Beruflich Dokumente

Kultur Dokumente

Wave Notes - Elliottwavepredictions

Hochgeladen von

pierOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Wave Notes - Elliottwavepredictions

Hochgeladen von

pierCopyright:

Verfügbare Formate

8/8/2015

WaveNoteselliottwavepredictions.com

elliottwavepredictions.com

Wave Notes

by Sid Aug. 8, 2015 15 min read original

Here arethepersonalnotes I tookwhile studying:

Elliott Wave Principle by Frost & Prechter 10th Ed. (2005)

Additionally, over a period of time, Ive inserted several pointers

from reading and/or viewing numerous Elliott Wave educational

materials presented by Wayne Gorman, Jeffrey Kennedy, Dave

Allman, Dan Esconi, Rich Swannell, and others.

Chapter 1 The Broad Concept:

The Basics:

Ralph Nelson Elliotts (1871-1948) Wave Principle states that

repetitive forms (waves) within the financial markets are generated

by mans social nature/mass psychology, which is keyed to a

mathematical law of nature, expressed by the Fibonacci sequence,

and more specifically, the golden ratio (.618 & its inverse, 1.618).

These forms/waves grow and decay independent of news.

Progress (referred to in Elliott as motive & actionary waves)

occurs in 5 waves, of which waves 2 and 4 are counter-trend

interruptions. Regress (corrective/reactionary waves) occurs in 3

waves, with wave 2 being an interruptive wave. The complete

advance and decline cycle is therefore 8 waves.

https://www.readability.com/articles/j9etjulc

1/14

8/8/2015

WaveNoteselliottwavepredictions.com

The basic 8 wave form is fractal in nature. It is operating at all

degrees (chart timeframes) simultaneously. See the Elliott Wave

labeling system (p.27).

In most impulses there is a 5-wave pattern which unfolds adhering

to the following rules:

subwave 2 does not overlap the start of wave 1.

subwave 4 does not overlap the extreme of wave 1. Also, as a strong

guideline, it is not advisable to assign a wave 4 label if there is any

overlap of the territory of wave 1 duringthe 4th wave.

subwave 3 is not the shortest of 1, 3 & 5

Impulses are typically bound by parallel lines (p.30)

In impulses, one of waves 1, 3 or 5 will likely extend substantially in

comparison to the other two. In the stock market, wave 3 is most

likely to extend, whereas in commodities, wave 5 is the more likely to

extend.

Rarely, a wedge shaped diagonal appears as wave 1, A, 5 or C. It is

sometimes referred to as a diagonal triangle. In a diagonal, both

trendlines slope/tilt in same direction (both up or both down). Most

often, the trendlines lines converge (get closer together) as they

extend. Sometimes the diverge (get further apart with time).

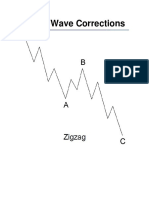

Corrective waves come in 3 basic variations:

o zigzag (5-3-5)

o flat (3-3-5)

o triangle (3-3-3-3-3)

Corrective waves can combine into more complex combinations

labeled W-X-Y or W-X-Y-X-Z.

https://www.readability.com/articles/j9etjulc

2/14

8/8/2015

WaveNoteselliottwavepredictions.com

In impulses, wave 2 & 4 nearly always alternate in form, one being

of the sharp (zigzag or zigzag combo) family, and the other being of the

sideways (flat, triangle or mixed combo) family.

Each wave label exhibits a unique personality, characterized by

volume, momentum, and sentiment.

Sometimes the patterns end differs from the associated price

extreme. Always label and draw trendlines & fibonaccis correctly by

using the orthodox (labeled) end of waves.

See my page regarding Elliotts degree-of-trend labeling system.

Impulse Waves:

Extension: in impulses, usually just one of waves 1, 3 or 5 extend.

Wave 3 is the most likely to extend. Rarely, both 3 and 5 extend.

Extensions can occur within extensions. For instance 3 of 3.

Sometimes, at the end of an impulse in which one of the waves

extended, there are 9 total waves, and it is difficult to determine

which wave extended. There also can be extensions within

extensions. 5 in extension manifests itself as 9, 13, 17, etc. 3 in

extension can appear as a 7, 11, 15, etc. If neither wave 1 or 3 is

extended, expect wave 5 to extend, especially if volume is greater

in the 5th than the 3rd.

Truncation: when the 5th wave does not reach beyond the 3rd

wave. Occurs most often after a particularly strong 3rd wave. The

wave 5 must still contain the necessary 5 subwaves. The message

truncations send is that there is tremendous pressure to start the

new trend. Expect big moves after truncations.

Diagonal: subdivides 3-3-3-3-3. Notated with digits 1-5. Signals

an imminent major trend reversal.

