Beruflich Dokumente

Kultur Dokumente

A Case Study On Tcs

Hochgeladen von

Rajiv MondalOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

A Case Study On Tcs

Hochgeladen von

Rajiv MondalCopyright:

Verfügbare Formate

IOSR Journal of Business and Management (IOSR-JBM)

e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 16, Issue 2. Ver. I (Feb. 2014), PP 75-80

www.iosrjournals.org

A Case Study on Critical Analysis of Tcs

Dr Pratibha Jain, Prof. Megha Mehta

(Asst Prof.) & (Asst. Prof.)

Sai Sinhgad Business school, Pune-411041

Abstract: The present study remained as an effort to analyse financial strengths, weaknesses, opportuniti es

and threats of TCS for study period of 5 years from 2009 to 2013. Assessment of the long -term financial

health is an important task to formulate business strategy for investors and lenders. Financial SWOT is an

important step in financial planning and financial decision making. Objectives of study were to analyse

Financial SWOT, profitability, liquidity, solvency and asset management situation of the company .The study

used accounting, finance and statistics related techniques which were Ratio analysis, Trend analysis,

Working capital growth, Operating and financial leverages, EBIT-EPS analysis, Dividend policy analysis

and Statistical measures. The study set certain indicators such as capital structure, working capital,

profitability, assets management and dividend decision, related to the four facets i.e. strength, weakness,

opportunity and threat in terms of financial aspects of TCS .The major findings revealed that the overall

financial position of TCS in terms of F SWOT was quite satisfactory .

Keywords: SWOT,Capital structure,asset management,dividend decision, profitability.

I.

Introduction:

Present age is the age of global competition. In this competitive environment the success or failure

of any business organisation depends upon effective use of financial resources. Consideration of non financial

activities like analysis of financial strengths, weaknesses, opportunities and threats is also matter of

importance. Thus SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis is a good technique for

building a strong competitive position for any organisation. The concept of financial SWOT was taken up to

analyse the overall trends in operating and financial performances of TCS, by appropriately linking up the

relevant aspects of performance. The financial performance includes the trends and the inter-relationships

between different aspects of financial management and its overall influence on profitability.

II.

Review Of Literature:

The present study considered some research work already done by the different scholars and

researchers as follows :

Bansal (1984) tried to identify the financial measures of performance in public sector enterprises by

constructing 91 different types of ratios. He employed the factor analysis to consider different sets of

variables to evaluate the profitability of Public Sector Enterprises.

Randall S. Hansen and Katharine Hansen (1996) found SWOT analysis as a useful technique in career

planning also. He suggested that while analysing SWOT one should set a course for career planning,

evaluation of current situation, assessment of his own strengths and weaknesses and develop awareness about

external opportunities and threats in the set career.

M. Sakthivel Murrugan(2001) studied financial and physical performance of (ONGC) for the period from

1994 to 2000. The collected data were analysed by using techniques of ratio analysis, trend analysis and Z

score analysis. He found that liquidity, solvency and profitability of the company was in a better position

compared to other public sector undertakings of India.

Ajeet Khurana(2005) considered SWOT analysis as a useful technique to analyse a company particularly in

order to evaluate business plans, performance and outlook and to make stock investment decisions. He has

suggested a checklist of 15 points each for strength, weakness, opportunity and threat for the purpose of

financial analysis.

Amit Singh Sisodiya and SailajaMannavar (2006)explained acquisition of Balsara group by Dabur India

Ltd. Balsara's focus was not right and they were not deploying their resources in the right manner thus over

the last two financial years, Balsara had only accumulated losses. As a result, in Jan. 2005 Dabur acquired

Balsara and earned net profit of Rs. 7.3 crores because of strong financial practices.

Mistry(2011) explained capital employed and net operating profit after tax have positive impact on next

periods profit while return on assets has negative impact thereon.

www.iosrjournals.org

75 | Page

A Case Study On Critical Analysis Of Tcs

NEED AND OBJECTIVES OF THE STUDY

The study will be very useful not only to the corporate bodies but also to the parties related including

regulatory bodies, investors, academicians, planners, researchers etc. Thus the following were the main

objectives of the present research work.

1. To understand and analyse the external and internal financial strengths, weaknesses, opportunities and

threats related with TCS during the study period.

2. To evaluate the liquidity, solvency and profitability position of TCS.

3. To analyse asset management situation and Dividend assessment of TCS.

III.

