Beruflich Dokumente

Kultur Dokumente

Form 3903 Moving Expense Deduction

Hochgeladen von

Sarah KuldipOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Form 3903 Moving Expense Deduction

Hochgeladen von

Sarah KuldipCopyright:

Verfügbare Formate

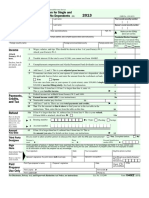

Form

3903

Moving Expenses

Department of the Treasury

Internal Revenue Service (99)

OMB No. 1545-0074

2013

Information about Form 3903 and its instructions is available at www.irs.gov/form3903.

Attach to Form 1040 or Form 1040NR.

Attachment

Sequence No. 170

Your social security number

Name(s) shown on return

Magdalena Schmitz

Before you begin:

1

2

294-83-2845

See the Distance Test and Time Test in the instructions to find out if you can deduct your moving

expenses.

See Members of the Armed Forces in the instructions, if applicable.

Transportation and storage of household goods and personal effects (see instructions) . . .

Travel (including lodging) from your old home to your new home (see instructions). Do not

include the cost of meals . . . . . . . . . . . . . . . . . . . . . . . .

Add lines 1 and 2

Enter the total amount your employer paid you for the expenses listed on lines 1 and 2 that is

not included in box 1 of your Form W-2 (wages). This amount should be shown in box 12 of your

Form W-2 with code P . . . . . . . . . . . . . . . . . . . . . . . .

3,200

00

3,200

00

3,200

00

Is line 3 more than line 4?

No.

You cannot deduct your moving expenses. If line 3 is less than line 4, subtract line 3

from line 4 and include the result on Form 1040, line 7, or Form 1040NR, line 8.

Yes. Subtract line 4 from line 3. Enter the result here and on Form 1040, line 26, or Form

1040NR, line 26. This is your moving expense deduction . . . . . . . . .

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 12490K

Form 3903 (2013)

INTENTIONALLY LEFT BLANK

Page 3

Form 3903 (2013)

General Instructions

Time Test

Future Developments

For the latest information about developments related to Form 3903

and its instructions, such as legislation enacted after they were

published, go to www.irs.gov/form3903.

Whats New

For 2013, the standard mileage rate for using your vehicle to move

to a new home is 24 cents a mile.

Purpose of Form

Use Form 3903 to figure your moving expense deduction for a move

related to the start of work at a new principal place of work

(workplace). If the new workplace is outside the United States or its

possessions, you must be a U.S. citizen or resident alien to deduct

your expenses.

If you qualify to deduct expenses for more than one move, use a

separate Form 3903 for each move.

For more details, see Pub. 521, Moving Expenses.

Moving Expenses You Can Deduct

You can deduct the reasonable expenses of moving your household

goods and personal effects and of traveling from your old home to

your new home. Reasonable expenses can include the cost of

lodging (but not meals) while traveling to your new home. You

cannot deduct the cost of sightseeing trips.

Who Can Deduct Moving Expenses

If you move to a new home because of a new principal workplace,

you may be able to deduct your moving expenses whether you are

self-employed or an employee. But you must meet both the

distance and time tests that follow. Also, your move must be closely

related both in time and place to the start of work at your new job

location. For more details, see Pub. 521.

Members of the Armed Forces may not have to meet the

distance and time tests. See Members of the Armed

Forces later in the instructions.

TIP

Distance Test

Your new principal workplace must be at least 50 miles farther from

your old home than your old workplace was. For example, if your

old workplace was 3 miles from your old home, your new workplace

must be at least 53 miles from that home. If you did not have an old

workplace, your new workplace must be at least 50 miles from your

old home. The distance between the two points is the shortest of

the more commonly traveled routes between them.

To see if you meet the distance test, you can use the

worksheet below.

TIP

Distance Test Worksheet

Keep a Copy for Your Records

1. Number of miles from your old home

to your new workplace

. . .

1.

miles

2. Number of miles from your old home

to your old workplace . . . .

2.

miles

3. Subtract line 2 from line 1. If zero or

less, enter -0- . . . . . .

3.

miles

Is line 3 at least 50 miles?

