Beruflich Dokumente

Kultur Dokumente

DJT Aerospace

Hochgeladen von

J. Swift (The Bulwark)Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

DJT Aerospace

Hochgeladen von

J. Swift (The Bulwark)Copyright:

Verfügbare Formate

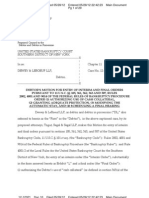

Case 14-12103-KG

Doc 704

Filed 12/30/14

Page 1 of 8

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

Chapter 11

Case No. 1412103 (KG)

In re:

TRUMP ENTERTAINMENT RESORTS,

INC., et al.,

(Jointly Administered)

Hearing Date: January 6, 2015, at 10:00 a.m.

Related Docket No. 638

Debtors.

LIMITED OBJECTION AND RESERVATION OF RIGHTS OF DJT

AEROSPACE LLC WITH RESPECT TO THE DEBTORS SECOND MOTION

FOR ENTRY OF AN ORDER, PURSUANT TO SECTIONS 105(a), 365(a) AND

554(a) OF THE BANKRUPTCY CODE, AUTHORIZING THE DEBTORS TO

REJECT CERTAIN EXECUTORY CONTRACTS AND UNEXPIRED LEASES,

NUNC PRO TUNC TO THE REJECTION EFFECTIVE DATE

DJT Aerospace LLC (DJT Aerospace), by and through its undersigned counsel,

hereby files this Limited Objection and Reservation of Rights (the Limited Objection) with

respect to the Debtors Second Motion for Entry of an Order, Pursuant to Sections 105(a),

365(a) and 554(a) of the Bankruptcy Code, Authorizing the Debtors to Reject Certain Executory

Contracts and Unexpired Leases, Nunc Pro Tunc to the Rejection Effective Date [D.I. 638] (the

Motion) 1 and respectfully states:

PRELIMINARY STATEMENT

1.

DJT Aerospace is the counterparty to the Helicopter Lease with the Debtors. It

does not object to the ultimate rejection of the Helicopter Lease. It does, however, object to the

rejection being granted nunc pro tunc and to the effectiveness of any rejection until, at a

minimum, the Debtors satisfy all obligations due on account of the hangar space at Teterboro

Airport (where the Debtors store and maintain the Helicopter) to Jet Aviation Teterboro, L.P.

Capitalized terms not otherwise defined herein shall be given the meanings ascribed to them in the

Motion.

53376/0001-11369599v1

Case 14-12103-KG

Doc 704

Filed 12/30/14

Page 2 of 8

(Jet Aviation), i.e., with respect to the so-called Rejected Real Property Lease (hereinafter,

the Hangar Lease). Without payment of those amounts to Jet Aviation, DJT Aerospace will

likely be precluded from retrieving the Helicopter, as Jet Aviation has (or likely can) assert a

possessory lien, enforceable against DJT Aerospace (and its secured creditors), for all amounts

that remain unpaid in accordance with N.J.S.A. 2A:44-1, et seq. and detain such aircraft at any

time it is lawfully in [its] possession until such sum is paid.

2.

Indeed, Jet Aviation has advised DJT Aerospace that it will insist upon full

payment of the obligations due to it before it will release the Helicopter to DJT Aerospace. Nunc

pro tunc relief is an equitable remedy that should not be granted here as the Debtors have not

and cannot effectively surrender the Helicopter to DJT Aerospace and fault for that failure

indisputably rests with the Debtors. Thus, to the extent the Court grants the Motion with respect

to the Helicopter Lease, it should be clear that the rejection thereof will not be effective until all

amounts due to Jet Aviation are in fact paid so that DJT Aerospace can obtain possession of its

property without the imposition of any lien. Any other relief would be inequitable.

3.

Finally, DJT Aerospace respectfully requests that the proposed form of order

provide that upon rejection of the Helicopter Lease, DJT Aerospace shall be entitled to apply its

security deposit to the Debtors obligations under the Helicopter Lease, and that the automatic

stay shall be lifted to the extent necessary to permit such setoff.

RELEVANT BACKGROUND

4.

Trump Entertainment Resorts Holdings, L.P. and DJT Aerospace are parties to an

Equipment Lease Agreement, dated as of December 1, 2010 (as amended, modified or

supplemented from time to time, the Helicopter Lease) whereby the Debtors lease the

2

53376/0001-11369599v1

Case 14-12103-KG

Doc 704

Filed 12/30/14

Page 3 of 8

Helicopter from DJT Aerospace. 2 As is apparent from the Motion, the Debtors store and

maintain the Helicopter at a hangar at Teterboro Airport located in Teterboro, New Jersey

pursuant to the terms of the Hangar Lease with Jet Aviation.

5.

Upon information and belief, the monthly obligations under the Hangar Lease

total $13,665.88. According to Jet Aviation, the Debtors have failed to pay Jet Aviation with

respect to the Hangar Lease since July 2014, including each month during which the Debtors

have operated under Chapter 11. 3

6.

