Beruflich Dokumente

Kultur Dokumente

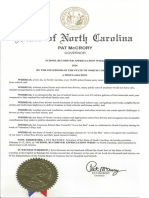

SL2004-105 (Session Law Creating Franklin TDA)

Hochgeladen von

Thunder PigOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

SL2004-105 (Session Law Creating Franklin TDA)

Hochgeladen von

Thunder PigCopyright:

Verfügbare Formate

GENERAL ASSEMBLY OF NORTH CAROLINA

SESSION 2003

SESSION LAW 2004-105

SENATE BILL 1060

AN ACT TO AUTHORIZE THE TOWN OF FRANKLIN TO LEVY A ROOM

OCCUPANCY AND TOURISM DEVELOPMENT TAX.

The General Assembly of North Carolina enacts:

SECTION 1. Occupancy tax. (a) Authorization and Scope. The Board

of Aldermen of the Town of Franklin may levy a room occupancy tax of up to three

percent (3%) of the gross receipts derived from the rental of any room, lodging, or

accommodation furnished by a hotel, motel, inn, tourist camp, or similar place within

the town that is subject to sales tax imposed by the State under G.S. 105-164.4(a)(3).

This tax is in addition to any State or local sales tax. This tax does not apply to

accommodations furnished by nonprofit charitable, educational, or religious

organizations when furnished in furtherance of their nonprofit purpose.

SECTION 1.(b) Administration. A tax levied under this section shall be

levied, administered, collected, and repealed as provided in G.S. 160A-215. The

penalties provided in G.S. 160A-215 apply to a tax levied under this section.

SECTION 1.(c) Distribution and use of tax revenue. The Town of Franklin

shall, on a quarterly basis, remit the net proceeds of the occupancy tax to the Franklin

Tourism Development Authority. The Authority shall use at least two-thirds of the funds

remitted to it under this subsection to promote travel and tourism in Franklin and shall

use the remainder for tourism-related expenditures.

The following definitions apply in this subsection:

(1)

Net proceeds. Gross proceeds less the cost to the town of

administering and collecting the tax, as determined by the finance

officer, not to exceed three percent (3%) of the first five hundred

thousand dollars ($500,000) of gross proceeds collected each year and

one percent (1%) of the remaining gross receipts collected each year.

(2)

Promote travel and tourism. To advertise or market an area or

activity, publish and distribute pamphlets and other materials, conduct

market research, or engage in similar promotional activities that attract

tourists or business travelers to the area; the term includes

administrative expenses incurred in engaging in the listed activities.

(3)

Tourism-related expenditures. Expenditures that, in the judgment of

the Franklin Tourism Development Authority, are designed to increase

the use of lodging facilities, meeting facilities, or convention facilities

in the town or to attract tourists or business travelers to the town. The

term includes tourism-related capital expenditures.

SECTION 2. Tourism Development Authority. (a) Appointment and

Membership. When the Board of Aldermen adopts a resolution levying a room

occupancy tax under this act, it shall also adopt a resolution creating the Franklin

Tourism Development Authority, which shall be a public authority under the Local

Government Budget and Fiscal Control Act. The resolution shall provide for the

membership of the Authority, including the members' terms of office, and for the filling

of vacancies on the Authority. At least one-third of the members must be individuals

who are affiliated with businesses that collect the tax in the town and at least

three-fourths of the members must be individuals who are currently active in the

promotion of travel and tourism in the town. The Board of Aldermen shall designate one

General Assembly of North Carolina

Session 2003

member of the Authority as chair and shall determine the compensation, if any, to be

paid to members of the Authority.

The Authority shall meet at the call of the chair and shall adopt rules of

procedure to govern its meetings. The Finance Officer for the Town of Franklin shall be

the ex officio finance officer of the Authority.

SECTION 2.(b) Duties. The Authority shall expend the net proceeds of the

tax levied under this act for the purposes provided in Section 1 of this act. The Authority

shall promote travel, tourism, and conventions in the town, sponsor tourist-related

events and activities in the town, and finance tourist-related capital projects in the town.

SECTION 2.(c) Reports. The Authority shall report quarterly and at the

close of the fiscal year to the Board of Aldermen on its receipts and expenditures for the

preceding quarter and for the year in such detail as the Board of Aldermen may require.

SECTION 3. City administrative provisions. G.S. 160A-215(g) reads as

rewritten:

"(g) This section applies only to Beech Mountain District W, to the Cities of

Gastonia, Goldsboro, Greensboro, High Point, Kings Mountain, Lexington, Lincolnton,

Lumberton, Monroe, Mount Airy, Shelby, Statesville, Washington, and Wilmington, to

the Towns of Beech Mountain, Blowing Rock, Carolina Beach, Carrboro, Franklin,

Kure Beach, Jonesville, Mooresville, North Topsail Beach, Selma, Smithfield, St. Pauls,

Wilkesboro, and Wrightsville Beach, and to the municipalities in Avery and Brunswick

Counties."

