Beruflich Dokumente

Kultur Dokumente

SPE 108081 Stochastic Modelling of Shale Gas Resource Play Economics

Hochgeladen von

David MontoyaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SPE 108081 Stochastic Modelling of Shale Gas Resource Play Economics

Hochgeladen von

David MontoyaCopyright:

Verfügbare Formate

SPE 108081

Stochastic Modelling of Shale Gas Resource Play Economics

Charles Stabell, SPE, Rosella Gonzales, SPE, and Espen Langlie, GeoKnowledge AS

Copyright 2007, Society of Petroleum Engineers

This paper was prepared for presentation at the 2007 SPE Hydrocarbon Economics and

Evaluation Symposium held in Dallas, Texas, U.S.A., 13 April 2007.

This paper was selected for presentation by an SPE Program Committee following review of

information contained in an abstract submitted by the author(s). Contents of the paper, as

presented, have not been reviewed by the Society of Petroleum Engineers and are subject to

correction by the author(s). The material, as presented, does not necessarily reflect any

position of the Society of Petroleum Engineers, its officers, or members. Papers presented at

SPE meetings are subject to publication review by Editorial Committees of the Society of

Petroleum Engineers. Electronic reproduction, distribution, or storage of any part of this paper

for commercial purposes without the written consent of the Society of Petroleum Engineers is

prohibited. Permission to reproduce in print is restricted to an abstract of not more than

300 words; illustrations may not be copied. The abstract must contain conspicuous

acknowledgment of where and by whom the paper was presented. Write Librarian, SPE, P.O.

Box 833836, Richardson, Texas 75083-3836 U.S.A., fax 01-972-952-9435.

Abstract

Unconventional petroleum resource plays present unique

assessment challenges. These large, single accumulations

cannot be counted and analysed as discrete entities that are

delineated by down-dip water contacts. Equally important, the

main assessment challenge relates to exploitation risks and

uncertainties. This paper presents an integrated stochastic

assessment framework for decisions related to shale gas

resource plays. The shale gas resource play is modelled as a

set of discrete cells that have not been explored (exploited)

and that have the potential for economic production. The

distinctive aspect of the modelling tool is the use of stochastic

simulation to calculate the risks of failure in either the

exploration, the appraisal/pilot, or the exploitation phases of

the project on the basis of both sub-surface uncertainties and

above-surface activity performance, cost and duration

uncertainties. The tool also generates stochastic performance

metrics that capture alternative outcome scenarios, economic

returns and the delivery schedule of production and reserves.

The performance metrics support both project-level and

portfolio-level decisions related to unconventional resource

plays. Project-level application is illustrated using data from a

Canadian shale gas resource play.

Introduction

Unconventional petroleum assets are large single

accumulations. They form a geologically diverse group, but

include coal-bed methane (CBM), tight gas and fractured shale

gas.

All unconventional petroleum assets share some

important characteristics:

they are often very large

accumulations, many of the largest accumulations are known

in the sense that we know where they are: The assets cannot

be counted and analysed as discrete entities that are delineated

by down-dip water contacts (Schmoker, 1999) as are

conventional accumulations and fields. They are therefore

also frequently referred to as continuous accumulations.

Unconventional petroleum assets present unique

assessment challenges. Estimates of in-place resources are not

very useful as recovery is key. Exploration is more like

appraisal, where the key decision is made after doing a pilot

test production that can prove the potential for commercial

production. Commercial production is often an issue of

investing in innovations that can facilitate effective,

manufacturing-style exploitation where scale is key. And the

key to commercial success is identification and exploitation of

what are potentially unevenly distributed and sparse number

of sweet spots. Referring to the localization of sweet spots in

coal based methane plays, Donovan (2001) states 75% of the

production in the San Juan Basin comes from 35% of the wells

on 5% of the acreage.

This paper presents the application of a framework for

integrated risk resource and economic value assessment of

unconventional petroleum assets (Stabell, 2005) that has been

applied to shale gas plays. The illustrative example is from a

potential Canadian shale gas play.

The analysis framework builds on the FORSPAN model

developed by the USGS (Schmoker, 1999, 2002). FORSPAN

is a stochastic geology- and engineering-based model for

assessment of the petroleum resources that can be recovered in

a finite forecast span (FORecast SPAN) from continuous

(unconventional) petroleum accumulations. Each continuous

petroleum accumulation is viewed as composed of a set of

discrete cells that have not been explored (exploited) and that

have the potential for economic production. Each cell is the

drainage area of a well. Assuming uniform well spacing, then

draining area and well spacing are synonymous model

parameters. Recoverable volumes can vary between cells,

with some cells being non-commercial.