Research Methodology

Methods of Data collection: -For collecting secondary data, annual reports of companies will be used as well

as financial reports available on various stock market websites are also used. No field work has been done in

order to collect primary data for the study and the study is entirely descriptive and analytical. The secondary

data, figure, facts and information has been collected from various publications, trade publications, brochures,

standard textbooks, internet journals, articles etc.

Data Analysis & Interpretation: - Collected data is analysed and interpreted with the help of accounting and

statistical tools and techniques which are as follows1. Ratio analysis

2. Average

3. Trend analysis

4. Leverage analysis

Time Period of the Study:-The study has been conducted from 2009 to 2013 ie. for 5 years.

IV.

Data Analysis & Interpretation

(i) Capital structure analysis

Table 1 : Capital Structure (2009-2013)

Particulars

2009

2010

2011

2012

2013

Average

Debt-equity ratio

0.01

0.01

0.01

0.01

0.01

0.01

Total Debt to owners

fund

0.01

0.01

0.01

0.01

0.01

0.01

Interest coverage

784.41

674.43

435.25

841.63

513.84

649.91

Fin. Charges coverage

ratio

840.52

723.63

462.68

857.98

540.06

684.97

B. Leverage

DOL

0.87

0.81

0.95

0.97

1.08

0.94

DFL

1.00

1.00

1.00

1.00

1.00

1.00

DCL

0.87

0.81

0.95

0.97

1.08

0.94

Long-term debt

100

128.23

268.95

220.43

411.56

225.83

Res. and surplus

100

88.53

101.86

238.37

404.06

186.56

Interest

100

111.87

145.56

185.39

243.55

157.27

Debt-equity ratio

100

100

100

100

100

100

Debt equity ratio remained constant ie. 0.01 throughout the whole study period. The ratio was below the norm

of 1:1. A low ratio of debt to equity implied a greater claim of owners than that of creditors. There was

financial opportunity to increase loans and borrowings for operational flexibility. Total debt to owners fund

ratio again remained constant ie. 0.01 throughout the whole study period. As such the rule of thumb suggests

a ratio of 0.67 : 1. It indicated financial opportunity in capital structure to increase proportion of permanent

capital consisting long-term debt.

Interest coverage was highest 841.63 times for 2012-13 while lowest 435.25 times for 2011-12. The average

ratio was around 649.91 times. The ratio was very high from standard of 8 times for study period

reflected that a company has an undesirable lack of debt or is paying down too much debt with earnings that

could be used for other projects. Financial expenses ratio remained high during the study period having

average 684.97 times. The ratio was highest during 2012-2013 i.e. 857.98 times while the lowest 462.68

times during 2011-12.

www.iosrjournals.org

76 | Page

A Case Study On Critical Analysis Of Tcs

The DOL, more than 1 is always favourable indicating financial strength. The DOL remained less

than 1 in four years of the study period but the trend was fluctuating which was not good for speedy growth.

The company faced threats of highly technology based industry.The degree of financial leverage indicated

correlation between PBIT and EPS. The DFL was constant throughout the study period with average of

1.00.The degree of combined leverage remained below one except during 2013-14. The average DCL was

around 0.94 indicated that one percent change in sales could change one percent in TCSs EPS. The DOL and

DFL were combined to see the effect of total leverage on EPS associated with a given change in sales.

The trend values of long-term debt was 128.23% in 2010-1011 while 411.56% in 2013-14, reflected

financial threat towards long-term solvency position as shown in Table 4.1. Reserves and surplus increased to

404.06% during 2013-14, thus following increasing trend. Interest increased from 111.87% in 2010-11 to

243.55% in 2013-14 . Increasing trend of interest was not good for company because, it had increased

financial liability of the company.

(ii) Working capital analysis

Table 2: Working Capital (2009-2013)

Particulars

2009

2010

2011

2012

2013

Average

A. Working capital ratios

(in times)

Current ratio

1.83

1.49

2.45

2.48

2.85

2.22

Quick ratio

1.83

1.48

2.44

2.47

2.88

2.22

3398.94

5451.71

9386.18

7638.32

Inventory

turnover

1321.77

5439.38

Debtors turnover

6.00

7.19

5.59

4.77

6.02

215.84

321.09

465.47

237.44

6.54

B. Trend measure (in percentage)

Working capital

100

84.78

Table 2 depicts that the current ratio remained satisfactory with certain exceptions during the study period.

The ratio remained highest in 2013-14, being 2.85 times while the lowest in 2010-11, which was 1.49

times. The ratio indicated financial strength of overall good working capital management and good paying

capacity to the short-term obligations. The average remained at 2.22 times.

