Beruflich Dokumente

Kultur Dokumente

Kewal Kiran Clothing Limited: Icra Equity Research Service

Hochgeladen von

Sumit PanjwaniOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Kewal Kiran Clothing Limited: Icra Equity Research Service

Hochgeladen von

Sumit PanjwaniCopyright:

Verfügbare Formate

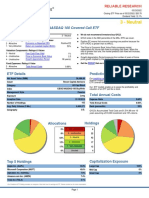

ICRA EQUITY RESEARCH SERVICE

KEWAL KIRAN CLOTHING LIMITED

Industry: Textile & Retail

Fundamental and Valuation Grades

December 30, 2011

ICRA Online Grading Matrix

Valuation Assessment

ICRA Equity Research Service has assigned the Fundamental Grade 4 and

the Valuation Grade C to Kewal Kiran Clothing Limited (KKCL). The

Fundamental Grade 4 assigned to KKCL implies that the company has

Strong Fundamentals. The Valuation Grade C assigned to KKCL implies

that the company is Fairly Valued on a relative basis (as on the date of the

grading assigned).

Kewal Kiran Clothing Limited (KKCL) is one of the leading manufacturer and retailer of

branded apparels and fashion-wear in India. KKCL has over two decades of experience

in the domestic readymade garments industry with some established brands like

Killer, Lawman Pg3, Integriti, Easies and ADDICTIONS. KKCL markets its products

through a chain of 223 K-LOUNGE showrooms and exclusive brand outlets (EBOs)

across the country. Besides, KKCLs products are widely marketed at over 3,500 multibrand outlets (MBOs) and national chain stores like Shoppers Stop and Hypercity.

KKCL is an established player in the denim Jeans category through its flagship Killer

brand, besides having a presence in Trousers, Shirts, T-shirts & Jackets. It has also

entered the lifestyle accessories segments like shoes, belts, watches, bracelets, wallets,

caps, bags, sunglasses and deodorants through the ADDICTIONS brand. KKCLs

designing and manufacturing facilities are mainly located at Dadar and Goregoan

(Mumbai), Daman and Vapi in Western India.

Fundamental

Assessment

Initiating Coverage

A

B

C

D

E

5

4

4C

3

2

1

Fundamental Grading of 4/5 indicates Strong

Fundamentals

Valuation Grading of C indicates Fairly Valued

on a relative basis

Key Stock Statistics

KEKC IN

Equity

Current Market Price* (Rs.)

700.0

Shares Outstanding (crore)

1.2

Market Cap (Rs. crore)

862.8

52-Week High (Rs.)

875.0

52-Week Low (Rs.)

426.5

Free Float (%)

25.9%

Beta

0.7

6 Month Avg Daily Volumes (Rs Cr)

0.3

Source: Bloomberg, as on 30th December, 2011

Bloomberg Code

Grading Positives

The key grading positives in our view are: 1) Strongly positioned to benefit from the

domestic consumption play due to Pan-India presence, including its first-movers

advantage in the Tier-II / Tier-III cities as well as relatively less penetrated eastern

states 2) established brand equity of its flagship product Killer Jeans 3) Asset light

model reduces overhead costs while maintaining product & service standards 4)

Continued focus on profitable growth and careful store expansion are expected to

ensure healthy profitability indicators (like RoCE) for the company going forward 5)

Strong designing expertise, vast experience of the promoters in the branded apparel

business

KKCL Industries: Current Valuations

Grading Sensitivities

The key grading sensitivities in our view are: 1) Intense competition in the domestic

branded apparels market with presence of large number of domestic as well as global

brands 2) Vulnerability to cotton price fluctuations and regulatory changes (like excise

duty levy) 3) Ability to scale up business while maintaining its financial profile 4) High

dependence on multi-brand outlets (MBOs) and National Chain Stores, which together

contribute ~70% of revenues, can limit bargaining power 5) Increasing contribution

from value brands (like Integriti, Lawman Pg3) and low margin products (like shirts,

T-shirts) could moderate margins; cash reserves held by the company yields lower

returns. 6) Merchandise obsolescence risks due to rapidly evolving fashion trends and

changing customer preferences

Shareholding

Table 1: KKCLs key financial indicators (Consolidated)

FY10A

FY11A

FY12E

Operating Income (Rs. crore)

175.9

236.5

315.5

EBITDA Margin (%)

27.3%

29.1%

25.6%

PAT Margin (%)

18.5%

19.6%

17.3%

EPS (Rs.)

26.4

37.5

44.2

EPS Growth (%)

101.6%

43.3%

17.4%

P/E (x)

26.5

18.7

15.9

P/BV (x)

4.9

4.4

3.8

RoE

19.9%

24.8%

25.6%

RoCE

28.2%

36.6%

38.1%

EV/EBITDA

16.6

11.2

9.4

Source: Company, ICRA Equity Research Service

FY13E

399.5

25.1%

16.7%

54.1

24.2%

12.9

3.3

27.1%

40.2%

7.5

FY14E

485.9

24.6%

16.2%

63.8

19.2%

11.0

2.8

27.5%

40.9%

6.2

30.0

25.0

20.0

15.0

10.0

5.0

-

26.5

16.6

FY10a

18.7

15.9

11.2

9.4

FY11a

FY12e

Price/Earnings

DIIs

4%

Pattern

12.9

7.5

11.0

6.2

FY13e

FY14e

EV/EBITDA

(30th

September,

2011)

Others

10%

FIIs

12%

Promoters

74%

Share Price Movement (18 months)

Source: Bloomberg, ICRA Equity Research Service

ICRA Equity Research Service

Kewal Kiran Clothing Limited

INVESTMENT SUMMARY

Strong domestic consumption play with Pan-India presence and negligible dependence on exports

Export

3%

North

15%

East

29%

West

29%

South

24%

Rising disposable incomes, rapid urbanisation, increasing

organized retail penetration and changing spending

trends are expected to result in branded apparels market

reach ~Rs. 700 billion by 2015 (implying 28% CAGR).

KKCL is strongly positioned to benefit from the domestic

consumption boom due to its pan-India franchise and

distribution through a wide network of multi-brand

outlets across the country. Besides, KKCL enjoys the firstmovers advantage in the Tier-II / Tier-III cities and

under-penetrated eastern states, which are expected to

remain the growth engines over the medium term.

Source: Company, ICRA Equity Research Service

Diversified brand portfolio, Strong homegrown brands nurtured over decades; presence across product

spectrum and price points

KKCL has a mature portfolio of well-established fashion

brands like Killer, Lawman Pg3 and Integriti that have

survived across economic cycles and successfully evolved

with changing customer preferences over last two

decades. KKCLs flagship Killer brand enjoys strong

brand equity and is amongst the few homegrown denim

brands that have survived the competitive pressures

emanating from the entry of leading global brands. As per

recent IMRB research report, Killer brand has been

slotted amongst the Top 5 denim brands in the country.

Integriti

25%

Others

1%

Easies

2%

Killer

51%

Lawman

21%

Source: Company, ICRA Equity Research Service

Killer is positioned mainly to cater to premium and designer wear (mainly denim jeans category), Lawman Pg3 is

positioned as trendy fashion for mid-premium clubwear (across products like jeans, trousers, shirts, t-shirts, jackets),

Integriti is positioned as value or mass market brand

T-Shirts

Others

(across product range) for the price conscious consumer,

4%

4%

Shirts

Easies is positioned as formal and semi-formal wear

20%

(mainly trousers and shirts) and ADDICTIONS is

positioned as a dedicated lifestyle accessories brand

(across products like shoes, belts, watches, bracelets,

Jeans

wallets, caps, bags, sunglasses and deodorants). Overall,

57%

KKCLs brands are positioned across product spectrum

Trousers

and price points to garner mind-wallet share of aspiring

15%

young population and burgeoning middle and uppermiddle class in India.

