Beruflich Dokumente

Kultur Dokumente

Oil E-Course

Hochgeladen von

Vali BazdagaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Oil E-Course

Hochgeladen von

Vali BazdagaCopyright:

Verfügbare Formate

OIL MODULE COURSE NOTES

WHERE IS OIL FOUND?

While petroleum is widely used, reserves of crude oil are spread unevenly around the world. Saudi

Arabia holds a fifth of the worlds oil and more than six times as much as the Asia-Pacific region.

Including Iran, Iraq, the United Arab Emirates, Kuwait and other producers, the Middle East holds

nearly 60% of the worlds proved reserves.

Reserves determine a countrys production potential, but production is influenced by other factors.

Saudi Arabia has by far the largest reserves and an estimated production capacity of 12.5

million barrels a day more than any other country could produce. However, it was not the

biggest producer in 2009, because it reduced its output, in line with Opecs production policy,

in order to support crude-oil prices during the recession. Iraq, with the third-largest oil

reserves in the world, did not even feature in the top-10 producer nations in 2008 war,

insurgency and prolonged underinvestment preventing it from realizing its potential. However,

it reached ninth position in 2009 and is expected to continue to climb the ranks over the next

few years. Venezuela, meanwhile, dropped out of the top-10 in 2009 because of persistent

underinvestment in its oil fields.

Worlds top-10 oil producers, 2009

Worlds top-10 oil producers, 2008

Million barrels a day

Country

Russia

Million barrels a day

Production

Country

10.032

Saudi Arabia

Production

10.846

Saudi Arabia

9.713

Russia

9.886

US

7.196

US

6.736

Iran

4.216

Iran

4.325

China

3.790

China

3.795

Canada

3.212

Canada

3.238

Mexico

2.979

Mexico

3.157

UAE

2.599

UAE

2.980

Iraq

2.482

Kuwait

2.784

Kuwait

2.481

Venezuela

2.566

Source: BP

Source: BP

OIL MODULE COURSE NOTES

OILS PLACE IN THE ENERGY MIX

Oil accounts for a third of the primary energy the world uses. Oil is used for heating, power generation and

as a feedstock for petrochemicals production. But transportation is the main driver of oil demand growth.

World primary energy demand

Oil: 34.1%

Gas: 20.9%

Coal: 26.5%

Nuclear: 5.9%

Other Renewables: 0.6%

Hydro: 2.2%

Biomass & Waste: 10%

Source: IEA

Oil demand growth may be dampened by a combination of the following factors:

Improvements in energy efficiency

Advances in engine technology

Biofuels

Electric vehicles

Synthetic transportation fuels produced from natural gas and coal

Government efforts to reduce oil usage by making it more expensive to produce carbon

However, no substitute is yet ready to replace oil at scale, and nothing can yet match it for economic

value or for energy density. As a result, oil will still be supplying a similar proportion perhaps 25%

by 2035 even if ambitious environmental policies are put in place.

In addition, because overall energy demand will increase in parallel with the expanding population

(see box), the world will continue to consume large volumes of oil for decades. The International

Energy Agency (IEA) estimates that oil demand will amount to between 81 million barrels a day and

107.4 million barrels a day in 2035, compared with the present level of about 87 million barrels a day.

2

OIL MODULE COURSE NOTES

The worlds population has roughly doubled in the past 50 years to 6.8 billion and its expected to

reach 9 billion or more by 2050 a lot more people wanting heat, light and mobility. In addition, in

China and India alone, more than 500 million people will move from a rural to an urban way of life

in the next two decades, leading to an increase in per capita energy consumption.

Forecasting oil demand

Oil demand will grow over the next two decades. Most, if not all of the growth in oil demand, is

expected to come from developing nations, such as China and India; oil demand in the rich countries

of the Organisation for Economic Co-operation and Development (OECD) has probably peaked.

But there is considerable uncertainty about the rate of growth. The IEA, for example, forecasts

demand will amount to between 81 million and 107.4 million barrels a day by 2035; the final

outcome will depend on economic growth, and the success governments have in introducing lowcarbon energy sources, such as biofuels, renewables and nuclear power, and energy-efficiency

policies. However, it is unlikely demand would ever reach the top end. It would be environmentally

undesirable because of its high carbon impact, and would be technically difficult to achieve.

