Beruflich Dokumente

Kultur Dokumente

ZCCM Ih Profile

Hochgeladen von

IBEX HILLOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ZCCM Ih Profile

Hochgeladen von

IBEX HILLCopyright:

Verfügbare Formate

ZCCM INVESTMENT HOLDINGS PLC

ZCCM INVESTMENT HOLDINGS PLC

COMPANY PROFILE

ZCCM INVESTMENT HOLDINGS PLC

ZCCM-INVESTMENT HOLDINGS PLC

COMPANY PROFILE

CONTENTS

Introduction and Background

Objectives of the Company

Board of Director

Management

Investment Criteria

Investment Portfolio

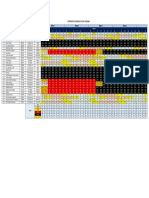

Financial Highlights for Year Ending June 2005

Corporate Information

Company Profile

ZCCM INVESTMENT HOLDINGS PLC

ZCCM INVESTMENTS HOLDINGS PLC

COMPANY PROFILE

INTRODUCTION AND BACKGROUND

His Excellency the President of the Republic of Zambia was recently quoted

referring to ZCCM-Investments Holdings plc (ZCCM-IH) as the business face of

the Government of the Republic of Zambia.

ZCCM-IH is a successor company to Zambia Consolidated Copper Mines Limited

(ZCCM) in which the Government of the Republic of Zambia (GRZ) holds 87.6%

of the shares with the remaining 12.4% held by private investors. ZCCM-IH

shares held by private investors are listed on the Lusaka Stock Exchange, Paris

Euronext and London Stock Exchanges under ISIN number ZM0000000034. The

geographical spread of the minority shareholders, who number around 2400,

covers about 29 countries in Europe, Africa, the Caribbean, Australia, Asia and

the USA.

Until 31 March 2000, ZCCM Ltd was a 60.3% state-owned mine operating

company in which Zambia Copper Investments Ltd (ZCI), an associate company

of Anglo American Plc, held 27.3% of shares with the balance of 12.4% of shares

held by private investors.

The privatisation of ZCCM commenced in 1996, after GRZ and the Boards of

ZCCM and the Zambia Privatisation Agency (ZPA) approved the ZCCM Limited

Privatisation Report and Plan presented by UK based financial and legal

advisors, NM Rothschild & Sons and Clifford Chance, respectively.

The objectives, which the Government was seeking to achieve through the

privatisation of ZCCM, were to:

Transfer control of and operating responsibilities for ZCCMs operations to

private sector mining companies as quickly as practicable;

Mobilise substantial amounts of committed new capital for

operations;

Ensure that ZCCM realised value for its assets and retained a significant

minority interest in principal mining operations;

Transfer or extinguish ZCCMs liabilities, including its third party debt;

Diversify ownership of Copperbelt assets;

3

Company Profile

new

ZCCM INVESTMENT HOLDINGS PLC

Promote Zambian participation in the ownership and management of the

mining assets; and

Conduct the privatisation as quickly and transparently as consistent with

good order, respecting other objectives and observing ZCCMs existing

contractual obligations.

The mode of privatisation adopted by GRZ was to unbundle ZCCM and sell its

assets in business packages. The reason for unbundling ZCCM into business

packages was to promote diversity of ownership and minimise political and

economic risks.

A two-stage privatisation process was adopted. Under Stage 1, majority interests

in the packages relating to certain of ZCCMs mining and pool distribution

operations were offered to trade buyers, which was to leave the transformed

ZCCM as an Investments Holdings Company, with minority interest in each of

these packages.

Stage 2 of the privatisation of ZCCM envisaged GRZ disposing of some or all of

its shareholding, with part of this being earmarked for Zambian institutional and

private investors as a way of promoting Zambian participation in the mining

sector.

GRZ obtained the support of the World Bank and the Nordic Development Fund

for the Copperbelt Environment Project (CEP), to address environmental

liabilities and obligations remaining with GRZ/ZCCM-IH following the privatization

of mining assets.

The Environmental Management Facility (EMF) which is composed of multiple

stakeholders, working as the EMF Steering Committee, was established by the

Minister of Finance and National Planning as provided for by the protocols, for

the purpose of prioritizing and approving subprojects of the CEP for funding. The

project which became effective on 31st July 2003 ends in August 2008.

Apart from environmental responsibilities ZCCM-IH has the additional

responsibility of managing the ex ZCCM employees trust fund and also the

finalization of the sale of ZCCM properties.

Company Profile

ZCCM INVESTMENT HOLDINGS PLC

OBJECTIVES OF THE COMPANY

In line with the company vision To be the leading Zambian Investment

Company in mining and preferred partner in other sectors of economic

development.

The

Board

of

Directors

of

ZCCM-IH

adopted the Code of Corporate Governance for Boards of Directors in Zambia.

This was done in order to reconfirm and safeguard continued distinct separation

of powers between the Board of Directors and Executives in the management of

the Company.

