Beruflich Dokumente

Kultur Dokumente

Rule: Income Taxes: Tax-Exempt Entities Not Currently Required To File Notification Requirement Correction

Hochgeladen von

Justia.com0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

19 Ansichten1 SeiteRule: Income taxes:

Tax-exempt entities not currently required to file; notification requirement

Correction, 71061 [E7-24114] Internal Revenue Service

Originaltitel

Rule: Income taxes:

Tax-exempt entities not currently required to file; notification requirement Correction

Copyright

© Public Domain

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenRule: Income taxes:

Tax-exempt entities not currently required to file; notification requirement

Correction, 71061 [E7-24114] Internal Revenue Service

Copyright:

Public Domain

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

19 Ansichten1 SeiteRule: Income Taxes: Tax-Exempt Entities Not Currently Required To File Notification Requirement Correction

Hochgeladen von

Justia.comRule: Income taxes:

Tax-exempt entities not currently required to file; notification requirement

Correction, 71061 [E7-24114] Internal Revenue Service

Copyright:

Public Domain

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Federal Register / Vol. 72, No.

240 / Friday, December 14, 2007 / Rules and Regulations 71061

SUPPLEMENTARY INFORMATION: DEPARTMENT OF THE TREASURY § 1.6033–6T Notification requirement for

entities not required to file an annual

Background Internal Revenue Service information return under section 6033(a)(1)

(taxable years beginning after December 31,

The temporary regulations (TD 9366) 2006).

that are the subject of this correction are 26 CFR Part 1

* * * * *

under section 6033 of the Internal (b) * * *

Revenue Code. [TD 9366]

(2) * * *

(vi) An organization described in

Need for Correction RIN 1545–BG38 section 501(c)(1); or

As published, the temporary Notification Requirement for Tax- * * * * *

regulations (TD 9366) contain errors that Exempt Entities Not Currently LaNita Van Dyke,

may prove to be misleading and are in Required To File; Correction Chief, Publications and Regulations Branch,

need of clarification. Legal Processing Division, Associate Chief

AGENCY: Internal Revenue Service (IRS),

Correction of Publication Counsel (Procedure and Administration).

Treasury.

[FR Doc. E7–24114 Filed 12–13–07; 8:45 am]

ACTION: Correcting amendment.

■ Accordingly, the publication of the BILLING CODE 4830–01–P

temporary regulations (TD 9366), which SUMMARY: This document contains a

was the subject of FR Doc. E7–22299, is correction to temporary regulations (TD

corrected as follows: 9366) that were published in the DEPARTMENT OF LABOR

■ 1. On page 64148, column 3, in the Federal Register on Thursday,

November 15, 2007 (72 FR 64147) Occupational Safety and Health

preamble, the language of the paragraph Administration

heading ‘‘Form 990–N, Electronic describing the time and manner in

Notification (e-Postcard) For Tax- which certain tax-exempt organizations

not currently required to file an annual 29 CFR Part 1910

Exempt Organizations Not Required to

information return under section [Docket No. OSHA–2007–0040]

File Form 990 or 990–EZ’’ is corrected

6033(a)(1) are required to submit an

to read ‘‘Form 990–N, Electronic Notice RIN 1218–AC08

annual electronic notice including

(e-Postcard) For Tax-Exempt certain information required by section

Organizations Not Required to File Updating OSHA Standards Based on

6033(i)(1)(A) through (F). National Consensus Standards

Form 990 of 990–EZ’’.

DATES: The correction is effective

■ 2. On page 64148, column 3, in the December 14, 2007. AGENCY: Occupational Safety and Health

preamble, under the paragraph heading Administration (OSHA); Department of

FOR FURTHER INFORMATION CONTACT:

‘‘Form 990–N, Electronic Notice (e- Labor.

Monice Rosenbaum at (202) 622–6070

Postcard) For Tax-Exempt ACTION: Direct final rule.

(not a toll-free number).