N.J.S.A. 2A:44-1 et seq. grants a possessory lien, enforceable against DJT

Aerospace, for sums due for the storage, maintenance, keeping or repair of aircraft 4 or the

furnishing of gasoline, accessories, materials and supplies therefor, in favor of persons engaged

in the business of supplying such goods or services. N.J.S.A. 2A:44-2. 5 The lien shall be

2

The Helicopter Lease is attached to DJT Aerospaces proof of claim filed in this case. See Claim # 716;

Electronic Proof of Claim - 2596.

3

The Debtors failure to pay the obligations under the Hangar Lease (and to DJT Aerospace) calls into

question the veracity of the information contained in the Debtors sworn operating reports and whether the Debtors

are or will be administratively insolvent. For example, the Debtors latest operating report reflects that TER

Holdings is current on its post-petition accounts payable (with $1,000 due within the period from 0-30 days and $0

due for the period 31-60 days). Yet, that is obviously inaccurate as the Debtors have failed to pay post-petition

obligations under the Hangar Lease (which are at least $55,000 for the post-petition period) and to DJT Aerospace

(which are no less than $130,000, comprised of base rent for September 2014 through December 2014 ($32,500 * 4

months)). The Debtors should not be permitted to enjoy the benefits of bankruptcy without meeting their burdens,

including the timely payment of administrative expenses. Indeed, this is not the only administrative obligations that

the Debtors have ignored. For example, the Debtors have also failed to pay post-petition administrative real estate

taxes regarding to the driveway property at the Plaza, which the Debtors are directly responsible for under a ground

lease with R&R Associates (under which Donald J. Trump is also personally liable). The Debtors non-payment

relating to 3rd and 4th quarter taxes has resulted in the landlord demanding that Mr. Trump pay those amounts

personally.

4

The Helicopter is an aircraft within the meaning of the statute. N.J.S.A. defines aircraft as follows:

Aircraft means any contrivance invented, used or designed for navigation or flight in the air except a parachute or

other contrivance designed for such navigation but used primarily as safety equipment. N.J.S.A. 2A:44-1.

Similarly, it is believed that Jet Aviation would be a hangar operator under the statute, which means any person

operating a hangar according to regulations of the United States department of commerce and the laws of the state of

New Jersey. Id.

5

2A:44-2, provides as follows:

Right of lien; detention; priorities; statement verified by oath

3

53376/0001-11369599v1

Case 14-12103-KG

Doc 704

Filed 12/30/14

Page 4 of 8

superior to all other liens, except liens for taxes, and the operator of such aircraft shall be deemed

the agent of any owner, mortgagee, conditional vendor or other lienor thereof for the creation of

such superior lien. Id.

7.

By failing to pay the amounts due Jet Aviation, the Debtors have created a

possessory lien in favor of Jet Aviation that would, upon information and belief, permit Jet

Aviation to detain the Helicopter until all such payments are received. Indeed, even if Jet

Aviation were to allow the Helicopter to be removed by DJT Aerospace, it is possible that Jet

Aviation could continue to assert its lien and later seize the Helicopter. See 2A:44-3. 6

8.

Without paying all amounts due Jet Aviation, the Debtors cannot effectively

surrender the Helicopter to DJT Aerospace, and would deprive DJT of its property.

Respectfully, therefore, this Court should condition the rejection of the Helicopter Lease on the

payment of all amounts due under the Hangar Lease.

a. Any person, engaged in the business of operating an airport, a hangar or place for the storage,

maintenance, keeping or repairing of aircraft who, in connection therewith, permits landings or take-offs or stores,

maintains, keeps or repairs any aircraft or furnishes gasoline, accessories, materials or other supplies therefor at the

request or with the consent of the owner or his representative, agent or lessee, whether such owner be a conditional

vendee or a mortgagor remaining in possession or otherwise, shall have a lien upon such aircraft or any part thereof

for the sum due as the fees for such landings or take-offs, or for such storing, maintaining, keeping or repairing of

such aircraft or for furnishing gasoline, accessories, materials or other supplies therefor, and may, without process of

law, detain such aircraft at any time it is lawfully in his possession until such sum is paid.

The lien shall be superior to all other liens, except liens for taxes, and the operator of such aircraft shall be

deemed the agent of any owner, mortgagee, conditional vendor or other lienor thereof for the creation of such

superior lien.

b. Any person entitled to a lien pursuant to subsection a. shall, within 90 days after the date upon which

work was last performed or material last furnished in performing such work or making such repairs or

improvements, or fees were last incurred for landings or take-offs, file in the office of the county recording officer of

the county in which the aircraft is based, or where the work was performed or material supplied, or landing and takeoff fees incurred, a statement verified by oath. The statement shall include the name of the person entitled to the lien,

the name of the owner of the aircraft, a description of the aircraft, the amount for which a lien is claimed, and the

date upon which the work was completed, materials supplied or fees incurred.

