Beruflich Dokumente

Kultur Dokumente

Finc301 15s2 Outline

Hochgeladen von

Marilyn WooCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Finc301 15s2 Outline

Hochgeladen von

Marilyn WooCopyright:

Verfügbare Formate

FINC301-15S2

College of Business and Economics

COURSE OUTLINE

Corporate Finance Theory and Policy

Semester Two

Department of Economics and Finance

Course Supervisor and Lecturer

Dr. Warwick Anderson

Room 406 Law Building

Phone 364-2626

Email: warwick.anderson@canterbury.ac.nz

Lecturer

Dr Debra Reed

Room 403 Law building

Email: debra.reed@canterbury.ac.nz

2015

FINC 301 2015 S2

Course Outline

PLEASE NOTE

The lecture outline may be subject to change depending on disruption from seismic

events that may occur from time to time

It is the students responsibility to retain all course outlines

for any future assessment by professional bodies

FINC 301 2015 S2

1.

Course Outline

PURPOSE OF COURSE and LEARNING OBJECTIVES

This course is designed to give students an in-depth understanding of the theory and practice of

corporate finance. The principal contention of the course is that managers should maximize firm

value. To do this, managers make investment decisions by allocating resources to good projects.

Managers also make financing decisions by choosing the appropriate mix of debt and equity and

investing the right amount back into operations. Students will learn how to choose good

projects and how to finance these projects. The emphasis will be on the why more than the

how in understanding finance. This will prepare them to be a financial manager of a firm that

will maximize firm value.

By the end of this course students will be able to:

1.

2.

3.

4.

5.

6.

7.

8.

9.

2.

Perform a capital budgeting exercise that may include any of the following: the effect of

expected inflation, fluctuations in net working capital requirement, variable cash flows,

replacement of assets and the decision whether to buy or lease assets.

Value a bond during, the life of which, changes in prevailing interest rates are expected, and

where a call is expected.

Perform a valuation of a firm in terms of each of Miller and Modiglianis three capital

structure models, the flows-to-equity model and the adjusted present value model.

Evaluate the strengths and weaknesses of a range of dividend-setting policies for a firm with a

given set of characteristics (expected earnings, capital structure and investment opportunity

set)

Critically evaluate the advantages and pitfalls associated with a proposed takeover by one

firm of another

Calculate the net present value of a takeover proposal involving, a cash payment or payment

in terms of the acquirers ordinary shares.

Critically evaluate the strengths and weaknesses of a domestic firm becoming a multinational

firm.

Calculate a cost of capital adjusted for changes in market risk and, where cross-border

investment is contemplated the cost of capital adjusted for exchange rate and interest rate

differences

Explain in depth why maximisation of a firms market capitalisation is a financial officers

objective function and how this objective function operates as a self-correcting

mechanism.

ASSESSMENT

Assessment for the course comprises:

(a)

Assignment #1 contributing 10% of the final grade,

(b)

Term Test contributing 25% towards the final grade

(c)

Case Study contributing 25% of the final grade,

(d)

Final examination contributing 40% towards the final grade.

FINC 301 2015 S2

Course Outline

The dates of assessments are:

Assignment: Due Monday 10th August at 5 pm.

Term Test : Wednesday 9th September 7:00-9:00 pm, in lecture theatre A2

The Term test will examine the material covered in weeks 1 through 4 plus the first half of

the fifth week (to the end of the Efficient Markets (EMH) topic).

Case Study: Presentations will be made in one-hour time slots during the days of

Thursday 1st October and Friday 2nd October in the Kirkwood Village, Room KG05.

See Section 3 (next section) for Case Study details.

Final Examination:

The final examination will be held on TBA. It will be three hours long and will cover

material from weeks 5 to 12, excluding the Efficient Markets (EMH) topic of week 5.

Students are reminded that it is their responsibility to check that no clashes of examination or test

dates occur between subjects for which they enrol.

These assessments are subject to slight changes due to room requirements. Any changes will be

announced in lectures and in LEARN.