Source: Company, ICRA Equity Research Service

ICRA Equity Research Service

Kewal Kiran Clothing Limited

Industry leading profitability indicators due to careful expansion and efficient working capital management

Unlike some domestic brand apparel manufacturers and large retailers, KKCL has restrained from acquiring market

shares by sacrificing near term profitability. Also, KKCL has maintained a relatively modest presence in intensely

competitive metro markets as high lease rentals and operating expenses could constrain profitability of its

franchisees. The company has also limited its dependence on national chain stores that enjoy higher bargaining power

and squeeze profit margins from the apparel manufacturers. Besides, the company has maintained low focus on the

exports market, since it may not command the same premium and margins as the domestic markets. All these factors

have combined to contribute a healthy profitability for KKCL.

KKCLs brands are predominantly targeted towards mid-premium and value segments; the strategy has paid rich

dividends on account of down-trading by customers from the premium / ultra-premium catergories due to the twin

impact of high inflation and slower economic / per-capita income growth rates over the last few years. The company

has also demonstrated adequate flexibility in passing on the input cost escalations (cotton prices, fuel prices & labour

costs) relative to its peers in the value / economy segments.

KKCL derives majority of its revenues from denim jeans category that normally enjoy better margins due to higher

scope for designing and value-addition relative to casuals, shirts & trousers categories. The company has introduced

its own brands and nurtured them over the years to save royalty payments, which range around 3 to 5% for some

foreign brands leased by of its domestic competitors. Besides, KKCLs brands are well established and focused only on

mid-premium to value segments, thereby resulting in relatively moderate advertising requirements (~4-5% of

revenues).

12%

10%

10%

9%

12%

5%

5%

Colorplus

Fashions

Raymond

Apparel

Arvind

Retail

Arvind

Lifestyle

Brands

Provogue

Zodiac

Clothing

Kewal

Kiran

0%

20%

13%

7%

17%

9%

12%

Colorplus

Fashions

11%

Raymond

Apparel

15%

Arvind

Retail

20%

37%

Arvind

Lifestyle

Brands

25%

40%

35%

30%

25%

20%

15%

10%

5%

0%

Provogue

29%

Zodiac

Clothing

30%

Branded Apparel Industry : RoCE (%)

Kewal

Kiran

Branded Apparel Industry: EBITDA Margins

35%

Source: Company Filings, ICRA Equity Research Service

KKCL has made continuous investments in advertising/innovations to increase brand recall and create a customer

pull effect rather than pushing its products aggressively through the distribution channel. Since the company follows

an outright sale model instead of consignment model; it has been able to efficiently manage its inventory levels, avoid

major markdowns / write-offs in case of obsolete inventories and hence optimizes operating margins for the

company. Besides, the company has low cost assets (estimated market value of manufacturing facilities, corporate

office and company owned stores significantly exceeds book value of ~Rs. 43 crore) and strong balance sheet (~Rs.

115 crore net cash and investments); resulting in low depreciation / interest costs and high non-operating incomes.

The working capital intensity too is favourable compared to its peers with strict control on receivables, while

inventory risk is partly mitigated by production against confirmed orders from its franchisees. Moreover, the

company mainly outsources production (> 55% outsourced) and distribution (~90% exclusive brand outlets are

franchisee owned) to reduce the fixed capital investments and uses outright sale model to reduce the working capital

requirements; thereby ensuring industry leading return indicators for the company.

3

ICRA Equity Research Service

Kewal Kiran Clothing Limited

On the other side, merchandize obsolescence risks remain high in fashion industry; intense competition and

dependence on MBOs and National Chain Stores reduces margin for error

The company operates in rapidly evolving fashion industry, where it competes with large number of domestic as well

as global brands. Hence, failure to keep abreast with the latest fashion trends and changing customer preferences

could result in obsolete inventories and affect the

Factory

Exports

competitiveness / brand equity of the company. Besides,

Outlet

3%

K-Lounge

high dependence on MBOs and National Chain Stores

3%

25%

National

reduces the margin for error, as these third party retailers

Chain

stock products of all competing brands and are inclined

Stores

towards the latest fashion products providing higher

9%

inventory turns and better margins. However, the

company has been able to demonstrate efficient inventory

management so far by regular monitoring of

MBO

inventory/products with its franchisses to take swift

60%

corrective actions wherever necessary.

Source: Company, ICRA Equity Research Service

Profitability indicators remain vulnerable to cotton price fluctuations and regulatory changes

Jul-10

Aug-10

Sep-10

Oct-10

Nov-10

Dec-10

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11

Sep-11

Oct-11

Nov-11

Dec-11

KKCL, being a garments manufacturer, remains vulnerable to

Domestic Cotton Prices (Sankar 6;

steep fluctuations in cotton prices. Raw cotton prices for the

Rs/Candy)

Sankar-6 variety had increased from ~30,000 Rs/candy (1

70,000

candy = 355 kg) in July 2010 to ~62,000 Rs/candy (1 candy =

60,000

50,000

355 kg) in March 2011 on account of demand revival in

40,000

developed economies and production disruptions due to

30,000

adverse agro-climatic conditions in China and Pakistan. The

20,000

steep rise in cotton prices had resulted in high cost inventories

10,000

and hence constrained volume growth as well as operating

0

margins across the value chain until the Q3, FY12. However, the

raw cotton prices have corrected significantly over the last 6-8

months to ~35,000 Rs/candy in Nov 2011 on account of

deterioration in global demand outlook and strong productions

Source: EmergingTextiles.com

estimates for the 2011-12 cotton season globally. As the high

cost inventory gets liquidated, the company is expected to benefit from lower cotton prices in the coming quarters.

The company also remains vulnerable to regulatory changes like the 10% excise duty levied on all branded apparel

during the last union budget, leading to a cascading effect across the value chain. After a representation from the

industry participants, the government agreed to a partial rollback, imposing the duty on 45% as against the earlier

60% of the MRP. The excise duty hike complicated matters at the time when the industry was already grappling with

severe cost inflation and higher raw material (cotton, polyester, etc) prices. Besides, the organized retail industry in

India continues to suffer due to stringent labour laws, multiple licences and clearances (40-45 approvals) required for

setting up and operating a retail stores, high stamp duties on property deals and exceptionally high property prices

and lease rentals in cities due to, among other things, urban land ceiling act and delays in new project approvals.

Although the proposed goods and services tax (GST) is expected to reduce complexities in doing business and

allowing foreign direct investments (FDI) in multi-brand retail is expected to improve efficiencies across the supply

chain and give a boost to KKCLs MBO & national chain store sales, the timelines for their implementation continue to

remain uncertain.

4

ICRA Equity Research Service

Kewal Kiran Clothing Limited

Strong revenue growth expected in-line with the branded apparel industry; increasing contribution from value

brands and low margin products could moderate margins

50.0%

45.0%

40.0%

35.0%

30.0%

25.0%

20.0%

15.0%

10.0%

5.0%

0.0%

43%

42%

34%

33%

17%

18%

FY11a

Sales Growth

FY12e

27%

24%

22%

23%

19%

18%

FY13e

EBITDA Growth

FY14e

EPS Growth

Source: Company, ICRA Equity Research Service

We expect the company to report 27% CAGR growth in

gross sales over the next three years, in-line with the

industry growth rates for branded apparels in India.

However, increasing contribution from value and mass

market brands like Lawman Pg3 and Integriti (which have

~3.0 times and ~2.8x MRP to prime cost ratio respectively

as compared to ~3.5 times for Killer brand) and lower

margin products like trouser, shirts and T-shirts (due to

lower scope for designing and value-addition) are

expected to moderate margins and result in 20% CAGR

EBITDA growth going forward. Finally, relatively low

depreciation and interest costs on account of asset light

business model, is expected to result in a healthy ~19%

CAGR EPS growth over the FY11-FY14e period.

However, asset light business model of expansion through franchise and third party distribution route are

expected to ensure robust profitability indicators and strong capital structure

The company had changed its business strategy in favour of an asset light model post 2008, when the lease rentals

reached peak levels and threatened the business viability of a large number of retailers. Instead of expanding through

own retail stores, KKCLs management focussed on expanding through the franchisee and third party distribution

route, thereby lowering operational costs (overhead costs) and capex requirements. Besides, the company opted for

an outright sales model instead of consignment model and maintained tight control on receivables as well as

inventory levels. This strategy of positioning itself as a fashion brand rather than a fashion retailer has paid rich

dividends and helped the company build a business model with established brand equity, well penetrated distribution

network, healthy profitability indicators and robust capital structure. We expect the company to retain and strengthen

its asset light model with focus on branding and product innovations, supported by increasing outsourcing of

production and franchise lead distribution.