The quick ratio varied from 1.48 times to 2.88 times with the average of 2.22 times. The ratio

remained more than 1 for whole study period which indicated that the company was paying its cash

obligations in an efficient way and had financials strength of good cash management and receivables

management.

The inventory turnover ratio was highest 9386.18 times during 2012-13 while lowest 1321.77 times

during 2009-10. The average ratio remained 5439.384 times. The turnover rate of stock was very high

reflected financial threat of inefficient management of stock.

Debtors turnover ratio has shown financial strength of adequate and strong trade credit management

of the company. It remained highest 7.19 times during 2011-12 while lowest 4.77 times during 2013-14.

The trend of working capital shown in Table 2 was increasing. The working capital was 84.78% during 2010 2011 then increased upto 465.47% in 2013-2014 reflected financial strength of efficient management of

liquid sources.

(iii)

Profitability analysis:

Table 3: Profitability(2009-2013)

Particulars

2009

2010

2011

2012

2013

Average

Gross profit margin

25.01

26.89

28.12

27.52

27.88

27.084

Net profit ratio

20.74

24.13

25.42

26.42

25.24

24.39

A. Profitability ratios (in percentage)

www.iosrjournals.org

77 | Page

A Case Study On Critical Analysis Of Tcs

Operating profit ratio

26.87

Return On Capital Employed

48.07

28.93

55.31

29.96

29.30

29.54

44.38

42.46

43.27

28.92

46.70

99.53

76.72

136.38

121.00

Return on Assets

165.86

126.49

B. EBIT-EPS analysis

EBIT (Rs. crores)

EPS (Rs.)

5564.59

6849.27

9258.26

14070.90

16536.66

10455.94

47.92

28.62

38.62

55.97

65.23

47.272

100

102.86

130.67

173.45

216.15

123.09

166.38

252.86

297.18

119.64

161.19

233.72

272.27

59.72

80.59

116.80

136.12

C. Trend measures (in percentage)

Sales

100

100

PBIT

PAT

100

EPS

144.63

187.90

177.36

98.65

Gross profit margin of the company was satisfactory, remained 25.01% during 2009 -10 while 27.88% during

2013-14. A satisfactory ratio of gross profits to sales clearly reflected financial strength showing good

management and low cost of production .

The operating profit ratio remained highest, 29.96% during 2011-12 while lowest, 26.87% during

2009-10 with the average of 28.92% . The net profit ratio was highest, 26.42% in 2012 -13 and lowest,

20.74% during 2009-10. It indicated that the management of the company was able to operate the business

with sufficient success and recover expenses from revenues of the period.

Return on assets was highest 165.86% during 2009-10 and lowest 76.72% in 2012-13 revealed

financial strength of satisfactory position. The average ratio was around 121.00%. Return on assets of 10% is

considered favourable for any firm. The ratio was very high from standard .

Return on capital employed remained highest i.e. 55.31% during 2010-11 while lowest 42.46%

during 2012-13. The average was 46.70% indicated good return on capital employed.

EBIT-EPS analysis of TCS was used in the direction of designing a firm's optimal capital structure.

EBIT of the company was in increasing order having highest value Rs. 16536.66 crores during 2013 -14 while

lowest Rs. 5564.59 crores during 2009-10. EPS had fluctuating trend varied from Rs. 47.92 during 2009-10

to Rs. 65.23 during 2013-14. Increasing EBIT and EPS were satisfactory and good signal for the company

Table 3 reveals that sales, PBIT, PAT and EPS had increasing trend reflected financial strength of growth

and profitability. They increased to 216.15%, 297.18%, 272.27%, 136.12% respectively in 2013-14.

(iv) Analysis of assets management

Table 4: Assets Management

Particulars

2009

2010

2011

2012

2013

Average

5.15

4.74

4.91

5.39

5.32

5.10

1.66

1.52

1.50

1.56

1.48

1.54

B. Trend measure (in percentage)

100

112.35

145.48

185.02

242.65

157.10

A. Assets management ratios (in times)

FA turnover

TA turnover

a)

Total Assets

The adequacy of assets, more importantly fixed assets in a business affected profits. The fixed assets

turnover ratio remained 4.74 to 5.39 times which was almost satisfactory as compared to standard accepted of

5 times. The ratio remained 5.10 times as an average that indicated good investments in fixed assets

compared to sales.

Total assets turnover ratio shown a mixed trend of increase and decrease. However if the extremes

were considered, it shown a good improvement on the part of the organisation. The ratio has started at 1.66

times in 2009-10. After decline and increase, it has reached 1.56 times in 2012-13. Average was 1.54 times.