NOTE: The Department normally uses 50% as a cut-off point between a nominal pass or fail but

may adjust the pass mark up or down to ensure justice. Note that you must have a weighted average

of 50% on the term test and final examination to pass the course. I.e. if you receive a high grade on

your assignments but do not receive a 50% average on the term test and final, you will not pass the

course.

3. CASE STUDY PROJECT

The case study project will be a group project which will be a case analysis. The actual case will

be distributed in the first lecture of Week 5 (Tuesday 11th August). You will form a group of three

to do this project.

If you have trouble finding a group, contact Deb Reed.

(debra.reed@canterbury.ac.nz) You need to email your group names to Deb by the end of term 3.

Your group will provide a recommendation as if you had been hired as a professional consultant.

Each project will consist of (1) an executive summary that you will write as an individual and an

oral presentation and (2) an oral report (3) assessment of the relative contributions of each group

member.

The Executive summary is limited to 1 page. Each member of the group will write his or her own

executive summary. (See section 8. for information on academic honesty.) The executive summary

should include your recommendation and a brief justification for your recommendation. You may

refer to and attach any exhibits that your group has used, but the executive summary should be your

own work. It will be marked for both substance and style.

The oral report will be done on either 1 or 2 October. Your group will need to sign up for your

preferred time. This sign up will be available on LEARN by the end of the third week of the

course. Your group will do a formal presentation on your groups recommendations. Each group

member must contribute to the oral report. You will be marked individually for your presentation

style, but also on the quality and the understanding of the material you present. There will be a

question and answer session after your presentation. Any member of your group can be asked

follow up questions on any part of the oral report. Therefore, it is essential that you work together

FINC 301 2015 S2

Course Outline

to make sure all group members understand all aspects of your oral report. You will need to prepare

a powerpoint presentation to use in your oral presentation. Hard copies of the powerpoint slides are

due at 3:00 pm on 30 September, to be deposited in the drop box on Level 2 of the Law Building.

The powerpoints need to be provided as 3 slides to a page. There is a lateness penalty of 10% if the

3pm deadline is missed, which rises to 25% if you deposit your powerpoint slides after 4pm.

Each group member will assess the relative contribution of the other members of the group. If the

overall assessment of a members contribution is determined to be less than that of other members,

that group members mark will be adjusted accordingly.

4. TEACHING ARRANGEMENTS

Lectures are scheduled for:

Tuesday 1pm 1.50pm in A6,

Wednesday 4pm 4.50pm in A2.

Friday 2pm 2.50pm in Law 108.

Lecturer: Warwick Anderson. Phone 364-2626.

Please note there are no tutorials for this paper. Instead, the third lecture hour (Friday 2pm) will be

assigned to either lecture material, or problem solving.

In addition, each week a list of questions and solutions will be provided for you to work through in

your own time and at your own speed. These will be provided in LEARN.

The three weekly sessions are recorded with Echo 360.

5. TEXTBOOKS

The course textbook is:

Ross, Westerfield and Jaffe, Corporate Finance, 10th Edition , McGraw Hill, 2013 (RWJ)

It is also recommended that you have calculators that do financial functions and scientific functions.

A Texas Instruments financial calculator from use for FINC201 is okay. If your financial calculator

does not do functions such as inverse, exponential, logarithmic and power functions, a scientific

calculator is also required. Programmable calculators are not permitted in exams or tests.

6. CONSULTATIONS

Enquiries concerning the lecture and tutorial material should be directed to the Course Supervisor,

Dr. Warwick Anderson in room Law 406. Times may be arranged by appointment, which you can

set by phoning 364-2626 or via email, or by knocking on his door.

Class Representatives

Class representatives will be selected at the beginning of the course. These people will provide a

valuable link between the course supervisor and the students. The representatives are expected to

facilitate dialogue between the students and the course supervisor on a regular basis. This process

should help to isolate and resolve potential concerns. The communications can also be used to

provide positive feedback on elements of the course which are going well.