6

2A:44-3 provides as follows: Removal of aircraft; seizure; costs of seizure. A person acquiring a lien

under section 2A:44-2 of this title shall not lose the same by reason of allowing the aircraft, or part thereof, to be

removed from his control, and if so removed, he may, after demand of payment of claim either personally or by

registered mail if the owner's address is known, and without further process of law, seize without force and in a

peaceable manner, the aircraft or part thereof, wherever found in this state.

4

53376/0001-11369599v1

Case 14-12103-KG

Doc 704

Filed 12/30/14

Page 5 of 8

LIMITED OBJECTION AND RESERVATION OF RIGHTS

A.

The Court Should Deny Retroactive Rejection of the Helicopter Lease

9.

In general, an executory contract is deemed rejected as of the date of the order of

the court authorizing rejection. In re Fleming Cos., Inc., 304 B.R. 85, 96 (Bankr. D. Del. 2003).

A bankruptcy court can authorize retroactive relief, deeming the contract rejected at an earlier

date, only in certain circumstances. Id. Such relief is an exercise of the courts equitable

powers and is, thus, only appropriate when the balance of equities calls for an earlier rejection

date. In re TW, Inc., No. 03-10785, 2004 WL 115521, at *2 (D. Del. Jan. 14, 2004) (affirming

the bankruptcy courts refusal to grant retroactive rejection).

10.

In fact, courts in this District will generally refuse to authorize retroactive

application of a rejection order, regardless of equities, prior to the date on which the property in

question is duly surrendered to the counterparty. See, e.g., Fleming, 304 B.R. at 96 (Rejection

has been allowed nunc pro tunc to the date the Motion is filed or the premises is surrendered,

whichever is later, only in certain circumstances.) (emphasis added); see also TW, 2004 WL

115521 (retroactive application of rejection order denied when debtor did not properly surrender

premises); In re Chi-Chis, Inc., 305 B.R. 396, 399 (Bankr. D. Del. 2004) (affirming bankruptcy

courts refusal to grant retroactive rejection as of the petition date, and instead allowing rejection

as of the date debtor surrendered possession of the premises to its landlords); New Valley Corp.

v. Corp. Prop. Assocs. (In re New Valley Corp.), No. 98-982, 2000 WL 1251858, at *15-16

(D.N.J. Aug. 31, 2000) (allowing rejection as of the date the landlord was known to be in full

control of the premises, preparing it for a new tenant).

11.

As Judge Robinson stated in TW:

An order granting relief nunc pro tunc is not a remedy that should

be given as a matter of course, but only after a balancing of the

equities in a particular case. It is the burden of the moving party to

5

53376/0001-11369599v1

Case 14-12103-KG

Doc 704

Filed 12/30/14

Page 6 of 8

show that relief, of this character, is appropriate. In the present

case, the bankruptcy court placed emphasis on the fact that

possession of the Premises was not properly surrendered and that

fault, in this regard, indisputably rested with the debtor. Unlike

circumstances where possession has been surrendered prior to the

petition date, a landlord without actual possession may face a

greater risk and greater uncertainty as to whether the lease will

ultimately be rejected. Consequently, the court concluded that

debtor-appellant failed to demonstrate that it was entitled to

retroactive relief.

TW, 2004 WL 115521 at *2 (affirming Judge Walraths and determining that decision to deny

the debtors request for retroactive relief did not constitute an abuse of its discretion).

12.

Here, the Debtors have failed to meet their burden of demonstrating that

retroactive application of the effective date of the rejection is appropriate under these factual

circumstances. Indeed, since the Debtors have not effectively surrendered the Helicopter to DJT

Aerospace free and clear of the potential lien of Jet Aviation, the rejection of the Helicopter

Lease should not be granted retroactively and, in fact, should not be granted until such time as

the Helicopter is effectively surrendered to DJT Aerospace free and clear of that lien (which

requires payment of all amounts due, including those due for the pre-Petition Date period).

13.

Moreover, if the Court were to allow such nunc pro tunc treatment, it might

vitiate the argument of DJT Aerospace for an administrative expense during a period in which

DJT Aerospace is being deprived of its property (solely as a result of the Debtors failures).

Accordingly, DJT Aerospace respectfully asks this Court not grant such nunc pro tunc relief or

in fact any relief until such time as all amounts due Jet Aviation have been paid.

B.

The Court Should Permit DJT Aerospace to Apply its Security Deposit

14.

As noted above, the Debtors have failed to pay DJT Aerospace the obligations

due under the Helicopter Lease. This includes amounts due with respect to both the pre-Petition

Date period and the post-Petition Date period. On November 24, 2014, DJT Aerospace timely

6

53376/0001-11369599v1

Case 14-12103-KG

Doc 704

Filed 12/30/14

Page 7 of 8

filed a proof of claim in this matter, asserting a claim for $46,165.68. 7 See Claim # 716;

Electronic Proof of Claim - 2596. The Debtors have also incurred liability under the

Helicopter Lease since the Petition Date in an amount of no less than $130,000 ($32,000 base

rent * 4 months), and such amounts continue to accrue, for which DJT Aerospace intends to file

an administrative expense claim. 8

15.