An ending contracting diagonal appears at the termination

point of larger movements, most often as wave 5, and rarely as

wave C. An expanding diagonal has only occurred only once

in the stock market. Wave 5 often over-shoots, and upon rare

https://www.readability.com/articles/j9etjulc

3/14

8/8/2015

WaveNoteselliottwavepredictions.com

occasion, falls short of its resistance trendline. If it does fall

short, the reversal will be more severe. Ending diagonal

triangles indicate exhaustion of a larger pattern that moved

too far too fast. Ending diagonals are usually followed by a

quick thrust which retraces to the starting level of the

diagonal.

A leading diagonal (3-3-3-3-3) occasionally appears in the

wave 1 (or A of zigzags) position. There are only two

historical instances where there was a diagonal triangle Type

II which sub divided 5-3-5-3-5, in which case is was a wave A

of a zigzag ABC bear market rally that was preceded and

followed by strong downward movements. Beware: what

appears to be a leading diagonal is usually a 1-2-1-2 instead.

Leading diagonals are typically deeply retraced, and if in wave

1 position, are typically followed by a zigzag retracement of

78.6%.

Wave 3 is never a diagonal.

Most Typical Impulse Fibonacci Ratios/Multiples (from Chapter

4: Ratio Analysis):

If wave 1 is extended, expect the net of wave 2-5 to be .618 x

wave 1

Wave 2 = 618 or .5 x wave 1

If wave 3 is extended, waves 1 and 5 tend toward equality. A

.618 relationship is next most likely.

Wave 3 = 1.618 or 2.618 x wave 1

Wave 4 = .382 x wave 3

Wave 4 (net) typically relates to its corresponding wave 2

(net) by a Fibonacci ratio.

Wave 5 = wave 1, or .618, or .382 x the net of waves 1 thru 3.

If neither wave 1 or 3 is extended, expect wave 5 to be 1.618 x

the net of 1-3.

The time to complete waves 1 thru 3 = the time to complete

the end of 3 to the end of 5.

Corrective Waves:

https://www.readability.com/articles/j9etjulc

4/14

8/8/2015

WaveNoteselliottwavepredictions.com

Corrective wave are more varied than impulse waves, contain

choppy overlapping waves, and are more difficult than impulses

to count correctly in real-time. They are generally not highconfidence areas in which to make predictions. Avoid things that

can hurt you!

Corrective waves are never 5s.

An initial 5-wave move against the larger trend is never the end of

the correction, only a part of it.

Corrective moves come in two styles, which almost always

alternate in waves 2 & 4:

Sharp: steeply angled, made up of a zigzag, or double or triple

zigzag. Usually .618 or .500.

Sideways: horizontal in nature. Consists of a flat, a triangle, a

double three, or a triple three. Triangles never appear alone

as wave 2. The final move of sideways corrections always

correct the extreme of the preceding wave by at least one

pip., and typically contain a movement back to or beyond its

starting level, often creating a new high or low during the

phase.

Corrective patterns fall into 3 categories:

Zigzag (5-3-5) sharp. Most common in wave 2s. If the 1st zigzag

doesnt retrace sufficiently, there may be a double or triple

zigzag. Wave B will not surpass the origin of A. C moves well

beyond the extreme of A. Zigzag and double and triple zigzags

produce a persistent move against the larger trend.

Flat (3-3-5) sideways. Most common in wave 4s. There are 3

types:

Regular Flat: B terminates near the start of A. C terminates

slightly beyond the end of wave A.

Expanded (Irregular) Flat: (actually far more common than

reg. flat). B terminates beyond the start of A, and C ends more

substantially beyond the end of wave A. Bear market

expanded flats may be referred to as an inverted expanded

flat.

https://www.readability.com/articles/j9etjulc

5/14

8/8/2015

WaveNoteselliottwavepredictions.com

Running Flat: (very rare). B terminates well beyond the start

of A, but C falls short of the end of wave A. BEWARE: if B

breaks down into 5 waves, it is more likely a wave 1 of an

impulse of the next higher degree. A Running Flat (sometimes

referred to as an Irregular Flat Type II by Prechter)

essentially exhibits a failure (truncation) in wave c, and

although rare, usually appears as a wave 2, because wave 3

just cant wait to get underway.

Triangle (3-3-3-3-3) sideways. Triangle waves are notated with

letters A through E, and consist of 5 overlapping waves. Indicate a

triangle on your chart by drawing trendlines connecting A & C,

and B & D. Triangles take up a lot of time. Wave E will likely over

or under-shoot the trendline. If E overshoots, it cannot surpass

the extreme of C. If it does, it is not an E wave in a triangle. At

wave Es end, all triangles affect at least a one pip corrective

result from the end of the preceding wave (wave 3, for instance).