Ratio below standard of 2 times indicated less frequency with which the assets were realized.

The trend of total assets given in Table 4 increased to 242.65% in 2013-14 reflected financial

strength of efficient utilisation of both fixed and current assets.

www.iosrjournals.org

78 | Page

A Case Study On Critical Analysis Of Tcs

(v)

Dividend Decision Analysis:

Table 5 : Dividend Decision

Particulars

2010

2011

2012

2013

Average

2.9

7

2.24

2.76

1.43

3.42

2.56

34.20

81.61

42.21

51.94

39.30

B. Trend measures (in percentage)

100

56.25

72.98

92.75

121.62

A.

2009

Dividend decision ratios

Dividend coverage

(times)

Dividend payout (%)

Book value per share

Dividend per ordinary

share

100

142.86

100

178.57

157.14

Dividend payout

100

238.63

123.42

151.87

114.91

49.85

88.72

135.71

145.77

Dividend coverage ratio was having fluctuating trend .The ratio measured the ability of company to

pay dividend on shares at a stated rate of return. The ratio remained highest 3.42 times during 2013 -14 and

lowest 1.43 times during 2012-13. The average ratio was around 2.56 times and the increasing trend during

last year indicated simultaneous increase in net profits (PAT) and dividend amount.

Dividend payout ratio registered a fluctuating trend, remained highest 81.61% during 2010 -11 while lowest

34.20% during 2009-10 with the average payout of 49.85% . The company was distributing almost 50% of

the profits as dividends showing financial strength.

Table 5 reveals that the trend of book value per share fluctuated and became 121.62% in 2013 14.Book value per share was not stable but in 2013-14, the value was highest has shown financial opportunity

for improving the profitability policy. Dividend per ordinary share had increasing trend except in 2011 -12.

Dividend payout ratio was 238.63% in 2010-11 while 123.42% in 2011-12 then finally 114.91% in 2013-14.

Fluctuating trend of D/P ratio indicated financial threat of liberal dividend policy and company was not

giving fixed dividends but on the basis of profits of the current year.

V.

Observations And Findings

Important observations and findings of the study covering different constituents of F-SWOT i.e.

financial strengths, weaknesses, opportunities and threats of TCS are given below. The average of five years

(Av5) was used most of the times for analysis in the study.

Financial strengths :The satisfactory current ratio (Av 5 : 2.22 times) and quick ratio (Av 5 :2.22

times) reflected good working capital management and liquidity position. Satisfactory gross profit margin

(Av5 : 27.084%) ,Net Profit Margin (Av 5 : 24.39%) &Operating Profit Ratio (Av 5 :28.92%)revealed cost price

effectiveness of the operations. Debtors turnover (Av 5 :6.02 times) of the company reflected strong trade

credit management. Good ROA (Av 5 :121.00 times )depicted high returns on assets. Fixed Assets turnover

ratio(Av5 :5.10 times) indicated efficient management & utilisation of fixed assets. Dividend Payout ratio(Av 5

:49.85% )revealed financial strength because the firm retained 50% of the profits for future investment &

growth. combined leverage (Av5 : 0.94) analysis reflected that TCS was not a risky company.

Financial weaknesses : Total assets turnover ratio(Av 5 :1.54 times) shows less frequency with

which the assets were realized .Dividend coverage ratio (Av 5 :2.56 times) was low showing inability of

company to pay dividends on shares

Financial opportunities : Financial opportunity for better debt equity mix was shown by debtequity (Av5 : 0.01 times) and Total debt to owners fund (Av 5 : 0.01 times) ratios. Increasing ROCE in 201011 (55.31%) shown opportunity to increase productivity of long term funds. EBIT_EPS analysis revealed the

direction of designing optimal capital structure. Degree of operating leverage (Av 5 : 0.94) reflected abundant

financial opportunities for tackling operating expenses of the TCS.

Financial threats : There was financial threat of high interest coverage ratio (Av 5 : 649.91) and

financial charges coverage ratio(Av 5 : 684.97) shown inability to pay fixed charges. Inventory Turnover ratio

was very high reflected threat of inefficient manangement of inventory(Av 5 : 5439.384 times) decreasing

gross profit margin in 2012-13.

www.iosrjournals.org

79 | Page

A Case Study On Critical Analysis Of Tcs

VI.