In the IEAs New Policies Scenario, which takes account of broad policy commitments and plans

already announced by countries around the world, oil demand (excluding biofuels) will reach 99

million barrels a day by 2035 15 million barrels a day higher than in 2009. All of the growth will

come from developing countries, with 57% from China alone, mainly because of rising use of

transport fuels. Biofuels will reduce the need for oil for transportation, but only slightly.

OILS PLACE IN THE WORLD ECONOMY

Oil consumption and economic strength are inextricably linked. The biggest oil consumer in the

world, the US, is also the worlds biggest economy. The countries with the smallest per capita oil

consumption are typically the poorest. When the worlds oil supply threatens to become scarcer, its

importance quickly becomes evident (see box).

The links between energy and many other aspects of the economy mean oil prices also have a

significant effect on inflation. The price of oil dictates the cost of other forms of energy including

natural gas and the prices of manufactured goods, which need energy to be made, as well as

transportation and services.

OIL MODULE COURSE NOTES

In 2011, unrest in the Middle East affecting the production of Libya, an important oil producer

resulted in rapid oil-price inflation. In 2008, oil futures reached almost $150 a barrel, partly as

a result of escalating tension between the US and Iran over the latters nuclear programme,

which gave rise to concerns that Iranian oil sales could be disrupted.

Those events are part of a longer trend. In 1973, Middle Eastern oil producers suspended

exports to the countries that supported Israel in the Yom-Kippur War; this prompted a

fourfold rise in oil prices and sent the world economy into decline. Similarly, in 1979, the Iranian

Revolution led to a drastic drop in exports and a rapid escalation in world oil prices.

WHAT MOVES THE OIL PRICE?

High prices, in theory, result from a shortage of spare capacity. If supply is struggling to keep

ahead of demand, even relatively small disruptions to supplies or fears of disruptions can

result in higher prices. In the short term, oil demand is inelastic unable to adjust itself quickly to

fluctuations in oil prices. Interruptions could be caused by variety of factors, including oil-producing

facilities being temporarily closed down for maintenance, sabotage or bad weather.

Conversely, if there is too much spare capacity and the oil system can easily cope with demand, prices fall.

Prices ultimately dictate future supply. Low prices result in less investment, which causes supply

growth to slow down and eventually for the balance between supply and demand to tighten,

pushing up prices again. High prices, meanwhile, stimulate investment, which can lead to excess

supply and an eventual slump in prices.

Other factors affect oil prices. Opec argued that the oil-price spike that occurred in mid-2008 was

largely the result of speculation in financial markets. Although it is difficult to prove, the theory is

compelling and has become widely accepted: with China and India consuming spare oil to fuel the

rapid expansion of their economies, some investors thought oil prices would rise indefinitely; they

bought oil futures in order to sell them later at a profit, driving up oil prices in the process and

creating a self-fulfilling prophesy.

In addition, oil prices often rise when the US dollar falls and fall when the dollar strengthens. This

happens because a rise in the US dollar on currency markets makes oil more expensive to buy with

other currencies; also, buying oil securities has come to be regarded by banks, hedge funds and

other investors as a hedge against the falling dollar.

Measuring oil: the barrel.

OIL MODULE COURSE NOTES

CRUDE-OIL COMPOSITION

Crude oil is mainly made up of chains of carbon and hydrogen atoms, called hydrocarbons; it also

contains small amounts of sulphur, nitrogen, oxygen, metals and salts.

In order to become useful, crude oil must be refined into oil products, using a combination of heat,

pressure and catalysts.

Oils chemical flexibility enables refiners to turn undesirable hydrocarbon combinations into valuable

ones. The hydrocarbon compound is the most versatile on the chemical charts it is able to make an

estimated 2.5 million combinations.

TRANSPORTING OIL TO MARKET

At some point on its way to market, oil must pass through a pipeline to go from the point of

production to a consumption centre or to a coastal export point for onward transport by ship.

