Beruflich Dokumente

Kultur Dokumente

Phase 4 IP SWOT Analysis and NPV

Hochgeladen von

Penelope ManzoCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Phase 4 IP SWOT Analysis and NPV

Hochgeladen von

Penelope ManzoCopyright:

Verfügbare Formate

SWOT ANALYSIS & NPV

Penelope Manzo

Colorado Technical University

ECON616 - Applied Managerial Economics

Phase 4 IP - SWOT Analysis & NPV

Janet Hunter

SWOT ANALYSIS & NPV

Introduction

We have come towards the end of this decision for the expansion, however after meeting

with Lester it has been decided that we will have to calculate the operating cash flows, net

income, free cash flows, and the present value cash flow. There should also be an explanation to

the implications for AutoEdge and their shareholders whether there is a negative or positive NPV

or a conversely NPV. (Colorado Technical University Online, 2015)

$30.00

$20.00

Change in fixed assets

$10.00

Initial Capital Expenditure

Net Income

Depreciation (provided)

$0.00

1

($10.00)

Operating Cash Flows (FV)

Increase in fixed assets (provided)

Free Cash Flow

($20.00)

($30.00)

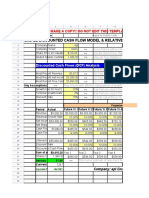

(Graph retrieved from Excel Spreadsheet)

SWOT ANALYSIS & NPV

SWOT Analysis & NPV

The Net Present Value (NPV) is the current value of the cash inflows that is generated by

the company. This calculation does not include the initial investment of the project. It is

considered to be the most reliable way to be used for the budgeting. It gives the final amount of

what comes into the business minus all the expenses of bills, supplies, salary, etc. The rule of the

NPV would be that if the value was under zero, then it would not be considered. The formula to

the NPV is:

. The Ct represents the net cash inflow period, the Co

represents the initial investment, the R is the discount Rate and the T is the period of time. The

biggest advantage to the NPV is that it calculates the time value of money and it is more reliable.

The disadvantage is that the calculation is the estimated cash flow and it could be inaccurate

from the actual result. (Jan, n.d.)

With the spreadsheet that Lester provided to calculate AutoEdges operational cash flows,

net earnings, present cash flows, NPV and free cash flows. As we can see from the image of the

spreadsheet below, (retrieved from Unit 4IP Spreadsheet) we can see that the NPV is at

US$55.29 million. This means that the cash flow for AutoEdge is being produced with a present

net worth that is higher than the initial investment expense of US$18 million. Since this is a good

amount of increase to the net cash flow for AutoEdge, it would be advisable to take advantage of

the opportunities at hand.

Time Period (Year 0, Year 1, etc)

Cost of Capital

6%

6%

7%

8%

8%

7%

$30.10

$34.20

$38.10

$40.40

$45.60

$50.00

(US$ in millions)

Revenue

SWOT ANALYSIS & NPV

($16.10)

($17.20)

($18.90

)

($19.50)

($21.40)

($24.30)

Depreciation

($4.10)

($4.40)

($4.80)

($4.90)

($5.30)

($5.70)

Interest Expense

($0.45)

($0.56)

($0.69)

($0.73)

($0.78)

($0.81)

Taxes

($1.10)

($1.30)

($1.70)

($1.90)

($2.00)

($2.10)

Food

$8.35

$10.74

$12.01

$13.37

$16.12

$17.09

Add: Depreciation

$4.10

$4.40

$4.80

$4.90

$5.30

$5.70

Cash Flows after tax

$12.45

$15.14

$16.81

$18.27

$21.42

$22.79

Change in fixed assets

($1.30)

($2.40)

($0.90)

$0.00

($4.90)

($2.10)

Net Income

$8.35

$10.74

$12.01

$13.37

$16.12

$17.09

Depreciation (provided)

$4.10

$4.40

$4.80

$4.90

$5.30

$5.70

Operating Cash Flows (FV)

$12.45

$15.14

$16.81

$18.27

$21.42

$22.79

Increase in fixed assets (provided)

($1.30)

($2.40)

($0.90)