DJT Aerospace is holding a security deposit of $65,000. To the extent the Court

grants the rejection of the Helicopter Lease, DJT Aerospace respectfully requests that such relief

be conditioned upon the right of DJT Aerospace, in accordance with sections 362 and 553 of the

Bankruptcy Code, to apply the security deposit to its claims (to be applied first to its pre-Petition

Date claims, including its rejection damage claims, and then, to the extent available, to its

administrative claims).

[REMAINDER OF PAGE INTENTIONALLY LEFT BLANK]

The amount asserted in the proof of claim includes amounts due Jet Aviation for August 2014, totaling

$13,665.68, to the extent DJT Aerospace is required to pay it to obtain a release of the Helicopter.

8

Nothing herein is intended to waive any rights or claims of DJT Aerospace, whether against the Debtors,

their estates or Jet Aviation, all of which are expressly preserved, or constitute an admission with respect to any

future matters with respect to Jet Aviation.

7

53376/0001-11369599v1

Case 14-12103-KG

Doc 704

Filed 12/30/14

Page 8 of 8

CONCLUSION

WHEREFORE, for the reasons stated above, DJT Aerospace respectfully requests that

the Motion only be granted on condition that the Debtors pay all amounts due Jet Aviation under

the Hangar Lease, including any amounts due for periods preceding the Petition Date and that the

rejection of Helicopter Lease will not be effective until such payment. Moreover, to the extent

the Helicopter Lease is rejected, DJT Aerospace requests, if necessary, that the Court modify the

automatic stay to allow it to exercise its offset/recoupment right as to the amount of its security

deposit, and that the Court grant such other relief as the Court deems just and proper.

Dated: December 30, 2014

Respectfully submitted,

COLE, SCHOTZ, MEISEL,

FORMAN & LEONARD, P.A.

By: /s/ Patrick J. Reilley

Patrick J. Reilley (No. 4451)

500 Delaware Avenue, Suite 1410

Wilmington, DE 19801

Telephone: (302) 652-3131

Facsimile: (302) 652-3117

preilley@coleschotz.com

- and

Michael D. Sirota (admitted pro hac vice)

David M. Bass (admitted pro hac vice)

25 Main Street

Hackensack, NJ 07601

Telephone: (201) 489-3000

Facsimile: (201) 489-1536

Counsel for DJT Aerospace LLC

8

53376/0001-11369599v1

Das könnte Ihnen auch gefallen

- Encyclopaedia of International Aviation Law: Volume 3 English and French Version Version Englaise Et Française 2013 EditionVon EverandEncyclopaedia of International Aviation Law: Volume 3 English and French Version Version Englaise Et Française 2013 EditionNoch keine Bewertungen

- In Re Airlift International, Inc., Debtor, Gatx Leasing Corp. v. Airlift International, Inc., 761 F.2d 1503, 11th Cir. (1985)Dokument14 SeitenIn Re Airlift International, Inc., Debtor, Gatx Leasing Corp. v. Airlift International, Inc., 761 F.2d 1503, 11th Cir. (1985)Scribd Government DocsNoch keine Bewertungen

- 056 G.R. No. L-51806 November 8, 1988 Civil Aeronautics Administration Vs CADokument6 Seiten056 G.R. No. L-51806 November 8, 1988 Civil Aeronautics Administration Vs CArodolfoverdidajrNoch keine Bewertungen

- William D. Seidle, As Trustee For The Estate of Airlift International, Inc., Debtor v. Gatx Leasing Corporation, 778 F.2d 659, 11th Cir. (1985)Dokument12 SeitenWilliam D. Seidle, As Trustee For The Estate of Airlift International, Inc., Debtor v. Gatx Leasing Corporation, 778 F.2d 659, 11th Cir. (1985)Scribd Government DocsNoch keine Bewertungen

- Credit Principles AppliedDokument13 SeitenCredit Principles AppliedNeo KigzNoch keine Bewertungen

- 10000002251Dokument13 Seiten10000002251Chapter 11 DocketsNoch keine Bewertungen

- Servicewide Specialists Inc Vs Intermediate Appellate CourtDokument6 SeitenServicewide Specialists Inc Vs Intermediate Appellate CourtJunalyn BuesaNoch keine Bewertungen

- Limited Objection of The Official Committee of Unsecured Creditors To The Motion by Medema Properties and Medema Family Trust To CompelDokument9 SeitenLimited Objection of The Official Committee of Unsecured Creditors To The Motion by Medema Properties and Medema Family Trust To CompelChapter 11 DocketsNoch keine Bewertungen

- PGE CRC Agreement Lucerne Habor Park (Signed)Dokument8 SeitenPGE CRC Agreement Lucerne Habor Park (Signed)LakeCoNewsNoch keine Bewertungen

- Ashu and Another V Body Corporate of London Place and Others (114632023) 2024 ZAWCHC 52 (27 February 2024)Dokument14 SeitenAshu and Another V Body Corporate of London Place and Others (114632023) 2024 ZAWCHC 52 (27 February 2024)pvtNoch keine Bewertungen