If you are an employee, you must work full time in the general area

of your new workplace for at least 39 weeks during the 12 months

right after you move. If you are self-employed, you must work full

time in the general area of your new workplace for at least 39 weeks

during the first 12 months and a total of at least 78 weeks during the

24 months right after you move.

What if you do not meet the time test before your return is due?

If you expect to meet the time test, you can deduct your moving

expenses in the year you move. Later, if you do not meet the time

test, you must either:

Amend your tax return for the year you claimed the deduction by

filing Form 1040X, Amended U.S. Individual Income Tax Return, or

For the year you cannot meet the time test, report as income the

amount of your moving expense deduction that reduced your

income tax for the year you moved.

If you did not deduct your moving expenses in the year you

moved and you later meet the time test, you can take the

deduction by filing an amended return for the year you moved. To

do this, use Form 1040X.

Exceptions to the time test. You do not have to meet the time test

if any of the following apply.

Your job ends because of disability.

You are transferred for your employers benefit.

You are laid off or discharged for a reason other than willful

misconduct.

You are in the Armed Forces and the move is due to a permanent

change of station (see below).

You meet the requirements (explained later) for retirees or

survivors living outside the United States.

You are filing this form for a decedent.

Members of the Armed Forces

If you are in the Armed Forces, you do not have to meet the

distance and time tests if the move is due to a permanent change of

station. A permanent change of station includes a move in

connection with and within 1 year of retirement or other termination

of active duty.

How To Complete This Form If You Are In the Armed

Forces

Do not include on lines 1 and 2 any expenses for moving or storage

services that were provided by the government. If you and your

spouse and dependents are moved to or from different locations,

treat the moves as a single move.

On line 4, enter the total reimbursements and allowances you

received from the government in connection with the expenses you

claimed on lines 1 and 2. Do not include the value of moving or

storage services provided by the government. Complete line 5 if

applicable.

Retirees or Survivors Living Outside the

United States

If you are a retiree or survivor who moved to a home in the United

States or its possessions and you meet the following requirements,

you are treated as if you moved to a new principal workplace

located in the United States. You are subject only to the distance

test.

Retirees

You can deduct moving expenses for a move to a new home in the

United States when you permanently retire if both your old principal

workplace and your old home were outside the United States.

Yes. You meet this test.

Survivors

No.

You can deduct moving expenses for a move to a home in the

United States if you are the spouse or dependent of a person

whose principal workplace at the time of his or her death was

outside the United States. The expenses must be for a move (a) that

begins within 6 months after the decedents death, and (b) from a

former home outside the United States that you lived in with the

decedent at the time of his or her death.

You do not meet this test. You cannot deduct your

moving expenses. Do not complete Form 3903.

Page 4

Form 3903 (2013)

Reimbursements

You can choose to deduct moving expenses in the year you are

reimbursed by your employer, even though you paid the expenses

in a different year. However, special rules apply. See When To

Deduct Expenses in Pub. 521.

Filers of Form 2555

If you file Form 2555, Foreign Earned Income, to exclude any of

your income or housing costs, report the full amount of your

deductible moving expenses on Form 3903 and on Form 1040.

Report the part of your moving expenses that is not allowed

because it is allocable to the excluded income on the appropriate

line of Form 2555. For details on how to figure the part allocable to

the excluded income, see Pub. 54, Tax Guide for U.S. Citizens and

Resident Aliens Abroad.

Specific Instructions

You can deduct the following expenses you paid to move your

family and dependent household members. Do not deduct

expenses for employees such as a maid, nanny, or nurse.

Line 1

Moves within or to the United States or its possessions. Enter

the amount you paid to pack, crate, and move your household

goods and personal effects. You can also include the amount you

paid to store and insure household goods and personal effects

within any period of 30 days in a row after the items were moved

from your old home and before they were delivered to your new

home.

Moves outside the United States or its possessions. Enter the

amount you paid to pack, crate, move, store, and insure your

household goods and personal effects. Also, include the amount

you paid to move your personal effects to and from storage and to

store them for all or part of the time the new workplace continues to

be your principal workplace.

Storage fees. Do not file Form 3903 if all of the following apply:

You moved in an earlier year,

You are claiming only storage fees during your absence from the

United States, and

Any amount your employer paid for the storage fees is included in

box 1 of your Form W-2 (wages).

