Beruflich Dokumente

Kultur Dokumente

Balance Sheet of Kansai Nerolac Paints

Hochgeladen von

sunilkumar978Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Balance Sheet of Kansai Nerolac Paints

Hochgeladen von

sunilkumar978Copyright:

Verfügbare Formate

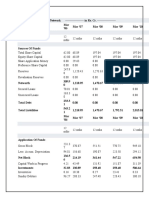

Balance Sheet of Kansai Nerolac Paints ------------------- in Rs. Cr.

-------------------

Mar '05 Mar '06 Mar '07 Mar '08 Ma

12 mths 12 mths 12 mths 12 mths 12

Sources Of Funds

Total Share Capital 25.51 25.51 25.51 26.95 2

Equity Share Capital 25.51 25.51 25.51 26.95 2

Share Application Money 0.00 0.00 1.44 0.00

Preference Share Capital 0.00 0.00 0.00 0.00

Reserves 297.89 380.55 484.78 566.74 62

Revaluation Reserves 0.00 0.00 0.00 0.00

Networth 323.40 406.06 511.73 593.69 65

Secured Loans 32.59 38.56 30.02 19.18 1

Unsecured Loans 54.55 71.22 79.98 78.77 7

Total Debt 87.14 109.78 110.00 97.95 9

Total Liabilities 410.54 515.84 621.73 691.64 74

Mar '05 Mar '06 Mar '07 Mar '08 Ma

12 mths 12 mths 12 mths 12 mths 12

Application Of Funds

Gross Block 294.34 354.62 424.41 480.15 54

Less: Accum. Depreciation 162.71 194.73 234.59 272.94 30

Net Block 131.63 159.89 189.82 207.21 23

Capital Work in Progress 29.26 17.96 17.63 26.64 3

Investments 179.12 163.93 154.82 232.14 29

Inventories 114.56 178.24 180.42 173.41 17

Sundry Debtors 104.84 143.92 194.69 212.93 20

Cash and Bank Balance 13.11 15.71 21.47 33.36 3

Total Current Assets 232.51 337.87 396.58 419.70 41

Loans and Advances 61.24 69.25 64.30 59.12 5

Fixed Deposits 0.21 0.08 0.02 0.02 4

Total CA, Loans & Advances 293.96 407.20 460.90 478.84 50

Deffered Credit 0.00 0.00 0.00 0.00

Current Liabilities 146.89 155.46 157.42 169.48 24

Provisions 76.54 77.70 44.03 83.70 8

Total CL & Provisions 223.43 233.16 201.45 253.18 32

Net Current Assets 70.53 174.04 259.45 225.66 18

Miscellaneous Expenses 0.00 0.00 0.00 0.00

Total Assets 410.54 515.82 621.72 691.65 74

Contingent Liabilities 14.36 6.90 2.88 5.91

Book Value (Rs) 126.78 159.19 200.05 220.33 24

Source : Religare Technova

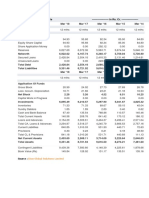

Profit & Loss account of Kansai Nerolac

------------------- in Rs. Cr. -------------------

Paints

Mar '05 Mar '06 Mar '07 Mar '08 Ma

12 mths 12 mths 12 mths 12 mths 12

Income

Sales Turnover 1,062.77 1,225.98 1,483.86 1,528.67 1,56

Excise Duty 136.83 164.65 196.39 209.19 18

Net Sales 925.94 1,061.33 1,287.47 1,319.48 1,38

Other Income 27.05 74.64 23.91 23.79 2

Stock Adjustments -2.16 41.22 5.82 -5.78

Total Income 950.83 1,177.19 1,317.20 1,337.49 1,40

Expenditure

Raw Materials 534.26 657.89 791.33 840.57 91

Power & Fuel Cost 10.63 15.49 19.95 20.46 2

Employee Cost 49.60 56.27 59.97 69.63 7

Other Manufacturing Expenses 16.37 15.85 18.81 17.12 1

Selling and Admin Expenses 170.01 187.48 217.08 163.46 18

Miscellaneous Expenses 10.48 11.93 14.33 13.81 1

Preoperative Exp Capitalised 0.00 0.00 0.00 0.00

Total Expenses 791.35 944.91 1,121.47 1,125.05 1,22

Mar '05 Mar '06 Mar '07 Mar '08 Ma

12 mths 12 mths 12 mths 12 mths 12

Operating Profit 132.43 157.64 171.82 188.65 15

PBDIT 159.48 232.28 195.73 212.44 17

Interest 1.00 0.84 1.33 1.81

PBDT 158.48 231.44 194.40 210.63 17

Depreciation 20.70 31.78 33.56 39.60 3

Other Written Off 0.00 0.00 0.00 0.00

Profit Before Tax 137.78 199.66 160.84 171.03 14

Extra-ordinary items 0.17 0.30 0.13 0.12

PBT (Post Extra-ord Items) 137.95 199.96 160.97 171.15 14

Tax 45.30 61.01 53.31 50.60 4

Reported Net Profit 91.96 138.76 107.66 119.79 9

Total Value Addition 257.09 287.02 330.14 284.48 30

Preference Dividend 0.00 0.00 0.00 0.00

Equity Dividend 29.33 51.02 30.99 32.34 3

Corporate Dividend Tax 4.16 7.15 4.40 5.50

Per share data (annualised)

Shares in issue (lakhs) 255.08 255.08 255.08 269.46 26

Earning Per Share (Rs) 36.05 54.40 42.21 44.46 3

Equity Dividend (%) 115.00 200.00 115.00 120.00 12

Book Value (Rs) 126.78 159.19 200.05 220.33 24

Source : Religare Technova

Explore Kansai Nerolac connections

Cash Flow of Kansai Nerolac Paints ------------------- in Rs. Cr. -------------------

