Beruflich Dokumente

Kultur Dokumente

Performing Substantive Test

Hochgeladen von

Zoren De CastroCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Performing Substantive Test

Hochgeladen von

Zoren De CastroCopyright:

Verfügbare Formate

CHAPTER 8 - PERFORMING SUBSTANTIVE TESTS

Substantive Tests - are audit procedures

designed to substantiate the account balances or

to detect material misstatements in the financial

statements.

Analytical Procedures

- enables the auditor to obtain corroborative

evidence about a particular account

- involves comparison of financial information with

auditors expectations to determine the

reasonableness of an account balance reported

in the financial statements

Factors affecting the effectiveness of analytical

procedures:

nature of the assertions

reliability

of

data

used

to

develop

expectations

precision of expectations

predictability of the accounts payable

Generalizations that are helpful in assessing

the predictability of the accounts:

Income statement accounts are more

predicable compared to balance sheet

accounts.

Accounts that are not subject to management

discretion are generally predicable.

Relationships in a stable environment are

more predictable than those in a dynamic or

unstable environment.

Audit Evidence - refers to the information

obtained by the auditor in arriving at the

conclusions on which the audit opinion is based.

Forms of test of details:

Test of details of balances - involves direct

testing of the ending balance of an account

Test of details of transactions - involves

testing the transact-tions which give rise to

the ending balance of an account

Substantive Test vs. Test of Control

Tests of Controls provide evidence that indicates

a misstatement is likely to occur. Substantive

Tests provide evidence about the existence of

misstatement in an account balance.

Quality of Evidence

Sufficiency - refers to the amount of evidence

that the auditor should accumulate.

Factors to be considered in evaluating the

sufficiency of evidence:

Competence of evidence - this varies

inversely with the amount of evidence that

is sufficient in a given situation. The more

competent the evidence, the less amount of

evidence is needed to support the auditors

opinion.

Materiality of item being examined - the

more material the fs amount being

examined, the more evidence will be

needed to support the validity.

Risk involved in a particular amount - as the

risk of mis-statement increases, the more

evidence will be needed.

Experience gained during previous audit

may indicate the amount of evidence taken

before and whether such evidence was

enough.

Test of Details

- involves examining the actual details making up

the various account balances

Factors affecting the effectiveness of substantive

tests:

Nature of substantive test - relates to the quality

of evidence

Timing of substantive test - interim date or at

year-end

Extent of substantive test - relates to the amount

of evidence needed to satisfy a particular

objective.

Underlying accounting data - refers to

accounting records

Corroborating information - supports UAD

obtained from clients and other resources

Appropriateness - measures the quality of

audit evidence and its relevance to a

particular assertions and its reliability.

- Relevance - relates the timeliness of

evidence and its ability to satisfy the audit

objective.

Reliability - relates to the objectivity of

evidence and is influenced by its source and

by its nature.

Generalizations that could help the auditor in

assessing the reliability of audit evidence:

Audit evidence obtained from independent

outside sources is more reliable than that

generated internally.

Audit evidence generated internally is more

reliable when the related accounting and

internal control systems are effective.

Audit evidence obtained directly by the

auditor is more reliable than that obtained

from the entity.

Audit evidence in the form of documents

and written representations is more reliable

than oral representations.

major contracts

engagement letter

organizational chart

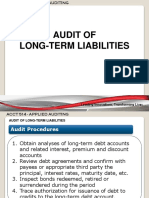

analyses of long-term accounts

internal control analyses

Current file - contains evidence gathered and

conclusions reached relevant to the audit of a

particular year.

a copy of the financial statements

audit program

working trial balance

lead schedules

detailed schedules

correspondence with other parties

Techniques used by auditor when preparing

working papers:

Heading

Indexing - refers to the use of letter or

numbering system

Cross-indexing/Cross referencing - provides a

trail useful to supervisors in reviewing the

working papers

Tick marks - symbols that describe the audit

procedures performed

Accounting Estimates - means an approximation

of the amounts of an item in the absence of a

precise means of measurement.

Audit Documentation or Working Papers - are

records kept by the auditor that documents the

audit procedures applied, information obtained

and conclusions reached.