Instead, enter the storage fees on Form 1040, line 26, or Form

1040NR, line 26, and write Storage on the dotted line next to

line 26.

Line 2

Enter the amount you paid to travel from your old home to your new

home. This includes transportation and lodging on the way. Include

costs for the day you arrive. The members of your household do not

have to travel together or at the same time. But you can only

include expenses for one trip per person. Do not include any

househunting expenses.

If you use your own vehicle(s), you can figure the expenses by

using either:

Actual out-of-pocket expenses for gas and oil, or

Mileage at the rate of 24 cents a mile.

You can add parking fees and tolls to the amount claimed under

either method.

Das könnte Ihnen auch gefallen

- Facebook Music Publisher ContractDokument11 SeitenFacebook Music Publisher ContractDigital Music News100% (2)

- File by Mail Instructions For Your Federal Amended Tax ReturnDokument14 SeitenFile by Mail Instructions For Your Federal Amended Tax ReturnRyan MayleNoch keine Bewertungen

- Employer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterDokument4 SeitenEmployer's QUARTERLY Federal Tax Return: Answer These Questions For This QuarterpdizypdizyNoch keine Bewertungen

- 1040 Exam Prep: Module II - Basic Tax ConceptsVon Everand1040 Exam Prep: Module II - Basic Tax ConceptsBewertung: 1.5 von 5 Sternen1.5/5 (2)

- AlaAL ZAALIG2011Dokument5 SeitenAlaAL ZAALIG2011Ala AlzaaligNoch keine Bewertungen

- Selling Skills WorkbookDokument25 SeitenSelling Skills WorkbookalokmenoninNoch keine Bewertungen

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Dokument2 SeitenChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipNoch keine Bewertungen

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- F 9465Dokument3 SeitenF 9465Pat PlanteNoch keine Bewertungen

- Frequently Asked Tax Questions 2015sdaDokument8 SeitenFrequently Asked Tax Questions 2015sdaVikram VickyNoch keine Bewertungen

- Submitting Your U.S. Tax Documents: Print, Sign, MailDokument5 SeitenSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- Expatriate Assignment TermsDokument4 SeitenExpatriate Assignment TermsAvinash KumarNoch keine Bewertungen

- Sample Contract Full Time or Part TimeDokument3 SeitenSample Contract Full Time or Part TimeBenchie B. GonzalesNoch keine Bewertungen

- Sample Contract CasualDokument2 SeitenSample Contract CasualandongNoch keine Bewertungen

- ECA Manpower Chart of Accounts ExplainedDokument8 SeitenECA Manpower Chart of Accounts ExplainedTelle SirchNoch keine Bewertungen

- Real MortgageDokument6 SeitenReal Mortgagechisel_159Noch keine Bewertungen

- RRC FAR Property Plant and EquipmentDokument18 SeitenRRC FAR Property Plant and Equipmenthazel alvarezNoch keine Bewertungen

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsVon Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNoch keine Bewertungen

- Tax Bar QA 2013-2017Dokument62 SeitenTax Bar QA 2013-2017Victor LimNoch keine Bewertungen

- Castro vs. CADokument1 SeiteCastro vs. CAjudielparejaNoch keine Bewertungen

- Similarities of Standard Forms of Contract in MalaysiaDokument5 SeitenSimilarities of Standard Forms of Contract in MalaysiaZinck Hansen88% (8)

- Moving Expenses: Before You BeginDokument4 SeitenMoving Expenses: Before You BeginEloy RodriguezNoch keine Bewertungen

- UnitedStates IRSPub521Dokument20 SeitenUnitedStates IRSPub521Jesse FaulknerNoch keine Bewertungen

- US Internal Revenue Service: f3903 - 2001Dokument2 SeitenUS Internal Revenue Service: f3903 - 2001IRSNoch keine Bewertungen

- US Internal Revenue Service: f3903 - 1995Dokument2 SeitenUS Internal Revenue Service: f3903 - 1995IRSNoch keine Bewertungen

- US Internal Revenue Service: I3903f - 1992Dokument2 SeitenUS Internal Revenue Service: I3903f - 1992IRSNoch keine Bewertungen