Mar '05 Mar '06 Mar '07 Mar '08 Ma

12 mths 12 mths 12 mths 12 mths 12

Net Profit Before Tax 137.26 199.60 160.97 170.39 14

Net Cash From Operating Activities 96.78 6.90 109.91 150.08 20

Net Cash (used in)/from

-96.40 30.38 -25.04 -122.54 -11

Investing Activities

Net Cash (used in)/from Financing Activities -5.77 -35.86 -81.15 -15.66 -4

Net (decrease)/increase In Cash and Cash

-5.39 2.54 3.73 11.88 4

Equivalents

Opening Cash & Cash Equivalents 18.71 13.24 17.77 21.49 3

Closing Cash & Cash Equivalents 13.32 15.79 21.49 33.38 7

Source : Religare Technova

Key Financial Ratios of Kansai Nerolac

------------------- in Rs. Cr. -------------------

Paints

Mar '05 Mar '06 Mar '07 Mar '08 Ma

Investment Valuation Ratios

Face Value 10.00 10.00 10.00 10.00 1

Dividend Per Share 11.50 20.00 11.50 12.00 1

Operating Profit Per Share (Rs) 51.65 61.72 67.36 69.73 5

Net Operating Profit Per Share (Rs) 363.01 416.08 504.74 489.68 51

Free Reserves Per Share (Rs) 116.78 149.19 189.94 210.21 23

Bonus in Equity Capital 61.23 61.23 61.23 57.96 5

Profitability Ratios

Operating Profit Margin(%) 14.22 14.83 13.34 14.24 1

Profit Before Interest And Tax Margin(%) 11.80 11.67 10.62 11.15

Gross Profit Margin(%) 15.50 15.97 14.17 11.23

Cash Profit Margin(%) 11.97 15.83 10.85 10.95

Adjusted Cash Margin(%) 10.66 10.30 10.04 10.95

Net Profit Margin(%) 9.77 12.88 8.27 9.00

Adjusted Net Profit Margin(%) 8.46 7.35 7.46 9.00

Return On Capital Employed(%) 30.66 27.33 24.41 22.90 1

Return On Net Worth(%) 28.44 34.17 21.04 20.17 1

Adjusted Return on Net Worth(%) 24.61 19.49 19.03 17.85 1

Return on Assets Excluding Revaluations 14.51 18.53 13.08 12.68

Return on Assets Including Revaluations 14.51 18.53 13.08 12.68

Return on Long Term Funds(%) 30.93 27.87 24.74 22.94 1

Liquidity And Solvency Ratios

Current Ratio 1.28 1.61 2.14 1.88

Quick Ratio 0.75 0.93 1.33 1.16

Debt Equity Ratio 0.27 0.27 0.22 0.16

Long Term Debt Equity Ratio 0.26 0.25 0.20 0.16

Debt Coverage Ratios

Interest Cover 163.92 180.74 157.85 112.68 7

Total Debt to Owners Fund 0.27 0.27 0.22 0.16

Financial Charges Coverage Ratio 147.27 206.32 139.20 109.41 7

Financial Charges Coverage Ratio Post Tax 114.17 204.63 107.07 89.06 6

Management Efficiency Ratios

Inventory Turnover Ratio 8.21 6.04 7.21 9.11