FINC 301 2015 S2

Course Outline

7. LEARN

You will find course materials on The University of Canterburys learning system at

http://learn.canterbury.ac.nz/ Note: there will be incomplete powerpoint slides available for you

before lectures. Please consider how best to use these. Some students benefit most by taking notes

and then use the powerpoint slides to review after the lecture. Other students prefer to have the

slides with them at the lecture. Either way, it is the students responsibility to think about what is

being presented at lectures instead of copying down what the lecturer says without thinking.

8. COURSE POLICIESs

Return of Scripts The term test and project will be handed back in lectures in the first instance,

thereafter from the College Office on the 2nd floor of the Law building.

Missing Tests or Exams - Check now for any conflict in dates for tests or assessments. If you

miss an assessment, you will receive a zero, unless it is a university approved absence or you have a

university accepted aegrotat.

Aegrotat Consideration Students are advised to note the regulations surrounding aegrotats from

the University Calendar, in particular the following:

A student prevented from completing any major item or items of work for assessment in a course, or who

considers that his or her performance in completing any major item or items of work for assessment in a course

has been impaired by illness or injury or bereavement or any other critical circumstance may apply for aegrotat

consideration for the course. A student may apply on the basis that disrupted revision through one of these

causes has resulted in impaired performance. Please refer to Regulation 6 also.

Note: Aegrotat consideration is not available where results have been affected by impairment to a students

ability to learn the material for the course(s) concerned. The aegrotat provisions are intended to assist students

who have covered the work of a course but have been prevented by illness or other critical circumstance from

demonstrating their mastery of the material or skills at the time of assessment.

Students should also note that ongoing conditions do not qualify for aegrotat consideration.

Students with ongoing conditions or disabilities should contact Disability Support to discuss their

needs. Ongoing stress which made it hard to study does not meet the criteria.

Aegrotat considerations are for unforeseen circumstances beyond the control of the student which

directly impacted on the performance in the item of assessment itself not the course as a whole.

In case of an aegrotat, your grade for that assessment is based on your rank on other assessments. It

is a waste of your time to apply for an aegrotat when you havent passed other assessments.

Late Submission of Assignment - There will be a 25% penalty for lateness up to 24 hours (or part

thereof); 50% for 24 hours to 48 hours (or part thereof) and a 100% penalty thereafter. (Note that

penalties associated with the case study project are different.)

Examples: an assignment that earned 80% would, if it were handed in . . .

up to 24 hours late, ........ receive a mark of 80% (75)% = 60%.

up to 48 hours late, ........ receive a mark of 80% (50)% = 40%.

more than 48 hours late, receive a mark of 80% ( 0)% = 0%.

FINC 301 2015 S2

Course Outline

Make back-ups and allow enough time! All students are urged to plan and manage their own

work in order to meet the required submission dates. This is a wicked world in which allowance

must be made for the unexpected, especially with computers. Disks become unreadable. Systems go

down. Files get overwritten. Cars get flat tyres.

Academic Honesty

Cheating (such as copying) is not acceptable and may lead to no credit

The department and the university require that the work you hand in for assessment for credit towards your

coursemust be your own work (or, for a group assessment, the work of the team alone).

What is cheating? If you submit material that is wholly or partly someone else's work as your own work

then you are cheating. In our eyes cheating includes the following, which are all very similar:

1.

Collusion: this is secretly arranging with another person to work jointly on an assessment then

submitting it as though it were your own work. (This would apply to your individual executive

summaries.)

NOTE: This definition of 'collusion' does not stop you discussing with each other, in general, your

understanding of the task, how to approach it, and incorporating the ideas coming out of such

discussions into your own individual submissions. Talkbut then write it up using your own

thoughts and your own words.

2. Copying from other students: this is submitting material (in any medium, including computer files)

that has been created by another person or persons, whether or not they gave their permission. This

includes copying from another person's examination script.