- Capitalized Terms Not Otherwise Defined Herein Shall Have The Meanings Ascribed To Such Terms in The ApplicationDokument4 SeitenCapitalized Terms Not Otherwise Defined Herein Shall Have The Meanings Ascribed To Such Terms in The ApplicationoldhillbillyNoch keine Bewertungen

- Servicewide Specialists vs. IAC G.R. No. 74553Dokument7 SeitenServicewide Specialists vs. IAC G.R. No. 74553ペラルタ ヴィンセントスティーブNoch keine Bewertungen

- BA Finance Corp. v. Court of AppealsDokument6 SeitenBA Finance Corp. v. Court of AppealsCarlota Nicolas VillaromanNoch keine Bewertungen

- Master Aircraft Lease Agreement: Lessor AddressDokument16 SeitenMaster Aircraft Lease Agreement: Lessor AddressIliann CNoch keine Bewertungen

- Orient Air Service Hotel Representatives V CADokument12 SeitenOrient Air Service Hotel Representatives V CAAllen Mark Buljatin TacordaNoch keine Bewertungen

- Aircraft Lease Agreement 2Dokument25 SeitenAircraft Lease Agreement 2Anonymous uMI5BmNoch keine Bewertungen

- Paic Finance Corporation, Service Equipment Specialists Co., Inc., Rodrigo ReyesDokument259 SeitenPaic Finance Corporation, Service Equipment Specialists Co., Inc., Rodrigo ReyesFernan CalvezNoch keine Bewertungen

- Phil-Air Conditioning Center Vs RCJ Lines and Rolando Abadilla, JRDokument4 SeitenPhil-Air Conditioning Center Vs RCJ Lines and Rolando Abadilla, JRBea CastilloNoch keine Bewertungen

- Philippine Airlines vs. CADokument9 SeitenPhilippine Airlines vs. CARomy Ian LimNoch keine Bewertungen

- Tie Down LeaseDokument6 SeitenTie Down LeasesherlNoch keine Bewertungen

- Ref. DocketDokument5 SeitenRef. DocketChapter 11 DocketsNoch keine Bewertungen

- 2310718230919000000000001Dokument9 Seiten2310718230919000000000001cgig63Noch keine Bewertungen

- Debry and Hilton Travel Services, Inc. v. Capitol International Airways, Inc., 541 F.2d 855, 10th Cir. (1976)Dokument4 SeitenDebry and Hilton Travel Services, Inc. v. Capitol International Airways, Inc., 541 F.2d 855, 10th Cir. (1976)Scribd Government DocsNoch keine Bewertungen

- Comm Law Transpo ReviewDokument12 SeitenComm Law Transpo ReviewAl SimbajonNoch keine Bewertungen

- 010 ADokument37 Seiten010 AmrpowerplusNoch keine Bewertungen

- BOC Aviation V DGCA (Arguments)Dokument5 SeitenBOC Aviation V DGCA (Arguments)Sejal NakraNoch keine Bewertungen

- PCI LEASING vs. DAIDokument8 SeitenPCI LEASING vs. DAIJohn FerarenNoch keine Bewertungen

- Nego Assigned Cases 1Dokument7 SeitenNego Assigned Cases 1Jodel Cris BalitaNoch keine Bewertungen

- MIAA v. AirspanDokument11 SeitenMIAA v. AirspanIldefonso HernaezNoch keine Bewertungen

- 1DAVAOSAWMILLtoBOARDOFASSESSORS PROPERTYDokument61 Seiten1DAVAOSAWMILLtoBOARDOFASSESSORS PROPERTYCamCam SumeraNoch keine Bewertungen

- Supreme CourtDokument3 SeitenSupreme CourtEmmylou Ferrando BagaresNoch keine Bewertungen

- 926 F.2d 1083 67 A.F.T.R.2d 91-710, 91-1 USTC P 50,159Dokument10 Seiten926 F.2d 1083 67 A.F.T.R.2d 91-710, 91-1 USTC P 50,159Scribd Government DocsNoch keine Bewertungen

- United States Court of Appeals, Third CircuitDokument10 SeitenUnited States Court of Appeals, Third CircuitScribd Government DocsNoch keine Bewertungen

- Oblicon DigestDokument16 SeitenOblicon DigestIyleNoch keine Bewertungen

- CIVIL AERONAUTICS ADMINISTRATION v. CA +Dokument12 SeitenCIVIL AERONAUTICS ADMINISTRATION v. CA +Richie PostigoNoch keine Bewertungen

- Right of Way Grant TemplateDokument5 SeitenRight of Way Grant TemplateImran GhifariaNoch keine Bewertungen

- Sec. 12 Prudential Bank vs. National Labor Relations CommissionDokument11 SeitenSec. 12 Prudential Bank vs. National Labor Relations Commissionjusang16Noch keine Bewertungen

- Statcon Assignment #2Dokument35 SeitenStatcon Assignment #2boks9s.9escaladaNoch keine Bewertungen