Debtors Turnover Ratio 8.55 8.53 7.60 6.47

Investments Turnover Ratio 9.75 7.18 8.53 9.11

Fixed Assets Turnover Ratio 6.87 6.27 6.68 2.75

Total Assets Turnover Ratio 2.26 2.06 2.07 1.91

Asset Turnover Ratio 3.15 2.99 3.03 2.75

Average Raw Material Holding 32.87 39.04 28.96 27.06 2

Average Finished Goods Held 30.21 42.41 39.21 35.23 3

Number of Days In Working Capital 27.42 59.03 72.55 61.57 4

Profit & Loss Account Ratios

Material Cost Composition 57.69 61.98 61.46 63.70 6

Imported Composition of Raw Materials

31.00 33.86 36.02 35.31 3

Consumed

Selling Distribution Cost Composition 15.59 14.95 14.27 9.72 1

Expenses as Composition of Total Sales 0.10 0.33 0.16 0.41

Cash Flow Indicator Ratios

Dividend Payout Ratio Net Profit 36.42 41.92 32.86 31.58 3

Dividend Payout Ratio Cash Profit 29.73 34.10 25.05 23.73 2

Earning Retention Ratio 57.93 26.53 63.58 64.32 5

Cash Earning Retention Ratio 66.61 47.57 72.93 74.03 7

AdjustedCash Flow Times 0.87 0.99 0.84 0.67

Mar '05 Mar '06 Mar '07 Mar '08 Ma

Earnings Per Share 36.05 54.40 42.21 44.46 3

Book Value 126.78 159.19 200.05 220.33 24

Source : Religare Technova

Das könnte Ihnen auch gefallen

- Arch PharmalabsDokument6 SeitenArch PharmalabsChandan VirmaniNoch keine Bewertungen

- Balance Sheet of Everest Kanto CylinderDokument2 SeitenBalance Sheet of Everest Kanto Cylindersatya936Noch keine Bewertungen

- Balance Sheet of Empee DistilleriesDokument4 SeitenBalance Sheet of Empee DistilleriesArun PandiyanNoch keine Bewertungen

- Emami BSDokument1 SeiteEmami BSsZCCSZcNoch keine Bewertungen

- Balance Sheet of Balrampur Chini MillsDokument1 SeiteBalance Sheet of Balrampur Chini MillsAsrar Ahmed HamidaniNoch keine Bewertungen

- Britannia Industries: PrintDokument1 SeiteBritannia Industries: PrintTejaswiniNoch keine Bewertungen

- Balance Sheet PDFDokument1 SeiteBalance Sheet PDFTejaswiniNoch keine Bewertungen

- Balance Sheet of Sun TV NetworkDokument2 SeitenBalance Sheet of Sun TV NetworkMehadi NawazNoch keine Bewertungen

- Asian Paints Money ControlDokument19 SeitenAsian Paints Money ControlChiranth BhoopalamNoch keine Bewertungen

- Balance SheetDokument1 SeiteBalance SheetsarvodayaprintlinksNoch keine Bewertungen

- Balance Sheet of Indiabulls - in Rs. Cr.Dokument3 SeitenBalance Sheet of Indiabulls - in Rs. Cr.MubeenNoch keine Bewertungen

