Beruflich Dokumente

Kultur Dokumente

5 Credit Investigation

Hochgeladen von

LansingOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

5 Credit Investigation

Hochgeladen von

LansingCopyright:

Verfügbare Formate

Management Tools for PFCCO ML Credit Administration

23

PFCCO Mindanao League

Credit Investigation

Purpose:

The purpose of this policy is to guide management on the process by which PFCCO

Mindanao League evaluates loans.

1.

Field Investigation

All loan applications must undergo credit investigation to determine trustworthiness

of the loan applicant. A copy of a thorough investigation report must be retained in the memberborrowers file. The loan officer obtains the necessary credit information from loan application

of the principal and the co-borrowers, which among others, must have the:

Name of applying cooperative borrower

Amount of initial loan and outstanding balance

Other information:

List of Current Directors and Officers

DOSRI Account and Aging of Loans

Project purpose/description of the project

Latest Bank Balances

Board of Resolution

Latest Financial Statement and with COOP PESOS Analysis

From the information gathered during the loan application process, the loan officer

provides the credit investigator with the information, which must be verified.

2.

Factors to be checked

The criteria for granting loans are the five (5) Cs of credit: capacity, character, condition,

collateral and capital, which are to be measured using the Credit Rating Form.

2.1.

Capacity This refers to the member-cooperative borrowers proven capability to

repay the loan on the agreed terms: i.e. size of amortization and frequency of

payments. This information is derived by computing the net disposable income of

the cooperative borrower. As a basic rule, the repayment terms should coincide

with the members cash flow, which could be daily, weekly, semi-monthly or

monthly. When the payment is quarterly, semi-annually or annually, the memberborrower should nonetheless be required to make monthly interest payments on the

loan.

PFCCO Mindanao League

Management Tools for PFCCO ML Credit Administration

24

In determining the capacity of the member-borrower/co-borrower to pay, the

following are taken into consideration:

2.2.

Total monthly amortization of the debt

Total debts of the member cooperative borrower (inclusive of debts to the

cooperative as well as from other sources)

Tangible asset value and their appraised value including share capital

Regular savings and share capital accumulation

Good credit record with others like banks and other lending institutions

Character- This refers to integrity, credibility, trustworthiness of the membercooperative borrower which among others, pertains to ones personal honesty,

dealings, reputation with other cooperative with in the area and organization and/or

other affiliations one is a member of. Officers of the Coop must be checked.

Character indicates the stability of the cooperative member-borrower as to the

investment. This is indicated by the following:

Good record of loan repayment with the League

Good record of loan repayment with other institutions (stores, banks, etc.)

Good reputation in the neighbourhood, organizations etc.

Regular savings habit.

2.3.

Capital this refers to the regular, consistent amount of savings or contributions

made by the member-borrower to the League and other institutions, which leads to

the build-up of financial, material resources.

2.4.

Collateral- this refers to any personal or movable asset, as well as real or

immovable asset owned by the cooperative member-borrower in the name that can

be offered as security for a loan. It could also be a personal or real property owned

by a third person, which is offered by this third party as security for the loan. All

loans should be collateralized, with the share capital as the minimum security.

The following are collaterals that can be accepted as loan security for mortgage or

chattel mortgage:

2.4.1. Real property (mortgage) all real estate offered collaterals shall carefully

be inspected, appraised and the mortgage lien annotated on the title. The

maximum amount of the loan to be granted shall not be more than 70% of

the conservative appraised value.

Required documents:

Land title (original or transfer certificate of title, tax declaration if

untitled land

Certification from the Registry of Deed that property has no lien

Current realty tax payment receipt and certificate of non-tax

delinquency

PFCCO Mindanao League

Management Tools for PFCCO ML Credit Administration

25

Registration of the mortgage with the Registry of Deeds; Tax

declaration annotated with the Assessors office of the Municipality

where the property is located

Appraisal report

Location map

Building plan

Insurance

Real estate mortgage document

2.4.2. Personal property (Chattel Mortgage)-movable properties, equipment,

inventories, jewellery, motor vehicles, etc.