There is usually a post-triangle terminal thrust from the extreme

of E equal to the width of the trendlines at the starting point of the

triangle. Most subwaves are zigzags, although wave C is often a

more complex double zigzag. One of the subwaves (usually E) can

itself be a triangle, which results in labeling of A-B-C-D-E-F-G-HI. Triangles always occur in a position prior to the final wave in

the pattern of one larger degree, most often wave 4 of an impulse,

but also B of an ABC, or the final X in a double or triple three. A

triangle may also occur as the final actuary pattern in a corrective

combination. Triangles never appear alone as wave 2. If wave B

makes a new high or low, it is called a running triangle. There are

3 types of triangles:

Contracting the upper trendline is sloping down, the other

up. (If B overshoots A, its called a running contracting

triangle).

Barrier (either the upper or lower line is virtually horizontal).

The horizontal line will be the line that will be broken after

the E wave is complete.

Expanding ( the upper & lower trendlines diverge, the upper

https://www.readability.com/articles/j9etjulc

6/14

8/8/2015

WaveNoteselliottwavepredictions.com

sloping up, the other down). Wave E must move beyond the

extreme of C in Expanding Triangles.

There can be combinations of corrective patterns. Combinations

are generally horizontal in nature. Each pattern within the

combination is connected by a 3-wave corrective movement

(most often a zigzag) labeled X. Each three in combinations can

be a zigzag or flat. Triangles only appear as the final wave in

combinations. The forms generally alternate. There is never

more than one zigzag or triangle in a combination. The two types

of corrective combinations are:

Double three (labeled W-X-Y). Extends the duration of the

correction.

Triple three (labeled W-X-Y X-Z) (rare). Extends the

duration even further.

If there are a number of similar waves in a row that are difficult to

label, remember that a double zigzag will have 7 waves, and triple

zigzag has 11.

Sometimes volume spikes at the end of corrections, but more

often it drops off.

Chapter 2 Guidelines of Wave Formation:

(Guidelines arent rules, they guide to what is probable)

Alternation: (expect a difference in the next expression of a

similar wave):

If wave 2 is sharp, expect wave 4 to be sideways, and vice versa,

except inside triangles, where alternation of 2 & 4 does not occur.

If wave 2 is sideways, a triangle can appear as wave 4 and still

fulfill alternation, but this less likely. (Triangles alternate with

everything else).

If wave 2 is simple, expect wave 4 to be a complex combination,

and vice versa.

One of the 2 corrective waves within an impulse will likely retrace

https://www.readability.com/articles/j9etjulc

7/14

8/8/2015

WaveNoteselliottwavepredictions.com

the entire last impulse (of one lesser degree?), the other will not.

Extension is an expression of alternation. Typically wave 1 is

short, 3 long, and 5 short. If wave 1 is extended, 3 and 5 will likely

not be extended. If 1 and 3 are not, 5 will likely be.

Within corrective ABC waves, if A is a flat, expect B to be a zigzag

and vice versa. If A is simple, expect B to be a more complex

combination, and C even more complex, or, the complete reverse:

most complex-complex-simple, although this is not as common as

increasing complexity.

Rich Swannell, in his Elite Trader Secrets book contends that

alternation only takes place 61.8% of the time. He contends that

the culprit causing this somewhat low percentage is that when

wave 2 is sideways, there is a 78% chance that wave 4 will be

sideways as well!! In his 20 years of research, this is the only

significant statistical anomaly he found comparing realtime

analysis to Elliots original guidelines.

Depth of Corrective Waves:

Corrections (especially 4th waves) tend to retrace to within the

span of the previous 4th wave of one lesser degree.

If the 1st wave of a sequence extends, the correction following the

5th wave of the sequence will retrace no further than the extreme

of wave 2 of a lesser degree (wave 2 of the 5th).

After 5th wave extensions, the ensuing correction will likely be

sharp and swift, and will end near the extreme of wave 2 of the

extension. This does not apply when the market is ending a 5th

wave simultaneously at more than one degree.

Wave Equality:

2 of the motive waves in a 5-wave sequence tend toward equality

in time and magnitude. If equality is lacking, a .618 relationship

in next most likely. Usually wave 3 is extended, so wave 1 and 5

are often nearly equal in amplitude and duration.

Waves A and C of a correction tend toward equality. C = 1.618 x A

is next most likely.

https://www.readability.com/articles/j9etjulc

8/14

8/8/2015

WaveNoteselliottwavepredictions.com

Channeling:

A parallel trend channel typically marks the upper and lower

boundaries of impulse waves.

When wave 3 ends. Connect 1 & 3, and place a parallel line thru 2.

