Beruflich Dokumente

Kultur Dokumente

Measuring Risk Adjusted Return (Sharpe Ratio) of The Selected Mutual Funds - A Case of Daily Returns

Hochgeladen von

Dhimen JaniOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Measuring Risk Adjusted Return (Sharpe Ratio) of The Selected Mutual Funds - A Case of Daily Returns

Hochgeladen von

Dhimen JaniCopyright:

Verfügbare Formate

Journal of Business Management & Social Sciences Research (JBM&SSR)

Volume 3, No.4, April 2014

ISSN No: 2319-5614

Measuring Risk Adjusted Return (Sharpe Ratio) of the Selected

Mutual Funds A case of Daily Returns

Dhimen J. Jani, Research Scholar, Mewar University, Chittargarh, Rajasthan, India

Dr. Rajeev Jain, Dean & Head, University of Kota, (Rj.), India

Abstract

Generally, it has been observed that most of the small & retail investor invest their money in avenue which shall provide

higher return at relatively low to moderate risk. Mutual fund in an investment option which provide higher return at relatively low to moderate risk. This paper aims to provide insights of risk and return aspect of three (3) mutual funds namely

Birla Sun life Top 100, ICICI Top 100 and HDFC Equity Fund by applying Sharpe Ratio. The comparison has been also

made with market return as benchmark. The calculations are done on daily basis for one year i.e. Jan. 2013 and Dec.

2013. The result indicates that, out of three funds Birla sun life top 100 and ICICI top 100 outperformed the market. As far

as Sharpe ratio is concerned only ICICI top 100 found positive, which is better option for investment out above three.

Keywords: Mutual Funds, Sharpe Ratio, BSE Sensex.

Introduction

With the initialization of reforms in Indian economy in

1991 and onwards, the economy has seen great growth in

almost all segment of the economy. As a part of global

treaties, India was forced to open its doors for private

players for business. Gradually, almost all sectors of

Indian economy were opened one by one and many are

in pipeline. Financial sector was also one of the part of

it. Indian capital market has observed so many fundamental changes by SEBI. In earlier times there were only

few investment options available to investors for investment but with the initialization of financial reforms, the

investors now have many options for investment. The

basic characteristic of an investment option, from the

investors point of view should be low risk and high return. Mutual funds are the options which provide relatively higher return with low to moderate risk. The concept of mutual fund in India was however launched by

UTI (Unit Trust of India), in 1964. However, due to lack

of transparencies and other issues related to capital market, investors suffered much loss on their investment.

With the great efforts performed by SEBI time to time,

capital market was able to manage several financial crisis. Mutual fund is one of the most transparent investment option for investment working on NAV (Net Asset

Value) concept. Presently the concept of mutual fund has

become very familiar to almost all retail investor. The

key benefits ofmutual funds is that, it can be started with

nominal amount of INR 500, besides that tax benefit is

also available in someschemes, smart moves by experts,

advantage of equity return and at the same time investors

can reap the benefit of economies of scale as well as

diversification of risk.

Review of Literature

Wermers (2000) made study of performance of mutual

fund in US from 1975 to 1994 on the basis of fund re-

www.borjournals.com

turns and cost associated with it. It was found that, mutual fund trading was more than double form 1975 to

1994 period besides that, several stock outperformed the

market by 1.3 percent but their net return was underperformed.

A study performed by Carhart (1997) suggest that net

return are negatively correlated with the expense level,

which are generally much higher for actively managed

funds.

Grinblatt and Titman (1989, 1993) and Wermers (1997)

mentioned that mutual fund that there is special ability of

managers to select the fund that outstripped their benchmark return, even before any expenses are deducted. It

was empirically proven that growth oriented mutual

funds were outperformed their benchmark by an average

two to three per cent per year before expense.

Sharpe (1966) mentioned that in a modern portfolio theory the expected return of portfolio is linearly associated

with risk (unsystematic risk), by the application of various theories and concepts he developed Sharpe Ratio.

The ratio deals with identifying the risk and return aspects with reference to risk free rate of return which is

also known as reward to variability. It was emphasized

that unsystematic risk can be reduced, and it is generally

due to managerial inefficiency. Sharpe examined 34

open ended mutual fund from 1954 to 1963 and found

substantial variability in the Sharpe ratio from .78 to .43.

He opined that the reason behind variability could be

high fund expenses of AMCs or may be differences in

the managerial skills of fund manager.

Brown et al (1996) found tournament view of funding.