Conclusion

On the basis of analysis of capital structure ratios, the solvency position of these corporations as a

whole could not be called sound. Moreover the policy of employing more borrowed funds as compared to

own funds could not be justified as financial expenses reduced the profits. The current and quick ratio

calculated have shown that the liquidity position was sound for these organisations .Trends of sales, PBIT,

PAT and EPS justified financial strength of satisfactory profitability.Thus the overall profitability of TCS

measured with the help of different ratios can be said to be satisfactory ,they had financial opportunity to earn

maximum or optimum profits for economic prosperity. total assets turnover was very poor & on the contrary

Fixed Assets turnover revealed financial strength of sufficient assets held by the company. After conclusion

of capital structure, profitability, working capital, assets management and dividend decision, sustainable

growth rate reflected financial SWOT in an effective manner. The average growth rate of TCS indicated

financial opportunity of better debt equity mix and dividend payout.

References

[1].

[2].

[3].

[4].

[5].

[6].

[7].

[8].

[9].

Bansal S.C.; "Financial Measures of Performance in Public Enterprises", Indian Journal of Commerce, Lucknow, Vol. 141, No.

4, December, 1984, pp. 107-130.

Hansen Randall S. and Hansen Katherine; Using a SWOT Analysis in Your Career Planning, Published by Quint Es sential

Careers, Deland, Florida, 1996, pp. 1-4.

BhattacherjeeSamata; "SWOT Analysis for Babhanan Sugar Mills Ltd.", Strategic Management : Indian Experience, Gyan

Publishing House, New Delhi, 1997, pp. 267-276.

Murugan M. Sakthivel; "Performance Evaluation of ONGC - A Case Study", Indian Journal of Public Enterprise, Institute of

Public Enterprise Research, Allahabad, Vol. 17, No. 31, Dec. 2001, pp. 83-91.

KhuranaAjeet; Understanding and Using SWOT Analysis, from businessmajors.about.com, About, Inc., New York Time

Co., 2005, pp 1-5.

Sisodiya Amit Singh and MannavarSailaja; "Balsara'sTurnaround :Dabur Delivers", Chartered Financial Analyst, The ICFAI

University Press, Hyderabad, Jan., 2006, pp. 62-65.

Gupta Santosh; "Research Methodology and Statistical Techniques", Deep & Deep Publications, New Delhi, 2001, p. 105.

Kishore Ravi M.; "Management Accounting", Taxmann Allied Services Pvt. Ltd., New Delhi, 2000, p. 26.

Khan M.Y. and Jain P.K.; "Theory and Problems in Financial Management", Tata McGraw-Hill Publishing Company Ltd., New

Delhi, 2000, p 9.1.

JOURNALS & PUBLICATIONS

[10].

[11].

[12].

[13].

[14].

Accounting Research, ICFAI University, Hyderabad.

Applied Finance, The ICFAI University. The Institute of Chartered Financial Journal Analysis of India, Hyderabad.

Finance India, Indian Institute of Finance, Ashok Vihar-II, Delhi.

Indian Journal of Accounting, Journal of Indian Accounting Association, Published from Ujjain.

NSE News, National Stock Exchange of India Ltd. Mumbai.

INTERNET SITES

[15].

[16].

[17].

[18].

www. indiapublicsector.com

www.moneycontrol.com

ww.google.com

www.investopedia.com

www.iosrjournals.org

80 | Page

Das könnte Ihnen auch gefallen

- Human Resources Role in The Target CorporationDokument16 SeitenHuman Resources Role in The Target CorporationKartik Tanna100% (1)

- HRM at Affluent AdvertisingDokument23 SeitenHRM at Affluent AdvertisingAbu Abdul RaheemNoch keine Bewertungen

- MM Module 1 A Prelude To The World of MarketingDokument11 SeitenMM Module 1 A Prelude To The World of MarketingAbhishek MukherjeeNoch keine Bewertungen

- Oaklo Medical System IncDokument2 SeitenOaklo Medical System Incbart19941105Noch keine Bewertungen

- Open Compensation Plan A Complete Guide - 2020 EditionVon EverandOpen Compensation Plan A Complete Guide - 2020 EditionNoch keine Bewertungen

- Strategic Management Project Report SampleDokument30 SeitenStrategic Management Project Report SampleRajiv Mondal100% (3)

- True-False Perfect CompetitionTrue-false Perfect CompetitionDokument37 SeitenTrue-False Perfect CompetitionTrue-false Perfect CompetitionVlad Guzunov50% (2)

- Identifying Strategic AlternativesDokument18 SeitenIdentifying Strategic AlternativesMANDEEPNoch keine Bewertungen

