Beruflich Dokumente

Kultur Dokumente

The Effects of Fuzzy Forecasting Models On Supply Chain Performance

Hochgeladen von

hammad59999Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Effects of Fuzzy Forecasting Models On Supply Chain Performance

Hochgeladen von

hammad59999Copyright:

Verfügbare Formate

9th WSEAS International Conference on FUZZY SYSTEMS (FS08) which was held in Sofia, Bulgaria

The Effects of Fuzzy Forecasting Models on Supply Chain Performance

HAKAN TOZAN

OZALP VAYVAY

Department of Industrial Engineering

Turkish Naval Academy

34942 Tuzla / Istanbul

TURKIYE

Abstract: - One of the important activities which directly affect the supply chain performance is the demand

forecasting. But selection of the appropriate forecasting model that best fits the demand pattern is not an easy decision.

This paper analyze the effects of fuzzy linear regression, fuzzy time series and fuzzy grey GM (1,1) forecasting models

on supply chain performance quantifying the demand variability through the stages.

Key-Words: - Forecasting, Supply chain, Fuzzy regression, Fuzzy time series, Fuzzy grey GM (1,1) .

reason of this phenomenon. Lee et.al. [5, 6, 7, 8]

declared causes of WE as: price fluctuations, rationing

game, order batching, lead times and demand forecast

updating; which is also the main scope of this paper.

Baganha et.al. [9], Graves[10], Drezner et.al [11], Chen

et.al.[12] and Li et.al. [13] also studied WE from the

perspective of information sharing and demand

forecasting / updating.

Accurate demand forecasting is one of the major

minimization tools for WE but, finding the adequate

model for the demand pattern is snarl [2]. Though past

the studies about forecasting bring to light that, under

relatively few data information and uncertainties; just

like the situation in many Sc systems, the fuzzy

forecasting models such as fuzzy time series (FTs) [14,

15, 16, 17] and fuzzy linear regression (FR) [18, 19, 20]

and fuzzy grey GM (1,1) (FGG) forecasting models [17,

21] performed successfully, not much attention is paid

on these systematic. This paper focuses on the effects of

selected fuzzy forecasting models on the Sc performance

via demand variability in the system.

The rest of this paper is organized as follow. In

section 2, FR, FTs and FGG forecasting models are

introduced. Section 3 deals with the quantification of

WE for evaluation of Sc performance. In Section 4 and 5

proposed Sc simulation model is discussed and the

effects of selected forecasting models on Sc performance

is examined. Finally in section 6 research findings and

conclusions are presented.

1 Introduction

In todays competitive business environment the

performance of companies and even countries are mainly

based on customer relations; understanding the needs of

customer and ability of immediate response to those

needs. Supply chain (Sc) systems clearly includes all

activities of this complex system required to satisfy the

customer demand and can be defined as the network of

organizations that are involved, through upstream and

downstream linkages, in the different process and

activities that produce value in the form of products and

services in the hand of ultimate customer[1].

Bethinking the definition of Sc exposes that the

performance of a successful Sc system concerns directly

with appropriate demand information flow [2]. A wellknown phenomenon of the Sc systems is the variability

of the demand information between the stages of the

supply chain (i.e. the whiplash or bullwhip effect (WE).)

This variability increases as the demand data moves

upstream from the customer to the other stages of the SC

system engendering undesirable excess inventory levels,

defective labor force, cost increases, overload errors in

production activities and etc.

Forrester [3, 4] with a simple Sc simulation consisted

of retailer, wholesaler, distributor and factory levels,

discovered the existence of WE as demand

amplification in Sc model. He argued about the possible

causes and suggested same ideas to control the WE. He

emphasized on the decision making process in each

phase of SC and betrayed that this process could be the

main reason the demand amplification through the chain

from the retailer to the factory level [2]. Later Sterman;

in 1989, studied this phenomenon using his well-known

simulation model; the beer game, and apprised that

inaccurate judgments made by the participants and the

adoption of this judgments to the Sc system is the main

ISBN: 978-960-6766-57-2

2 FR, FTs, FGG Forecasting Models

2.1 FR Forecasting Model

107

ISSN: 1790-5109

9th WSEAS International Conference on FUZZY SYSTEMS (FS08) which was held in Sofia, Bulgaria

Linear regression; which shows the relation between

response or dependent variable y and independent or

explanatory variable x , can be formulate considering the

relation of y to x as a linear function of parameters

Y = f ( x) = X

where is the vector of

with

coefficients and X is the matrix of independent variable

[2]. The application of linear regression model is suitable

for the systems in which the data sets observed are

distributed according to a statistical model (i.e.

unobserved error term is mutually independent and

identically distributed). But generally, fitting the demand

pattern of a real Sc to a specific statistical distribution is

not possible. The FR model introduced by Tanaka et al.