KKCL's Profitability Indicators & Gearing

198

Total

125

48

7

32

4

7

223

Source: Company

COCO: Company-owned company-operated

COMFO: Company-owned management franchisee-operated

FOFO: Franchisee-owned franchisee-operated

50%

40%

30%

37%

29%

38%

26%

40%

25%

41%

25%

20%

10%

0%

EBITDA Margin

FY14e

7

25

FOFO

113

45

3

32

5

FY13e

COMFO

11

3

4

FY12e

COCO

1

FY11a

Store type

K-Lounge

Killer EBO

LawmanPg3-EBO

Integriti-EBO

Addiction-EBO

Factory Outlet

Total

Return indicator (%)

Exhibit 1: KKCLs store details (September 2011)

ROCE

Total Debt/(Equity + MI)

Source: Company, ICRA Equity Research Service

S

o

u

5r

c

e

:

ICRA Equity Research Service

Kewal Kiran Clothing Limited

As shown in the exhibit above, the company currently has 1:8 ratio of company-owned: franchise owned K-Lounge

stores and exclusive brand outlets (EBOs). Going forward, we expect the company to maintain such ratio and add over

50 exclusive stores in each of the next three years. Besides, the company currently outsources ~55% of production to

unorganized third party garment manufactures to reduce capital expenditure, labour costs and concentrate on its core

areas of designing and brand building. Overall, we expect the management to continue to focus on profitable growth

along with a careful store expansion, which will ensure strong return indicators (over 40% returns on capital

employed) and financial profile (below 0.1x debt to equity) for the company going forward.

Premium valuations justified considering the strong market positioning and balance sheet strengths

KKCLs current valuation multiple (~12.9x times FY13 earnings) is at a premium to broader market indices like Nifty

Index, CNX 500 index or CNX Midcap index. However, KKCL continues to be one of the most reasonably valued

domestic consumption plays with strong established brand, wide distribution reach and strong balance sheet. Overall,

we expect the company to report a healthy 27% CAGR revenue growth and 19% CAGR EPS growth over the FY11aFY14e period, aided by rapid expansions in Tier II and Tier III cities. Hence, we assign a valuation grade of C to

KKCL on a grading scale of A to E, which indicates that the company is Fairly Valued on a relative basis.

Exhibit 2: KKCLS Relative Valuations

NIFTY

INDEX

KEWAL KIRAN

CLOTHING

ICRA Estimates

CNX 500

INDEX

CNX MIDCAP

INDEX

FY12E

FY13E

FY12E

FY13E

FY12E

FY13E

FY12E

FY13E

Price/Earnings

15.85

12.93

13.19

11.29

12.38

10.31

10.63

8.79

EV/EBITDA

9.45

7.53

9.25

8.11

9.13

7.69

9.39

7.44

Price /Sales

2.73

2.16

1.45

1.33

1.15

1.04

0.67

0.61

Price /Book Value

3.79

3.26

2.03

1.78

1.78

1.56

1.21

1.09

Price/Cash Flow

14.06

11.46

9.46

8.15

8.93

7.42

8.17

6.34

ICRA Estimates

KEWAL KIRAN

CLOTHING

PANTALOON

RETAIL

SHOPPERS

STOP

TRENT

PROVOGUE

(INDIA)

ARVIND

FY12

FY13

FY12

FY13

FY12

FY13

FY12

FY13

FY12

FY13

FY12

FY13

Price/Earnings

15.85

12.93

13.72

10.25

36.49

23.53

n.m.

35.29

6.75

5.27

6.37

5.20

EV/EBITDA

9.45

7.53

9.66

8.26

17.01

12.14

146.01

14.70

6.14

5.54

9.42

8.14

Price /Sales

2.73

2.16

0.21

0.18

0.73

0.59

0.89

0.63

0.38

0.34

0.37

0.34

Price /Book Value

3.79

3.26

0.84

0.78

3.82

3.40

1.99

2.24

0.75

0.66

0.43

0.40

Price/Cash Flow

14.06

11.46

6.30

5.13

19.92

14.35

57.93

19.81

3.45

2.90

5.34

4.59

Source: Bloomberg, ICRA Equity Research Service

* Bloomberg Consensus Estimates as on

30th

December, 2011

ICRA Equity Research Service

Kewal Kiran Clothing Limited

OPERATING PROFILE

Strong brands built over the years through product designing / innovations rather than competing on price

points; presence in mid-premium / value segments have paid rich dividends due to down-trading by customers

Over the years, the company has built and nourished strong brands through focus on the product innovations and

designs to create a brand identity, rather competing on price points. For example, it has always positioned Killer as

an upmarket/international brand by associating with foreign models for the advertisement campaigns. The exclusive

brand outlets (EBOs) are aesthetically designed to maintain consistency with the advertising campaigns and resonate

with the brand appeal. The company has stayed away from advertising on price points, thereby helping it to absorb

cost escalation and report margins better than the competition. Also, KKCLs brands are predominantly targeted

towards mid-premium and value segments, which has paid rich dividends due to the down-trading of customers from

the premium / ultra-premium catergories due to the twin impacts of high inflation and slower economic / per-capita

income growth rates over the last few years.

Exhibit 3: KKCLs Brand Portfolio

Brand

Launch

Year

Positioning

Average

MRP in Rs

Average

Denim

MRP in Rs

Competition

FY11

Revenues

(Rs. Cr.)

Revenues

% Share

Killer

1989

Mid-Premium

to Premium

~1,650

1,800

Lee, Levis, Wrangler,

UCB, Pepe Jeans

120.6

51%

Lawman Pg3

1998

Mid Premium

~1,500

1,500

Mufti, Trigger, Spykar,

Flying Machine, Bare

49.2

21%

Integriti

2002

Value

to mid-premium

~1,150

1,200

Denizen, Indigo Nation,

John Players, Peter England

32.4

25%

Easies

1989

Value

to mid-premium

~1,550

Not

Applicable

John Players,

Austin Reed,

Indian Terrain

5.9

2%

Source: Company, ICRA Equity Research Service

Killer: It was launched in 1989 and is KKCLs flagship brand positioned as a global Indian brand conveying the trendy,

vibrant and youthful look with an attitude. With average MRP at around Rs, 1,800 per piece, it is focused towards the

mid-premium to premium denim segment for 16-30 years age group. Throughout its brand history, it has focused on

continuous innovation in style, design and product supported by adequate advertising campaign conveying the above

features and creating imagery in sync with an international brand. This has enabled it to compete well with the large

number of international denim players that have entered Indian markets. It is distributed through MBOs, EBOs, both

K-Lounge as well as exclusive Killer stores and national chain stores like Shoppers Stop and Lifestyle.

Product portfolio: It includes ready-to-wear jeans, trousers, cargos, capris, shirts, jackets, t-shirts, innerwear (vests

and briefs), footwear (shoes, socks). It also has eye-wear and other accessories (belts, bracelets etc) in its portfolio. To

target the growing women-wear denim segment, the 'Killer for her' range was launched in 2007.

Lawman Pg3: The brand was launched in 1998 and targets the 18-30 years age group in the mid-premium segment

with average MRP for denim jeans at around Rs. 1,500. For Lawman, the company has focused on creating a theme

each season under which the designers add different textures, cuts, drapes, washes and feel to the product. The

company holds three patents under the Lawman brand - for introducing the Yi-Fi stitch, Vertebrae collection

(where it has patented the wash and stitch) and Emboss (which was another stitch related improvement). It is

distributed through MBOs, EBOs, both K-Lounge as well as exclusive Killer stores and national chain stores like

Westside and Central.