$0.00

($4.90)

($2.10)

Free Cash Flow

$11.15

$12.74

$15.91

$18.27

$16.52

$20.69

0.943

0.89

0.816

0.735

0.681

0.666

$10.51

$11.34

$12.98

$13.43

$11.25

$13.78

$10.51

$11.34

$12.98

$13.43

$11.25

$13.78

Selling, General, Admin

Initial Capital Expenditure

($18.00)

Pvif factor

PV Cash flows

Value of future flows

Initial expenditure

NPV

($18.00)

$55.29

In Conclusion, even though the part for manufacturing would be at a lower price from

South Korea, we have to consider that they did not meet the quality standards for AutoEdge.

Since we were not able to provide this to the consumers, it has caused the reputation for

AutoEdge to go down leaving us with a few impediments. It would be recommended that

AutoEdge relocate their manufacturing operations into the United States and take full control.

This will help AutoEdge to see how the labor cost, human resources and investment capital will

end up being an advantage with lower costing.

SWOT ANALYSIS & NPV

Reference:

Colorado Technical University Online. (2014). ECON616 Phase 4 [Task List]. retrieved August

10, 2015, from Colorado Technical University Virtual Campus

Jan, I. (Ed.). (n.d.). Net Present Value (NPV). Retrieved August 11, 2015, from

http://accountingexplained.com/managerial/capital-budgeting/npv

Keat, P. G. Young, P. K. Y., & Erfle, S. E. (2013). Managerial Economics: Economic Tools for

Today's Decision Makers. 7th Edition. Pearson Publishing Co.

Manktelow, J. (n.d.). SWOT Analysis: Discover New Opportunities, Manage and Eliminate

threats. Retrieved August 11, 2015, from

http://www.mindtools.com/pages/article/newTMC_05.htm

Das könnte Ihnen auch gefallen

- Logic of English - Spelling Rules PDFDokument3 SeitenLogic of English - Spelling Rules PDFRavinder Kumar80% (15)

- CCIM Financial Calculator V 7 1Dokument60 SeitenCCIM Financial Calculator V 7 1rclemente01Noch keine Bewertungen

- The Investment DetectiveDokument10 SeitenThe Investment Detectivewiwoaprilia100% (1)

- TOEFL Critical AnalysisDokument7 SeitenTOEFL Critical AnalysisrobmijNoch keine Bewertungen

- Asl Story LessonDokument3 SeitenAsl Story Lessonapi-250216531100% (1)

- CCIM Financial Calculator V 6.0Dokument63 SeitenCCIM Financial Calculator V 6.0Wade KellyNoch keine Bewertungen

- Theo Hermans (Cáp. 3)Dokument3 SeitenTheo Hermans (Cáp. 3)cookinglike100% (1)

- Task-5-Didactics-of-English PaulaDBHdez UNADDokument12 SeitenTask-5-Didactics-of-English PaulaDBHdez UNADmishellNoch keine Bewertungen

- Unit 2 - Task 3 - Contrasting Teaching ApproachesDokument4 SeitenUnit 2 - Task 3 - Contrasting Teaching Approachesjaider gòmez vega100% (1)

- Page 37 - Word Stress, Intonation, SpeedDokument2 SeitenPage 37 - Word Stress, Intonation, Speedstarskyhutch100% (1)

- Task 1 Teaching English For Specific PurposesDokument3 SeitenTask 1 Teaching English For Specific PurposesAcolitos Parroquia San Matías ApóstolNoch keine Bewertungen

- Activity Guide and Evaluation Rubric - Task 5 - Pragmatics PDFDokument5 SeitenActivity Guide and Evaluation Rubric - Task 5 - Pragmatics PDFJulianna EscobarNoch keine Bewertungen

- Cep Lesson Plan 4Dokument6 SeitenCep Lesson Plan 4api-239043781Noch keine Bewertungen

- Activity Guide and Evaluation Rubric - Phase 1 - Terminology of Language TeachingDokument4 SeitenActivity Guide and Evaluation Rubric - Phase 1 - Terminology of Language TeachingedinsonNoch keine Bewertungen