- Petitioners VS.: Third DivisionDokument15 SeitenPetitioners VS.: Third DivisionyakyakxxNoch keine Bewertungen

- Credit Cases - Rem, CHM, AchDokument18 SeitenCredit Cases - Rem, CHM, AchJose MasarateNoch keine Bewertungen

- Cta 2D CV 10059 D 2023apr26 AssDokument47 SeitenCta 2D CV 10059 D 2023apr26 AssFirenze PHNoch keine Bewertungen

- Office of The Solicitor General Pompeyo Diaz and Solicitor Augusto M. Luciano For Petitioner. Ozeata, Roxas, Lichauco and Picazo For RespondentsDokument3 SeitenOffice of The Solicitor General Pompeyo Diaz and Solicitor Augusto M. Luciano For Petitioner. Ozeata, Roxas, Lichauco and Picazo For RespondentsdanNoch keine Bewertungen

- Agency Case DigestDokument47 SeitenAgency Case DigestQuinnee VallejosNoch keine Bewertungen

- State ImmunityDokument134 SeitenState ImmunityHermay BanarioNoch keine Bewertungen

- Silkair Vs CIRDokument5 SeitenSilkair Vs CIRMark DungoNoch keine Bewertungen

- Unlawful Detainer ComplaintDokument81 SeitenUnlawful Detainer ComplaintThe Salt Lake Tribune100% (1)

- 67 Pacific Wide Realty and Dev T Corp Vs Puerto Azul Land Inc 2009Dokument5 Seiten67 Pacific Wide Realty and Dev T Corp Vs Puerto Azul Land Inc 2009ronilarbisNoch keine Bewertungen

- Re:) LL) Debtors.) : in Mervy - I'S LLC, EtDokument8 SeitenRe:) LL) Debtors.) : in Mervy - I'S LLC, EtChapter 11 DocketsNoch keine Bewertungen

- Lease Agreememnt HagenDokument14 SeitenLease Agreememnt HagenjuliusomotayooluwagbemiNoch keine Bewertungen

- /Debtors Motion for Entry of Interim and Final Orders Pursuant to 11 U.S.C. Sections 105, 361, 362, 363 and 507, Rules 2002, 4001, 9014 of the Federal Rules of Bankruptcy Procedure for an Order (1) Authorizing Use of Cash Collateral, (II) Granting Adequate Protection, (III) Modifying the Automatic Stay, and (IV) Scheduling a Final Hearing filed by Albert Togut on behalf of Dewey & LeBoeuf LLP. (Attachments: # (1) Pleading Declaration of Jonathan A. Mitchell In Support of Debtors Motion# (2) Exhibit 1: Proposed Interim Order# (3) Exhibit A: Budget)Dokument29 Seiten/Debtors Motion for Entry of Interim and Final Orders Pursuant to 11 U.S.C. Sections 105, 361, 362, 363 and 507, Rules 2002, 4001, 9014 of the Federal Rules of Bankruptcy Procedure for an Order (1) Authorizing Use of Cash Collateral, (II) Granting Adequate Protection, (III) Modifying the Automatic Stay, and (IV) Scheduling a Final Hearing filed by Albert Togut on behalf of Dewey & LeBoeuf LLP. (Attachments: # (1) Pleading Declaration of Jonathan A. Mitchell In Support of Debtors Motion# (2) Exhibit 1: Proposed Interim Order# (3) Exhibit A: Budget)Chapter 11 DocketsNoch keine Bewertungen

- Petitioners Vs Vs Respondent: First DivisionDokument13 SeitenPetitioners Vs Vs Respondent: First DivisionAnne MadambaNoch keine Bewertungen

- Trust AgreementDokument32 SeitenTrust Agreementmike_val100% (1)

- MACTAN-CEBU INTERNATIONAL AIRPORT AUTHORITY vs. BENJAMIN TUDTUD, ET AL., G.R. No. 174012, November 14, 2008Dokument13 SeitenMACTAN-CEBU INTERNATIONAL AIRPORT AUTHORITY vs. BENJAMIN TUDTUD, ET AL., G.R. No. 174012, November 14, 2008Sisinio BragatNoch keine Bewertungen

- Caltex (Phils.) Inc. V. Ca and Security Bank and Trust Co. (1992)Dokument11 SeitenCaltex (Phils.) Inc. V. Ca and Security Bank and Trust Co. (1992)Aerith AlejandreNoch keine Bewertungen

- 131870-1989-Manila Banking Corp. v. Teodoro Jr.20160321-9941-1tqp9q1 PDFDokument9 Seiten131870-1989-Manila Banking Corp. v. Teodoro Jr.20160321-9941-1tqp9q1 PDFTintin SumawayNoch keine Bewertungen

- FIASMMS Collection AgreementDokument7 SeitenFIASMMS Collection AgreementCristopher JavidoNoch keine Bewertungen

- Global Aerospace, Inc. v. Platinum Jet Management, LLC, Michael Brassington, 11th Cir. (2012)Dokument7 SeitenGlobal Aerospace, Inc. v. Platinum Jet Management, LLC, Michael Brassington, 11th Cir. (2012)Scribd Government DocsNoch keine Bewertungen