- Performance Appraisal ProjectDokument4 SeitenPerformance Appraisal ProjectbllaassNoch keine Bewertungen

- Tcs PresentationDokument13 SeitenTcs Presentationanon_153697387Noch keine Bewertungen

- Lassessing Strengths and Weaknesses: Internal AnalysisDokument41 SeitenLassessing Strengths and Weaknesses: Internal AnalysisFiorella Leon100% (1)

- Airtel - A Case StudyDokument12 SeitenAirtel - A Case StudyGirjesh ChohanNoch keine Bewertungen

- Organization Behavior Solved Subjective QuestionsDokument6 SeitenOrganization Behavior Solved Subjective QuestionsRaheel KhanNoch keine Bewertungen

- Compensation MGMTDokument27 SeitenCompensation MGMTUlpesh SolankiNoch keine Bewertungen

- Performance Management MobilinkDokument9 SeitenPerformance Management MobilinkMuhammad Hassan100% (1)

- Performance Appraisal SystemsDokument17 SeitenPerformance Appraisal SystemsAbhijeet GandageNoch keine Bewertungen

- Competency Mapping - ToyotaDokument7 SeitenCompetency Mapping - ToyotaSureshNoch keine Bewertungen

- Talent Management Information SystemDokument7 SeitenTalent Management Information SystemAnkita BhardwajNoch keine Bewertungen

- HRM Cia 1 - Anushree BG (1937617) PDFDokument9 SeitenHRM Cia 1 - Anushree BG (1937617) PDFAnushree BgNoch keine Bewertungen

- GAT Subject SyllabusDokument5 SeitenGAT Subject SyllabusAliNoch keine Bewertungen

- HRM Research Article CIA 1Dokument11 SeitenHRM Research Article CIA 1Apoorv GoelNoch keine Bewertungen

- Leadership EssayDokument36 SeitenLeadership Essayarun joseNoch keine Bewertungen

- Performance Management Unit 1Dokument23 SeitenPerformance Management Unit 1Bhuvana GanesanNoch keine Bewertungen

- HRM Revision NotesDokument13 SeitenHRM Revision NotesGrim ReaperNoch keine Bewertungen

- Group 2 Valley TechnologyDokument5 SeitenGroup 2 Valley TechnologyKhanMuhammadNoch keine Bewertungen

- HRPDDokument2 SeitenHRPDSoniaNoch keine Bewertungen

- Managerial Behaviour and Effectiveness BA5017Dokument22 SeitenManagerial Behaviour and Effectiveness BA5017AvineshNoch keine Bewertungen

- Marketing 4 ReportDokument15 SeitenMarketing 4 ReportJenina GrandeNoch keine Bewertungen

- New Trends in Compensation mANAGMEENTDokument15 SeitenNew Trends in Compensation mANAGMEENTshivaniNoch keine Bewertungen

- Unit 1: Focus and Purpose of Organizational BehaviorDokument12 SeitenUnit 1: Focus and Purpose of Organizational Behaviorrakum81Noch keine Bewertungen

- IGNOU MS-02 Solved Assignments Jan - June 2013 2Dokument22 SeitenIGNOU MS-02 Solved Assignments Jan - June 2013 2abdultvm2000Noch keine Bewertungen

- VODafoneDokument46 SeitenVODafoneAshish Sah100% (1)

- Chapter 9 NotesDokument2 SeitenChapter 9 NotesAdamNoch keine Bewertungen

- NTCC RoughDokument55 SeitenNTCC RoughAnisha JainNoch keine Bewertungen

- TCS Case StudyDokument21 SeitenTCS Case StudyJahnvi Manek0% (1)

- Measuring ROI For HRD Interventions - Wang, Dou & LiDokument22 SeitenMeasuring ROI For HRD Interventions - Wang, Dou & LiBoofus ShockNoch keine Bewertungen

- SHRM and Its Scope by Sajjad Ul AzizDokument9 SeitenSHRM and Its Scope by Sajjad Ul AzizDr-Sajjad Ul Aziz QadriNoch keine Bewertungen

- Vishal's ProjectDokument95 SeitenVishal's Projectsanchittkool100% (1)

- CenturyDokument54 SeitenCenturySagar BansalNoch keine Bewertungen

- W5 - Motivation, Reward and Performance ManagementDokument47 SeitenW5 - Motivation, Reward and Performance ManagementElla DenizNoch keine Bewertungen

- Final BRM ProjectDokument14 SeitenFinal BRM ProjectSameer ButtNoch keine Bewertungen

