

PREPARED BY . . . . . . . . . . . .

DATE . . . . . . .

PERIOD . . . . . . . . . . . . . . . . . . . . . . . .

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Audit senior in charge)

AUDIT AREA INVENTORY

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Manager)

The purpose of the auditing procedures set out in this section of the program is to obtain

reasonable assurance that inventories are not materially misstated.

Work

performed

by

Ref. to

supporting

working paper

RELIANCE ON INTERNAL CONTROL PROCEDURES

1.

Where we have placed reliance on the clients internal control procedures, test that the

controls on which we are relying have been complied with, and record the details of such

tests in the working papers.

TESTS OF DETAIL EXISTENCE AND OWNERSHIP

Planning attendance at physical inventory counting

2.

Where the date selected for the count is an interim date we must be able to rely on the

year-end book inventory records. Assess the past reliability of the book records by

examining the materiality of differences disclosed by previous physical counts. If there

are any doubts as to the reliability of the book records, discuss immediately with the

manager whether we should request the client to conduct a year-end count.

3.

Review the adequacy of the clients instructions. Any serious shortcomings must be

discussed immediately with responsible client officials so that they can be rectified before

the inventory count.

4.

Select for test counting (by reference to perpetual records or prior period inventory

summaries and purchases selected under the AP for income and expenses) those

inventory items expected to have the largest monetary value at the count date.

5.

Where the client maintains inventory of a technical nature which is not readily

identifiable, or whose conditions we are not competent to ascertain, consider using

independent experts.

6.

Obtain a list of all inventory held by third party custodians. Ensure that the list is

complete. In respect of these inventories:

(A) Establish the suitability of the custodian.

(B) Confirm the existence and title of such inventory directly with the custodians.

(C) Review the controls exercised by the client over these inventories (including

cutoff) and consider whether there is any need for us to inspect them.

7.

Arrange for the necessary audit staff to attend physical inventory counting at the various

locations. Brief the audit staff and ensure that they have a copy of the client's instructions

together with a list of the inventory items pre-selected in 4 above and the audit program

for procedures during counting which they will need to complete.

See end of

this program

Make arrangements for the audit staff to be present at the end of the count.

8.

On completion of the count obtain and review the audit working papers prepared during

our attendance at the various locations, and summarise the adequacy and effectiveness of

the counts.

3709

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

Procedures subsequent to physical inventory counting

9.

Obtain the clients count records and test that they are complete and accurate, as follows:

(A) Test for completeness, by comparing the numerical sequence of count records

with the details recorded in our working papers at the time of the physical count.

(B) Scrutinise the count records to ensure that they have not been altered subsequent

to our attendance at the physical count by comparing the records with details

recorded in our working papers at the time of the physical count (e.g.

photocopies).

Testing continuous stockchecking procedures

10. Review the instructions issued and the procedures adopted by the client, in order to

determine whether such instructions and procedures are adequate. Pay particular

attention to controls revealed on the ICQ for the inventory system where inventory is not

physically counted at the end of the reporting period.

11. Arrange to attend at least one of the continuous stockchecks during the year. Review

reports of inventory counting or the inventory records to ascertain the extent to which

inventories have been counted during the year, and also to determine (by reviewing any

differences disclosed) the accuracy of the inventory records. In the light of this review,

determine the extent of the counting to be performed under 12 (A) and (B) below. Test

that the differences disclosed by counting have been adjusted in the inventory records.

12. Carry out audit tests as follows:

(A) Select from the inventory account at the end of the reporting period a sample of

inventory items, and check the quantities with the underlying inventory records

and the valuation of the items with supporting documents.

(B) Count a number of items that are in inventory, and check these by comparing

them with the inventory account.

13. Summarise on a working paper our findings on the adequacy and effectiveness of the

continuous counting procedures and on the reliability of the inventory records. Also

indicate the approximate amount of the differences found during the year.

Checking quantities on stocksheets

14. Test the casts of the stocksheets by:

(A) Casting the pages to which counted items have been traced and follow the totals

through to the inventory summary.

(B) Casting the final inventory summary, selecting individual page totals and casting

them at the same time selecting items for examination in procedure 15(A).

Where inventories are subject to continuous counting, test that the list of inventory has been

properly extracted (by selecting from the list and comparing with the inventory records and

vice versa).

15. Test that the physical quantities shown on the final stocksheets are neither overstated nor

understated by performing the following procedures:

(A) Overstatement: Agree the details of those items selected in procedures 14 (B)

above with the clients count records, to ensure that the stocksheets only

incorporate count records from physical inventory counting.

(B) Understatement: Agree items which were counted by us, or in our presence, with

the final stocksheets.

3710

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

Testing the cutoff of inventory

(Note: The cutoff tests detailed below should be co-ordinated with the cutoff tests on

receivables, payables, sales and purchases.)

16.

Test that there was a proper cutoff at the physical count date, as follows:

(A) Select from the goods received reports for a few days either side of the inventorytaking date, and compare with the relevant inventory records (and vice versa) to

ensure that goods received were recorded in the inventory records in the correct

accounting period.

(B) Select from despatch records for a few days either side of the count date, and

compare with the relevant inventory records (and vice versa) to ensure goods

despatched were recorded in inventory records in the correct accounting period.