This provides an estimated boundary for wave 4. When wave 4

ends, connect 2 & 4, and place a parallel line thru 3. This will

forecast the end of wave 5. If wave 4 moves out of the channel,

expect wave 5 to be a throw-over. (WG) Alternative method for

projecting the end of wave 5: if wave 3 is abnormally strong

(vertical) and wave 4 is sideways, connect 2 and 4, and draw a

parallel line that intersects the extreme of wave 1. This will

project the end of wave 5.

Trendlines can also help with zigzags. Connect the origin of A

with point B, and place a parallel line through point A. This will

project the end of C. (Wayne Gorman)

Remember: Its not over until wave 5 of 5 of 5 is finished. The

wave count takes precedence over channel lines and projected

Fibonacci targets.

Wave 5s can throw-over or throw-under, depending on

volume. During a throw-over, it is difficult to identify waves of

smaller degrees, as channels lines are penetrated.

Volume:

Late in a corrective phase, a decline in volume often indicates a

decline in selling/buying pressure, and coincides with a turning

point in the market.

Of the impulse waves, 3rd waves almost always exhibit the

greatest volume. If volume during the 5th wave is as high as the

3rd, expect an extended 5th wave.

Volume during corrective patterns will generally dry up during

triangles and combinations, and will climax during A waves, and

during wave 3 of C.

The Right Look

https://www.readability.com/articles/j9etjulc

9/14

8/8/2015

WaveNoteselliottwavepredictions.com

If wave 4 terminated well above the top of wave 1 in a 5-wave move,

it must be labeled as an impulse.

It is extremely dangerous to accept a wave count that represents

disproportionate wave relationships or a misshapen pattern.

The right look may not be evident at all degrees of trend

simultaneously, so focus on the degrees that are the clearest.

You need short term charts to analyze subdivisions in fast moving

markets, and long term charts for slowly moving markets.

When re-working your count, always start from a significant

bottom. (WG)

Movements with the larger trend subdivide into 5. Movements

against the larger trend subdivide into 3. (DA)

The belief that there is only one direction the market can take, and

the refusal to consider alternatives is a recipe for trouble. (DA)

Its not over until the 5th of the 5th of the 5th of the 5th is complete.

Confirmation that a trend change has occurred of a certain degree

comes with a 5-wave move of one lesser degree in the opposite

direction.

Wave Personality:

At times, more than one wave count is admissible, making wave

personality invaluable in determining the preferred count:

1st Waves: unfold in a 5-wave impulse. Part of a basing process.

Maybe well actually survive this after all. Most, however do not

believe that the trend has changed.

2nd Waves: unfold in a 3-wave corrective fashion, and usually

deeply retrace wave 1. The masses are convinced that the old

trend is still in force, and pessimism is even worse than the origin

https://www.readability.com/articles/j9etjulc

10/14

8/8/2015

WaveNoteselliottwavepredictions.com

of 1. Here we go again. Wave 2s end up exhibiting low

volume/volatility, with sentiment (the put/call ratio) at its low.

Wave 2s provide a great trading opportunity!

3rd Waves unfold as a 5, and are strong, broad, and steep.

Optimism returns. Economic fundamentals improve. At about

the middle of wave 3, there is mass recognition that a new trend is

underway. This is when volatility is at its highest. MACD will

usually confirm wave 3 peaks.

4th Waves unfold as a 3, and are predictable in depth and form due

to alternation from the 2nd wave. They are very likely sideways

affairs, and are building a base for the final 5th wave. They are

accompanied by a surprising disappointment because the

advance did not continue.

5th Waves unfold as a 5, and are less dynamic than wave 3s, unless

the wave 5 is an extension. Volume is less than wave 3, but

optimism/pessimism is at its highest, although fundamentals

arent as good. Wave 5s are typically accompanied by MACD

divergence. FYI: wave 5s in commodities are stronger than wave

3s, and are driven by fear.

A Waves unfold as 5s if the beginning of a zigzag, or 3s if the

beginning of a flat or triangle. Arrogance and complacence is

lingering. Most are convinced that it is just another pullback

before the larger trend continues, although they are often sharp,

and can retrace more than the previous impulse wave. A waves

following extensions on commodities are often crashes. A waves

do not kill the hopes associated with the old trend though. MACD

will be deeper at the end of A waves than it was during the

previous waves 2 or 4.

B Waves unfold as 3s, and are sucker plays, especially in

expanded/irregualar flats. The masses believe the up trend has

resumed. Wave Bs are usually zigzags, and the next most likely is

a triangle.

C Waves unfold as 5s (unless part of a triangle, or rarely a

diagonal), and are strong like a wave 3. The illusions held through

A and B quickly evaporates into fear. Near the end of C, the

corrective phase will be widely mistaken for a new overall trend.

https://www.readability.com/articles/j9etjulc

11/14

8/8/2015

WaveNoteselliottwavepredictions.com

D Waves are 3s are accompanied by expanding volume, and are

phonies, like wave Bs.

