Beruflich Dokumente

Kultur Dokumente

Weekly Foreign Holding & Block Trade Update: Net Buying Net Selling

Hochgeladen von

Randora LkOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Weekly Foreign Holding & Block Trade Update: Net Buying Net Selling

Hochgeladen von

Randora LkCopyright:

Verfügbare Formate

WEEKLY FOREIGN HOLDING & BLOCK TRADE UPDATE

Summary

A net foreign outflow of LKR 109mn was recorded for the week with net foreign selling mainly coming from John Keells Holdings (LKR 102mn), Commercial Bank Voting (LKR 51mn) and Aitken

Spence (LKR 51mn). The net foreign buying list was topped by Tokyo Cement Non Voting (LKR 116mn), Commercial Bank Non Voting (LKR 68mn) and Asiri Hospital Holdings (LKR 39mn). Foreign

participation accounted for 25% of the week's turnover.

Foreign buying and selling (31st August-4th September 2015)

Trailing 12 week average daily net foreign inflow/outflow

Week ended

LKR mn

400

300

200

100

0

-100

-200

-300

-400

-500

Top 10 stocks with net foreign buying for the week ended 04/09/2015

NET BUYING

TOKYO CEMENT(X)

COMMERCIAL BANK(X)

ASIRI HOSPITAL HOLDING

HEMAS HOLDINGS

CENTRAL FINANCE

LB FINANCE

TEXTURED JERSEY

LANKA WALLTILE

ACL CABLES

SUNSHINE HOLDING

Closing price

for the

week(LKR)

42.0

133.5

21.9

88.0

265.0

127.0

31.9

117.2

112.2

58.1

Value

(LKR mn)*

116

68

39

32

17

6

6

5

5

4

Tot. foreign

holding

04/09/2015

31%

22%

34%

28%

12%

1%

41%

1%

1%

37%

339

72

-17

-22

-180

-126

-209

-228

-134

-205

-205

-442

Top 10 stocks with net foreign selling for the week ended 04/09/2015

Tot. foreign

holding

28/08/2015

28%

21%

34%

28%

12%

0%

41%

1%

1%

37%

% point

change

2.5%

0.9%

0.2%

0.1%

0.1%

0.0%

0.0%

0.1%

0.1%

0.1%

NET SELLING

JKH

COMMERCIAL BANK

AITKEN SPENCE

LAUGFS GAS

KAHAWATTE

HNB

SAMPATH

LAUGFS GAS(X)

HNB(X)

SEYLAN BANK(X)

Closing

price for

the

week(LKR)

Value

(LKR mn)*

177.0

169.5

98.0

40.7

33.0

215.0

262.8

36.8

173.1

74.0

* Value based on weighted avg closing price & not actual traded prices

See page 4 for important disclaimer

-102

-51

-51

-45

-33

-29

-24

-18

-11

-10

Foreign

holding at

04/09/2015

51%

35%

37%

1%

3%

27%

19%

14%

38%

6%

Tot. foreign

holding

28/08/2015

51%

35%

37%

1%

4%

27%

19%

15%

39%

6%

% point

change

-0.1%

0.0%

-0.1%

-0.3%

-1.3%

0.0%

-0.1%

-1.0%

-0.1%

-0.1%

Foreign ownership changes by sector for the week ended 04/09/2015

SECTOR

Sector market

cap (LKR mn)

04/09/2015

S&P SL20 foreign holding changes for the week ended 04/09/2015

Tot. Foreign

holding

(LKR mn)

04/09/2015

Tot. Foreign

holding

(LKR mn)

28/08/2015

Foreign

holding %

S&P SL 20

Closing price

for the week

(LKR)

Incr/(Decr) in

foreign holding

value (LKR mn)

Tot. foreign

holding

04/09/2015

Tot. foreign

holding

28/08/2015

% point

change

BANKS FINANCE & INSURANCE

824,743

191,449

191,506

23.2%

JKH

177

(102)

