Beruflich Dokumente

Kultur Dokumente

Capital Asset Vs Ordinary Asset

Hochgeladen von

KR ReborosoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Capital Asset Vs Ordinary Asset

Hochgeladen von

KR ReborosoCopyright:

Verfügbare Formate

Capital Asset vs.

Ordinary asset

One of the frequent concerns of a taxpayer who disposes or transfers his property is the resulting tax

consequences. Proper classification of the property to be disposed of or transferred is imperative in order

to determine the correct applicable tax. A question which must be first addressed is whether it is a capital

asset or ordinary asset.

Section 39 of the Tax Code defines the term capital assets by the process of exclusion. The term capital

assets means property held by the taxpayer (whether or not connected with his trade or business), but

does not include the following: stock in trade of the taxpayer or other property of a kind which would

properly be included in the inventory of the taxpayer if on hand at the close of the taxable year; property

held by the taxpayer primarily for sale to customers in the ordinary course of his trade or business;

property used in the trade or business, of a character which is subject to the allowance for depreciation ;

and real property used in trade or business of the taxpayer.

From the foregoing, capital assets are generally properties that are not used in trade or business of the

taxpayer. On the other hand, ordinary assets are properties used in trade or business or primarily held for

sale by the taxpayer.

The sale of capital assets (land and/ or building) is subject to capital gains tax at the rate of six percent

based on the gross selling price or fair market value at the time of sale, whichever is higher and the

corresponding documentary stamp tax (DST). Conversely, sale of ordinary assets is subject to the

creditable withholding tax at a rate ranging from 1.5 percent- 6 percent and consequently to ordinary

income tax, corresponding DST and likewise to the 12 percent VAT.

Nevertheless, one vital point which must also be considered is the conversion of the classification of the

properties. Take for instance, if a taxpayer suffering from financial distress decides to cease its business

operations leaving its properties formerly used in business as idle and abandoned. If those properties

were subsequently disposed of, what would then be the classification? Would they maintain their

classification as ordinary assets? Or will they be converted into capital assets?

Section 3(4) (e) of Revenue Regulations (RR) No. 07-2003 provides for the guidelines in determining

whether a particular real property is a capital asset or an ordinary asset. It provides that real properties

formerly forming part of the stock in trade of a taxpayer engaged in the real estate business, or formerly

being used in the trade or business of a taxpayer engaged or not engaged in the real estate business,

which were later on abandoned and became idle, shall nonetheless continue to be treated as ordinary

assets. Real property initially acquired by a taxpayer engaged in real estate business shall not result in its

conversion into a capital asset even if the same is subsequently abandoned or becomes idle. However,

properties classified as ordinary assets for being used in business by a taxpayer engaged in the business

other than real estate business are automatically converted into capital assets upon showing of proof that

the same have not been used in business for more than two (2) years prior to the consummation of the

taxable transactions involving said properties.

Ordinary Tax vs. Final Tax

Section 24. Income Tax Rates.

(A) Rates of Income Tax on Individual Citizen and Individual Resident Alien of the

Philippines.

(1) An income tax is hereby imposed:

(a) On the taxable income defined in Section 31 of this Code, other than

income subject to tax under Subsections (B), (C) and (D) of this Section,

derived for each taxable year from all sources within and without the

Philippines be every individual citizen of the Philippines residing therein;

(b) On the taxable income defined in Section 31 of this Code, other than

income subject to tax under Subsections (B), (C) and (D) of this Section,

derived for each taxable year from all sources within the Philippines by an

individual citizen of the Philippines who is residing outside of the Philippines

including overseas contract workers referred to in Subsection(C) of Section

23 hereof; and

(c) On the taxable income defined in Section 31 of this Code, other than

income subject to tax under Subsections (b), (C) and (D) of this Section,

derived for each taxable year from all sources within the Philippines by an

individual alien who is a resident of the Philippines.