- Business Intelligence Unit 1 Chapter 2Dokument13 SeitenBusiness Intelligence Unit 1 Chapter 2vivekNoch keine Bewertungen

- Synopsis ON: Emotional Intelligence Among Young Employees in Heston Kuwait"Dokument9 SeitenSynopsis ON: Emotional Intelligence Among Young Employees in Heston Kuwait"Vilas_123Noch keine Bewertungen

- Bba 106 Communication SkillsDokument3 SeitenBba 106 Communication SkillsSanjib SapkotaNoch keine Bewertungen

- Strategic Human Resources UGB 320Dokument13 SeitenStrategic Human Resources UGB 320Vance RollinNoch keine Bewertungen

- Performance Appraisal in COCO COLADokument103 SeitenPerformance Appraisal in COCO COLAAnnapurna VinjamuriNoch keine Bewertungen

- Recruitment Factors at BankDokument16 SeitenRecruitment Factors at BankAkshay PArakh100% (3)

- Topic - Compensation Management System at Iocl and Its Relation To Employee SatisfactionDokument12 SeitenTopic - Compensation Management System at Iocl and Its Relation To Employee Satisfactionmeghs7682Noch keine Bewertungen

- Performance Management System Wipro Vs InfosysDokument18 SeitenPerformance Management System Wipro Vs InfosysAnkita Aggarwal100% (1)

- InfosysDokument5 SeitenInfosysDarshit NarechaniaNoch keine Bewertungen

- Organizing For HRDDokument7 SeitenOrganizing For HRD9934529377100% (2)

- Indofil IndustriesDokument47 SeitenIndofil IndustriesPrabhjot BakshiNoch keine Bewertungen

- Dell IHRM PresentationDokument16 SeitenDell IHRM PresentationLilyMSUNoch keine Bewertungen

- Case StudyDokument5 SeitenCase StudyAnum AfzalNoch keine Bewertungen

- Standard Chartered Bank Lt1.docx 2Dokument7 SeitenStandard Chartered Bank Lt1.docx 2Atiqur RahmanNoch keine Bewertungen

- EXIM Bank Case StudyDokument6 SeitenEXIM Bank Case Studysanju_1000on100% (1)

- Case Study 1 - Recruitment and SelectionDokument6 SeitenCase Study 1 - Recruitment and SelectionMiroslav GrbicNoch keine Bewertungen

- Org - Behaviour Ch.1Dokument21 SeitenOrg - Behaviour Ch.1kavitachordiya86Noch keine Bewertungen

- Performance Management System at TCSDokument6 SeitenPerformance Management System at TCSRIA VINCENT RCBSNoch keine Bewertungen

- Training & Development Process of PranDokument8 SeitenTraining & Development Process of PranJabid IqbalNoch keine Bewertungen

- Public Service Motivation A Complete Guide - 2021 EditionVon EverandPublic Service Motivation A Complete Guide - 2021 EditionNoch keine Bewertungen

- International Strategic Management A Complete Guide - 2020 EditionVon EverandInternational Strategic Management A Complete Guide - 2020 EditionNoch keine Bewertungen

- Digital Transformation 2015Dokument31 SeitenDigital Transformation 2015Rajiv MondalNoch keine Bewertungen

- Ibm GHV March 2014Dokument1 SeiteIbm GHV March 2014Rajiv MondalNoch keine Bewertungen

- Webdiaeia2015d4 enDokument32 SeitenWebdiaeia2015d4 enRajiv MondalNoch keine Bewertungen

- Project Report ON Strategic Analysis of ReebokDokument18 SeitenProject Report ON Strategic Analysis of ReebokRajiv MondalNoch keine Bewertungen

- Marketing Segmentation - KotlerDokument23 SeitenMarketing Segmentation - KotlerRajiv MondalNoch keine Bewertungen

- Keeping Information Safe: Privacy and Security Issues: Intellectual Property SocietyDokument15 SeitenKeeping Information Safe: Privacy and Security Issues: Intellectual Property SocietyipspatNoch keine Bewertungen

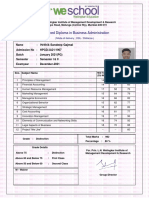

- Advanced Diploma in Business Administration: Hrithik Sandeep GajmalDokument1 SeiteAdvanced Diploma in Business Administration: Hrithik Sandeep GajmalNandanNoch keine Bewertungen