The amount of the loan shall not be more than 50% of the appraised value

of the chattel. The chattel must not be more than three (3 ) years old.

Documents Required:

Certificate of ownership

Registration of ownership with the appropriate government agency

Deed of sale

List of equipment, machinery and/or inventories

2.4.3. Certificate of time or money market deposit in banks with a deed of

assignment executed by the cooperative borrower and duly endorsed by

the bank or the cooperative.

2.4.4. Assignment of deposit with the cooperative

2.4.5. Pledge of personal property

2.4.6. Deed of assignment of cooperative borrower consumers inventory

Documents required:

Deed of assignment

Promissory note

Loan application with co-makers signature

2.4.7. The signature(s) of the all the cooperative officers must always be present

on the loan application JSS form as well as on the promissory note and

other pertinent, relevant accessory contract; and signed in the present of

the loan officer, notary public except in applicable case(s) when fully

secured by savings deposits, time deposits and share capital.

2.4.8. Generally, tax declaration for untitled land is not acceptable as a basis for

granting real estate loan; except, when the real property offered is proven

not yet under the torrens title system (titles issue through the Registry of

Deeds); and/or if the loan applicant belongs to the indigenous peoples

groups of the locality and no other document of ownership can be

PFCCO Mindanao League

Management Tools for PFCCO ML Credit Administration

26

supplied. In such cases, other acceptable collaterals must be required of

the cooperative member-borrower, or the decision would depend on the

cooperative rules and regulations and the board authorization and or

decision.

Collateral shall not be the primary consideration in deciding to grant a

loan. It does not reduce the risk of the cooperative member-borrower to

default on his/her loan. It is used only to add value to the loan application

when the decision to grant the loan has been made based on the repayment

capacity of the member-borrower.

2.5.

Condition-refers to external factors affecting the socioeconomic circumstances of

the loan applicant and the loan. These factors are:

Legality of the proposed project

Environmental soundness of the project

Appropriateness of the business in relation with the climatic conditions

PFCCO Mindanao League

Das könnte Ihnen auch gefallen

- Receivable and Collections Policy - SampleDokument10 SeitenReceivable and Collections Policy - SampleMrLarry168Noch keine Bewertungen

- De La Salle University Petty Cash Replenishment FormDokument1 SeiteDe La Salle University Petty Cash Replenishment FormJP OcampoNoch keine Bewertungen

- Credit Investigation, Property Appraisal, Code of Ethics & Credit Evaluation PDFDokument75 SeitenCredit Investigation, Property Appraisal, Code of Ethics & Credit Evaluation PDFelizabeth bernales100% (1)

- A U T H o R I Z A T I o N To Conduct Credit InvestigationDokument2 SeitenA U T H o R I Z A T I o N To Conduct Credit InvestigationkitaNoch keine Bewertungen

- Certification of Acceptance for On-the-Job Training DocumentDokument1 SeiteCertification of Acceptance for On-the-Job Training DocumentangelNoch keine Bewertungen

- Chapter 6 & 7 - Credit and Collection ReportDokument25 SeitenChapter 6 & 7 - Credit and Collection Reportshairalee201475% (4)

- Credit and Collections PolicyDokument7 SeitenCredit and Collections PolicySrinivasan Kadangot33% (3)

- Credit Report InvestigationDokument3 SeitenCredit Report InvestigationKrizel DA0% (1)

- The New Leader's 100-Day Action PlanDokument15 SeitenThe New Leader's 100-Day Action Planramjet1Noch keine Bewertungen

- Credit Policy Sample637225320210415Dokument7 SeitenCredit Policy Sample637225320210415o'brianNoch keine Bewertungen

- Credit Investigation or Background Investigation PDFDokument4 SeitenCredit Investigation or Background Investigation PDFjoan100% (3)