One of the key elements in the framework is that it

includes modelling of the activities and economics of

exploring and exploiting the resource play with explicit

attention to costs, durations and production in order to

generate after-tax cash flow profiles.

Another important

element is the use of the sweet spot as the analytical unit of

analysis for both the assessment of the potential resources in

the unconventional asset and the modeling of how the asset is

explored and exploited. A sweet spot is a collection of cells

where production characteristics are particularly favorable.

The shorthand notation for the integrative framework is

therefore also SWEETR, for SWEET spot Resources

(Stabell, 2005).

There are a number of earlier published models and

approaches that are similar in that they include explicit

modelling of exploration and exploitation activities with

consideration of economic returns (see for example, White,

1981, Power and Jewkes, 1992, UGRSS, 2001). However, the

design of SWEETR reflects that the analysis framework is

directed at supporting decisions concerning investments in

technology improvement, asset acquisition and exploitation of

unconventional petroleum assets. Most of the other published

models have been directed at assessing reserves and

production potential for public policy making and resource

management. A notable exception is the approach advocated

by Haskett and Brown (2005).

The rest of the paper is organized as follows. First we

briefly review the Canadian shale gas scene. We then present

the analysis framework. In the following sections we review

in more detail the modelling of the in-place resources in a

single sweet spot as well as the model for

exploration/appraisal and exploitation of the single sweet spot.

The concluding discussion contrast and compares SWEETR

application to shale gas plays with other approaches.

In rest of this paper we use the term resource play as a

short hand notation for unconventional petroleum asset. We

think this label (that we have borrowed from Encana (2005) is

useful as it captures that the resources in the unconventional

petroleum asset are most often identified. The challenge is to

transform the resources into recovered reserves.

Canadian Shale Gas Plays

Shale gas plays are getting increasing interest in Canada

(Roche, 2006). The effort is however much less advanced

than in the US. There is therefore also much less public

information available for third-party assessments.

In this

paper we have considered broadly a potential play in eastern

British Columbia related to the Devonian Ireton and Duvernay

formations. The figures used are solely meant to be

illustrative where data in part is based on the assumption that

the target shale gas resource play might be viewed as a Barnett

Shale analog.

Integrated Modelling Framework

The modelling framework is an extended version of the

SWEETR framework (see Stabell, 2005).

The main

extensions involve the resource assessment module that can

explicitly handle both shale gas and CBM resource plays. It

also includes a new component for modelling the pilot

production that captures the appraisal phase of sweet spot

exploration. In addition single cell production uses a

hyperbolic model. Finally, the different components have

been implemented in an integrated software package.

Overview of framework

The SWEETR analysis framework consists of a set of distinct,

but interrelated modules that are used to estimate the number

and size of sweet spots in the resource play, to model the

SPE 108081

exploration for the sweet spots and the exploitation of

discovered sweet spots. Sweet spot exploitation consists of the

drilling and production of the cells in the sweet spot. The cell

is the basic analysis unit when modeling sweet spot

exploitation. The sweet spot is the basic analysis unit in the

modules that are used to estimate the number and size of sweet

spots in the resource play and model the exploration of the

resource play.

The overall logic of the analysis framework is quite simple

(Figure 1). The assessment module is used to estimate the

ultimate number of sweet spots in the resource play. The

resource play exploration models the pilot production required

to verify identification of a sweet spot in the play. The sweet

spot exploitation module models the drilling and production of

petroleum from the cells in a discovered sweet spot.

Assessment of Resource Play

Size distribution of

Sweet Spots

Resource Play

Exploration & Exploitation

Technology

Investment

Exploration for

Sweet Spot

Sweet Spot Exploitation

Sweet Spot

infrastructure

Single Cell

drilling & production

Resource Play

HC & AT Cash Flows

HC & After Tax

Cash Flows

Figure 1. Analysis Framework

The output of the risk, resource and value assessment is a

stochastic estimate of economic returns from investing in the

resource play based on generation of stochastic net cash flow

profiles as well as petroleum production profiles.