It was described as those mutual funds which has poor

financial performance for the half year tend to increase

the risk position in the upcoming half year. The fund

manager tend to strive with each other for capturing

Blue Ocean Research Journals

43

Journal of Business Management & Social Sciences Research (JBM&SSR)

Volume 3, No.4, April 2014

ISSN No: 2319-5614

market. It was empirically found that investor used to

invest in those mutual fund which realize good performance at the end of year.

b) To identify the best performing mutual fund scheme

with compare to risk and return amongst the selected mutual fund with reference to BSE Sensex

Sharpe Ratio

Research Methodology

In finance, the Sharpe ratio (also known as the Sharpe

index, the Sharpe measure, and the reward-tovariability ratio) is a way to examine the performance

of an investment by adjusting for its risk. The ratio

measures the excess return (or risk premium) per unit of

deviation in an investment asset or a trading strategy,

typically referred to as risk (and is a deviation risk measure), named after William Forsyth Sharpe.The higher the

ratio the better performance(http://en.wikipedia.org)

Data Collection- The entire study is based on secondary

data. These data have been collected from various websites and annual reports of respective AMCs. (Mentioned

at reference)

Period of Study-For the evaluation of selected mutual

fund, time period from Jan.2013 to Dec.2013 was selected. The calculation were made on daily bases by NAV.

Application of Statistical Tool- For the calculation of

risk and return were made on the basis of Sharpe Model.

BSE Sensex is taken as Benchmark return.

Calculation of Risk-free return SBI fixed deposit

interest rate has been considered as risk free return

which is 8.25% P.A.

(http://www.investopedia.com/terms/s/sharperatio.asp)

Research Objectives

a)

To measure performance of selected mutual fund i.e.

Birla Sun Life Top 100, HDFC Top 200 and ICICI

Top100 by application of Shape ratio.

Calculation of Return on Fund- Daily returns have

been calculated by closing value of NAV (minus)

Opening Value of NAV/Opening Value i.e. New NAVOld NAV/Old NAV on daily basis. For calculation of

Std. Dev. PA 252 trading days have been considered.

Limitation- Transaction cost and dividend payout have

been ignored (if any)

Results and Discussion

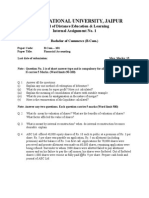

Table No.1.1

Birla Sun

HDFC

ICICI

Benchmark

Life Top

Equity

Top

BSE

100

SENSEX

Particulars

100

Total Return

0.08021

0.01892

0.1064

0.073878

Performance with benchmark (Sensex)

0.006332

-0.05496

0.032522

---

Std. Dev. (Daily)

0.010605

0.011954

0.009666

0.01100301

St. Dev (Annual)

0.168355

0.189762

0.153447

0.17466736

G sec SBI FDInt. Rate

0.0825

0.0825

0.0825

---

Sharpe Ratio

-0.0136

-0.33505

0.155754

---

www.borjournals.com

Blue Ocean Research Journals

44

Journal of Business Management & Social Sciences Research (JBM&SSR)

Volume 3, No.4, April 2014

ISSN No: 2319-5614

The above table indicates that Sharpe ratio for Birla Sun

Life Top 100 is -.0136, -.33505 for HDFC equity and

0.155754 for ICICI Top 100. Which indicates that from

the selected three mutual fund ICICI Top 100 is best as

far as Sharpe ratio is concerned. With reference to

benchmark return Birla Sun Life Top 100 and ICICI top

100 are outperformed stock, while HDFC equity is underperformed.

Reference

[1] Acharya, Debashis. & Sidana, Gajendra. (2007),

Classifying Mutual Funds in India: some results

from clustering Indian Journal of Economics and

Business, Vol.6, No.1, pp71-79.

[2] Barua, Samir K. & Verma, Jaynath R. (1991), Master Share: a Bonanza for Large Investors, Vikalpa,

Vol.16, No.1. Jan-March, pp29-34.

[3] Chandra Parssana (2007) Corporate Financial

Management Tata McGraw Publishing House.

[4] Brown, K.C, Harlow, W.V. and L. T. Starks (1996):

"Of Tournaments and Temptations: An Analysis of

Managerial Incentives in the Mutual Fund Industry",

Journal of Finance, 51, 85-110.

[5] Carhart, Mark, 1997, On persistence in mutual fund

performance, Journal of Finance 52, 5782.

[6] Grinblatt, Mark, and Sheridan Titman, 1989, Mutual

fund performance: An analysis of quarterly portfolio

holdings, Journal of Business 62, 394415.\

[7] Grinblatt, Mark, and Sheridan Titman, 1993, Performance measurement without benchmarks: An examination of mutual fund returns, Journal of Business 66, 4768.

[8] Wermers, Russ, 1997, Momentum investment strategies of mutual funds, performance persistence, and

survivorship bias, working paper, University of

Colorado.