- Abc Multi-Purpose Cooperative Approving and Signing Authority Policy RationaleDokument8 SeitenAbc Multi-Purpose Cooperative Approving and Signing Authority Policy RationaleKhints EttezilNoch keine Bewertungen

- Sprint Brief TemplateDokument3 SeitenSprint Brief TemplateCLDFNoch keine Bewertungen

- Memorandum of Contract For Sale and Purchase of Property PDFDokument2 SeitenMemorandum of Contract For Sale and Purchase of Property PDFLee LenynnNoch keine Bewertungen

- Starting A Business - Malabon CityDokument15 SeitenStarting A Business - Malabon CityJul ParaleNoch keine Bewertungen

- Cash AdvanceDokument2 SeitenCash AdvanceMatths Apoche100% (2)

- Credit Policy Manual Guide Provides RulesDokument2 SeitenCredit Policy Manual Guide Provides RulesAkther Hossain100% (8)

- Credit Operational Manual PDFDokument183 SeitenCredit Operational Manual PDFAwais Alvi93% (14)

- Credit Approval PolicyDokument15 SeitenCredit Approval Policymentor_muhaxheriNoch keine Bewertungen

- Loan Policy GuidelinesDokument4 SeitenLoan Policy GuidelinesNauman Malik100% (1)

- Service Catalog Template DocDokument3 SeitenService Catalog Template DocBabul BhattNoch keine Bewertungen

- Credit Management Essentials for CooperativesDokument141 SeitenCredit Management Essentials for CooperativesAndres Lorenzo III75% (16)

- Credit Instruments Power PointDokument11 SeitenCredit Instruments Power PointEd Leen Ü80% (10)

- Policy On Cash ShortagesDokument2 SeitenPolicy On Cash Shortagesmarvinceledio67% (3)

- SKF Dom Prod Pricelist - Nov 2013 FinalDokument8 SeitenSKF Dom Prod Pricelist - Nov 2013 FinalAnshul LoyaNoch keine Bewertungen

- Credit and Collection 2Dokument8 SeitenCredit and Collection 2Jaimee VelchezNoch keine Bewertungen

- Concise Australian Commercial Law by Clive Trone Turner John Gamble Roger - NewDokument659 SeitenConcise Australian Commercial Law by Clive Trone Turner John Gamble Roger - NewPhương TạNoch keine Bewertungen

- Salient Features of Revised Implementing Rules and Regulations of Ra 9520Dokument84 SeitenSalient Features of Revised Implementing Rules and Regulations of Ra 9520Gen60% (5)

- Security Analysis SyllabusDokument2 SeitenSecurity Analysis SyllabusTaksh DhamiNoch keine Bewertungen

- Project On SpicesDokument96 SeitenProject On Spicesamitmanisha50% (6)

- Cash Count SheetDokument1 SeiteCash Count Sheetjem monraeNoch keine Bewertungen

- Credit Administration and Documentation StandardsDokument7 SeitenCredit Administration and Documentation StandardsEINSTEIN2DNoch keine Bewertungen

- Chattel Mortgage Registration ProceduresDokument2 SeitenChattel Mortgage Registration ProceduresJan Roots100% (1)

- RR No. 31-2020Dokument3 SeitenRR No. 31-2020nathalie velasquezNoch keine Bewertungen

- PROCEDURE FLOWCHART - CREDIT AND COLLECTIONDokument2 SeitenPROCEDURE FLOWCHART - CREDIT AND COLLECTIONeunice cisneroNoch keine Bewertungen

- Introduction To Credit Management: Group 2 BSBA FM 3-10SDokument30 SeitenIntroduction To Credit Management: Group 2 BSBA FM 3-10SThamuz Lunox100% (2)

- Performance Standards For Credit and Other Types of Cooperatives With Credit ServicesDokument56 SeitenPerformance Standards For Credit and Other Types of Cooperatives With Credit ServicesIpiphaniaeFernandezItalio100% (3)