- Seminar 9 and 10 - Charges and MorgagesDokument12 SeitenSeminar 9 and 10 - Charges and MorgagesDiana WangamatiNoch keine Bewertungen

- Unit 5 (LAND DEALINGS)Dokument16 SeitenUnit 5 (LAND DEALINGS)Zara Nabilah93% (14)

- Florida Power & Light Company, A Florida Corporation v. Mid-Valley, Inc., A Texas Corporation, Brown & Root, Inc. and Graeme R. Poke, 763 F.2d 1316, 11th Cir. (1985)Dokument9 SeitenFlorida Power & Light Company, A Florida Corporation v. Mid-Valley, Inc., A Texas Corporation, Brown & Root, Inc. and Graeme R. Poke, 763 F.2d 1316, 11th Cir. (1985)Scribd Government DocsNoch keine Bewertungen

- Taylor Opening StatementDokument16 SeitenTaylor Opening Statementacohnthehill100% (4)

- Hagel Feingold Letter To SenateDokument44 SeitenHagel Feingold Letter To SenateJ. Swift (The Bulwark)Noch keine Bewertungen

- Articles of ImpeachmentDokument9 SeitenArticles of ImpeachmentKelli R. Grant67% (3)

- Mueller ReportDokument448 SeitenMueller ReportStefan Becket95% (165)

- Acting AG OpDokument20 SeitenActing AG OpKatie PavlichNoch keine Bewertungen

- Mueller ReportDokument448 SeitenMueller ReportJenna Lowenstein96% (580)

- Kavanaugh Support Letter Yale Law School Class of 1990Dokument2 SeitenKavanaugh Support Letter Yale Law School Class of 1990J. Swift (The Bulwark)100% (1)

- 17 35105Dokument1 Seite17 35105J. Swift (The Bulwark)Noch keine Bewertungen

- Statement of Facts On GOP Territorial CommitteeDokument3 SeitenStatement of Facts On GOP Territorial CommitteeJ. Swift (The Bulwark)Noch keine Bewertungen

- Deterring European Attempts To Evade U.S. Sanctions On IranDokument2 SeitenDeterring European Attempts To Evade U.S. Sanctions On IranJ. Swift (The Bulwark)Noch keine Bewertungen

- Flynn Statement of OffenseDokument6 SeitenFlynn Statement of OffenseJ. Swift (The Bulwark)Noch keine Bewertungen

- DOL BriefDokument58 SeitenDOL BriefJ. Swift (The Bulwark)Noch keine Bewertungen

- FISA MemoDokument6 SeitenFISA MemoAnonymous MS54FL85% (54)

- What Fredy Did WrongDokument3 SeitenWhat Fredy Did WrongJ. Swift (The Bulwark)Noch keine Bewertungen

- DOL OrderDokument18 SeitenDOL OrderJ. Swift (The Bulwark)Noch keine Bewertungen

- Right To Life Sen Marco Rubio Endorsement 2016Dokument1 SeiteRight To Life Sen Marco Rubio Endorsement 2016J. Swift (The Bulwark)Noch keine Bewertungen

- William J. Clinton Foundation Part 02Dokument509 SeitenWilliam J. Clinton Foundation Part 02J. Swift (The Bulwark)100% (2)

- Rubin LetterDokument2 SeitenRubin LetterJ. Swift (The Bulwark)Noch keine Bewertungen

- The Magic of FlightDokument1 SeiteThe Magic of FlightJ. Swift (The Bulwark)Noch keine Bewertungen

- Donald Trump Medical ReportDokument1 SeiteDonald Trump Medical ReportWJLA-TVNoch keine Bewertungen

- Report of The Attorney General's Rights Restoration Advisory CommitteeDokument6 SeitenReport of The Attorney General's Rights Restoration Advisory CommitteeJ. Swift (The Bulwark)Noch keine Bewertungen

- United States Court of Appeals Tenth CircuitDokument19 SeitenUnited States Court of Appeals Tenth CircuitJ. Swift (The Bulwark)Noch keine Bewertungen

- Letter RE: King-Reid Amendment To Senate Energy BillDokument3 SeitenLetter RE: King-Reid Amendment To Senate Energy BillJ. Swift (The Bulwark)Noch keine Bewertungen

- An Interrogator Breaks His SilenceDokument40 SeitenAn Interrogator Breaks His SilenceJ. Swift (The Bulwark)100% (4)

- Andy Barr FSC Letter To Leadership On TIA Rider On OmnibusDokument2 SeitenAndy Barr FSC Letter To Leadership On TIA Rider On OmnibusJ. Swift (The Bulwark)Noch keine Bewertungen

- Secure America Now Iran PollDokument35 SeitenSecure America Now Iran PollJ. Swift (The Bulwark)Noch keine Bewertungen

- hb0483 Texas DescriptionDokument4 Seitenhb0483 Texas DescriptionJ. Swift (The Bulwark)Noch keine Bewertungen