Assesment of resource play

The unit of analysis in the resource play is the sweet spot. A

sweet spot is a collection of cells. A cell has a standard area

and is usually the drainage area of a single well or the spacing

of wells. The in-place resources in a cell are estimated by a

yield per cell area.

The areal extent of the untested portion of the resource

play defines a maximum number of cells. Sweet spots can

have a variable number of cells that are represented by a

probability distribution.

The number of potential sweet spots is also represented by

a probability distribution. The number of potential sweet spots

and the size distribution of sweet spots will typically be

negatively correlated in order to reflect that there is a finite

amount of untested cells in the resource play.

The probability of finding a sweet spot defines the number

of sweet spots in the resource play. SWEETR is primarily

SPE 108081

aimed at proven resource plays. The probability of the

existence of the resource play is therefore set to 1.0. The

framework can however also deal with frontier (unproven)

resource plays.

The cells in a sweet spot can be viewed as contiguous,

although the important implication is that they share a

meaningful threshold in terms of shared investments and

infrastructure. As is apparent in modeling of the exploration

and exploitation of the resource play, besides the number and

size of the sweet spots, the other important implication of a

finite number of sweet spots is that there is a probability of

exploring what turns out to be a sour spot the equivalent

of a dry hole in conventional resource exploration. There is a

minimum sweet spot size.

Both the estimated size distribution and the number of

sweet spots need to be calibrated to reflect the level of

technology for exploiting the unconventional petroleum

resources in the resource play.

determines which of the remaining undiscovered sweet spots

in the resource play that has been identified.

An exploration capacity parameter controls how many

pilots on the resource play can be in progress at the same time.

A failure tolerance in terms of number of failed pilots can stop

further exploration of a resource play.

Failure pilots and success pilots have different costs and

duration to reflect that early results might clarify failure while

success requires performing a complete pilot sequence.

The exploitation module (see below) models drilling and

producing out the discovered sweet spot. The results of the

exploitation of the sweet spot in terms of a combined set of

petroleum production profiles and after tax net cash flows are

returned to the resource play exploration module for

aggregation.

Overall aggregates in terms of production profiles and

cumulative production as well as after-tax cash flows are used

to estimate economic performance of the effort to explore and

exploit the resource play.

The time horizon of both the sweet spot exploration effort

and the net cash flow discounting is defined explicitly. The

importance of the former will depend on the number of sweet

spots in the resource play and the rate at which they can be

explored and exploited. If desired, the simulation can be run

until the whole resource play has been played out.

Figure 2. Sweet spot size-by-rank

The main output of the resource assessment module is the

simulated size-by-rank of sweet spots in the resource play

(Figure 2). The assessment module also produces an estimate

of the total in-place resources in the untested area of the

resource play in addition to the estimate of the total number of

untested cells in the play and proportion of the untested area in

the resource play that is covered by cells.

Exploration of resource play

Exploration for sweet spots involves identification of the

potential location of a sweet spot (pre-pilot investigation),

acquisition of acreage, pilot production in a potential sweet

spot to test for sweet spot performance. Each activity has both

costs and durations. A failure (sour spot) results in both costs

and lost time.

The probability of finding a sweet spot determines whether

the pilot is successful. An exploration efficiency coefficient

The exploration and exploitation of the resource play can

also involve an initial development activity designed to

improve the technology required to both explore and exploit

the resource play. The duration and costs of the technology

improvement effort are included in the resource play

exploration and exploitation model. However, the effects of

the investment on sweet spot size, well productivity, drilling

durations and costs are handled exogenously in the

framework.

Exploitation of a sweet spot

Sweet spot exploitation models the drilling and production of

petroleum from the collection of cells in sweet spot. Activity

costs and durations as well as petroleum production are

modeled at the level of the individual cell.

Cell level drilling duration, drilling costs, operating costs

and well productivity is required in order to be able to capture

learning effects. Durations, costs and productivity are defined

as a function of cumulative number of wells drilled where

costs and durations will decrease with cumulative number of

wells while well productivity will increase with cumulative

number of wells.

Cell production is defined by an estimate of in-place

resources, an initial well production rate and a hyperbolic

exponent for each well.

SPE 108081

Number of rigs combined with the single cell drilling

duration defines the effective rate of drilling out the cells in

the sweet spot.

Duration and investment in shared production and

transportation infrastructure are defined for the sweet spot.

There can also be an incremental acreage acquisition fee.