[18, 19] in which deviations reflect the vagueness of the

system structure expressed by the fuzzy parameters of

the regression model (i.e. possibilistic) is suitable for

the declared demand patterns and basically can be

formulate as:

Y = (c0 , s0 ) + (c1 , s1 )x1 + (c2 , s2 )x2 + .... + (cn , sn )xn

Hwangs FTs forecasting models can be summarized

as follow. First, the variation between two continuous

historical

data

is

to

be

calculated

and

minimum/maximum increases; i.e. Dmin / Dmax , are to

be determined. Next step is to define the universe

discourse; U d , with following equation and separate

U d into several equal length intervals.

U d = [ Dmin D1 , D max + D2 ]

where D1 and D2 are positive values that fits for

separating U d into equal lengths. Then fuzzy sets on

U d are to be defined and historical data is to be

fuzzified. And the final step is to calculate the output

using operation and criterion matrixes defuzzifying the

calculated variation (see [17], [23]).

(1)

where c k is the central value and s k is the spread value,

of the kth fuzzy coefficient; Ak = (ck , sk ) , usually

presented as a triangular fuzzy number (TFN). And this

representation is fact that relaxes the crisp linear

regression model. Using fuzzy triangular membership

function for Ak , the minimum fuzziness for Yk can be

maintained with a linear programming (LP) model as

follow [2, 19, 22];

2.2

st

nk =1 ck xki

where

c x (1 h ) s k x ki y i

k =1 k ki

kn=1

(1 h ) sk xki yi

(2)

k =1

x0 i = 1, 0 h 1

and

k = 1,2,3,..., n i = 1,2,3,..., n .

2.2

FTs Forecasting Model

When historical demand data that will use to calculate

the desirable forecast value are linguistic values and (or)

are in small amounts, fuzzy time series model best fit the

aspect. Song et.al.[14, 15]; fuzzifying the enrollments of

the University of Alabama, used fuzzy time series in

forecasting problems and proposed a first-order timevariant fuzzy time series and first-order time-invariant

fuzzy time series for the solution of the forecasting

problems. Later Song et.al.[16] introduced an new FTs

model and betrayed that best results are held by applying

neural network for defuzzifying data. Hwang [23] and

Wang [17] also successfully used FTs forecasting model.

ISBN: 978-960-6766-57-2

FGG Forecasting Model

The grey system theory introduced by Deng [24,25] can

simply be summarized as a methodology that concerns

with the systems comprising uncertainties and lack of

sufficient amount of information; in which, the term

grey indicates the system information that lies between

the clearly and certainly known ones and the unknown

part of the system [2].The discrete time sequence data is

used to expose a regular differential equation; GM (n,m),

with the accumulated generating operation (AGO) and

inverse accumulated generic operation (IAGO). In GM

(n,m), terms n and m represents the order of ordinary

differential equation and the number of grey variable

respectively, defining the order of AGO and IAGO. In

addition to the facts defined above; if the data sets

collected from the system are linguistic, FGG

forecasting models may perform successfully.

The FGG forecasting model introduced by Tsaur

[21]; which assumes data series collected from the

system are symmetrical triangular fuzzy numbers (TFN),

is very similar to the crisp one and can be explained with

the following equations. The original data series

collected from the model is:

m n

Z = Minms0 (1 h ) s k xik

i =1k =0

(3)

D 0 = D 1 0 + D 2 0 + D 3 0 + ... + D n 0

(4)

where n is the number data collected from the system.

And D 1 ; the new fuzzy data sequence generated with

AGO, can be shown with the following equation as:

D 1 = D 11 + D 21 + D 31 + ... + D n1

108

ISSN: 1790-5109

(5)

9th WSEAS International Conference on FUZZY SYSTEMS (FS08) which was held in Sofia, Bulgaria

; k = 1,2,..., n , is a symmetrical TFN with

where D

k

central

and

spread

values

1

D ,

i =1

k

0

i =1 i

Min z = b1

st

(b aQk ) + (1 h)(b1 apk ) Dk0 + (1 h )sk0

i = 1,2,..., k respectively. And the

(b aQk ) + (1 h)(b1 apk )

fuzzy GM(1,1) model is denoted as;

dD 1 / dk + aD 1 = b

0 h 1;

(6)

b - b1 b + b1

otherwise

(7)

(8)

(9)

= aQ

D

1

k +1

+ b ,

Dt = + Dt 1 + t

(10)

(11)

Var ( Dt ) =

and the spread value

k +1

k

pk +1 = 1 / 2 si0 +

si0

i =1

i =1

(15)

2

1 2

(16)

Assuming the inventory system in the retailer is orderup-to policy with fixed lead time and the forecasting

technique used is simple moving average, the orders

placed by the retailer at period t ; qt ( which is an

important variable owing to the fact that WE is

quantified as Var (q ) relative to Var (D ) ) is denoted as:

(12)

As the spread determines fuzziness; values of unknown

variables a, b and b 1 can be obtained from the solution

of the following LP model with the objective function

that minimizes the spread value of STFN b .