- Sagar CementsDokument33 SeitenSagar Cementssarbjeetk21Noch keine Bewertungen

- Balance Sheet of Gitanjali GemsDokument5 SeitenBalance Sheet of Gitanjali GemsHarold GeorgeNoch keine Bewertungen

- Apollo Hospitals Enterprises: PrintDokument2 SeitenApollo Hospitals Enterprises: Printm kumarNoch keine Bewertungen

- Kalindee Rail Nirman: Balance SheetDokument9 SeitenKalindee Rail Nirman: Balance Sheetrajat_singlaNoch keine Bewertungen

- 2 - Aditya - Balaji TelefilmsDokument12 Seiten2 - Aditya - Balaji Telefilmsrajat_singlaNoch keine Bewertungen

- Eveready Industries India Balance Sheet - in Rs. Cr.Dokument5 SeitenEveready Industries India Balance Sheet - in Rs. Cr.Jb SinghaNoch keine Bewertungen

- 32 - Akshita - Sun Pharmaceuticals Industries.Dokument36 Seiten32 - Akshita - Sun Pharmaceuticals Industries.rajat_singlaNoch keine Bewertungen

- Balance Sheet of Bata India LTDDokument1 SeiteBalance Sheet of Bata India LTDSanket BhondageNoch keine Bewertungen

- Money ControlDokument1 SeiteMoney ControlvishalNoch keine Bewertungen

- Balance Sheet MaricoDokument2 SeitenBalance Sheet Maricoajisha10Noch keine Bewertungen

- Previous YearsDokument9 SeitenPrevious YearsBhat Ashiq AzizNoch keine Bewertungen

- Balance Sheet of Reliance IndustriesDokument6 SeitenBalance Sheet of Reliance IndustrieskushkheraNoch keine Bewertungen

- HTTP WWW - MoneycontrolDokument1 SeiteHTTP WWW - MoneycontrolPavan PoliNoch keine Bewertungen

- 12 AdityaGupta Apollo Hospitals EnterprisesDokument112 Seiten12 AdityaGupta Apollo Hospitals EnterprisesPrateek GuptaNoch keine Bewertungen

- Balance Sheet of Essar Oil: - in Rs. Cr.Dokument7 SeitenBalance Sheet of Essar Oil: - in Rs. Cr.sonalmahidaNoch keine Bewertungen

- Mahindra Sources of DundDokument1 SeiteMahindra Sources of DundThe Addict VidzNoch keine Bewertungen

- Godrej IndustriesDokument5 SeitenGodrej Industriesshashank sagarNoch keine Bewertungen

- Balance Sheet of Apollo Tyres2010Dokument2 SeitenBalance Sheet of Apollo Tyres2010shivamgupt18Noch keine Bewertungen

- Indian Oil Corporation LTDDokument50 SeitenIndian Oil Corporation LTDpriyankagrawal7Noch keine Bewertungen

- Balance Sheet of ITC: - in Rs. Cr.Dokument13 SeitenBalance Sheet of ITC: - in Rs. Cr.Satyanarayana BodaNoch keine Bewertungen

- 12 - Ishan Aggarwal - Shreyans Industries Ltd.Dokument11 Seiten12 - Ishan Aggarwal - Shreyans Industries Ltd.rajat_singlaNoch keine Bewertungen

- Balance Sheet of Blue Dart ExpressDokument6 SeitenBalance Sheet of Blue Dart ExpressTakauv-thiyagi ThiyaguNoch keine Bewertungen

- Fianacial Analysis of Cement Industry (Ultratech, Ambuja, ACC)Dokument32 SeitenFianacial Analysis of Cement Industry (Ultratech, Ambuja, ACC)mayank0963Noch keine Bewertungen

- Finance Satyam AnalysisDokument12 SeitenFinance Satyam AnalysisNeha AgarwalNoch keine Bewertungen

- 15 - Manish - DLFDokument8 Seiten15 - Manish - DLFrajat_singlaNoch keine Bewertungen