E Waves are 3s, and are often mistaken as a kickoff of a new trend

(because of the typical throw-over). News often coincides with

the overshoot, and caused the masses to join the wrong side of the

trade at the worst moment.

X Waves connect corrective waves into combinations, and consist

of any type of 3 wave corrective structure, but are most often a

zigzag. An X, being a 3 wave move, signals that the correction is

not over yet.

Fibonacci Relationships (from Chapter 4: Ratio Analysis):

Fibonacci relationships of waves moving in the same direction

are more important than Fibonacci retracements.

The most typical corrective Fibonacci Ratios are:

In a zigzag, C = A, or 1.618 x wave A, or .618 x wave A (in that

order)

In a regular flat, A, B & C are each nearly equal

In an expanded flat, B = 1.236 or 1.382 x A

In an expanded flat, C = 1.618 x A (very common!) Sometimes

C will overshoot A by .618 x A.

In a contracting triangle, B = .618 x A, C .618 X B, and D = .618

x C.

In an extremely rare expanding triangle, the ratio is 1.618.

In double and triple corrections, the net travel of one simple

pattern related to the next by equality, or if one of the 3s is a

triangle, by .618.

Rich Swannells research showed that stock market wave 2s are

most likely to retrace wave 1 by 38.2%, and are about twice as

likely to retrace 38.2% than 61.8%. 2nd waves are widely varied in

the percentage that they retrace.

Wave 4 retracements of wave 3 are generally more predictable. A

.382 retracement is most common, and as little as a .236 is next,

especially if it is a wave 4 of larger wave 3. Also, wave 4s very

https://www.readability.com/articles/j9etjulc

12/14

8/8/2015

WaveNoteselliottwavepredictions.com

often retrace to the about the end of the previous wave 4 of a

lesser degree, for instance wave 4 of a larger wave 3.

The 5th wave, if the longest, typically travels 1.618 the distance of

from the start of wave 1 thru the end of wave 3.

Wave 3 will often be 1.618 x the length of wave 1. 2.618 is also

common.

Wave 5 will often be equal to wave 1 if wave 3 is extended.

Prechter, despite mighty efforts, has not been able to produce

anything useful as far as Fibonacci time relationships. Check out

Corolyn Boroden or Glenn Neelyswork for that.

Percentage Retracements and Extentions (from Rules and

Guidelines p. 86-91)

In a diagonal, waves 2 & 4 each usually retrace .66 to .81 of the

preceding wave.

In a zigzag, waveB typically retraces 38-79 percent of wave A.

In a zigzag, if waveB is a running triangle, it will typically retrace

10 to 40 percent of wavc A.

In a zigzag if waveB is a zigzag, it will typically retrace 50 to 79

percent of wave A.

In a zigzag, if wave B is a triangle, it will typically retrace 38 to 50

percent of wave A

In a flat, wave B must retrace at least 90 percent of wave A. This

is a rule.

In a flat, wave B usually retraces between 100 and 138 percent of

wave A.

In a flat, wave C is usually 100 to 165 percent as long as wave A.

In aflat, when wave B is more than 105 percent as long as wave A,

and wave C ends beyond the end of wave A, the formation is called

an expanded flat.

In an expanding triangle, subwaves B, C, and D each retrace at

least 100 percent but no more than 150 percent of the previous

subwave.

In an expanding triangle, subwaves B, C, and D usually retrace 105

to 125 percent of the preceding subwave.

https://www.readability.com/articles/j9etjulc

13/14

8/8/2015

WaveNoteselliottwavepredictions.com

Memorable Quotes from Chapter 3 Historical and

Mathematical Background:

When you have eliminated the impossible, whatever remains,

however improbable, must be the truth. Sherlock Holmes

Trading with Elliott Wave Principle helps you remain both flexible

and decisive, both defensive and aggressive, depending on the

demands of the situation.

The Elliott Wave principle is a means of first limiting the

possibilities, and then ordering the relative probabilities of possible

future market paths.

Because applying the Wave Principle is an exercise in probability,

the ongoing maintenance of alternative wave counts is an essential

part of using it correctly.

Of course, there are often times when, despite a rigorous analysis,

there is no clearly preferred interpretation. At such times, you must

wait until the count resolves itself.

Refer to the Summary of Rules and Guidelines for Waves (p.8692) During Wave Counting!

__________________________________________________________________

Announcing LIVE webinars every weekendwith Sid from

ElliottWavePredictions.com!Learn More . .