Organizations Not Required to File

SUPPLEMENTARY INFORMATION: SUMMARY: In this direct final rule, the

Form 990 or 990–EZ’’, first line of the

Agency is removing several references

third paragraph of the column, the Background

to consensus standards that have

language ‘‘Form 990–N, ‘‘Electronic The temporary regulations (TD 9366) requirements that duplicate, or are

Notification’’ is corrected to read ‘‘ Form that are the subject of this correction are comparable to, other OSHA rules; this

990–N, ‘‘Electronic Notice’’. under section 6033 of the Internal action includes correcting a paragraph

■ 3. On page 64149, column 1, in the Revenue Code. citation in one of these OSHA rules. The

preamble, under the paragraph heading Need for Correction Agency also is removing a reference to

‘‘Organizations Required To File American Welding Society standard

Returns or Submit Electronic Notice’’, As published, the temporary A3.0–1969 (‘‘Terms and Definitions’’) in

line 5 of the second paragraph of the regulations (TD 9366) contain an error its general-industry welding standards.

column, the language ‘‘an organization that may prove to be misleading and is This rulemaking is a continuation of

in need of clarification. OSHA’s ongoing effort to update

exemption from’’ is corrected to read

‘‘an organization exempt from’’. List of Subjects in 26 CFR Part 1 references to consensus and industry

standards used throughout its rules.

LaNita Van Dyke, Income taxes, Reporting and

DATES: This direct final rule will

Chief, Publications and Regulations Branch, recordkeeping requirements.

become effective on March 13, 2008

Legal Processing Division, Associate Chief Correction of Publication unless significant adverse comment is

Counsel (Procedure and Administration). received by January 14, 2008.

[FR Doc. 07–6044 Filed 12–13–07; 8:45 am] ■ Accordingly, 26 CFR part 1 is Comments to this direct final rule

BILLING CODE 4830–01–M

corrected by making the following (including comments to the

amendment: information-collection (paperwork)

determination described under the

PART 1—INCOME TAXES

section titled SUPPLEMENTARY

■ Paragraph 1. The authority citation INFORMATION of this notice), hearing

for part 1 continues to read, in part, as requests, and other information must be

follows: submitted by January 14, 2008. All

rmajette on PROD1PC64 with RULES

Authority: 26 U.S.C. 7805 * * *

submissions must bear a postmark or

provide other evidence of the

■ Par. 2. Section 1.6033–6T is amended submission date. (See the following

by revising paragraph (b)(2)(vi) to read section titled ADDRESSES for methods

as follows: you can use in making submissions.)

VerDate Aug<31>2005 14:52 Dec 13, 2007 Jkt 214001 PO 00000 Frm 00007 Fmt 4700 Sfmt 4700 E:\FR\FM\14DER1.SGM 14DER1

Das könnte Ihnen auch gefallen

- Daphne Spain - How Women Saved The CityDokument332 SeitenDaphne Spain - How Women Saved The CityApple XuNoch keine Bewertungen

- Order 119 MiscComm 31 1 24Dokument6 SeitenOrder 119 MiscComm 31 1 24Mmkpss Sriram Sista MmkpssNoch keine Bewertungen

- Adobe Scan Jan 26, 2023Dokument25 SeitenAdobe Scan Jan 26, 2023Rafael AbedesNoch keine Bewertungen

- GST Rfd-01 07aabcw4620l1z8 Expwop 202204 FormDokument3 SeitenGST Rfd-01 07aabcw4620l1z8 Expwop 202204 FormSANDEEP SINGHNoch keine Bewertungen

- GST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormDokument3 SeitenGST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormkotisanampudiNoch keine Bewertungen

- 1w1212notification 54 2020Dokument4 Seiten1w1212notification 54 2020Adrian ŠainaNoch keine Bewertungen

- Taxation 2 Remedies - P.M. ReyesDokument31 SeitenTaxation 2 Remedies - P.M. ReyesGlossier PlayNoch keine Bewertungen

- 2020-09801 2 PDFDokument6 Seiten2020-09801 2 PDFchristianNoch keine Bewertungen

- Rules and Regulations: Federal RegisterDokument1 SeiteRules and Regulations: Federal RegisterManikanta Sai KumarNoch keine Bewertungen

- US Internal Revenue Service: 11547203Dokument6 SeitenUS Internal Revenue Service: 11547203IRSNoch keine Bewertungen

- SRO 376 (I) 2023 - Special Procedure For CollectionDokument4 SeitenSRO 376 (I) 2023 - Special Procedure For CollectionUbaidullah SiddiquiNoch keine Bewertungen