The tax shall be computed in accordance with and at the rates established in the

following schedule:

Not over P10,000

5%

Over P10,000 but not over P30,000

P500+10% of the excess over P10,000

Over P30,000 but not over P70,000

P2,500+15% of the excess over P30,000

Over P70,000 but not over P140,000

P8,500+20% of the excess over P70,000

Over P140,000 but not over P250,000

P22,500+25% of the excess over P140,000

Over P250,000 but not over P500,000

P50,000+30% of the excess over P250,000

Over P500,000

P125,000+34% of the excess over P500,000 in

1998.

Provided, That effective January 1, 1999, the top marginal rate shall be thirty-three

percent (33%) and effective January 1, 2000, the said rate shall be thirty-two percent

(32%).

For married individuals, the husband and wife, subject to the provision of Section 51

(D) hereof, shall compute separately their individual income tax based on their

respective total taxable income: Provided, That if any income cannot be definitely

attributed to or identified as income exclusively earned or realized by either of the

spouses, the same shall be divided equally between the spouses for the purpose of

determining their respective taxable income.

Das könnte Ihnen auch gefallen

- Week 5 Special Revenue and Measurement Focus and Basis of Accounting - ACTG343Dokument10 SeitenWeek 5 Special Revenue and Measurement Focus and Basis of Accounting - ACTG343Marilou Arcillas PanisalesNoch keine Bewertungen

- Creditable Withholding Tax ReviewerDokument6 SeitenCreditable Withholding Tax ReviewerMark Rainer Yongis LozaresNoch keine Bewertungen

- Fria 2010Dokument128 SeitenFria 2010Mary Joyce Cornejo100% (1)

- Confirmation of Lease / Authority To Construct For Smart CellsiteDokument2 SeitenConfirmation of Lease / Authority To Construct For Smart CellsiteJan Brian Guillena BangcayaNoch keine Bewertungen

- Fundamental Principles in Assesment of Real Property TaxesDokument42 SeitenFundamental Principles in Assesment of Real Property TaxesRegina Mueller67% (3)

- Estate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andDokument6 SeitenEstate Tax - A Tax Levied On The Transmission of Properties From A To His Lawful Heirs andAngelyn SamandeNoch keine Bewertungen

- TRAIN LAW DONOR'S TAX RULESDokument8 SeitenTRAIN LAW DONOR'S TAX RULESJP PalamNoch keine Bewertungen

- Amended Guidelines Abot-Kamay Pabahay Program'Dokument30 SeitenAmended Guidelines Abot-Kamay Pabahay Program'Ge-An Moiseah Salud AlmueteNoch keine Bewertungen

- Save Money On Taxes: VAT Exemptions For Real Estate Sales And LeasesDokument5 SeitenSave Money On Taxes: VAT Exemptions For Real Estate Sales And Leasesenal92Noch keine Bewertungen

- OM No. 2018-04-03Dokument2 SeitenOM No. 2018-04-03Christian Albert HerreraNoch keine Bewertungen

- Lecture On Percentage TaxesDokument4 SeitenLecture On Percentage TaxesGlenn AquinoNoch keine Bewertungen

- Documentation and Registration-ExamDokument11 SeitenDocumentation and Registration-ExamLina Michelle Matheson Brual100% (1)

- UndertakingDokument4 SeitenUndertakingJunneth TheReaderNoch keine Bewertungen

- PD 957 - Subdivision and Condominium Buyers' Protective DecreeDokument12 SeitenPD 957 - Subdivision and Condominium Buyers' Protective DecreeremramirezNoch keine Bewertungen

- RR 2-98Dokument85 SeitenRR 2-98Elaine LatonioNoch keine Bewertungen

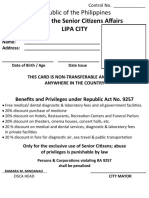

- Senior Citizen ID Card BenefitsDokument3 SeitenSenior Citizen ID Card BenefitsArenz Rubi Tolentino IglesiasNoch keine Bewertungen

- Amended Guidelines On The Pag-IBIG Fund Affordable Housing ProgramDokument11 SeitenAmended Guidelines On The Pag-IBIG Fund Affordable Housing ProgramVaishaNoch keine Bewertungen

- Local Government Code Concept MapDokument3 SeitenLocal Government Code Concept MapBon Jovi RosarioNoch keine Bewertungen