3. Internet Case Solutions: Some case solutions are available on the internet. Many of these are done

by students and therefore should not be considered correct. Using these solutions is academic

dishonesty. Using these solutions, will not prepare you for the final exam which you must pass to

pass the course. Every semester, someone is caught using these and the consequences are not

pleasant. It is plagiarism.

4.

Plagiarism: this is making use of any material without clear and academically proper acknowledgment of its author or source.

NOTES:

You may feel that you are showing respect for wise authors by using their words. But you show

respect only when you acknowledge the quotations as quotations, and name the real authors.

When you name the authors of quotations you cannot be accused of cheating.

But using too many quotations or excessively long quotations without explaining, in your own

words, why they are relevant to your argument, will be considered to be poor scholarship and

earn a lowered grade.

5.

Ghost writing: this is having another party (whether paid or not) write work for you to submit.

The regulations call all these "dishonest or improper practices". We watch for them and use computer

systems to detect them. If dishonest practices are detected an examiner may refuse to mark the assessment,

may refer it to the Proctor (the university's disciplinary officer) and the Proctor may refer it to the

Discipline Committee.

Penalties for cheating can range from zero credit for the work, zero credit for the whole course or

exclusion from the course or from the University.

So prepare for an assessment with your own study, research and thinking. Then take personal pride from

writing your submission in your own words.

FINC 301 2015 S2

Course Outline

9. Schedule of Lectures and related Text Readings

Lecture

Wk Topic

Text Chapter

14 July

15 July

17 July

Capital budgeting

Capital budgeting

Capital budgeting

RWJ 6. Revision in RWJ 4 & Ch5

21 July

22 July

24 July

Valuation

Valuation

Valuation

28 July

29 July

31 July

Cost of Equity

Cost of Equity

Cost of Equity

RWJ 9 and RWJ 11

4 August

5 August

7 August

Beta

Beta

Beta

RWJ 11, 12 and 13

11 August

12 August

14 August

Case Study Briefing

Efficient Markets Hypothesis

Capital Structure

18 August

19 August

21 August

Capital Structure

Capital Structure

Capital Structure

RWJ 8

RWJ 14

RWJ 16

RWJ 16 and 17

Mid-semester Break 22 August 6 September

8 Sept

9 Sept

11 Sept

Flows to Equity & Adjusted PV

Flows to Equity & Adjusted PV

Flows to Equity & Adjusted PV

RWJ 18

15 Sept

16 Sept

18 Sept

Dividend Policy

Dividend Policy

Dividend Policy

RWJ 19

22 Sept

23 Sept

25 Sept

Leasing

Leasing

Leasing

RWJ 21

29 Sept

30 Sept

2 October

10

Mergers and Acquisitions

Mergers and Acquisitions

Mergers and Acquisitions

RWJ 29

6 October

7 October

9 October

11

International Capital Budgeting

International Capital Budgeting

International Capital Budgeting

RWJ 31

13 October

14 October

16 October

12

Objective Function and Agency Theory

Objective Function and Agency Theory

Objective Function and Agency Theory

RWJ 1 (pp10-19)

Das könnte Ihnen auch gefallen

- How To Register Your CPNDokument15 SeitenHow To Register Your CPNMaryUmbrello-Dressler81% (37)

- Cost Behavior and CVP Chpter 8Dokument89 SeitenCost Behavior and CVP Chpter 8Leya De'ReBorn Momo100% (3)

- CIR vs. Shinko Elec. Industries Co., LTDDokument5 SeitenCIR vs. Shinko Elec. Industries Co., LTDPio Vincent BuencaminoNoch keine Bewertungen

- Economics Unit OutlineDokument8 SeitenEconomics Unit OutlineHaris ANoch keine Bewertungen

- Topic 6 - Concepts of National Income (Week5)Dokument52 SeitenTopic 6 - Concepts of National Income (Week5)Wei SongNoch keine Bewertungen