Revenue and cost profiles are based on petroleum price

scenarios and cost inflation rate scenarios. Fiscal terms are

modeled explicitly in order to generate after tax cash flows.

The output of the sweet spot exploitation module is a

production profile for the sweet spot as a whole as well as net

before-tax and after tax-cash flows. The resource play

exploration and exploitation module aggregates the results of

sweet spot exploitation for over the set of sweet spots that are

successfully explored.

Figure 3. Aggregate yearly production for single sweet spot (in

million scf)

Estimating the Sweet Spot IGIP

Resource estimates of initial gas in place (IGIP) for the sweet

spot are the sum of free (fracture) gas and adsorbed gas.

These resources are modelled as two separate virtual

reservoirs for respectively the adsorbed and the free gas.

The free gas reservoir (called a segment) is modelled using

a traditional volumetric model while the adsorbed reservoir

includes parameters for shale density and gas content (see

Figure 4).

Figure 4. Separate segments for adsorbed & free gas

The two reservoirs capture the same bulk rock volume and the

overall resources are then the stochastic summation of the

resources with 100% correlated bulk volumes (see Figure 5).

Figure 5. Total IGIP

Sweet spot economics

Single sweet spot economics are modelled as a four-stage

process (see Figure 6). The two first stages are the exploration

phase that provides the initial identification of the sweet spot

and the appraisal phase that executes a pilot production.

Successful pilot production is then the basis for initiating the

development activities and the production for the sweet spot.

Development involves investment in necessary additional

infrastructure and facilities for initiating a manufacturing-like

style drilling and production.

Figure 6. Sweet spot exploration and exploitation

SPE 108081

Transitioning from the exploration to the appraisal phase

is controlled by the success of identifying a potential sweet

spot. Transitioning from the appraisal phase to exploitation

(development and production) is controlled by the results of

the pilot production.

The overall cash flow results are summarized in a box plot

(see Figure 7).

Figure 8. Sweet spot NPV outcomes

Concluding discussion

Figure 7. Overall cash flow from sweet spot project (in million

USD)

There are numerous other reports from the simulation of

the sweet spot economics that provide a basis for both

verifying and interpreting the implications for a decision to

invest in a sweet spot. A simple binary tree summarizes the

main activity outcomes (see Figure 7). As can be seen, the

simulation run summarized indicates that there is 25% chance

of not identifying a sweet spot. There is 18% chance that the

pilot production will not be successful while there is a 57%

chance of going to production.

This paper has presented the structure, main elements,

motivation and application of a framework for integrated

evaluation of risks, resources and value in shale gas resource

plays. The framework is modular, flexible and can be applied

to other types of unconventional resources.

We have reviewed the assessment of full cycle economic

evaluation of a single sweet spot in the shale gas resource

play.

Assessing the complete resource play involves

replicating the exploration-appraisal-development-production

activities for the other sweet spots in the play. In other words,

the activity definitions (see Figure 10) for the single sweet

spot are repeated for the other sweet spot targets in the

resource play.

Figure 8. Summary overview of sweet spot activity outcomes

The overall EMV of the illustrative project for the targeted

sweet spot is USD 124.6 million. Figure 9 shows the full

distribution of the estimated NPV outcomes.

Figure 10. Sweet spot acitivity definition

A key aspect of the approach advocated is that we assume

that wells in a sweet spot have similar but not necessarily

identical performance. This assumption can obviously be

relaxed. In the extreme case, the whole resource play can be

viewed as a single entity with full variability in well

performance. We then either ignore or assume that there is

we are not able to map any spatial, geological pattern in the

performance of reservoirs and associated wells.

References

Donovan, W.S., 2001, Coalbed Methane Content Determined with

Mudlogging Methods: abstract, The Outcrop, RMAG

Newsletter, 50, 11, November 2001.

Haskett, W.J., P. J. Brown, 2005, Evaluation of Unconventional

Resource Plays, SPE 96879, SPE Hydrocarbon Economics and

Evaluation Symposium 2005.

Roche, P., 2006, Liberation Play, New Technology Magazine,

Oct/Nov.

Schmoker, J.W., 1999, U.S. Geological Survey assessment model for

continuous (unconventional) oil and gas accumulatins the

FORSPAN model: U.S. Geological Survey Bulletin 2168,

Accessed December 1999.

Schmoker, J.W., 2002, Resource-assessment perspectives for

uncoventional gas systems, AAPG Bulletin, 86, 11, November,

pp. 1993-1999.