ISBN: 978-960-6766-57-2

(14)

where and denotes a non negativity constant and

correlation parameters p < 1 respectively (as

indicates the relationship between demands = 0

betrays the independent identically distributed (i.d.d.)

demand). The variance of Dt is emerged as

where Q k1 +1 = 1 / 2 D k1 + D k1+1 with the central value

k +1

k

Qk +1 = 1 / 2 Di0 + Di0

i =1

i =1

This study evaluates the Sc performance by quantifying

the demand variability (i.e. WE) in various stages of the

proposed Sc simulation using Chen et.al.s model [9,10]

that defines WE as the ratio of demand variances of two

consequent stages. The smaller the WE the better the Sc

performance will be.

Chen et al.; assuming the customer demand in period

t to the retailer ( Dt ) as random variables; defined Dt

with the following equation.

is a fuzzy number with central and spread

where D

k 0

and c 0 , k = 2,3,..., n . Let the average

values; D

0

and kD 0 , Q 1 k ( which is a STFN with the central

of D

k +1

k

k +1

value Qk +1 and the spread value p k +1 ) be the second

part of equation (6) as ;

0

k

3 The Measuring Sc Performance with

Quantified WE

or

dD 1 / dk = D k 1 + D k1+1 = D k0 , k = 1,2,..., n

D k0, g = D k1, g D k1,g1 , for k 2 and g = low, upr.

By setting the sampling interval one unit as in crisp

1 / dk can be rewritten as

model dD

dD 1 / dk = D k 1 + D k11 = D k0 ; k = 2,3,..., n

(13)

sk0

After solving the LP problem; similar to the crisp grey

GM(1,1) model, Tsaur suggested that estimated fuzzy

1,low and upper bound

number D k1 with lower bound D

k

1

,

upr

1

1

,

low

1

,

upr

D k ; D k = D k , D k

, could be obtained. Finally

the fuzzy forecast value for period k+1;

D k0 = D k0,low , D k0,upr , could be determined as follow

where a is the developing coefficient and STFN b

denotes the fuzzy grey input with the central value b

and the spread value b1 and the membership function for

b is constructed as follow.

b

1

b( ) =

b1

+ (1 h )

a, b, b1 R

Dk0

qt = y t y t 1 + Dt 1

and Var ( q ) / Var ( D ) have the following relation:

109

ISSN: 1790-5109

(17)

9th WSEAS International Conference on FUZZY SYSTEMS (FS08) which was held in Sofia, Bulgaria

2 L 2 L2

Var (q )

1 +

+ 2

Var ( D )

p

p

(1 p )

(18)

5

where L is the period p is the number of observations.

Experiment

The following figures illustrate randomly generated Dc

(the same for all simulation runs), and calculated Dr and

4 The Simulation Model

D f values derived from the simulations using selected

In this study a near beer distribution game model is used;

which is extended from the Paiks [26] model with

predetermined cost items (holding, setup / production),

inventory restrictions, production restrictions and delay

functions. The beer game model; which is an effective

tool for investigating the behaviors and factors effecting

Sc performance as it successfully can reflect the attitude

of the real life models, was introduced by Sterman [27].

The model proposed here, is simply a two staged Sc

system consists of a retailer and a factory. Due to its

common use and successful primed fuzzy functions;

MatLab is the adjudicated simulation tool. Demand

information in each period can be either crisp or fuzzy

depending on the forecasting model that will be

analyzed; similar to our previous model [2]. The model

evaluates the Sc performance by computing the ratio of

demand variances of consequent stages; i.e.

VarDS i / VarDSi +1 , where DSi denotes the demand

forecasting methods for a time horizon of 30 periods.

And to reflect the response of Sc performance to the

selected forecasting model, the calculated standard

deviation values are given Table-1. In the simulations,

the production capacity of factory is taken as 100 units

per period and on hand inventory in each echelon at time

zero is set to again 100 units. The set of Dc values for

from

stage

to

upstream

stage

S i +1

30 periods; Dset are given below. The results gathered

from FTs forecasting model are not illustrated as they

are similar to FR results.

Dset ={66.2297; 62.7269; 76.2016; 56.5420; 36.5401;

47.0135; 1.0196 ; 59.4657; 52.3389; 38.1779; 36.9058;

28.3868; 49.0454; 57.5869; 43.3928; 40.0020; 49.2804;

46.5048; 30.8547; 75.8510; 58.8182; 75.6188; 40.0454;

27.6257; 66.1530; 50.8240; 34.8758; 48.2174; 9.8230;

71.6784}.

(i.e

i = c, r , f where c, r, f represent customer, retailer,

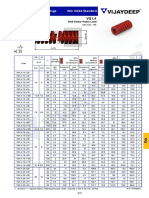

Table-1. Standard deviation values

factory respectively. The cost, delay and factory

production capacity parameters are variable and their

values depend on the analyzer. The generic decision rule

in each time period t can be summarized with the

following equation [2, 27].