(C) Where necessary, test the cutoff on the internal movement of inventory.

17. Where certain sections only of the inventory have been physically counted (other sections

being represented by book figures) check that a clean cutoff has been achieved between

the several sections (raw materials, supplies, work in progress, finished goods, etc).

Determine in this way that all movements of inventory into or out of the sections

physically counted have been properly recorded. Where appropriate, test that the cutoff

at the end of the reporting period between the various sections of inventory was adequate.

18. Where the clients count did not take place at the end of the reporting period, test that the

inventory records at that date reflected a correct cutoff regarding receipts and issues of

inventory. In doing this, use the cutoff samples tested in the following:

AP for income and expenses credit sales (paragraph 3)

purchases on credit (paragraph 3)

AP for payables, accrued expenses and provisions (paragraph 8)

AP for receivables and prepayments (paragraph 9)

VALUATION

Checking valuations and calculations on stocksheets

19. Record in the working papers in detail the bases and methods of costing used, and obtain

reasonable assurance that these bases and methods are being applied consistently, and are

in accordance with generally accepted accounting practices and the stated accounting

policies of the company.

20. Test the items selected in procedure 15 above as follows:

(A) Prove the unit costs on the stocksheets by reference to supporting records (e.g.

suppliers invoices, labour cost analyses, overhead allocations etc).

(B) Prove the extensions on the stocksheets.

21. Where the costs have been obtained from standard cost records, review the variance

reports or the entries in the variance accounts to determine whether or not the standard

costs are materially different from actual costs. If there are material differences, ascertain

the reasons for them and consider the need to adjust the inventory valuation.

22. Examine the overheads included in the inventory valuation and ensure that:

(A) Their inclusion is in accordance with generally accepted accounting principles.

(B) They reflect the clients normal level of activity.

23. Ensure that inter-department or inter-branch profit included in inventory has been

properly eliminated and that any goods purchased or transferred from group companies

have been so identified and segregated on the inventory summary.

24. Check that the general ledger accounts have been adjusted to reflect the results of

physical count. Establish the reasons for any material differences disclosed.

3711

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

TESTING THE NET REALISABLE VALUE OF INVENTORY

25. Apply the procedures set out in (A) to (E) below to ascertain whether or not inventory

write-downs and provisions are adequate (but not excessive) so that inventories are stated

at the lower of cost and net realisable value. In doing this, consider the following factors

where applicable: the condition of the inventory, its saleability, the possibility of

obsolescence, the levels of inventory in relation to current and expected sales or usage,

the estimated costs of completing work in progress, and current and expected selling

prices less reasonable costs of disposal.

(A) Test the amount at which inventory of finished products and of other items held

for sale to customers is stated does not exceed the selling price less reasonable

costs of disposal. Also test that the quantities held are not excessive. Compare

inventory levels (where appropriate) with sales for the current year, with orders,

and with sales forecasts.

(B) Test that work in progress is current and saleable. Also test that (where

appropriate) it has been written down by the amount of any losses expected to

arise on realisation taking into account reasonable costs of completion and

disposal.

(C) Test that inventories of raw material and supplies which are defective, obsolete or

surplus to production requirements have been adequately written down.

(D) Test that adequate provision has been made for any major purchase commitments

which are surplus to requirements or which are at prices in excess of current

replacement prices.

FOLLOWING UP AN INTERIM COUNT

26. Where the physical inventory count date differs from the end of the reporting period

examine all significant entries in the general ledger inventory control account, as follows:

(A) Test debits for overstatement by selecting from debits to general ledger inventory

accounts and agree with the underlying records.

(B) Test credits to the inventory account for understatement by comparing with the

appropriate debits to cost of sales.

(C) Test credits to the inventory account for misstatement by reviewing analytically

the expected cost of sales (e.g. by reference to sales and gross profit margins) and

comparing this amount with the inventory credits.

27. Test cost of sales for overstatement by completing the AP for Income and Expenses.

28. Confirm that there has been no material change in the relationship of inventory cost to net

realisable value between the count date and the end of the reporting period.

TESTING GOODS IN TRANSIT

29. In respect of goods in transit:

(A) Examine the basis for recording any inventory that is in transit.

(B) Check that the goods have been subsequently received and were validly in transit.

Goods in transit will be tested for understatement in conjunction with the cutoff tests

under steps 16 to 18 in this program and cutoff tests in the AP for Payables, accrued

expenses and provisions.

OVERALL REVIEW

30. Compare the inventories at the end of the reporting period with those of the previous

year, and obtain explanations for any significant differences. Compare inventory

turnover rates with those of previous years. Generally consider whether inventories are

stated on appropriate bases consistent with those stated in the preceding year.

3712

These steps

should be coordinated

with related

procedures

for payables,

cost of sales

and

receivables

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

PROCEDURES DURING PHYSICAL INVENTORY COUNT

1.

Before carrying out the procedures set out below, ensure that you are familiar with and

understand, the clients procedures and instructions.

2.

At the outset, tour the areas for which you are responsible to ascertain the nature,

location and size of the inventory to be counted.

3.