U.S. Geological Survey National Oil and Gas Resource Assessment

Team, 1995, 1995 national assessment of United States oil and

gas resources: U.S. Geological Survey Circular 1118, 20 p.

SPE 108081

Das könnte Ihnen auch gefallen

- Agra Wal 2012Dokument11 SeitenAgra Wal 2012rafaelNoch keine Bewertungen

- Screening Eor Spe 129768 Ms PDokument10 SeitenScreening Eor Spe 129768 Ms PDavidNoch keine Bewertungen

- Spe 135396 PaDokument11 SeitenSpe 135396 PaChris LimNoch keine Bewertungen

- SPE-180108-MS Robust Optimization of Unconventional Reservoirs Under UncertaintiesDokument11 SeitenSPE-180108-MS Robust Optimization of Unconventional Reservoirs Under Uncertaintiesoppai.gaijinNoch keine Bewertungen

- SPE 152371-STU Improved Estimation of Bubble Point Pressure of Crude Oils: Modelling by Regression AnalysisDokument14 SeitenSPE 152371-STU Improved Estimation of Bubble Point Pressure of Crude Oils: Modelling by Regression AnalysisHomayoun NajafiNoch keine Bewertungen

- Boniface Obah Et AlDokument12 SeitenBoniface Obah Et AlIbama MirillaNoch keine Bewertungen

- Probabilistic Approach Takes You Back To RealityDokument8 SeitenProbabilistic Approach Takes You Back To RealityCursi OchoNoch keine Bewertungen

- SPE-166365-MS-P - Comparison of Decline Curve Analysis Methods With Analytical Models in Unconventional Plays - 2013Dokument32 SeitenSPE-166365-MS-P - Comparison of Decline Curve Analysis Methods With Analytical Models in Unconventional Plays - 2013Belen FourcadeNoch keine Bewertungen

- SPE-170669-MS The Use of Reservoir Simulation in Estimating ReservesDokument14 SeitenSPE-170669-MS The Use of Reservoir Simulation in Estimating Reservesvladimirch86Noch keine Bewertungen

- Research Paper Topics For PetroleumDokument7 SeitenResearch Paper Topics For Petroleumkpikaaaod100% (1)

- List of Thesis Topics For Petroleum EngineeringDokument5 SeitenList of Thesis Topics For Petroleum EngineeringPortland100% (1)

- SPE-193518-MS Optimal Well Placement in A Brown Field: Integrating Subsurface Data, Surface Constraints and Business GoalsDokument13 SeitenSPE-193518-MS Optimal Well Placement in A Brown Field: Integrating Subsurface Data, Surface Constraints and Business GoalsMarcos SilvaNoch keine Bewertungen

- Monte Carlo - EgemenDokument6 SeitenMonte Carlo - EgemenAhmed RaafatNoch keine Bewertungen

- Reservoir SimulationDokument4 SeitenReservoir SimulationASaifulHadiNoch keine Bewertungen

- Monte Carlo - EgemenDokument6 SeitenMonte Carlo - Egemenjoo123456789Noch keine Bewertungen

- SPE 164820 MS Probabilistic and Deterministic Methods Applicability in Unconventional Reservoirs PDFDokument12 SeitenSPE 164820 MS Probabilistic and Deterministic Methods Applicability in Unconventional Reservoirs PDFNGT56Noch keine Bewertungen

- Eor ScreeningDokument25 SeitenEor ScreeningMinh LeNoch keine Bewertungen

- Spe 96879 MS PDokument11 SeitenSpe 96879 MS PInnobaPlusNoch keine Bewertungen

- Sajad FalahDokument12 SeitenSajad FalahSajad FalahNoch keine Bewertungen

- Prototype Thesis For Petroleum EngineeringDokument4 SeitenPrototype Thesis For Petroleum EngineeringBuyPaperOnlineSingapore100% (1)

- Risk Analysis in ESP Failure 1.0Dokument31 SeitenRisk Analysis in ESP Failure 1.0emad ramadanNoch keine Bewertungen

- Petroleum Dissertation ExamplesDokument8 SeitenPetroleum Dissertation ExamplesCheapPaperWritingServiceSingapore100% (1)

- Analysis of Best Hydraulic Fracturing Practices in The Golden Trend Fields of OklahomaDokument1 SeiteAnalysis of Best Hydraulic Fracturing Practices in The Golden Trend Fields of OklahomaAliNoch keine Bewertungen