Sd c

Sd r

Sd f

Forecasting Model

EXS

FR

FGG

18.24

18.24

18.24

65.39

28.86

81.13

33.28

29.42

44

Upstream Order Quantity =[Forecast Value + Correction

of Inventory + Correction for Supply Line]

( 19)

Simple exponential smoothing (EXS) model is used as a

crisp forecasting technique for comparison. The

customer order received from retailer in period t is

taken as a base for forecasting the forthcoming demand,

and each time the order received, forecasting function

update its structure according to the new demand

information. After estimating the forthcoming demand;

simulation model, using the decision rule in (19) and

other parameters (i.e. cost, lead time, availability,

demand pattern etc.), makes an ordering decision to

upper echelon of Sc. And the ratio of variability between

the customer orders, retailer orders and manufacturing

decision of factory shows the performance of Sc system

based on the selected forecasting model.

Fig.1. The demand response to EXS forecasting model

(i.e. W.E.)

ISBN: 978-960-6766-57-2

110

ISSN: 1790-5109

9th WSEAS International Conference on FUZZY SYSTEMS (FS08) which was held in Sofia, Bulgaria

GM(1,1) Forecasting Models, Information Sciences

2007, World Scientific, 2007, pp. 1088--1094.

[3]Forrester J., Industrial Dynamics: A major

breakthrough for decision makers, Harvard Business

Review, 36, 1958, pp. 37--66.

[4]Forrester J., Industrial Dynamics, MIT Press,

Cambridge, MA, 1961.

[5]Lee H. L., Padmanabhan V., Whang S., The Bullwhip

Effect in Supply Chains, MIT Sloan Management

Rev., 38, 1997a, pp. 93-10 2.

[6]Lee H. L., Padmanabhan V., Whang S., Information

Distortion in a Supply Chain: The bullwhip effect,

Management Science, 43, 1997b, pp. 546--558.

[7]Lee H. L., Aligning Supply Chain Strategies with

Product Uncertainties, California Management

Review, 44, 2002, pp. 105--119.

[8]Lee H. L., Padmanabhan V., Whang S.:Information

Distortion in a Supply Chain: The bullwhip effect .

Management Science, 50, 2004, pp. 1875--1886.

[9]Baganha M., Cohen M., The Stabilizing Effect of

Inventory in Supply Chains, Operations Research,

46, 1998, pp.572-583.

[10]Graves S. C., A Single Inventory Model foe a

Nonstationary Demand Process, Manufacturing

&Service Operations Management, 1, 1999, pp.5061.

[11]Drezner Z., Ryan J., Simchi-Levi D., Quantifiying

the Bullwhip Effect : The impact of forecasting, lead

time and information, Management Science, 46 (3),

pp.436-443.

[12]Chen F., Drezner Z., Ryan J., Simchi-Levi D.,The

Impact of Exponential Smoothing Forecasts on the

Bullwhip Effect, Naval Research Logistics, 47, 2000,

pp. 269-286.

[13]Li G., Wang S., Yan H., Yu G., Information

Transportation in Supply Chain, Computers and

Operation research, 32, 2005, 707-725.

[14]Song Q., Chissom B. S., Forecasting Enrollments

with Fuzzy Time Series, Fuzzy Sets and Systems, 54,

1993, pp. 19.

[15]Song Q., Chissom B. S., Fuzzy Time Series and Its

Models, Fuzzy Sets and Systems, 54, 1993, pp. 269

277.

[16]Song Q., Chissom B. S., Forecasting Enrollments

with Fuzzy Time Series-Part II, Fuzzy Sets and

Systems, 54, 1993, pp. 19.

[17]Wang C.H., Predicting Tourism Demand Using

Fuzzy Time Series and Hybrid Grey Theory, Tourism

Management, 25, 2004, pp.367-374.

[18]Tanaka H., Uejima S., Asai K., Fuzzy Linear

Regression Model, IEEE Trans. System, Man and

Cybernet, 12 , 1982, pp. 903--907.

[19] Tanaka H., Watada J., Possibilistic Linear Systems

and Their Application to the Linear Regression

Model, Fuzzy Sets and Systems, 27, 1988, pp.275

Fig.2. Demand response to FR forecasting model

Fig.3. Demand response to FGG forecasting model

6 Research Findings and Conclusion

In this study the effects of selected fuzzy forecasting

models (FR, FGG and FTs) to Sc performance is

examined by using measured demand variability

(i.e.WE). As a crisp base technique, EXS forecasting

model is chosen for comparison. The results exposed

that the fuzzy forecasting model used in the study;

except FGG, considerably increased the performance of

proposed Sc system decreasing demand variability

through the chain. Further researches can be made using

fuzzy lead times as to more adapt the model to complex

real-world Sc systems.

References:

[1]Christopher M., Logistic and Supply Chain

Management, Pitman Publishing, London, UK, 1994,

pp.30.