[9] http://portal.amfiindia.com/NavHistoryReport_Frm.

aspx

[10] www.bseindia.com

www.borjournals.com

Blue Ocean Research Journals

45

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Chart of Entity ComparisonDokument4 SeitenChart of Entity ComparisonDee BeldNoch keine Bewertungen

- Dividend PolicyDokument15 SeitenDividend PolicyRahul AgrawalNoch keine Bewertungen

- DeluxeDokument4 SeitenDeluxeshielamaeNoch keine Bewertungen

- ArinoLegal PowerPoints Securities Regulation Ver2019Aug03Dokument89 SeitenArinoLegal PowerPoints Securities Regulation Ver2019Aug03KinitDelfinCelestialNoch keine Bewertungen

- BOI Self-Rating ScorecardDokument2 SeitenBOI Self-Rating ScorecardReynaldo YuNoch keine Bewertungen

- Republic Vs City of Paranaque Digest GR No. 191109Dokument2 SeitenRepublic Vs City of Paranaque Digest GR No. 191109Patrick James Tan100% (4)

- Mathay V Consolidated BankDokument2 SeitenMathay V Consolidated BankRaya Alvarez TestonNoch keine Bewertungen

- Mahusay Bsa 315 Module 3 Major OutputDokument7 SeitenMahusay Bsa 315 Module 3 Major OutputJeth MahusayNoch keine Bewertungen

- Bitfinex Preview BFX Conversion PitchDokument25 SeitenBitfinex Preview BFX Conversion PitchAnonymous wRn8eDNoch keine Bewertungen

- Industrial Renaissance - A One Stop ShopDokument4 SeitenIndustrial Renaissance - A One Stop ShopLex Artifex LLPNoch keine Bewertungen

- IM ChecklistDokument4 SeitenIM Checklistluvisfact7616Noch keine Bewertungen

- BCG - Value Creation - More Than Commodity PriceDokument31 SeitenBCG - Value Creation - More Than Commodity PricejrpranayNoch keine Bewertungen

- Barbeque Nation Hospitality Limited DRHP CompressedDokument515 SeitenBarbeque Nation Hospitality Limited DRHP Compressedsiddhant kohliNoch keine Bewertungen

- Fundamentals of Corporate Finance, 2/e: Robert Parrino, Ph.D. David S. Kidwell, Ph.D. Thomas W. Bates, PH.DDokument50 SeitenFundamentals of Corporate Finance, 2/e: Robert Parrino, Ph.D. David S. Kidwell, Ph.D. Thomas W. Bates, PH.DThành NguyễnNoch keine Bewertungen

- Corporate Governance: Mbat5 Saintgits Satheesh Kumar T.NDokument40 SeitenCorporate Governance: Mbat5 Saintgits Satheesh Kumar T.NMohd ThahzinNoch keine Bewertungen

- Bcom 101Dokument2 SeitenBcom 101ajtt38Noch keine Bewertungen

- State Bank of India (SBI)Dokument24 SeitenState Bank of India (SBI)Dayananda Singh AmomNoch keine Bewertungen

- Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseDokument9 SeitenMar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseYASH KOTHARINoch keine Bewertungen

- Ratio Analysis AssessmentDokument2 SeitenRatio Analysis AssessmentShyam SNoch keine Bewertungen

- BadhravathiDokument82 SeitenBadhravathitvasanthoshNoch keine Bewertungen

- Efficient Market HypothesisDokument10 SeitenEfficient Market Hypothesisabag0910Noch keine Bewertungen

- Reliance Infrastructure 091113 01Dokument4 SeitenReliance Infrastructure 091113 01Vishakha KhannaNoch keine Bewertungen

- Taxation ManagementDokument11 SeitenTaxation Managementshreya chhajerNoch keine Bewertungen

- Registered Office: 3 CIN: L17110MH1973PLC019786: Floor, Maker Chambers IV, 222, Nariman Point, Mumbai 400 021Dokument2 SeitenRegistered Office: 3 CIN: L17110MH1973PLC019786: Floor, Maker Chambers IV, 222, Nariman Point, Mumbai 400 021corona virusNoch keine Bewertungen

- Company Info - Print FinancialsDokument2 SeitenCompany Info - Print FinancialsregelNoch keine Bewertungen

- V. Marketing Plan: SWOT Analysis StrengthsDokument7 SeitenV. Marketing Plan: SWOT Analysis StrengthsA cNoch keine Bewertungen

- Story 0901 02Dokument1 SeiteStory 0901 02Pradeepa DharmawardanaNoch keine Bewertungen

- IDX Monthly Statistics Oktober 2009Dokument57 SeitenIDX Monthly Statistics Oktober 2009fahriyaniNoch keine Bewertungen

- Corporate and Economic Law MCQ PDFDokument157 SeitenCorporate and Economic Law MCQ PDFraj kumarNoch keine Bewertungen

- 8e Ch3 Mini Case MaterialityDokument8 Seiten8e Ch3 Mini Case MaterialityAnonymous Ul3litq0% (9)