7

ICRA Equity Research Service

Kewal Kiran Clothing Limited

Product portfolio: The LawmanPg3 apparel range has shirts, blazers, jackets, denim and cotton trousers, tee-shirts,

cargos, capris, drapes, jeggings, skirts and shorts. It accessories collection includes innerwear, socks, footwear,

headwear, sunglasses, deodorants and trinkets.

Integriti: The brand was launched in 2002 mainly to counter completion from unorganised players as well as other

domestic players competing through low price points. Integriti is aimed at the price conscious value segment with

average MRP at around Rs. 1,150 for its products. Being a value brand, majority (~70%) of its sales are in Tier-II and

Tier-III cities mainly through the MBOs, balance through EBOs and a small proportion through national chain stores.

Product portfolio: The product range under the brand includes casuals and formal shirts, T-shirts, Jeans and cotton

trousers. A sub-brand Integriti Galz was also launched to cater to women-wear category.

Thrust on enhancing brand equity, designing latest fashions and introducing innovative product; lower focus on

in-house production to reduce fixed overheads and avoid labour issues

Over the years the company has steadily reduced its focus on manufacturing. In FY10, the company produced 76% of

the garments in-house and rest were outsourced to vendors located in Bangalore and Mumbai. In FY11, the in-house

to outsourced manufacturing ratio was 53:47, which is further expected to tilt in favour of outsourcing in FY12.

Garmenting is a labour intensive business high labour costs coupled with the rigid labour laws has resulted in weak

competitive positioning for Indian garment manufacturers. Overall, as the management plans to stay focused on

higher value added activities like brand building and product design, significance of activities like manufacturing are

expected to reduce.

Continuous investments in advertising/marketing over the years to nurture brand image; however advertising

costs remain moderate due to established brands and exposure to mid-premium / value segments

15.0%

12.8%

12.0%

8.3%

9.0%

7.0% 7.3% 6.6%

6.0%

4.7%

4.1%

2.5%

3.0%

Source: Annual Reports, ICRA Equity Research Service

Page

Industries

Arvind

Retail

Kewal

Kiran

Colorplus

Fashions

Provogue

Arvind

Lifestyle

Raymond

Apparel

Zodiac

Clothing

0.0%

Since it takes decades to nurture superior brands (for

example Levis, Diesel, Tommy Hilfiger, etc), KKCL has

made continuous investments in advertising/marketing to

increase brand recall and pull customers rather pushing

its brand across various channels of distribution. In

addition to print media, the company also attempts to

reach out to target audiences through contemporary

forms of advertising such as in-film placements and

cricket sponsorships (like Pune Warriors in Indian

Premium League, IPL). The company is currently running

a television advertisement campaign for its Killer

deodorant. However, since the company has well

established brands focused on mid-premium to value

segments, overall advertising spend for the company has

remained near the industry average (~4-5% of revenues).

Effective distribution strategy through exclusive franchisees and multi-brand outlets ensures wider penetration;

outright sale model ensures efficient inventory management

The company has carved out an effective distribution strategy wherein it has a mix of Exclusive Brand outlets EBOs

(own as well as franchisees), Multi-brand outlets - MBOs and sales through National Chain Stores (organized retailers)

to maintain an optimum balance between growth rate / penetration levels and profitability margins.

ICRA Equity Research Service

Kewal Kiran Clothing Limited

The aesthetically designed EBOs for its Killer, Lawman Pg3 and Integriti brands and complete brand portfolio

under K-Lounge stores helps builds brand image and visibility for the company. The company also has considerable

presence through national chain stores such as Shoppers Stop that have high footfalls and provide a vital channel for

swiftly building up brand awareness. On the other hand, distribution through multi-brand outlets (MBOs) enables the

company to expand its distribution network wide across the country and deep into Tier-III and Tier-IV towns.

The management has cautiously limited its dependence on national chain stores that enjoy higher bargaining power

and squeeze profit margins for the apparel manufacturers. Even for the exclusive brand outlets, the company mainly

uses franchisee route to reduce capital investments (fixed assets as well as inventories) and concentrate on its core

strengths of designing and brand building. However, careful screening of the franchisees owners in terms of relevant

industry experience and business acumen has helped the company to maintain services standards and brand equity.

Since the management follows an outright sale model instead of a consignment model, for its franchisees as well as

distributors, the company has been able to efficiently manage its inventory levels and hence report better the

operating margins. Again, the management has consciously maintained low focus on the exports market, since the

company may not command the same premium as domestic markets where it has high brand equity. The lower

exports dependence has also shielded the company from near term global economic uncertainties and currency

fluctuations.

KKCL : Distribution-wise revenue Break-up

FY14e

FY13e

FY12e

FY11

FY09

0%

28% 27% 25% 26% 27% 27%

FY10

20%

Export

80%

22% 25% 29% 31% 32% 33%

East

National Chain

Stores

MBO

60%

26% 25% 24%

22% 22% 21%

South

34% 32% 29% 27% 27% 26%

West

14% 15% 16% 16% 16% 17%

North

K Lounge

40%

20%

0%

FY14e

58% 58% 60% 58% 56% 54%

40%

100%

Factory Outlet

FY13e

10% 12% 13%

FY12e

9%

FY11

60%

8%

FY10

80%

Exports

5%

FY09

100%

KKCL : Geographic revenue break-up

Source: Company, ICRA Equity Research Service

Geographically well diversified sales mix; thrust on under-penetrated Eastern region likely to continue

KKCL has a well diversified geographic sales mix, mainly owing to its wide distribution network spanning the length

and breadth of the country. The company is based out of Mumbai and has traditionally had a strong presence in the

Western region and Southern states of the country. However, the Eastern region has emerged as a strong growth

driver for the company in recent periods due to increasing brand recognition, rapid distribution expansion and low

penetration of branded apparels and fashion products in these markets.

However, the company has relatively modest presence and market share in the otherwise lucrative Northern region

due to intense competition, unfavourable credit terms demanded by the distributors and lack of winter-wear products

in its portfolio. Nevertheless, the company has revamped its distribution set-up in the region to focus on growth

through exclusive stores and introduced a wide range of winter-wear merchandises (like jackets and woollen wears)

to cater to the northern region. The above strategies seem to have already started to pay off, as evident through ~43%

revenue growth in the region in FY11.

ICRA Equity Research Service

Kewal Kiran Clothing Limited

Dependence on flagship Killer brand to reduce with strong growth from value brands as well as recently

launched lifestyle accessories brand ADDICTIONS

KKCL is an established player in the domestic denim jeans market through its flagship Killer brand, which has been

consistently contributing over 50% of KKCLs revenues in the past. The mid-premium brand continues to be slotted

amongst the Top-5 denim brands in the country, enjoys strong brand equity and is amongst the few homegrown

denim brands that have survived the competitive pressures emanating from the entry of leading global brands.

However, the Killer brand did not cater to the mass value-conscious segment constituting the largest consumer base

in the domestic market. As a result, the company introduced Lawman Pg3 and Integriti cater to mid-premium

and Value segments respectively and garner its fair market share in the value market segment. These brands have

exhibited robust growth rates over the last few years due to customer down-trading due to high primary articles

inflations and impact of uncertain economic conditions. We expect these brands to continue to grow at a faster CAGR

going forward due to increasing acceptance / brand awareness for these brands. Besides, the recently launched

lifestyle accessories brand ADDICTIONS too is expected to start contributing meaningfully in the top-line growth of

the company going forward. Overall, we expect the revenue contribution from Killer brand to reduce from ~51% in

FY11 to ~45% in FY14 and thereby reducing the brand concentration of the company over the next three years.