- Binani Cement LTD Profit and Loss A/c: Mar '06 Mar '07 IncomeDokument8 SeitenBinani Cement LTD Profit and Loss A/c: Mar '06 Mar '07 IncomemrupaniNoch keine Bewertungen

- Analysis of Financial StatementsDokument7 SeitenAnalysis of Financial StatementsGlen ValereenNoch keine Bewertungen

- Jet AirwaysDokument5 SeitenJet AirwaysKarthik SrmNoch keine Bewertungen

- ClairantDokument2 SeitenClairantABHAY KUMAR SINGHNoch keine Bewertungen

- Hero Honda PNL &balanceDokument5 SeitenHero Honda PNL &balanceMukul AliNoch keine Bewertungen

- Balance Sheet of DR Reddys Laboratories: - in Rs. Cr.Dokument14 SeitenBalance Sheet of DR Reddys Laboratories: - in Rs. Cr.Anand MalashettiNoch keine Bewertungen

- Balance Sheet of Grasim IndustriesDokument7 SeitenBalance Sheet of Grasim IndustriesHiren KariyaNoch keine Bewertungen

- Wip Ro Key Financial Ratios - in Rs. Cr.Dokument4 SeitenWip Ro Key Financial Ratios - in Rs. Cr.Priyanck VaisshNoch keine Bewertungen

- Balance Sheet - in Rs. Cr.Dokument3 SeitenBalance Sheet - in Rs. Cr.jelsiya100% (1)

- United Breweries Holdings LimitedDokument7 SeitenUnited Breweries Holdings Limitedsalini sasiNoch keine Bewertungen

- Balance Sheet of Reliance IndustriesDokument5 SeitenBalance Sheet of Reliance Industriessabak37332Noch keine Bewertungen

- Capital and Liabilities:: United Western BankDokument15 SeitenCapital and Liabilities:: United Western BankAbhishek KarumbaiahNoch keine Bewertungen

- Balance Sheet - in Rs. Cr.Dokument72 SeitenBalance Sheet - in Rs. Cr.sukesh_sanghi100% (1)

- Balance Sheet of Reliance Industries: - in Rs. Cr.Dokument2 SeitenBalance Sheet of Reliance Industries: - in Rs. Cr.Sara HarishNoch keine Bewertungen

- Balance Sheet of TCSDokument8 SeitenBalance Sheet of TCSSurbhi LodhaNoch keine Bewertungen

- Balance Sheet of TCSDokument8 SeitenBalance Sheet of TCSAmit LalchandaniNoch keine Bewertungen

- Indigo FSADokument8 SeitenIndigo FSAKarthik AnanthNoch keine Bewertungen

- Ememi BlanceDokument6 SeitenEmemi BlanceAnonymous ldN95iANoch keine Bewertungen

- Income Statement 2018-2019 %: Sources of FundsDokument8 SeitenIncome Statement 2018-2019 %: Sources of FundsDebanjan MukherjeeNoch keine Bewertungen

- Reliance Chemotex Balance SheetDokument2 SeitenReliance Chemotex Balance SheetRushil GabaNoch keine Bewertungen

- Balance Sheet of JSLDokument2 SeitenBalance Sheet of JSLmail2jimmiNoch keine Bewertungen

- Company Info - Print FinancialsDokument2 SeitenCompany Info - Print Financialsmohan raj100% (1)

- Balancesheet - MRF LTDDokument4 SeitenBalancesheet - MRF LTDAnuNoch keine Bewertungen

- Discounted Cash Flow: A Theory of the Valuation of FirmsVon EverandDiscounted Cash Flow: A Theory of the Valuation of FirmsNoch keine Bewertungen

- Ricardo Pangan CompanyDokument38 SeitenRicardo Pangan CompanyAndrea Tugot67% (15)

- Tugas Pertemuan 3 - Alya Sufi Ikrima - 041911333248Dokument5 SeitenTugas Pertemuan 3 - Alya Sufi Ikrima - 041911333248Alya Sufi IkrimaNoch keine Bewertungen

- Internal Reconstruction - Theory NotesDokument3 SeitenInternal Reconstruction - Theory NotesNaomi SaldanhaNoch keine Bewertungen