SECTION 4. This act is effective when it becomes law.

In the General Assembly read three times and ratified this the 16 th day of

July, 2004.

s/ Beverly E. Perdue

President of the Senate

s/ Richard T. Morgan

Speaker of the House of Representatives

Senate Bill 1060

Session Law 2004-105

Page 2

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- TaxSaleResearch OkDokument44 SeitenTaxSaleResearch OkMarlon Ferraro100% (1)

- Basic Foreclosure Litigation Defense ManualDokument155 SeitenBasic Foreclosure Litigation Defense ManualDiane Stern100% (2)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Exhibits and Student TemplateDokument7 SeitenExhibits and Student Templatesatish.evNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Vault GuideDokument414 SeitenVault Guidethum_liangNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Section 5 - Maintenance Plan - Revised 2015 TrackDokument27 SeitenSection 5 - Maintenance Plan - Revised 2015 TrackThunder PigNoch keine Bewertungen

- Coursebook Answers: Answers To Test Yourself QuestionsDokument5 SeitenCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii85% (20)

- Form 16 TDS Certificate SummaryDokument2 SeitenForm 16 TDS Certificate SummaryPravin HireNoch keine Bewertungen

- Doa TradeDokument17 SeitenDoa TradeEduardo WitonoNoch keine Bewertungen

- Ichimoku Trader - SignalsDokument6 SeitenIchimoku Trader - Signalsviswaa.anupindiNoch keine Bewertungen

- Preqin Latin America Report 2021Dokument35 SeitenPreqin Latin America Report 2021Carlos ArangoNoch keine Bewertungen

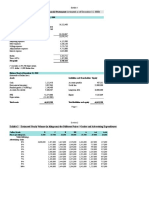

- Feb 2016 Franklin TDA Agenda PacketDokument14 SeitenFeb 2016 Franklin TDA Agenda PacketThunder PigNoch keine Bewertungen

- 2016 Proclamation School Bus Driver WeekDokument1 Seite2016 Proclamation School Bus Driver WeekThunder PigNoch keine Bewertungen

- Macon County FY 2015 Financial ReportDokument200 SeitenMacon County FY 2015 Financial ReportThunder PigNoch keine Bewertungen

- Press Packet Franklin Aldermen - Jan 2016Dokument96 SeitenPress Packet Franklin Aldermen - Jan 2016Thunder PigNoch keine Bewertungen

- Feb 2016 Franklin Aldermen Press PacketDokument79 SeitenFeb 2016 Franklin Aldermen Press PacketThunder PigNoch keine Bewertungen

- DRAFT COPY Wireless Telecommunications OrdinanceDokument12 SeitenDRAFT COPY Wireless Telecommunications OrdinanceThunder PigNoch keine Bewertungen

- Memo From NCDPS January 2016Dokument2 SeitenMemo From NCDPS January 2016Thunder PigNoch keine Bewertungen

- Feb 2016 Press Packet Macon Co CommissionersDokument104 SeitenFeb 2016 Press Packet Macon Co CommissionersThunder PigNoch keine Bewertungen

- Feb 2016 Macon Co Board of Education Press PacketDokument3 SeitenFeb 2016 Macon Co Board of Education Press PacketThunder PigNoch keine Bewertungen

- Clay Macon Hazard Mitigation PlanDokument421 SeitenClay Macon Hazard Mitigation PlanThunder PigNoch keine Bewertungen

- Franklin TDA Jan 2016 Press PacketDokument15 SeitenFranklin TDA Jan 2016 Press PacketThunder PigNoch keine Bewertungen

- Jan 2016 Macon Commissioners Press KitDokument93 SeitenJan 2016 Macon Commissioners Press KitThunder PigNoch keine Bewertungen

- Section 6 - SecurityDokument16 SeitenSection 6 - SecurityThunder PigNoch keine Bewertungen

- General Info TrackDokument12 SeitenGeneral Info TrackThunder PigNoch keine Bewertungen

- Section 1 - Driver & Employee SelectionDokument19 SeitenSection 1 - Driver & Employee SelectionThunder PigNoch keine Bewertungen

- Section 4 - Drug & Alcohol Abuse ProgramsDokument36 SeitenSection 4 - Drug & Alcohol Abuse ProgramsThunder PigNoch keine Bewertungen

- Section 3 - Safety Data Acquisition & AnalysisDokument38 SeitenSection 3 - Safety Data Acquisition & AnalysisThunder PigNoch keine Bewertungen

- Section 2 - Driver & Employee Training TrackDokument39 SeitenSection 2 - Driver & Employee Training TrackThunder PigNoch keine Bewertungen

- Dec 2015 Macon Commissioners Press PacketDokument19 SeitenDec 2015 Macon Commissioners Press PacketThunder PigNoch keine Bewertungen