51.2%

51.2%

-0.1%

BEVERAGE FOOD & TOBACCO

558,709

331,416

331,415

59.3%

CEYLON TOBACCO

961

+3

96.9%

96.9%

0.0%

CHEMICALS & PHARMACEUTICALS

23,525

883

880

3.8%

NESTLE LANKA

95.5%

95.5%

CONSTRUCTION & ENGINEERING

47,749

17,954

17,951

37.6%

COMMERCIAL BANK (V)

170

(51)

35.0%

35.0%

-0.0%

DIVERSIFIED HOLDINGS

534,677

185,799

185,927

34.7%

DIALOG AXIATA

11.4

+3

94.5%

94.5%

0.0%

FOOTWEAR & TEXTILES

12,716

60

60

0.5%

CARSONS CUMBERBATCH

400

17.4%

17.4%

HEALTH CARE

51,386

11,468

11,430

22.3%

DISTILLERIES

279

+0

23.1%

23.1%

0.0%

163,940

13,457

13,457

8.2%

THE BUKIT DARAH PLC

651

21.2%

21.2%

85.5%

HNB (V)

215

(29)

27.0%

27.0%

-0.0%

DFCC BANK

187

+3

25.3%

25.3%

0.0%

-0.1%

HOTELS & TRAVELS

INFORMATION TECHNOLOGY

INVESTMENT TRUSTS

1,595

1,364

1,365

37,196

3,446

3,445

9.3%

AITKEN SPENCE

LAND & PROPERTY

49,772

22,401

22,401

45.0%

MANUFACTURING

180,964

42,807

42,679

23.7%

2,050

98

(51)

37.2%

37.3%

LOLC

104

(6)

34.4%

34.4%

-0.0%

SAMPATH BANK

263

(24)

18.8%

18.8%

-0.1%

27,276

7,871

7,870

28.9%

115,222

59,647

59,647

51.8%

CARGILLS

170

+0

7.4%

7.4%

0.0%

PLANTATIONS

25,431

1,180

1,222

4.6%

CHEVRON LUBRICANTS

390

(10)

30.9%

30.9%

-0.0%

POWER & ENERGY

55,731

20,288

20,353

36.4%

NDB

238

+1

31.3%

31.3%

0.0%

SERVICES

7,790

208

208

2.7%

LION BREWERY

650

37.3%

37.3%

STORES & SUPPLIES

6,379

2,203

2,203

34.5%

ASIAN HOTELS & PROP.

64

2.1%

2.1%

175,863

125,101

125,098

71.1%

C T HOLDINGS

147

15.9%

15.9%

30,553

16,192

16,192

53.0%

HAYLEYS

350

(6)

3.5%

3.5%

-0.0%

MOTORS

OIL PALMS

TELECOMMUNICATIONS

TRADING

* Values based on weighted avg closing price & not actual traded prices

S&P SL20 share price volatility

Closing price as

at 04/09/2015

Closing price as

at 07/08/2015

(30 days)

% change

Closing price

as at

10/07/2015

(60 days)

S&P INDEX

3,958

4,097

(3.4%)

3,905

1.3%

3,914

1.1%

JKH

177.0

192.5

(8.1%)

182.8

(3.2%)

194.3

(8.9%)

201,796

13.6%

CEYLON TOBACCO

961.0

0.5%

890.0

8.0%

910.0

5.6%

180,018

12.1%

1.5%

2,000.0

2.5%

2,100.0

(2.4%)

110,137

7.4%

(1.9%)

164.2

3.2%

161.0

5.3%

146,413

9.9%

1.8%

10.3

10.7%

11.1

2.7%

92,839

6.3%

1.1%

400.0

407.9

(1.9%)

78,555

5.3%

(5.2%)

270.0

3.3%

268.0

4.1%

83,700

5.6%

S&P SL 20

NESTLE LANKA

COMMERCIAL BANK (V)