[2]Tozan H., Vayvay O., Analyzing Demand Variability

Through SC Using Fuzzy Regression and Grey

ISBN: 978-960-6766-57-2

111

ISSN: 1790-5109

9th WSEAS International Conference on FUZZY SYSTEMS (FS08) which was held in Sofia, Bulgaria

289.

[20]Wang, H.F., Tsaur R.H., Insight of a Fuzzy

Regression Model, Fuzzy Sets and Systems, 2000,

112, pp. 355-369.

[21]Tsaur RC., Fuzzy Grey GM(1,1) Model Under

Fuzzy Systems, International Journal of Computer

Mathematics,Vol.82 No.2, 2005, pp.141-149.

[22]Ross T. J., Fuzzy Logic with Engineering

Applications, 2th edt., John Wiley and Sons, 2005,

pp.555-567.

[23]Hwang J., Chen S.M., Lee C.H., Handling

Forecasting Problems Using Fuzzy Time Series,

Fuzzy Sts and Systems, 100, 1998, pp.217-228.

[24]Deng,,L.J., Grey Prediction and Decision (in

Chinese), Huazong Institute Of Technology Press,

Wuhan, China, 1989

[25]Deng,,L.J., The Journal of Grey Systems,1, 1989,

pp.1-24.

[26] Paik S.K., Analysis of the Causes of Bullwhip

Effect in Supply Chain: A Simulation Approach,

George Washington University, 20031

[27]Sterman J.D., Management Science, 35, 1989,

pp.321-399.

ISBN: 978-960-6766-57-2

112

ISSN: 1790-5109

Das könnte Ihnen auch gefallen

- Hamiltonian Monte Carlo Methods in Machine LearningVon EverandHamiltonian Monte Carlo Methods in Machine LearningNoch keine Bewertungen

- Bining Neural Network Model With Seasonal Time Series ARIMA ModelDokument17 SeitenBining Neural Network Model With Seasonal Time Series ARIMA ModelMiloš MilenkovićNoch keine Bewertungen

- Long Term Behavior Monitoring of An Arch Dam Using Adaptive Neuro-Fuzzy Model TechniqueDokument1 SeiteLong Term Behavior Monitoring of An Arch Dam Using Adaptive Neuro-Fuzzy Model Techniqueulastuna2001Noch keine Bewertungen

- Document 5Dokument16 SeitenDocument 5Su BoccardNoch keine Bewertungen

- Document 1Dokument16 SeitenDocument 1Su BoccardNoch keine Bewertungen

- Time Series Forecast of Electrical Load Based On XGBoostDokument10 SeitenTime Series Forecast of Electrical Load Based On XGBoostt.d.sudhakar.staffNoch keine Bewertungen

- Learning FCM by Data Mining in A Purchase System: S. Alizadeh, M. Ghazanfari & M. FathianDokument10 SeitenLearning FCM by Data Mining in A Purchase System: S. Alizadeh, M. Ghazanfari & M. FathianKenietaNoch keine Bewertungen

- Short Term Load Forecasting Using Gaussian Process ModelsDokument12 SeitenShort Term Load Forecasting Using Gaussian Process ModelsDedin DiyantoNoch keine Bewertungen

- Data-Driven Design of Model-Based Fault Diagnosis SystemsDokument8 SeitenData-Driven Design of Model-Based Fault Diagnosis Systemsbnousaid2014Noch keine Bewertungen

- (Ruey Chyn Tsaur) Markov Chain-RCTDokument12 Seiten(Ruey Chyn Tsaur) Markov Chain-RCTDzaky MuhammadNoch keine Bewertungen

- Demand Forecast in A Supermarket Using S Hybrid Intelligent SystemDokument8 SeitenDemand Forecast in A Supermarket Using S Hybrid Intelligent SystemgoingroupNoch keine Bewertungen

- Nonlinear Extension of Asymmetric Garch Model Within Neural Network FrameworkDokument11 SeitenNonlinear Extension of Asymmetric Garch Model Within Neural Network FrameworkCS & ITNoch keine Bewertungen

- Online Estimation of Stochastic Volatily For Asset Returns: Ivette Luna and Rosangela BalliniDokument7 SeitenOnline Estimation of Stochastic Volatily For Asset Returns: Ivette Luna and Rosangela BalliniIvetteNoch keine Bewertungen

- Ifac Workshop On Distributed Estimation and Control in Networked Systems (Netsys 2012), September 14-15, Santa Barbara, California, USA. ThisDokument7 SeitenIfac Workshop On Distributed Estimation and Control in Networked Systems (Netsys 2012), September 14-15, Santa Barbara, California, USA. Thisfalcon_vamNoch keine Bewertungen

- Real-Time Feedback Control of Computer Networks Based On Predicted State EstimationDokument27 SeitenReal-Time Feedback Control of Computer Networks Based On Predicted State Estimationbavar88Noch keine Bewertungen