- Event Contract - TemplateDokument17 SeitenEvent Contract - Templatenoel damotNoch keine Bewertungen

- U3A5 - Transactions With HST - TemplateDokument2 SeitenU3A5 - Transactions With HST - TemplateJay Patel0% (1)

- SCL - I. Letters of CreditDokument5 SeitenSCL - I. Letters of CreditlealdeosaNoch keine Bewertungen

- WI15 ADMS 4900R Course OutlineDokument7 SeitenWI15 ADMS 4900R Course OutlinezmcoupNoch keine Bewertungen

- Assessment and Feedback in Higher Education: A Guide for TeachersVon EverandAssessment and Feedback in Higher Education: A Guide for TeachersBewertung: 5 von 5 Sternen5/5 (1)

- SEC v. Interport Resources Corporation Case SummaryDokument4 SeitenSEC v. Interport Resources Corporation Case SummaryNath AntonioNoch keine Bewertungen

- IELTS Writing Section (Academic) - How To Achieve A Target 8 Score!Von EverandIELTS Writing Section (Academic) - How To Achieve A Target 8 Score!Bewertung: 3.5 von 5 Sternen3.5/5 (7)

- ACCG340Dokument11 SeitenACCG340Dung Tran0% (1)

- ECON 2113 SyllabusDokument6 SeitenECON 2113 SyllabusJason KristiantoNoch keine Bewertungen

- MGT3412Fall - 2016 Course OutlineDokument8 SeitenMGT3412Fall - 2016 Course OutlineJNoch keine Bewertungen

- FBE 421: Financial Analysis and Valuation Spring 2013Dokument5 SeitenFBE 421: Financial Analysis and Valuation Spring 2013Gabriel PereyraNoch keine Bewertungen

- FINA305 Course Outline 2014 Tri 1Dokument4 SeitenFINA305 Course Outline 2014 Tri 1lehvan93Noch keine Bewertungen

- FINM3006 - Banking, Debt Markets & Financial RegulationDokument6 SeitenFINM3006 - Banking, Debt Markets & Financial RegulationMayank Reach TutejaNoch keine Bewertungen

- The University of New South Wales: Acct5970 Accounting Concepts and Financial ReportingDokument15 SeitenThe University of New South Wales: Acct5970 Accounting Concepts and Financial ReportingallanNoch keine Bewertungen

- FINC3017 UoS 2012Dokument4 SeitenFINC3017 UoS 2012Ricky RatnayakeNoch keine Bewertungen

- Ais Auditing Adm4346aDokument16 SeitenAis Auditing Adm4346aArienNoch keine Bewertungen

- POL 374 - Australian Governments and Public PolicyDokument16 SeitenPOL 374 - Australian Governments and Public PolicyMitchNoch keine Bewertungen

- Carlson School Corporate Investment Decisions Spring 2017Dokument12 SeitenCarlson School Corporate Investment Decisions Spring 2017Novriani Tria PratiwiNoch keine Bewertungen

- Research Accounting Issues SyllabusDokument10 SeitenResearch Accounting Issues Syllabussodstar4Noch keine Bewertungen

- ECMC40 Syllabus 2012 Lec 01Dokument5 SeitenECMC40 Syllabus 2012 Lec 01Adele BreakNoch keine Bewertungen

- AC512 Expanded SyllabusDokument18 SeitenAC512 Expanded SyllabusVenn Bacus RabadonNoch keine Bewertungen

- NUS ACC1002X Financial Accounting SyllabusDokument3 SeitenNUS ACC1002X Financial Accounting SyllabusethanchiaaNoch keine Bewertungen

- rsm427h1f 20129Dokument8 Seitenrsm427h1f 20129nnoumanNoch keine Bewertungen

- Undergrad Course Outline ADR-3Dokument12 SeitenUndergrad Course Outline ADR-3Sphamandla NdlovuNoch keine Bewertungen

- ACCT 2010 - Principles of Accounting I: Acho@ust - HKDokument6 SeitenACCT 2010 - Principles of Accounting I: Acho@ust - HKpapaNoch keine Bewertungen