DIALOG AXIATA

2,050.0

169.5

11.4

956.0

2,020.0

172.7

11.2

% change

Closing price as

at 12/06/2015

(90 days)

% change

Market capitalisation

(LKR mn)

% Weightage of S&P 20

market cap:

CARSONS CUMBERBATCH

400.0

DISTILLERIES

279.0

THE BUKIT DARAH PLC

651.1

650.5

0.1%

652.1

(0.2%)

685.0

(4.9%)

66,412

4.5%

HATTON NATIONAL BANK (V)

215.0

222.3

(3.3%)

208.0

3.4%

219.0

(1.8%)

83,573

5.6%

DFCC BANK

187.4

200.0

(6.3%)

190.5

(1.6%)

207.3

(9.6%)

49,679

3.3%

98.0

100.9

(2.9%)

97.1

0.9%

99.0

(1.0%)

39,788

2.7%

LOLC

103.5

108.0

(4.2%)

99.3

4.2%

101.6

1.9%

49,183

3.3%

SAMPATH BANK

262.8

264.3

(0.6%)

253.5

3.7%

255.0

3.1%

45,284

3.0%

CARGILLS

170.1

156.2

8.9%

135.2

25.8%

140.0

21.5%

38,102

2.6%

CHEVRON LUBRICANTS

389.7

405.8

(4.0%)

391.2

(0.4%)

370.0

5.3%

46,764

3.1%

NDB

238.4

266.5

(10.5%)

258.0

(7.6%)

259.0

(8.0%)

39,376

2.7%

LION BREWERY

650.0

640.0

1.6%

621.0

4.7%

640.0

1.6%

52,000

3.5%

63.9

63.0

1.4%

66.0

(3.2%)

66.5

(3.9%)

28,293

1.9%

C T HOLDINGS

147.0

133.2

10.4%

130.0

13.1%

137.5

6.9%

26,915

1.8%

HAYLEYS

350.0

350.0

345.0

1.4%

350.0

26,250

1.8%

AITKEN SPENCE

ASIAN HOTELS & PROP.

** JKH historical prices are adjusted to reflect the rights issue bonus element

395.6

294.4

Block trades for the week ended 04/09/2015

Transacted

CROSSINGS

Date

COMMERCIAL BANK [NON V

4/9/2015

TEXTURED JERSEY

4/9/2015

TOKYO CEMENT [NON VOTI

4/9/2015

TOKYO CEMENT [NON VOTI

4/9/2015

ASIRI HOSPITAL

3/9/2015

COMMERCIAL BANK

3/9/2015

HNB

3/9/2015

COMMERCIAL BANK

2/9/2015

CEYLON TOBACCO

2/9/2015

HNB [NON VOTING]

2/9/2015

SAMPATH

2/9/2015

HOTELS CORP.

1/9/2015

Market performance during the period ended 04/09/2015

Transacted

Price

22

32

44

42

22

170

220

171

965

175

265

30

No. of Shares

511,014

689,500

1,000,000

855,754

1,000,000

789,200

111,324

350,000

50,000

200,000

100,000

10,000,000

Turnover

(LKR Mn)

68.7

22.1

43.5

35.9

21.8

134.2

24.5

59.9

48.3

35.0

26.5

300.0

Market

Cap. %

4.8%

0.7%

0.4%

0.4%

0.3%

4.8%

2.4%

4.8%

6.2%

2.4%

1.6%

0.2%

MARKET PERFORMANCE

Index

Turnover (LKR Mn)

7,550

4,000

7,500

3,500

7,450

3,000

7,400

7,350

2,500

7,300

2,000

7,250

1,500

7,200

1,000

7,150

7,100

500

7,050

Turnover

ASPI

Exchange rates as at 04/09/2015

FOREX RATES

US DOLLAR

BRITISH POUND

EURO

SINGAPORE DOLLAR

CANADIAN DOLLAR

AUSTRALIAN DOLLAR

SWISS FRANC

YEN

RENMINBI(INDICATIVE)

INDIAN RUPEE (INDICATIVE)

Buying

134.1

203.7

148.3

94.2

100.8

92.8

136.8

1.1

21.2

2.0

Selling

138.9

212.4

155.3

98.6

105.8

97.9

143.6

1.2

This document has been prepared and issued on the basis of publicly available information, internally developed data and other sources, believed to be reliable. Capital Alliance Securities (Private) Limited however does not warrant its completeness or accuracy.