- An Intelligent Demand Forecasting Model Using A Hybrid of Metaheuristic Optimization and Deep Learning Algorithm For Predicting Concrete Block ProductionDokument9 SeitenAn Intelligent Demand Forecasting Model Using A Hybrid of Metaheuristic Optimization and Deep Learning Algorithm For Predicting Concrete Block ProductionIAES IJAINoch keine Bewertungen

- SSRN Id3900141Dokument43 SeitenSSRN Id3900141김기범Noch keine Bewertungen

- Time-Series Forecasting Through Recurrent Topology: ArticleDokument10 SeitenTime-Series Forecasting Through Recurrent Topology: ArticleJc OlimpiadaNoch keine Bewertungen

- Manifold DataminingDokument5 SeitenManifold Dataminingnelson_herreraNoch keine Bewertungen

- Fuzzy System Modeling by Fuzzy Partition and GA Hybrid SchemesDokument10 SeitenFuzzy System Modeling by Fuzzy Partition and GA Hybrid SchemesOctavio AsNoch keine Bewertungen

- IJAMSS - Collective Behaviour Detection of Stock Markets - Heba ElsegaiDokument12 SeitenIJAMSS - Collective Behaviour Detection of Stock Markets - Heba Elsegaiiaset123Noch keine Bewertungen

- Short Term Load Forecasting Using Interval Type-2 Fuzzy Logic SystemsDokument8 SeitenShort Term Load Forecasting Using Interval Type-2 Fuzzy Logic SystemsJoseph Kithinji MNoch keine Bewertungen

- Clustering Safe Process 09Dokument6 SeitenClustering Safe Process 09Ha_JafarianNoch keine Bewertungen

- Paper 22 - Adaptive Outlier-Tolerant Exponential Smoothing Prediction Algorithms With Applications To Predict The Temperature in SpacecraftDokument4 SeitenPaper 22 - Adaptive Outlier-Tolerant Exponential Smoothing Prediction Algorithms With Applications To Predict The Temperature in SpacecraftEditor IJACSANoch keine Bewertungen

- SMRY08 ConfDokument6 SeitenSMRY08 ConfarmanNoch keine Bewertungen

- Document 2Dokument16 SeitenDocument 2Su BoccardNoch keine Bewertungen

- Control-Relevant Demand Forecasting For Management of A Production-Inventory SystemDokument6 SeitenControl-Relevant Demand Forecasting For Management of A Production-Inventory SystemVrushabh SahareNoch keine Bewertungen

- TMP 6932Dokument12 SeitenTMP 6932FrontiersNoch keine Bewertungen

- Artificial Neural Network Based Model For Forecasting of Inflation in IndiaDokument17 SeitenArtificial Neural Network Based Model For Forecasting of Inflation in IndiaSenthilraja SNoch keine Bewertungen

- Fault Diagnosis Model Through Fuzzy Clustering: LV of Science ofDokument5 SeitenFault Diagnosis Model Through Fuzzy Clustering: LV of Science ofrvicentclasesNoch keine Bewertungen

- Pgagenplan (Ieee Trans) 2Dokument8 SeitenPgagenplan (Ieee Trans) 2bhumaniNoch keine Bewertungen

- An ANFIS Based Fuzzy Synthesis Judgment For Transformer Fault DiagnosisDokument10 SeitenAn ANFIS Based Fuzzy Synthesis Judgment For Transformer Fault DiagnosisDanh Bui CongNoch keine Bewertungen

- Big Bang - Big Crunch Learning Method For Fuzzy Cognitive MapsDokument10 SeitenBig Bang - Big Crunch Learning Method For Fuzzy Cognitive MapsenginyesilNoch keine Bewertungen

- System Identification Using Intelligent AlgorithmsDokument13 SeitenSystem Identification Using Intelligent AlgorithmsAnonymous gJHAwzENoch keine Bewertungen

- Document 4Dokument16 SeitenDocument 4Su BoccardNoch keine Bewertungen

- 2020 Kong Short-Term Forecast AEDokument13 Seiten2020 Kong Short-Term Forecast AE구본찬Noch keine Bewertungen

- Int Statistical Rev - 2013 - H Rdle - Bootstrap Methods For Time SeriesDokument25 SeitenInt Statistical Rev - 2013 - H Rdle - Bootstrap Methods For Time SeriesTitin AgustinaNoch keine Bewertungen

- Determinacion Del d50c PDFDokument5 SeitenDeterminacion Del d50c PDFAnonymous caHv3DvtNoch keine Bewertungen

- Document 4Dokument16 SeitenDocument 4Su BoccardNoch keine Bewertungen

- Document 5Dokument16 SeitenDocument 5Su BoccardNoch keine Bewertungen

- A Formal Modeling Approach For Supply Chain Event ManagementDokument18 SeitenA Formal Modeling Approach For Supply Chain Event ManagementpishinedaNoch keine Bewertungen