Oil can be transported by pipeline, rail and truck, but most internationally traded crude oil is

transported by sea.

Tankers are classified according to their

carrying capacity and usually have several

separate cargo tanks, enabling them

to carry different grades at the same

time. Transport costs fluctuate widely,

depending on oil supply and demand, and

the time of the year, as well as available

shipping capacity. Shorter-range product

tankers also transport refined petroleum

products by sea.

OIL MODULE COURSE NOTES

Oil tanker classifications

The carrying capacity of tankers is measured in deadweight tonnes (DWT) the weight of a

ships cargo, fuel, stores, passengers and crew, minus the weight of the ship itself.

The biggest tankers are called Ultra Large Crude Carriers, which can carry between 320,000

and 550,000 dwt. They are used for carrying crude oil on long-haul routes from the Persian

Gulf to Europe, the US and east Asia, via the Cape of Good Hope or the Strait of Malacca.

However, ULCCs are less common than Very Large Crude Carriers (VLCCs), which have a

capacity of between 150,000 and 320,000 dwt. Other categories include: Medium Range,

Panamax (the maximum size of vessel that can pass through the Panama Canal), Aframax,

and Suezmax (the biggest the Suez Canal can accommodate).

GRADES OF OIL

Oil varies in quality. Crudes are classified by density, sulphur content and various other

measurements established in an analysis called a crude-oil assay.

Lighter, or less dense, crude oils generally contain a greater proportion of higher-value products,

such as gasoline which can be recovered with simple distillation.

When simple distillation is applied to heavier, or denser, crudes, they tend to yield a greater share of

lower-value products, such as fuel oil. They generally require additional processing to produce the

desired range of products.

A grade or type of oil that yields a greater volume of high-value products is usually more

expensive than one that yields greater quantities of lower-value products.

The value of a particular crude oil is usually expressed as a premium or discount to a single

representative crude oil, a benchmark grade and reflects the degree of refining that it requires.

Grades are gauged by their specific gravity, according to a scale, calibrated in degrees, developed by

the American Petroleum Institute (API). Most values fall between 10 and 70API gravity. The heavier

the oil, the lower the gravity rating; the lighter the oil, the higher the gravity rating (see graphic).

OIL MODULE COURSE NOTES

Oil containing high levels of sulphur is known as sour crude. Crude with low levels of sulphur

is sweet crude. The sourer a crude, the more processing it requires and the less valuable it

tends to be.

West Texas Intermediate, the US benchmark, is a premium crude grade. It has a relatively

high natural yield of naphtha and gasoline, both of which are desirable, high-value products.

Nigerias Bonny Light, another premium grade, has a high natural yield of middle distillates.

However, almost half of the simple distillation yield from Saudi Arabias Arabian Light is a heavy

residue that requires further processing.

REFINING

Refineries come in many different sizes and configurations, depending on the size of the local

market, the types of products needed and the types of feedstocks available for processing.

But they all perform the same basic tasks; distilling crude oil into its various constituent fractions;

chemically rearranging low-value configurations of hydorcarbons molecules into high-value

combinations to produce a variety of end-products, from hydrocarbon gasoline to Tupperware; and

treating those products to meet environmental and other specifications and standards.

Hydrocarbons have a variety of uses, depending on their molecular structure.

For example, molecules used for cooking gas usually have up to four carbons, while gasoline is composed

of a longer chain, of up to 12. Lubricants motor oils, for example are even longer, with 50 carbons.

OIL MODULE COURSE NOTES

FRACTIONAL DISTILLATION

The components of petroleum have

different boiling points, so they can be

separated by heating the crude and

distilling the resulting vapour. First,

impurities such as water and salt are

removed from the crude. Then it is heated

often by burning fuel oil in a furnace.

The vaporised petroleum, heated to about

350C, is pumped into a fractionating

tower or atmospheric pipestill.

As the vapour rises up the tower, it cools down and its components condense back into several

distinct liquids, collecting in a series of trays.

The lightest products liquefied petroleum gas, naphtha and so-called straight-run gasoline are

recovered at the lowest temperatures, collecting near the top of the tower.