- Taxbits 20 Vol5 July - August 2013Dokument16 SeitenTaxbits 20 Vol5 July - August 2013John Dx LapidNoch keine Bewertungen

- US Internal Revenue Service: Irb03-35Dokument101 SeitenUS Internal Revenue Service: Irb03-35IRSNoch keine Bewertungen

- US Internal Revenue Service: 10274002Dokument7 SeitenUS Internal Revenue Service: 10274002IRSNoch keine Bewertungen

- Form16 16 2015-16Dokument4 SeitenForm16 16 2015-16BDO KhandalaNoch keine Bewertungen

- Circular No. 57/31/2018 GST Dated 04.09.2018Dokument17 SeitenCircular No. 57/31/2018 GST Dated 04.09.2018RAJARAJESHWARI M GNoch keine Bewertungen

- US Internal Revenue Service: Irb02-18Dokument50 SeitenUS Internal Revenue Service: Irb02-18IRSNoch keine Bewertungen

- Revenue Memorandum Order No. 25-2020Dokument1 SeiteRevenue Memorandum Order No. 25-2020Cliff DaquioagNoch keine Bewertungen

- Ister On Thursday, August 17, 2006 (71Dokument1 SeiteIster On Thursday, August 17, 2006 (71IRSNoch keine Bewertungen

- US Internal Revenue Service: 12256402Dokument6 SeitenUS Internal Revenue Service: 12256402IRSNoch keine Bewertungen

- Casa Systems, Inc: United States Securities and Exchange Commission FORM 10-QDokument54 SeitenCasa Systems, Inc: United States Securities and Exchange Commission FORM 10-QtmaillistNoch keine Bewertungen

- RMO No. 34-2020Dokument1 SeiteRMO No. 34-2020Joel SyNoch keine Bewertungen

- US Internal Revenue Service: Irb07-41Dokument52 SeitenUS Internal Revenue Service: Irb07-41IRSNoch keine Bewertungen

- US Internal Revenue Service: Irb03-52Dokument41 SeitenUS Internal Revenue Service: Irb03-52IRSNoch keine Bewertungen

- No Taxpayer Left Behind ActDokument2 SeitenNo Taxpayer Left Behind ActAdam ForgieNoch keine Bewertungen

- ICT (Tax On Services) Updated Upto 15.01.2022Dokument15 SeitenICT (Tax On Services) Updated Upto 15.01.2022Zafar IqbalNoch keine Bewertungen

- B. Tenet Healthcare Corporation - 2023 Q3 Report (Form 10-Q)Dokument73 SeitenB. Tenet Healthcare Corporation - 2023 Q3 Report (Form 10-Q)yoongie253Noch keine Bewertungen

- 2016-Resolución FDaDokument25 Seiten2016-Resolución FDaMedardo Camposano FigueroaNoch keine Bewertungen

- CIR vs. Aichi Forging Company of AsiaDokument27 SeitenCIR vs. Aichi Forging Company of AsiaChristle CorpuzNoch keine Bewertungen

- Bir1600 July52019 - 2 PDFDokument2 SeitenBir1600 July52019 - 2 PDFMaureen AlapaapNoch keine Bewertungen

- SRO 279 (I) - 2018Dokument14 SeitenSRO 279 (I) - 2018muhammadjavaid698Noch keine Bewertungen

- CIR Vs Achi 2010Dokument24 SeitenCIR Vs Achi 2010Christelle Ayn BaldosNoch keine Bewertungen

- Evertec-10K FY2022Dokument290 SeitenEvertec-10K FY2022Jorge Antonio ArroyoNoch keine Bewertungen

- Vat ZNZDokument6 SeitenVat ZNZAndrey PavlovskiyNoch keine Bewertungen

- Osha Icr1218 0226 2002 2006 0406 0002Dokument1 SeiteOsha Icr1218 0226 2002 2006 0406 0002dolientes plazaamericasNoch keine Bewertungen

- United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-QDokument68 SeitenUnited States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-QJinye LiangNoch keine Bewertungen

- TGT (Target Corporation)Dokument157 SeitenTGT (Target Corporation)murtazachohan006Noch keine Bewertungen

- GST Automated NoticesDokument6 SeitenGST Automated NoticesMaunik ParikhNoch keine Bewertungen