- Finalproduct Unit 2 - Group 10Dokument11 SeitenFinalproduct Unit 2 - Group 10Erinzon CentanaroNoch keine Bewertungen

- Task 5 - Final ExamDokument3 SeitenTask 5 - Final ExamDago Nestor Ropain MartinezNoch keine Bewertungen

- Unit 2 Step 4 Speech Sounds and SemanticsDokument11 SeitenUnit 2 Step 4 Speech Sounds and Semanticscarolina mawadNoch keine Bewertungen

- Homework MetacognitionDokument5 SeitenHomework Metacognitiont0zivolyg1z3100% (1)

- App That Does Your Math HomeworkDokument5 SeitenApp That Does Your Math Homeworkukcbtfuif100% (1)

- Task 6 Group 1Dokument12 SeitenTask 6 Group 1Harold RojasNoch keine Bewertungen

- Collaborative LearningDokument24 SeitenCollaborative LearningJamilah VzqzNoch keine Bewertungen

- Activity Guide and Evaluation Rubric - Task 6 - Case StudiesDokument8 SeitenActivity Guide and Evaluation Rubric - Task 6 - Case StudiesHarold RojasNoch keine Bewertungen

- Assignment 1 (Ms. Ha)Dokument12 SeitenAssignment 1 (Ms. Ha)Nguyễn Khánh NgọcNoch keine Bewertungen

- Appendix 1: Lesson Plan (Template)Dokument5 SeitenAppendix 1: Lesson Plan (Template)bashaer abdul azizNoch keine Bewertungen

- Le Waijiao Magazine Volume 9Dokument52 SeitenLe Waijiao Magazine Volume 9Le Waijiao - CEO OfficeNoch keine Bewertungen

- Task 2 - Learning Strategies, Erika AlbaDokument4 SeitenTask 2 - Learning Strategies, Erika Albavitya100% (1)

- Task 4 - ReflectionDokument4 SeitenTask 4 - ReflectionAk PreciousNoch keine Bewertungen

- California Math Expressions Common Core Homework and Remembering Grade 5Dokument4 SeitenCalifornia Math Expressions Common Core Homework and Remembering Grade 5zskyyzrmg100% (1)

- Phase 2 Observational Practice Step 1 FOREIGN PDFDokument10 SeitenPhase 2 Observational Practice Step 1 FOREIGN PDFRosalinda Perez0% (2)

- Argumentative EssayDokument4 SeitenArgumentative Essaydinaluz0% (1)

- Berlitz Kids Self Evaluation - 00.02.02.12Dokument2 SeitenBerlitz Kids Self Evaluation - 00.02.02.12Mariusz RosińskiNoch keine Bewertungen

- UoPeople English Composition 2 Learning Journal Unit 3 T1 2022Dokument3 SeitenUoPeople English Composition 2 Learning Journal Unit 3 T1 2022Nang Shun Lei WinNoch keine Bewertungen

- Maths Homework Key Stage 1Dokument7 SeitenMaths Homework Key Stage 1p0hug0vewyz2100% (1)

- Phase 5 SWOT Analysis - Cristian Camilo Naranjo.Dokument10 SeitenPhase 5 SWOT Analysis - Cristian Camilo Naranjo.cristian arevaloNoch keine Bewertungen

- Homework Catch PhrasesDokument8 SeitenHomework Catch Phraseszskyyzrmg100% (1)

- Level 1 - Cambridge Vocab For IELTS, English, Ielts - MemriseDokument3 SeitenLevel 1 - Cambridge Vocab For IELTS, English, Ielts - MemrisetunisianouNoch keine Bewertungen

- Task 3 - Translation - Activity Design 551037Dokument7 SeitenTask 3 - Translation - Activity Design 551037Miller OrtizNoch keine Bewertungen

- Task 6 - Group 31 Corregido DianaDokument22 SeitenTask 6 - Group 31 Corregido Dianatulia carabaliNoch keine Bewertungen

- Teaching Language SkillsDokument6 SeitenTeaching Language Skillsfatihgun007Noch keine Bewertungen