Opinions and estimates given constitute a judgment as of the date of the material and are subject to change without notice. This report is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The recipient of this report must

make their own independent decision regarding any securities, investments or financial instruments mentioned herein. Securities or financial instruments mentioned may not be suitable to all investors. Capital Alliance Securities (Private) Limited its directors,

officers, consultants, employees, outsourced research providers associates or business partner, will not be responsible, for any claims damages, compensation, suits, damages, loss, costs, charges, expenses, outgoing or payments including attorneys fees which

recipients of the reports suffers or incurs directly or indirectly arising out actions taken as a result of this report. This report is for the use of the intended recipient only. Access, disclosure, copying, distribution or reliance on any of it by anyone else is prohibited and

may be a criminal offence.

Das könnte Ihnen auch gefallen

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDokument4 SeitenWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkNoch keine Bewertungen

- Weekly Foreign Holding & Block Trade - Update - 04 04 2014Dokument4 SeitenWeekly Foreign Holding & Block Trade - Update - 04 04 2014Randora LkNoch keine Bewertungen

- Weekly Foreign Holding & Block Trade - Update - 07 02 2014Dokument4 SeitenWeekly Foreign Holding & Block Trade - Update - 07 02 2014Randora LkNoch keine Bewertungen

- Weekly Foreign Holding & Block Trade - Update - 13 02 2014Dokument4 SeitenWeekly Foreign Holding & Block Trade - Update - 13 02 2014Randora LkNoch keine Bewertungen

- Weekly Foreign Holding & Block Trade - Update - 28 02 2014Dokument4 SeitenWeekly Foreign Holding & Block Trade - Update - 28 02 2014Randora LkNoch keine Bewertungen

- Weekly Foreign Holding & Block Trade Update - 31 01 2014Dokument4 SeitenWeekly Foreign Holding & Block Trade Update - 31 01 2014Randora LkNoch keine Bewertungen

- Weekly Foreign Holding & Block Trade - Update - 21 02 2014Dokument4 SeitenWeekly Foreign Holding & Block Trade - Update - 21 02 2014Randora Lk100% (1)

- Weekly Foreign Holding Update - 11 01 2013Dokument2 SeitenWeekly Foreign Holding Update - 11 01 2013ran2013Noch keine Bewertungen

- Weekly Foreign Holding & Block Trade Update - 01 11 2013Dokument4 SeitenWeekly Foreign Holding & Block Trade Update - 01 11 2013Randora LkNoch keine Bewertungen

- Weekly Foreign Holding Update - 21 12 2012Dokument2 SeitenWeekly Foreign Holding Update - 21 12 2012ran2013Noch keine Bewertungen

- Daringderivatives-Nov11 11Dokument3 SeitenDaringderivatives-Nov11 11Shahid IbrahimNoch keine Bewertungen

- Market Outlook 29th September 2011Dokument3 SeitenMarket Outlook 29th September 2011Angel BrokingNoch keine Bewertungen

- Weekly Foreign Holding & Block Trade - Update - 17 10 2013Dokument4 SeitenWeekly Foreign Holding & Block Trade - Update - 17 10 2013Randora LkNoch keine Bewertungen

- Daily Technical Report: Sensex (16839) / NIFTY (5100)Dokument4 SeitenDaily Technical Report: Sensex (16839) / NIFTY (5100)angelbrokingNoch keine Bewertungen