- Petroleum Engineering Dissertation TopicsDokument6 SeitenPetroleum Engineering Dissertation TopicsPaperHelpWritingSingapore100% (1)

- Modern Techniques For History Matching - Schulze-Riegert - GhedanDokument50 SeitenModern Techniques For History Matching - Schulze-Riegert - GhedanAbou Moslem Al AthariNoch keine Bewertungen

- Zhang 2019Dokument23 SeitenZhang 2019Romel Angel Erazo BoneNoch keine Bewertungen

- 2003 140 Uncertainty - QuantificationDokument9 Seiten2003 140 Uncertainty - QuantificationrezaNoch keine Bewertungen

- Lee2014 Monitoring Survey HODokument14 SeitenLee2014 Monitoring Survey HONOVI LESTARI YULIANINoch keine Bewertungen

- Spe 189969 PaDokument15 SeitenSpe 189969 PaChris PonnersNoch keine Bewertungen

- SPE-180084-MS Performance of CO - EOR and Storage Processes Under UncertaintyDokument19 SeitenSPE-180084-MS Performance of CO - EOR and Storage Processes Under Uncertaintyoppai.gaijinNoch keine Bewertungen

- SPE 130768 Multi-Field Asset Integrated Optimization BenchmarkDokument19 SeitenSPE 130768 Multi-Field Asset Integrated Optimization BenchmarkIndo UtamaNoch keine Bewertungen

- Spe 123561 MSDokument10 SeitenSpe 123561 MSJosé TimanáNoch keine Bewertungen

- Simplified Cost Models For Pre Feasibility Mineral EvaluationsDokument42 SeitenSimplified Cost Models For Pre Feasibility Mineral Evaluationschris.mwabaNoch keine Bewertungen

- SPE-180376-MS Optimization of CO - EOR Process in Partially Depleted Oil ReservoirsDokument17 SeitenSPE-180376-MS Optimization of CO - EOR Process in Partially Depleted Oil Reservoirsoppai.gaijinNoch keine Bewertungen

- Spe-123561-Ms NetPay WhatDokument10 SeitenSpe-123561-Ms NetPay WhatserviciosNoch keine Bewertungen

- (IOR) Spe-185640-MsDokument24 Seiten(IOR) Spe-185640-MsFaysal MalikNoch keine Bewertungen

- Viability of EORDokument20 SeitenViability of EORDavid OtálvaroNoch keine Bewertungen

- JPT2007 - 05 - Reserves Estimation-The Challenge For The IndustryDokument10 SeitenJPT2007 - 05 - Reserves Estimation-The Challenge For The Industry유인항Noch keine Bewertungen

- SPE-174583-MS Overview of Advancement in Core Analysis and Its Importance in Reservoir Characterisation For Maximising RecoveryDokument17 SeitenSPE-174583-MS Overview of Advancement in Core Analysis and Its Importance in Reservoir Characterisation For Maximising RecoveryRizwan KhanNoch keine Bewertungen

- SPE-139669-A Survey of CO2-EOR and CO2 Storage Project CostsDokument4 SeitenSPE-139669-A Survey of CO2-EOR and CO2 Storage Project Costsmiguel_jose123Noch keine Bewertungen

- Spe 123057Dokument17 SeitenSpe 123057Jose Gregorio Fariñas GagoNoch keine Bewertungen

- Aspects of Evaluating Mining ProjectsDokument12 SeitenAspects of Evaluating Mining ProjectsIury VazNoch keine Bewertungen

- EOR ReportDokument119 SeitenEOR Reportrarunr1100% (2)

- Optimization Models For Petroleum Field Exploitation: Handelsh0yskoleDokument209 SeitenOptimization Models For Petroleum Field Exploitation: Handelsh0yskoleSayaf SalmanNoch keine Bewertungen

- Production Prediction of Hydraulically Fractured Reservoirs Based On Material Balances v1Dokument31 SeitenProduction Prediction of Hydraulically Fractured Reservoirs Based On Material Balances v1Mario MNoch keine Bewertungen

- SPE 89382 A Guide To Chemical Oil Recovery For The Independent OperatorDokument11 SeitenSPE 89382 A Guide To Chemical Oil Recovery For The Independent OperatormsmsoftNoch keine Bewertungen