KKCL : Product-wise revenue contributions

KKCL : Brand-wise revenue break-up

20%

52% 52% 51% 47% 46% 45%

Easies

Lawman

Killer

FY14e

FY13e

FY12e

FY11

FY10

FY09

0%

60%

40%

20%

53% 55% 57% 54% 53% 52%

T-Shirts

Shirts

Trousers

Jeans

0%

FY14e

40%

80%

FY13e

21% 22% 21%

20% 21% 21%

Integriti

FY12e

23% 23% 23%

Others

19% 21% 20% 22%

23% 24%

19% 17% 15% 12% 11%

10%

FY11

60%

22% 23% 25%

100%

FY10

80%

Addictions

FY09

100%

Source: Company, ICRA Equity Research Service

Presence across product spectrum and price points; dependence on jeans category to reduce with increasing

contribution from Shirts, T-shirts, Winter-wears and lifestyle accessories

Killer is positioned mainly to cater to mid-premium to premium and designer wears (mainly denim jeans category),

Lawman Pg3 is positioned as trendy fashion for mid-premium clubwears (across products like jeans, trousers,

shirts, t-shirts, jackets), Integriti is positioned as value or mass market brand (across product range) for the price

conscious consumer, Easies is positioned as formal and semi-formal wear (mainly trousers and shirts) and

ADDICTIONS is positioned as a dedicated lifestyle accessories brand (across products like shoes, belts, watches,

bracelets, wallets, caps, bags, sunglasses and deodorants). Overall, KKCLs brands are positioned across product

spectrum and price points to garner mind-wallet share of aspiring young population and burgeoning middle and

upper-middle class in India.

Traditionally, KKCL has been strongly associated with the denim jeans category that contributed over 55% of the

overall revenues of the company. However, the company has introduced large number of products and brand

extension across categories like womens wears, winter-wears, shirts, t-shirts, trousers and lifestyle accessories. As a

result, we expect the contribution of jeans category to decline from ~57% in FY11 to ~52% in FY14.

10

ICRA Equity Research Service

Kewal Kiran Clothing Limited

Industry leading profitability indicators due to careful expansion and efficient working capital management

KKCL enjoys the highest operating margins among the industry peers attributable to its focus on profitable growth.

Additionally, since the company operates on an outright sales model for majority of its sales, it does not have to

provide for inventory markdowns in its books as compared to the industry players aiding operating profitability. The

working capital intensity too is favourable compared to its peers with strict control on receivables while inventory

risk is partly mitigated by production against confirmed orders. Besides, the company continues to enjoy high net

margins as its depreciation & interest costs are among the lowest in the industry, while the return indicators benefit

from the franchisee model requiring lower capital investments.

Exhibit 4: Industry Comparison

Kewal Kiran

Zodiac

Provogue

Brands

Killer, Lawman

Pg 3,Integriti

Zodiac, Z3 and

ZOD!

Provogue

Brand

ownership

Owned

Licensed from

its group

company

Owned

Category

Present across

premium, midpremium and

value segments

for casual wear

Premium

segment across

formal wear,

party and

relaxed casual

wear

Mid-premium

to premium

segment for

casual, party

and formal

wear

DomesticExport mix

Domestic

~95%, balance

5% exports

60% Exports

and balance

40% domestic

44% Exports

and balance

56% domestic

sales

Distribution

Mainly through

MBOs and

exclusive

franchisees

Through MBOs,

company leased

stores and

national chain

stores

Through

exclusive

outlets and

national chain

stores

53% in-house,

balance 47%

outsourced

FY11 (Rs Cr)

Net Sales

236.5

EBITDA

Manufacturing

Arvind

Lifestyle

Brands

Limited

Flying Machine,

Arrow, US Polo

Assn., IZOD,

Energee, Gant

Except Flying

Machine others

are licensed

Premium to

super-premium

segment for

casual wear,

semi-formal

and formal

wear

Arvind Retail

Raymond

Apparel

Colorplus

Fashions

Excalibur,

Cherokee,

Raymond, Park

Avenue and

Parx

Colorplus

Mix of owned

and licensed

Owned

Owned

Value segment

across casual

wear, formal

wear and semiformal wear

Premium

segment for

casual and

formal wear

Premium

segment for

casual wear

Majority

domestic sales

Majority

domestic sales

Majority

domestic sales

Own retail

stores, MBOs as

well as National

chain stores

Distribution

through own

retail

Through

wholesalers,

MBOs, national

chain stores

and exclusive

stores

Through

wholesalers,

MBOs, national

chain stores

and exclusive

stores

Majority

domestic sales

Not available

Not available

Not available

Not available

FY11 (Rs Cr)

60% in-house,

balance

outsourced

FY11 (Rs Cr)

FY11 (Rs Cr)

FY11 (Rs Cr)

FY11 (Rs Cr)

FY11 (Rs Cr)

356.3

561.3

415.8

374.6

471.3

172.2

68.9

38.3

69.9

38.2

20.1

48.6

20.5

10.4

In-house

PAT

46.2

33.2

33.5

10.2

-0.2

22.6

Sales growth

34%

8%

26%

64%

32%

8%

5%

PAT growth

42%

26%

9%

387%

n.m.*

99%

n.m.*

EBITDA (%)

29%

11%

12%

9%

5%

10%

12%

PAT (%)

20%

9%

6%

2%

0%

5%

6%

ROCE

37%

20%

7%

13%

9%

12%

17%

RONW

25%

17%

5%

7%

0%

22%

14%

Gearing

0.0

0.2

0.3

0.7

1.8

1.4

0.1

20

Debtor days

46

37

114

105

30

Payable days

51

42

47

177

142

70

62

Inventory days

112

127

235

209

164

196

194

Source: Company filings, ICRA Equity Research Service

*n.m. stands for not meaningful

11

ICRA Equity Research Service

Kewal Kiran Clothing Limited

Profitability indicators remain vulnerable to cotton price fluctuations; volume/margin pressures likely to ease

from Q4, FY12 onwards when the decline in cotton prices will reflect for the garment retail industry

Domestic Cotton Prices (Sankar 6;

Rs/Candy)

70,000

60,000

50,000

40,000

30,000

20,000

10,000

Nov-11

Dec-11

Sep-11

Oct-11

Aug-11

Jun-11

Jul-11

Apr-11

May-11

Jan-11

Feb-11

Mar-11

Nov-10

Dec-10

Sep-10

Oct-10

Jul-10

0

Aug-10

KKCL, being a leading garments manufacturer, remains

vulnerable to steep fluctuations in cotton prices. Raw cotton

prices for the Sankar-6 variety had increased from ~30,000

Rs/candy (1 candy = 355 kg) in July 2010 to ~62,000

Rs/candy (1 candy = 355 kg) in March 2011 on account of

demand revival in developed economies and production

disruptions due to adverse agro-climatic conditions in China

and Pakistan. The steep rise in cotton prices had resulted in

high cost inventories and hence constrained volume growth

as well as operating margins across the value chain until the

Q3, FY12. However, the raw cotton prices have corrected

significantly over the last 6-8 months to ~35,000 Rs/candy

in Dec 2011 on account of deterioration in global demand

outlook and healthy productions estimates for the 2011-12

cotton season globally.

Source: EmergingTextiles.com; ICRA Equity Research Service

Raw material costs accounts for a higher proportion of the

Denim fabric costs due to higher cotton yarn usage than trouser/shirting fabrics. As a result, the denim fabric prices

had risen by approximately 30-40% in the past one year while shirting fabric prices had risen by 20-25% in the same

period. Faced with the twin challenge of rising input costs and excise duty hike, most players had increased their

prices with KKCL increasing it by about 10-12%. Since the production cycle for branded apparel manufacturers

function with a lag of about eight-nine months, the pricier garments produced from high cost fabric inventory will

remain in the retail stores until Q3, FY12. This has led to some volume pressure as witnessed in slowdown in same

store sales during the current season as well as margin pressure as the raw material cost increases could not be

passed on completely. The lower cotton costs will start reflecting for branded apparel industry only from Q4 FY12

onwards, easing pressure on the volumes as well as operating margins of the players across the value chain.

Regulatory changes a risk factor..

The company also remains vulnerable to regulatory changes like the 10% excise duty levied on all branded apparel

during the last union budget, leading to a cascading effect across the value chain. After a representation from the

industry participants, the government agreed to a partial rollback, imposing the duty on 45% as against the earlier

60% of the MRP. The excise duty hike complicated matters at the time when the industry was already grappling with

severe cost inflation and higher raw material (cotton, polyester, etc) prices. Besides, the organized retail industry in

India continues to suffer due to stringent labour laws, multiple licences and clearances (40-45 approvals) required for

setting up and operating a retail stores, high stamp duties on property deals and exceptionally high property prices

and lease rentals in cities due to urban land ceiling act and delays in new project approvals. Although the proposed

goods and services tax (GST) is expected to reduce complexities in doing business and allowing foreign direct

investments (FDI) in multi-brand retail is expected to improve efficiencies across the supply chain and give a boost to

KKCLs MBO & national chain store sales, the timelines for their implementation continue to remain uncertain.