- Weekly Foreign Holding & Block Trade - Update - 15 11 2013Dokument4 SeitenWeekly Foreign Holding & Block Trade - Update - 15 11 2013Randora LkNoch keine Bewertungen

- Market Outlook 25th August 2011Dokument3 SeitenMarket Outlook 25th August 2011Angel BrokingNoch keine Bewertungen

- Daringderivatives-Jan10 13Dokument3 SeitenDaringderivatives-Jan10 13balaji_resourceNoch keine Bewertungen

- Derivatives Report 31st DecDokument3 SeitenDerivatives Report 31st DecAngel BrokingNoch keine Bewertungen

- Nifty Futures Turn To DiscountDokument3 SeitenNifty Futures Turn To DiscountSakha SabkaNoch keine Bewertungen

- Derivatives Report 20th October 2011Dokument3 SeitenDerivatives Report 20th October 2011Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16973) / NIFTY (5146)Dokument4 SeitenDaily Technical Report: Sensex (16973) / NIFTY (5146)Angel BrokingNoch keine Bewertungen

- Derivatives Report 19th December 2011Dokument3 SeitenDerivatives Report 19th December 2011Angel BrokingNoch keine Bewertungen

- Weekly Foreign Holding & Block Trade - Update - 27 09 2013Dokument4 SeitenWeekly Foreign Holding & Block Trade - Update - 27 09 2013Randora LkNoch keine Bewertungen

- Technical Report 25th July 2011Dokument3 SeitenTechnical Report 25th July 2011Angel BrokingNoch keine Bewertungen

- Derivatives Report, 22 February 2013Dokument3 SeitenDerivatives Report, 22 February 2013Angel BrokingNoch keine Bewertungen

- Technical Report 3rd October 2011Dokument3 SeitenTechnical Report 3rd October 2011Angel BrokingNoch keine Bewertungen

- Derivatives Report 9th December 2011Dokument3 SeitenDerivatives Report 9th December 2011Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16950) / NIFTY (5139)Dokument4 SeitenDaily Technical Report: Sensex (16950) / NIFTY (5139)Angel BrokingNoch keine Bewertungen

- Daringderivatives-Jul05 11Dokument3 SeitenDaringderivatives-Jul05 11Vamsi BhargavaNoch keine Bewertungen

- Market Outlook 20th December 2011Dokument4 SeitenMarket Outlook 20th December 2011Angel BrokingNoch keine Bewertungen

- Premarket KnowledgeBrunch Microsec 30.11.16Dokument5 SeitenPremarket KnowledgeBrunch Microsec 30.11.16Rajasekhar Reddy AnekalluNoch keine Bewertungen

- Market Outlook 8th September 2011Dokument4 SeitenMarket Outlook 8th September 2011Angel BrokingNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument4 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Derivative Report: Nifty Vs OIDokument3 SeitenDerivative Report: Nifty Vs OIAngel BrokingNoch keine Bewertungen

- Technical Report 19th October 2011Dokument5 SeitenTechnical Report 19th October 2011Angel BrokingNoch keine Bewertungen

- Derivatives Report 28 Aug 2012Dokument3 SeitenDerivatives Report 28 Aug 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 26th September 2011Dokument3 SeitenMarket Outlook 26th September 2011Angel BrokingNoch keine Bewertungen

- Technical Report 24th April 2012Dokument5 SeitenTechnical Report 24th April 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 29th March 2012Dokument3 SeitenDerivatives Report 29th March 2012Angel BrokingNoch keine Bewertungen

- Derivatives Report 1st December 2011Dokument3 SeitenDerivatives Report 1st December 2011Angel BrokingNoch keine Bewertungen

- Market Outlook 27th September 2011Dokument3 SeitenMarket Outlook 27th September 2011angelbrokingNoch keine Bewertungen

- Technical Report 24th October 2011Dokument5 SeitenTechnical Report 24th October 2011Angel BrokingNoch keine Bewertungen