- Teaching SkillsDokument21 SeitenTeaching SkillsAMIR HAMIDNoch keine Bewertungen

- Chemistry Homework AppDokument8 SeitenChemistry Homework Appl0p0bivozol3100% (1)

- Discussion Text About Is Homework Necessary For StudentsDokument8 SeitenDiscussion Text About Is Homework Necessary For Studentsjfurrksmg100% (1)

- Online Mode of Teaching-LearningDokument3 SeitenOnline Mode of Teaching-LearningAthira I PNoch keine Bewertungen

- Evaluating and Adaptin Materials-Paul DickinsonDokument26 SeitenEvaluating and Adaptin Materials-Paul DickinsonJoanne Lian Li FangNoch keine Bewertungen

- Future Value of MoneyDokument11 SeitenFuture Value of Moneyaymanmomani2111Noch keine Bewertungen

- Discounted Cash Flow AnalysisDokument12 SeitenDiscounted Cash Flow Analysisaymanmomani2111Noch keine Bewertungen

- BUS 5111 - Financial Management - Written Assignment Unit 3Dokument5 SeitenBUS 5111 - Financial Management - Written Assignment Unit 3LaVida LocaNoch keine Bewertungen

- Financial CalculatorDokument58 SeitenFinancial CalculatorAngela HarringtonNoch keine Bewertungen

- Economic Analysis of Product Development: MANOJ KIRAN - 2020214008Dokument33 SeitenEconomic Analysis of Product Development: MANOJ KIRAN - 2020214008ManojKiranNoch keine Bewertungen

- Chapter 4 Financial Statement AnalysisDokument63 SeitenChapter 4 Financial Statement AnalysismindayeNoch keine Bewertungen

- ACC602: Strategic Management Accounting: Week 10: Topic 7Dokument12 SeitenACC602: Strategic Management Accounting: Week 10: Topic 7Azmeena FezleenNoch keine Bewertungen

- Why You Should Use Capital Budgeting To Make InvestmentsDokument20 SeitenWhy You Should Use Capital Budgeting To Make InvestmentsRamish Kamal SyedNoch keine Bewertungen

- 5.2 Discounted Cash Flows, Internal Rate of Return, ROI. Feb 8-12. 2Dokument13 Seiten5.2 Discounted Cash Flows, Internal Rate of Return, ROI. Feb 8-12. 2John GarciaNoch keine Bewertungen

- Financial Institutions: Sonipat Narela Road, Near Jagdishpur Village Sonipat-131001, HaryanaDokument6 SeitenFinancial Institutions: Sonipat Narela Road, Near Jagdishpur Village Sonipat-131001, HaryanaBisma KhalidNoch keine Bewertungen

- Simple Discounted Cash Flow Model & Relative ValuationDokument14 SeitenSimple Discounted Cash Flow Model & Relative ValuationlearnNoch keine Bewertungen

- SolutionsToPracticeProblems Working Capital ManagementDokument2 SeitenSolutionsToPracticeProblems Working Capital ManagementPrima Facie100% (1)

- Chap 007Dokument32 SeitenChap 007NazifahNoch keine Bewertungen

- Error CDokument20 SeitenError CkleeNoch keine Bewertungen

- Example of Capital BudgetingDokument10 SeitenExample of Capital Budgetingreshma chauhanNoch keine Bewertungen

- Financial Forecasting: SIFE Lakehead 2009Dokument7 SeitenFinancial Forecasting: SIFE Lakehead 2009Marius AngaraNoch keine Bewertungen

- Enter Project Name HereDokument11 SeitenEnter Project Name HereMatthew AdeyinkaNoch keine Bewertungen

- CITATION Ste15 /L 1033Dokument5 SeitenCITATION Ste15 /L 1033GR PandeyNoch keine Bewertungen

- Different Types of Classrooms in An Architecture FacultyDokument21 SeitenDifferent Types of Classrooms in An Architecture FacultyLisseth GrandaNoch keine Bewertungen

- Karnu: Gbaya People's Secondary Resistance InspirerDokument5 SeitenKarnu: Gbaya People's Secondary Resistance InspirerInayet HadiNoch keine Bewertungen