Related Party - refers to the persons or entities

that may have dealings with one another in

which one party has the ability to exercise

significant influence or control over the other

party in making financial and operating

decisions.

Primary functions of the working papers:

support the auditors opinion on the financial

statements

- support the auditors representation as to

compliance with PSA

- assist

the

auditor

in

the

planning,

performance, review and supervision of the

engagement

-

Secondary functions of the working papers:

planning future audits

providing information useful in rendering

other services

- providing adequate defense in case of

litigation

-

Classification of working papers

Permanent file - contains information of

continuing signify-cance to the auditor in

performing recurring audits

- copies of the articles of incorporation and

by-laws

Expert - it is a person or firm possessing special

skill, knowledge and expertise in a particular

field other than accounting and auditing.

Kinds of expert:

Auditors expert - an expert, whose work in

his/her field of specialization, is used by the

auditor to assist the auditor in obtaining

sufficient appropriate audit evidence.

Managements expert - an expert, whose

work is his/her field of expertise, is used by

the entity to assist the entity in preparing the

financial statement.

Evaluating the auditors expert:

1. Assess the competence and objectivity of the

expert.

2. Understand the field of the expertise of the

auditors expert.

3. Establish the terms of the agreement with

the expert.

4. Evaluate the results of the work of the

expert.

Internal auditing - is an appraisal activity

established within an entity as a service to the

entity.

Considering the work of internal auditor

involves two phases:

Making a preliminary assessment of internal

auditing

External auditors must consider the internal

auditors:

Competence - professional qualifications

and expertise

Objectivity - organizational level to which

the internal auditors report the results of

their work

Due professional care - proper planning,

supervision and documentation of internal

auditors work

Scope of function - nature and extent of the

internal auditors assignment

Evaluating and testing the work of internal

auditing

Routine/Mechanical audit procedures - is an

acceptable practice that provided that the

external auditor supervises and reviews

work perforrmed by the internal auditors.

Das könnte Ihnen auch gefallen

- Audit Evidence and DocumentationDokument4 SeitenAudit Evidence and DocumentationJudy100% (1)

- Audit Procedures, Evidence, Documentation and SamplingDokument49 SeitenAudit Procedures, Evidence, Documentation and Samplingchim.chimNoch keine Bewertungen

- Audit Objectives Procedures Evidences and DocumentationDokument35 SeitenAudit Objectives Procedures Evidences and Documentationrietzhel22100% (3)

- Preliminary Engagement and Audit Planning QuizDokument7 SeitenPreliminary Engagement and Audit Planning QuizGraceila P. CalopeNoch keine Bewertungen

- Audit Liabilities Completeness ProceduresDokument3 SeitenAudit Liabilities Completeness ProceduresJobby Jaranilla100% (1)

- Audit Planning Chapter 5Dokument6 SeitenAudit Planning Chapter 5威陈Noch keine Bewertungen

- Audit of Long-Term LiabilitiesDokument43 SeitenAudit of Long-Term LiabilitiesEva Dagus0% (1)

- Lecture Notes: Auditing Theory AT.0106-Understanding The Entity and Its Environment MAY 2020Dokument7 SeitenLecture Notes: Auditing Theory AT.0106-Understanding The Entity and Its Environment MAY 2020MaeNoch keine Bewertungen

- Auditing Theory Summary Auditing Theory SummaryDokument42 SeitenAuditing Theory Summary Auditing Theory SummaryCJ TinNoch keine Bewertungen

- Fundamentals of Assurance Services FinalDokument6 SeitenFundamentals of Assurance Services FinalLv ValenzonaNoch keine Bewertungen

- Performing Substantive Tests Chapter 8Dokument30 SeitenPerforming Substantive Tests Chapter 8Aimerose ObedencioNoch keine Bewertungen

- The PRC Cpe CouncilDokument4 SeitenThe PRC Cpe CouncilRenzo Ramos100% (1)

- Valuation Concepts and Methodologies - LascanoDokument218 SeitenValuation Concepts and Methodologies - LascanoMa Cielito AndaNoch keine Bewertungen

- At.3006-Planning An Audit of Financial StatementsDokument5 SeitenAt.3006-Planning An Audit of Financial StatementsSadAccountantNoch keine Bewertungen