- Derivatives Report 20th Dec 2012Dokument3 SeitenDerivatives Report 20th Dec 2012Angel BrokingNoch keine Bewertungen

- Market Outlook 19th August 2011Dokument3 SeitenMarket Outlook 19th August 2011Angel BrokingNoch keine Bewertungen

- Derivatives Report 24th October 2011Dokument3 SeitenDerivatives Report 24th October 2011Angel BrokingNoch keine Bewertungen

- Daringderivatives-Aug29 11Dokument3 SeitenDaringderivatives-Aug29 11ansfaridNoch keine Bewertungen

- Derivatives Report 14 JUNE 2012Dokument3 SeitenDerivatives Report 14 JUNE 2012Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16897) / NIFTY (5121)Dokument4 SeitenDaily Technical Report: Sensex (16897) / NIFTY (5121)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16668) / NIFTY (5054)Dokument4 SeitenDaily Technical Report: Sensex (16668) / NIFTY (5054)Angel BrokingNoch keine Bewertungen

- Daily Technical Report: Sensex (16882) / NIFTY (5115)Dokument4 SeitenDaily Technical Report: Sensex (16882) / NIFTY (5115)Angel BrokingNoch keine Bewertungen

- Stock Tips - Equity Tips For 08 MayDokument7 SeitenStock Tips - Equity Tips For 08 MayTheequicom AdvisoryNoch keine Bewertungen

- Daily Technical Report: Sensex (16678) / NIFTY (5055)Dokument4 SeitenDaily Technical Report: Sensex (16678) / NIFTY (5055)Angel BrokingNoch keine Bewertungen

- Technical Report 27th April 2012Dokument5 SeitenTechnical Report 27th April 2012Angel BrokingNoch keine Bewertungen

- CALWeekly Foreign Holding & Block Trade - Update - 30 08 2013Dokument4 SeitenCALWeekly Foreign Holding & Block Trade - Update - 30 08 2013Randora LkNoch keine Bewertungen

- Daily Technical Report: Sensex (16968) / NIFTY (5142)Dokument4 SeitenDaily Technical Report: Sensex (16968) / NIFTY (5142)Angel BrokingNoch keine Bewertungen

- Market Outlook 23rd September 2011Dokument4 SeitenMarket Outlook 23rd September 2011Angel BrokingNoch keine Bewertungen

- Technical Report 25th October 2011Dokument5 SeitenTechnical Report 25th October 2011Angel BrokingNoch keine Bewertungen

- Daily Derivatives: December 17, 2015Dokument3 SeitenDaily Derivatives: December 17, 2015choni singhNoch keine Bewertungen

- Derivatives Report 23rd September 2011Dokument3 SeitenDerivatives Report 23rd September 2011Angel BrokingNoch keine Bewertungen

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsVon EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNoch keine Bewertungen

- Global Market Update - 04 09 2015 PDFDokument6 SeitenGlobal Market Update - 04 09 2015 PDFRandora LkNoch keine Bewertungen

- Weekly Update 04.09.2015 PDFDokument2 SeitenWeekly Update 04.09.2015 PDFRandora LkNoch keine Bewertungen

- Wei 20150904 PDFDokument18 SeitenWei 20150904 PDFRandora LkNoch keine Bewertungen

- Sri0Lanka000Re0ounting0and0auditing PDFDokument44 SeitenSri0Lanka000Re0ounting0and0auditing PDFRandora LkNoch keine Bewertungen

- Daily 01 09 2015 PDFDokument4 SeitenDaily 01 09 2015 PDFRandora LkNoch keine Bewertungen

- 03 September 2015 PDFDokument9 Seiten03 September 2015 PDFRandora LkNoch keine Bewertungen

- Global Market Update - 04 09 2015 PDFDokument6 SeitenGlobal Market Update - 04 09 2015 PDFRandora LkNoch keine Bewertungen

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDokument3 SeitenICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkNoch keine Bewertungen

