Beruflich Dokumente

Kultur Dokumente

Ebs Tax Implementation

Hochgeladen von

kforkotaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ebs Tax Implementation

Hochgeladen von

kforkotaCopyright:

Verfügbare Formate

EBiz

Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Regime

is

a

set

of

condi0ons

mainly

poli0cal.

Eec0vely

one

the

condi0ons

imposed

can

be

taxa0on

related.

In

EBiz

tax,

you

can

create

a

new

responsibility

based

on

Tax

Manager

responsibility

per

OU,

by

seMng

MO

Opera0ng

Unit.

Once

within

this

responsibility,

you

can

dene

the

Tax

Rules,

Rates

and

condi0on.

To

allow

dening

taxa0on

for

Regimes

[a

poli0cally

governed

unit],

there

is

something

called

as

regime

to

rate

ow

in

R12.

Using

this

you

can

build

taxes

based

on

rules.

These

tax

rules

are

based

on

4Ps,

which

are

product,

place,

party

and

process.

Using

the

EBiz

Tax

module

in

R12,

you

can

dene

taxa0on

that

will

be

dependent

on

one

of

these

four

Ps.

For

example

the

taxa0on

can

vary

for

consumable

product

and

for

engineering

products.

Likewise

for

California

and

New

York

the

taxa0on

can

vary.

In

some

countries

with

agricultural

subsidies,

the

taxa0on

on

necessi0es

like

food

products

could

be

lower.

The

country

regime

is

driven

by

regime

to

rate

ow,

and

the

congura0ons

that

we

do

in

regime

to

rate

ow

varia0on

factors

for

varia0ons

in

taxa0on

rules

to

be

implemented.

Any

tax

in

the

world

is

based

on

either

party

specic

or

place

specic

or

product

specic

or

process

specic.

By

process

specic

it

means

this

is

associated

with

a

type

of

transac0on.

To

begin

with

we

need

to

know

the

geographic

tax

structure

of

the

country

and

how

exactly

the

product

types

relate

to

transac0ons.

The

regime

to

rate

ow

is

a

wizard,

in

which

the

rst

thing

we

do

is

to

create

a

regime.

However

the

regime

itself

belongs

to

Tax

Authority,

for

example

Government

of

Canada.

Within

the

tax

authority

you

can

have

regime.

A

Tax

authority

is

the

tax

administrator

of

the

country.

But

within

the

Tax

authority

there

will

be

dierent

bodies

that

manage

Central

Sales

Tax

or

State

Sales

Tax

or

VAT

etc.

These

dierent

bodies

are

called

regimes.

In

11i

the

equivalent

of

Tax

Regimes

was

the

Tax

Loca0ons.

Likewise

the

dierent

Tax

states

from

11i

are

now

available

as

jurisdic0ons

in

R12.

Within

the

regimes

you

can

build

rules.

These

rules

can

be

based

on

4

Ps.

Aber

dening

the

regime,

you

will

dene

something

called

as

"Tax".

This

is

a

charge

that

people

will

incur

or

recover.

Next

we

need

to

dene

jurisdic0on

which

is

an

op0onal

setup.

Jurisdic0on

for

example

species

that

a

tax

"ABC"

applies

to

country

"DEF".

The

tax

could

be

specic

to

country

or

to

state.

Therefore

jurisdic0on

is

a

geographical

loca0on

or

an

area

to

which

this

tax

applies.

The

step

by

step

guide

for

implemen0ng

Tax

by

Loca0on

in

R12

is

given

in

this

Metalink

h7ps://

support.oracle.com/CSP/main/ar0cle?cmd=show&type=ATT&id=557139.1:EBTAX

This

document

can

alternately

be

downloaded

from

link

h7p://0nyurl.com/23smd2n

You

could

have

0%

tax

or

exempt

tax

or

a

reduced

rate

tax

as

Tax

Status,

for

a

regime

for

a

par0cular

tax

that

you

have

dened

and

for

possibly

a

jurisdic0on.

This

is

the

purpose

of

tax

statuses.

Aber

dening

the

Regime,

Tax

Name,

Jurisdic0on,

Tax

Status-

next

we

specify

a

Tax

Rate.

This

can

be

a

10

or

12%

etc

on

the

combina0on

of

"Regime+Tax

Name+Jurisdic0on+Tax

Status".

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Based

on

these

the

jurisdic0on

of

the

transac0on,

tax,

tax

status-

a

Tax

rate

will

be

specied.

Then

tax

rules

are

applied,

based

on

the

tax

rules,

which

is

a

place

where

you

can

give

the

rules

based

on

4

Ps.

Basically,

when

a

transac0on

occurs,

it

can

determine

the

Product,Place,

Party

and

processes.

There

are

8

rules

given

here,

these

8rules

generate

excep0ons

to

the

arrive

at

the

generic

tax.