- Strategies and Tactics for Collecting on Overdue AccountsDokument9 SeitenStrategies and Tactics for Collecting on Overdue AccountsAkii WingNoch keine Bewertungen

- LOAN DELINQUENCY MANAGEMENTDokument32 SeitenLOAN DELINQUENCY MANAGEMENTAyomideNoch keine Bewertungen

- Retail Lending Policy 2010-11Dokument25 SeitenRetail Lending Policy 2010-11Bhandup YadavNoch keine Bewertungen

- Vault Cash ManagementDokument36 SeitenVault Cash ManagementJubaida Alam 203-22-694100% (2)

- Credit Policy PDFDokument23 SeitenCredit Policy PDFlyka libreNoch keine Bewertungen

- Social Responsibility and Good GovernanceDokument6 SeitenSocial Responsibility and Good GovernanceMark Asis100% (1)

- Feasibility StudyDokument4 SeitenFeasibility StudyChristieJoyCaballesParadela0% (1)

- Credit InvestigationDokument23 SeitenCredit Investigationdeshmukhprajakta369Noch keine Bewertungen

- 4 1.11 Credit Policy Sample 02022016Dokument13 Seiten4 1.11 Credit Policy Sample 02022016o'brianNoch keine Bewertungen

- Poro Sea Lovers Savings and Credit Cooperative Business PlanDokument6 SeitenPoro Sea Lovers Savings and Credit Cooperative Business PlanRizzvillEspinaNoch keine Bewertungen

- DBP Application For EmploymentDokument2 SeitenDBP Application For EmploymentDSWD6 DRMD - RRLM SECTIONNoch keine Bewertungen

- Del Monte Philippines, Inc. vs. AragoneDokument1 SeiteDel Monte Philippines, Inc. vs. AragoneLeizle Funa-FernandezNoch keine Bewertungen

- Rural BanksDokument11 SeitenRural BanksArah Pucayan Porras100% (1)

- Mix Occ - Site 2b1Dokument27 SeitenMix Occ - Site 2b1Neil VillasNoch keine Bewertungen

- Credit Policy and Procedure ManualDokument4 SeitenCredit Policy and Procedure ManualRafiq AhmedNoch keine Bewertungen

- Week 4 Credit and Collection Policies-2Dokument9 SeitenWeek 4 Credit and Collection Policies-2Akii WingNoch keine Bewertungen

- Asialink Finance CorporationDokument52 SeitenAsialink Finance CorporationJay BagsNoch keine Bewertungen

- SMDC Annual Report 2012Dokument61 SeitenSMDC Annual Report 2012Andrea Yu100% (1)

- Module OneDokument95 SeitenModule OneJoana Marie CabuteNoch keine Bewertungen

- Rdo 57Dokument6 SeitenRdo 57Simon David PañoNoch keine Bewertungen

- Commercial banks minimum capital requirementsDokument7 SeitenCommercial banks minimum capital requirementsMariel Crista Celda Maravillosa100% (1)

- Credit and Collection Management Practices CreditDokument8 SeitenCredit and Collection Management Practices CreditAilene QuintoNoch keine Bewertungen

- Resignation LetterDokument1 SeiteResignation LetterAntonio GanubNoch keine Bewertungen

- By Laws of Tski (06!09!2017 Revised)Dokument19 SeitenBy Laws of Tski (06!09!2017 Revised)Stewart Paul TorreNoch keine Bewertungen

- Reflection 2-Capital Markets VideoDokument2 SeitenReflection 2-Capital Markets Videojonald almazarNoch keine Bewertungen

- The Development and Functions of Credit in the PhilippinesDokument16 SeitenThe Development and Functions of Credit in the Philippinesweddiemae villarizaNoch keine Bewertungen

- SGV leadership structureDokument10 SeitenSGV leadership structureMajoy BantocNoch keine Bewertungen