- Earnings & Market Returns Forecast - Jun 2015 PDFDokument4 SeitenEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkNoch keine Bewertungen

- Results Update Sector Summary - Jun 2015 PDFDokument2 SeitenResults Update Sector Summary - Jun 2015 PDFRandora LkNoch keine Bewertungen

- Press 20150831ebDokument2 SeitenPress 20150831ebRandora LkNoch keine Bewertungen

- Results Update For All Companies - Jun 2015 PDFDokument9 SeitenResults Update For All Companies - Jun 2015 PDFRandora LkNoch keine Bewertungen

- Earnings Update March Quarter 2015 05 06 2015 PDFDokument24 SeitenEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkNoch keine Bewertungen

- CCPI - Press Release - August2015 PDFDokument5 SeitenCCPI - Press Release - August2015 PDFRandora LkNoch keine Bewertungen

- Press 20150831ea PDFDokument1 SeitePress 20150831ea PDFRandora LkNoch keine Bewertungen

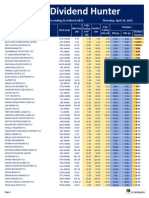

- Dividend Hunter - Apr 2015 PDFDokument7 SeitenDividend Hunter - Apr 2015 PDFRandora LkNoch keine Bewertungen

- Microfinance Regulatory Model PDFDokument5 SeitenMicrofinance Regulatory Model PDFRandora LkNoch keine Bewertungen

- GIH Capital Monthly - Mar 2015 PDFDokument11 SeitenGIH Capital Monthly - Mar 2015 PDFRandora LkNoch keine Bewertungen

- Daily - 23 04 2015 PDFDokument4 SeitenDaily - 23 04 2015 PDFRandora LkNoch keine Bewertungen

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDokument12 SeitenCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkNoch keine Bewertungen

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDokument9 SeitenJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkNoch keine Bewertungen

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDokument9 SeitenChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkNoch keine Bewertungen

- Dividend Hunter - Mar 2015 PDFDokument7 SeitenDividend Hunter - Mar 2015 PDFRandora LkNoch keine Bewertungen

- Dividend Hunter - Mar 2015 PDFDokument7 SeitenDividend Hunter - Mar 2015 PDFRandora LkNoch keine Bewertungen

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Dokument5 SeitenN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkNoch keine Bewertungen

- Daily Stock Watch 08.04.2015 PDFDokument9 SeitenDaily Stock Watch 08.04.2015 PDFRandora LkNoch keine Bewertungen

- The Morality of Capitalism Sri LankiaDokument32 SeitenThe Morality of Capitalism Sri LankiaRandora LkNoch keine Bewertungen

- BRS Monthly (March 2015 Edition) PDFDokument8 SeitenBRS Monthly (March 2015 Edition) PDFRandora LkNoch keine Bewertungen

- Mivi Thunder Beats Earphones InvoiceDokument1 SeiteMivi Thunder Beats Earphones InvoiceVishal R SisodiyaNoch keine Bewertungen

- IMF Quotas: Quotas of Existing MembersDokument3 SeitenIMF Quotas: Quotas of Existing MembersRishibha SinglaNoch keine Bewertungen

- Riyal To Dollar - Google SearchDokument1 SeiteRiyal To Dollar - Google SearchWissam WissNoch keine Bewertungen

- SFM FT M-2 PDFDokument31 SeitenSFM FT M-2 PDFveenamadhurimeduriNoch keine Bewertungen

- Shopping Maths Money Lesson PlanDokument2 SeitenShopping Maths Money Lesson Planapi-466313157Noch keine Bewertungen

- Globalization #1 PDFDokument2 SeitenGlobalization #1 PDFSuzette Hermoso100% (4)

- Nakkattani Kin KarissanthiDokument7 SeitenNakkattani Kin KarissanthiM. M. Rohana WasanthaNoch keine Bewertungen