- US Internal Revenue Service: I3903f - 1993Dokument2 SeitenUS Internal Revenue Service: I3903f - 1993IRSNoch keine Bewertungen

- US Internal Revenue Service: f3903f - 1996Dokument2 SeitenUS Internal Revenue Service: f3903f - 1996IRSNoch keine Bewertungen

- US Internal Revenue Service: f3903f - 1997Dokument2 SeitenUS Internal Revenue Service: f3903f - 1997IRSNoch keine Bewertungen

- U.S. Domestic 1-Way Relocation GuideDokument12 SeitenU.S. Domestic 1-Way Relocation GuideCin QuesadaNoch keine Bewertungen

- US Internal Revenue Service: f3903 - 1997Dokument2 SeitenUS Internal Revenue Service: f3903 - 1997IRSNoch keine Bewertungen

- COMPLIANCE CHECKLISTDokument5 SeitenCOMPLIANCE CHECKLISTPrajjun ReddyNoch keine Bewertungen

- Adjusted Employer's Annual Federal Tax Return For Agricultural Employees or Claim For RefundDokument4 SeitenAdjusted Employer's Annual Federal Tax Return For Agricultural Employees or Claim For RefundFrancis Wolfgang UrbanNoch keine Bewertungen

- 401 KhardshipDokument10 Seiten401 KhardshipRickey LemonsNoch keine Bewertungen

- IRS Form 673 - Foreign Earned Income ExclusionDokument2 SeitenIRS Form 673 - Foreign Earned Income Exclusionawang90Noch keine Bewertungen

- 2011 Quebec Tax FormsDokument4 Seiten2011 Quebec Tax FormsManideep GuptaNoch keine Bewertungen

- Information About Moving ExpensesDokument6 SeitenInformation About Moving ExpensesSebastien OuelletNoch keine Bewertungen

- Bir60 EguideDokument15 SeitenBir60 Eguidekumar.arasu8717Noch keine Bewertungen

- US Internal Revenue Service: I1040c - 1994Dokument6 SeitenUS Internal Revenue Service: I1040c - 1994IRSNoch keine Bewertungen

- US Internal Revenue Service: p967 - 2001Dokument6 SeitenUS Internal Revenue Service: p967 - 2001IRSNoch keine Bewertungen

- Form W-4P Withholding Certificate for Pension or Annuity PaymentsDokument4 SeitenForm W-4P Withholding Certificate for Pension or Annuity Paymentsts0m3Noch keine Bewertungen

- F1040ez PDFDokument2 SeitenF1040ez PDFjc75aNoch keine Bewertungen

- Weekly Tax Table: Pay As You Go (PAYG) WithholdingDokument12 SeitenWeekly Tax Table: Pay As You Go (PAYG) Withholdingwawen03Noch keine Bewertungen

- US Internal Revenue Service: F1040es - 2004Dokument7 SeitenUS Internal Revenue Service: F1040es - 2004IRSNoch keine Bewertungen

- Adjust Maryland withholdingDokument2 SeitenAdjust Maryland withholdingsosureyNoch keine Bewertungen

- Bir60 EguideDokument12 SeitenBir60 EguidekunalkhubaniNoch keine Bewertungen

- Bir60 EguideDokument12 SeitenBir60 EguideRay Li Shing KitNoch keine Bewertungen

- Participant Get Form DocumentDokument14 SeitenParticipant Get Form DocumentRonald SandersNoch keine Bewertungen

- WWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enDokument17 SeitenWWW - Humanservices.gov - Au SPW Customer Forms Resources Modjy-1211enLeslie BrownNoch keine Bewertungen

- Wage Tax Refund Petition Tax Year: Salary/Hourly EmployeesDokument2 SeitenWage Tax Refund Petition Tax Year: Salary/Hourly EmployeesStanley AndersonNoch keine Bewertungen

- 2009 Personal Tax Credits Return: Disability Tax Credit Certificate, Enter $7,196Dokument2 Seiten2009 Personal Tax Credits Return: Disability Tax Credit Certificate, Enter $7,196Muneeb ArshadNoch keine Bewertungen