These

tax

Rules

can

be

based

on

a.

Place

of

supply,

based

on

where

you

are

billing

or

shipping

the

product

b.

Determina0on

of

the

applicability

of

the

tax

c.

Determina0on

of

the

tax

registra0on

d.

Determina0on

of

the

tax

based

on

status.

e.

Tax

rate

f.

Taxable

basis

-

based

on

line

amount

g.

Recovery

Rates

h.

Calcula0on

tax

amount

=

tax

basis

*

tax

rate

There

are

two

type

of

rules,

one

is

guided

rule

or

expert

rules.

Guided

rule

is

a

5

step

process,

this

is

like

a

wizard

and

is

used

for

crea0ng

a

new

rule.

If

the

setup

is

based

on

exis0ng

condi0ons

or

factors,

then

we

use

expert

rules

which

is

a

3

steps

process.

Expert

rules

has

two

less

steps

because

you

leverage

the

exis0ng

tax

condi0ons/factors.

A

typical

example

could

be

that

if

bill

to

is

from

London

and

ship

to

is

from

Dublin,

then

tax

should

be

5%.

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

In

Oracle

R12,

there

is

something

called

as

Legal

En0ty

Congurator

for

crea0ng

Legal

En0ty.

In

11i

Legal

En0ty

was

dummy

en0ty,

however

in

R12

it

has

real

signicance.

There

is

one

Accoun0ng

Legal

En0ty

and

another

is

GRE

legal

en0ty.

##

GRE

legal

en0ty

is

used

in

HRMS.

In

Accoun0ng

Legal

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Every

party,

whether

it

is

a

rst

party

or

third

party

gets

registered

in

TCA.

Here

we

will

do

the

EBiz

Tax

congura0on

such

that

goods

shipped

to

California

will

a7ract

7%

Taxa0on.

As

shown

in

gure

below,

when

crea0ng

an

invoice,

our

tax

regime

is

not

being

picked,

because

we

are

yet

to

create

an

eligible

Tax

Regime.

In

the

next

screenshots,

we

will

see

how

to

create

the

Tax

Regime

Code.

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

First

step

is

to

create

a

Tax

Regime

which

is

the

umbrella

for

the

en0re

tax

congura0on

you

will

perform

in

EBusiness

Tax

Module.

Now

dene

the

Tax

Regime

by

clicking

the

Create

bu7on.

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Here

you

can

create

a

Regime

either

for

a

country

or

group

of

countries.

For

example

in

Euro

zone,

mul0ple

countries

might

have

similar

taxa0ons.

This

is

shown

in

the

gure

below,

where

a

dropdown

list

for

Regime

Level

is

present.

In

this

example,

you

are

crea0ng

a

Tax

Regime

code

-

ANIL_TAX_REGIME.

This

regime

will

be

congured

in

a

manner

that

will

allow

it

to

be

eligible

when

crea0ng

transac0ons

where

goods

are

shipped

to/from

California

state.

Expand

the

Hide

Controls

and

Defaults

and

here

you

can

specify

if

the

taxes

calculated

by

this

engine

will

be

allowed

modica0on

from

invoice

screen.

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Click on con0nue and you will see a screen to assign party.

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Now proceed with further cong of regime.

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Now click Regime to Rate Flow for Wizard

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Now create Tax Status

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Create

tax

jurisdic0on

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

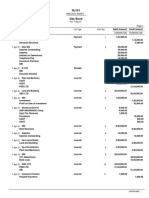

Now specify the accounts applicable for this tax

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Above

we

have

set

the

default

tax

status

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

We forgot to dene tax rate, let us create it and also set to default as well

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Now enable regime for transac0ons

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Now

create

invoice

with

Ship

to

in

California.

Click

Calculate

Tax

aber

saving.

At

the

0me

of

valida0ng

the

invoice

itself,

this

Tax

gets

calculated

anyways

.

Now,

we

can

create

an

invoice

with

Ship

To

being

in

California.

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Whenever

you

use

a

new

Tax,

you

can

use

the

tax

simulator

to

know

if

the

tax

calculated

is

correct

or

wrong.

Now

go

to

receivables....

Create

an

invoice

such

that

our

cong

works.

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Even

this

will

create

similar

tax

because

our

cong

is

not

specic

to

Payables.

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

++++

Tax

register

report

Also

the

Financial

Tax

Register

Report

++++++++++++++

begin

new

blog

You

can

provide

exemp0ons

for

specic

par0es.

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

end

new

blog

++++++++

begin

new

blog

Tax

Simulator

Using

Tax

simulator

you

can

test

your

congura0on

in

EBiz

Tax

without

crea0ng

a

transac0on.

This

module

is

not

very

stable

as

of

now,

but

is

a

very

important

feature

of

R12.