Middle distillates jet fuel, kerosene, diesel and home heating oil come next. These are followed

by the heaviest products, asphalt, lubricants and waxes. Heavy residue from the atmospheric

distillation process can also be reprocessed in a vacuum distillation unit, which uses a combination

of low pressure and high temperature to make more useful products.

At this stage of the refining process, jet fuel

is pretty much ready for use in an aircraft,

but most of the products arent finished.

They are blendstocks or feedstocks for

other processes. A combination of further

heating, pressure treatment and the use

of chemical catalysts break the chemical

bonds that link these chains together,

reconfiguring them into new combinations

to yield a host of desirable products.

A catalytic cracker can handle a number of feedstocks, including heavy gasoil, treated fuel oil and

residue from the lubricant treatment plant. Mixing the feedstock with a hot catalyst enables the

cracking reaction to take place at a relatively low temperature (about 500C). The products are

then separated in a fractionating column.

Another refining process, reforming, uses heat and pressure in the presence of catalysts to convert

naphtha feedstock into higher-octane, gasoline-blending components. The finished products

with marketable octane ratings and specific engine properties are then stored in tanks on the

refinerys premises, before being loaded onto barges, ships and trucks, or into special pipelines for

transportation beyond the refinery gate to market. Sulphur and other unwanted compounds are

removed in a hydrotreater.

8

OIL MODULE COURSE NOTES

OIL PRODUCTS

Motor gasoline/petrol: Gasoline is a light hydrocarbon fraction used in internal-combustion

engines. It is distilled from crude oil at between 35C and 215C. It can include additives such

as oxygenates to reduce the amount of carbon monoxide created during combustion, as well

as octane enhancers. It can also be mixed with ethanol.

Distillate fuels: This category covers a wide range of products, including diesels for use

in car engines, light heating oil and heavy gas-oils, which can be used as a feedstock in

petrochemicals plants. Diesel oil is distilled at around 180-380C. Diesel has overtaken

gasoline in the European market: fuel consumption is lower, and the performance of diesel

cars is now close to that of gasoline engines.

Jet fuel: Large turbine and turbo jet commercial aeroplanes use kerosene, similar to diesel.

This jet fuel needs to satisfy a welter of strict international regulations and usually has a

freezing point of lower than -40C to cope with cold temperatures at high altitude. Aircraft

operated by piston engines run on a different fuel aviation gasoline (avgas). This has a high

octane rating and more closely resembles motor gasoline than diesel.

Still gas: Also known as refinery gas, this is a gas, or mixture of gases (methane, ethane and

ethylene, for example), produced as a by-product of upgrading heavy petroleum fractions to

more valuable, lighter products through distillation, cracking and other methods. It can be

used as a refinery fuel or petrochemicals feedstock.

Residual fuel oils: Sometimes known as heavy fuel oils, these are extracted from what is

left after the distillate oils and lighter hydrocarbons have been distilled in the refinery. They

include oils suitable for powering some types of ships, power plants and heating equipment, as

well as for use in various other industrial purposes.

Asphalt and road oil: Also known as bitumen in some regions, asphalt is best known as a roadsurfacing material. A sticky semi-solid, it can be found in naturally occurring deposits, but it

can also be derived from crude oil, by separation through fractional distillation, usually in a

vacuum. It can be made harder by reacting it with oxygen. Road oil is any heavy petroleum oil

used as a surface treatment on roads.

Liquefied refinery gas: This is fractionated from refinery or still gases and kept liquid through

compression and/or refrigeration. These gases can include ethane, propane, butane, isobutane

and their various derivatives.

Petroleum coke: A black solid residue used as a feedstock in coke ovens for the steel industry,

for heating, chemicals production and for other purposes. It has high carbon content around

90-95% and low ash content, so it burns well. However, it has a high sulphur content, which

can create environmental problems. It is obtained by cracking and carbonising petroleumderived feedstocks, vacuum bottoms (the heavier material produced in vacuum distillation),

tar and pitches using processes such as delayed coking and fluid coking.

Liquefied petroleum gas (LPG): LPG is a type of refinery gas, mainly comprising propane. LPG

can be used to run vehicles and for domestic cooking and heating in remote areas that lack

alternative fuel sources. Or, indeed, firing up your barbecue.