- Philippine Financial Reporting Standards 16 Leases (PFRS 16)Dokument3 SeitenPhilippine Financial Reporting Standards 16 Leases (PFRS 16)Queen ValleNoch keine Bewertungen

- Module 6 Community Relations and Strategic PhilanthropyDokument21 SeitenModule 6 Community Relations and Strategic Philanthropychoose1Noch keine Bewertungen

- Loan Policy 1Dokument13 SeitenLoan Policy 1Vijay GangwaniNoch keine Bewertungen

- Outline 2Dokument1 SeiteOutline 2LansingNoch keine Bewertungen

- What Are The Remedies Provided For in Rule 63?Dokument1 SeiteWhat Are The Remedies Provided For in Rule 63?LansingNoch keine Bewertungen

- Outline 1Dokument1 SeiteOutline 1LansingNoch keine Bewertungen

- What Is Declaratory Relief?Dokument1 SeiteWhat Is Declaratory Relief?LansingNoch keine Bewertungen

- In Terp Leader 1Dokument1 SeiteIn Terp Leader 1LansingNoch keine Bewertungen

- PreambleDokument1 SeitePreambleLansingNoch keine Bewertungen

- What Is The Basis of R64Dokument1 SeiteWhat Is The Basis of R64LansingNoch keine Bewertungen

- What Is The Basis of R6Dokument1 SeiteWhat Is The Basis of R6LansingNoch keine Bewertungen

- FAQs K To 12 As of 6 February 2014Dokument7 SeitenFAQs K To 12 As of 6 February 2014Ernesto Mayo FogataNoch keine Bewertungen

- Outline The Procedure in Interpleader.Dokument1 SeiteOutline The Procedure in Interpleader.LansingNoch keine Bewertungen

- CH 11 OutlineDokument5 SeitenCH 11 OutlineLansingNoch keine Bewertungen

- Insurance V NLRCDokument3 SeitenInsurance V NLRCJovanni Christian Duarte PlaterosNoch keine Bewertungen

- ElectionDokument1 SeiteElectionLansingNoch keine Bewertungen

- Aquino Submits Draft Bangsamoro Law To CongressDokument4 SeitenAquino Submits Draft Bangsamoro Law To CongressLansingNoch keine Bewertungen

- Senate Approves New Dept. of ICTDokument1 SeiteSenate Approves New Dept. of ICTLansingNoch keine Bewertungen

- Senate Approves New Dept. of ICTDokument1 SeiteSenate Approves New Dept. of ICTLansingNoch keine Bewertungen

- The Place of Logic in PhilosophyDokument3 SeitenThe Place of Logic in PhilosophyLansingNoch keine Bewertungen

- The Higaonon Tribe of MindanaoDokument1 SeiteThe Higaonon Tribe of MindanaoLansing50% (2)

- Why We Shout in AngerDokument1 SeiteWhy We Shout in AngerLansingNoch keine Bewertungen

- ElectionDokument1 SeiteElectionLansingNoch keine Bewertungen

- 1 Min PrayerDokument5 Seiten1 Min PrayerLansingNoch keine Bewertungen

- 9 - Footnotes To Chapter 1Dokument1 Seite9 - Footnotes To Chapter 1LansingNoch keine Bewertungen

- Principles of LogicDokument67 SeitenPrinciples of LogicLansingNoch keine Bewertungen

- Its MagicDokument16 SeitenIts MagicRaju100% (15)

- Poverty SAEDokument3 SeitenPoverty SAELansingNoch keine Bewertungen

- 8 - Modern LogicDokument1 Seite8 - Modern LogicLansingNoch keine Bewertungen

- 7 - Logic of The Pure IdeaDokument1 Seite7 - Logic of The Pure IdeaLansingNoch keine Bewertungen

- Carangdang v. de Guzman (Remedial Law)Dokument20 SeitenCarangdang v. de Guzman (Remedial Law)LansingNoch keine Bewertungen