- WTC/ GSA Lease From GSA FOIADokument139 SeitenWTC/ GSA Lease From GSA FOIAJ. Swift (The Bulwark)Noch keine Bewertungen

- BUL 202 Law of Contract IIDokument18 SeitenBUL 202 Law of Contract IISarkar Rakesh100% (1)

- Project Work On Crime Against HumanityDokument5 SeitenProject Work On Crime Against Humanityashu pathakNoch keine Bewertungen

- Nifty Home Products v. Brumis ImportsDokument4 SeitenNifty Home Products v. Brumis ImportsPriorSmartNoch keine Bewertungen

- Regina Ongsiako Reyes vs. Commission On Elections and Joseph Socorro B. TanDokument2 SeitenRegina Ongsiako Reyes vs. Commission On Elections and Joseph Socorro B. TanGraciana FuentesNoch keine Bewertungen

- Jessup ApplicantDokument15 SeitenJessup ApplicantMulugeta BarisoNoch keine Bewertungen

- BC Provincial Court REGINA v. T.F. and T.A.F.Dokument19 SeitenBC Provincial Court REGINA v. T.F. and T.A.F.CKNW980100% (1)

- 14th Month PayDokument2 Seiten14th Month PayMicky MoranteNoch keine Bewertungen

- StandingDokument19 SeitenStandingRajiv JosephNoch keine Bewertungen

- Legislative Drafting in GermanyDokument131 SeitenLegislative Drafting in GermanysaharsaqibNoch keine Bewertungen

- Hostel Admissiom FormDokument4 SeitenHostel Admissiom FormAnss AliNoch keine Bewertungen

- Shafer v. Judge of OlongapoDokument1 SeiteShafer v. Judge of OlongapoarctikmarkNoch keine Bewertungen

- 110517EVFTCNCOLR2Dokument11 Seiten110517EVFTCNCOLR2masterjhayNoch keine Bewertungen

- Taarifa Ya Kutishiwa Kuuawa Wakili Wa Mahakama Kuu Ya TDokument3 SeitenTaarifa Ya Kutishiwa Kuuawa Wakili Wa Mahakama Kuu Ya Tapi-67201372Noch keine Bewertungen

- Arbitration and Conciliation Act 2019Dokument7 SeitenArbitration and Conciliation Act 2019jyoti chouhanNoch keine Bewertungen

- DAVID, ET AL. v. ARROYO, ET AL. G.R. No. 171396Dokument29 SeitenDAVID, ET AL. v. ARROYO, ET AL. G.R. No. 171396Ashley Kate PatalinjugNoch keine Bewertungen

- R.A. 8353Dokument4 SeitenR.A. 8353Russel Tabunan AbañoNoch keine Bewertungen

- 1975 - Black Clawson V Papierworke PDFDokument21 Seiten1975 - Black Clawson V Papierworke PDFAnnadeJesusNoch keine Bewertungen

- Sac City Man Accused of Supplying Alcohol To A 14 and 16-Year OldDokument5 SeitenSac City Man Accused of Supplying Alcohol To A 14 and 16-Year OldthesacnewsNoch keine Bewertungen

- Torts Cases-Human Dignity AllDokument311 SeitenTorts Cases-Human Dignity AllRacel AbulaNoch keine Bewertungen

- 43 G.R. No. 138051, June 10, 2004, 431 SCRA 538Dokument18 Seiten43 G.R. No. 138051, June 10, 2004, 431 SCRA 538Shila Tabanao VisitacionNoch keine Bewertungen

- Commercial Law, Lecture Notes - Law - Prof Hellen Chirry 3Dokument15 SeitenCommercial Law, Lecture Notes - Law - Prof Hellen Chirry 3Anshu Saurabh80% (5)

- 008 - Historical Background of The Indian Evidence Act, 1872 (1-25) PDFDokument25 Seiten008 - Historical Background of The Indian Evidence Act, 1872 (1-25) PDFsaurabh887Noch keine Bewertungen

- Constitution of American SamoaDokument2 SeitenConstitution of American SamoaThiago PiresNoch keine Bewertungen

- Adaptive Studios V ZimbalistDokument10 SeitenAdaptive Studios V ZimbalistTHROnlineNoch keine Bewertungen

- Jaka Vs PacotDokument5 SeitenJaka Vs PacotSachuzenNoch keine Bewertungen

- Letter Judge WolfsonDokument3 SeitenLetter Judge WolfsonTerry HurlbutNoch keine Bewertungen

- Limitations of The Pardoning Power of The PresidentDokument2 SeitenLimitations of The Pardoning Power of The PresidentGabby KakilalaNoch keine Bewertungen

- Civil ProcedureDokument12 SeitenCivil ProcedureJoselle ReyesNoch keine Bewertungen

- Zervos MotionDokument17 SeitenZervos MotionLaw&CrimeNoch keine Bewertungen

- Bautista v. de GuzmanDokument2 SeitenBautista v. de GuzmanSGTNoch keine Bewertungen