__________________________________________________________________

Original URL:

http://elliottwavepredictions.com/wave-notes/

https://www.readability.com/articles/j9etjulc

14/14

Das könnte Ihnen auch gefallen

- Sperandeo, Victor - Trader Vic - Methods of A Wall Street MasterDokument147 SeitenSperandeo, Victor - Trader Vic - Methods of A Wall Street Mastervinengch93% (28)

- Jeffrey Kennedy - How To Trade The Highest Probability Opportunities - Price BarsDokument47 SeitenJeffrey Kennedy - How To Trade The Highest Probability Opportunities - Price Barsmr1232386% (22)

- Plans PDFDokument49 SeitenPlans PDFEstevam Gomes de Azevedo85% (34)

- How To Count Elliott Waves On Any Chart Through ChannelsDokument3 SeitenHow To Count Elliott Waves On Any Chart Through ChannelsRakesh Kumar Munda100% (2)

- Elliott Wave CorrectionsDokument22 SeitenElliott Wave CorrectionsBogdanC-tin100% (1)

- EW Swing Sequence SeminarFinalEditedDokument32 SeitenEW Swing Sequence SeminarFinalEditedfrancescoabcNoch keine Bewertungen

- Elliott Wave Crib SheetDokument5 SeitenElliott Wave Crib SheetKKenobi100% (7)

- 14p-220 Mud PumpDokument2 Seiten14p-220 Mud PumpMurali Sambandan50% (2)

- Diagonal Triangles With Jeffrey KennedyDokument2 SeitenDiagonal Triangles With Jeffrey KennedyDavid G. KariukiNoch keine Bewertungen

- Elliott GuideDokument42 SeitenElliott GuideemreNoch keine Bewertungen

- L27/38S Project Guide - Power Plant: Four-Stroke GensetDokument392 SeitenL27/38S Project Guide - Power Plant: Four-Stroke GensetAaron Chan100% (1)

- Fighting Techniques of The Early Modern World AD 1500-AD 1763 - Equipment Combat Skills Amp Amp TacticsDokument258 SeitenFighting Techniques of The Early Modern World AD 1500-AD 1763 - Equipment Combat Skills Amp Amp Tacticslupoeva100% (3)

- Catalogo Aesculap PDFDokument16 SeitenCatalogo Aesculap PDFHansNoch keine Bewertungen

- Basics Gorman WaveDokument150 SeitenBasics Gorman WaveHiren Mandaliya100% (1)

- Elliott Wave Crash CourseDokument23 SeitenElliott Wave Crash CourseRoshni Mahapatra100% (4)

- Elliott Wave Cheat SheetsDokument56 SeitenElliott Wave Cheat SheetsXuân Bắc100% (5)

- 1001 Discovering EWPDokument11 Seiten1001 Discovering EWPJustin Yeo0% (1)

- Tramline Trading: A practical guide to swing trading with tramlines, Elliott Waves and Fibonacci levelsVon EverandTramline Trading: A practical guide to swing trading with tramlines, Elliott Waves and Fibonacci levelsBewertung: 3.5 von 5 Sternen3.5/5 (7)

- Elliott Wave Crib SheetDokument5 SeitenElliott Wave Crib SheetezrawongNoch keine Bewertungen

- Elliott Wave Cheat Sheet FINAL PDFDokument6 SeitenElliott Wave Cheat Sheet FINAL PDFdogajunkNoch keine Bewertungen

- Social Mood, "Deep" History, and The Elliott Wave PrincipleDokument16 SeitenSocial Mood, "Deep" History, and The Elliott Wave Principlefreemind3682Noch keine Bewertungen

- Immigrant Italian Stone CarversDokument56 SeitenImmigrant Italian Stone Carversglis7100% (2)

- Fibonacci Retracement Part 1Dokument76 SeitenFibonacci Retracement Part 1Jayabharathi Yoganath0% (1)

- Transcript Glenn Neely InterviewDokument15 SeitenTranscript Glenn Neely Interviewasdfghjkjgfdxz100% (1)

- Elliott Wave TheroistDokument5 SeitenElliott Wave TheroistANIL1964100% (1)

- Introduction & OverviewDokument26 SeitenIntroduction & Overviewblank no100% (1)

- Impulse Wave PatternDokument13 SeitenImpulse Wave Patternpuplu123Noch keine Bewertungen

- Purpose in LifeDokument1 SeitePurpose in Lifeaashish95100% (1)

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDokument148 SeitenHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerNoch keine Bewertungen

- Biophoton RevolutionDokument3 SeitenBiophoton RevolutionVyavasayaha Anita BusicNoch keine Bewertungen

- Easy Way To Spot Elliott Waves With Just One Secret Tip PDFDokument4 SeitenEasy Way To Spot Elliott Waves With Just One Secret Tip PDFJack XuanNoch keine Bewertungen

- Summary of Rules and Guidelines For WavesDokument6 SeitenSummary of Rules and Guidelines For WavesemailtodeepNoch keine Bewertungen