- AP-100 (Audit of Shareholders' Equity)Dokument8 SeitenAP-100 (Audit of Shareholders' Equity)Gwyneth CartallaNoch keine Bewertungen

- Chapter 8: Quality Control: Questions 3 To 5Dokument12 SeitenChapter 8: Quality Control: Questions 3 To 5Janeth NavalesNoch keine Bewertungen

- AT Quizzer 4 (Audit Documentation)Dokument5 SeitenAT Quizzer 4 (Audit Documentation)JimmyChaoNoch keine Bewertungen

- Chapter 4 - Evidential Matter and Its DocumentationDokument14 SeitenChapter 4 - Evidential Matter and Its DocumentationKristine WaliNoch keine Bewertungen

- Psa 240Dokument46 SeitenPsa 240Joanna Caballero100% (2)

- Chapter 1 Auditing and Internal Control PDFDokument21 SeitenChapter 1 Auditing and Internal Control PDFDenmarc John AragosNoch keine Bewertungen

- PSA 700, 705, 706, 710, 720 ExercisesDokument11 SeitenPSA 700, 705, 706, 710, 720 ExercisesRalph Francis BirungNoch keine Bewertungen

- Module 2 - Audit Process - For LMSDokument71 SeitenModule 2 - Audit Process - For LMSKrystalah CañizaresNoch keine Bewertungen

- Course Title: Auditing and Assurance: Concepts and Applications 2 Course DescriptionDokument1 SeiteCourse Title: Auditing and Assurance: Concepts and Applications 2 Course DescriptionMichael Arevalo100% (1)

- THE AUDIT PROCESS - Accepting An Engagement: Financial Statement AssertionsDokument24 SeitenTHE AUDIT PROCESS - Accepting An Engagement: Financial Statement AssertionsEliza Beth100% (3)

- Auditing Theory: Audit SamplingDokument11 SeitenAuditing Theory: Audit SamplingFayehAmantilloBingcangNoch keine Bewertungen

- Module 2 - The Risk-Based Financial Statement Audit - Client Acceptance, Audit Planning, Supervision and MonitoringDokument19 SeitenModule 2 - The Risk-Based Financial Statement Audit - Client Acceptance, Audit Planning, Supervision and MonitoringEvie MarionetteNoch keine Bewertungen

- Chapter 12 - Assurance & Other Related ServicesDokument5 SeitenChapter 12 - Assurance & Other Related ServicesellieNoch keine Bewertungen

- Audit of The Financing and Investing CycleDokument14 SeitenAudit of The Financing and Investing CycleMie- AnnNoch keine Bewertungen

- Department of Accountancy: Page - 1Dokument14 SeitenDepartment of Accountancy: Page - 1NoroNoch keine Bewertungen

- The New Code of Ethics For CPA S by Atty Eranio Punsalan PDFDokument9 SeitenThe New Code of Ethics For CPA S by Atty Eranio Punsalan PDFsamuel debebeNoch keine Bewertungen

- Auditing Process Part 2: Tests of Control and Substantive TestsDokument6 SeitenAuditing Process Part 2: Tests of Control and Substantive TestsMaria PauNoch keine Bewertungen

- Auditing Theory Audit of The Inventory and Warehousing CycleDokument15 SeitenAuditing Theory Audit of The Inventory and Warehousing CycleMark Anthony Tibule100% (2)

- The Budget ProcessDokument8 SeitenThe Budget ProcessChris tine Mae MendozaNoch keine Bewertungen

- Introduction To Audit and Assurance in Specialized IndustriesDokument15 SeitenIntroduction To Audit and Assurance in Specialized IndustriesJohann VillegasNoch keine Bewertungen

- Lecture On Shareholders' EquityDokument3 SeitenLecture On Shareholders' EquityevaNoch keine Bewertungen

- Understanding Internal ControlsDokument4 SeitenUnderstanding Internal ControlsGlaizzaNoch keine Bewertungen

- Notes in Operations AuditingDokument4 SeitenNotes in Operations AuditingJenny Kimmey100% (1)

- 2015 Solman AsuncionDokument219 Seiten2015 Solman AsuncionMarwin AceNoch keine Bewertungen

- The Risk-Based Audit ProcessDokument16 SeitenThe Risk-Based Audit ProcessCarlo manejaNoch keine Bewertungen