Free Trade Agreement with Bangladesh likely to result in cost efficiencies for the branded apparel companies

KKCLs strategy towards outsourcing is expected to receive a thrust after the recent Free Trade Agreement signed

with Bangladesh. Earlier, there was a cap on import of garments from Bangladesh at 10 million pieces, which is now

removed with effect from September, 2011. Though the Bangladeshi garment sector lacks a raw material base, it has

12

ICRA Equity Research Service

Kewal Kiran Clothing Limited

emerged more cost competitive than even the Chinese manufacturers owing to significant low labour cost costs,

economies of scale, flexible labour laws and subsidies from the Government which makes garmenting cost effective.

The recent free trade agreement is likely to create substantial cost savings for the industry and help the branded

apparel industry to reduce prices after recent inflationary trends witnessed over the past one year. KKCL has also

started making efforts in this direction for exploring the options of outsourcing manufacturing to Bangladesh.

Proposed Goods and Services Tax (GST) could provide further fillip

The implementation of the proposed goods and services tax (GST) can provide further fillip to organized retail growth

by reducing complexities of doing business, improving efficiencies across the supply chain and optimizing the taxation

system of the country. Currently organized retailers pay value added tax (VAT: 5% to 12.5%) which is generally

evaded by the unorganized players. Besides, organized retailers pay service tax (10.3%) on lease rentals which would

be completely setoff once GST is implemented. Again, Inter-state taxes like central sales tax (2%) and local octroi taxes

result in retailers having multiple warehouses to reduce taxes. This results in losses due to wastage, over-investments

and sub-optimal inventories, while investments in high-end warehousing and storage facilities remain restricted. GST

implementation will enable efficient implementation of hub-and-spoke distribution model, help rationalize entire

supply chain, optimize warehousing capacities and reduce storage, handling and transport costs for the organized

retailers. Besides, GST is expected to streamline documentation and reduce multiple tax incidences from central, state

and local government bodies; thereby facilitating uniform retail pricing across the country.

Robust growth expected over the next three years through product/brand extensions and entry into lifestyle

products such as bags, headgear, eyewear etc. and personal care segment

The company initially mainly focused on jeans under its flagship brand, Killer. However, over the years, it gradually

expanded into other product categories such as trousers, shirts and T-shirts under Killer as well as its other brands.

Additionally, most of the sales were of mens apparels until now, with little focus on womens wear. With the increase

in number of working women, rising income levels and a cultural shift in favour of western outfits, the womens

branded apparels market has seen higher growth rates where KKCL has already started tapping the opportunity. We

expect the proportion of sales from womens apparels to increase in the coming future and drive part of the growth

for the company. Additionally, with rise in disposable incomes, spend on personal care products like deodorants and

lifestyle accessories such as eyewear, sunglasses etc., has received a huge thrust in the past few years. With the

growth the segment has seen increased competition from players such as Provogue and Titan which have launched

their own stores in the past. The company has started retailing such products through its newly launched

ADDICTIONS outlets. Currently, the concept is in the initial stage and management expects to give the segment a

push once it is able to gauge the initial market response and demand. We expect ADDICTIONS to contribute ~9% of

overall sales by FY14.

Asset light franchisee model leading to low capital requirements and high return on investments

Post FY08, the company had changed its retail distribution model from company owned/leased stores to franchisee

owned/leased stores, where the franchisee bears all capital investments as well as the operational costs, chiefly rental

and overhead costs for the stores. While the company shares considerable margins with its franchisees, distributors

as well as third party manufacturers; the asset light business model facilitates rapid ramp-up in operations without

substantial capital requirements. Besides, substantial outsourced production provides economies of scale while

keeping the company relatively immune to demand slowdowns or labour unrest related issues. Moreover, lower

capital requirements results in robust return indicators (RoCE ~36%) and strong balance sheet position with almost

zero debt and free cash & cash equivalents of ~Rs. 120 crore. Currently the ratio of company owned to franchisee

stores stand at 1:8; going forward we expect the company to maintain such ratio and add about 75 exclusive stores in

each of the next three years ensuring strong free cash flow generation and return indicators.

13

ICRA Equity Research Service

Kewal Kiran Clothing Limited

Industry Scenario

As per Images Yearbook 2011, the size of the domestic textile and apparel Industry is estimated at Rs. 246,000 crore

with apparels constituting approximately 70% of the market at Rs. 170,900 crore. The apparel segment is expected to

grow at a CAGR of 11% over the next five years to grow to Rs, 288,880 crore. Increasing population with rising

disposable incomes, rapid urbanisation, change in spending attitude and increasing retail penetration into smaller

cities are expected to be crucial growth drivers.

Total Apparel Market (Rs Crore)

Total Apparel Market (Rs Crore)

470,000

11%

288,880

5%

5%

170,900

2020e

2015e

2010e

1%

2009

2005

101,425

154,000

Population

Growth

Increase in Growth in Unit

Individual

Value

Consumption

Total CAGR

Source: Images Yearbook, ICRA Equity Research Service

Percentage of Organized and Unorganized Sectors

in Retail Industry

87%

86%

83%

75%

60%

13%

14%

17%

25%

40%

2005

2009

2010e

2015e

2020e

Organised

Unorganized

The organised apparel retail sector shall lead the way for

the domestic apparel industry, likely to grow at ~28%

CAGR between 2010 and 2015. Thus the organised

garment retail penetration shall increase to ~25%

(translating to a market of Rs. 72,200 crore) in 2015 from

~16% at present (~Rs. 27,350 crore). This presents ample

room for all organised players to compete and grow while

presenting significant advantage for established industry

players such as KKCL to capture a greater share of the

consumers wallet.

Source: Images Yearbook, ICRA Equity Research Service

KKCLs target segment between 16-25 age is expected to witness higher than the average 11% growth expected for

the readymade garment industry. This is expected to be fuelled by the growth of services sector especially the new

generation IT and BPOs which is expected to generate higher employment among the youth leading to their greater

consumption. Furthermore, Segment wise, womens wear and girls wear is expected to lead the growth with CAGR of

12% and 11% respectively while menswear and boys wear are expected to grow at relatively lower CAGR of 9% and

10% respectively. The increased growth in womens wear reflects increasing independence among women as a

greater number enters the workforce and changing lifestyle which encourages higher spending among women. In line

with higher expected growth for womens wear, KKCL too has increased its focus on the segment and is marketing

aggressively through events and advertising focussing on women. Also there is paucity of national brands targeted

exclusively at women and KKCL intends to capture this largely untapped market.

14

ICRA Equity Research Service

Kewal Kiran Clothing Limited

Currently share of urban market is higher at 55% with greater organised retail penetration than the rural market.

However, the rural market at 45% share remains extremely underserved with huge potential for organised retail to

grow. KKCL is well positioned with respect to the rural market too having its value to mid-premium brand, Integriti

and mid-premium offering, Lawman Pg3 in the portfolio.

2009

Boys

10%

2015e

Girls

9%

Boys

10%

Boys

10%

Mens

40%

Mens

43%

Women

38%

2020e

Girls

9%

Women

41%

Girls

10%

Mens

37%

Women

43%

Source: Company, ICRA Equity Research Service

The Indian denim market (CY 2009) is estimated at Rs. 4,600 crore with menswear segment dominating at Rs. 3,900

crore, followed by women-wear at Rs. 415 crore and balance comprised by girls-wear and boys-wear categories. The

menswear market is expected to exhibit a moderate 9% CAGR with the women-wear category to expand at 13%

CAGR. Even though the readymade denim wear market has been on a growth trajectory, the per capita consumption

still lags behind considerably that of large consuming economies. The Indian average is between 2-3 pairs of jeans visa-vis China at 4 and US with 9, indicating the growth potential of the domestic denim market. A fast growing middle

class and changing income pyramid is further expected to fuel growth. In terms of demanding the latest fashion

trends, the Indian consumer is less dynamic as compared to the more fashion forward western consumers. Currently,

basic denims comprise 50-60% of the denim category, 25-30% is value-added while only 5-10% can be considered as

a fashion product. The proportion is broadly expected to remain on similar lines in the medium term.