- SQ1 Mogas95Dokument1 SeiteSQ1 Mogas95Basant Kumar SaxenaNoch keine Bewertungen

- 60617-7 1996Dokument64 Seiten60617-7 1996SuperhypoNoch keine Bewertungen

- Narrative ReportDokument6 SeitenNarrative ReportAlyssa Marie AsuncionNoch keine Bewertungen

- EDCA PresentationDokument31 SeitenEDCA PresentationToche DoceNoch keine Bewertungen

- Xavier High SchoolDokument1 SeiteXavier High SchoolHelen BennettNoch keine Bewertungen

- APICS-Houston Newsletter Sept 2012Dokument16 SeitenAPICS-Houston Newsletter Sept 2012Christopher SeifertNoch keine Bewertungen

- BRAC BrochureDokument2 SeitenBRAC BrochureKristin SoukupNoch keine Bewertungen

- Project Report On ICICI BankDokument106 SeitenProject Report On ICICI BankRohan MishraNoch keine Bewertungen

- GE 110HP DC Trolley MotorDokument10 SeitenGE 110HP DC Trolley MotorAnthony PetersNoch keine Bewertungen

- Curriculum Vitae Mukhammad Fitrah Malik FINAL 2Dokument1 SeiteCurriculum Vitae Mukhammad Fitrah Malik FINAL 2Bill Divend SihombingNoch keine Bewertungen

- Gee 103 L3 Ay 22 23 PDFDokument34 SeitenGee 103 L3 Ay 22 23 PDFlhyka nogalesNoch keine Bewertungen

- Chain of CommandDokument6 SeitenChain of CommandDale NaughtonNoch keine Bewertungen

- ListeningDokument2 SeitenListeningAndresharo23Noch keine Bewertungen

- CAPE Env. Science 2012 U1 P2Dokument9 SeitenCAPE Env. Science 2012 U1 P2Christina FrancisNoch keine Bewertungen

- Ruahsur Vangin Basket-Ball Court Lungrem ChimDokument4 SeitenRuahsur Vangin Basket-Ball Court Lungrem ChimchanmariansNoch keine Bewertungen

- Nikulin D. - Imagination and Mathematics in ProclusDokument20 SeitenNikulin D. - Imagination and Mathematics in ProclusannipNoch keine Bewertungen

- Sample Financial PlanDokument38 SeitenSample Financial PlanPatrick IlaoNoch keine Bewertungen

- StatisticsAllTopicsDokument315 SeitenStatisticsAllTopicsHoda HosnyNoch keine Bewertungen

- Performance MeasurementDokument13 SeitenPerformance MeasurementAmara PrabasariNoch keine Bewertungen

- 9francisco Gutierrez Et Al. v. Juan CarpioDokument4 Seiten9francisco Gutierrez Et Al. v. Juan Carpiosensya na pogi langNoch keine Bewertungen

- Animal Welfare in Bangladesh and The Role of Obhoyaronno CaseDokument11 SeitenAnimal Welfare in Bangladesh and The Role of Obhoyaronno CaseZarin Tanjim WoyshorjoNoch keine Bewertungen

- Launchy 1.25 Readme FileDokument10 SeitenLaunchy 1.25 Readme Fileagatzebluz100% (1)

- PCI Bank V CA, G.R. No. 121413, January 29, 2001Dokument10 SeitenPCI Bank V CA, G.R. No. 121413, January 29, 2001ademarNoch keine Bewertungen

- Volvo D16 Engine Family: SpecificationsDokument3 SeitenVolvo D16 Engine Family: SpecificationsJicheng PiaoNoch keine Bewertungen

- Name: Kartikeya Thadani Reg No.: 19bma0029Dokument4 SeitenName: Kartikeya Thadani Reg No.: 19bma0029Kartikeya ThadaniNoch keine Bewertungen

- Conceptual Diagram of Ways To Increase SalesDokument1 SeiteConceptual Diagram of Ways To Increase SalesO6U Pharmacy RecordingsNoch keine Bewertungen