By observing the procedures being carried out, obtain reasonable assurance that the

instructions are being complied with and that the procedures followed are adequate to

ensure an accurate count. Bring any significant breakdown in procedures to the

attention of the senior auditor in charge and the client official in charge of physical

inventory counting.

4.

Make the following test counts, and record sufficient details in the working papers so

that the selected items can be traced to the final inventory summary. (Indicate on the

working papers that all test counts have been agreed to final client counts):

ISA 501

(A) All items pre-selected in step 4 of the main program. (To test inventory for

overstatement and understatement.)

(B) A sample of items selected from the physical inventory items. (To test inventory

for understatement.)

(C) A sample of items selected from the clients count records, or in the case of

continuous inventory checking, from the inventory records. (To test inventory for

overstatement.)

For (B) and (C) pay particular attention to high value items.

5.

Ensure against subsequent alteration of the clients count figures by, for example, taking

photocopies of the stocksheets and recording the numbers of sheets utilised.

6.

During the course of the count make and record such tests as are necessary to ensure that:

(A) All differences disclosed by double counts are investigated and resolved.

(B) All inventory is included in the physical count and all areas are systematically

cleared.

(C) Any goods that are sub-standard, defective, obsolete, or slow-moving are identified

and recorded as such on the stocksheets.

7.

Check that all goods which do not belong to the client are properly identified and

segregated, and that they are not included in count records.

8.

(A)

Observe the procedures for dealing with goods received or despatched during the

count. Record on an audit working paper the details of a number of such items to

enable subsequent checking of purchases-inventory and inventory-sales cutoff.

(e.g. the serial numbers of the last goods despatched note(s) for each location,

checking previous and subsequent sequences).

(B)

Observe the control over the movement of goods between areas whilst counting

is in progress.

9.

Examine the serial numbering or count records and record details of all records used.

10. Where work in progress is being inspected during the count, ensure that adequate

information is available relating to the degree of completion.

11. Where inventory is stored in bulk and cannot be measured accurately, attend with

suitably experienced client personnel. Record and assess the effectiveness of the

methods used for inspecting and estimating such inventory.

12. Prepare a summary of the adequacy and effectiveness of the count procedures.

3713

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

RECEIVABLES AND PREPAYMENTS

HASTINGS & WARWICK

Sch. Ref.

CLIENT . . . . . . . . . . . . . . . . . . . . . . . .

PREPARED BY . . . . . . . . . . . .

DATE . . . . . . .

PERIOD . . . . . . . . . . . . . . . . . . . . . . . .

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Audit senior in charge)

AUDIT AREA RECEIVABLES AND

PREPAYMENTS

REVIEWED BY . . . . . . . . . . . .

The purpose of the auditing procedures set out in this section of the program is to obtain

reasonable assurance that receivables and prepayments are not materially overstated.

RELIANCE ON INTERNAL CONTROL PROCEDURES

1.

Where we have placed reliance on the clients internal control procedures, test that the

controls on which we are relying have been complied with, and record the details of such

tests in the working papers.

TESTS OF DETAIL

CONFIRMING THE EXISTENCE OF TRADE RECEIVABLES

Note: Receivables may be confirmed at the end of the reporting period or at an interim date.

If an interim date is chosen the follow-up procedures set out in paragraph 9 of this AP must

also be applied.

2.

Obtain a list of trade receivables at the confirmation date and test these receivables for

overstatement by carrying out the audit procedures set out in paragraphs 3, 4 and 5

below. Wherever possible, use as the list the clients analysis of customer accounts.

3.

Test the list as follows:

(A) Agree or reconcile the total of the list with the receivables control account in the

general ledger.

(B) Test the casts of the list for overstatement.

(C) Test the individual items on the list for overstatement, by applying the procedures

set out below:

(1) Select either debit balances from the list of receivables of invoices outstanding

by use of sub-sampling techniques.

Note: Test for understatement of credit balances, using the tests required to

verify payables see AP for payables, accrued expenses and provisions.

(2) In respect of the selected balances, send out positive confirmation requests.

Note:

(a) Where the client prepares the confirmation requests, check that they have

all been properly prepared. Retain a copy of the working paper that lists all

accounts selected.

(b) Obtain the signature of the clients official on each request.

(c) Mail the request direct, and do not use the client's staff or facilities for this

purpose.

(d) After a reasonable period of time, send out second request to those

customers who have not responded.

(3) Where the customer will not confirm the balance in writing, try (with the

clients permission) to obtain confirmation by fax or telephone.

3714

DATE . . . . . . .

(Manager)

Work

performed

by

Ref. to

supporting

working paper

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

(4) Review each reply received. In cases where the customer disputes the balance,

request the client to investigate the reasons for all differences. Establish the

validity of the differences and prepare a schedule of the differences and their

subsequent disposition.

Note: It is important to investigate thoroughly any instances where the

customer disputes the amount paid by him or the date on which the clients

records indicate payment was received. Factors such as these may indicate

teeming and lading.

4.