- Action Which Does Not SurviveDokument1 SeiteAction Which Does Not SurviveLansingNoch keine Bewertungen

- Plasabas v. CA (Civil Procedure)Dokument7 SeitenPlasabas v. CA (Civil Procedure)LansingNoch keine Bewertungen

- Model Trading Standard ExplainedDokument12 SeitenModel Trading Standard ExplainedVinca Grace SihombingNoch keine Bewertungen

- Customer Vendor/Supplier: Needs/Payment Accept-Reject/InvoiceDokument4 SeitenCustomer Vendor/Supplier: Needs/Payment Accept-Reject/InvoiceAshish VermaNoch keine Bewertungen

- What Are Mutual Funds?Dokument8 SeitenWhat Are Mutual Funds?ShilpiVaishkiyarNoch keine Bewertungen

- Aparna Singh 19021141023Dokument2 SeitenAparna Singh 19021141023Aparna SinghNoch keine Bewertungen

- Full PFSDokument61 SeitenFull PFSrowel manogNoch keine Bewertungen

- Microeconomics Midterm Review QuestionsDokument14 SeitenMicroeconomics Midterm Review QuestionsRashid AyubiNoch keine Bewertungen

- Alk2-Brief Bible History - MachenDokument80 SeitenAlk2-Brief Bible History - Machenanthonius70Noch keine Bewertungen

- Exploring Supply Chain Collaboration of Manufacturing Firms in ChinaDokument220 SeitenExploring Supply Chain Collaboration of Manufacturing Firms in Chinajuan cota maodNoch keine Bewertungen

- Activity #1:: V F3QpgxbtdeoDokument4 SeitenActivity #1:: V F3QpgxbtdeoSafaNoch keine Bewertungen

- Thermo-020H Decanter DownLoadLy - IrDokument6 SeitenThermo-020H Decanter DownLoadLy - IrLuis Rodriguez GonzalesNoch keine Bewertungen

- Australian Government Data Centre Strategy Strategy 2010-2025Dokument8 SeitenAustralian Government Data Centre Strategy Strategy 2010-2025HarumNoch keine Bewertungen

- BOP - Payments ChartDokument11 SeitenBOP - Payments ChartThe Russia MonitorNoch keine Bewertungen

- Stages in Consumer Decision Making ProcessDokument19 SeitenStages in Consumer Decision Making ProcessAnshita GargNoch keine Bewertungen

- Profile of The Indian Consumers 1Dokument2 SeitenProfile of The Indian Consumers 1mvsrikrishna100% (1)

- Pay Out DecisionDokument19 SeitenPay Out DecisiondawncpainNoch keine Bewertungen

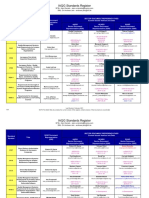

- IAQG Standards Register Tracking Matrix February 01 2021Dokument4 SeitenIAQG Standards Register Tracking Matrix February 01 2021sudar1477Noch keine Bewertungen

- Crs Report For Congress: Worldcom: The Accounting ScandalDokument6 SeitenCrs Report For Congress: Worldcom: The Accounting ScandalMarc Eric RedondoNoch keine Bewertungen

- Acetic Acid Uses, Suppliers & PropertiesDokument46 SeitenAcetic Acid Uses, Suppliers & PropertiesUsman DarNoch keine Bewertungen

- Agreement Form Undertaking Govt of IndiaDokument9 SeitenAgreement Form Undertaking Govt of IndiaPratik KulkarniNoch keine Bewertungen

- How Organizations Change Over TimeDokument36 SeitenHow Organizations Change Over TimeTareq Abu Shreehah100% (1)

- Copier CoDokument9 SeitenCopier CoHun Yao ChongNoch keine Bewertungen

- Capital StructureDokument2 SeitenCapital StructurenidayousafzaiNoch keine Bewertungen