- Elliott Wave Lesson 4Dokument6 SeitenElliott Wave Lesson 4Haryanto Haryanto HaryantoNoch keine Bewertungen

- EWT Lecture Notes by Soros1Dokument131 SeitenEWT Lecture Notes by Soros1Shah Aia Takaful Planner100% (1)

- Elliott Wave 2Dokument29 SeitenElliott Wave 2francisblesson100% (1)

- Elliot Wave Techniques Simplified: How to Use the Probability Matrix to Profit on More TradesVon EverandElliot Wave Techniques Simplified: How to Use the Probability Matrix to Profit on More TradesBewertung: 1 von 5 Sternen1/5 (2)

- Elliott Wave Rules GuidelinesDokument15 SeitenElliott Wave Rules GuidelinesDaniel PoianiNoch keine Bewertungen

- Elliott Wave Structures Guide - Page 1Dokument2 SeitenElliott Wave Structures Guide - Page 1Access LimitedNoch keine Bewertungen

- Pattern Analysis: A Capsule Summary of The Wave PrincipleDokument118 SeitenPattern Analysis: A Capsule Summary of The Wave PrincipleHarmanpreet DhimanNoch keine Bewertungen

- Elliott Wave Rules and GuidelinesDokument4 SeitenElliott Wave Rules and Guidelineskacraj100% (1)

- New Elliottwave Execution and Correlation Final Aug 13 14552100Dokument95 SeitenNew Elliottwave Execution and Correlation Final Aug 13 14552100Peter Nguyen100% (3)

- New Elliottwave Short VersionDokument58 SeitenNew Elliottwave Short VersionPeter Nguyen100% (1)

- Putting It All Together. Welcome To Module 4Dokument52 SeitenPutting It All Together. Welcome To Module 4Raul Domingues Porto Junior100% (3)

- 25.channeling and Fibonacci Relations in Corrective PatternsDokument21 Seiten25.channeling and Fibonacci Relations in Corrective PatternsSATISHNoch keine Bewertungen

- 1002 MaddenDokument55 Seiten1002 MaddenAM PM100% (1)

- Esignal Manual Ch6Dokument10 SeitenEsignal Manual Ch6dee138100% (1)

- Definitive Guide of Elliott Wave Forecasting EWFDokument14 SeitenDefinitive Guide of Elliott Wave Forecasting EWFaqhilNoch keine Bewertungen

- Elliott Wave FractalsDokument5 SeitenElliott Wave Fractalsuser_in100% (1)

- Elliott Waves Tips +++Dokument31 SeitenElliott Waves Tips +++Mihut Gregoretti100% (13)

- Pattern Analysis: A Capsule Summary of The Wave PrincipleDokument34 SeitenPattern Analysis: A Capsule Summary of The Wave PrincipleCarlos XaplosNoch keine Bewertungen

- Elliott Wave Theory, Cycle, Rules and Personality ExplainedDokument3 SeitenElliott Wave Theory, Cycle, Rules and Personality ExplainedanishghoshNoch keine Bewertungen

- Practical Ew StrategiesDokument48 SeitenPractical Ew Strategiesanudora100% (2)

- Corrective WaveDokument1 SeiteCorrective WaveMoses ArgNoch keine Bewertungen

- Excerpts, Contents & Prices: Elliott Wave TradingDokument47 SeitenExcerpts, Contents & Prices: Elliott Wave TradingCristian100% (1)

- Forex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders: A Technical Analysis for Spot and Futures Curency TradersVon EverandForex Wave Theory: A Technical Analysis for Spot and Futures Curency Traders: A Technical Analysis for Spot and Futures Curency TradersNoch keine Bewertungen

- Unorthodox Corrections & Weird Fractals & SP500 ImplicationsDokument8 SeitenUnorthodox Corrections & Weird Fractals & SP500 ImplicationsAndysTechnicals100% (1)

- Hyperwave Theory: The Rogue Waves of Financial MarketsVon EverandHyperwave Theory: The Rogue Waves of Financial MarketsNoch keine Bewertungen

- 3 Step Guide To Identify Confirm and Place A Low Risk Position Using Elliott Wave TheoryDokument13 Seiten3 Step Guide To Identify Confirm and Place A Low Risk Position Using Elliott Wave Theoryomi221Noch keine Bewertungen

- Home of GOLD Technical Analysis by Lara: 7 Min ReadDokument6 SeitenHome of GOLD Technical Analysis by Lara: 7 Min ReadpierNoch keine Bewertungen

- 7866 Neowave Equity FundDokument37 Seiten7866 Neowave Equity Fundganesh2cbeNoch keine Bewertungen

- 9.NeoWave Theory by Glenn NeelyDokument13 Seiten9.NeoWave Theory by Glenn NeelySATISHNoch keine Bewertungen

- Master Trading JournalDokument352 SeitenMaster Trading Journalpier100% (2)