- Financial Accounting Valix Summary 1 7Dokument12 SeitenFinancial Accounting Valix Summary 1 7notsogoodNoch keine Bewertungen

- Accounting EquationsDokument3 SeitenAccounting Equationsamitabhkumar1979Noch keine Bewertungen

- Detecting Financial Statement Fraud: Best Known For Committing Accounting FraudDokument11 SeitenDetecting Financial Statement Fraud: Best Known For Committing Accounting FraudKelvin LeongNoch keine Bewertungen

- CHP 18 - Controlling Activities and Operations On Page 630Dokument42 SeitenCHP 18 - Controlling Activities and Operations On Page 630Marvel MoviesNoch keine Bewertungen

- Divestiture SDokument26 SeitenDivestiture SJoshua JoelNoch keine Bewertungen

- 1.0 1.1 Company BackgroundDokument50 Seiten1.0 1.1 Company BackgroundFarah Izzaty0% (1)

- Importance of Capital BudgetingDokument4 SeitenImportance of Capital BudgetingSauhard AlungNoch keine Bewertungen

- JSW Energy Valuation 2022Dokument40 SeitenJSW Energy Valuation 2022ShresthNoch keine Bewertungen

- Midland County Popular Annual Financial ReportDokument18 SeitenMidland County Popular Annual Financial ReportMidland Daily NewsNoch keine Bewertungen

- IGCSE-OL - Bus - CH - 21 - Answers To CB ActivitiesDokument3 SeitenIGCSE-OL - Bus - CH - 21 - Answers To CB ActivitiesOscar WilliamsNoch keine Bewertungen

- RA 11524 Implementing Rules and RegulationsDokument19 SeitenRA 11524 Implementing Rules and RegulationsJuven Genovia LuzorataNoch keine Bewertungen

- Analysis of Financial StatementsDokument67 SeitenAnalysis of Financial StatementsAbdul BasitNoch keine Bewertungen

- Accounting GeniusDokument9 SeitenAccounting Geniusryan angelica allanicNoch keine Bewertungen

- Financial Accounting and Reporting Exam - FORMULAE SHEETDokument1 SeiteFinancial Accounting and Reporting Exam - FORMULAE SHEETDiivay AgarwalNoch keine Bewertungen

- Chapter 4Dokument73 SeitenChapter 4Queenie RanqueNoch keine Bewertungen

- Mastering Quickbooks - Part 1Dokument112 SeitenMastering Quickbooks - Part 1Shahriar Kabir Khan100% (2)

- Annual Report PT Sepatu Bata TBK 2015-2019Dokument15 SeitenAnnual Report PT Sepatu Bata TBK 2015-2019Kevin LetsoinNoch keine Bewertungen

- QuestionsDokument8 SeitenQuestionsHislord BrakohNoch keine Bewertungen

- CH 03Dokument50 SeitenCH 03lexfred55Noch keine Bewertungen

- Accounting Methods For GoodwillDokument4 SeitenAccounting Methods For GoodwillaskmeeNoch keine Bewertungen

- Basic Concept of ITIL and RACIDokument7 SeitenBasic Concept of ITIL and RACIAditi PandeyNoch keine Bewertungen

- Business PlanDokument27 SeitenBusiness Planminzy11Noch keine Bewertungen

- Discussion of Organization's Approach To Strategic Management of Knowledge and Organizational Learning. Evaluation of Its Use of Strategic Frameworks and Tools.Dokument13 SeitenDiscussion of Organization's Approach To Strategic Management of Knowledge and Organizational Learning. Evaluation of Its Use of Strategic Frameworks and Tools.chino monyatsiwa100% (1)

- Fixed Asset Accounting Project ReportDokument80 SeitenFixed Asset Accounting Project ReportRobinn Tigga0% (1)

- Journal To Final AccountsDokument38 SeitenJournal To Final Accountsguptagaurav131166100% (5)

- iDempiereDocBook PDFDokument2.572 SeiteniDempiereDocBook PDFDJ JAMNoch keine Bewertungen

- Business CombinationDokument40 SeitenBusiness Combinationjulia4razoNoch keine Bewertungen