Where we are unable to obtain confirmation of a customers balance obtain evidence (by

applying appropriate procedures) that the balance was a bona fide receivable of the client

at the confirmation date. The appropriate alternative procedures consist of:

(A) Checking the opening balance of the account with the list of balances at the end of

the subsequent reporting period, testing the casts of the account during the year

and agreeing the balance; and

(B) Testing the outstanding items with independent evidence of validity including

customers orders, despatch records and subsequent payments (where these can be

substantiated by remittance advices or other independent means); and

(C) Testing for the understatement of payments etc by discussing the outstanding

items with a responsible official who is independent of the cash receiving

function.

5.

Where confirmation procedures are not applied, select individual balances from the list of

receivables and carry out the procedures listed in paragraph 4 above.

6.

Prepare a summary of the confirmation procedures applied and of our conclusions.

TESTING THE VALUATION OF TRADE RECEIVABLES

7.

Test trade receivables for collectability and for understatement of the doubtful debts

provision as follows:

(A) Obtain reasonable assurance that the clients listing of overdue accounts has been

correctly prepared by checking it with the sample selected in procedure 3(C)

(l).Check the casts of each column and agree the total with the receivables control

account.

(B) Select overdue items from the clients listing of overdue accounts and check and

investigate the extent to which they are collectable by reviewing credit reports,

correspondence and other independent evidence.

(C) Establish the reasonableness of formulae used to calculate general provisions.

Review generally the clients bad debt experience for the current and recent

financial years and establish the reasons for significant differences. Check the

calculations on which the provision is based.

8.

Test the bad debts written off against the provision during the year for overstatement by

selecting debts written off and checking them with such independent evidence of validity

as correspondence with solicitors, debt collection agencies etc.

FOLLOWING UP AN INTERIM CONFIRMATION OF TRADE RECEIVABLES

9.

Where the procedures in paragraphs 2 to 8 above were applied to a date other than the

end of the reporting period, apply the following additional procedures:

(A) Test for overstatement of trade receivables at the end of the reporting period by

examining the transactions in the intervening period from the confirmation date to

the end of the reporting period, as set out below:

3715

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

(1) Test the credit sales in the intervening period for overstatement, as follows.

Select debit entries from the receivables control account and compare these

with the final sales records. Select individual transactions by sub-sampling

these final records and the related intermediate and initial sales records. Check

these transactions with independent evidence of validity (e.g. customer orders,

delivery notes signed by the customers, despatch records, etc).

(2) Test the sales returns and allowances in the intervening period for

understatement, as follows. Examine the evidence of sales returns and

allowances (e.g. goods returned records, correspondence with customers, and

the relevant sales invoices). Trace major items in these records to the credit

notes and (via the accounting records) to the credit of the receivables control

account. In doing this ensure that these sales returns were recorded in the

correct financial year.

(3) Test the receipts from customers in the intervening period for understatement,

as follows. Examine customers remittance advices, and any other available

independent evidence. Trace major items in these records (via the accounting

records) to the credit of the receivables control account. In doing this, ensure

that these receipts were recorded in the correct financial year.

(B) Review and summarise the movements on the receivables control account from

the confirmation date to the end of the reporting period and establish the reasons

for all unusual fluctuations. Compare the individual balances which were

selected for confirmation at the interim date with the corresponding balances at

the end of the reporting period, and investigate major differences.

TESTING THE CUTOFF OF RECEIVABLES

10. Test for any overstatement of receivables as at the end of the reporting period that has

arisen from recording transactions in the wrong financial year. Do this by testing for

overstatement of sales and for understatement of sales returns and receipts, in the

following manner:

(A) Test for overstatement of credit sales in the period immediately preceding the

end of the reporting period, as follows. Compare major billings as recorded in

the receivables control account (or other appropriate accounting record of

billings) in the last few days of the year, with evidence of the date on which

goods were despatched or services were rendered. In doing this, ensure that the

billings are for sales made during the financial year under review. (The evidence

of despatch should preferably comprise the customers acknowledgement of

delivery or service (e.g. signed delivery notes) or, failing that, the clients

despatch records.)

(B) Test for understatement of sales returns and allowances in the period immediately

preceding the end of the reporting period, as follows:

(1) Examine the evidence of sales returns and allowances (e.g. goods returned

records, correspondence with customers, and the relevant sales invoices) for

the last few days of the year and the first few weeks after the end of the

reporting period. Trace major items in these records to the relevant credit

notes and (via the accounting records) to the credit of the receivables control

account. In doing this, ensure that the sales returns and allowances have been

recorded in the correct financial year or, alternatively, that adequate provision

for sales returns and allowances has been made as at the end of the reporting

period.

(2) Compare major sales credit notes in the first few weeks after the end of the

reporting period with the relevant supporting evidence (e.g. goods returned

records, correspondence with customers, and the relevant sales invoices). In

doing this, ensure that these credit notes have been recorded in the correct

financial year or, alternatively, that adequate provision for sales returns and

allowances has been made as at the end of the reporting period.

3716

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

(C) Test for understatement of receipts from customers in the last few weeks of the

year, as follows. Examine customers remittance advices, listings of remittances,

and any other independent evidence. Trace major items in these records (via the

accounting records) to the credit of the receivables control account. In doing

this, ensure that these receipts were recorded in the correct financial year.

Note: The cutoff tests set out above should be carried out in conjunction with the cutoff

procedures relating to the understatement of sales (and the overstatement of sales returns

and allowances) See the AP for income and expenses credit sales (paragraph 3).