- Mastering Elliott Wave Principle: Elementary Concepts, Wave Patterns, and Practice ExercisesVon EverandMastering Elliott Wave Principle: Elementary Concepts, Wave Patterns, and Practice ExercisesBewertung: 3.5 von 5 Sternen3.5/5 (2)

- 1970 - Transformer FMEA PDFDokument7 Seiten1970 - Transformer FMEA PDFSing Yew Lam0% (1)

- 24.progress Labels in ZigzagsDokument16 Seiten24.progress Labels in ZigzagsSATISHNoch keine Bewertungen

- Study The Effect of Postharvest Heat Treatment On Infestation Rate of Fruit Date Palm (Phoenix Dactylifera L.) Cultivars Grown in AlgeriaDokument4 SeitenStudy The Effect of Postharvest Heat Treatment On Infestation Rate of Fruit Date Palm (Phoenix Dactylifera L.) Cultivars Grown in AlgeriaJournal of Nutritional Science and Healthy DietNoch keine Bewertungen

- Neowave Charts: Gold - Daily DataDokument5 SeitenNeowave Charts: Gold - Daily DataSantosh Rangnekar100% (3)

- 28 Elliot Wave PDFDokument14 Seiten28 Elliot Wave PDFRavikumar GandlaNoch keine Bewertungen

- Elliott Wave International 5 PDFDokument4 SeitenElliott Wave International 5 PDFawdasfdsetsdtgfrdfNoch keine Bewertungen

- Edition 24 - Chartered 16 February 2011Dokument11 SeitenEdition 24 - Chartered 16 February 2011Joel HewishNoch keine Bewertungen

- 17.dear FriendsDokument18 Seiten17.dear FriendsSATISHNoch keine Bewertungen

- VBAC MCQsDokument3 SeitenVBAC MCQsHanaNoch keine Bewertungen

- Robert Prechter Is Awaiting A DepressionDokument6 SeitenRobert Prechter Is Awaiting A Depressionabcd1234Noch keine Bewertungen

- Exporting Strategies - J.S. HillDokument31 SeitenExporting Strategies - J.S. HillpierNoch keine Bewertungen

- Option Trading Work BookDokument28 SeitenOption Trading Work BookpierNoch keine Bewertungen

- Fulltext 4 PDFDokument4 SeitenFulltext 4 PDFSubhadip Banerjee0% (1)

- Electricity NotesDokument35 SeitenElectricity Notesapi-277818647Noch keine Bewertungen

- NF en Iso 5167-6-2019Dokument22 SeitenNF en Iso 5167-6-2019Rem FgtNoch keine Bewertungen

- GP1 Q1 Week-1Dokument18 SeitenGP1 Q1 Week-1kickyknacksNoch keine Bewertungen

- The Broadband ForumDokument21 SeitenThe Broadband ForumAnouar AleyaNoch keine Bewertungen

- Someone Who Believes in YouDokument1 SeiteSomeone Who Believes in YouMANOLO C. LUCENECIONoch keine Bewertungen

- Paediatric Intake Form Modern OT 2018Dokument6 SeitenPaediatric Intake Form Modern OT 2018SefNoch keine Bewertungen

- Shawal 1431 AH Prayer ScheduleDokument2 SeitenShawal 1431 AH Prayer SchedulemasjidibrahimNoch keine Bewertungen

- Straight LineDokument15 SeitenStraight LineAyanNoch keine Bewertungen

- Piriformis Syndrome: Hardi Adiyatma, Shahdevi Nandar KusumaDokument6 SeitenPiriformis Syndrome: Hardi Adiyatma, Shahdevi Nandar Kusumaismael wandikboNoch keine Bewertungen

- Surface TensionDokument13 SeitenSurface TensionElizebeth GNoch keine Bewertungen

- Socialized HousingDokument48 SeitenSocialized HousingJessieReiVicedoNoch keine Bewertungen

- DR PDFDokument252 SeitenDR PDFa_ouchar0% (1)

- Determination of Drop-Impact Resistance of Plastic BottlesDokument11 SeitenDetermination of Drop-Impact Resistance of Plastic BottlesAndres BrañaNoch keine Bewertungen

- Gemh 108Dokument20 SeitenGemh 108YuvrajNoch keine Bewertungen

- Twilight PrincessDokument49 SeitenTwilight PrincessHikari DiegoNoch keine Bewertungen

- Kinematics in One DimensionDokument4 SeitenKinematics in One DimensionAldrin VillanuevaNoch keine Bewertungen

- DMDWLab Book AnswersDokument44 SeitenDMDWLab Book AnswersNarpat Makwana Pune100% (1)

- Main Girders: CrossDokument3 SeitenMain Girders: Crossmn4webNoch keine Bewertungen