- Thrift Savings Plan TSP-1-C: Catch-Up Contribution ElectionDokument2 SeitenThrift Savings Plan TSP-1-C: Catch-Up Contribution ElectionIonut NeacsuNoch keine Bewertungen

- US Internal Revenue Service: p521 - 1998Dokument16 SeitenUS Internal Revenue Service: p521 - 1998IRSNoch keine Bewertungen

- 2013 Application For Automatic Extension of Time To File U.S. Individual Income Tax ReturnDokument4 Seiten2013 Application For Automatic Extension of Time To File U.S. Individual Income Tax ReturnRoy TannerNoch keine Bewertungen

- std686 PDFDokument2 Seitenstd686 PDFnmkeatonNoch keine Bewertungen

- td1 13eDokument2 Seitentd1 13eMel McSweeneyNoch keine Bewertungen

- Occupational Tax and Registration Return For Wagering: Type or PrintDokument6 SeitenOccupational Tax and Registration Return For Wagering: Type or Printdfasdfas1Noch keine Bewertungen

- Tax Guide To U.S. Civil Service Retirement Benefits: RemindersDokument33 SeitenTax Guide To U.S. Civil Service Retirement Benefits: RemindersChristopher RiceNoch keine Bewertungen

- Fortnightly Tax Table AuDokument12 SeitenFortnightly Tax Table AujaeadaNoch keine Bewertungen

- Tax File Number DeclarationDokument7 SeitenTax File Number DeclarationJessie YuNoch keine Bewertungen

- Form 8862Dokument2 SeitenForm 8862Francis Wolfgang UrbanNoch keine Bewertungen

- Guidance Temporary Work Permit Form T1Dokument7 SeitenGuidance Temporary Work Permit Form T1Kim PimoNoch keine Bewertungen

- Tuition and Fees Deduction: Before You BeginDokument4 SeitenTuition and Fees Deduction: Before You BeginSarah Kuldip100% (1)

- Granville Agreement Letter-3 Months PDFDokument3 SeitenGranville Agreement Letter-3 Months PDFDanjelaNoch keine Bewertungen

- US Internal Revenue Service: f3903 - 2002Dokument2 SeitenUS Internal Revenue Service: f3903 - 2002IRSNoch keine Bewertungen

- US Internal Revenue Service: F1040esn - 2004Dokument5 SeitenUS Internal Revenue Service: F1040esn - 2004IRSNoch keine Bewertungen

- Letter of Engagement Template For Hiring New Employees - Full-Time/part-TimeDokument7 SeitenLetter of Engagement Template For Hiring New Employees - Full-Time/part-TimeShoaib AkramNoch keine Bewertungen

- 18Dokument1 Seite18Sarah KuldipNoch keine Bewertungen

- 19Dokument1 Seite19Sarah KuldipNoch keine Bewertungen

- Assurance Through A Phrase Such As "We Are Not Aware of Any Material Modifications"Dokument2 SeitenAssurance Through A Phrase Such As "We Are Not Aware of Any Material Modifications"Sarah KuldipNoch keine Bewertungen

- Answer: 10 Out of 10 PointsDokument4 SeitenAnswer: 10 Out of 10 PointsSarah KuldipNoch keine Bewertungen

- 20Dokument2 Seiten20Sarah KuldipNoch keine Bewertungen

- Auditor ProceduresDokument1 SeiteAuditor ProceduresSarah KuldipNoch keine Bewertungen

- 21Dokument1 Seite21Sarah KuldipNoch keine Bewertungen

- Quiz 4Dokument4 SeitenQuiz 4Sarah KuldipNoch keine Bewertungen

- Communicating with Web servers: Understanding how HTTP worksDokument4 SeitenCommunicating with Web servers: Understanding how HTTP worksSarah KuldipNoch keine Bewertungen

- Accounts ReceivableDokument1 SeiteAccounts ReceivableSarah KuldipNoch keine Bewertungen

- Tuition and Fees Deduction: Before You BeginDokument4 SeitenTuition and Fees Deduction: Before You BeginSarah Kuldip100% (1)

- File Self-Employment Tax Schedule SEDokument2 SeitenFile Self-Employment Tax Schedule SESarah KuldipNoch keine Bewertungen

- Interest and Ordinary DividendsDokument2 SeitenInterest and Ordinary DividendsSarah KuldipNoch keine Bewertungen