You

can

use

this

feature

on

development

system

for

example,

so

that

you

can

run

by

various

scenarios

for

tax

calcula0on

without

crea0ng

the

transac0ons.

Go

to

responsibility

Oracle

Tax

Simulator

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

end new blog

+++++++++++++

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

begin new blog

VAT

end

blog

++++++++++

new

blog

-

having

a

look

at

tax

cong

for

US

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Now Let us change the Taxable Basis

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

In

case

of

Expert

rules,

the

steps

for

Tax

Condi0on

Steps

and

Tax

Determining

Factors

is

not

a

part

of

the

wizard.

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

There

we

need

to

look

at

determining

factor

sets.

There

are

approx

100

factors

available

in

Oracle

R12.

Based

on

these

factors

you

can

create

the

rules,

for

example

product

classica0ons.

You

can

also

specify

excep0ons

condi0onally.

++++++++++

begin

blog

advanced

setup

op0ons

Let

us

create

a

formula

to

modify

the

Tax

List,

using

Advanced

Setup

Op0ons

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

The

City

Tax

should

compound

from

State

Tax

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Click

next

Now

dene

Rule

Condi0ons

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Click Next

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Click Next

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

+++

VAT

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

##

Look

at

Day

4

of

the

recording

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Tax Expense 03-000-7710-000-000

Interim Recovery 03-000-1220-000-000

Now create Tax Status

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

##2 We need to generate the accoun0ng.

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

EBiz Tax Implementa0on Demo - Notes

h7p://apps2fusion.com

training@apps2fusion.com

Das könnte Ihnen auch gefallen

- Ielts Support Tools 0915.original PDFDokument22 SeitenIelts Support Tools 0915.original PDFVatin ChalermdamrichaiNoch keine Bewertungen

- IBM BIometric ConsentDokument1 SeiteIBM BIometric ConsentPavan Manikanta ANoch keine Bewertungen

- Oracle 11i - Beginner Technical TrainingDokument105 SeitenOracle 11i - Beginner Technical TrainingkforkotaNoch keine Bewertungen

- SQL TutorialDokument200 SeitenSQL Tutorialroamer10100% (1)

- Excel 2Dokument86 SeitenExcel 2kforkota100% (3)

- Excel 2Dokument86 SeitenExcel 2kforkota100% (3)

- Listening Sample Task - Form CompletionDokument4 SeitenListening Sample Task - Form CompletionTrần Đăng Khoa100% (1)

- SQL TutorialDokument200 SeitenSQL Tutorialroamer10100% (1)

- Cross Charge in Oracle Projects AccountingDokument18 SeitenCross Charge in Oracle Projects Accountingdsgandhi6006100% (1)

- Fusion Payables Essentials Study GuideDokument10 SeitenFusion Payables Essentials Study Guidekforkota100% (2)

- Evosys Fso Fusion Financials V 1.1Dokument28 SeitenEvosys Fso Fusion Financials V 1.1kforkotaNoch keine Bewertungen

- Imp QueryDokument1 SeiteImp QuerykforkotaNoch keine Bewertungen

- Fusion General Ledger Cloud Study GuideDokument14 SeitenFusion General Ledger Cloud Study Guidekforkota33% (3)

- Self Prepared PA NotesDokument1 SeiteSelf Prepared PA NoteskforkotaNoch keine Bewertungen

- Cross Charge in Oracle Projects AccountingDokument18 SeitenCross Charge in Oracle Projects Accountingdsgandhi6006100% (1)

- EBS DataDokument106 SeitenEBS DatakforkotaNoch keine Bewertungen

- Navin Order To Cash With TablesDokument14 SeitenNavin Order To Cash With TableskforkotaNoch keine Bewertungen

- Navin Order To Cash With TablesDokument14 SeitenNavin Order To Cash With TableskforkotaNoch keine Bewertungen

- GL Recurring JournalDokument5 SeitenGL Recurring JournalkforkotaNoch keine Bewertungen

- BR100 Fixed AssetDokument28 SeitenBR100 Fixed AssetranzestarNoch keine Bewertungen

- Barcode Integration in OracleDokument5 SeitenBarcode Integration in OraclekforkotaNoch keine Bewertungen

- SETUPS FOR ALLDokument22 SeitenSETUPS FOR ALLpadmanabha14Noch keine Bewertungen

- Cash AdvancesDokument1 SeiteCash AdvanceskforkotaNoch keine Bewertungen

- Uber FinalDokument8 SeitenUber Finalkforkota100% (1)

- BR100 Fixed AssetDokument28 SeitenBR100 Fixed AssetranzestarNoch keine Bewertungen

- E Business TaxDokument15 SeitenE Business Taxkforkota100% (2)

- Oracle I-Procurement Process ManualDokument24 SeitenOracle I-Procurement Process Manualkforkota100% (1)

- Oracle I-Procurement Process ManualDokument24 SeitenOracle I-Procurement Process Manualkforkota100% (1)