- Form 1619042024 085917Dokument3 SeitenForm 1619042024 085917SODHI SINGHNoch keine Bewertungen

- Form16 1945007 JC570193L 2020 2021Dokument2 SeitenForm16 1945007 JC570193L 2020 2021Ranjeet RajputNoch keine Bewertungen

- Form No. 16 Part A (2020)Dokument2 SeitenForm No. 16 Part A (2020)Dharmendra ParmarNoch keine Bewertungen

- Adobe Scan Jun 10, 2023Dokument3 SeitenAdobe Scan Jun 10, 2023Atharv KumarNoch keine Bewertungen

- Kind The O/s Tax Year It: Under inDokument2 SeitenKind The O/s Tax Year It: Under inRiya SinghNoch keine Bewertungen

- US Internal Revenue Service: I8390 - 1996Dokument2 SeitenUS Internal Revenue Service: I8390 - 1996IRSNoch keine Bewertungen

- US Internal Revenue Service: 10869702Dokument4 SeitenUS Internal Revenue Service: 10869702IRSNoch keine Bewertungen

- 2023741475729233icto30 06 2023Dokument17 Seiten2023741475729233icto30 06 2023areebamushtaq717Noch keine Bewertungen

- Form 16Dokument2 SeitenForm 16Narendra Nath TripathiNoch keine Bewertungen

- DD ProjectDokument2 SeitenDD Projectjatin kuashikNoch keine Bewertungen

- US Internal Revenue Service: Irb01-30Dokument27 SeitenUS Internal Revenue Service: Irb01-30IRSNoch keine Bewertungen

- Cbic Notifies Effective Date For Amendments Under GST Law Made Vide Finance Act 2021 and 2023Dokument6 SeitenCbic Notifies Effective Date For Amendments Under GST Law Made Vide Finance Act 2021 and 2023PradeepkumarNoch keine Bewertungen

- Ministry: File IndiaDokument13 SeitenMinistry: File IndiaNarayanaNoch keine Bewertungen

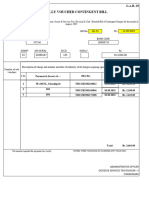

- Contigent Bill OE 54 - Dated 11.09.2023Dokument5 SeitenContigent Bill OE 54 - Dated 11.09.2023jaideep sainiNoch keine Bewertungen

- US Internal Revenue Service: 10523799Dokument4 SeitenUS Internal Revenue Service: 10523799IRSNoch keine Bewertungen

- Demanda JCFDokument38 SeitenDemanda JCFJaime VazquezNoch keine Bewertungen

- GSTR2B 20CHSPM6149M1ZS 032023 10062023Dokument7 SeitenGSTR2B 20CHSPM6149M1ZS 032023 10062023laxmi handloommdpNoch keine Bewertungen

- Appellate Tribunal For Forfeited Property (Conditions of Service of Chairman and Members) Amendment Rules, 1985Dokument2 SeitenAppellate Tribunal For Forfeited Property (Conditions of Service of Chairman and Members) Amendment Rules, 1985Latest Laws TeamNoch keine Bewertungen

- Mindanao I Geothermal Partnership vs. Commissioner of Internal Revenue, 844 SCRA 386, November 08, 2017Dokument12 SeitenMindanao I Geothermal Partnership vs. Commissioner of Internal Revenue, 844 SCRA 386, November 08, 2017Vida MarieNoch keine Bewertungen

- 110773Dokument6 Seiten110773asheesh kumarNoch keine Bewertungen

- CD Technologies IncDokument38 SeitenCD Technologies InconlyshubhankarNoch keine Bewertungen

- 2307 FormDokument3 Seiten2307 FormK and F Construction Dev't CorpNoch keine Bewertungen

- Tax SeptDokument4 SeitenTax SeptJessica CrisostomoNoch keine Bewertungen

- U.S. v. Rajat K. GuptaDokument22 SeitenU.S. v. Rajat K. GuptaDealBook100% (1)

- USPTO Rejection of Casey Anthony Trademark ApplicationDokument29 SeitenUSPTO Rejection of Casey Anthony Trademark ApplicationJustia.comNoch keine Bewertungen

