Beruflich Dokumente

Kultur Dokumente

FINS1612 Tutorial 4 Homework

Hochgeladen von

itoki229Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FINS1612 Tutorial 4 Homework

Hochgeladen von

itoki229Copyright:

Verfügbare Formate

FINS1612 Tutorial 4 Questions:

5.

- Has to meet the ASX listing requirements

- Usually appoint an underwriter (usually an investment bank that specializes in

IPOs) who will make sure that the company has the necessary and right financials.

Underwriter will also ensure that the company raises the full amount of the issue

and assist with the structure, price and marketing of securities.

- Company then has to lodge a prospectus with ASIC that states terms and

conditions of security issue to public.

- If all requirements are met, company will float to the stock market.

11.

- Pro rata rights issue:

- Increase in companys issued capital to all shareholders that is typically issued at a

discount to market price.

Advantages:

- Gives existing shareholders an opportunity to maintain their pro rata share in the

earning and surplus of the company

- Financial management is relieved of having to sell the shares on the open market

- However can take time as company must prepare a prospectus (6 weeks)

Private Placement:

- Additional new ordinary shares that are issued to selected investors.

- No need to register a prospectus but a memorandum of information has to be

prepared

- Dilutes holding of non-participating shareholders.

13. Preferences shares are stocks with dividends that are paid before common stock

dividends are paid. In the event of bankruptcy, preferred shareholders have higher

priorities than common stock in being paid.

a) Structure of a preference share

allows the company to expand funds even if its reached its optimal debt/equity

ratio as preference shares are essentially fixed interest borrowings which count as

equity. Associated cash flows are the dividends that the company will payout at a

fixed date, the cash payment to the holder if the preference share is redeemable,

and in the case of bankruptcy, the preference share holder would receive cash in

priority ahead of ordinary shares.

b) Cumulative / Non-Cumulative, Redeemable / Non-redeemable, Convertible / Nonconvertible, Participating / Non-participating

All options will still meet funding needs of the bank.

Convertible Notes:

- fixed interest debt security with option to convert into ordinary shares

- issued at a price close to the market price of the share at the time, rate of interest

is usually lower than normal debt instruments due to conversion option.

- different from straight debt as rate of interest is usually lower and term to maturity

is considerable longer

Company Issued Options:

- Security that option to buy ordinary shares of the company at a predetermined

future date and pre-determined price.

- usually offered with rights issue or placement or sold at a price

- different from straight equity as the funding isnt guaranteed

Company Issue Equityt Warrants:

- Option to convert warrant into ordinary shares at a specified price over a given

period. (Form of an option).

- Warrant generally attaches to a corporate bond debt issue of the company

Das könnte Ihnen auch gefallen

- Work It Daily - Resume TemplateDokument2 SeitenWork It Daily - Resume TemplateAlessandra CallegaroNoch keine Bewertungen

- Corporate Finance Assignment 2Dokument7 SeitenCorporate Finance Assignment 2manishapatil25Noch keine Bewertungen

- Long Term FinancingDokument5 SeitenLong Term Financingjayaditya joshiNoch keine Bewertungen

- Social Media Marketing ProposalDokument7 SeitenSocial Media Marketing Proposalsaurabh100% (3)

- UntitledDokument10 SeitenUntitledRima WahyuNoch keine Bewertungen

- Turtle Trader Practical SummaryDokument7 SeitenTurtle Trader Practical SummaryGrant Muddle67% (6)

- Capsim Decisions AssistDokument68 SeitenCapsim Decisions AssistRose KNoch keine Bewertungen

- Mutual Funds for Beginners Learning Mutual Funds BasicsVon EverandMutual Funds for Beginners Learning Mutual Funds BasicsNoch keine Bewertungen

- CIMA F2 Course Notes PDFDokument293 SeitenCIMA F2 Course Notes PDFganNoch keine Bewertungen

- Negotiations, Deal StructuringDokument30 SeitenNegotiations, Deal StructuringVishakha PawarNoch keine Bewertungen

- Buy Back of SharesDokument57 SeitenBuy Back of SharesNirmalNoch keine Bewertungen

- Mission Vision and ObjectivesDokument5 SeitenMission Vision and ObjectiveskarunaduNoch keine Bewertungen

- A Level Business Studies CH 5 B.S. FinanceDokument8 SeitenA Level Business Studies CH 5 B.S. Financebelovedtadiwa835Noch keine Bewertungen

- Business FinanceDokument1 SeiteBusiness FinancePro NdebeleNoch keine Bewertungen