The company has maintained distinct identity of each of its brands by focussing on the softer aspects such as unique

features and creating a lifestyle product so that people are drawn towards the brand for these reasons and not on

price. For example, it has always positioned Killer as an upmarket brand by associating/using foreign models for the

advertisement campaigns. It has never advertised on pricing of its products, as it is difficult to retain customers once

the price point moves. Thus it has been able to pass on cost increases better than the peer group, which in-turn has

allowed it to generate above-average operating margins.

15

ICRA Equity Research Service

Kewal Kiran Clothing Limited

FINANCIAL OUTLOOK

Healthy revenue growth visibility through higher sales volumes and increasing realizations

We expect KKCL to remain a leading branded apparel manufacturer with a strong retail presence across the country

through a mix of own stores, franchisee stores, national chain stores and multi-brand outlets. We expect KKCLs sales

to increase from ~3.36 million pieces in FY11 to ~5.55 million pieces by FY14e, resulting in a healthy 18% CAGR

volume growth. While the realizations are expected to increase by ~10% in FY12e due to the increase in excise duties

on branded apparels, we have assumed 5% CAGR increase in realizations thereafter.

3.36

2.72

2.36

4.03

4.82

5.55

Apparels in Mns

FY14e

FY13e

FY12e

FY11a

FY10a

FY09a

7%

608

639

685

750

Growth %

Realization Rs/Pc

5%

787

827

FY14e

5%

5%

FY13e

8%

FY12e

10%

900

800

700

600

500

400

300

200

100

0

FY11a

15%

30%

25%

20%

15%

10%

5%

0%

-5%

-10%

-15%

-20%

FY10a

20%

FY09a

15%

5

Rs Crore

20%

Rs Crore

23%

10%

9%

8%

7%

6%

5%

4%

3%

2%

1%

0%

Growth %

Source: Company, ICRA Equity Research Service

Strong revenue growth expected in-line with the industry; increasing contribution from value brands & low

margin products could moderate margins

Overall, we expect the company to report a strong 27% CAGR in net sales over the next three years in line with the

strong industry growth rates and KKCLs established position in branded apparels in India. However, increasing

contribution from value and mass market brands like Integriti (which has ~2.8x MRP to prime cost ratio vs. ~3.0

times for Lawman Pg3 and ~3.5 times for Killer brand) and lower margin products like trouser, shirts and T-shirts

(due to lower scope for designing than in denim jeans) are expected to moderate the EBITDA margins by ~450 bps

(from ~29.1% in FY11 to ~24.6% in FY14e). However, relatively low depreciation and interest costs, on account of

asset light business model followed by the company, is expected to reduce the impact on net profit margins, which are

expected to contract by ~340 bps (from 19.6% in FY11 to 16.2% in FY14e) over the next three years.

400

10.0%

Operating Income (OI)

FY14e

FY13e

FY12e

0.0%

Growth Rate (%)

15.0%

50

10.0%

5.0%

0.0%

FY14e

315

20.0%

20.0%

FY13e

236

486

30.0%

25.0%

100

FY12e

21%

176

40.0%

FY11a

22%

KKCL's Trend in Profitability Margins

FY10a

27%

150

Rs Crore

33%

30.0%

FY11a

600

500

400

300

200

100

0

34%

FY10a

Rs Crore

KKCL's Consolidated Revenue Growth

EBITDA

PAT

EBITDA Margin (RHS)

PAT Margin (RHS)

Source: Company, ICRA Equity Research Service

16

ICRA Equity Research Service

Kewal Kiran Clothing Limited

Asset light business model of expansion through franchise and third party retailing route would ensure industry

leading profitability indicators and strong capital structure going forward

We expect the company to retain and strengthen its asset light model with optimal mix of own vs. outsourced

production as well as own vs. franchise distribution that reduces overhead costs while maintaining product & service

standards. The company currently has 1:8 ratio of company-owned: franchise owned K-Lounge stores and exclusive

brand outlets (EBOs). Going forward, we expect the company to maintain similar ratio and add about 75 exclusive

stores in each of the next three years at an estimated capex of Rs. 130 crore (Rs. 60 crore for infrastructure and Rs. 70

crore for working capital management).

Strong operating profitability and relatively moderate capital requirements are expected resulting in further

improvement in RoCE (from ~36.6% to ~40.9%) and RoE (from ~24.8% to ~27.5%) during the next three years.

Besides, healthy cash accruals are expected to increase the cash and bank balances from ~Rs 95 crore to ~Rs. 125

crore during the same period. Overall, we expect a robust 19% CAGR growth in EPS from 37.5 Rs/share to 63.8

Rs/share for the company over the FY11-FY14e period, aided by stable store expansion and healthy domestic demand

for branded / fashion apparels.

EPS

EPS Growth

45%

40%

35%

30%

25%

20%

15%

10%

5%

0%

0.10

0.08

0.06

0.04

0.02

ROCE

RoE

FY14e

FY13e

FY12e

FY11a

0.00

FY10a

64

140.0%

120.0%

100.0%

80.0%

60.0%

40.0%

20.0%

0.0%

Return indicator (%)

KKCL's Return Indicators & Gearing

FY14e

54

FY13e

FY12e

26

44

38

FY11a

70.0

60.0

50.0

40.0

30.0

20.0

10.0

0.0

FY10a

Rs / Share

KKCL's EPS Growth

Total Debt/(Equity + MI)

Source: Company, ICRA Equity Research Service

17

ICRA Equity Research Service

Kewal Kiran Clothing Limited

COMPANY PROFILE

Kewal Kiran Clothing Limited (KKCL) is a leading manufacturer and retailer of branded apparels and fashion-wear in

India. KKCL has over two decades of experience in the domestic readymade garments industry with some leading

brands like Killer, Lawman Pg3, Integriti, Easies and ADDICTIONS.

KKCL is an established player in the Jeans segment through its flagship Killer brand, besides having a formidable

presence in Trousers, Shirts, T-shirts & Jackets segments and an emerging presence in lifestyle accessories like shoes,

belts, watches, bracelets, wallets, caps, bags, sunglasses and deodorants through the ADDICTIONS brand.

KKCL markets its products through a chain of 223 K-LOUNGE showrooms and exclusive brand outlets (EBOs) across

the country. Besides, KKCLs products are widely marketed at over 3,500 multi-brand outlets (MBOs) and national

chain stores like Shoppers stop and Hypercity. KKCLs designing, fabric washing, cutting, stitching and garment

manufacturing facilities are mainly located at Dadar and Goregoan (Mumbai), Daman and Vapi in Western India.