REVIEWING TRADE RECEIVABLES

11. Review generally the list of balances as at the end of the reporting period. Compute

trade receivables as a percentage of sales and as the number of days sales outstanding.

Compare these ratios with those of preceding years and obtain satisfactory explanations

for any significant differences. Determine that the balances have been correctly

classified for statement of financial position purposes and in particular that:

(A) Material credit balances have not been deducted from receivables (except where

there is a right to set-off).

(B) Inter-group balances have been classified correctly.

(C) Balances due from any person or company which is in any way connected with

the client arise from bona fide transactions on an arms length basis.

TESTING OF LOANS

12. Obtain a list of loans at the end of the reporting period or, where appropriate, as at an

interim date. Test this for overstatement, as follows:

(A) Agree the total with the balance of the control account in the general ledger.

(B) Test the casts of the list for overstatement.

(C) Select loans from the list, or where the loans bear interest, from the sources

specified in the note below. Test the selected items for overstatement as follows:

(1) Obtain written confirmation direct from the individual borrowers.

(2) Compare the selected loans with adequate evidence of ultimate collectability.

Do this by checking that the interest and principal are being paid on time and

that the loan is not in default of the loan agreement. Also, determine that the

loan is adequately secured, by confirming that the client has a charge on the

security and by examining evidence of the existence and value of the security

(e.g. correspondence, the borrowers accounts, etc). Where necessary, review

the loans with responsible client officials.

(3) In the case of those selected loans which were made during the financial year,

compare with the relevant supporting documents for:

(i)

Approval by the board of directors or by other designated officials or

committees; and

(ii) Other independent evidence of validity (e.g. loan agreements and

evidence of receipt).

Note: Where the loans bear interest, the selection should be made instead from the list of

loans at the beginning of the year and from the loans made during the year. The items

selected should then be used for:

(A) Testing the loans for overstatement as in procedure (C) above, and

(B) Testing for understatement of loan interest, by checking that the interest relating

to the selected loans has been included in the relevant income account in the

general ledger.

Loans to directors or employees

13. Identify loans made to, or debts due by either directors, or employees, and consider the

disclosure of such loans in the accounts.

3717

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

TESTING OTHER RECEIVABLES AND PREPAYMENTS

14. Obtain a list of other receivables as at the end of the reporting period or, where

appropriate, as at an interim date. Test this for overstatement, as follows:

(A) Agree the list with the balances on the relevant accounts in the general ledger.

(B) Test the casts of the list for overstatement.

(C) Select receivables from the list and test them for overstatement by applying

procedures similar to those set out in paragraph 12(C) above.

(D) Determine the nature and bona fides of all significant receivables, paying

particular attention to amounts due from any person or company which is in any

way connected with the client.

15. Obtain a list of prepayments as at the end of the reporting period or, where appropriate,

as at an interim date. Test this for overstatement, as follows:

(A) Agree the list with the balances on the relevant accounts in the general ledger.

(B) Test the casts of the list of overstatement.

(C) Select prepayments from the list and test them for overstatement by comparing

them with supporting independent documentation and with the corresponding

amounts in prior years.

3718

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

RECEIVABLE/PAYABLE CONFIRMATION SUMMARY

HASTINGS & WARWICK

Sch. Ref.

CLIENT . . . . . . . . . . . . . . . . . . . . . . . .

PREPARED BY . . . . . . . . . . . .

DATE . . . . . . .

PERIOD . . . . . . . . . . . . . . . . . . . . . . . .

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Audit senior in charge)

AUDIT AREA DIRECT CONFIRMATION

SUMMARY

REVIEWED BY . . . . . . . . . . . .

No. of

accounts

% of total

accounts

Value

$

% of total

value

100.0

100.0

Additional selections

______

______

______

______

Total sample

______

______

______

______

______

______

______

______

Population total

Sample for confirmation

DATE . . . . . . .

(Manager)

Ref. to

supporting

schedules

Statistical selections

Results of confirmation

Confirmed by:

(a) Letter

(b) Fax

(c) Telephone

Replies reconciled

Non-replies agreed by alternative procedures

Total balances agreed

Balances in dispute

Total sample

Date initial circularisation letter despatched . . . . . . . . . . . . . . . . . .

Percentage reply on initial circularisation . . . . . . . . . . . . . . . . . . %

Date of follow up letter . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3719

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

BANK AND CASH BALANCES

HASTINGS & WARWICK

Sch. Ref.

CLIENT . . . . . . . . . . . . . . . . . . . . . . . .

PREPARED BY . . . . . . . . . . . .

DATE . . . . . . .

PERIOD . . . . . . . . . . . . . . . . . . . . . . . .

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Audit senior in charge)

AUDIT AREA BANK AND CASH

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Manager)

The purpose of the auditing procedures set out in this section of the program is to obtain

reasonable assurance that bank and cash balances are not materially overstated.

RELIANCE ON INTERNAL CONTROL PROCEDURES

1.

Where we have placed reliance on the clients internal control procedures, test that the

controls on which we are relying have been complied with, and record the details of such

tests in the working papers.