9

OIL MODULE COURSE NOTES

Octane rating

This measures the resistance of fuels such as gasoline to detonation (or knocking) in an

engine. The rating is derived from comparisons between a given fuel and a benchmark mixture

of iso-octane and heptane. Higher octane ratings are more suitable for higher-performance

engines, whose greater compression ratios make the gasoline used more likely to detonate.

Gasoline engines work on 95- or 98-octane gasoline.

REFINERY ECONOMICS

Refining is a cyclical business. Gross margins the value of the products exiting the refinery minus

the cost of the crude oil reflect the sectors health. In recent years the refining business has spent

more time in weak parts of the cycle than strong ones, squeezed by rising operating costs and the

need for additional investment to meet higher environmental standards. Aided by sophisticated

computer software, refiners aim to run the optimal mix or slate of crudes through their refineries.

A refinerys profitability depends on:

The type and cost of the crude purchased

The prevailing price of individual oil products

The cost of the process that is selected to process the feedstock

The availability of facilities and technology capable of producing in-demand products

New flows of crude

Oil from unconventional sources, such as oil sands and oil

shale, is becoming more common.

These feedstocks require different refining techniques

from those used to process conventional crude oil, adding

another layer of cost.

For example, Canadas

oil sands produce

bitumen, which must

first be upgraded

in special units into

synthetic oil before

it can be refined

(synthetic crude oil

is called synthetic

10

OIL MODULE COURSE NOTES

because it is altered from its naturally occurring state by a chemical process.) The synthetic

crude oil can be upgraded using refinery processes such as distillation, coking, catalytic

cracking and hydroprocessing into a light sweet crude that can be converted into useful

petroleum products in a conventional refinery.

DOWNSTREAM: MARKETING AND DISTRIBUTION

Significant infrastructure in the form of roads, ships and products pipelines is required to move end

products from the refinery gate to end consumers.

Before being delivered to the customer, however, they are stored in petroleum products depots,

intermediary storage centres responsible for supplying a region, from which large volumes of

gasoline, diesel and heating oil can be dispensed locally as required.

Road tankers collect fuels heating oil, gasoline, diesel and aviation fuel from these depots,

delivering them to filling stations, businesses, homes and airlines.

The price of products to end-users are determined by a combination of the crude oil price, industry

margin and government taxes.

11

OIL MODULE COURSE NOTES

Storage

Crude oil is not always processed as soon as it arrives at its destination.

Many countries, especially in the developed world, hold strategic stocks of crude oil in

depleted reservoirs, above-ground tanks and tanker ships and products that allow them to

cope with any unexpected shortages of oil.

The level of oil stocks held in different locations around the world (but especially in big

markets such as the US and Europe) is an important determinant in the oil price because

stored oil serves as a buffer against supply shocks. The higher the stock level, the less the

market worries about supply interruptions. The lower the stock level, the more volatile prices

tend to become.

Mostly, governments mandate companies to hold minimum volumes of petroleum. Some

including the US, China and Japan have government-administered emergency oil stocks.

The US Strategic Petroleum Reserve (SPR), maintained by the Department of Energy, is the

worlds biggest, with a capacity of up to 727 million barrels.

IEA countries must hold oil-stock equivalent to 90 days of the previous years net imports.

PETROCHEMICALS

More value can be extracted from hydrocarbons by treating petroleum feedstocks in petrochemicals

plants to create new products.

The feedstocks the main ones being naphtha,

diesel and butane are treated in steam crackers,

which are usually located in the same place as a

refinery. The aim is to break down the molecules

under the action of heat to obtain substances

such as olefins (a group that includes ethylene

and propylene) and aromatics (distinctive smelling

chemicals like benzene and toluene).

12

OIL MODULE COURSE NOTES

These in turn provide the foundations for a range of familiar materials, including polyester, vinyl

acetate, polystyrene, polyurethane, detergent alcohols, synthetic rubber and many more products.

Petrochemicals production facilities are expensive to build, maintain and run. Like refiners, they

must contend with volatility in the prices of the commodities they produce, planning in years when

profits are high for times when margins are low.