- 15.10 Off-Line DSA: 2006 by Taylor & Francis Group, LLCDokument4 Seiten15.10 Off-Line DSA: 2006 by Taylor & Francis Group, LLCfirst lastNoch keine Bewertungen

- Wiley Journal of Applied Econometrics: This Content Downloaded From 128.143.23.241 On Sun, 08 May 2016 12:18:10 UTCDokument19 SeitenWiley Journal of Applied Econometrics: This Content Downloaded From 128.143.23.241 On Sun, 08 May 2016 12:18:10 UTCmatcha ijoNoch keine Bewertungen

- Document 5Dokument16 SeitenDocument 5Su BoccardNoch keine Bewertungen

- Chen - Fault Section Estimation Using Fuzzy Matrix-Based Reasoning Methods - 2011Dokument9 SeitenChen - Fault Section Estimation Using Fuzzy Matrix-Based Reasoning Methods - 2011Aécio OliveiraNoch keine Bewertungen

- Document 4Dokument16 SeitenDocument 4Su BoccardNoch keine Bewertungen

- Time Series Forecasting With Neural Networks: A Comparative Study Using The Airline DataDokument20 SeitenTime Series Forecasting With Neural Networks: A Comparative Study Using The Airline Dataap5518Noch keine Bewertungen

- Zarandi, MHF, Alaeddini, A I. and Turksen, BDokument11 SeitenZarandi, MHF, Alaeddini, A I. and Turksen, BDr Abhijeet GangulyNoch keine Bewertungen

- S C - B E D F N - I L M: Equential Lustering Ased Vent Etection OR ON Ntrusive OAD OnitoringDokument9 SeitenS C - B E D F N - I L M: Equential Lustering Ased Vent Etection OR ON Ntrusive OAD OnitoringCS & ITNoch keine Bewertungen

- System Identification and Modeling For Interacting and Non-Interacting Tank Systems Using Intelligent TechniquesDokument15 SeitenSystem Identification and Modeling For Interacting and Non-Interacting Tank Systems Using Intelligent TechniquesMandy DiazNoch keine Bewertungen

- Panda 2019Dokument6 SeitenPanda 2019Sai Pavan Reddy k.jNoch keine Bewertungen

- Folding@home: Lessons From Eight Years of Volunteer Distributed ComputingDokument8 SeitenFolding@home: Lessons From Eight Years of Volunteer Distributed ComputingLucasOliveiraNoch keine Bewertungen

- Considerations About Establishing Mathematical Models Using System Identification ProceduresDokument4 SeitenConsiderations About Establishing Mathematical Models Using System Identification ProceduresioncopaeNoch keine Bewertungen

- Linear System Order Reduction Model Using Stability Equation Method and Factor Division Algorithm For MIMO SystemsDokument10 SeitenLinear System Order Reduction Model Using Stability Equation Method and Factor Division Algorithm For MIMO SystemsIJRASETPublicationsNoch keine Bewertungen

- Event Log Modeling and Analysis For System Failure PredictionDokument14 SeitenEvent Log Modeling and Analysis For System Failure PredictionsreenivasNoch keine Bewertungen

- Ijaret: ©iaemeDokument9 SeitenIjaret: ©iaemeIAEME PublicationNoch keine Bewertungen

- Document 3Dokument16 SeitenDocument 3Su BoccardNoch keine Bewertungen

- Cusum Charts (V-Mask) : Sample XDokument12 SeitenCusum Charts (V-Mask) : Sample Xvista10Noch keine Bewertungen

- Machine Learning and Law and Economics: A Preliminary OverviewDokument34 SeitenMachine Learning and Law and Economics: A Preliminary Overviewhari sudhanNoch keine Bewertungen

- A Neuro Fuzzy System Based Inflation Prediction of Agricultural CommoditiesDokument6 SeitenA Neuro Fuzzy System Based Inflation Prediction of Agricultural CommoditiesAbhishek DuttaNoch keine Bewertungen

- Procuring Fast Delivery: Sole Sourcing With Information AsymmetryDokument16 SeitenProcuring Fast Delivery: Sole Sourcing With Information Asymmetryhammad59999Noch keine Bewertungen

- Troubleshooting April 04Dokument2 SeitenTroubleshooting April 04Miike Md ZamriNoch keine Bewertungen

- Warranty Cost Analysis For Second-Hand Products: Mathematical Computer ModellingDokument3 SeitenWarranty Cost Analysis For Second-Hand Products: Mathematical Computer Modellinghammad59999Noch keine Bewertungen

- The Harvard Law Review Association Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Harvard Law ReviewDokument38 SeitenThe Harvard Law Review Association Is Collaborating With JSTOR To Digitize, Preserve and Extend Access To Harvard Law Reviewhammad59999Noch keine Bewertungen

- Sania Zahra Malik: Curriculum Vitae Page 1 of 1Dokument1 SeiteSania Zahra Malik: Curriculum Vitae Page 1 of 1hammad59999Noch keine Bewertungen