- Course OutlineDokument14 SeitenCourse OutlineAlex SewrattanNoch keine Bewertungen

- Updated FIN812 Capital Budgeting - 2015 - SpringDokument6 SeitenUpdated FIN812 Capital Budgeting - 2015 - Springnguyen_tridung2Noch keine Bewertungen

- Fnce210 Ke JinghasdaoDokument6 SeitenFnce210 Ke JinghasdaoSimon HoNoch keine Bewertungen

- Name: Office: Telephone: E-Mail:: Following Caption For The Subject Line: .)Dokument11 SeitenName: Office: Telephone: E-Mail:: Following Caption For The Subject Line: .)Ray LaiNoch keine Bewertungen

- AGEC 440 Syllabi F16Dokument9 SeitenAGEC 440 Syllabi F16Peter WuenschelNoch keine Bewertungen

- Acct 587Dokument6 SeitenAcct 587socalsurfyNoch keine Bewertungen

- Syllabus Fina6216 FinalDokument4 SeitenSyllabus Fina6216 Finalobliv11Noch keine Bewertungen

- FINS1613 Business Finance S12010Dokument13 SeitenFINS1613 Business Finance S12010Yang ShanNoch keine Bewertungen

- ACCO 400 Course Outline - Fall 2014Dokument8 SeitenACCO 400 Course Outline - Fall 2014GrishtaDarlingNoch keine Bewertungen

- Outline - BU387.Fall 2017 FinalDokument8 SeitenOutline - BU387.Fall 2017 FinalLinNoch keine Bewertungen

- MGM101 Introduction to Management FunctionsDokument11 SeitenMGM101 Introduction to Management FunctionsBookAddict721Noch keine Bewertungen

- FIN 502 SyllabusDokument5 SeitenFIN 502 Syllabusasantosh10% (1)

- Courseguideline-Micro Fall 2022Dokument9 SeitenCourseguideline-Micro Fall 2022NGÂN ĐẶNG HOÀNGNoch keine Bewertungen

- Outline 2019 JanMGFC30Dokument13 SeitenOutline 2019 JanMGFC30KevinNoch keine Bewertungen

- ACC 5350 Professional Accounting ResearchDokument5 SeitenACC 5350 Professional Accounting ResearchAimee JiangNoch keine Bewertungen

- Course Outline - Fall 2015Dokument9 SeitenCourse Outline - Fall 2015anoshaNoch keine Bewertungen

- ACCT421 Financial ReportingDokument8 SeitenACCT421 Financial ReportingAnna Rhecca De Joseph AgustinNoch keine Bewertungen

- Australian College of Business & Technology: INB2102D - International Business Unit Outline - Trimester 1, 2017Dokument11 SeitenAustralian College of Business & Technology: INB2102D - International Business Unit Outline - Trimester 1, 2017Aloka RanasingheNoch keine Bewertungen

- 251 Course Outline S1 2016Dokument5 Seiten251 Course Outline S1 2016Jay JNoch keine Bewertungen

- 189 SyllabusDokument8 Seiten189 SyllabusAlicea LinNoch keine Bewertungen

- F S 2 0 1 2 MBA-1V (3) : ALL Emester YRSDokument7 SeitenF S 2 0 1 2 MBA-1V (3) : ALL Emester YRSChaudhry KhurramNoch keine Bewertungen

- Fnce103 Term 2 Annual Year 2014. SMU Study Outline David DingDokument5 SeitenFnce103 Term 2 Annual Year 2014. SMU Study Outline David DingAaron GohNoch keine Bewertungen

- Course Outline F2000TDokument6 SeitenCourse Outline F2000Txixi.cz7651Noch keine Bewertungen

- School of Business and Finance (SBF) University of The Western CapeDokument11 SeitenSchool of Business and Finance (SBF) University of The Western CaperomeoNoch keine Bewertungen