- Chapter 2 Audit Cash PDFDokument6 SeitenChapter 2 Audit Cash PDFalemayehu100% (2)

- CPAR Reviewer MAY 2019 Auditing ProblemsDokument28 SeitenCPAR Reviewer MAY 2019 Auditing ProblemsLiza Magat MatadlingNoch keine Bewertungen

- Psa 330Dokument25 SeitenPsa 330xxxxxxxxx50% (2)

- Public and Professional AccountingDokument5 SeitenPublic and Professional Accountingemc2_mcvNoch keine Bewertungen

- Total Bills = P 800Coins 10.00 x 50 pieces = P 500 5.00 x 15 pieces = 75 0.25 x 32 pieces = 8Dokument8 SeitenTotal Bills = P 800Coins 10.00 x 50 pieces = P 500 5.00 x 15 pieces = 75 0.25 x 32 pieces = 8Anonymous LC5kFdtcNoch keine Bewertungen

- COSO IC-IF and ISO Standards for Internal AuditorsDokument6 SeitenCOSO IC-IF and ISO Standards for Internal AuditorsRenelle HabacNoch keine Bewertungen

- Lecture Notes: Auditing Theory AT.0103-Fundamentals of Assurance and Non-Assurance EngagementsDokument8 SeitenLecture Notes: Auditing Theory AT.0103-Fundamentals of Assurance and Non-Assurance EngagementsMaeNoch keine Bewertungen

- Semi-Final Examination: Auditing Assurance in Specialized IndustriesDokument3 SeitenSemi-Final Examination: Auditing Assurance in Specialized IndustriesNikky Bless LeonarNoch keine Bewertungen

- AUD CIS CH 1-6Dokument25 SeitenAUD CIS CH 1-6Bela BellsNoch keine Bewertungen

- Attestation Services 2Dokument8 SeitenAttestation Services 2sana olNoch keine Bewertungen

- Operational Auditing DefinitionDokument51 SeitenOperational Auditing DefinitionJoyce Anne GarduqueNoch keine Bewertungen

- At Quiz 2 - October 2019Dokument3 SeitenAt Quiz 2 - October 2019Mitchiejash CruzNoch keine Bewertungen

- ACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Dokument76 SeitenACCO 30053 Auditing and Assurance Concepts and Applications 1 Module - AY2021Christel Oruga100% (1)

- Applied Auditing Preliminary Examination Multiple ChoiceDokument7 SeitenApplied Auditing Preliminary Examination Multiple ChoicestillwinmsNoch keine Bewertungen

- AP 08 Substantive Audit Tests of EquityDokument2 SeitenAP 08 Substantive Audit Tests of EquityJobby JaranillaNoch keine Bewertungen

- RA 9298: Philippine Accountancy Act of 2004Dokument12 SeitenRA 9298: Philippine Accountancy Act of 2004Alex OngNoch keine Bewertungen

- Ap-1403 ReceivablesDokument18 SeitenAp-1403 Receivableschowchow123Noch keine Bewertungen

- Performing Substantive TestDokument33 SeitenPerforming Substantive TestDawn Jenina Francisco100% (2)

- A&a L6 EditedDokument6 SeitenA&a L6 EditedKimosop Isaac KipngetichNoch keine Bewertungen

- Process of Assurance: Evidence and Reporting: Mohammad Salahuddin Chowdhury, ACADokument18 SeitenProcess of Assurance: Evidence and Reporting: Mohammad Salahuddin Chowdhury, ACACarey HillNoch keine Bewertungen

- Performing Substantive Tests and Audit DocumentationDokument5 SeitenPerforming Substantive Tests and Audit DocumentationJhondelNoch keine Bewertungen

- Tugas 2 Resume PBT, CBT, Ibt TOEFLDokument5 SeitenTugas 2 Resume PBT, CBT, Ibt TOEFLLiliana AnggariniNoch keine Bewertungen

- Challenges in Teaching MTB-MLEDokument7 SeitenChallenges in Teaching MTB-MLECatherine BonNoch keine Bewertungen

- Guide To Reflective WritingDokument4 SeitenGuide To Reflective WritingPaul Rose100% (2)