- R12 Web ADIDokument9 SeitenR12 Web ADIkforkotaNoch keine Bewertungen

- Oracle Order Management Functional Interview Questions and AnswersDokument5 SeitenOracle Order Management Functional Interview Questions and Answerskforkota100% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Part B EnglsihDokument86 SeitenPart B EnglsihLiyana AzmanNoch keine Bewertungen

- De Thi Business Econ K58 CTTT C A Vinh Thi 14h30 Ngày 15.7.2021Dokument2 SeitenDe Thi Business Econ K58 CTTT C A Vinh Thi 14h30 Ngày 15.7.2021Trương Tuấn ĐạtNoch keine Bewertungen

- Computational Multiple Choice Questions on Cash and ReceivablesDokument18 SeitenComputational Multiple Choice Questions on Cash and ReceivablesAndrin LlemosNoch keine Bewertungen

- Spoilage and Rework ProbsDokument3 SeitenSpoilage and Rework ProbsShey INFTNoch keine Bewertungen

- Thekeystolateralleadership PDFDokument8 SeitenThekeystolateralleadership PDFMichael SmithNoch keine Bewertungen

- Praktikum Akuntansi Biaya 2021 VEA - Template KerjaDokument228 SeitenPraktikum Akuntansi Biaya 2021 VEA - Template KerjaHendy Prastyo W0% (2)

- Swot Analysi S: Output Process I NputDokument20 SeitenSwot Analysi S: Output Process I Nputchobiipiggy26Noch keine Bewertungen

- Day Book 2Dokument2 SeitenDay Book 2The ShiningNoch keine Bewertungen

- Bicolandia Drug Vs CirDokument6 SeitenBicolandia Drug Vs CiritatchiNoch keine Bewertungen

- Supply Chain Management: Sunil Chopra (3rd Edition)Dokument29 SeitenSupply Chain Management: Sunil Chopra (3rd Edition)azamtoorNoch keine Bewertungen

- Test Bank For Accounting Principles 12th Edition WeygandtDokument37 SeitenTest Bank For Accounting Principles 12th Edition Weygandtdupuisheavenz100% (13)

- Agora - Managing Supply ChainDokument25 SeitenAgora - Managing Supply Chainabid746Noch keine Bewertungen

- Q3 - Financial Accounting and Reporting (Partnership Accounting) All About Partnership DissolutionDokument3 SeitenQ3 - Financial Accounting and Reporting (Partnership Accounting) All About Partnership DissolutionALMA MORENANoch keine Bewertungen

- Software Asssociates11Dokument13 SeitenSoftware Asssociates11Arslan ShaikhNoch keine Bewertungen

- WorkbookDokument33 SeitenWorkbookapi-295284877Noch keine Bewertungen

- Printers' Marketplace September 21, 2010Dokument66 SeitenPrinters' Marketplace September 21, 2010Christopher AllenNoch keine Bewertungen

- Rogers bill summary for $307.35 dueDokument6 SeitenRogers bill summary for $307.35 dueLayla CastilloNoch keine Bewertungen

- SOW - General - ConcretingDokument23 SeitenSOW - General - ConcretingJonald DagsaNoch keine Bewertungen

- TPM Essay - 1st PartDokument4 SeitenTPM Essay - 1st PartFernanda MarquesNoch keine Bewertungen

- Capital ManagementDokument61 SeitenCapital Managementra2002ma2002931Noch keine Bewertungen

- 11th Commerce 3 Marks Study Material English MediumDokument21 Seiten11th Commerce 3 Marks Study Material English MediumGANAPATHY.SNoch keine Bewertungen

- Depreciation Notes - Advanced AccountingDokument16 SeitenDepreciation Notes - Advanced AccountingSam ChinthaNoch keine Bewertungen

- Ahrend Sen 2012Dokument12 SeitenAhrend Sen 2012sajid bhattiNoch keine Bewertungen

- Comprehensive PlanDokument338 SeitenComprehensive PlanAldo NahedNoch keine Bewertungen

- Advertisment and MediaDokument21 SeitenAdvertisment and MediaMohit YadavNoch keine Bewertungen

- Citizens CharterDokument505 SeitenCitizens CharterBilly DNoch keine Bewertungen

- Maximize Google Ads Results With a Low BudgetDokument3 SeitenMaximize Google Ads Results With a Low BudgetErick Javier FlorezNoch keine Bewertungen

- Andersen violated auditing standards in Enron auditDokument2 SeitenAndersen violated auditing standards in Enron auditJanelAlajasLeeNoch keine Bewertungen

- Ihrm 1Dokument77 SeitenIhrm 1Farha Naz0% (1)

- Kaizen Management for Continuous ImprovementDokument39 SeitenKaizen Management for Continuous ImprovementSakshi Khurana100% (4)