- Optimization Models For Petroleum Field Exploitation: Tore Wiig JonsbråtenDokument207 SeitenOptimization Models For Petroleum Field Exploitation: Tore Wiig JonsbråtenlhomkarpediemNoch keine Bewertungen

- SPE-186884-MS Revisiting EOR Projects in Indonesia Through Integrated Study: EOR Screening, Predictive Model, and OptimisationDokument19 SeitenSPE-186884-MS Revisiting EOR Projects in Indonesia Through Integrated Study: EOR Screening, Predictive Model, and OptimisationQueen DevilNoch keine Bewertungen

- Abstract:: Investigation of Reservoir Production Performance Using Decline Curve AnalysisDokument13 SeitenAbstract:: Investigation of Reservoir Production Performance Using Decline Curve AnalysisridhuanNoch keine Bewertungen

- Spe 179137 MSDokument26 SeitenSpe 179137 MSaxel.tokoNoch keine Bewertungen

- Software For Reservoir Performance Prediction: August 2015Dokument17 SeitenSoftware For Reservoir Performance Prediction: August 2015Prem Kumar MNoch keine Bewertungen

- 20200626195518Dokument3 Seiten20200626195518Diego RamirezNoch keine Bewertungen

- Framework For Maximizing Recovery From Oil FieldsDokument10 SeitenFramework For Maximizing Recovery From Oil FieldsJorge SalinasNoch keine Bewertungen

- Spe-152066-Pa (Repetido) PDFDokument12 SeitenSpe-152066-Pa (Repetido) PDFFrancisco LaguardiaNoch keine Bewertungen

- Drilling Risk OperationsDokument10 SeitenDrilling Risk OperationsPrem KishanNoch keine Bewertungen

- Experimental Design in Petroleum Reservoir StudiesVon EverandExperimental Design in Petroleum Reservoir StudiesNoch keine Bewertungen

- Fuel Cells: Technologies for Fuel ProcessingVon EverandFuel Cells: Technologies for Fuel ProcessingDushyant ShekhawatNoch keine Bewertungen

- Event Studies for Financial Research: A Comprehensive GuideVon EverandEvent Studies for Financial Research: A Comprehensive GuideNoch keine Bewertungen

- Saudi Aramco JournalDokument82 SeitenSaudi Aramco JournalDavid MontoyaNoch keine Bewertungen

- Petrel 2014 Quick Start GuideDokument6 SeitenPetrel 2014 Quick Start GuideDavid MontoyaNoch keine Bewertungen

- 07Dokument30 Seiten07David MontoyaNoch keine Bewertungen

- ECLIPSE Advanced Field Management Facilities - 02 PDFDokument19 SeitenECLIPSE Advanced Field Management Facilities - 02 PDFDavid MontoyaNoch keine Bewertungen

- Core-Scale Simulation of Polymer Flow Through Porous MediaDokument89 SeitenCore-Scale Simulation of Polymer Flow Through Porous MediaDavid MontoyaNoch keine Bewertungen

- 11V9 Members AttendanceDokument1 Seite11V9 Members AttendanceDavid MontoyaNoch keine Bewertungen

- Data Mining of Operator Benchmarking For Artificial Lift Information Rushmore ReviewsDokument23 SeitenData Mining of Operator Benchmarking For Artificial Lift Information Rushmore ReviewsDavid MontoyaNoch keine Bewertungen

- Spe 171342 MSDokument8 SeitenSpe 171342 MSDavid MontoyaNoch keine Bewertungen

- Spe 174521 MSDokument17 SeitenSpe 174521 MSDavid MontoyaNoch keine Bewertungen

- Dipen Baroda Follo-Up SheetDokument92 SeitenDipen Baroda Follo-Up Sheetanon-272209100% (1)

- MES ManualDokument122 SeitenMES ManualDenis AlfinNoch keine Bewertungen

- All Clear kl8 Unit3 Extra Test ADokument3 SeitenAll Clear kl8 Unit3 Extra Test AKaRtonEkNoch keine Bewertungen

- ELL-332 Electric Drives Lecture 3: Different Types of Load TorquesDokument25 SeitenELL-332 Electric Drives Lecture 3: Different Types of Load TorquesNikhil KumarNoch keine Bewertungen

- Actuador VAURIEN (ON-OFF)Dokument1 SeiteActuador VAURIEN (ON-OFF)Rafael SalazarNoch keine Bewertungen