TESTS OF DETAIL

CONFIRMING BANK BALANCES

Note: Normally, bank balances should be confirmed at the end of the reporting period. An

interim date should not be chosen for confirmation unless the manager responsible for the

audit expressly permits this.

2.

Obtain or prepare a list of all bank accounts that were open at any time during the year.

Send out requests for confirmation to the banks concerned at least one week before the

confirmation date. (Use the firms standard confirmation request letter and ensure that the

client has authorised the banks to divulge the required information to us.)

3.

Obtain, and retain, a copy of the clients bank reconciliations as at the confirmation date.

Test the reconciliations as follows:

(A) Check the casts of the reconciliations and agree the balances with the general

ledger (or where appropriate with the cash books) and with bank statements.

(B) Obtain bank statements for a sufficient period (usually ten working days)

immediately subsequent to the confirmation date. (If there are any suspicious

circumstances, obtain these statements direct from the bank.)

(1) Test for understatement of outstanding cheques and other items which decrease

the cash book balance. Select from payments recorded by the bank in the

subsequent period and comparing these with the payment records to ensure that

they were recorded in the correct accounting period. Compare the cheques

recorded prior to the confirmation date with the reconciliation.

(2) Check for overstatement any unbanked receipts and other items which increase

the balance at the bank. Do this by selecting from the list of unbanked receipts

and comparing with paying-in slips and with bank statements. Investigate the

reasons for any delay in banking receipts.

(3) Test for worthless cheques deposited to cover shortages by scrutinising the

bank statements for dishonoured cheques in the first ten working days after the

end of the reporting period.

4.

Agree bank certificates with the balances shown on the reconciliations as being due to or

from the banks. Also check that all other information given on the certificates agrees

with the clients records and is properly reflected in the accounts.

3720

Work

performed

by

Ref. to

supporting

working paper

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

WINDOW DRESSING

5.

Test for window dressing by reviewing material payments and receipts in the last month

of the year and for a sufficient period immediately after the end of the reporting period.

SETTING-OFF OF BALANCES

6.

Ensure that:

(A) A legal right of set-off exists where bank balances have been set-off.

(B) The client has made all known material set-offs in the accounts.

CONFIRMING CASH BALANCES

7.

Obtain or prepare a list of all petty cash funds, undeposited receipts, unclaimed wages

and other items. Include, where appropriate, negotiable instruments, title deeds, share

certificates, etc. Agree this list with the general ledger accounts or other appropriate

records.

8.

Where cash balances are material, count them (on the date chosen for the confirmation

of bank balances) as follows:

(A) Count and list notes, coins and cheques, vouchers and any negotiable

instruments. Control all funds and other items to ensure that there can be no

substitution. Carry out the count in the presence of the custodian of the funds

and do not, at any time, assume sole custody of these funds. Where there is a

significant difference between the book records and the count, consult the

clients officials immediately.

(B) In respect of cheques:

(1) Ensure that these have been entered correctly in the receipt records. If they

have not yet been entered, obtain a copy of the client's paying-in slip which

records them and, subsequently, check that they have been properly recorded.

(2) Check that these items are lodged in the bank promptly. Also check that there

are no undeposited receipts on hand at the date of our count.

(3) Where cashed cheques are part of petty cash funds, ensure that these are

controlled, that they are not post-dated and that they are banked promptly.

Review with an appropriate official of the client any cheques which are for a

relatively large amount or are signed by the custodian or are in any way

suspicious.

(C) In respect of vouchers:

(1) Inspect these for approval, for authenticity and for date.

(2) Check that the vouchers have been recorded in the cash fund records. If they

have not been recorded, prepare a list of the items in sufficient detail to enable

this check to be carried out at a subsequent date.

(3) Examine the cash fund records to ensure that those vouchers that have been

used to support a cash fund balance do not also support previous payments.

3721

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

TRADE PAYABLES AND ACCRUED EXPENSES

HASTINGS & WARWICK

Sch. Ref.

CLIENT . . . . . . . . . . . . . . . . . . . . . . . .

PREPARED BY . . . . . . . . . . . .

DATE . . . . . . .

PERIOD . . . . . . . . . . . . . . . . . . . . . . . .

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Audit senior in charge)

AUDIT AREA TRADE PAYABLES

REVIEWED BY . . . . . . . . . . . .

DATE . . . . . . .

(Manager)

The purpose of the auditing procedures set out in this section of the program is to obtain

reasonable assurance that payables, accrued expenses and provisions are not materially

understated.

RELIANCE ON INTERNAL CONTROL AND INTERNAL AUDIT PROCEDURES

1.

Where we have placed reliance on the clients internal control or internal audit

procedures:

(A) List the internal control or internal audit procedures that we consider are essential

to the system of internal control or internal audit.

(B) State whether each procedure is, or is not, documented in writing.

(C) Test that the controls have been complied with, and record the details of our tests

in the working papers.

TESTS OF DETAIL

Note: Where the client keeps book records of inventory, trade payables should be confirmed at

the date of the physical count.

TESTING TRADE PAYABLES FOR COMPLETENESS

Confirmation date

2.

Obtain a list of accounts payables at the confirmation date and apply the following

procedures:

(A) Agree or reconcile the total of the list with the general ledger account(s).

(B) Cast the list.