In its transformed form as an investments holding company, the main functions of

the Company are as follows:

-

To monitor commercial and corporate agreements (excluding development

agreements) entered into by the privatized mining companies and to

ensure compliance;

To have and appoint representatives on the Boards of Directors of the

subsidiaries and other companies in which the minority investments are

held;

To monitor the investments by attendance at the Board Meetings and

tracking of financial and operational performance;

To receive returns on the investments in form of dividends; and

To liaise with prospective green field investors in the mining industry

seeking to enter into Agreements with the Government.

BOARD OF DIRECTORS

ZCCM-IH is lead by a Board of Directors whose Membership comprises leading

figures from private commerce and Government institutions, namely: the

Chairman and at least one Director who are nominated from the Private Sector;

Deputy Governor of the Central Bank; Commissioner of the Revenue Authority;

Chief Executive Officers (Permanent Secretaries) in the Ministry of Finance and

National Development; Ministry of Mines and Minerals Development and Ministry

of Energy and Water Development.

The Company has three working Committees of the Board, namely the Audit,

Investment and Remuneration Committees and the membership of each one is

there except Investments which has at least four non-executive directors.

Company Profile

ZCCM INVESTMENT HOLDINGS PLC

The names of the current non-executive directors as indicated below:

Mr A.J Lungu

Mr L Nkhata

Mr C Evans Chibiliti

Dr D H Kalyalya

Mrs L I Ngandwe

Dr DH Kayalya

Mr P Mumba

Non-Executive Chairman

MANAGEMENT

ZCCM-IH is run on a day-to-day basis by a dedicated multidisciplinary

management team. The most apparent attribute of the team is its heterogeneous

composition and cohesive nature. Each member of the team brings varied but

complimentary skills that range from mining and chemical engineering,

economics, project management, corporate finance, banking, and investment

appraisal and management. In essence, the skill set reinforces and mirrors the

Companys commitment to fulfilling an important role post privatisation. At

present, the teams focus is on accessing high quality deals, structuring

incentivised participation vehicles and delivering added value to its investee

companies and other stakeholders.

At the moment ZCCM-IH employs a total of Fifty-Nine (59) people under a Hybrid

Structure that comprises the Companys core functional departments of

investments, company secretarial and finance, technical, property and legal

activities, on the one hand. The other side of the hybrid structure houses the

Companys environmental operations (Copperbelt Environmental Project), which

are separately funded and provided for under a pure project format without

constraints within the limits of final accountability.

The following is the composition of the management team:

Chief Executive Officer

Company Secretary

Legal Manager

Environmental Manager

Finance Manager

Technical Manager

Investments Manager

Company Profile

ZCCM INVESTMENT HOLDINGS PLC

INVESTMENT CRITERIA

All investments undertaken by ZCCM-IH shall seek to achieve a positive Net

Present Value (NPV) and Internal Rate of Return (IRR) in excess of annual

inflation and the GRZ 5-year bond rate.

The Company shall not seek management participation or control, and to this

end, shall not hold more than 49% of the shareholding in any of its investments,

unless under exceptional circumstance.

The Company will look favorably at investments that are in line with the

Empowerment and Investment Acts in terms of local shareholding, employment

creation and the amount of reinvestment into the business. Others include

acceptable environmental practices and the retention of capital within Zambia.

In the case where the Company is unable to commit fully in terms of taking up an

equity stake but is confident of the company making a meaningful contribution,

consideration may be given to buying convertible loan stock. These could be

converted to shares if the company is successful or redeemed within a stipulated

period.

As a general rule the Company will make investments in the range of US

$500,000 and upwards to US $20,000,000.

PRESENT INVESTMENT PORTFOLIO

ZCCM-IH has the following shareholding interests:

-

Konkola Copper Mines Plc

20.6%

Kansanshi Copper Mines Plc

20.0%

Copperbelt Energy Corporation Plc

20.0%

Luanshya Copper Mines Plc

15.0%

NFC Africa Mining Plc

15.0%

Chibuluma Mines Plc

15.0%

Chambishi Metals Plc

10.0%

Mopani Copper Mines Plc

10.0%

Equinox Minerals Ltd /Lumwana Copper Mines

5.75%

Maamba Collieries

100%

Ndola Lime Company Limited

100.0%

Konkola North Mining Project

{option to take up 15% or 20%}

Company Profile

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 2 K 12 VoltDokument424 Seiten2 K 12 VoltIBEX HILLNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- 5series Sedan CatalogueDokument47 Seiten5series Sedan CatalogueIBEX HILLNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Pikes Peak MapDokument1 SeitePikes Peak MapIBEX HILLNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Iintermediate Microeconomics 3rd YearDokument493 SeitenIintermediate Microeconomics 3rd YearIBEX HILLNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- App Roster May 2021Dokument1 SeiteApp Roster May 2021Cory PurbaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Integrated - Tata Steel CaseDokument14 SeitenIntegrated - Tata Steel CaseJyoti GuptaNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Frequently Asked Questions: Safety and HealthDokument5 SeitenFrequently Asked Questions: Safety and HealthAnusmita BhowmickNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Gold Prices FluctuationsDokument6 SeitenGold Prices Fluctuationskuldeep_chand10Noch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- 216 - JSAW Annual Report 2013 14Dokument137 Seiten216 - JSAW Annual Report 2013 14utalentNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Data Mining OverviewDokument14 SeitenData Mining OverviewAnjana UdhayakumarNoch keine Bewertungen