- Ouano Vs CADokument7 SeitenOuano Vs CAgraceNoch keine Bewertungen

- Chapter 1Dokument15 SeitenChapter 1Yap Chee HuaNoch keine Bewertungen

- Retail BankingDokument11 SeitenRetail Banking8095844822Noch keine Bewertungen

- Cost-Volume-Profit Analysis: Additional Issues: Summary of Questions by LearningDokument53 SeitenCost-Volume-Profit Analysis: Additional Issues: Summary of Questions by LearningHero CourseNoch keine Bewertungen

- The Ideal Essay ST Vs PLTDokument1 SeiteThe Ideal Essay ST Vs PLTAlisha HoseinNoch keine Bewertungen

- Test of Significance - : 3-Standard Error of DifferenceDokument4 SeitenTest of Significance - : 3-Standard Error of Differenceavinash13071211Noch keine Bewertungen

- Saudi Aramco Test Report: 30.apr.13 Inst SATR-J-6501 Instrument Loop - Inputs - Transmitter Circuit TestDokument4 SeitenSaudi Aramco Test Report: 30.apr.13 Inst SATR-J-6501 Instrument Loop - Inputs - Transmitter Circuit TestRashid Arshad100% (1)

- Key Attributes of The World-Class Information Technology OrganizationDokument7 SeitenKey Attributes of The World-Class Information Technology OrganizationMichael Esposito100% (1)

- Writing Stored Procedures For Microsoft SQL ServerDokument334 SeitenWriting Stored Procedures For Microsoft SQL Serverviust100% (4)

- Aula - Simple Past, Formas Afirmativa, Negativa e Interrogativa Parte IDokument16 SeitenAula - Simple Past, Formas Afirmativa, Negativa e Interrogativa Parte IfelippeavlisNoch keine Bewertungen

- AccountingDokument7 SeitenAccountingHà PhươngNoch keine Bewertungen

- Q1. Comment On The Future of Rural Marketing in The Lights of This Case StudyDokument5 SeitenQ1. Comment On The Future of Rural Marketing in The Lights of This Case StudySarthak AroraNoch keine Bewertungen

- Policy Guidelines On Issuance and Operation of Prepayment Instruments in IndiaDokument10 SeitenPolicy Guidelines On Issuance and Operation of Prepayment Instruments in IndiaPreethiNoch keine Bewertungen

- ARTA PresentationDokument45 SeitenARTA PresentationRaissa Almojuela Del Valle0% (1)

- HIMeeting2 KOM3364Dokument28 SeitenHIMeeting2 KOM3364Susan ChongNoch keine Bewertungen

- Pulido GraftDokument4 SeitenPulido GraftJoan EvangelioNoch keine Bewertungen

- End-of-Sale Notice For: DM-NVX-350/352Dokument2 SeitenEnd-of-Sale Notice For: DM-NVX-350/352Donici OvooovoNoch keine Bewertungen

- Book of Abstracts - 1Dokument128 SeitenBook of Abstracts - 1Shejal SinhaNoch keine Bewertungen

- IMTMA Training CalendarDokument2 SeitenIMTMA Training Calendarashish shrivasNoch keine Bewertungen

- Test Pattern Changed For Promotion To MMGS-II & IIIDokument3 SeitenTest Pattern Changed For Promotion To MMGS-II & IIIsamuelkishNoch keine Bewertungen

- ACC221 Quiz1Dokument10 SeitenACC221 Quiz1milkyode9Noch keine Bewertungen

- Presented By:: Pranav V Shenoy Gairik Chatterjee Kripa Shankar JhaDokument20 SeitenPresented By:: Pranav V Shenoy Gairik Chatterjee Kripa Shankar JhaPranav ShenoyNoch keine Bewertungen

- Masing & Sons Development Corporation (MSDC) V Rogelio (Labor Standards)Dokument2 SeitenMasing & Sons Development Corporation (MSDC) V Rogelio (Labor Standards)Atty. Providencio AbraganNoch keine Bewertungen

- 120 OcmugDokument176 Seiten120 Ocmugatiwari_45Noch keine Bewertungen

- Accounting For Managers - Assignment 5 - Chapter 5Dokument4 SeitenAccounting For Managers - Assignment 5 - Chapter 5Abeba GselassieNoch keine Bewertungen

- Strengths in The SWOT Analysis of Hero Moto CropDokument4 SeitenStrengths in The SWOT Analysis of Hero Moto CropMd aadab razaNoch keine Bewertungen

- NCUA NGN 2010-R1 - Final Prelim Offering MemorandumDokument72 SeitenNCUA NGN 2010-R1 - Final Prelim Offering Memorandumthe_akinitiNoch keine Bewertungen