- A Report On RA 9904Dokument88 SeitenA Report On RA 9904carlos armonesNoch keine Bewertungen

- BIR compromise penalties explainedDokument2 SeitenBIR compromise penalties explainedCkey ArNoch keine Bewertungen

- CLWETAX Finals Module 5 7Dokument12 SeitenCLWETAX Finals Module 5 7johndanielsantosNoch keine Bewertungen

- Documented History of PhilRES' Recognition and Accreditation As The Sole Accredited and Integrated Professional Organization (AIPO) For The Real Estate Service of The PRCDokument96 SeitenDocumented History of PhilRES' Recognition and Accreditation As The Sole Accredited and Integrated Professional Organization (AIPO) For The Real Estate Service of The PRCEM Gesmundo Sevilla100% (2)

- Cases Maceda and Recto LawDokument9 SeitenCases Maceda and Recto LawAnonymous NqaBAyNoch keine Bewertungen

- Donation-Donor's Tax - Law That Governs Donor's TaxDokument8 SeitenDonation-Donor's Tax - Law That Governs Donor's TaxPat QuiaoitNoch keine Bewertungen

- Old and Revised Corporation Code of The Philippines - DeliberationsDokument44 SeitenOld and Revised Corporation Code of The Philippines - Deliberationsaudreyracela100% (1)

- Philippine Taxation Review QuestionsDokument4 SeitenPhilippine Taxation Review QuestionsJane TuazonNoch keine Bewertungen

- Timeline of Land and Agrarian Reform in The PhilippinesDokument1 SeiteTimeline of Land and Agrarian Reform in The PhilippinesYsai GeverNoch keine Bewertungen

- BMBE Law quiz answersDokument7 SeitenBMBE Law quiz answersRuiz, CherryjaneNoch keine Bewertungen

- Local Government Taxation Short Cases ExplainedDokument1 SeiteLocal Government Taxation Short Cases ExplainedRichard Rhamil Carganillo Garcia Jr.Noch keine Bewertungen

- Labor Law I Cases P-8-10Dokument212 SeitenLabor Law I Cases P-8-10Mary Joy GorospeNoch keine Bewertungen

- KNOW ALL MEN BY THESE PRESENTS Contract To SellDokument3 SeitenKNOW ALL MEN BY THESE PRESENTS Contract To SellLeonard Wong100% (1)

- A) B) C) D) : 1 PointDokument11 SeitenA) B) C) D) : 1 Pointprey kunNoch keine Bewertungen

- Dealings in PropertyDokument30 SeitenDealings in PropertyPrie DitucalanNoch keine Bewertungen

- Chapter VIII Ordinary Asset and Capital AssetsDokument3 SeitenChapter VIII Ordinary Asset and Capital AssetsJasmin Alapag100% (2)

- Vat ExemptDokument33 SeitenVat ExemptJohney DoeNoch keine Bewertungen

- Real Estate Taxation - 12.11.15 (Wo Answers)Dokument7 SeitenReal Estate Taxation - 12.11.15 (Wo Answers)Juan FrivaldoNoch keine Bewertungen

- Reorientation On The Ease of Doing Business Law PPT 11162021Dokument40 SeitenReorientation On The Ease of Doing Business Law PPT 11162021csc caraga artuNoch keine Bewertungen

- Transfer Taxes ExplainedDokument87 SeitenTransfer Taxes ExplainedMyka FloresNoch keine Bewertungen

- Introduction To Transfer and Business Tax and Basic Concept of Succession and Will (Philippines)Dokument16 SeitenIntroduction To Transfer and Business Tax and Basic Concept of Succession and Will (Philippines)Randy Delumen100% (1)

- Bir - Train - It - WT - Tmap 04262018Dokument74 SeitenBir - Train - It - WT - Tmap 04262018Mark Lord Morales Bumagat100% (1)

- Sale with Right to Repurchase Deed ExplainedDokument2 SeitenSale with Right to Repurchase Deed ExplainedManny Sandicho100% (1)

- Real Property TaxDokument5 SeitenReal Property TaxRacinef Tee100% (2)

- Donor's Tax A) Basic Principles, Concept and DefinitionDokument4 SeitenDonor's Tax A) Basic Principles, Concept and DefinitionAnonymous YNTVcDNoch keine Bewertungen