- Amended Poker Civil ComplaintDokument103 SeitenAmended Poker Civil ComplaintpokernewsNoch keine Bewertungen

- Divorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoDokument12 SeitenDivorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoJustia.comNoch keine Bewertungen

- Arbabsiar ComplaintDokument21 SeitenArbabsiar ComplaintUSA TODAYNoch keine Bewertungen

- Signed Order On State's Motion For Investigative CostsDokument8 SeitenSigned Order On State's Motion For Investigative CostsKevin ConnollyNoch keine Bewertungen

- Emmanuel Ekhator - Nigerian Law Firm Scam IndictmentDokument22 SeitenEmmanuel Ekhator - Nigerian Law Firm Scam IndictmentJustia.comNoch keine Bewertungen

- Deutsche Bank and MortgageIT Unit Sued For Mortgage FraudDokument48 SeitenDeutsche Bank and MortgageIT Unit Sued For Mortgage FraudJustia.com100% (1)

- Rabbi Gavriel Bidany's Sexual Assault and Groping ChargesDokument4 SeitenRabbi Gavriel Bidany's Sexual Assault and Groping ChargesJustia.comNoch keine Bewertungen

- Clergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesDokument22 SeitenClergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesJustia.comNoch keine Bewertungen

- NY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldDokument6 SeitenNY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldJustia.comNoch keine Bewertungen

- U.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftDokument5 SeitenU.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftJustia.comNoch keine Bewertungen

- Guilty Verdict: Rabbi Convicted of Sexual AssaultDokument1 SeiteGuilty Verdict: Rabbi Convicted of Sexual AssaultJustia.comNoch keine Bewertungen

- Online Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedDokument52 SeitenOnline Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedJustia.comNoch keine Bewertungen

- Brandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportDokument1 SeiteBrandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportJustia.comNoch keine Bewertungen

- Sweden V Assange JudgmentDokument28 SeitenSweden V Assange Judgmentpadraig2389Noch keine Bewertungen

- Defamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionDokument25 SeitenDefamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionJustia.comNoch keine Bewertungen

- Van Hollen Complaint For FilingDokument14 SeitenVan Hollen Complaint For FilingHouseBudgetDemsNoch keine Bewertungen

- FBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatDokument15 SeitenFBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatJustia.comNoch keine Bewertungen

- OJ Simpson - Nevada Supreme Court Affirms His ConvictionDokument24 SeitenOJ Simpson - Nevada Supreme Court Affirms His ConvictionJustia.comNoch keine Bewertungen

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Dokument2 SeitenCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comNoch keine Bewertungen

- Federal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerDokument6 SeitenFederal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerWBURNoch keine Bewertungen

- Function Media, L.L.C. v. Google, Inc. Et Al - Document No. 56Dokument4 SeitenFunction Media, L.L.C. v. Google, Inc. Et Al - Document No. 56Justia.com100% (4)

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Dokument2 SeitenCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comNoch keine Bewertungen

- Testifying Before Congress, by William LaForge. A Practical Guide to Preparing and Delivering Testimony before Congress and Congressional Hearings for Agencies, Associations, Corporations, Military, NGOs, and State and Local OfficialsDokument88 SeitenTestifying Before Congress, by William LaForge. A Practical Guide to Preparing and Delivering Testimony before Congress and Congressional Hearings for Agencies, Associations, Corporations, Military, NGOs, and State and Local OfficialsTheCapitol.NetNoch keine Bewertungen

- The History of Advertising and It's Important in Modern BusinessDokument61 SeitenThe History of Advertising and It's Important in Modern BusinessAli Wajid100% (1)

- Admin Law ReviewerDokument3 SeitenAdmin Law ReviewertynajoydelossantosNoch keine Bewertungen

- Qualifications of Labor Arbiters and ProsecutorsDokument3 SeitenQualifications of Labor Arbiters and ProsecutorsGerard Martin CamiñaNoch keine Bewertungen

- Theoretical Foundations OnDokument17 SeitenTheoretical Foundations OnAli Azam KhanNoch keine Bewertungen

- Freedom of SpeechDokument3 SeitenFreedom of Speechapi-318745921Noch keine Bewertungen