(C) Establish whether or not the list appears reasonable by reviewing it for payables

which are obviously misstated, or which, clearly, have been omitted (e.g. by

comparing the list with the balances at the beginning of the period and with the

general ledger debit sample).

3.

Test the subsidiary records of trade payables (normally the payables ledger or a listing of

unpaid invoices) for understatement or omission of amounts due to suppliers at the

confirmation date. Do this by selecting suppliers for confirmation as follows:

(A) Determine the length of the average trade payable cycle by dividing the larger of

the trade payable balances at the most recent month end or at the end of the

subsequent reporting period (or the estimated current year-end balance if it is

expected to be significantly larger) by the average monthly payments to trade

payables.

(B) Select suppliers accounts for confirmation by selecting a CMA sample for a

period of two trade payable cycles (or three months if longer) prior to the

examination date from either:

(1) The cash payment records; or

(2) The general ledger debits (i.e. in purchase and expense accounts).

3722

Work

performed

by

Ref. to

supporting

working paper

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

Note:

4.

1. The sampling interval we use to select suppliers in 3(B) above should be the

sampling interval for the detailed testing of trade payables.

2. The period defined in 3(B) above should end not more than one month before

the confirmation date and should not begin before the current audit period.

3. We should review the list of suppliers selected in 3(B) above to ascertain

whether we have failed to select for confirmation any suppliers with whom the

client conducts substantial business. We should consider whether we wish to

include these suppliers in our sample for confirmation at the confirmation date. If

we do so we should exclude from our evaluation procedure any errors we discover

that relate to these suppliers.

For the period we used in 3(B) above, do one of the following:

(A) If we have sampled from the cash payment records, determine the total payments

made in the period to each supplier we have selected.

(B) If we have sampled from the ledger debits, determine the total purchases made in

the period from each supplier we have selected.

5.

Request each supplier selected in 3(B) above to confirm his balance in writing. If we

receive no reply send second requests or apply other procedures (e.g. telex or telephone

calls made under our control) that might be expected to produce a direct reply from the

supplier.

Note:

6.

1. The optimum date for despatching a written confirmation request will be

shortly before the confirmation date.

2. We will not need to confirm directly liability accounts such as rentals, public

utilities, payroll deductions, etc if we can reasonably estimate the maximum

unrecorded liability.

(A) Reconcile each reply that we receive with the subsidiary records of trade payables

and investigate any differences by examining supporting documents, direct contact

with the supplier or other appropriate means.

(B) Where we are unable to obtain a direct reply from the supplier, either:

(1) Obtain a payable statement from the client, scrutinise it for evidence of

alteration, and reconcile the balance at the examination date as in (A) above; or

(2) If a statement is not available, examine purchase invoices and documents

supporting cash payments to that supplier for a period of one trade payable

cycle following the confirmation date to determine the adequacy of the liability

recorded at that date. Sample also the debit entries to the payables account

and establish their validity by examining paid cheques, credit notes or other

relevant evidence. Agree the opening balance on the account with the list of

payables at the end of the subsequent reporting period and test the casts of the

account.

Note:

7.

For the purpose of 6 above, our reconciliation with supporting documentation will

include selecting purchase items on a judgement basis and tracing them to the

goods received records and the inventory records.

Complete part A of the evaluation schedule for trade payables. Consider whether the

extent of the errors we discover necessitates our extending the confirmation procedures.

3723

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

Following up an interim confirmation of payables

Note:

8.

If trade payables have been confirmed at the end of the reporting period omit

procedures 8 to 10.

Test debit entries to the trade payables recorded between the confirmation date and the

end of the reporting period as follows:

(A) Select items from the cash payments records and examine supporting documents

(including each related cancelled cheque) to determine whether a liability

recorded at the confirmation date has been satisfied.

(B) Trace the selected items to the credits in the subsidiary records of trade payables.

(C) Review the level of purchase returns and allowances. If they are material, select

a sample of purchase returns and allowances from the debit entries to the

payables control account and ensure that they are both valid and recorded in the

correct accounting period by comparing them with supporting evidence (e.g.

goods returned records, inspection reports, correspondence with suppliers and the

relevant purchase invoice).

9.

Review and summarise the movements on the payables control account from the

confirmation date to the end of the reporting period, and establish the reasons for any

unusual movements.

10. Compare the individual balances which we selected for confirmation at the confirmation

date with the corresponding balances at the end of the reporting period, and investigate

any major differences.

End of the reporting period

11. Select a CMA sample of items from the cash payments records for one trade payable

cycle, or (if shorter) the period between the end of the reporting period and the

approximate date of completion of fieldwork. The sampling interval we use should be

the sampling interval for the detailed testing of trade payables.

12. Where the completion of fieldwork occurs later than one trade payable cycle from the

end of the reporting period, select all further top stratum payments until the date of

completion of fieldwork.

Note:

Where our reporting deadline follows closely on the end of the reporting period,

we will normally confirm trade payables at an interim date to allow ourselves a

sufficient period to adequately test post-confirmation date payments. This

procedure will compensate for the restricted period between the end of the

reporting period and the date of completion of fieldwork.

13. Test the items selected in 11 and 12 above with supporting documents and determine

whether those payments that satisfied a liability at the end of the reporting period

satisfied a recorded liability at that same date.