- Development CompanyDokument3 SeitenDevelopment CompanySheryl VelascoNoch keine Bewertungen

- Civil Code Provisions on Guaranty, Suretyship, Pledge, Mortgage and AntichresisDokument12 SeitenCivil Code Provisions on Guaranty, Suretyship, Pledge, Mortgage and AntichresisdenelizaNoch keine Bewertungen

- BIR's Tax Ruling Process ExplainedDokument3 SeitenBIR's Tax Ruling Process ExplainedConnieAllanaMacapagaoNoch keine Bewertungen

- Taxation LawDokument10 SeitenTaxation LawflorNoch keine Bewertungen

- Save Coconut Foundation Inc AOI and By-LawsDokument8 SeitenSave Coconut Foundation Inc AOI and By-LawsMario Vergel Ocampo100% (1)

- Obillos et al vs. CIR/CA Tax Ruling on Siblings' Land SaleDokument4 SeitenObillos et al vs. CIR/CA Tax Ruling on Siblings' Land Salekjhenyo218502Noch keine Bewertungen

- Income Taxation - Chapter 1 DefinitionDokument3 SeitenIncome Taxation - Chapter 1 DefinitionAntonioGloriaComiqueNoch keine Bewertungen

- RMC 24-02 Format SLS-SLPDokument60 SeitenRMC 24-02 Format SLS-SLPMikz Polzz67% (3)

- Estate Tax PDFDokument13 SeitenEstate Tax PDFAlexis Jaina TinaanNoch keine Bewertungen

- File 4061506199676160319Dokument5 SeitenFile 4061506199676160319Arah OpalecNoch keine Bewertungen

- Real Propert Y: TaxationDokument41 SeitenReal Propert Y: TaxationFreeza Masculino FabrigasNoch keine Bewertungen

- Philippine Civil Code Law On Sales - Case Digest (Powerpoint Presentation)Dokument31 SeitenPhilippine Civil Code Law On Sales - Case Digest (Powerpoint Presentation)Abhor TyrannyNoch keine Bewertungen

- Phillipines Real Estate Management LawsDokument5 SeitenPhillipines Real Estate Management LawsPaulyn Marie ValdezNoch keine Bewertungen

- Defaulting Payments Maceda LawDokument7 SeitenDefaulting Payments Maceda LawAbayabay KarlaNoch keine Bewertungen

- Taxation Reviewer Part 1: Introduction to Tax Laws and PrinciplesDokument8 SeitenTaxation Reviewer Part 1: Introduction to Tax Laws and PrinciplesIon FashNoch keine Bewertungen

- Tax On IndividualsDokument9 SeitenTax On IndividualsshakiraNoch keine Bewertungen

- Income Tax Principles and Rates in the PhilippinesDokument5 SeitenIncome Tax Principles and Rates in the PhilippinesLoren MandaNoch keine Bewertungen

- Cross Examination 1Dokument5 SeitenCross Examination 1KR ReborosoNoch keine Bewertungen

- KkiiDokument11 SeitenKkiiKR ReborosoNoch keine Bewertungen

- Your Personal Philosophy of LifeDokument1 SeiteYour Personal Philosophy of LifeKR ReborosoNoch keine Bewertungen

- AuditingDokument2 SeitenAuditingKR ReborosoNoch keine Bewertungen

- Memorandum For The Plaintiff EMMA CRISOSTOMODokument2 SeitenMemorandum For The Plaintiff EMMA CRISOSTOMOJona AddatuNoch keine Bewertungen

- Philippine Criminal Law Distinction Between Mala in Se and Mala ProhibitaDokument1 SeitePhilippine Criminal Law Distinction Between Mala in Se and Mala ProhibitaKR Reboroso100% (1)

- JAL Liable for Breach of Contract, Damages in Kidney Donor CaseDokument2 SeitenJAL Liable for Breach of Contract, Damages in Kidney Donor CaseKR ReborosoNoch keine Bewertungen

- Obligations and ContractsDokument120 SeitenObligations and ContractsYhelene Marie Avenido-AbiasNoch keine Bewertungen