- 308BMS Medical Microbiology Coursework Resit Poster June 2015Dokument5 Seiten308BMS Medical Microbiology Coursework Resit Poster June 2015Daghan HacıarifNoch keine Bewertungen

- FTX 4057 2022 Course DocumentDokument4 SeitenFTX 4057 2022 Course DocumentkateNoch keine Bewertungen

- PHIL 210 - Critical Thinking Winter 2024Dokument15 SeitenPHIL 210 - Critical Thinking Winter 2024christena.youssefNoch keine Bewertungen

- Introduction to Finance SyllabusDokument16 SeitenIntroduction to Finance SyllabusSpencer HikadeNoch keine Bewertungen

- ECON2206 Course OutlineDokument12 SeitenECON2206 Course OutlineChris Bury0% (1)

- Investments Portfolio ManagementDokument5 SeitenInvestments Portfolio ManagementsuseeexNoch keine Bewertungen

- Course Plan 2123 Sept 2011-300911 - 122106Dokument5 SeitenCourse Plan 2123 Sept 2011-300911 - 122106harayn92Noch keine Bewertungen

- Econ 3102Dokument10 SeitenEcon 3102pahpraNoch keine Bewertungen

- Professor Lochstoer's Capital Markets CourseDokument5 SeitenProfessor Lochstoer's Capital Markets Coursedarwin12Noch keine Bewertungen

- rsm430h1f 20229R2022 08 29Dokument7 Seitenrsm430h1f 20229R2022 08 29MimiNoch keine Bewertungen

- Sociology 102Dokument8 SeitenSociology 102anicktumuNoch keine Bewertungen

- AUB BBA Finance CourseDokument6 SeitenAUB BBA Finance CourseMahmoud KambrisNoch keine Bewertungen

- FIN2303 Syllabus Ekkacha Feb1 PDFDokument7 SeitenFIN2303 Syllabus Ekkacha Feb1 PDFsamuelifamilyNoch keine Bewertungen

- University of Canterbury: End-Of-Year Examinations 2012Dokument7 SeitenUniversity of Canterbury: End-Of-Year Examinations 2012Marilyn WooNoch keine Bewertungen

- International Law NotesDokument6 SeitenInternational Law NotesMarilyn WooNoch keine Bewertungen

- Pinegar: What Managers Think of Capital Structure PinegarDokument11 SeitenPinegar: What Managers Think of Capital Structure PinegarMarilyn Woo100% (1)

- Laws 101Dokument16 SeitenLaws 101Marilyn WooNoch keine Bewertungen

- Int'l Law Sources & State InterestsDokument1 SeiteInt'l Law Sources & State InterestsMarilyn WooNoch keine Bewertungen

- STRATEGY REVIEWDokument5 SeitenSTRATEGY REVIEWMarilyn WooNoch keine Bewertungen

- CMSA Committee Meeting MinutesDokument2 SeitenCMSA Committee Meeting MinutesMarilyn WooNoch keine Bewertungen

- Group AccountingDokument3 SeitenGroup AccountingMarilyn WooNoch keine Bewertungen

- Ten Terms Used in Case AnalysisDokument1 SeiteTen Terms Used in Case AnalysisMarilyn WooNoch keine Bewertungen

- Chap 011Dokument9 SeitenChap 011Marilyn WooNoch keine Bewertungen

- Financial Accounting NotesDokument18 SeitenFinancial Accounting NotesMarilyn WooNoch keine Bewertungen

- Ten Terms Used in Case AnalysisDokument1 SeiteTen Terms Used in Case AnalysisMarilyn WooNoch keine Bewertungen

- Stat Interpretation TutDokument3 SeitenStat Interpretation TutMarilyn WooNoch keine Bewertungen

- Parliamentary Sovereignty and The CourtsDokument2 SeitenParliamentary Sovereignty and The CourtsMarilyn WooNoch keine Bewertungen