- Request For Issue of DegreeDokument1 SeiteRequest For Issue of Degreehammad59999Noch keine Bewertungen

- Ecb 3Dokument17 SeitenEcb 3chakradhar pmNoch keine Bewertungen

- Output Vat Zero-Rated Sales ch8Dokument3 SeitenOutput Vat Zero-Rated Sales ch8Marionne GNoch keine Bewertungen

- Chapter 3 - A Top-Level View of Computer Function and InterconnectionDokument8 SeitenChapter 3 - A Top-Level View of Computer Function and InterconnectionChu Quang HuyNoch keine Bewertungen

- Network Administration and Mikrotik Router ConfigurationDokument17 SeitenNetwork Administration and Mikrotik Router ConfigurationbiswasjoyNoch keine Bewertungen

- Electrical NTPCDokument24 SeitenElectrical NTPCSenthil KumarNoch keine Bewertungen

- David-Huynh Indeed ResumeDokument3 SeitenDavid-Huynh Indeed Resumeapi-546353822Noch keine Bewertungen

- Blockchain Unit Wise Question BankDokument3 SeitenBlockchain Unit Wise Question BankMeghana50% (4)

- Good Practice On The Project "Improve The Food Security of Farming Families Affected by Volatile Food Prices" (Nutrition Component) in CambodiaDokument2 SeitenGood Practice On The Project "Improve The Food Security of Farming Families Affected by Volatile Food Prices" (Nutrition Component) in CambodiaADBGADNoch keine Bewertungen

- Introduction To Content AnalysisDokument10 SeitenIntroduction To Content AnalysisfelixNoch keine Bewertungen

- 036 ColumnComparisonGuideDokument16 Seiten036 ColumnComparisonGuidefarkad rawiNoch keine Bewertungen

- Comprehensive Case 2 - QuestionDokument7 SeitenComprehensive Case 2 - QuestionPraveen RoshenNoch keine Bewertungen

- PLLV Client Consent FormDokument4 SeitenPLLV Client Consent Formapi-237715517Noch keine Bewertungen

- JKR SPJ 1988 Standard Specification of Road Works - Section 1 - GeneralDokument270 SeitenJKR SPJ 1988 Standard Specification of Road Works - Section 1 - GeneralYamie Rozman100% (1)

- PETRO TCS Engineering Manual 682Dokument44 SeitenPETRO TCS Engineering Manual 682paulm3565Noch keine Bewertungen

- Hi Smith, Learn About US Sales Tax ExemptionDokument2 SeitenHi Smith, Learn About US Sales Tax Exemptionsmithmvuama5Noch keine Bewertungen

- Accomplishment Report Dictrict Preventive MaintenanceDokument2 SeitenAccomplishment Report Dictrict Preventive MaintenanceZenia CapalacNoch keine Bewertungen

- Attachment 05 - BFD, ELD and P&I Diagrams-PearlDokument77 SeitenAttachment 05 - BFD, ELD and P&I Diagrams-Pearlum er100% (1)

- HRM Ass1Dokument3 SeitenHRM Ass1asdas asfasfasdNoch keine Bewertungen

- Es 590Dokument35 SeitenEs 590Adnan BeganovicNoch keine Bewertungen

- Crystallization of Para-Xylene in Scraped-Surface CrystallizersDokument11 SeitenCrystallization of Para-Xylene in Scraped-Surface Crystallizersanax22Noch keine Bewertungen

- DPWH Cost EstimationDokument67 SeitenDPWH Cost EstimationAj Abe92% (12)

- 1.1 Cruz v. DENR PDFDokument7 Seiten1.1 Cruz v. DENR PDFBenBulacNoch keine Bewertungen

- Rectangular Wire Die Springs ISO-10243 Standard: Red Colour Heavy LoadDokument3 SeitenRectangular Wire Die Springs ISO-10243 Standard: Red Colour Heavy LoadbashaNoch keine Bewertungen

- Motion To DismissDokument24 SeitenMotion To DismisssandyemerNoch keine Bewertungen

- Execution Lac 415a of 2006Dokument9 SeitenExecution Lac 415a of 2006Robin SinghNoch keine Bewertungen

- Part List SR-DVM70AG, SR-DVM70EUDokument28 SeitenPart List SR-DVM70AG, SR-DVM70EUAndrea BarbadoroNoch keine Bewertungen

- Tesco Travel Policy BookletDokument64 SeitenTesco Travel Policy Bookletuser001hNoch keine Bewertungen

- Vehicle Detection and Identification Using YOLO in Image ProcessingDokument6 SeitenVehicle Detection and Identification Using YOLO in Image ProcessingIJRASETPublicationsNoch keine Bewertungen

- Chapter 1Dokument2 SeitenChapter 1Reymond Homigop GalarpeNoch keine Bewertungen

- Evaporator EfficiencyDokument15 SeitenEvaporator EfficiencySanjaySinghAdhikariNoch keine Bewertungen