- Consideration of Internal ControlDokument4 SeitenConsideration of Internal ControlKR ReborosoNoch keine Bewertungen

- Counter Affidavit by Group TagleDokument5 SeitenCounter Affidavit by Group TagleKR ReborosoNoch keine Bewertungen

- EcoDokument3 SeitenEcoDEHADOSNoch keine Bewertungen

- Hacienda Luisita IncDokument15 SeitenHacienda Luisita IncKR ReborosoNoch keine Bewertungen

- Reflection: Reboroso Quennie P. Marketing BSA-2ADokument2 SeitenReflection: Reboroso Quennie P. Marketing BSA-2AKR ReborosoNoch keine Bewertungen

- Cases - Republic To Lim Law (LOANS)Dokument27 SeitenCases - Republic To Lim Law (LOANS)KR ReborosoNoch keine Bewertungen

- Doctrines - CivRev2Dokument1 SeiteDoctrines - CivRev2KR ReborosoNoch keine Bewertungen

- Reboroso Quennie P. BSA-2A General Psychology:: Animal CognitionDokument1 SeiteReboroso Quennie P. BSA-2A General Psychology:: Animal CognitionKR ReborosoNoch keine Bewertungen

- Republic of The PhilippinesDokument3 SeitenRepublic of The PhilippinesKR ReborosoNoch keine Bewertungen

- Socsci 14Dokument3 SeitenSocsci 14KR ReborosoNoch keine Bewertungen

- RA 8791 General Banking ActDokument22 SeitenRA 8791 General Banking ActStephanie Mei100% (1)

- CompiledcasessalesDokument110 SeitenCompiledcasessalesKR ReborosoNoch keine Bewertungen

- COMP11 - KomikDokument1 SeiteCOMP11 - KomikKR ReborosoNoch keine Bewertungen

- Socsci 14Dokument3 SeitenSocsci 14KR ReborosoNoch keine Bewertungen

- #17 Republic vs. Phil ResourcesDokument2 Seiten#17 Republic vs. Phil ResourcesKR ReborosoNoch keine Bewertungen

- 2031rr15 02Dokument8 Seiten2031rr15 02KatharosJaneNoch keine Bewertungen

- Partnership: Facie Evidence That He Is A Partner in The Business, But No Such Inference ShallDokument14 SeitenPartnership: Facie Evidence That He Is A Partner in The Business, But No Such Inference ShallAnonymous 3u8SzAk4Noch keine Bewertungen

- Soriano v. BautistaDokument2 SeitenSoriano v. BautistaKR ReborosoNoch keine Bewertungen

- Years Percent Standard: In-House Factor Rate Bank Financing Factor Rate C/O MetrobankDokument1 SeiteYears Percent Standard: In-House Factor Rate Bank Financing Factor Rate C/O MetrobankKR ReborosoNoch keine Bewertungen

- SampleDokument6 SeitenSampleKR ReborosoNoch keine Bewertungen

- Different Kinds of Income TaxDokument25 SeitenDifferent Kinds of Income TaxKR ReborosoNoch keine Bewertungen

- COGSA ReviewerDokument6 SeitenCOGSA ReviewerKR ReborosoNoch keine Bewertungen

- Telecommunications Consultants India Ltd. (A Govt. of India Enterprise) TCIL Bhawan, Greater Kailash - 1, New Delhi - 110048Dokument5 SeitenTelecommunications Consultants India Ltd. (A Govt. of India Enterprise) TCIL Bhawan, Greater Kailash - 1, New Delhi - 110048Amit NishadNoch keine Bewertungen

- Valuing Business EDP SDMDokument104 SeitenValuing Business EDP SDMsamrulezzzNoch keine Bewertungen

- CSR Policy PDFDokument7 SeitenCSR Policy PDFRAJAT SINGHNoch keine Bewertungen

- MGT ACC3Dokument46 SeitenMGT ACC3MsKhan0078Noch keine Bewertungen

- 04 - The Internal AssessmentDokument43 Seiten04 - The Internal AssessmenthammadNoch keine Bewertungen