- Motores de Fund.Dokument26 SeitenMotores de Fund.Edwing William Salhuana MendozaNoch keine Bewertungen

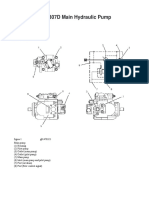

- Cat 307D Main Pump OperationDokument3 SeitenCat 307D Main Pump Operationkahandawala100% (1)

- NSGAFÖU 1,8/3 KV: Product InformationDokument3 SeitenNSGAFÖU 1,8/3 KV: Product InformationAttila HorvathNoch keine Bewertungen

- A Study of Integrated Choke Characteristic For EMI Filter DesignDokument4 SeitenA Study of Integrated Choke Characteristic For EMI Filter DesignDiego GutierrezNoch keine Bewertungen

- Ashrae 90.1-2010Dokument92 SeitenAshrae 90.1-2010asarlakNoch keine Bewertungen

- CMG StarsDokument2 SeitenCMG StarsSedighi100% (1)

- 1SDC210058L0201 Sace Tmax XTDokument8 Seiten1SDC210058L0201 Sace Tmax XTGrzegorz Greg KrukNoch keine Bewertungen

- The Hazards of Pork ScratchingsDokument1 SeiteThe Hazards of Pork ScratchingsSteve ForsterNoch keine Bewertungen

- TurbochargerDokument8 SeitenTurbochargersudheeshNoch keine Bewertungen

- Capability Statement WGIM Integrity Operating WindowsDokument3 SeitenCapability Statement WGIM Integrity Operating WindowsRomainKabs100% (2)

- Biblioteca Ingenieria Petrolera 2015Dokument54 SeitenBiblioteca Ingenieria Petrolera 2015margaritaNoch keine Bewertungen

- A Novel High-Gain DC-DC Converter Applied in Fuel Cell VehiclesDokument13 SeitenA Novel High-Gain DC-DC Converter Applied in Fuel Cell Vehiclesrock starNoch keine Bewertungen

- Shaffer Et Al. - 2003 - Foraging Effort in Relation To The Constraints ofDokument9 SeitenShaffer Et Al. - 2003 - Foraging Effort in Relation To The Constraints ofBenjamin MendezNoch keine Bewertungen

- Generator Selection Calculation: 1 2 3 4 5 6 7 8 9 Total Load KvaDokument2 SeitenGenerator Selection Calculation: 1 2 3 4 5 6 7 8 9 Total Load KvaAmir SultanNoch keine Bewertungen

- Снимок экрана 2023-03-01 в 09.16.43Dokument48 SeitenСнимок экрана 2023-03-01 в 09.16.43Maksim ZolotarjovNoch keine Bewertungen

- Heat Transfer ActivityDokument4 SeitenHeat Transfer ActivityMark Angelo UyNoch keine Bewertungen

- ASTM G128 - Oxygen Awareness Write-Up#1Dokument26 SeitenASTM G128 - Oxygen Awareness Write-Up#1Indrajit SaoNoch keine Bewertungen

- Laboratory Equipment Dose CalibratorDokument9 SeitenLaboratory Equipment Dose CalibratorPedro978Noch keine Bewertungen

- Electrical CircuitsDokument53 SeitenElectrical Circuitssuganyav6Noch keine Bewertungen

- High Pressure Drilling Hoses: Fleximak Industrial CatalogueDokument5 SeitenHigh Pressure Drilling Hoses: Fleximak Industrial CatalogueitangNoch keine Bewertungen

- Sunlight Battery 12V 12ahDokument1 SeiteSunlight Battery 12V 12ahCarolyn MunozNoch keine Bewertungen

- Self Cleaning Hydro ScreensDokument4 SeitenSelf Cleaning Hydro ScreenssavuNoch keine Bewertungen

- S41/42 + S62 + S86 + S110 Plate Heat ExchangerDokument2 SeitenS41/42 + S62 + S86 + S110 Plate Heat ExchangerTrần Khắc ĐộNoch keine Bewertungen

- FMC Flowline Products & Services Catalog PDFDokument80 SeitenFMC Flowline Products & Services Catalog PDFsekead67% (3)

- 8015-0151-ENTR-41-411-EL-MS-41205 - A0 Method Statement For Cathodic Protection PDFDokument9 Seiten8015-0151-ENTR-41-411-EL-MS-41205 - A0 Method Statement For Cathodic Protection PDFCripoNoch keine Bewertungen