- Ifm - Lecture NotesDokument272 SeitenIfm - Lecture NotesJeremy MaihuaNoch keine Bewertungen

- Jim Rickards' IMPACT SystemDokument101 SeitenJim Rickards' IMPACT SystemTushar KukretiNoch keine Bewertungen

- AFAR 3 AnswersDokument5 SeitenAFAR 3 AnswersTyrelle Dela CruzNoch keine Bewertungen

- How central bank digital currency can promote financial inclusion and international tradeDokument2 SeitenHow central bank digital currency can promote financial inclusion and international tradetung ziNoch keine Bewertungen

- PROBLEM SET 5 Part 2.: SwapsDokument8 SeitenPROBLEM SET 5 Part 2.: SwapsSumit GuptaNoch keine Bewertungen

- How To Trade Forex with COT DataDokument4 SeitenHow To Trade Forex with COT DataBandoler ForexNoch keine Bewertungen

- How to Trade Cryptocurrencies on Binance for BeginnersDokument34 SeitenHow to Trade Cryptocurrencies on Binance for BeginnersAnne88% (8)

- Complaint Letter V1Dokument2 SeitenComplaint Letter V1Daniela PaguintoNoch keine Bewertungen

- Export Trade History2Dokument6 SeitenExport Trade History2Erjohn PapaNoch keine Bewertungen

- Vi DecimalsDokument4 SeitenVi DecimalsRahul JhaNoch keine Bewertungen

- UntitledDokument9 SeitenUntitledapi-213954485Noch keine Bewertungen

- CHAP 4 - Global EconomyDokument57 SeitenCHAP 4 - Global EconomySamantha Cleopas DemetrioNoch keine Bewertungen

- Accomplishment Report of Iosss Organization 1 1Dokument14 SeitenAccomplishment Report of Iosss Organization 1 1DavidEzekiel Zaragoza Caña CarilloNoch keine Bewertungen

- Instructional Material FOR ECON 30063 Monetary Economics: Polytechnic University of The PhilippinesDokument9 SeitenInstructional Material FOR ECON 30063 Monetary Economics: Polytechnic University of The PhilippinesMonicDuranNoch keine Bewertungen

- Big Ticket Millionaire 2018 Draw Dates Please Keep This Portion With You Web Ticket Copy - Do Not Drop in The DrumDokument3 SeitenBig Ticket Millionaire 2018 Draw Dates Please Keep This Portion With You Web Ticket Copy - Do Not Drop in The DrumXavier PokharelNoch keine Bewertungen

- Chap05 Tutorial QuestionsDokument5 SeitenChap05 Tutorial QuestionsLe Hong Phuc (K17 HCM)Noch keine Bewertungen

- Commercial Invoice 190410ja Rev1Dokument1 SeiteCommercial Invoice 190410ja Rev1Luis VelasquezNoch keine Bewertungen

- Djarum Ali 2Dokument1 SeiteDjarum Ali 2Erwin AdhariNoch keine Bewertungen

- Invoice# INV2122/10638: Invoice Date: Sale Order: Purchase Order NoDokument1 SeiteInvoice# INV2122/10638: Invoice Date: Sale Order: Purchase Order NoBinode SarkarNoch keine Bewertungen

- #3 Lesson 2.4-2.6Dokument3 Seiten#3 Lesson 2.4-2.6Chelsea A. SADSADNoch keine Bewertungen

- Consensus Economics - Commodity PricesDokument28 SeitenConsensus Economics - Commodity PricesMattNoch keine Bewertungen

- Name:-Sachin Sharma Course: - Mca 4 Semester Subject: - Blockchain and TechnologyDokument3 SeitenName:-Sachin Sharma Course: - Mca 4 Semester Subject: - Blockchain and TechnologySachin SharmaNoch keine Bewertungen

- AECOM Market Forecast Q2 2020 FINALDokument11 SeitenAECOM Market Forecast Q2 2020 FINALMahmoud MoussaNoch keine Bewertungen