- Assume That Without Taxes The Consumption Schedule For An EconDokument1 SeiteAssume That Without Taxes The Consumption Schedule For An Econtrilocksp SinghNoch keine Bewertungen

- Certified Patent Valuation Analyst - TrainingDokument8 SeitenCertified Patent Valuation Analyst - TrainingDavid WanetickNoch keine Bewertungen

- Form No. 49A ApplicationDokument2 SeitenForm No. 49A ApplicationThota MaheshNoch keine Bewertungen

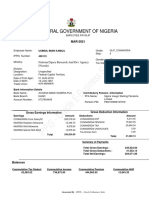

- IPPIS - Oracle E-Business Suite: Federal Government of NigeriaDokument1 SeiteIPPIS - Oracle E-Business Suite: Federal Government of NigeriaKamil Usman100% (1)

- Zimbabwe School Examinations Council: General Certificate of Education Ordinary LevelDokument24 SeitenZimbabwe School Examinations Council: General Certificate of Education Ordinary Levelthabo100% (2)

- Test Bank For Entrepreneurial Finance 5th Edition Leach, MelicherDokument12 SeitenTest Bank For Entrepreneurial Finance 5th Edition Leach, Melichera790327112Noch keine Bewertungen

- Index to 23 Volumes of The International Journal of Accounting Education and ResearchDokument82 SeitenIndex to 23 Volumes of The International Journal of Accounting Education and ResearchDianita SafitriNoch keine Bewertungen

- Finman 3Dokument10 SeitenFinman 3teryNoch keine Bewertungen

- Financial Management Class Notes For BBADokument20 SeitenFinancial Management Class Notes For BBASameel Rehman67% (3)

- Flash - Memory - Inc From Website 0515Dokument8 SeitenFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- BU330 Accounting For Managers Exam Part 1Dokument6 SeitenBU330 Accounting For Managers Exam Part 1G JhaNoch keine Bewertungen

- Packaging Equipment ROI Calculator v2018Dokument4 SeitenPackaging Equipment ROI Calculator v2018pangregisterlang99Noch keine Bewertungen

- Nicaragua Land Taxation PresentationDokument24 SeitenNicaragua Land Taxation PresentationJoseph Antony StiglitzNoch keine Bewertungen

- Milkindo CaseDokument5 SeitenMilkindo Casewahyu hidayatNoch keine Bewertungen

- Mini Case Chapter 8Dokument2 SeitenMini Case Chapter 8Peter PkNoch keine Bewertungen

- Rent control harms housing marketsDokument16 SeitenRent control harms housing marketsheda kaleniaNoch keine Bewertungen

- Compilation of Income Tax CasesDokument10 SeitenCompilation of Income Tax CasesPaula Jane EscasinasNoch keine Bewertungen

- Basics of Reinsurance PricingDokument55 SeitenBasics of Reinsurance PricingthisisghostactualNoch keine Bewertungen

- Hospitality IndustryDokument7 SeitenHospitality Industrygoodthoughts100% (1)

- Krispy Kreme-Case Study Solution FinanceDokument32 SeitenKrispy Kreme-Case Study Solution FinanceHayat Omer Malik100% (3)

- Please Note: Fields Marked With: (Red Asterisk) Are Mandatory Fields and Need To Be Filled UpDokument20 SeitenPlease Note: Fields Marked With: (Red Asterisk) Are Mandatory Fields and Need To Be Filled UpHinglaj SinghNoch keine Bewertungen

- Business Reporting July 2013 Exam PapersDokument16 SeitenBusiness Reporting July 2013 Exam Paperskarlr9Noch keine Bewertungen

- Replacement analysis optimizationDokument32 SeitenReplacement analysis optimizationNag RajuNoch keine Bewertungen

- I) Ii) Iii) 5 September 2014: ACC 106/115/117/114/418 (GENERIC CODES) AssignmentDokument4 SeitenI) Ii) Iii) 5 September 2014: ACC 106/115/117/114/418 (GENERIC CODES) AssignmentBryan Villarreal20% (5)

- Multiples Choice Questions With AnswersDokument60 SeitenMultiples Choice Questions With AnswersVaibhav Rusia100% (2)