- OJT FormsDokument17 SeitenOJT FormsShaina Delos SantosNoch keine Bewertungen

- Very Helpful Exam Tips From Your Fellow StudentsDokument2 SeitenVery Helpful Exam Tips From Your Fellow Studentssanthakumar GNoch keine Bewertungen

- Module 5 Descriptive Research DesignDokument23 SeitenModule 5 Descriptive Research DesignRowel P. Raña Jr.Noch keine Bewertungen

- Planning and Writing A Critical ReviewDokument5 SeitenPlanning and Writing A Critical ReviewGaurav LamichhaneNoch keine Bewertungen

- PR10 2008 (ISM Auditors)Dokument10 SeitenPR10 2008 (ISM Auditors)Amster LimatogNoch keine Bewertungen

- ASSESSMENT IN LEARNING 2 ReportDokument24 SeitenASSESSMENT IN LEARNING 2 ReportNICHOLE DIANNE DIME. DIAZ100% (1)

- CBS Course in HRM OutlineDokument8 SeitenCBS Course in HRM OutlineKumar Gaurab Jha100% (1)

- Prospect SRSKerlaDokument23 SeitenProspect SRSKerlaSonal ShahNoch keine Bewertungen

- Module 1pt1-EDUC 202Dokument57 SeitenModule 1pt1-EDUC 202Win Rigor0% (1)

- Teaching Listening and Speaking SkillsDokument156 SeitenTeaching Listening and Speaking SkillsAlina Cretu100% (2)

- Fundamentals of Human Resource ManagementDokument25 SeitenFundamentals of Human Resource Managementpinku13Noch keine Bewertungen

- Case Study On New Performance Appraisal On The System at XeroxDokument3 SeitenCase Study On New Performance Appraisal On The System at XeroxNirupam NayakNoch keine Bewertungen

- Ipoh International Secondary School Checkpoint Exam PreparationDokument22 SeitenIpoh International Secondary School Checkpoint Exam PreparationTharrshiny Selvaraj100% (2)

- Bloom's Taxonomy of Learning Objectives (HOTS LOTS)Dokument3 SeitenBloom's Taxonomy of Learning Objectives (HOTS LOTS)Ninja ni MarkeeNoch keine Bewertungen

- Cambridge Learner Guide For As and A Level Biology PDFDokument82 SeitenCambridge Learner Guide For As and A Level Biology PDFN.h. AnikNoch keine Bewertungen

- 2016 Fall-MGT16-Ethics-Syllabus-9-20-2016Dokument5 Seiten2016 Fall-MGT16-Ethics-Syllabus-9-20-2016ArjunLohanNoch keine Bewertungen

- Earth & Life WHLP Week 3 & 4Dokument1 SeiteEarth & Life WHLP Week 3 & 4RICHARD CORTEZNoch keine Bewertungen

- Acid and Base Study Guide (Multiple Choice Questions)Dokument47 SeitenAcid and Base Study Guide (Multiple Choice Questions)Anika So100% (3)

- TOS 3RDquarter Exam Grade 8Dokument6 SeitenTOS 3RDquarter Exam Grade 8Shawn IsaacNoch keine Bewertungen

- Asan Jo School Essay in SindhiDokument6 SeitenAsan Jo School Essay in Sindhitaimoorshaikh50% (2)

- Mindful Attention Awareness Scale (MAAS) PDFDokument5 SeitenMindful Attention Awareness Scale (MAAS) PDFAndreea Mihai100% (1)

- Third RevisionDokument22 SeitenThird Revisionapi-3759646Noch keine Bewertungen

- Item Response Theory Item Response Theory (IRT)Dokument4 SeitenItem Response Theory Item Response Theory (IRT)Jessan Ybañez JoreNoch keine Bewertungen

- Function ASSIGNMENT FOR IIT-JEEDokument13 SeitenFunction ASSIGNMENT FOR IIT-JEEApex Institute75% (8)

- Science, Technology and SocietyDokument21 SeitenScience, Technology and SocietySarah YumulNoch keine Bewertungen

- Exam PhobiaDokument8 SeitenExam PhobiaAnonymous qksm04vNoch keine Bewertungen

- Kite Flying - ReflectionDokument11 SeitenKite Flying - ReflectionRosemarie Miano Trabuco50% (2)