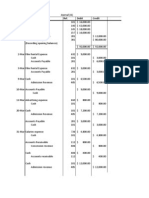

- Date Explanation Ref. Debit CreditDokument10 SeitenDate Explanation Ref. Debit CreditMarilyn WooNoch keine Bewertungen

- Acct103 HW 2Dokument5 SeitenAcct103 HW 2Marilyn WooNoch keine Bewertungen

- UntitledDokument1 SeiteUntitledMarilyn WooNoch keine Bewertungen

- Accounting HomeworkDokument11 SeitenAccounting HomeworkMarilyn WooNoch keine Bewertungen

- Book Review-The Street LawyerDokument4 SeitenBook Review-The Street LawyerMarilyn WooNoch keine Bewertungen

- Book Review-The Street LawyerDokument4 SeitenBook Review-The Street LawyerMarilyn WooNoch keine Bewertungen

- Duties CMSADokument1 SeiteDuties CMSAMarilyn WooNoch keine Bewertungen

- PrivatizationDokument69 SeitenPrivatizationgakibhaiNoch keine Bewertungen

- Tax Comp ExampleDokument115 SeitenTax Comp ExampleJayjay FarconNoch keine Bewertungen

- FINMAN 4 - Instructional Material 1Dokument25 SeitenFINMAN 4 - Instructional Material 1Justine NeronaNoch keine Bewertungen

- ICT Mentorship EP3 SummaryDokument23 SeitenICT Mentorship EP3 SummaryYassine ZerNoch keine Bewertungen

- LK Spto 2019 - Q2Dokument87 SeitenLK Spto 2019 - Q2siput_lembekNoch keine Bewertungen

- Skripsi Tanpa PembahasanDokument99 SeitenSkripsi Tanpa PembahasanJohanes ProNoch keine Bewertungen

- Residual Income Model ExplainedDokument12 SeitenResidual Income Model ExplainedKanav GuptaNoch keine Bewertungen

- Unintended Consequences: by John MauldinDokument11 SeitenUnintended Consequences: by John Mauldinrichardck61Noch keine Bewertungen

- Fical PolicyDokument51 SeitenFical Policyrasel_203883Noch keine Bewertungen

- Marketing - Project CDokument7 SeitenMarketing - Project Chaithere123Noch keine Bewertungen

- The Effect of Financial Constraints, Investment Opportunity Set, and Financial Reporting Aggressiveness On Tax AggressivenessDokument16 SeitenThe Effect of Financial Constraints, Investment Opportunity Set, and Financial Reporting Aggressiveness On Tax AggressivenessmuchlisNoch keine Bewertungen

- Factors affecting saving behaviour of college studentsDokument16 SeitenFactors affecting saving behaviour of college studentsSiew XuanNoch keine Bewertungen

- Engineering EconomyDokument18 SeitenEngineering EconomyWesam abo HalimehNoch keine Bewertungen

- Economy of Philippines PDFDokument15 SeitenEconomy of Philippines PDFMirmoDeponNoch keine Bewertungen

- SAP FICO Consultant ResumeDokument3 SeitenSAP FICO Consultant ResumeAbdul RaheemNoch keine Bewertungen

- 1240 - Dela Cruz v. ConcepcionDokument6 Seiten1240 - Dela Cruz v. ConcepcionRica Andrea OrtizoNoch keine Bewertungen

- Capacity To ContractDokument33 SeitenCapacity To ContractAbhay MalikNoch keine Bewertungen

- Consti Cases Part 1Dokument173 SeitenConsti Cases Part 1Michael Ang SauzaNoch keine Bewertungen

- Chapter 17 Homework ProblemsDokument5 SeitenChapter 17 Homework ProblemsAarti JNoch keine Bewertungen

- Finance - Cost of Capital TheoryDokument30 SeitenFinance - Cost of Capital TheoryShafkat RezaNoch keine Bewertungen

- ANMC 2021 Group2 UnlockedDokument145 SeitenANMC 2021 Group2 UnlockedPragnesh PatilNoch keine Bewertungen