14. Test for understatement of credit purchases in the period immediately preceding the end

of the reporting period by selecting items on a judgement basis from the purchase and

expense records for the first few weeks after the end of the reporting period, and

ensuring that those purchases and expenses which relate to the period before the end of

the reporting period were accrued as liabilities at the end of the reporting period.

15. Enquire whether any old, disputed or questionable liabilities (either recorded or

unrecorded) exist, and investigate as we deem appropriate.

16. Review the level of trade payables and its relationship to purchases. Compare with the

previous year and investigate any significant changes in the composition of the trade

payables between the opening balance and the balance at the end of the reporting period.

Record the results of the investigation in a working paper.

3724

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

17. Evaluate the errors we discover during our work. If the revised monetary precision is

unacceptable, apply any or all of the following procedures:

(A) Extend the confirmation at the end of the reporting period.

(B) Extend the tests conducted in 8 to 14 above.

(C) Request the client to re-check the recorded liabilities at the end of the reporting

period.

(D) Request the client to record an acceptable adjustment based on the estimated

population error in the evaluation for trade payables.

18. Review unpaid suppliers invoices and unmatched receiving reports shortly before the

completion of fieldwork. Identify any items that represent unrecorded liabilities at the

end of the reporting period.

TESTING ACCRUED EXPENSES AND PROVISIONS

19. Test for omission and other understatement of accrued liabilities and provisions. Do

this by examining documentation and by checking calculations to ensure that adequate

(but not excessive) provision has been made for the items listed in (A) to (J) below.

Where there is no independent evidence available concerning the amount of an accrued

expense, test the debits to the accrual accounts by comparing with internal evidence of

validity and with paid cheques, etc.

(A) Periodic payments (e.g. rent, utilities, insurance, etc)

(B) Accrued salaries, wages and employers social security contributions.

(C) Accumulated holiday pay.

(D) Accrued commissions and bonuses.

(E) Payroll deductions (e.g. PAYE, NI, and retirement benefit contributions.)

(F) Professional charges.

(G) Directors remuneration.

(H) Royalties and similar charges.

(I)

Further expenditure for completed work and after-sales service (e.g. warranties.)

(J) VAT.

20. In addition, test for omission of other accrued expenses and provisions, by comparing

with accrued expenses and provisions in previous years, by comparing with expenses

incurred during the year, by making enquiry, and by other appropriate methods.

RESERVATION OF TITLE

21. (A) Use the information obtained from 9 above and step 5(C) of the AP for income and

expenses purchases, to ensure for the selected suppliers that the year-end liability

for goods purchased subject to reservation of title is not understated.

(B) Test the items comprising the disclosed secured liability for overstatement.

(C) Review the tax correspondence to ensure that it is appropriate for the tax

computation to be prepared on the commercial basis. If it is not, and if the

legal basis applies, seek advice from the tax department.

Note:

The commercial basis of the contract is that the goods are treated as purchases

in the accounts of the purchasing company and as sales in the accounts of the

selling company. The legal basis means that the relevant goods are not treated

as either a sale or a purchase until the buyer has paid for them.

(D) Record in the working papers the work we have done and the enquiries we made.

3725

SESSION 37 APPENDIX 3 AUDIT PROGRAMS

REVIEWING THE CLASSIFICATION OF BALANCES

22. Examine the listing of liabilities at the end of the reporting period, and reclassify debit

balances, non-current balances and inter-group balances where appropriate.

SETTING-OFF OF BALANCES

23. Ensure that:

(A) A legal right of set-off exists where receivable and payable balances have been set

off.

(B) The client has made all known material set-offs in the financial statements.

3726

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- 7th & 8th SheduleDokument3 Seiten7th & 8th SheduleTareq ChowdhuryNoch keine Bewertungen

- The Income Tax Ordinance, 1984 (CHAPTER-VI Exemptions and Allowances)Dokument12 SeitenThe Income Tax Ordinance, 1984 (CHAPTER-VI Exemptions and Allowances)Tareq ChowdhuryNoch keine Bewertungen

- Taxp 15 18aDokument11 SeitenTaxp 15 18aTareq ChowdhuryNoch keine Bewertungen

- Taxp 15 18aDokument11 SeitenTaxp 15 18aTareq ChowdhuryNoch keine Bewertungen

- Taxp 02 03Dokument5 SeitenTaxp 02 03Tareq ChowdhuryNoch keine Bewertungen

- The Second ScheduleDokument12 SeitenThe Second ScheduleTareq ChowdhuryNoch keine Bewertungen

- 1st Schedule (Part ABC)Dokument8 Seiten1st Schedule (Part ABC)Tareq ChowdhuryNoch keine Bewertungen

- KPMG TestDokument1 SeiteKPMG TestTareq ChowdhuryNoch keine Bewertungen

- ACC702 Managerial Accounting Group Assessment Task T1-15Dokument8 SeitenACC702 Managerial Accounting Group Assessment Task T1-15Tareq ChowdhuryNoch keine Bewertungen

- F8 AA (Int) Session20 - j08 PDFDokument8 SeitenF8 AA (Int) Session20 - j08 PDFTareq ChowdhuryNoch keine Bewertungen