Exhibit 5: Company Factsheet

Name of the Company

Kewal Kiran Clothing Limited (KKCL)

Year of Incorporation

1980

Nature of Businesses

Branded apparels manufacturing and retailing

Products

Jeans, Trousers, Shirts, T-shirts, Jackets and Lifestyle accessories

Brands

Killer, Lawman Pg3, Integriti, Easies and ADDICTIONS

Company Stores

125 K-Lounges, 48 Killer EBOs, 32 Integriti EBOs, 7 LawmanPg3-EBOs, 4 Addiction-EBO, 7 Factoy Outlet

Distribution Network

Over 3,500 Multi-brand outlets (MBOs) and National Chain stores (like Shoppers stop and Hypercity)

Exports

Middle East, Sri Lanka, Nepal and other countries

Vendors

Fabric manufacturers like Arvind Mills, Raymond, KG Denim, etc

Manufacturing Capacity

3.5 Million pieces per annum (could be stretched further depending on product mix)

Manufacturing Locations

Washing, cutting, stitching and garmenting facilities at Dadar and Goregaon (Mumbai), Daman and Vapi

Board of Directors

Mr. Kewalchand P. Jain

Mr. Hemant P. Jain

Mr. Dinesh P. Jain

Mr. Vikas P. Jain

- Chairman & Managing Director

- Executive Director

- Executive Director

- Executive Director

Mr. Popatlal F. Sundesha

Mr. Mrudul D. Inamdar

Dr. Prakash A.Mody

Mr. Nimish G. Pandya

- Independent Director

- Independent Director

- Independent Director

- Independent Director

Key Joint Ventures

33% stake in White Knitwear Private Ltd in Surat SEZ

Bankers

Standard Chartered Bank

Auditors

M/s. Jain & Trivedi, M/s. N.A. Shah Associates

IPO Details

Rs. 80.6 crore raised in 2006, Issue of 31 lac shares at Rs. 260 per share, shares are listed on BSE and NSE

Registered & Corporate Office

Kewal Kiran Estate, Behind Tirupati Udyog, 460/7, I.B. Patel Road, Goregaon (East), Mumbai - 400 063

Windmill

0.6 MW Capacity at Survey No.1119/P, Village Kuchhadi, Taluka Porbunder, District Porbunder, Gujarat

Source: Company, ICRA Online Research

18

ICRA Equity Research Service

Kewal Kiran Clothing Limited

KKCLs Key Milestones:

1980:

M/s Keval Kiran

& Co

incorporated

1989:

Launch of

KILLER

1998:

Launch of

LAWMAN

& EASIES

2002:

Launch of

INTEGRITI

2004:

Launch of

the first KLOUNGE

2006:

IPO of 31

Lac Shares

2007:

KILLER

WOMEN

Wear

Launched

2011:

Launch of

'Addictions'

KKCLs Corporate Structure:

Branded apparel

manufacturer and retailer

Kewal Kiran Clothing Limited (KKCL)

Killer

Lawman Pg3

easies

Integriti

Addictions

Launch: 1989

Launch: 1998

Launch: 1998

Launch: 2002

Launch: 2011

Segment: Premium

Segment: Mid-premium

Segment: Mid-premium

Segment: Value

Segment: Lifestyle

Products: Denim Jeans,

Designer wear

Products: Clubwear

Jeans, Shirts, Jackets,

trousers, etc

Products: Formal &

Semi-formal menswear

Products: Casuals,

formals and Jeans

Products: Footwear,

Gym Wear, Swim Wear,

eyewear, etc

Revenue Contribution:

51%

Revenue Contribution:

21%

Revenue Contribution:

2%

Revenue Contribution:

25%

Revenue Contribution:

1%

Competition: Levis, Lee,

Spyker, Pepe, Wrangler

Competition: Mufti,

Newport, Flying

Machine, etc

Competition: Peter

England, Dockers, S.

Kumars, etc

Competition: Mufti,

Adams, Ruff & Tuff, etc

Competition: Titan,

Fastrack, etc

Latest Innovations &

Launches: Vertebrae and

Chica range

Latest Innovations &

Launches: Winter wear

Latest Innovations &

Launches: Integriti Galz

Latest Innovations &

Launches: Deodorants

and personal care

products

Latest Innovations &

Launches: Winter wear

Jackets and Sweaters

Source: Company, ICRA Online Research

Governance structure:

KKCL is managed by an eight member Board, which includes four independent directors and four members from the

Jain family. While the family is closely involved in running KKCLs business, the company has a professional

management structure across the company. The promoter group holds 74% equity stake in the company and the rest

is widely held by institutional and retail investors. The disclosures in KKCLs Annual Report are adequate and have

been broadly in line with that followed by the industry.

19

ICRA Equity Research Service

Kewal Kiran Clothing Limited

VALUATION GRADING

In assessing a company's valuation, various parameters are looked at including the company's earnings and growth

prospects; its ability to generate free cash flows and its capacity to generate returns from the capital invested. The

valuation is also benchmarked against an appropriate peer set or index. The opinion on a company's relative valuation

is expressed using the following five-point scale as follows:

Exhibit 6: ICRA Equity Research ServiceValuation Grades

Valuation Grade

Grade Implication

Significantly Undervalued

Moderately Undervalued

Fairly Valued

Moderately Overvalued

Significantly Overvalued

While assessing a company's relative valuation,

the historical price volatility exhibited by the

stock, besides its liquidity, is also taken into

account. The extent of overvaluation or

undervaluation is adjusted for the relative

volatility displayed by the stock.

Source: ICRA Online Research

KKCLs current valuation multiple (~12.9x times FY13 earnings) is at a premium to broader market indices like Nifty

Index, CNX 500 index or CNX Midcap index. However, KKCL continues to be one of the most reasonably valued

domestic consumption plays with strong established brand, wide distribution reach and strong balance sheet. Overall,

we expect the company to report a healthy 27% CAGR revenue growth and 19% CAGR EPS growth over the FY11aFY14e period, aided by rapid expansions in Tier II and Tier III cities. Hence, we assign a valuation grade of C to

KKCL on a grading scale of A to E, which indicates that the company is Fairly Valued on a relative basis.

Exhibit 7: KKCLS Relative Valuations:

NIFTY

INDEX

KEWAL KIRAN

CLOTHING

ICRA Estimates

CNX 500

INDEX

CNX MIDCAP

INDEX

FY12E

FY13E

FY12E

FY13E

FY12E

FY13E

FY12E

FY13E

Price/Earnings

15.85

12.93

13.19

11.29

12.38

10.31

10.63

8.79

EV/EBITDA

9.45

7.53

9.25

8.11

9.13

7.69

9.39

7.44

Price /Sales

2.73

2.16

1.45

1.33

1.15

1.04

0.67

0.61

Price /Book Value

3.79

3.26

2.03

1.78

1.78

1.56

1.21

1.09

Price/Cash Flow

14.06

11.46

9.46

8.15

8.93

7.42

8.17

6.34

ICRA Estimates

KEWAL KIRAN

CLOTHING

PANTALOON

RETAIL

SHOPPERS

STOP

TRENT

PROVOGUE

(INDIA)

ARVIND

FY12

FY13

FY12

FY13

FY12

FY13

FY12

FY13

FY12

FY13

FY12

FY13

Price/Earnings

15.85

12.93

13.72

10.25

36.49

23.53

n.m.

35.29

6.75

5.27

6.37

5.20

EV/EBITDA

9.45

7.53

9.66

8.26

17.01

12.14

146.01

14.70

6.14

5.54

9.42

8.14

Price /Sales

2.73

2.16

0.21

0.18

0.73

0.59

0.89

0.63

0.38

0.34

0.37

0.34

Price /Book Value

3.79

3.26

0.84

0.78

3.82

3.40

1.99

2.24

0.75

0.66

0.43

0.40

Price/Cash Flow

14.06

11.46

6.30

5.13

19.92

14.35

57.93

19.81

3.45

2.90

5.34

4.59

Source: Bloomberg, ICRA Equity Research Service

* Bloomberg Consensus Estimates as on

30th

December, 2011

20

ICRA Equity Research Service

Kewal Kiran Clothing Limited

ANNEXURES

Kewal Kiran Clothing Limited Revenue Break-up (Consolidated)

FY09a

FY10a

FY11a

FY12e

FY13e

FY14e

Killer

Volumes (Mn Pcs)

1.10

Growth %

Realizations (Rs/ Pc)

681

Growth %

Sales (Rs Crore)

75.27

Growth %

1.31

1.52

1.81

2.12

2.42

18.5%

16.3%

18.7%

17.1%

14.3%

700

780

854

896

941

2.8%

11.3%

9.5%

5.0%

5.0%

91.72

118.77

154.39

189.90

227.88

21.9%

29.5%

30.0%

23.0%

20.0%

0.80

1.05

1.23

1.50

1.74

16.5%

31.9%

17.0%

21.9%

16.2%

515

553

606

636

668

8.6%

7.3%

9.5%

5.0%

5.0%

41.03

58.09

74.40

95.23

116.18

26.6%

41.6%

28.1%

28.0%

22.0%

0.59

0.70

0.87

1.06

1.23

17.8%

19.0%

24.6%

21.9%

16.2%

652

697

763