13

OIL MODULE COURSE NOTES

BIOFUELS

Biofuels are a growing part of the fuel mix. These can be blended with, or even used instead of,

conventional gasoline and diesel.

Many governments, including the EU and the US, have mandated that biofuels account for a minimum

percentage of the fuel mix, so oil companies have become adept at acquiring and handling them.

The main biofuels on the market today so-called first-generation biofuels are:

Bioethanol

Biodiesel

They are made from a variety of raw materials, but are generally derived from crops such as:

Maize (bioethanol)

Sugar cane (bioethanol)

Palm oil (biodiesel)

Rapeseed (biodiesel)

Limits on biofuels market penetration

There are doubts over whether first-generation biofuels make a positive contribution to

the environment. In some cases, CO2 savings made by burning biofuels in motor vehicles can

be outweighed by the CO2 emitted during the cultivation of the crops, their conversion into

fuels and transportation to market. Ethanol has been successful in Brazil, where gasoline

has a 25% ethanol blend, but the country has the right climate and enough land to grow large

amounts of sugar cane. Few other countries share those natural advantages.

The US, for example, the worlds biggest ethanol producer, uses maize (corn) to produce

ethanol, but this is eight times less efficient as a biofuel crop than sugar cane. Ethanol

also has a lower energy density than gasoline about a third less. Biodiesel compares

more favourably to conventional refinery diesel in terms of energy content, but its a living

fuel; store it under the wrong conditions and it will go rancid. That adds another layer of

complication and cost. Ethanol or biodiesel tend to cause starting problems in cold weather,

too. And ethanol is corrosive, making it hard to transport.

In addition, land used for growing crops for fuels is land that cant be used for growing

crops for food; so biofuels cultivation presents a threat to food production and may cause

inflation in food prices.

Theres hope that second-generation biofuels, such as those produced from algae or biomass,

will help mitigate these problems by harnessing crops that grow on land that wouldnt be

suitable for food crops and by converting non-edible parts of plants into energy. But it will be

many years before these nascent technologies begin to have a big impact on fuel supply.

14

Das könnte Ihnen auch gefallen

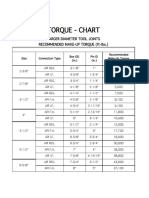

- Torque - Chart: Larger Diameter Tool Joints Recommended Make-Up Torque (FT-LBS.)Dokument1 SeiteTorque - Chart: Larger Diameter Tool Joints Recommended Make-Up Torque (FT-LBS.)Vali BazdagaNoch keine Bewertungen

- POMPA PZL 1600 HP Triplex PDFDokument2 SeitenPOMPA PZL 1600 HP Triplex PDFVali Bazdaga0% (1)

- Revised GP-7033 Handbook - CoverDokument116 SeitenRevised GP-7033 Handbook - CoverVali BazdagaNoch keine Bewertungen

- Make Up Torque Chart BesteDokument1 SeiteMake Up Torque Chart BesteVali Bazdaga100% (1)

- Make Up Torque Chart BesteDokument1 SeiteMake Up Torque Chart BesteVali Bazdaga100% (1)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 18 Oct 2017 Pre Feasibility Study Report Vallur TerminalDokument33 Seiten18 Oct 2017 Pre Feasibility Study Report Vallur TerminalasNoch keine Bewertungen

- PTQ 2009Dokument60 SeitenPTQ 2009Ale SanzNoch keine Bewertungen

- Training Course: International Oil Supply, Transportation, Refining & TradeDokument10 SeitenTraining Course: International Oil Supply, Transportation, Refining & TradeIbrahim SalahudinNoch keine Bewertungen

- CHE522 - Lecture01 (W2024) - Introduction - Rev0Dokument31 SeitenCHE522 - Lecture01 (W2024) - Introduction - Rev0MansiNoch keine Bewertungen

- 34 - Caustic Embrittlement in The Bayer IndustryDokument8 Seiten34 - Caustic Embrittlement in The Bayer IndustryEmily FreireNoch keine Bewertungen

- Syllabus Assistant Manager-2Dokument2 SeitenSyllabus Assistant Manager-2swarupkumarnayakNoch keine Bewertungen