- Press Packet Novemeber 2015 Town Board MeetingDokument63 SeitenPress Packet Novemeber 2015 Town Board MeetingThunder PigNoch keine Bewertungen

- Press Packet Dec 2015 Town BoardDokument89 SeitenPress Packet Dec 2015 Town BoardThunder PigNoch keine Bewertungen

- Press Packet For OCtober 2015 Commissioner MeetingDokument71 SeitenPress Packet For OCtober 2015 Commissioner MeetingThunder PigNoch keine Bewertungen

- Nov 2015 Commissioner AgendaDokument100 SeitenNov 2015 Commissioner AgendaThunder PigNoch keine Bewertungen

- Press Packet October 2015 School Board MeetingDokument3 SeitenPress Packet October 2015 School Board MeetingThunder PigNoch keine Bewertungen

- Franklin Aldermen Occupancy Tax ResolutionDokument2 SeitenFranklin Aldermen Occupancy Tax ResolutionThunder PigNoch keine Bewertungen

- Press Packet Franklin TDA Nov 2015Dokument18 SeitenPress Packet Franklin TDA Nov 2015Thunder PigNoch keine Bewertungen

- Read2Me Study Walk Info PacketDokument37 SeitenRead2Me Study Walk Info PacketThunder PigNoch keine Bewertungen

- Press Packet For Oct 2015 Aldermen MeetingDokument123 SeitenPress Packet For Oct 2015 Aldermen MeetingThunder PigNoch keine Bewertungen

- 1234449Dokument19 Seiten1234449Jade MarkNoch keine Bewertungen

- TCCB Revision - ProblemsDokument4 SeitenTCCB Revision - ProblemsDiễm Quỳnh 1292 Vũ ĐặngNoch keine Bewertungen

- Bank Reconciliation NotesDokument3 SeitenBank Reconciliation Notesjudel ArielNoch keine Bewertungen

- Brexit Implications On CM FXDokument6 SeitenBrexit Implications On CM FXAyobami EkundayoNoch keine Bewertungen

- Service-Charges 01.01.2022 WEBDokument58 SeitenService-Charges 01.01.2022 WEBRenesh RNoch keine Bewertungen

- Icici Prudential Life InsuranceDokument19 SeitenIcici Prudential Life InsuranceShubhanshu DubeyNoch keine Bewertungen

- Donor's Tax QuizDokument2 SeitenDonor's Tax Quizsujulove foreverNoch keine Bewertungen

- Open Banking: A Perspective For Financial InstitutionsDokument22 SeitenOpen Banking: A Perspective For Financial InstitutionsAyon BhattacharyaNoch keine Bewertungen

- Macroeconomic Effects of Banking TaxesDokument35 SeitenMacroeconomic Effects of Banking TaxesAlan Dennis Martínez SotoNoch keine Bewertungen

- Equifax Credit Report - A New Credit Score in IndiaDokument4 SeitenEquifax Credit Report - A New Credit Score in IndiaVyas Maharshi GarigipatiNoch keine Bewertungen

- 25dairy Cow ModuleDokument47 Seiten25dairy Cow ModulericoliwanagNoch keine Bewertungen

- MACROECONOMICS MADE SIMPLEDokument19 SeitenMACROECONOMICS MADE SIMPLEnorleen.sarmientoNoch keine Bewertungen

- BITS Pilani Course Handout on Fundamentals of Finance & AccountingDokument2 SeitenBITS Pilani Course Handout on Fundamentals of Finance & Accountingbijesh9784Noch keine Bewertungen

- Financial MarketDokument8 SeitenFinancial Marketindusekar83Noch keine Bewertungen

- Internal Audit For Finance SectorDokument1 SeiteInternal Audit For Finance SectorSURYA SNoch keine Bewertungen

- USC EDRES Committee Proposal by USC Councilor Jules GuiangDokument14 SeitenUSC EDRES Committee Proposal by USC Councilor Jules GuiangJules GuiangNoch keine Bewertungen

- FXCM Traits of Successful Traders GuideDokument43 SeitenFXCM Traits of Successful Traders GuidefizzNoch keine Bewertungen

- Virginia's Annual Holder Report Forms & Instructions: Unclaimed Property DivisionDokument27 SeitenVirginia's Annual Holder Report Forms & Instructions: Unclaimed Property DivisionWilliamsNoch keine Bewertungen

- SECP PresDokument29 SeitenSECP PresZoha MirNoch keine Bewertungen

- Principles and Methods for Improving CollectionsDokument7 SeitenPrinciples and Methods for Improving Collectionsrosalyn mauricioNoch keine Bewertungen

- Yukitoshi Higashino MftaDokument29 SeitenYukitoshi Higashino MftaSeyyed Mohammad Hossein SherafatNoch keine Bewertungen