- Equity Capital Common and Preffered StockDokument23 SeitenEquity Capital Common and Preffered StockNicole LasiNoch keine Bewertungen

- Factors Determining Capital StructureDokument2 SeitenFactors Determining Capital StructureMostafizul HaqueNoch keine Bewertungen

- Topic 3 - Stock ValuationDokument39 SeitenTopic 3 - Stock ValuationSin Yee HohNoch keine Bewertungen

- CH 07Dokument23 SeitenCH 07mehdiNoch keine Bewertungen

- Financial Management: Investment, Financing and Dividend DecisionsDokument7 SeitenFinancial Management: Investment, Financing and Dividend Decisionssonal2901Noch keine Bewertungen

- Factors Determining Capital Structure EssayDokument2 SeitenFactors Determining Capital Structure Essayrakesh kumarNoch keine Bewertungen

- Buyback DelistingDokument51 SeitenBuyback DelistingSowjanya Hp SowjuNoch keine Bewertungen

- Sources of FinanceDokument6 SeitenSources of FinanceNeesha NazNoch keine Bewertungen

- Chapter 7 - Sources of FinanceDokument12 SeitenChapter 7 - Sources of FinanceSai SantoshNoch keine Bewertungen

- Chapter 3 Shares, Debenture and ChargesDokument4 SeitenChapter 3 Shares, Debenture and ChargesKien Wah100% (1)

- CZ Patel College Submits Report on Equity Shares, Debentures & Preference SharesDokument18 SeitenCZ Patel College Submits Report on Equity Shares, Debentures & Preference Sharesrishi raj modiNoch keine Bewertungen

- MBI Corporate Finance Topic 4 Share CapitalDokument124 SeitenMBI Corporate Finance Topic 4 Share Capitaljonas sserumagaNoch keine Bewertungen

- Chapter 4 FIDokument7 SeitenChapter 4 FISeid KassawNoch keine Bewertungen

- Features and Types of Equity and Preference SharesDokument11 SeitenFeatures and Types of Equity and Preference SharesTanya SinghNoch keine Bewertungen

- Ordinary Share CapitalDokument7 SeitenOrdinary Share CapitalKenneth RonoNoch keine Bewertungen

- Finance Management: Swapnil S KarvirDokument29 SeitenFinance Management: Swapnil S KarvirMarvellous NerdNoch keine Bewertungen

- Short Term and Working Capital Financing OptionsDokument44 SeitenShort Term and Working Capital Financing OptionsSarahNoch keine Bewertungen

- Sourcing Money May Be Done For A Variety of ReasonsDokument24 SeitenSourcing Money May Be Done For A Variety of ReasonsFelix Amirth RajNoch keine Bewertungen

- Chapter 8 Sources of Business Finance.-1-6Dokument6 SeitenChapter 8 Sources of Business Finance.-1-6pran029276Noch keine Bewertungen

- CF 3rd AssignmentDokument6 SeitenCF 3rd AssignmentAnjum SamiraNoch keine Bewertungen

- Module 4-CoC-1Dokument13 SeitenModule 4-CoC-1Abida RiazNoch keine Bewertungen

- Equity Market: Equity Market Is One of The Key Sectors of Financial Markets Where Long-Term FinancialDokument10 SeitenEquity Market: Equity Market Is One of The Key Sectors of Financial Markets Where Long-Term Financialfrancis dungcaNoch keine Bewertungen

- Source of Finance 1Dokument35 SeitenSource of Finance 1Niraj GuptaNoch keine Bewertungen

- Stock ValuationDokument36 SeitenStock ValuationAlifa ChowdhuryNoch keine Bewertungen

- MB20202 Corporate Finance Unit IV Study MaterialsDokument21 SeitenMB20202 Corporate Finance Unit IV Study MaterialsSarath kumar CNoch keine Bewertungen

- An overview of capital market productsDokument22 SeitenAn overview of capital market productsshakirNoch keine Bewertungen

- Capital Structure, Capitalisation and LeverageDokument53 SeitenCapital Structure, Capitalisation and LeverageCollins NyendwaNoch keine Bewertungen

- FINANCIAL MANAGEMENT - ORDINARY Week 9Dokument42 SeitenFINANCIAL MANAGEMENT - ORDINARY Week 9Syrell NaborNoch keine Bewertungen

- On Sore InstrumentsDokument19 SeitenOn Sore InstrumentsPrashant GharatNoch keine Bewertungen

- Chapter 3 PDFDokument24 SeitenChapter 3 PDFCarlos PadillaNoch keine Bewertungen

- Capital Market: Group MembersDokument17 SeitenCapital Market: Group MembersSushil MirguleNoch keine Bewertungen