- 2008 Sro 947Dokument3 Seiten2008 Sro 947Faheem ShaukatNoch keine Bewertungen

- Evaluation of A Small RefineryDokument364 SeitenEvaluation of A Small RefineryAdamu Musa100% (4)

- Engineering Standards for Construction of Plant PipingDokument19 SeitenEngineering Standards for Construction of Plant PipingAbdul Mateen100% (1)

- Project Profile of Edible OilDokument47 SeitenProject Profile of Edible OilManish Bhoyar100% (2)

- API STD 680Dokument1 SeiteAPI STD 680ErnestoSalMarNoch keine Bewertungen

- The Economics of Petroleum Refining: Understanding Profit DriversDokument20 SeitenThe Economics of Petroleum Refining: Understanding Profit Driversnelhuitron100% (1)

- Japan's Petroleum Industry OutlineDokument67 SeitenJapan's Petroleum Industry OutlineHoang ThangNoch keine Bewertungen

- Organic vs Inorganic ChloridesDokument4 SeitenOrganic vs Inorganic Chloridesck19654840Noch keine Bewertungen

- 0.2 HydrocrackingDokument26 Seiten0.2 HydrocrackingEsteban Lopez Arboleda100% (1)

- National Oil and Gas Policy For Uganda: Ministry of Energy and Mineral DevelopmentDokument68 SeitenNational Oil and Gas Policy For Uganda: Ministry of Energy and Mineral DevelopmentDunstan SendiwalaNoch keine Bewertungen

- Flowchart of Oil Refinining ProcessDokument32 SeitenFlowchart of Oil Refinining ProcessMalik MussadiqueNoch keine Bewertungen

- Simple & Complex RefineriesDokument6 SeitenSimple & Complex RefineriesFernanda Guerrero100% (1)

- Satorp Jubail RefineryDokument43 SeitenSatorp Jubail RefineryrmkhanNoch keine Bewertungen

- Fractionator Design PDFDokument6 SeitenFractionator Design PDFcutefrenzyNoch keine Bewertungen

- (D.e.petcoke Final Report) Gujarat Technological UniversityDokument30 Seiten(D.e.petcoke Final Report) Gujarat Technological Universityjaimin100% (1)

- PARCO (Pak Arab Oil Refinery) LTD Pakistan: Operation ManagementDokument23 SeitenPARCO (Pak Arab Oil Refinery) LTD Pakistan: Operation ManagementXtylish RajpootNoch keine Bewertungen

- Functional Specifications FOR Test Separation Module: Onshore Engg Services, N Delhi Document No.: OESG/ARP/TSP/M002 REVDokument18 SeitenFunctional Specifications FOR Test Separation Module: Onshore Engg Services, N Delhi Document No.: OESG/ARP/TSP/M002 REVAnonymous O0lyGOShYGNoch keine Bewertungen

- Pipeline and BlendingDokument37 SeitenPipeline and Blendingsohail1985Noch keine Bewertungen

- Designing a 50,000 TPA Rapeseed Oil Modification PlantDokument19 SeitenDesigning a 50,000 TPA Rapeseed Oil Modification PlantGift NkwochaNoch keine Bewertungen

- BIPUL KUMAR Inventory Managment in Iocl Barauni RefineryDokument99 SeitenBIPUL KUMAR Inventory Managment in Iocl Barauni RefineryAjay SastryNoch keine Bewertungen

- HMPP Hempaline Bro - WEBDokument6 SeitenHMPP Hempaline Bro - WEBvpjagannaathNoch keine Bewertungen

- Fundamentals of Refining and Petrochemicals ProcessesDokument263 SeitenFundamentals of Refining and Petrochemicals ProcessesneocentricgeniusNoch keine Bewertungen

- (PRL) Pakistan Refinery LimitedDokument16 Seiten(PRL) Pakistan Refinery LimitedHammad Naeem0% (1)

- Sankey Diagrams For Energy Balance: Statistics ExplainedDokument21 SeitenSankey Diagrams For Energy Balance: Statistics ExplainedSHREENoch keine Bewertungen