- F1040sa 2013Dokument2 SeitenF1040sa 2013Sarah KuldipNoch keine Bewertungen

- Certain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnDokument3 SeitenCertain Cash Contributions For Typhoon Haiyan Relief Efforts in The Philippines Can Be Deducted On Your 2013 Tax ReturnSarah Kuldip50% (4)

- Principles of TakafulDokument3 SeitenPrinciples of TakafulMuhamad NazriNoch keine Bewertungen

- Marine InsuranceDokument174 SeitenMarine InsuranceparishaNoch keine Bewertungen

- Top Large Cap Companies - List of Top Large Cap Companies - Best Blue Chip Stocks in IndiaDokument14 SeitenTop Large Cap Companies - List of Top Large Cap Companies - Best Blue Chip Stocks in IndiasandeepNoch keine Bewertungen

- December 6 2013Dokument48 SeitenDecember 6 2013fijitimescanadaNoch keine Bewertungen

- Comprehensive Arabic Motor Insurance Cover for DriveSecureDokument100 SeitenComprehensive Arabic Motor Insurance Cover for DriveSecureSama88823Noch keine Bewertungen

- OR02BU7259 - Car InsuranceDokument4 SeitenOR02BU7259 - Car InsuranceDevdoot SahuNoch keine Bewertungen

- Marketing and Branding Professional Seeks Managerial RoleDokument3 SeitenMarketing and Branding Professional Seeks Managerial RoleVirendra SinghNoch keine Bewertungen

- CHAPTER 6 - Legal AspectsDokument58 SeitenCHAPTER 6 - Legal AspectsNurarief Affendy100% (1)

- Project Report ON: Microinsurance: The Role of Community Based Insurance and Financial SustainabilityDokument44 SeitenProject Report ON: Microinsurance: The Role of Community Based Insurance and Financial SustainabilitysmritipaliwalNoch keine Bewertungen

- Jspes DDM Bkrev ConfidgameDokument4 SeitenJspes DDM Bkrev ConfidgameDwight MurpheyNoch keine Bewertungen

- AnnuitiesDokument16 SeitenAnnuitiesbharathvigneshwar kNoch keine Bewertungen

- Production StrategyDokument15 SeitenProduction StrategyArra FresnoNoch keine Bewertungen

- Carpenters Annuity Fund 2007Dokument19 SeitenCarpenters Annuity Fund 2007Latisha WalkerNoch keine Bewertungen

- Introduction To TdsDokument28 SeitenIntroduction To TdsGavendra BhartiNoch keine Bewertungen

- Literature Review On Insurance Company - PDF - Systemic Risk - InsuranceDokument34 SeitenLiterature Review On Insurance Company - PDF - Systemic Risk - Insurance61Rohit PotdarNoch keine Bewertungen

- Unit 5 - Legal Environment For The Tourism Entrepreneurship PDFDokument22 SeitenUnit 5 - Legal Environment For The Tourism Entrepreneurship PDFNarayanPrasadPoudelNoch keine Bewertungen

- Philippine HIMOAP BrochureDokument33 SeitenPhilippine HIMOAP BrochuredtiSV2012Noch keine Bewertungen

- INSURANCE LAW: HMOS NOT ENGAGED IN INSURANCE BUSINESSDokument9 SeitenINSURANCE LAW: HMOS NOT ENGAGED IN INSURANCE BUSINESSninomaurin14Noch keine Bewertungen

- Halsbury Trust LawDokument169 SeitenHalsbury Trust LawnewmanggNoch keine Bewertungen

- Purchase OrderDokument4 SeitenPurchase OrderMandeep SinghNoch keine Bewertungen

- TOMMY MANION OF TEXAS, INC. v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA, INC. ComplaintDokument21 SeitenTOMMY MANION OF TEXAS, INC. v. INDEMNITY INSURANCE COMPANY OF NORTH AMERICA, INC. ComplaintACELitigationWatchNoch keine Bewertungen

- ENCYCLOPEDIA BRITANNICA v. NLRCDokument2 SeitenENCYCLOPEDIA BRITANNICA v. NLRCGeremae MataNoch keine Bewertungen