- Summary Judgment by Minnesota District Court Judge Mary Leahy On Minnesota Sands ChallengeDokument21 SeitenSummary Judgment by Minnesota District Court Judge Mary Leahy On Minnesota Sands ChallengeSally Jo Sorensen100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Intro and Definition EXCAVATORDokument2 SeitenIntro and Definition EXCAVATORMisz_10_ScorpioNoch keine Bewertungen

- Analysis of The Value - Added For Tayan Bauxite Ore and Chemical Grade AluminaDokument12 SeitenAnalysis of The Value - Added For Tayan Bauxite Ore and Chemical Grade AluminaSas MikoNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Modern Placer MiningDokument36 SeitenModern Placer MiningHarshitShuklaNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Determination of Ultimate Pit LimitsDokument16 SeitenDetermination of Ultimate Pit LimitsOrlando Chura Torres100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- IDEX India Retail, June 2012Dokument60 SeitenIDEX India Retail, June 2012New Acropolis MumbaiNoch keine Bewertungen

- ACC Cement Research Report and Equity ValuationDokument12 SeitenACC Cement Research Report and Equity ValuationSougata RoyNoch keine Bewertungen

- Business Case - Blue Mine GroupDokument34 SeitenBusiness Case - Blue Mine GroupLungisaniNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Company Profile Radiant Utama GroupDokument28 SeitenCompany Profile Radiant Utama GroupryandoundipNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Argument On Workplace SafetyDokument2 SeitenArgument On Workplace SafetyEeshan BhagwatNoch keine Bewertungen

- Strategic Mine Planning Integrating Computer Software, Simulation, and Social ResponsibilityDokument66 SeitenStrategic Mine Planning Integrating Computer Software, Simulation, and Social ResponsibilityLuis BNoch keine Bewertungen

- MINING ENGINEERING II Applied Mathematics SolutionsDokument35 SeitenMINING ENGINEERING II Applied Mathematics Solutionsronnel laurenteNoch keine Bewertungen

- Shaft, Tumbler Drive: 4100XPC Electric Shovel Parts Manual Machine Serial Number: 41271Dokument2 SeitenShaft, Tumbler Drive: 4100XPC Electric Shovel Parts Manual Machine Serial Number: 41271Francisco Javier González LópezNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- N2016 001 Scoggings Et Al. Reporting Exploration Results and Mineral Resources For Lithium Mineralised Pegmatites - v2 PDFDokument10 SeitenN2016 001 Scoggings Et Al. Reporting Exploration Results and Mineral Resources For Lithium Mineralised Pegmatites - v2 PDFAbaz NurzainNoch keine Bewertungen

- One Night at The Call CenterDokument11 SeitenOne Night at The Call CenterSampat PrajapatiNoch keine Bewertungen

- Company Profille PT - Timah TBKDokument2 SeitenCompany Profille PT - Timah TBKAbrar RamadhanNoch keine Bewertungen

- (Quantitative Geology and Geostatistics 19) J. Jaime Gómez-Hernández, Javier Rodrigo-Ilarri, María Elena Rodrigo-Clavero, Eduardo Cassiraga, José Antonio Vargas-Guzmán (eds.) - Geostatistics Valencia .pdfDokument949 Seiten(Quantitative Geology and Geostatistics 19) J. Jaime Gómez-Hernández, Javier Rodrigo-Ilarri, María Elena Rodrigo-Clavero, Eduardo Cassiraga, José Antonio Vargas-Guzmán (eds.) - Geostatistics Valencia .pdfMaría Fernanda RamírezNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Mats PPT (Draft)Dokument18 SeitenMats PPT (Draft)Arpit ShuklaNoch keine Bewertungen

- Maptek Vulcan BrochureDokument11 SeitenMaptek Vulcan BrochureMunajat Nursaputra100% (1)

- NewsRelease - Appointment of VECV As New SEM Channel Partner in India FINAL - 4may17 - RoutedDokument2 SeitenNewsRelease - Appointment of VECV As New SEM Channel Partner in India FINAL - 4may17 - RoutedFirdaus AliNoch keine Bewertungen

- Company Profile of Pama PersadaDokument2 SeitenCompany Profile of Pama PersadairsyadjamaludinNoch keine Bewertungen

- Gold HistoryDokument4 SeitenGold HistoryRakesh WalaNoch keine Bewertungen

- Year Minimills 2010Dokument8 SeitenYear Minimills 2010mishtinilNoch keine Bewertungen

- SAS TrainingDokument11 SeitenSAS TrainingShiva KumarNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)