- Investments An Introduction 10Th Edition Mayo Solutions Manual Full Chapter PDFDokument39 SeitenInvestments An Introduction 10Th Edition Mayo Solutions Manual Full Chapter PDFWilliamCartersafg100% (8)

- Review 1 (5.1.12)Dokument24 SeitenReview 1 (5.1.12)sathy_sathyNoch keine Bewertungen

- Sources of Business Finance Part IDokument37 SeitenSources of Business Finance Part Ishetty.reshmagNoch keine Bewertungen

- Sources of Company FinanceDokument15 SeitenSources of Company Financenileprab877Noch keine Bewertungen

- Unit 4 - FInancial Management & Corporate Finance - KMBN 204-1 - 230707 - 185305Dokument18 SeitenUnit 4 - FInancial Management & Corporate Finance - KMBN 204-1 - 230707 - 185305upsc viewNoch keine Bewertungen

- Sources of Finance FinanceDokument10 SeitenSources of Finance FinanceNitin PariharNoch keine Bewertungen

- Fin MGT Lecture 2Dokument3 SeitenFin MGT Lecture 2Noushin KhanNoch keine Bewertungen

- What are Preferred Shares and How Do They Differ from Common StockDokument9 SeitenWhat are Preferred Shares and How Do They Differ from Common StockMariam LatifNoch keine Bewertungen

- Stock Valuation Written ReportDokument14 SeitenStock Valuation Written ReportJesse John A. CorpuzNoch keine Bewertungen

- Dividend PolicyDokument3 SeitenDividend PolicyJaspreet KaurNoch keine Bewertungen

- Chapter 12 - Shareholders' Equity: Capital Contributions, Distributions, and EarningsDokument47 SeitenChapter 12 - Shareholders' Equity: Capital Contributions, Distributions, and EarningsDeepanshu PartiNoch keine Bewertungen

- Chapter 7 - Homework & Solution: Answers To QuestionsDokument15 SeitenChapter 7 - Homework & Solution: Answers To QuestionsSumera SarwarNoch keine Bewertungen

- Blackboard - Financial Strategy WK 4Dokument26 SeitenBlackboard - Financial Strategy WK 4Motassem MoustafaNoch keine Bewertungen

- Brian Ghilliotti-Money and Banking-Ch 10 SummaryDokument7 SeitenBrian Ghilliotti-Money and Banking-Ch 10 SummaryBrian GhilliottiNoch keine Bewertungen

- Meaning:: Difference Between Equity Shares and Preference SharesDokument7 SeitenMeaning:: Difference Between Equity Shares and Preference SharesAnkita ModiNoch keine Bewertungen

- FM ReviewerDokument20 SeitenFM ReviewerBSA - Cabangon, MerraquelNoch keine Bewertungen

- Managerial Finance chp7Dokument11 SeitenManagerial Finance chp7Linda Mohammad FarajNoch keine Bewertungen

- Sources of Corporate Finance JustifyDokument10 SeitenSources of Corporate Finance Justifyshridhar DeshmukhNoch keine Bewertungen

- Types of SharesDokument10 SeitenTypes of Sharesinsomniac_satanNoch keine Bewertungen

- PM AssignmentDokument22 SeitenPM AssignmentEmuyeNoch keine Bewertungen

- Means of Finance (2003)Dokument83 SeitenMeans of Finance (2003)TamannaAroraNoch keine Bewertungen

- Online QuizDokument63 SeitenOnline QuizUnswlegend50% (2)

- Problem Set 7 - FINS2624Dokument1 SeiteProblem Set 7 - FINS2624itoki229Noch keine Bewertungen

- Share Market Investment - FINS1612 NotesDokument4 SeitenShare Market Investment - FINS1612 Notesitoki229Noch keine Bewertungen

- Econometrics Final Exam InsightsDokument9 SeitenEconometrics Final Exam Insightsitoki229Noch keine Bewertungen

- (2016-S1) - FINS3616 - Tutorial Slides - Week 02 - Introduction + FX Bas...Dokument53 Seiten(2016-S1) - FINS3616 - Tutorial Slides - Week 02 - Introduction + FX Bas...itoki229Noch keine Bewertungen

- ARC Club HandbookDokument68 SeitenARC Club Handbookitoki229Noch keine Bewertungen

- Joel Adams: Founder and General Partner of ACM Venture Capital FirmDokument3 SeitenJoel Adams: Founder and General Partner of ACM Venture Capital Firmitoki229100% (1)