- October 19, 2009, Cover Letter To Clerk of The Court, Anne Richard, From George H. LeBlanc Solicitor For Plaintiffs ROYAL BANK OF CANADA, 501376 N.B. Ltd. A Body Corporate.Dokument3 SeitenOctober 19, 2009, Cover Letter To Clerk of The Court, Anne Richard, From George H. LeBlanc Solicitor For Plaintiffs ROYAL BANK OF CANADA, 501376 N.B. Ltd. A Body Corporate.Justice Done Dirt CheapNoch keine Bewertungen

- Rti India Sub Judice InformationDokument2 SeitenRti India Sub Judice InformationukxgerardNoch keine Bewertungen

- 22-Malacat v. CA G.R. No. 123595 December 12, 1997Dokument13 Seiten22-Malacat v. CA G.R. No. 123595 December 12, 1997Jopan SJNoch keine Bewertungen

- Garcia vs. Executive Secretary, 677 SCRA 751Dokument1 SeiteGarcia vs. Executive Secretary, 677 SCRA 751Patrick SilveniaNoch keine Bewertungen

- M-9 Release of Records PDFDokument19 SeitenM-9 Release of Records PDFRecordTrac - City of OaklandNoch keine Bewertungen

- Evidence Cases (Jopep)Dokument105 SeitenEvidence Cases (Jopep)Lim Jacqueline100% (1)

- Crim Written Digest FulltextDokument31 SeitenCrim Written Digest FulltextAerith AlejandreNoch keine Bewertungen

- Lalita Kumari vs. State of U.P.Dokument41 SeitenLalita Kumari vs. State of U.P.Abhimanyu NirulaNoch keine Bewertungen

- Right To DevelopmentDokument13 SeitenRight To DevelopmentUmang ModiNoch keine Bewertungen

- People V ArrojadoDokument7 SeitenPeople V ArrojadoKris Anne TuralloNoch keine Bewertungen

- "Red Hunt" Stories of Human Rights Violations in Time of Martial Law in Mindanao, 2018Dokument70 Seiten"Red Hunt" Stories of Human Rights Violations in Time of Martial Law in Mindanao, 2018Kilusang Magbubukid ng PilipinasNoch keine Bewertungen

- TOLENTINO vs. COMELECDokument2 SeitenTOLENTINO vs. COMELECJa RuNoch keine Bewertungen

- Pilapil vs. Ibay-SomeraDokument8 SeitenPilapil vs. Ibay-SomeraFrance De LunaNoch keine Bewertungen

- G.R. No. 46896 El Pueblo D Filipinas Vs Pablo San Juan WordDokument2 SeitenG.R. No. 46896 El Pueblo D Filipinas Vs Pablo San Juan WordJey-eel NastorNoch keine Bewertungen

- Lowering The Age of Criminal LiabilityDokument3 SeitenLowering The Age of Criminal LiabilityRalphjustin SaransateNoch keine Bewertungen

- Aggravating Circumstances ReportDokument19 SeitenAggravating Circumstances ReportApril Yang100% (3)

- Crimes Psda FinalDokument22 SeitenCrimes Psda FinalPrachi RanaNoch keine Bewertungen

- Villarica Pawnshop, Inc, Et Al. vs. Social Security Commission, Et Al., GR No. 228087, 24 January 2018Dokument12 SeitenVillarica Pawnshop, Inc, Et Al. vs. Social Security Commission, Et Al., GR No. 228087, 24 January 2018MIGUEL JOSHUA AGUIRRENoch keine Bewertungen

- People v. MoricoDokument2 SeitenPeople v. MoricoitsmestephNoch keine Bewertungen

- Group 3 - Juvenile Delinquency and CrimeDokument11 SeitenGroup 3 - Juvenile Delinquency and CrimeCarl Edward TicalaNoch keine Bewertungen

- School Uniforms - Background of and Descriptive ResearchDokument51 SeitenSchool Uniforms - Background of and Descriptive ResearchKadesh Hanah McCarthy50% (2)

- Republic of The Philippines Regional Trial Court: PetitionerDokument10 SeitenRepublic of The Philippines Regional Trial Court: PetitionerLiza MarieNoch keine Bewertungen

- Falcon and The Winter Soldier Episode 1 TorrentDokument16 SeitenFalcon and The Winter Soldier Episode 1 TorrentSbl IrvNoch keine Bewertungen