- Fins 1613 S2 Yr 2014 Midterm Exam FormulasDokument2 SeitenFins 1613 S2 Yr 2014 Midterm Exam Formulasitoki229Noch keine Bewertungen

- FINS1613 Business Finance Course OutlineDokument15 SeitenFINS1613 Business Finance Course OutlineWheatedNoch keine Bewertungen

- Lectures NotesDokument1 SeiteLectures Notesitoki229Noch keine Bewertungen

- Notes On Capital StructureDokument24 SeitenNotes On Capital Structureitoki229Noch keine Bewertungen

- Exam Topics Overview ECON1203Dokument1 SeiteExam Topics Overview ECON1203itoki229Noch keine Bewertungen

- SOBHA DEVELOPERS LTD Investor PresentationDokument29 SeitenSOBHA DEVELOPERS LTD Investor PresentationSobha Developers Ltd.Noch keine Bewertungen

- PuregoldDokument9 SeitenPuregoldCarmina BacunganNoch keine Bewertungen

- Case Assignment 2Dokument5 SeitenCase Assignment 2Ashish BhanotNoch keine Bewertungen

- Pricing Strat QuizDokument3 SeitenPricing Strat QuizJohana ReyesNoch keine Bewertungen

- V K 11 Create PricingDokument9 SeitenV K 11 Create PricingNguyenkimthang86Noch keine Bewertungen

- Internal Control Assessment ReportDokument4 SeitenInternal Control Assessment ReportMATRON DAIESNoch keine Bewertungen

- Palmer Cook Productions Manages and Operates Two Rock Bands TheDokument1 SeitePalmer Cook Productions Manages and Operates Two Rock Bands TheLet's Talk With HassanNoch keine Bewertungen

- Case Study 06Dokument4 SeitenCase Study 06lieselenaNoch keine Bewertungen

- Marketing PlanDokument11 SeitenMarketing PlanVINAY PHOGATNoch keine Bewertungen

- Curriculum Vitae: Purpose To DevelopDokument2 SeitenCurriculum Vitae: Purpose To DevelopDuc TuNoch keine Bewertungen

- Brand Equity On Purchase Intention Consumers' Willingness To Pay Premium Price JuiceDokument7 SeitenBrand Equity On Purchase Intention Consumers' Willingness To Pay Premium Price JuiceThuraMinSweNoch keine Bewertungen

- Name: - Date: - : Table: Consumer Surplus and Phantom TicketsDokument12 SeitenName: - Date: - : Table: Consumer Surplus and Phantom TicketsRacaz EwingNoch keine Bewertungen

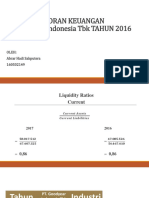

- Analisis Laporan Keuangan PT. Goodyear Indonesia TBK TAHUN 2016 DAN 2017Dokument34 SeitenAnalisis Laporan Keuangan PT. Goodyear Indonesia TBK TAHUN 2016 DAN 2017Tri AmbarNoch keine Bewertungen

- Hjalmar Lindholm - Investment BankingDokument2 SeitenHjalmar Lindholm - Investment BankingHjalmarLindholmNoch keine Bewertungen

- Chapter 6 PDFDokument28 SeitenChapter 6 PDFDiva CarissaNoch keine Bewertungen

- Property Inventory: Msu-Iit National Multi-Purpose CooperativeDokument4 SeitenProperty Inventory: Msu-Iit National Multi-Purpose CooperativeNestorJepolanCapiña100% (1)

- Aud TheoryDokument14 SeitenAud TheoryIm In TroubleNoch keine Bewertungen

- 1 Blank Model TemplateDokument28 Seiten1 Blank Model TemplateMasroor KhanNoch keine Bewertungen

- A Study On Distribution Channels in CementindustryDokument8 SeitenA Study On Distribution Channels in CementindustryAashish MishraNoch keine Bewertungen

- Buyers' Cartels An Empirical Study of Prevalence and Economic CharacteristicsDokument48 SeitenBuyers' Cartels An Empirical Study of Prevalence and Economic CharacteristicsmgNoch keine Bewertungen

- Costing Accounting ProblemsDokument3 SeitenCosting Accounting Problemstrixie maeNoch keine Bewertungen

- CH 1Dokument42 SeitenCH 1Rana HarisNoch keine Bewertungen

- Perhitungan Bab 4 ChopraDokument5 SeitenPerhitungan Bab 4 ChoprarobbyNoch keine Bewertungen

- Emerging cost approaches and JIT manufacturingDokument3 SeitenEmerging cost approaches and JIT manufacturingLAKSHMANAN MPNoch keine Bewertungen